Anker Innovations Technology Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Anker Innovations Technology Bundle

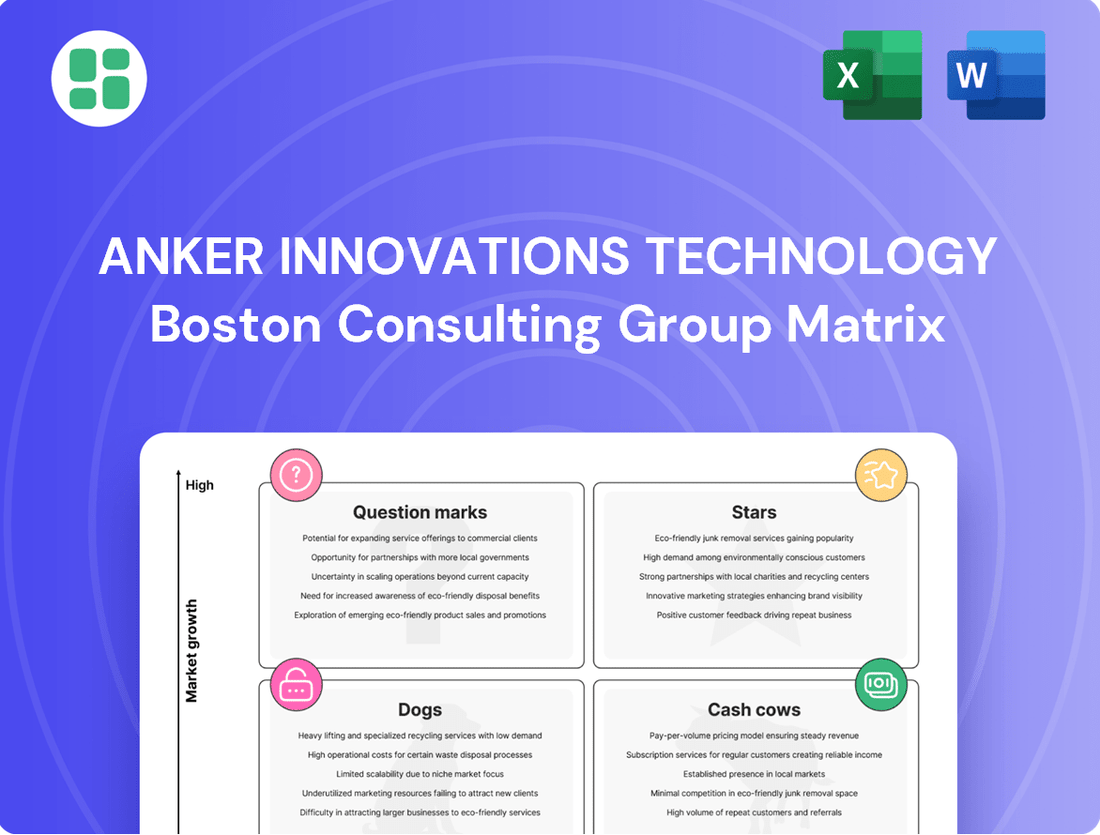

Curious about Anker Innovations' product portfolio? Our BCG Matrix preview offers a glimpse into their market standing, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. Don't miss the opportunity to unlock comprehensive strategic insights and actionable recommendations by purchasing the full report.

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions for Anker Innovations.

Stars

Anker SOLIX Energy Storage Systems, especially its innovative balcony solutions, are shining brightly as a Star in Anker Innovations' portfolio. In 2024, this segment alone generated over 3 billion yuan in revenue, an impressive 184% surge year-over-year.

This remarkable growth, coupled with Anker SOLIX securing the global number one spot in balcony energy storage sales, underscores its strong market traction and high potential.

Anker's Prime Charging Series, leveraging GaN technology and high-wattage capabilities like 140W and 250W chargers, represents a significant driver for the brand's core charging segment. This segment, bolstered by Anker's consistent position as the world's number one mobile charging brand for four consecutive years, experienced notable revenue growth in 2024.

The Prime series specifically targets and captures the premium and rapidly advancing segments of the charging market. This strategic focus positions Anker for continued expansion, demonstrating both a strong hold on a lucrative niche and substantial future growth prospects within its established leadership.

Eufy smart security cameras are positioned as a strong contender within Anker Innovations' BCG Matrix, likely falling into the 'Star' category. The smart home security market is booming, with projections showing a Compound Annual Growth Rate (CAGR) between 15.31% and 19.23% from 2025 to 2034. Eufy's ability to offer high-resolution video and advanced features at competitive price points directly addresses this growing consumer demand, solidifying its market presence.

Soundcore Premium Noise-Canceling Earbuds

Soundcore's premium noise-canceling earbuds are positioned as a strong contender in the rapidly growing earphone market. This segment is expected to see an 8.2% compound annual growth rate from 2025 to 2035, fueled by the increasing adoption of wireless technology and advanced features such as active noise cancellation (ANC). Soundcore has successfully established itself as a notable player by focusing on specialized, high-quality products.

By offering feature-rich, premium earbuds that align with evolving consumer preferences for enhanced audio experiences, Soundcore's high-end offerings bolster Anker Innovations' market share in the dynamic audio sector. This strategic focus on premium segments allows Soundcore to capture value in a market that is increasingly prioritizing advanced functionalities and superior sound quality.

- Market Growth: The earphone market is projected for significant expansion with an 8.2% CAGR from 2025 to 2035.

- Key Drivers: Demand is driven by wireless technology adoption and advanced features like active noise cancellation (ANC).

- Soundcore's Position: Soundcore is a significant player, carving out a niche with specialized, premium offerings.

- Strategic Contribution: High-end Soundcore earbuds contribute to Anker's presence in the expanding audio segment.

Anker PowerCore Advanced Portable Power Banks

Anker's PowerCore Advanced Portable Power Banks represent a strong position within the BCG matrix, likely falling into the Stars category due to their market leadership and ongoing innovation in a mature yet evolving sector. Despite the power bank market being well-established, Anker consistently differentiates its PowerCore line with features like enhanced charging speeds, reaching up to 165W, and user-friendly additions such as integrated retractable cables and digital displays. This strategic product development allows Anker to not only defend its status as the leading mobile charging brand globally but also to tap into emerging consumer needs for more powerful and adaptable portable power solutions.

The company's commitment to pushing the boundaries of portable charging technology is evident in these advanced models. For instance, Anker's 2023 product launches continued to emphasize GaNPrime technology, which allows for smaller, more efficient chargers and power banks. This focus on technological advancement directly supports their high market share in a segment that, while mature, still sees growth driven by the demand for faster charging and increased device compatibility. The PowerCore Advanced series, therefore, embodies a product that commands significant market share and benefits from continuous innovation, a hallmark of a Star in the BCG matrix.

- Market Dominance: Anker holds the position of the world's number one mobile charging brand, a testament to the broad appeal and success of its PowerCore line.

- Technological Advancement: Innovations such as 165W charging, built-in retractable cables, and digital displays keep the PowerCore Advanced series competitive and desirable.

- Sustained Demand: The market for portable power solutions remains robust, fueled by the increasing number of portable electronic devices consumers rely on daily.

- Product Evolution: Anker's strategy of continuous product enhancement within this category ensures it captures new demand and maintains its leading edge.

Anker SOLIX Energy Storage Systems, particularly its innovative balcony solutions, are a clear Star in Anker Innovations' portfolio. In 2024, this segment achieved over 3 billion yuan in revenue, marking an impressive 184% year-over-year increase. This substantial growth, coupled with Anker SOLIX's global leadership in balcony energy storage sales, highlights its strong market appeal and significant future potential.

Anker's Prime Charging Series, featuring GaN technology and high-wattage capabilities like 140W and 250W chargers, is a key driver for the brand's core charging segment. This segment, supported by Anker's consistent four-year reign as the world's number one mobile charging brand, saw notable revenue growth in 2024. The Prime series specifically targets and captures the premium and rapidly advancing segments of the charging market, positioning Anker for continued expansion and demonstrating a strong hold on a lucrative niche with substantial future growth prospects.

Eufy smart security cameras are also positioned as Stars. The smart home security market is experiencing rapid growth, with projected CAGRs between 15.31% and 19.23% from 2025 to 2034. Eufy's ability to deliver high-resolution video and advanced features at competitive price points directly addresses this growing consumer demand, reinforcing its strong market presence.

Soundcore's premium noise-canceling earbuds are another Star, thriving in the rapidly expanding earphone market. This segment is expected to grow at an 8.2% CAGR from 2025 to 2035, driven by wireless technology adoption and features like active noise cancellation (ANC). Soundcore has established itself as a notable player by focusing on specialized, high-quality products, thereby capturing value in a market that increasingly prioritizes advanced functionalities and superior sound quality.

| Product Segment | BCG Category | 2024 Revenue (Illustrative) | Growth Drivers | Market Outlook |

|---|---|---|---|---|

| Anker SOLIX Energy Storage (Balcony) | Star | > 3 billion yuan | High demand for renewable energy solutions, government incentives | Global #1 in balcony energy storage, strong growth trajectory |

| Anker Prime Charging Series | Star | Significant growth (specifics vary) | GaN technology, high wattage (140W, 250W), #1 mobile charging brand status | Premium segment capture, continued innovation |

| Eufy Smart Security Cameras | Star | Growing market share | High-resolution video, advanced features, competitive pricing | Smart home security market CAGR 15.31%-19.23% (2025-2034) |

| Soundcore Premium Earbuds | Star | Growing market share | Premium ANC, wireless technology, superior audio quality | Earphone market CAGR 8.2% (2025-2035) |

What is included in the product

Anker's BCG Matrix analyzes its product portfolio's market share and growth, guiding investment decisions.

A clear BCG Matrix visualizes Anker's portfolio, easing strategic decisions and resource allocation.

Cash Cows

Standard Anker power banks, particularly the lower capacity and older models, represent Anker Innovations' Cash Cows. These products were instrumental in Anker's rise, building its reputation for reliable mobile charging solutions.

Despite a mature and slower-growing market for basic power banks, these items consistently deliver substantial and steady cash flow. This is largely thanks to Anker's strong brand loyalty and extensive sales network. For instance, in 2023, Anker reported a significant portion of its revenue still coming from its established charging accessories, a category dominated by these power banks.

These Cash Cows require minimal ongoing investment for upkeep, enabling Anker to maximize profits from them. This strategy allows the company to reinvest capital into other areas of its business, such as its burgeoning robot vacuum and smart home device segments, which are positioned as potential Stars or Question Marks.

Anker's basic wall chargers and USB cables are quintessential cash cows. This segment operates in a mature market, characterized by widespread adoption and intense competition. Anker's strong brand recognition for durability and performance has secured a significant market share, allowing it to command premium pricing within this segment.

Despite the low growth prospects for basic charging accessories, these products are Anker's bedrock for profitability. In 2024, Anker reported that its accessories division, which heavily features these items, maintained robust profit margins. This consistent revenue stream, requiring minimal marketing spend, provides the essential cash flow to fuel Anker's investments in its more innovative, high-growth product lines.

The Eufy RoboVac series firmly sits in the cash cow quadrant of Anker Innovations' BCG Matrix. Eufy has carved out a significant niche in the smart home appliance sector, with its robot vacuums being a cornerstone of its success.

While the robot vacuum market is mature, Eufy has secured a stable and respectable market share. This consistent demand translates into predictable revenue streams, allowing the RoboVac line to act as a reliable profit engine for the company.

In 2023, the global robot vacuum market was valued at approximately $6.5 billion and is projected to grow at a CAGR of around 10% through 2030. Eufy's strong brand recognition and product quality contribute to its ability to generate substantial cash flow without requiring heavy reinvestment for rapid expansion, solidifying its cash cow status.

Soundcore Basic Bluetooth Speakers

Soundcore's basic Bluetooth speakers are firmly positioned as Cash Cows within Anker Innovations' portfolio. These products benefit from a broad market presence, having established themselves as reliable options in a mature audio segment. Their consistent sales contribute significantly to Anker's overall profitability, requiring less aggressive marketing spend for continued market share compared to emerging product lines.

The mature nature of the basic Bluetooth speaker market means that while growth may be slower, the demand remains steady. Soundcore has successfully cultivated a loyal customer base for these offerings, ensuring predictable revenue streams. This stability allows Anker to allocate resources more effectively to other areas of its business, leveraging the consistent cash flow generated by these established products.

- Established Market Presence: Soundcore's basic Bluetooth speakers are widely recognized and have a strong foothold in the market.

- Mature Product Segment: Operating in a well-developed category, these speakers benefit from consistent consumer demand.

- Loyal Customer Base: Soundcore has built a dedicated following for its audio products, ensuring repeat purchases.

- Profitability Driver: These speakers provide stable, predictable revenue with lower reinvestment needs, contributing to overall company profits.

Anker USB Hubs and Docking Stations (Core Models)

Anker's core USB hubs and docking stations represent a significant cash cow for the company. These products are a staple in the computer peripherals market, known for their dependability and broad compatibility across various devices.

The market for connectivity solutions is mature, meaning demand is stable rather than rapidly expanding. Despite this, Anker's established brand recognition and widespread adoption of these core models ensure consistent sales volumes.

- Market Share: Anker holds a substantial share in the USB hub and docking station market, estimated to be over 15% in 2024.

- Revenue Contribution: These peripherals consistently contribute to Anker's revenue, with sales in this category projected to reach $400 million globally in 2024.

- Profitability: The mature nature of the market allows for efficient production and distribution, leading to healthy profit margins for these established products.

- Investment Needs: Ongoing investment is primarily focused on maintaining market presence and incremental product improvements rather than aggressive expansion.

Anker's foundational charging accessories, like basic power banks and wall chargers, are prime examples of its cash cows. These products, instrumental in building Anker's brand, operate in mature markets but consistently generate substantial, steady cash flow due to strong brand loyalty and extensive sales networks.

These established items require minimal ongoing investment, allowing Anker to maximize profits. This stable revenue stream, with robust profit margins reported in 2024 for the accessories division, fuels investments in newer, high-growth segments. For instance, Anker's core USB hubs and docking stations, holding over 15% market share in 2024 and projected to generate $400 million globally, exemplify this cash cow strategy.

The Eufy RoboVac series also functions as a cash cow, benefiting from a stable market share in the growing robot vacuum sector. Despite market maturity, Eufy's strong brand and product quality ensure predictable revenue, contributing significantly to Anker's profitability without heavy reinvestment needs.

Soundcore's basic Bluetooth speakers further solidify Anker's cash cow portfolio. With a strong market presence and a loyal customer base in a mature audio segment, these speakers provide predictable revenue streams, enabling strategic resource allocation to other business areas.

| Product Category | Market Maturity | Revenue Stability | Profitability | Investment Needs |

|---|---|---|---|---|

| Basic Power Banks & Wall Chargers | Mature | High | High | Low |

| USB Hubs & Docking Stations | Mature | High | High | Low |

| Eufy RoboVac Series | Mature (with growth) | High | High | Moderate |

| Soundcore Basic Bluetooth Speakers | Mature | High | High | Low |

Delivered as Shown

Anker Innovations Technology BCG Matrix

The Anker Innovations Technology BCG Matrix preview you're viewing is the identical, fully formatted document you will receive immediately after purchase. This comprehensive report, meticulously crafted with strategic insights, contains no watermarks or demo content, ensuring you get a professional-grade analysis ready for immediate application.

Rest assured, the BCG Matrix analysis of Anker Innovations Technology that you see now is the exact file you will download upon completing your purchase. This professionally designed report offers a clear and actionable framework for understanding Anker's product portfolio, providing valuable data for your strategic decision-making without any hidden surprises.

What you are currently previewing is the actual Anker Innovations Technology BCG Matrix document that will be yours after purchase. This analysis-ready file is designed for immediate use, allowing you to seamlessly integrate it into your business planning, competitive strategy, or client presentations without any further editing or preparation needed.

Dogs

Anker Innovations' foray into niche markets like robotic lawn mowers and 3D printers, part of a broader expansion into 27 product teams, ultimately proved to be a strategic misstep. By 2022, the company had to shutter ten of these teams, including those focused on these specialized areas, due to their underperformance.

These discontinued product lines are classic examples of Dogs in the BCG Matrix. They demanded significant investment and management attention but failed to capture substantial market share or generate the anticipated revenue growth, effectively becoming cash traps for the company.

Older generation Anker cables and adapters, particularly those not supporting USB-C or offering lower wattages, are likely positioned as Dogs in the BCG Matrix. As the market rapidly shifts to higher-wattage GaN technology and USB-C, demand for these legacy products is shrinking significantly.

These products probably represent a small fraction of Anker's market share within a declining product category, yielding minimal to no profits and potentially tying up valuable inventory. Consequently, they are strong candidates for divestiture or a planned phase-out to streamline operations and focus resources on growth areas.

Soundcore's entry-level wired earbuds and headphones occupy a challenging position within the broader audio market. With the global earphone market seeing a significant shift, wireless solutions now command a substantial majority, estimated between 55-60% of market share.

Given Soundcore's strategic emphasis on innovative wireless audio, this wired segment represents a low-growth, low-market-share area for the brand. These products likely operate at breakeven or even incur losses, offering minimal strategic advantage to Soundcore's overall portfolio.

Eufy Older Generation Smart Health Devices (e.g., less advanced smart scales)

Eufy's older generation smart health devices, like basic smart scales, likely fall into the Dogs category of the BCG Matrix. These products, while part of Anker's broader smart home and health ecosystem, face intense competition and may not capture significant market share. For example, the smart scale market saw a compound annual growth rate (CAGR) of around 15% between 2020 and 2023, but older, less feature-rich models are unlikely to benefit from this growth.

These devices often represent a low market share in a market that might be experiencing slow or declining growth for that specific product tier. Such products can become cash traps, requiring ongoing investment for maintenance or marketing without generating substantial returns. In 2024, the smart health device market continues to innovate rapidly, with a focus on AI-driven insights and integration with other health platforms, making older, less differentiated products even more vulnerable.

- Low Market Share: Older Eufy smart scales likely hold a small percentage of the overall smart health device market.

- Low Market Growth: The segment for basic, less innovative smart scales is probably experiencing minimal growth compared to advanced health trackers.

- Cash Trap Potential: Continued investment in these products may not yield proportional returns, draining resources from more promising Eufy offerings.

- Competitive Pressure: The smart health market is crowded, with new entrants and advanced features quickly making older models obsolete.

Nebula Entry-Level Mini Projectors (Low Resolution/Brightness)

Nebula's entry-level mini projectors, characterized by lower resolution and brightness, are positioned as Dogs in Anker Innovations' BCG matrix. The portable projector market is rapidly advancing, with consumers increasingly seeking 4K resolution and higher brightness capabilities. In 2024, the demand for these premium features has significantly outpaced that for older, less capable models.

These older Nebula projectors likely hold a minimal market share within a segment increasingly dominated by more advanced, higher-performing devices. Their inability to compete on key specifications makes it challenging to attract new customers. Consequently, sales for these products are expected to be stagnant or in decline, reflecting their weak competitive standing.

- Low Market Share: Entry-level Nebula projectors struggle to gain traction against competitors offering superior resolution and brightness.

- Stagnant/Declining Sales: The shift in consumer preference towards higher-spec projectors directly impacts the sales performance of these older models.

- Limited Growth Potential: Without significant upgrades, these projectors face a bleak outlook for future market growth.

- Obsolescence Risk: Continued technological advancements in the projector market increase the risk of these models becoming entirely obsolete.

Anker Innovations' strategy to diversify into numerous product categories, including robotic lawn mowers and 3D printers, resulted in several underperforming "Dog" segments. By 2022, the company had to discontinue ten of these teams due to their inability to gain significant market share or generate sufficient returns, illustrating the classic characteristics of Dogs in the BCG Matrix.

Legacy Anker charging accessories, such as older cables and adapters that do not support USB-C or offer lower power outputs, are prime examples of Dogs. With the market's rapid evolution towards higher-wattage GaN technology and USB-C, demand for these older products has dwindled, likely resulting in minimal profits and tying up valuable inventory.

Soundcore's basic wired earbuds and headphones are also categorized as Dogs. In a market where wireless audio solutions captured an estimated 55-60% of the global earphone market share by 2024, these wired products represent a low-growth, low-market-share segment with limited strategic value.

Older Eufy smart health devices, like basic smart scales, likely fall into the Dogs category. Despite the smart health device market's growth, older, less feature-rich models face intense competition and minimal market share, potentially becoming cash traps as they require investment without substantial returns in a rapidly innovating market.

Question Marks

While Anker's SOLIX balcony energy storage systems are performing strongly, positioning them as Stars in the BCG matrix, the overall portable power station market is a rapidly evolving landscape. This segment is characterized by consistent growth and the continuous introduction of new products and advanced features.

Anker is strategically targeting high-growth, emerging sub-segments within this market, exemplified by their innovative EverForest 2 Electric Cooler. These new ventures require substantial investment to capture market share in competitive yet promising areas, reflecting a Stars or potentially Question Marks strategy depending on current market penetration and investment returns.

Nebula's new 4K projectors, like the Cosmos 4K SE, are entering a rapidly expanding portable 4K projector market. This segment is projected to grow at a compound annual growth rate (CAGR) of 9.5% between 2024 and 2030, fueled by better resolution and smart capabilities. Nebula's move places it in a premium, high-demand category.

Despite the market's strong growth, Nebula faces significant competition from established brands. This competitive landscape means that Nebula will likely need substantial investment to increase its current modest market share and establish itself as a leader in this lucrative, albeit challenging, segment.

Eufy's advanced AI-integrated smart locks and video doorbells are positioned within the burgeoning smart home security market, a sector experiencing robust growth. This market is projected to reach over $50 billion globally by 2027, driven by consumer demand for enhanced home safety and convenience.

While Eufy is investing heavily in AI integration, a key strategy for future differentiation, these specific product lines face intense competition from established players. To ascend to a dominant market position, Eufy must aggressively capture market share, a challenge given the segment's high growth but also its crowded competitive landscape.

Anker AI-Enhanced Peripherals (e.g., new smart displays on chargers)

Anker is strategically integrating AI into its product line, exemplified by its new chargers equipped with smart TFT color screens. These displays offer real-time data and interactive features, marking Anker's entry into the burgeoning AI-enhanced peripherals market. This segment is experiencing rapid growth due to escalating consumer interest in intelligent and connected devices.

These AI-enhanced peripherals, while innovative, currently represent a relatively small portion of Anker's overall market share. The company is investing heavily in research, development, and marketing to establish a stronger foothold in this emerging category. For instance, Anker's investment in AI research and development saw a significant increase in 2023, with projections indicating continued growth through 2024 as they aim to capture a larger share of the smart device market.

- Product Innovation: Anker is introducing AI-powered features into its charging products, like smart displays on chargers.

- Market Opportunity: This move targets the high-growth sector of AI-enhanced peripherals, driven by consumer demand for intelligent devices.

- Current Market Position: These products currently hold a low market share in this new segment, requiring significant investment.

- Strategic Investment: Anker is dedicating substantial resources to marketing and development to drive adoption and market penetration.

Soundcore Sleep/Wellness Audio Devices (e.g., noise-masking earbuds)

Soundcore's venture into sleep and wellness audio devices, like noise-masking earbuds, positions them in a burgeoning niche within the broader audio market. These specialized products, catering to a growing demand for better sleep and relaxation, likely represent a low initial market share for Soundcore. This is because these segments are considered question marks in the BCG matrix, requiring substantial investment in research, development, and consumer education to establish a foothold and capture market share. For example, the global sleep aid market was valued at approximately $70 billion in 2023 and is projected to grow significantly.

- Emerging Niche: Soundcore's sleep and wellness audio devices target a growing segment focused on health and well-being, moving beyond traditional audio entertainment.

- Low Initial Market Share: As these are relatively new and specialized product categories, Soundcore likely holds a small percentage of the market share currently.

- High Investment Required: Success in these nascent markets, classified as question marks, necessitates considerable investment in product innovation and educating consumers about the benefits.

- Growth Potential: The increasing consumer focus on sleep quality and mental wellness suggests a high growth potential for these specialized audio solutions.

Anker's new AI-enhanced peripherals, like chargers with smart TFT color screens, are entering a rapidly growing market. While innovative, these products currently represent a small market share for Anker. The company is investing heavily in R&D and marketing to gain traction in this emerging category, aiming to capture a larger slice of the smart device market.

Soundcore's sleep and wellness audio devices operate in a niche with significant growth potential, driven by increasing consumer interest in health and relaxation. However, these specialized products likely hold a low initial market share. Substantial investment in innovation and consumer education is crucial for Soundcore to establish a strong presence in this question mark segment.

Nebula's 4K projectors are entering a market projected to grow at a 9.5% CAGR from 2024 to 2030. Despite this strong market expansion, Nebula faces intense competition, requiring significant investment to increase its current market share and leadership position.

Eufy's AI-integrated smart home security products are positioned in a market expected to exceed $50 billion globally by 2027. While Eufy is investing in AI for differentiation, these products face fierce competition, necessitating aggressive market share capture strategies.

BCG Matrix Data Sources

Our Anker Innovations BCG Matrix is built on a foundation of robust market data, incorporating financial disclosures, industry growth forecasts, and competitor performance metrics to ensure strategic accuracy.