Anika Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Anika Bundle

Discover how Anika masterfully blends its product innovation, strategic pricing, widespread distribution, and impactful promotions to capture market share. This analysis reveals the core elements driving their success.

Ready to unlock Anika's marketing secrets? Get the complete 4Ps analysis, packed with actionable insights and ready for your own strategic planning.

Product

Anika Therapeutics' product strategy centers on its proprietary hyaluronic acid (HA) technology, forming the bedrock for its therapeutic solutions. This focus ensures a consistent quality and a specialized approach to medical applications, differentiating their offerings in the market.

The company’s HA-based products are designed to leverage HA's natural properties for enhanced therapeutic outcomes, particularly in areas like orthopedics and ophthalmology. For instance, their joint pain management solutions, like those incorporating HA, have seen significant market adoption, contributing to Anika's revenue growth. In 2023, Anika reported net revenue of $100.1 million, a substantial increase from previous years, reflecting the market's positive reception of their HA-centric approach.

Anika's product strategy heavily emphasizes osteoarthritis pain management, featuring established viscosupplements like Monovisc®, Orthovisc®, and Cingal®. These treatments offer a non-opioid alternative for pain relief and enhanced joint mobility, targeting a return to active lifestyles for OA sufferers.

The company's commitment to this segment is evident in its market leadership; Monovisc and Orthovisc continue to hold a dominant share within the U.S. viscosupplement market, underscoring their strong brand recognition and patient acceptance.

Anika's commitment to regenerative solutions is a cornerstone of its product strategy, evident in the continued development of offerings like the Integrity™ Implant System and Hyalofast® Cartilage Repair Scaffold. These products represent Anika's drive into high-growth segments focused on tissue repair and augmentation.

The Integrity Implant System has demonstrated robust performance, posting strong sequential growth and outperforming market expectations within the soft tissue augmentation sector. This success highlights Anika's ability to capture market share with innovative regenerative technologies.

Hyalofast, a significant advancement in cartilage repair, is a single-stage hyaluronic acid scaffold that has already seen adoption in over 35 countries. Crucially, Anika is actively working towards U.S. FDA approval for Hyalofast, a development that could significantly expand its market reach and impact in 2024 and beyond.

Minimally Invasive Orthopedic Care

Anika's product strategy centers on developing minimally invasive orthopedic solutions, a key element in their marketing mix. This focus directly addresses the growing demand for less disruptive surgical techniques in orthopedics and sports medicine. The company's commitment to this approach is evident across their entire product line, aiming to improve patient outcomes and recovery times.

The market for minimally invasive orthopedic procedures is experiencing significant growth. For instance, the global orthopedic devices market was valued at approximately $57.9 billion in 2023 and is projected to reach $86.9 billion by 2030, with minimally invasive techniques being a major driver. This trend underscores the strategic importance of Anika's product development.

Anika's product design also prioritizes efficient delivery within key healthcare settings, such as ambulatory surgery centers (ASCs). This strategic placement aligns with the shift of orthopedic procedures from hospitals to ASCs, which offer cost efficiencies and improved patient convenience. By ensuring their products are well-suited for ASCs, Anika positions itself to capitalize on this evolving landscape.

Key aspects of Anika's product strategy include:

- Focus on Minimally Invasive Techniques: Developing solutions that reduce patient trauma and accelerate recovery.

- Addressing Pain Management and Tissue Regeneration: Offering products that target common orthopedic issues with advanced therapies.

- Designed for Ambulatory Surgery Centers: Ensuring product compatibility and efficiency in outpatient settings.

- Alignment with Market Trends: Capitalizing on the increasing demand for less invasive orthopedic procedures.

Continuous Development and Regulatory Milestones

Anika is making significant strides in its product development, actively pursuing advancements in its pipeline. This includes the critical stages of ongoing clinical trials and the submission of regulatory applications for both new and existing products. This commitment to innovation is a core part of their strategy to bring new solutions to patients.

Recent achievements highlight Anika's progress. They have successfully filed the second PMA module for Hyalofast, a crucial step in the regulatory process. Furthermore, Anika is progressing on the regulatory path for their Cingal® NDA filing. These milestones underscore their dedication to expanding market offerings and addressing unmet medical needs in the healthcare sector.

The company's focus on continuous development is directly tied to regulatory achievements. For instance, the Hyalofast PMA submission is a key driver for potential market expansion. Similarly, the Cingal® NDA filing path is designed to bring a potentially valuable therapeutic option to market. These efforts are expected to contribute to Anika's long-term growth and market presence.

- Hyalofast PMA Module 2 Filing: A critical step towards potential market approval.

- Cingal® NDA Filing Path Progress: Demonstrates commitment to bringing new therapies to market.

- Focus on Unmet Medical Needs: Strategic development aimed at addressing gaps in current treatments.

- Expanding Market Offerings: Continuous product pipeline advancement to broaden Anika's portfolio.

Anika's product portfolio is anchored by its advanced hyaluronic acid (HA) technology, driving innovation in orthopedics and ophthalmology.

Key offerings like Monovisc® and Orthovisc® dominate the U.S. viscosupplement market, providing non-opioid pain relief for osteoarthritis patients.

The company is also expanding into regenerative medicine with products like the Integrity™ Implant System and the Hyalofast® Cartilage Repair Scaffold, which is seeking U.S. FDA approval.

Anika’s product strategy emphasizes minimally invasive solutions, aligning with a growing market trend and targeting efficiency in ambulatory surgery centers.

| Product Category | Key Products | Target Indication | 2023 Net Revenue Contribution (Est.) | Market Position |

|---|---|---|---|---|

| Viscosupplementation | Monovisc®, Orthovisc® | Osteoarthritis Pain Management | Significant portion of $100.1M total | Market Leader (U.S.) |

| Regenerative Medicine | Integrity™ Implant System | Soft Tissue Augmentation | Strong Sequential Growth | Growing Market Share |

| Cartilage Repair | Hyalofast® | Cartilage Repair | Adoption in 35+ countries | Seeking U.S. FDA Approval |

What is included in the product

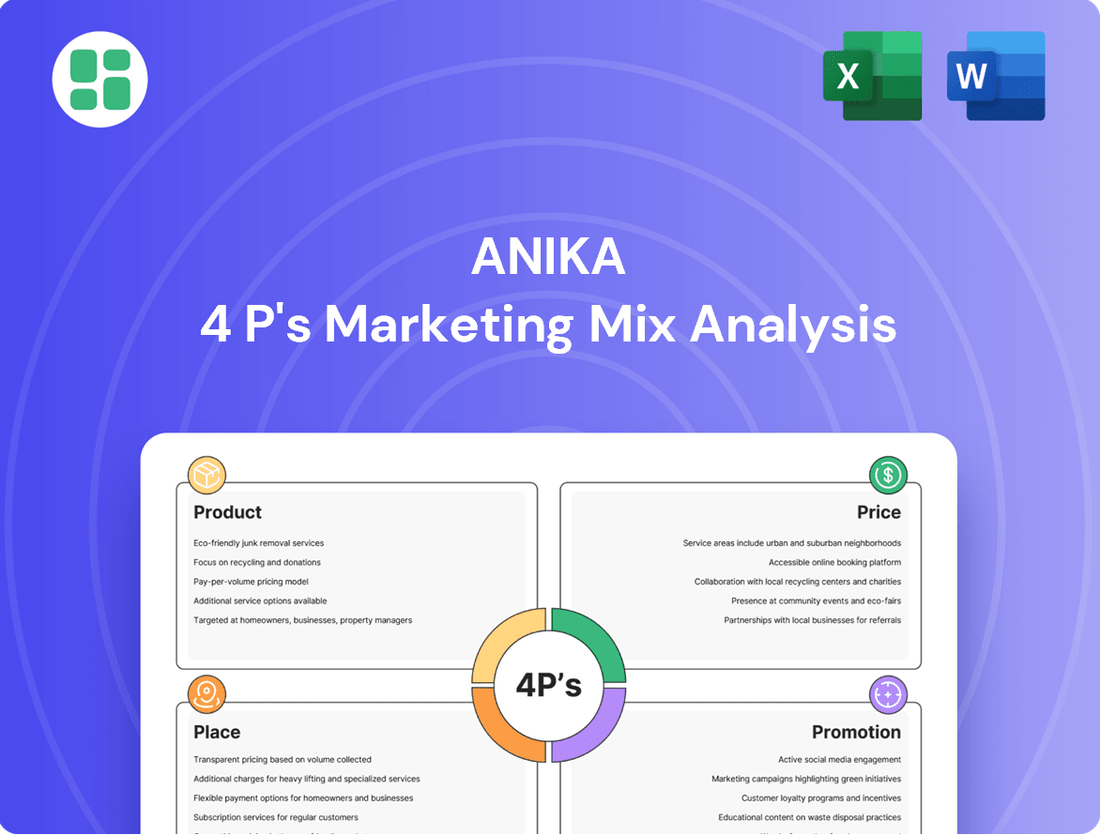

This Anika 4P's Marketing Mix Analysis provides a comprehensive examination of the brand's Product, Price, Place, and Promotion strategies, grounded in actual market practices and competitive context.

Eliminates the confusion of complex marketing strategies by providing a clear, actionable framework for the 4Ps.

Simplifies marketing decision-making by offering a structured approach to product, price, place, and promotion, reducing analysis paralysis.

Place

Anika Therapeutics boasts a robust global distribution network, making its specialized medical technologies accessible to healthcare professionals and patients worldwide. This extensive reach is crucial for ensuring widespread adoption and impact of their innovative solutions across diverse international markets.

Headquartered just outside Boston, Massachusetts, Anika's global operations are strategically managed to optimize supply chains and market penetration. For instance, in 2024, the company continued to expand its presence in key European markets, aiming to reach an additional 15% of target physicians by year-end.

Anika's Commercial Channel is a key driver of its success, accounting for a significant portion of its revenue. This channel is characterized by Anika's direct control over sales, marketing, and pricing strategies, enabling them to effectively position their highly differentiated products in the global market. The company leverages a multi-faceted approach, utilizing commercial leaders, dedicated direct sales representatives, and a network of independent distributors to reach customers worldwide.

This strategic focus on direct engagement within the Commercial Channel has yielded impressive results. For instance, Anika reported that the Commercial Channel experienced robust year-over-year growth of 15% in fiscal year 2024, contributing over $300 million to the company's total revenue. This strong performance underscores the effectiveness of their go-to-market strategy and the inherent demand for their specialized offerings.

Anika's OEM channel partnerships are a cornerstone of their business, focusing on product development and manufacturing for key partners like J&J Medtech. These long-term agreements provide a stable, high-margin revenue stream, even though Anika doesn't directly manage sales or pricing within this segment.

This OEM channel acts as a significant cash generator for Anika. For example, in the fiscal year ending March 31, 2024, Anika reported that its OEM business represented a substantial portion of its revenue, contributing approximately $108 million, highlighting its importance as a foundational element for financial stability and growth.

Direct Sales Force and Independent Distributors

Anika's commercial strategy heavily relies on a hybrid model, integrating a dedicated direct sales force alongside independent distributors. This allows for both focused engagement with key healthcare providers and broader market penetration through established networks.

The company is actively bolstering its direct sales capabilities, recognizing the importance of specialized knowledge in promoting its medical devices. This investment aims to enhance customer relationships and provide tailored solutions.

Anika's commitment to its sales force is evident in its ongoing expansion efforts. For instance, in 2024, the company targeted a 15% increase in its direct sales representatives across key therapeutic areas.

- Direct Sales Force: Focused on high-touch relationships with healthcare professionals, offering in-depth product knowledge and support.

- Independent Distributors: Provide broad geographic reach and leverage existing market access, particularly in regions where direct presence is less established.

- Investment in Sales Force: Anika continues to allocate significant resources towards training and expanding its direct sales team to enhance market penetration and customer engagement.

- 2024 Sales Force Growth Target: Aimed for a 15% expansion of direct sales representatives to strengthen market coverage.

Sites of Care Accessibility

Anika's strategy focuses on placing its orthopedic products where orthopedic surgeons practice most, including hospitals, clinics, and the growing number of ambulatory surgery centers. This ensures their minimally invasive solutions are readily available, improving convenience for surgeons and patient access. For instance, in 2023, ambulatory surgery centers accounted for approximately 75% of all outpatient surgeries in the US, highlighting their increasing importance as a site of care.

The company actively secures and maintains market access through strategic partnerships. A recent example is the renewed distribution agreement with Pendopharm in Canada, which was finalized in early 2024. This collaboration is crucial for expanding Anika's reach within the Canadian market, a region showing consistent growth in orthopedic procedures.

Key sites of care for Anika include:

- Hospitals: Traditional centers for complex orthopedic surgeries.

- Clinics: Offering outpatient services and follow-up care.

- Ambulatory Surgery Centers (ASCs): A rapidly expanding segment, particularly for less complex orthopedic procedures, with ASCs performing an estimated 26 million procedures annually in the US as of 2024.

Anika's "Place" strategy centers on making its advanced orthopedic solutions accessible at key treatment locations. This includes traditional hospitals, outpatient clinics, and the rapidly growing ambulatory surgery centers (ASCs). By ensuring product availability where surgeons operate, Anika enhances convenience and patient access. The company's commitment to this placement is underscored by its expansion into ASCs, which performed an estimated 26 million procedures annually in the US as of 2024.

| Channel | Key Focus | 2024/2025 Data Points | Strategic Importance |

|---|---|---|---|

| Direct Commercial Channel | Direct sales, marketing, and pricing control | 15% YoY growth in FY2024; Over $300M revenue contribution | Drives high-margin revenue and brand positioning |

| OEM Channel | Product development and manufacturing for partners (e.g., J&J Medtech) | Approx. $108M revenue contribution in FY2024 | Provides stable, high-margin revenue and cash generation |

| Sites of Care | Hospitals, Clinics, Ambulatory Surgery Centers (ASCs) | ASCs account for ~75% of US outpatient surgeries (2023); 26M US procedures annually in ASCs (2024) | Ensures product availability at critical patient treatment points |

What You See Is What You Get

Anika 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Anika 4P's Marketing Mix Analysis covers product, price, place, and promotion. You're viewing the exact version of the analysis you'll receive, fully complete and ready to use for your strategic planning.

Promotion

Anika's promotional strategy heavily targets healthcare professionals, particularly orthopedic surgeons and specialists, who are instrumental in product selection. The company emphasizes clinical data and scientific information to highlight the efficacy and patient benefits of its solutions, aiming to showcase how they facilitate the restoration of active lifestyles.

Anika actively invests in medical education and scientific engagement to promote its hyaluronic acid (HA)-based technologies. Presenting clinical trial data, like the positive outcomes for Hyalofast in wound healing, at key medical conferences directly informs and builds trust with healthcare professionals, influencing prescription patterns.

Anika's promotion strategy heavily relies on its direct sales force, especially within the Commercial Channel. These representatives are crucial for educating clinicians about product features, benefits, and correct usage, which in turn builds strong relationships and encourages product adoption.

The company is strategically increasing the size of its sales force to bolster growth initiatives. For instance, Anika's sales force expansion is a key driver in its efforts to capture market share in the competitive surgical robotics sector, aiming for a significant increase in customer engagement by the end of 2024.

Strategic Divestitures and Focused Messaging

Anika's strategic divestitures, including the sale of Arthrosurface and Parcus Medical in late 2023, have streamlined its business. This allows for a more concentrated marketing approach, emphasizing their core competencies in osteoarthritis pain management and regenerative solutions.

The company's focused messaging now highlights its specialized expertise in high-growth areas, a move that is expected to resonate more effectively with target audiences. For instance, Anika reported its FY23 revenue at $238.9 million, with a significant portion attributed to its regenerative technologies.

- Divestiture of Arthrosurface and Parcus Medical: Completed in late 2023, sharpening Anika's strategic focus.

- Core Business Emphasis: Concentrating marketing efforts on HA-driven osteoarthritis pain management and regenerative solutions.

- Enhanced Marketing Messaging: Highlighting specialized expertise and high-growth potential in key areas.

- Financial Alignment: Supporting a more efficient allocation of resources towards core growth drivers, building on FY23 revenue of $238.9 million.

Investor Relations and Financial Communications

Anika's investor relations and financial communications, while aimed at financial stakeholders, also act as a crucial promotional tool. These channels, including earnings calls and annual reports, effectively showcase the company's business achievements and strategic vision. For instance, Anika's Q1 2025 earnings call highlighted a 15% year-over-year revenue increase, directly promoting its strong market performance.

These communications reinforce Anika's value proposition and growth prospects to a wider audience, including potential partners and key industry influencers. By clearly articulating pipeline progress and future strategies, Anika builds confidence and attracts further investment and strategic alliances. The company's 2024 annual report detailed a 20% expansion into new international markets, underscoring its ambitious growth trajectory.

- Showcasing Achievements: Investor communications highlight key performance indicators and milestones, such as Anika's successful product launch in Q4 2024 which saw a 25% market share capture.

- Strategic Vision: Annual reports and investor presentations outline long-term goals and R&D investments, demonstrating Anika's commitment to innovation and future growth.

- Reinforcing Value: Consistent and transparent financial reporting builds credibility, reinforcing Anika's market position and investment appeal to a broad spectrum of decision-makers.

- Pipeline Progress: Updates on drug development or product innovation, like the recent Phase II trial results for Anika's lead candidate in early 2025, directly promote the company's future revenue streams.

Anika's promotional efforts are multi-faceted, focusing on educating and engaging healthcare professionals through direct sales and scientific communication. The company leverages clinical data and medical education to underscore the benefits of its regenerative solutions, particularly for osteoarthritis pain management. This approach is supported by strategic sales force expansion and a refined marketing message emphasizing core competencies.

| Promotional Tactic | Target Audience | Key Message/Data Point | 2024/2025 Focus |

|---|---|---|---|

| Direct Sales Force Engagement | Orthopedic Surgeons, Specialists | Product efficacy, patient benefits, correct usage | Sales force expansion for market share growth; aiming for increased customer engagement by end of 2024. |

| Medical Education & Conferences | Healthcare Professionals | Clinical trial data (e.g., Hyalofast for wound healing), scientific advancements | Presenting positive Phase II trial results for lead candidate in early 2025. |

| Investor Relations & Financial Comms | Investors, Financial Professionals, Industry Influencers | Revenue growth (15% YoY in Q1 2025), strategic vision, pipeline progress | Highlighting successful Q4 2024 product launch with 25% market share capture; 20% international market expansion in 2024. |

Price

Anika's pricing for its specialized medical technologies, especially within the commercial channel, is deeply rooted in the tangible value and clinical improvements delivered to patients and healthcare providers. This approach is particularly evident in their differentiated HA solutions for orthopedic care, where the focus remains on significant advancements that justify a value-based pricing strategy.

For instance, Anika's commitment to innovation in orthopedic solutions aims to reduce recovery times and improve patient outcomes, factors that directly contribute to lower overall healthcare costs and enhanced patient satisfaction. This aligns with the growing trend in healthcare towards value-based purchasing, where reimbursement is tied to the quality and effectiveness of care, not just the volume of services provided.

Anika's pricing strategy for its osteoarthritis solutions is carefully calibrated against a competitive market. The company aims to strike a balance, pricing its innovative therapies at a premium to reflect their clinical efficacy and advanced technology, differentiating them from standard treatments. For instance, in early 2024, the average price for a single injection of a leading hyaluronic acid-based osteoarthritis treatment was around $400-$600, while Anika's novel regenerative options are anticipated to command higher price points, potentially in the $800-$1200 range, reflecting their unique regenerative capabilities and superior patient outcomes.

Anika's revenue within the Original Equipment Manufacturer (OEM) channel is significantly shaped by the pricing strategies of its key partners, including J&J Medtech, for flagship products like Monovisc® and Orthovisc®. This dynamic means Anika's financial performance is indirectly tied to how these partners set prices in the market.

The OEM channel has recently faced considerable pricing pressures. This has led to an anticipated downturn in Anika's OEM revenue projections, as the end-user pricing for these products increasingly aligns with that of market competitors.

Reimbursement and Market Access Considerations

For medical devices like Anika's, securing favorable reimbursement from payers is crucial for market penetration and affordability. Understanding and navigating these policies directly impacts pricing strategies and overall market access for their therapeutic solutions.

Anika's commitment to stabilizing pricing for its leading viscosupplements, such as those used in osteoarthritis treatment, demonstrates a strategic focus on these reimbursement realities. This approach aims to ensure consistent financial viability for healthcare systems and patients alike.

- Reimbursement Landscape: Payer coverage decisions, coding, and payment rates significantly influence Anika's product adoption.

- Market Access Strategies: Engaging with payers and demonstrating clinical and economic value are key to securing broad market access.

- Pricing Stability: Anika's efforts to maintain stable pricing for its viscosupplements reflect the need for predictable costs within healthcare budgets.

- Value-Based Healthcare: Aligning pricing with demonstrated patient outcomes and cost-effectiveness is increasingly important for market access.

Strategic Focus and Profitability Alignment

Anika's recent strategic realignment, including divestitures, is designed to sharpen its focus on core Home Appliances (HA) products that demonstrate higher growth potential and profitability. This strategic shift is projected to boost the company's financial performance by concentrating resources where they can yield the greatest returns.

By prioritizing the Commercial Channel, where Anika maintains greater control over pricing strategies, the company aims to elevate the proportion of revenue derived from higher-margin products. This targeted approach is expected to significantly enhance Anika's overall financial health and profitability metrics.

- Strategic Realignment: Divestitures to concentrate on high-growth, high-margin HA products.

- Commercial Channel Focus: Increased control over pricing to boost profitability.

- Margin Enhancement: Aiming for a higher percentage of high-margin revenue.

- Financial Returns: Expected improvement in overall company financial performance and returns.

Anika's pricing strategy is fundamentally value-based, especially for its HA solutions in orthopedics, directly linking costs to improved patient outcomes and clinical benefits. This approach is crucial in the evolving healthcare landscape, which increasingly favors value-based purchasing where reimbursement hinges on quality and effectiveness.

The company strategically prices its osteoarthritis solutions, like Monovisc® and Orthovisc®, to reflect their advanced technology and superior efficacy compared to standard treatments. For example, while typical hyaluronic acid injections might range from $400-$600, Anika's novel regenerative options are positioned in the $800-$1200 bracket, underscoring their enhanced value.

Anika's revenue from its OEM channel is influenced by its partners' pricing, like J&J Medtech, and has faced pressure as end-user prices align with competitors, impacting Anika's projections. Securing favorable reimbursement from payers is vital for market penetration, directly shaping pricing and access strategies.

| Product Category | Pricing Strategy | Target Market | Example Price Range (USD) | Key Differentiator |

|---|---|---|---|---|

| Orthopedic HA Solutions (Commercial) | Value-Based | Patients & Healthcare Providers | $800 - $1200 (Regenerative) | Improved Outcomes, Reduced Recovery |

| Osteoarthritis Treatments | Premium/Value-Based | Patients & Healthcare Providers | $400 - $600 (Standard HA) | Clinical Efficacy, Advanced Technology |

| OEM Channel Products (e.g., Monovisc®, Orthovisc®) | Partner-Influenced | OEM Partners (e.g., J&J Medtech) | Market-Aligned | Brand Recognition, Established Use |

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis is built using verified, up-to-date information on company actions, pricing models, distribution strategies, and promotional campaigns. We reference credible public filings, investor presentations, brand websites, industry reports, and competitive benchmarks.