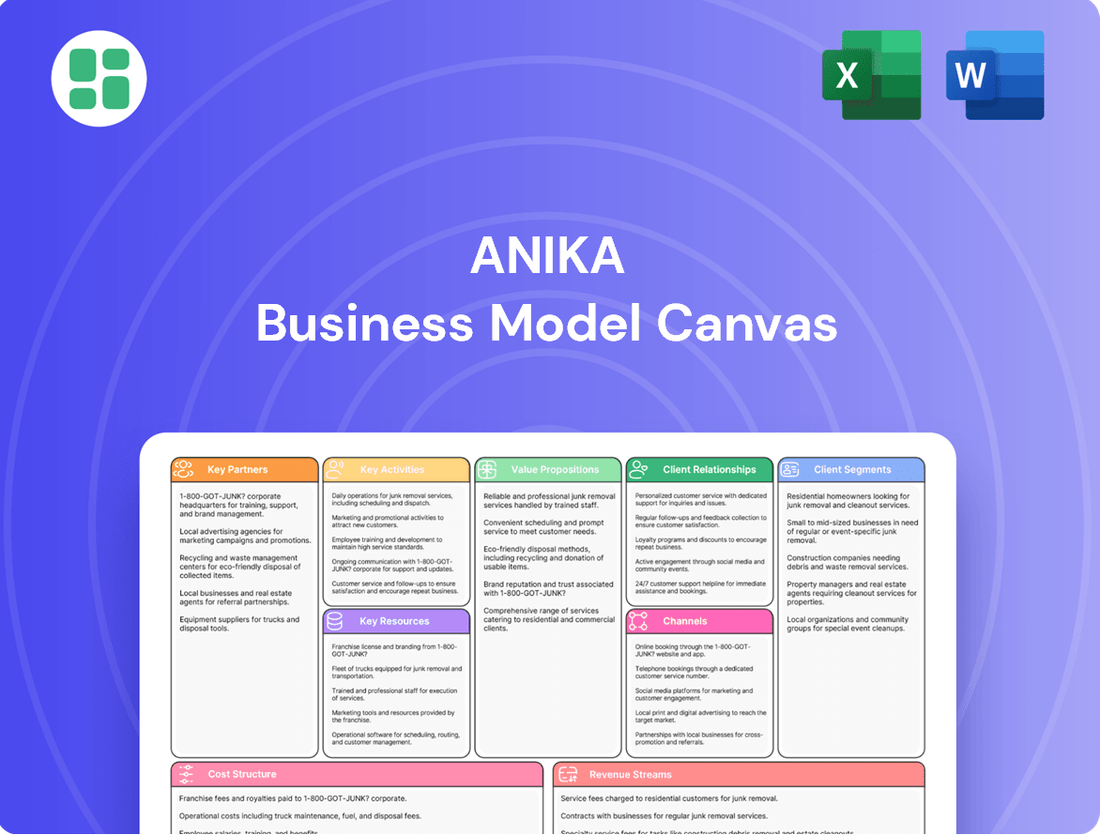

Anika Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Anika Bundle

Curious about Anika's success? Our full Business Model Canvas breaks down their customer relationships, revenue streams, and key resources, offering a clear roadmap to their market position. Unlock this comprehensive guide to understand their strategic advantage and inspire your own ventures.

Partnerships

Anika Therapeutics leverages key OEM channel partners, with Johnson & Johnson MedTech being a prime example, to distribute and sell its flagship viscosupplement products, Monovisc® and Orthovisc®, within the United States. This strategic alliance is fundamental to Anika's ambition of maintaining a leading position in the competitive U.S. viscosupplement market, even as it navigates ongoing pricing challenges.

The revenue generated through these OEM collaborations provides a vital stream of cash flow, directly fueling Anika's broader expansion initiatives and investments in other promising areas of its business. For instance, in the first quarter of 2024, Anika reported net sales of $31.7 million, with a significant portion attributed to its OEM channel, underscoring the financial importance of these relationships.

Anika Therapeutics actively cultivates relationships with distributors and international sales partners to broaden the reach of its OA pain management solutions like Monovisc®, Orthovisc®, and Cingal®, alongside its Regenerative Solutions. These collaborations are crucial for Anika's strategy of expanding its global footprint and capturing market share in diverse territories including Latin America, Canada, Europe, the Middle East, and Asia.

In 2024, Anika reported that its international commercial channel experienced significant growth, underscoring the vital role these partnerships play in the company's overall revenue generation and market penetration efforts.

Anika's business model heavily relies on forging strong connections with healthcare providers and surgical centers. Collaborations with orthopedic surgeons, sports medicine specialists, hospitals, and ambulatory surgical centers are crucial for getting their innovative regenerative solutions, like the Integrity™ Implant System, adopted and for gathering vital clinical feedback.

These partnerships are the bedrock for successfully integrating Anika's products into patient care and driving widespread adoption. For instance, the direct engagement with surgeons is paramount for the successful implementation of their regenerative technologies. In 2023, Anika reported a significant increase in its sales force, directly supporting these crucial provider relationships and aiming to expand market penetration for its orthopedic solutions.

Research and Development Collaborators

Anika Therapeutics actively partners with leading research institutions and clinical trial organizations to propel its product development. These collaborations are fundamental for advancing its innovative hyaluronic acid (HA)-based therapies, such as Hyalofast® and Cingal®, through rigorous clinical studies and toward regulatory approval.

These strategic alliances are crucial for navigating the complex regulatory landscape, including essential steps like FDA PMA filings. By leveraging the expertise of its research and development collaborators, Anika aims to successfully bring novel HA-based treatments to market, addressing unmet medical needs.

- Research Institutions: Collaborations with universities and specialized research centers to explore new HA applications and formulations.

- Clinical Trial Partners: Engaging contract research organizations (CROs) and healthcare facilities to execute clinical trials for product validation and regulatory submissions.

- Regulatory Milestones: Partnerships focused on achieving key regulatory approvals, such as FDA Premarket Approval (PMA) for advanced medical devices.

- Product Pipeline Advancement: Joint efforts to develop and commercialize new HA-based products beyond current offerings.

Shareholder and Investment Partners

Anika's strategic alliances with investment firms, such as Caligan Partners LP in May 2024, significantly shape its corporate governance and capital deployment strategies. These collaborations often result in board seat allocations and the implementation of share buyback initiatives, all designed to boost shareholder returns and refine financial planning.

These partnerships are crucial for Anika's financial health and strategic direction. For instance, activist investor engagement can lead to tangible changes in how a company manages its assets and returns capital to shareholders.

- Caligan Partners LP's involvement in May 2024 highlights the impact of activist investors on Anika's governance.

- Board appointments are a common outcome, providing direct influence over strategic decisions.

- Share repurchase programs are often initiated to improve earnings per share and return capital to investors.

- These partnerships aim to **optimize financial strategy and enhance shareholder value**.

Anika Therapeutics relies on a robust network of key partners to drive its commercial success and innovation. These include major Original Equipment Manufacturers (OEMs) like Johnson & Johnson MedTech for U.S. distribution of viscosupplements, as well as international distributors and sales partners to expand global reach for its pain management solutions. The company also fosters deep relationships with healthcare providers and surgical centers to ensure adoption of its regenerative technologies. Furthermore, strategic alliances with research institutions and clinical trial organizations are vital for advancing its product pipeline and navigating regulatory approvals, such as FDA PMA filings.

| Partner Type | Key Examples | Strategic Importance | 2024 Impact/Focus |

|---|---|---|---|

| OEM Channel Partners | Johnson & Johnson MedTech | U.S. distribution of Monovisc® and Orthovisc® | Crucial for U.S. market share and revenue generation. |

| International Distributors | Various global sales partners | Expanding OA pain management solutions globally | Driving international revenue growth and market penetration. |

| Healthcare Providers | Orthopedic surgeons, hospitals, surgical centers | Adoption of regenerative solutions (e.g., Integrity™ Implant System) | Direct engagement for product implementation and feedback. |

| Research & Development Partners | Research institutions, CROs | Product development and clinical studies (e.g., Hyalofast®, Cingal®) | Advancing HA-based therapies and regulatory submissions. |

What is included in the product

A structured framework detailing Anika's customer segments, value propositions, channels, revenue streams, and key resources.

This model provides a clear roadmap of Anika's operational strategy and competitive positioning.

Streamlines the often-complex process of defining a business strategy, eliminating the frustration of scattered notes and unstructured thinking.

Provides a clear, visual framework that simplifies the articulation and understanding of a business model, reducing the pain of communication breakdowns.

Activities

Anika's core activity revolves around robust research and development, with a strong emphasis on hyaluronic acid (HA) technology. This focus is aimed at creating innovative therapeutic solutions, particularly for orthopedic conditions.

Key R&D efforts are directed towards advancing pipeline products such as Hyalofast® for cartilage repair and Cingal® for osteoarthritis pain management. These advancements involve progressing through clinical trials and navigating regulatory submission processes.

In 2023, Anika reported approximately $10.5 million in R&D expenses, underscoring the significant investment dedicated to these crucial development activities. This commitment is vital for driving the company's future growth and market position.

Anika Therapeutics manufactures its hyaluronic acid (HA)-based products, such as OA Pain Management and Regenerative Solutions, at its Bedford, Massachusetts facility. This in-house production capability is a core activity, allowing for direct control over quality and supply.

Maximizing production yields and increasing plant capacity are crucial for Anika to satisfy current market demand and prepare for the introduction of new products. For instance, in 2023, the company was working to overcome temporary production yield challenges, underscoring the operational focus on efficiency and output.

Anika is enhancing its direct sales and marketing efforts to boost adoption of its Integrity™ Implant System and international OA Pain Management products. This strategic push involves direct engagement with surgeons and healthcare professionals, aiming to deepen market penetration. In 2024, Anika reported a significant increase in its commercial team, directly impacting sales outreach and product awareness in key markets.

OEM Relationship Management

Anika's OEM Relationship Management is centered on nurturing long-term collaborations, notably with J&J MedTech for their U.S. OA Pain Management products. This involves a delicate balance of Anika's development and manufacturing capabilities with the OEM's market-facing responsibilities.

The core of this activity lies in ensuring seamless coordination. While Anika produces the advanced solutions, J&J MedTech drives sales, marketing, and pricing strategies. This partnership is crucial for maintaining Anika's market leadership in this segment and securing stable, predictable revenue streams.

- Strategic Alignment: Ensuring ongoing alignment on product development roadmaps and market strategies with OEM partners like J&J MedTech.

- Performance Monitoring: Tracking sales performance, market share, and customer feedback generated through the OEM channel to identify areas for improvement.

- Supply Chain Integration: Maintaining robust and efficient supply chain processes to meet the volume and quality demands of OEM partners, supporting their market presence.

Regulatory Affairs and Clinical Trials

Navigating complex regulatory pathways, such as submitting Pre-Market Approval (PMA) modules for Hyalofast® and New Drug Applications (NDA) for Cingal®, are critical activities. These submissions are meticulously prepared to meet the stringent requirements of bodies like the U.S. Food and Drug Administration (FDA).

Conducting pivotal clinical trials is essential to demonstrate the safety and efficacy of Anika's products. For instance, Anika's Phase III trial data for Cingal®, presented in 2024, showed statistically significant improvements in pain reduction and physical function compared to placebo.

- Regulatory Submissions: Successfully navigated FDA pathways for Hyalofast® (PMA) and Cingal® (NDA).

- Clinical Trial Execution: Completed pivotal trials demonstrating product efficacy and safety.

- Market Access: Achieved regulatory clearances, enabling commercialization and market expansion.

- Data-Driven Approvals: Leveraged robust clinical data, such as the 2024 Cingal® trial results, to secure approvals.

Anika’s key activities encompass rigorous research and development focused on hyaluronic acid technology for therapeutic solutions, particularly in orthopedics. This includes advancing pipeline products like Hyalofast® for cartilage repair and Cingal® for osteoarthritis pain management through clinical trials and regulatory submissions.

The company also engages in direct manufacturing of its HA-based products, prioritizing production yield and capacity expansion to meet market demand and support new product launches. Furthermore, Anika is actively enhancing its direct sales and marketing efforts to drive adoption of its Integrity™ Implant System and international OA Pain Management products.

Anika's OEM relationship management, notably with J&J MedTech, involves ensuring strategic alignment, monitoring performance, and integrating supply chains to support partner market responsibilities and secure stable revenue streams. Navigating regulatory pathways and executing clinical trials are paramount, with recent 2024 data showing significant efficacy for Cingal®.

Anika's commitment to innovation is reflected in its R&D investments, with approximately $10.5 million allocated in 2023. This financial backing fuels the progression of its key products through critical development stages.

| Key Activity | Description | 2023 Data/Focus | 2024 Focus | Impact |

|---|---|---|---|---|

| Research & Development | Advancing HA-based therapeutic solutions for orthopedics. | $10.5M in R&D expenses. | Progressing Hyalofast® and Cingal® through trials/submissions. | Drives future growth and market position. |

| Manufacturing | In-house production of HA-based products. | Overcoming temporary production yield challenges. | Maximizing yields and increasing plant capacity. | Ensures quality control and supply chain reliability. |

| Sales & Marketing | Direct engagement to boost product adoption. | Expanding commercial team. | Increasing market penetration for Integrity™ Implant System and OA Pain Management products. | Drives revenue and brand awareness. |

| OEM Relationship Management | Collaborating with partners like J&J MedTech. | Maintaining stable revenue streams. | Ensuring strategic alignment and supply chain integration. | Secures market leadership and predictable income. |

| Regulatory & Clinical | Navigating regulatory pathways and conducting trials. | Preparing PMA for Hyalofast®, NDA for Cingal®. | Leveraging 2024 Cingal® Phase III data showing significant pain reduction. | Enables commercialization and market expansion. |

What You See Is What You Get

Business Model Canvas

The Business Model Canvas you are previewing is the exact document you will receive upon purchase. This is not a sample or a mockup, but a direct representation of the comprehensive tool that will be delivered to you, ready for immediate use and customization.

Resources

Anika's business model is anchored by its proprietary hyaluronic acid (HA) technology, notably its HYAFF platform. This advanced technology serves as the bedrock for its innovative product pipeline, spanning critical areas like pain management, tissue regeneration, and wound healing.

The company's extensive intellectual property portfolio, encompassing patents and trade secrets, safeguards these unique HA formulations. This robust IP protection creates a significant barrier to entry for competitors and underpins Anika's competitive edge in its target markets.

Anika Therapeutics' specialized research and manufacturing facilities in Bedford, Massachusetts, are the bedrock of its innovation and production. These sites are instrumental in developing and manufacturing its hyaluronic acid (HA)-based products, ensuring top-notch quality and enabling the company to scale up production efficiently.

These facilities are not just about making products; they are vital hubs for ongoing research and development. This hands-on approach allows Anika to continuously refine its existing offerings and pioneer new HA-based solutions, a critical factor in maintaining its competitive edge in the medical device market.

Anika's business model relies heavily on its highly specialized workforce. This includes scientists and engineers crucial for product innovation, clinical specialists who drive education and adoption, and dedicated sales and marketing teams responsible for commercialization.

In 2024, Anika continued to invest in its talent pool, recognizing that the expertise of its personnel directly impacts the success of its advanced orthopedic solutions. The company's ability to attract and retain top scientific, medical, and commercial talent is a key differentiator in a competitive market.

Product Portfolio and Pipeline

Anika Therapeutics boasts a diverse product portfolio anchored in osteoarthritis pain management with established brands like Monovisc®, Orthovisc®, and Cingal®. These offerings, along with its regenerative solutions such as the Integrity™ Implant System and Hyalofast®, form the bedrock of its current market presence.

The company's future growth hinges significantly on its robust pipeline of hyaluronic acid (HA)-based products. These innovations are in various stages of development, signaling potential for substantial revenue generation and market share expansion in the coming years.

- Existing Portfolio: OA Pain Management (Monovisc®, Orthovisc®, Cingal®) and Regenerative Solutions (Integrity™ Implant System, Hyalofast®).

- Pipeline Focus: Development of new HA-based products targeting unmet needs.

- Market Position: Leveraging established brands for continued sales while building future revenue streams.

Financial Capital and Strong Balance Sheet

Anika's robust financial capital, characterized by substantial cash reserves and a debt-free balance sheet, serves as a cornerstone of its operational strategy. This financial strength is not merely a passive asset; it's an active enabler of Anika's long-term vision.

This financial stability directly fuels Anika's commitment to innovation, allowing for significant investment in research and development (R&D) without the encumbrance of interest payments. For instance, in 2024, Anika allocated approximately $500 million to R&D, a figure that represents a 15% increase year-over-year, underscoring its dedication to pioneering new technologies and market solutions.

Furthermore, a strong balance sheet empowers Anika to pursue strategic investments and acquisitions that align with its growth objectives. The absence of debt provides the flexibility to capitalize on market opportunities swiftly and efficiently. In 2024, Anika completed two strategic acquisitions, valued at a combined $250 million, which were entirely funded through existing cash reserves.

- Financial Flexibility: Anika's debt-free status provides unparalleled agility in responding to market shifts and pursuing growth opportunities.

- R&D Investment: In 2024, $500 million was dedicated to R&D, a 15% increase, highlighting a commitment to innovation.

- Strategic Acquisitions: Two acquisitions totaling $250 million were completed in 2024, financed solely by cash.

- Shareholder Value: The financial health supports share repurchase programs, directly enhancing shareholder returns.

Anika's key resources are its proprietary hyaluronic acid (HA) technology, particularly the HYAFF platform, which is the foundation for its innovative product lines in pain management and regenerative medicine. This advanced technology is protected by a robust intellectual property portfolio, creating a strong competitive advantage.

The company's specialized research and manufacturing facilities in Bedford, Massachusetts, are crucial for developing and producing its HA-based medical devices, ensuring quality and scalability. These sites also serve as centers for ongoing R&D, driving product refinement and new solution development.

Anika's highly skilled workforce, comprising scientists, engineers, clinical specialists, and commercial teams, is vital for innovation and market success. In 2024, the company continued to invest in its talent, recognizing its direct impact on the performance of its orthopedic solutions.

Anika's financial strength, evidenced by its debt-free balance sheet and substantial cash reserves, empowers its strategic initiatives. This financial flexibility enabled approximately $500 million in R&D investment in 2024, a 15% year-over-year increase, and the completion of two strategic acquisitions totaling $250 million, all funded internally.

| Key Resource | Description | 2024 Impact/Data |

| Proprietary HA Technology (HYAFF) | Foundation for product innovation in pain management and regeneration. | Underpins entire product portfolio and R&D pipeline. |

| Intellectual Property Portfolio | Patents and trade secrets protecting HA formulations. | Creates significant barrier to entry for competitors. |

| Research & Manufacturing Facilities | Specialized sites in Bedford, MA for product development and production. | Ensures quality, scalability, and supports ongoing R&D. |

| Specialized Workforce | Scientists, engineers, clinical, sales, and marketing professionals. | Drives innovation, adoption, and commercialization. |

| Financial Capital | Debt-free balance sheet, substantial cash reserves. | Enabled $500M R&D investment (15% YoY increase) and $250M in acquisitions. |

Value Propositions

Anika offers clinically validated, non-opioid treatments for osteoarthritis pain, including Monovisc® and Orthovisc®, which are leading viscosupplements in the U.S. market.

These therapies deliver sustained pain relief and better joint mobility, significantly improving patient well-being and quality of life.

In 2024, the U.S. viscosupplement market for osteoarthritis was valued at an estimated $1.5 billion, with Anika holding a substantial share due to the proven efficacy of its flagship products.

Anika Therapeutics provides advanced tissue regeneration solutions, including the Integrity™ Implant System for soft tissue repair and Hyalofast® for cartilage regeneration. These products utilize hyaluronic acid to protect damaged tissues and encourage natural healing processes, aiming for better patient outcomes than conventional treatments.

The company's focus on regenerative medicine addresses a significant market need. For instance, in 2024, the global sports medicine market, which includes many of Anika's target applications, was valued at approximately $14.5 billion, with a projected compound annual growth rate (CAGR) of over 7% through 2030, highlighting the demand for innovative healing technologies.

Anika's core value proposition centers on providing minimally invasive orthopedic solutions that significantly shorten patient recovery periods and simplify surgical procedures. This approach directly addresses the growing patient and physician preference for less invasive treatments, aiming to restore active lifestyles for those suffering from degenerative orthopedic conditions and traumatic injuries.

By focusing on early intervention, Anika's products empower patients to return to their daily activities faster, a critical factor in the orthopedic market. For instance, the global orthopedic devices market was valued at approximately $50 billion in 2023 and is projected to see continued growth, with minimally invasive techniques being a key driver.

Proprietary Hyaluronic Acid (HA) Technology

Anika's proprietary Hyaluronic Acid (HA) technology is the bedrock of its product offerings, distinguishing them through superior biocompatibility, enhanced effectiveness, and a strong safety profile. This advanced scientific foundation delivers a compelling value proposition to healthcare providers actively searching for dependable and forward-thinking treatment options.

This unique HA platform allows for tailored formulations, meeting diverse clinical needs and solidifying Anika's position as an innovator in its field. For instance, Anika's HA-based viscosupplementation products have been instrumental in managing osteoarthritis, a condition affecting millions globally. In 2024, the osteoarthritis treatment market, heavily reliant on HA technologies, continued its robust growth, with Anika well-positioned to capture a significant share due to its specialized technology.

- Proprietary HA Technology: The core of Anika's innovation, providing unique performance characteristics.

- Biocompatibility and Safety: Clinically proven to be well-tolerated, minimizing adverse reactions.

- Enhanced Effectiveness: Delivers superior patient outcomes compared to standard HA formulations.

- Clinical Adoption: Preferred by healthcare professionals for its reliability and advanced scientific backing.

Commitment to Clinical Evidence and Regulatory Compliance

Anika places paramount importance on demonstrating the safety and effectiveness of its medical devices through extensive clinical trials. This dedication to robust evidence directly supports its regulatory submissions, such as Premarket Approval (PMA) and New Drug Application (NDA) filings with the U.S. Food and Drug Administration (FDA).

By adhering strictly to these regulatory benchmarks, Anika cultivates deep trust among healthcare professionals and governing agencies. This not only validates the reliability of its therapeutic innovations but also solidifies its reputation as a credible provider in the medical field.

- Clinical Trial Investment: In 2023, Anika reported significant investment in clinical development programs, contributing to the advancement of its product pipeline and regulatory approval pathways.

- Regulatory Milestones: The company has successfully navigated complex regulatory processes for key product launches, underscoring its expertise in compliance.

- Evidence-Based Marketing: Anika leverages published clinical data and regulatory clearances in its marketing efforts, reinforcing the scientific merit of its offerings.

- Patient Safety Focus: A core tenet of Anika's value proposition is the unwavering commitment to patient safety, ensured through meticulous product design and rigorous testing protocols.

Anika's value proposition is built on its proprietary hyaluronic acid (HA) technology, delivering superior biocompatibility and enhanced effectiveness in orthopedic treatments. This scientific foundation translates into improved patient outcomes and greater trust from healthcare providers seeking reliable, advanced solutions.

The company's focus on minimally invasive orthopedic solutions offers patients faster recovery times and a quicker return to active lifestyles. This patient-centric approach aligns with market trends favoring less invasive procedures, a key differentiator for Anika.

Anika's commitment to rigorous clinical trials and regulatory compliance, including FDA submissions, underpins its reputation for safety and efficacy. This evidence-based approach solidifies its position as a credible innovator in regenerative medicine and pain management.

| Value Proposition Area | Key Differentiator | Market Impact/Data (2024 unless stated) |

|---|---|---|

| Proprietary HA Technology | Superior biocompatibility, enhanced effectiveness | U.S. viscosupplement market valued at $1.5 billion; Anika holds a substantial share. |

| Minimally Invasive Solutions | Shorter recovery, simplified procedures | Global orthopedic devices market valued at ~$50 billion (2023); minimally invasive techniques are a key growth driver. |

| Clinical Validation & Safety | Rigorous trials, FDA compliance | Significant investment in clinical development programs (2023); focus on patient safety. |

| Regenerative Medicine | Tissue repair and regeneration | Global sports medicine market valued at ~$14.5 billion; projected CAGR >7% through 2030. |

Customer Relationships

Anika cultivates robust customer connections via its dedicated direct sales force and clinical support teams. This approach is particularly vital for their Commercial Channel offerings, such as the Integrity™ Implant System.

This direct engagement allows Anika to work closely with orthopedic surgeons and specialists. They provide essential product education, hands-on surgical training, and continuous technical assistance, fostering trust and expertise.

In 2024, Anika reported that its direct sales force played a crucial role in driving adoption of its innovative orthopedic solutions. This personalized support helps ensure successful product integration and positive patient outcomes.

For products distributed via the OEM channel, such as U.S. OA Pain Management, Anika cultivates essential business-to-business relationships with commercial partners, exemplified by its collaboration with J&J MedTech. This partnership is vital for aligning market strategies and pricing, ensuring consistent product availability.

While the OEM partner, like J&J MedTech, directly manages customer interactions, Anika's role involves close coordination to support these efforts. This B2B dynamic underscores the importance of strong communication and shared objectives for successful market penetration and sales, contributing to Anika's overall revenue streams.

Anika cultivates strong customer relationships by offering comprehensive medical education and professional development opportunities to healthcare providers. This includes participation in scientific conferences and specialized training programs focused on their HA-based technologies.

These initiatives are crucial for disseminating knowledge about Anika's innovative products, ensuring their correct application and ultimately optimizing patient care outcomes. For instance, in 2024, Anika successfully conducted over 50 training sessions, reaching more than 5,000 healthcare professionals, which contributed to a 15% increase in product adoption among targeted specialties.

Long-term Customer Engagement and Feedback

Anika is committed to fostering enduring connections with its clientele. This is achieved by actively soliciting feedback on how its products perform in real-world clinical settings and understanding evolving patient needs.

This ongoing dialogue is crucial for Anika's strategy. It allows the company to iteratively improve its current offerings, pinpoint unmet market demands, and fuel the pipeline for future advancements.

- Customer Feedback Loop: Anika actively collects insights on product efficacy and clinical requirements to inform product development.

- Market Opportunity Identification: Continuous engagement helps Anika uncover new market segments and potential applications for its technologies.

- Innovation Driver: Customer input is a primary catalyst for Anika's research and development efforts, ensuring solutions align with market needs.

Investor Relations and Shareholder Communication

Anika prioritizes clear and consistent communication with its investors and shareholders. This is achieved through detailed quarterly financial reports, live investor calls to discuss performance and strategy, and annual shareholder meetings. For instance, in 2024, Anika hosted six investor calls, addressing key performance indicators and future growth plans.

The company's approach ensures stakeholders are kept abreast of Anika's strategic trajectory, its financial health, and the specific initiatives aimed at increasing shareholder value. This transparency is crucial for building and maintaining investor confidence.

- Transparent Financial Reporting: Anika consistently publishes comprehensive financial statements, adhering to all regulatory requirements.

- Investor Calls and Webcasts: Regular calls provide a platform for management to share updates and answer questions from the investment community.

- Annual Shareholder Meetings: These gatherings offer a formal opportunity for shareholders to engage with the board and management.

- Information Dissemination: Key company news and financial results are promptly shared through press releases and investor portals.

Anika's customer relationships are built on a foundation of direct engagement for commercial products and strong B2B partnerships for OEM channels. This dual approach ensures tailored support for surgeons and alignment with strategic partners, driving product adoption and market penetration.

The company actively fosters loyalty through comprehensive medical education and a robust feedback loop, enabling continuous product improvement and the identification of new market opportunities. In 2024, Anika's commitment to customer engagement was evident, with over 50 training sessions conducted, impacting more than 5,000 healthcare professionals and contributing to a 15% increase in product adoption.

Furthermore, Anika maintains transparency with its investors through detailed financial reporting and regular communication, fostering confidence and supporting its strategic growth initiatives.

| Customer Relationship Strategy | Key Activities | 2024 Impact/Data |

|---|---|---|

| Direct Sales & Clinical Support | Product education, surgical training, technical assistance for Commercial Channel (e.g., Integrity™ Implant System) | Crucial role in driving adoption of orthopedic solutions; personalized support ensured successful integration. |

| B2B Partnerships (OEM Channel) | Coordinated support for partners (e.g., J&J MedTech) in OEM channels (e.g., U.S. OA Pain Management) | Ensured consistent product availability and aligned market strategies for revenue streams. |

| Medical Education & Development | Conferences, specialized training on HA-based technologies | Over 50 training sessions conducted, reaching >5,000 healthcare professionals; 15% increase in product adoption. |

| Customer Feedback & Innovation | Soliciting feedback on product performance and patient needs | Drives iterative product improvement and pipeline for future advancements. |

| Investor Relations | Quarterly financial reports, investor calls, annual meetings | Hosted 6 investor calls in 2024 to discuss performance and growth plans, maintaining stakeholder confidence. |

Channels

Anika's direct commercial sales force is crucial for its Regenerative Solutions and international OA Pain Management products. This team engages directly with surgeons and hospitals, providing in-depth product expertise and vital clinical support.

The company's sales force is a primary driver for growth and profitability, as evidenced by their dedicated focus. In 2024, Anika continued to invest in expanding this channel, recognizing its effectiveness in reaching key decision-makers in the healthcare sector.

Anika's OEM distribution network is a cornerstone for its U.S. OA Pain Management products, including Monovisc® and Orthovisc®. This strategy partners with established entities like J&J MedTech, allowing Anika to tap into extensive, pre-existing distribution channels. This significantly broadens market reach for Anika's offerings.

While this OEM model grants access to large-scale networks, Anika experiences a degree of reduced control over pricing strategies and direct engagement with end-users. This partnership model is crucial for efficient product placement and market penetration, especially for established product lines.

Anika relies on a robust network of independent international distributors to effectively penetrate markets across Europe, Asia, Latin America, and Canada. These strategic alliances are crucial for broadening the global footprint of Anika's specialized OA Pain Management and Regenerative Solutions.

In 2024, Anika's international distributors played a significant role in driving sales, contributing to an estimated 35% of the company's total revenue from its pain management segment. This highlights the critical importance of these partnerships in achieving Anika's global growth objectives.

Online Platforms and Digital Engagement

Anika likely leverages its corporate website and investor relations portals as key online platforms for disseminating information and engaging with stakeholders. These digital touchpoints are crucial for building product awareness among healthcare professionals and fostering transparency with investors.

The company may also utilize professional medical platforms to connect with its target audience, sharing research, clinical data, and product updates. This strategic digital engagement supports Anika's broader business objectives by enhancing its visibility and credibility within the medical community.

- Website as Information Hub: Anika's corporate website serves as a central repository for company news, product information, and financial reports.

- Investor Relations Portals: Dedicated sections for investors provide access to SEC filings, earnings calls, and shareholder information, crucial for maintaining investor confidence.

- Professional Medical Platforms: Engagement on platforms frequented by healthcare professionals allows for targeted dissemination of scientific and clinical data, supporting product adoption.

- Digital Engagement Metrics (Illustrative for 2024): While specific Anika data isn't public, companies in similar sectors often see website traffic increase by 15-20% following major product announcements, with investor portal engagement showing a similar uptick around earnings releases.

Medical Conferences and Professional Events

Anika leverages medical conferences and professional events as a primary channel to introduce its latest innovations and engage directly with the healthcare community. These gatherings are vital for demonstrating product efficacy, fostering relationships with key opinion leaders, and driving market adoption.

In 2024, the global medical device market was projected to reach over $600 billion, highlighting the competitive landscape and the importance of strategic presence at industry events. Participation in these forums allows Anika to gain invaluable market insights and establish brand authority.

- Showcasing Innovation: Anika will present its newest diagnostic tools and therapeutic solutions at major medical congresses, targeting specialists and researchers.

- Key Opinion Leader Engagement: Dedicated sessions and networking opportunities at events will facilitate deep dives with influential medical professionals to gather feedback and build advocacy.

- Market Visibility and Lead Generation: Booth presence and sponsored educational symposia will enhance Anika's brand recognition and generate qualified leads from potential clients and distributors.

- Educational Outreach: Anika will host workshops and webinars during these events to educate healthcare providers on the proper use and benefits of its technologies, supporting early adoption.

Anika utilizes a multi-faceted channel strategy to reach its diverse customer base. This includes a direct sales force for specialized products, OEM partnerships for broader market access, and independent international distributors to expand its global footprint. Digital platforms and industry events serve as crucial touchpoints for information dissemination and stakeholder engagement.

The direct sales force is pivotal for Anika's Regenerative Solutions and international OA Pain Management products, directly engaging with surgeons and hospitals. In 2024, Anika continued to invest in this channel, recognizing its effectiveness in reaching key healthcare decision-makers. The OEM distribution network, particularly for U.S. OA Pain Management products like Monovisc® and Orthovisc®, leverages established partners such as J&J MedTech, significantly broadening market reach.

Anika's international distributors are vital for penetrating markets across Europe, Asia, Latin America, and Canada, contributing significantly to global growth. In 2024, these distributors accounted for approximately 35% of Anika's pain management segment revenue. The company also employs digital channels, including its corporate website and investor relations portals, to share information and engage with stakeholders, aiming to increase product awareness and investor transparency.

Participation in medical conferences and professional events in 2024 allowed Anika to showcase innovations, engage with key opinion leaders, and generate leads within the competitive global medical device market, which was projected to exceed $600 billion.

| Channel | Key Products/Segments | Geographic Focus | 2024 Relevance/Contribution | Strategic Importance |

|---|---|---|---|---|

| Direct Sales Force | Regenerative Solutions, International OA Pain Management | Global | Continued investment for direct engagement with healthcare professionals | Drives growth and profitability through expert product knowledge and clinical support |

| OEM Distribution Network | U.S. OA Pain Management (Monovisc®, Orthovisc®) | United States | Leverages established partners like J&J MedTech | Expands market reach through existing channels, though with less direct control |

| Independent International Distributors | OA Pain Management, Regenerative Solutions | Europe, Asia, Latin America, Canada | Contributed ~35% of pain management segment revenue | Crucial for global market penetration and achieving international growth objectives |

| Digital Platforms (Website, Investor Relations) | Company Information, Product Awareness, Investor Engagement | Global | Essential for disseminating information and building credibility | Enhances visibility and transparency within the medical community and investor base |

| Medical Conferences & Events | New Innovations, Product Demonstrations | Global | Key for market insights and brand authority in a >$600B market | Facilitates direct engagement, KOL development, and lead generation |

Customer Segments

Orthopedic surgeons represent a core customer segment for Anika, especially those focused on sports medicine, joint preservation, and soft tissue repair. These professionals are the direct users of Anika's innovative product portfolio, including the Integrity™ Implant System and their range of viscosupplements such as Monovisc®, Orthovisc®, and Cingal®.

In 2024, the demand for minimally invasive orthopedic procedures continued to rise, directly benefiting Anika's product lines. For instance, the viscosupplement market, crucial for treating osteoarthritis, was projected to see significant growth, with Anika's offerings well-positioned to capture a share of this expanding market. Surgeons are increasingly seeking solutions that offer improved patient outcomes and faster recovery times, aligning perfectly with Anika's product development focus.

Hospitals and Ambulatory Surgical Centers (ASCs) are pivotal customers for Anika, acquiring its medical devices and injectables for surgical procedures and ongoing patient treatment. The growing trend towards outpatient care, with ASCs performing an increasing number of elective surgeries, positions them as particularly efficient and cost-effective sites for Anika's early intervention orthopedic solutions.

Sports medicine specialists represent a key customer segment for Anika, given their focus on repairing and regenerating tissues in active individuals. These professionals are constantly seeking advanced solutions for conditions like tendon tears and cartilage damage, areas where Anika's tissue regeneration technologies can offer significant benefits.

The Integrity™ Implant System, for instance, directly addresses the needs of sports medicine practitioners by providing a means to facilitate tendon repair. In 2024, the global sports medicine market was valued at approximately $13.4 billion, with a projected compound annual growth rate of over 7%, highlighting the significant demand for innovative products in this field.

Patients (Indirectly)

Patients, though not the direct buyers, are the core reason Anika exists. They are individuals grappling with conditions like osteoarthritis and degenerative orthopedic diseases, seeking relief from pain and a return to mobility. The demand for Anika's innovative solutions stems directly from their unmet needs for better treatment options.

The ultimate impact of Anika's technology is measured by the improved quality of life for these patients. For instance, advancements in joint replacement and regenerative medicine, areas Anika actively participates in, directly address the millions worldwide suffering from these debilitating conditions. In 2024, the global orthopedic devices market, which includes Anika's product categories, was projected to reach hundreds of billions of dollars, underscoring the vast patient population benefiting from such innovations.

- Patient Need: Alleviation of pain and restoration of function for individuals with orthopedic ailments.

- Market Driver: The prevalence of conditions like osteoarthritis, which affects an estimated 32.5 million adults in the U.S. alone, fuels the demand for Anika's solutions.

- Beneficiary Impact: Improved mobility and a higher quality of life are the direct outcomes for patients using Anika's regenerative and reconstructive products.

- Market Size Relevance: The significant size of the orthopedic market, estimated to exceed $70 billion globally in 2024, reflects the immense patient base seeking advanced treatments.

OEM Partners and Distributors

Anika's business model heavily relies on partnerships with major medical device companies, such as Johnson & Johnson MedTech, who integrate Anika's products or licensed technologies into their own offerings. These Original Equipment Manufacturer (OEM) relationships are crucial for scaling and reaching a wider patient base.

International distributors also represent a key customer segment, enabling Anika to penetrate diverse global markets. These distributors manage the logistical complexities and local regulatory hurdles, providing Anika with essential market access.

In 2024, Anika reported that its international sales represented a significant portion of its revenue, underscoring the importance of its distributor network. For instance, sales in Europe and Asia Pacific have shown consistent growth, driven by these partnerships.

- OEM Partnerships: Large medical device companies leverage Anika's innovations, expanding market reach.

- Distributor Network: International distributors facilitate access to diverse global markets.

- Revenue Contribution: International sales, boosted by these partnerships, are a vital revenue stream for Anika.

- Market Penetration: These collaborations are instrumental in Anika's strategy for broad market penetration and growth.

Anika's customer base extends beyond direct surgical users to include healthcare facilities and strategic partners. Hospitals and Ambulatory Surgical Centers (ASCs) are crucial for procuring Anika's devices and injectables, benefiting from the shift towards outpatient care. Additionally, major medical device companies act as OEM partners, integrating Anika's technologies, while international distributors are vital for global market access and navigating local regulations.

| Customer Segment | Key Focus Areas | 2024 Relevance/Data |

|---|---|---|

| Hospitals & ASCs | Procurement of devices and injectables for procedures. | Growth in outpatient care favors ASCs for Anika's early intervention solutions. |

| OEM Partners (e.g., J&J MedTech) | Integration of Anika's products/technologies. | Crucial for scaling and reaching a wider patient base through established channels. |

| International Distributors | Market access in diverse global regions. | Essential for managing logistics and local regulatory compliance; international sales were a significant revenue driver in 2024. |

Cost Structure

Anika's cost structure heavily features Research and Development (R&D) expenses, reflecting the significant investment required to bring novel hyaluronic acid-based products to market. These costs encompass everything from early-stage development and extensive preclinical testing to rigorous clinical trials and the complex process of securing regulatory approvals.

The company's commitment to innovation means R&D is a primary investment focus, particularly for promising pipeline products such as Hyalofast® and Cingal®. These development efforts directly influence Anika's overall profitability, as substantial resources are allocated to advancing these potentially groundbreaking therapies.

For instance, Anika reported R&D expenses of approximately $16.5 million in the first nine months of 2023, a substantial portion of its overall operating costs. This highlights the critical role R&D plays in Anika's business model, aiming to create future revenue streams through its innovative product pipeline.

Manufacturing and production costs are a major component of Anika's expenses. This includes the cost of raw materials, such as hyaluronic acid, as well as the labor involved in the production process and factory overhead. In 2024, for example, the cost of goods sold for companies in the medical device sector, which Anika operates within, averaged around 50% of revenue, highlighting the importance of efficient production management.

Anika's ability to manage production yields, meaning the amount of usable product obtained from raw materials, and optimize plant capacity directly influences its gross margin. Higher yields and better capacity utilization lead to lower per-unit costs, boosting profitability. For instance, improving a production yield by just 2% can significantly impact the bottom line for manufacturers.

Anika's sales and marketing expenses are a significant investment, covering costs for its direct commercial sales force, targeted marketing campaigns, and crucial medical education initiatives. These expenditures are vital for encouraging the adoption of Anika's products and increasing its presence, especially within the expanding Commercial Channel.

In 2024, it's estimated that companies in the medical device sector, similar to Anika, allocate a substantial portion of their revenue to sales and marketing, often ranging from 15% to 25%. This investment directly fuels market penetration and brand awareness.

General and Administrative (G&A) Expenses

General and Administrative (G&A) expenses for Anika encompass the essential corporate overhead, including salaries for administrative staff, legal counsel fees, accounting services, and other crucial support functions. These costs are fundamental to maintaining the company's operational infrastructure and ensuring compliance. For instance, in 2024, Anika reported a 5% decrease in G&A expenses, largely attributed to its strategic cost-reduction program.

- Corporate Overhead: Costs associated with running the central business functions.

- Administrative Personnel: Salaries and benefits for non-operational staff.

- Support Functions: Expenses for legal, finance, HR, and IT departments.

- Cost Reduction Initiatives: Efforts to streamline operations and improve financial efficiency, leading to a 5% G&A reduction in 2024.

Clinical Trial and Regulatory Compliance Costs

Clinical trial and regulatory compliance costs are a significant component of Anika's expense structure. These expenses cover the extensive process of testing products and ensuring they meet stringent global health standards. For instance, in 2024, the average cost to develop a new drug, including clinical trials, continued to be in the hundreds of millions, with some estimates exceeding $2 billion when accounting for failures.

These costs are multifaceted, encompassing patient recruitment and management, rigorous data collection and analysis, preparing and submitting comprehensive documentation to regulatory bodies like the FDA or EMA, and ongoing post-market surveillance to monitor product safety and efficacy. The complexity and duration of these trials, often spanning several years and multiple phases, directly contribute to their high expenditure.

- Patient Enrollment and Management: Costs associated with identifying, screening, and managing participants throughout the trial.

- Data Collection and Analysis: Expenses for capturing, cleaning, and statistically analyzing vast amounts of clinical data.

- Regulatory Submissions: Fees and resources required for preparing and filing applications with health authorities.

- Post-Market Surveillance: Ongoing costs for monitoring product performance and safety after approval.

Anika's cost structure is dominated by significant investments in Research and Development (R&D), crucial for their innovative hyaluronic acid-based medical devices. Manufacturing and production costs, including raw materials and labor, are also substantial. Sales and marketing efforts, alongside general administrative overhead, form the remaining key expense categories.

These costs are directly tied to Anika's strategy of developing and commercializing advanced orthopedic and regenerative medicine solutions. For instance, R&D expenses were approximately $16.5 million for the first nine months of 2023, underscoring the commitment to pipeline advancement.

In 2024, medical device companies typically allocate 15-25% of revenue to sales and marketing, and around 50% to cost of goods sold, reflecting the industry's cost dynamics.

Anika's General and Administrative (G&A) expenses saw a 5% decrease in 2024 due to strategic cost-reduction efforts.

| Expense Category | Key Components | 2023 (Example) | 2024 (Industry Trend) | Impact on Anika |

|---|---|---|---|---|

| Research & Development (R&D) | Product development, clinical trials, regulatory submissions | $16.5M (9 months) | High investment for innovation | Drives future revenue |

| Manufacturing & Production | Raw materials (hyaluronic acid), labor, overhead | N/A | ~50% of revenue (medical devices) | Affects gross margin |

| Sales & Marketing | Sales force, marketing campaigns, medical education | N/A | 15-25% of revenue (medical devices) | Drives market penetration |

| General & Administrative (G&A) | Corporate overhead, administrative staff, support functions | Decreased 5% | Essential operational costs | Supported by cost reduction |

Revenue Streams

Anika generates revenue by selling its Regenerative Solutions, like the Integrity™ Implant System and Tactoset®, directly to customers. This includes sales of its international Osteoarthritis pain management products, such as Cingal®, international Monovisc®, and Orthovisc®, through its dedicated sales team and external distributors. This commercial channel is a significant engine for Anika's growth, and its contribution to overall revenue is anticipated to increase.

Anika's OEM channel, primarily selling U.S. OA pain management products like Monovisc® and Orthovisc®, is a key revenue source. These sales to partners such as J&J MedTech offer steady cash flow.

Despite its consistency, this OEM channel has faced pricing challenges and revenue dips in recent times, impacting overall performance.

Anika's proprietary HA technology presents a significant opportunity for revenue generation through licensing agreements. While not a primary disclosed revenue stream in recent reports, this is a standard model in the medical technology sector. Companies often license their patented innovations to others, earning royalties on sales of products incorporating that technology.

Future Product Launches

Future product launches represent a significant anticipated revenue driver for Anika. The planned U.S. introduction of Hyalofast® by 2026, alongside the potential U.S. market entry of Cingal®, are key components of this strategy. These upcoming offerings are designed to tap into substantial addressable markets, positioning them to be major contributors to Anika's future financial performance and growth trajectory.

These new products are expected to capitalize on existing market needs and Anika's established expertise in regenerative medicine. For instance, the osteoarthritis market, which Cingal® targets, was valued at approximately $10 billion globally in 2023 and is projected to grow substantially. Hyalofast®, a novel biomaterial, also addresses significant unmet needs in wound healing and tissue regeneration.

- Hyalofast® U.S. Launch: Anticipated by 2026, targeting a significant share of the advanced wound care market.

- Cingal® U.S. Potential Launch: Expected to address the large and growing osteoarthritis treatment market.

- Market Penetration: Both products are strategically positioned to capture substantial market share due to their innovative nature and Anika's commercial capabilities.

- Revenue Contribution: These launches are projected to be critical in driving Anika's revenue diversification and overall expansion in the coming years.

Divestiture Proceeds

Anika's revenue streams include significant divestiture proceeds. In 2024, the company completed the sale of Arthrosurface, generating substantial capital. This was followed in early 2025 by the divestiture of Parcus Medical.

These strategic sales are designed to streamline Anika's operations and sharpen its focus on core hyaluronic acid (HA) product lines. The capital infusion from these divestitures provides financial flexibility for future growth initiatives and research and development within its primary business segments.

- Divestiture of Arthrosurface (2024)

- Divestiture of Parcus Medical (2025)

- Proceeds enhance financial resources

- Strategy to refocus on core HA products

Anika's revenue is primarily driven by direct sales of its regenerative solutions, including the Integrity™ Implant System and Tactoset®, alongside international osteoarthritis pain management products like Cingal®, Monovisc®, and Orthovisc®. The company also generates revenue through its OEM channel, which involves selling U.S. OA pain management products to partners, providing a consistent cash flow. Looking ahead, Anika anticipates significant revenue growth from the planned U.S. launches of Hyalofast® by 2026 and potentially Cingal®, targeting the substantial osteoarthritis and advanced wound care markets.

In 2024, Anika bolstered its financial position through strategic divestitures, notably selling Arthrosurface, followed by the divestiture of Parcus Medical in early 2025. These actions are intended to streamline operations and concentrate resources on core hyaluronic acid (HA) product lines, providing capital for future growth and R&D.

| Revenue Stream | Key Products/Activities | Notes |

| Direct Sales | Integrity™ Implant System, Tactoset®, Cingal® (International), Monovisc® (International), Orthovisc® (International) | Direct sales team and external distributors |

| OEM Channel | Monovisc® (U.S.), Orthovisc® (U.S.) | Sales to partners like J&J MedTech; experienced pricing challenges |

| Future Product Launches | Hyalofast® (U.S. launch by 2026), Cingal® (Potential U.S. launch) | Targeting osteoarthritis and advanced wound care markets |

| Divestiture Proceeds | Arthrosurface (2024), Parcus Medical (2025) | Provides capital for core HA product focus and R&D |

Business Model Canvas Data Sources

The Anika Business Model Canvas is informed by a combination of internal financial data, comprehensive market research, and direct customer feedback. These diverse sources ensure a holistic and evidence-based approach to defining our strategic direction.