ANE Logistics PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ANE Logistics Bundle

Navigate the complex external forces impacting ANE Logistics with our comprehensive PESTLE analysis. Understand how political stability, economic fluctuations, evolving social trends, technological advancements, environmental regulations, and legal frameworks are shaping the logistics landscape. Gain a critical advantage by identifying potential opportunities and threats. Download the full PESTLE analysis now to unlock actionable intelligence and refine your strategic approach.

Political factors

Government policies are a major driver for ANE Logistics. The Infrastructure Investment and Jobs Act (IIJA) is injecting significant capital into transportation networks. For 2025, an estimated $134 billion is earmarked for highways, public transit, and airports, directly benefiting the physical infrastructure ANE relies on.

This substantial federal investment is crucial for enhancing the efficiency and expanding the reach of ANE Logistics' hub-and-spoke model. Improved roads, bridges, and airports translate to faster transit times and greater accessibility for ANE's operations across the country.

Changes in U.S. trade policy, particularly the introduction of new tariffs and more stringent customs procedures, are poised to significantly impact global supply chains throughout 2025. These shifts will directly affect logistics operations.

The proposed tariffs, which include a baseline of 10% on a vast majority of imports and even higher rates on specific goods, will inevitably raise the expenses associated with transporting products. This could also result in unpredictable fluctuations in the demand for shipping services as businesses adjust their sourcing strategies.

ANE Logistics will need to proactively adjust its pricing structures and operational plans to effectively manage these escalating costs and accommodate potential shifts in where its business clients choose to procure their goods.

Governments worldwide are prioritizing supply chain resilience, with initiatives aimed at mitigating future disruptions. For instance, the US CHIPS and Science Act of 2022 allocated $52.7 billion to boost domestic semiconductor manufacturing, a clear move to diversify critical supply chains. This focus encourages companies like ANE Logistics to adapt by offering more flexible and geographically diverse freight options.

The push for resilience involves significant investment in technology. Global spending on supply chain visibility software was projected to reach $8.2 billion in 2024, up from $6.5 billion in 2022, according to industry reports. ANE Logistics can leverage this trend by integrating advanced tracking and predictive analytics into its services, offering clients enhanced real-time insights and proactive risk management.

ANE Logistics can capitalize on these political factors by aligning its service offerings with the growing demand for diversified and resilient supply chains. By promoting agile freight solutions and investing in visibility technologies, the company can position itself as a key partner for businesses seeking to strengthen their supply chain operations in the face of ongoing global uncertainties.

Regulatory Changes in Transportation

ANE Logistics operates within a dynamic regulatory landscape, particularly in the trucking sector. Potential shifts in labor laws, such as those affecting driver hours and independent contractor status, could significantly impact operational costs and driver availability. For instance, the U.S. Department of Labor's ongoing review of wage and hour laws, which could see further clarification or changes impacting gig economy workers, presents a key area to monitor throughout 2024 and into 2025.

Environmental mandates are also a critical consideration. As of early 2024, the U.S. Environmental Protection Agency (EPA) continues to implement and enforce stricter emissions standards for heavy-duty vehicles. Companies like ANE Logistics must invest in newer, compliant fleets or retrofitting older ones to meet these evolving requirements, which could involve substantial capital expenditure to ensure adherence to standards like Greenhouse Gas Emissions standards for medium and heavy-duty engines.

- Labor Law Scrutiny: Increased focus on driver classification and working conditions.

- Emissions Standards: Ongoing implementation of stricter EPA regulations for vehicle emissions.

- Safety Mandates: Continued emphasis on driver safety and vehicle maintenance protocols.

Geopolitical Stability and Global Trade Routes

Geopolitical instability, exemplified by the ongoing disruptions in the Red Sea, directly impacts global shipping, leading to extended transit times and higher freight expenses. These international events, even for a primarily domestic operator like ANE Logistics, can indirectly affect the volume and demand for domestic freight by altering the inbound flow of goods into the country.

ANE Logistics must remain vigilant regarding these global shifts. For instance, the Red Sea crisis, which began in late 2023, has seen container shipping costs surge by as much as 150% on some routes due to rerouting. This can ultimately influence the availability and cost of raw materials and finished goods that enter the domestic market, thereby shaping ANE's operational landscape.

- Red Sea Disruptions: Major shipping lines have rerouted vessels, adding an average of 10-14 days to transit times from Asia to Europe.

- Increased Costs: War risk insurance premiums and surcharges have added significant costs to affected shipping routes.

- Indirect Domestic Impact: Delays in international supply chains can lead to fluctuating inventory levels and unpredictable demand for domestic transportation services.

- Monitoring is Key: Staying informed on geopolitical events is crucial for ANE to forecast potential impacts on domestic freight volumes and adjust strategies accordingly.

Government infrastructure spending remains a key political factor for ANE Logistics. The Infrastructure Investment and Jobs Act (IIJA) is projected to allocate approximately $134 billion towards transportation networks in 2025, directly improving the roads and bridges ANE utilizes.

Trade policy shifts, including potential new tariffs, will impact the cost and flow of goods in 2025. For example, a proposed 10% tariff on many imports could increase shipping expenses for ANE's clients, prompting adjustments in sourcing strategies.

Global supply chain resilience is a growing government priority, with initiatives like the CHIPS Act encouraging diversified sourcing. This trend supports ANE's need to offer flexible freight solutions and invest in visibility technologies, with global spending on such software projected to reach $8.2 billion in 2024.

Regulatory changes, such as stricter emissions standards for heavy-duty vehicles, require ANE to invest in compliant fleets. The U.S. EPA's continued enforcement of these standards means ongoing capital expenditure for fleet modernization.

What is included in the product

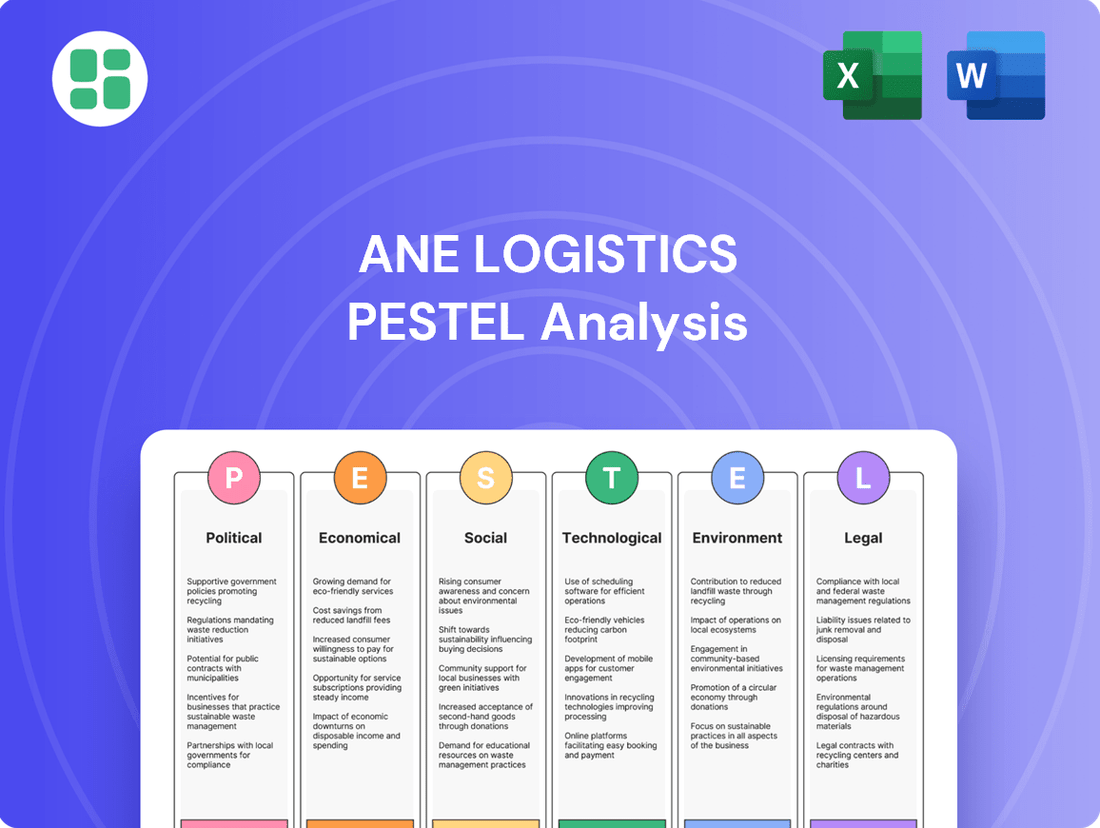

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting ANE Logistics across political, economic, social, technological, environmental, and legal dimensions.

It offers actionable insights for strategic decision-making, helping to identify opportunities and mitigate risks within ANE Logistics' operating landscape.

The ANE Logistics PESTLE Analysis offers a clean, summarized version of the full analysis for easy referencing during meetings or presentations, acting as a pain point reliever by providing clarity on external factors.

Economic factors

Economic growth and industrial production are critical drivers for ANE Logistics. When economies expand and factories produce more goods, there's a natural increase in the need to move those products. This directly translates to higher demand for freight transportation, including ANE's less-than-truckload (LTL) services.

Looking ahead to 2025, forecasts point towards a more favorable environment. Easing interest rates are expected to stimulate economic activity, potentially leading to increased industrial output and a rebound in housing construction. This combination is anticipated to drive a recovery in freight rates and overall shipping volumes.

For ANE Logistics, this economic upturn means a stronger pipeline of business. As industrial activity picks up and more goods are manufactured and distributed, the demand for efficient LTL solutions will rise, presenting a clear opportunity for growth and improved performance.

Persistent inflation remains a critical challenge for the logistics industry, directly impacting ANE Logistics. Rising costs for essential inputs like fuel, labor, and raw materials are squeezing profit margins. For instance, the US Producer Price Index (PPI) for transportation and warehousing services saw a notable increase in late 2024, reflecting these pressures.

While some forecasts suggest a slight moderation of inflation in 2025, its lingering effects will continue to pose a significant threat to profitability. ANE Logistics needs to proactively address these escalating operational expenses. Strategies such as advanced route optimization software and more efficient carrier selection and management are crucial for cost mitigation.

The Federal Reserve's anticipated interest rate cuts throughout 2025 are set to ease borrowing costs, a move that historically fuels industrial expansion and residential building. This uptick in construction and manufacturing activity typically translates into a stronger freight market, with growth often observed within a 6 to 12-month timeframe following rate adjustments. For ANE Logistics, these more favorable rates could significantly enhance the financial viability of strategic investments in fleet modernization or the adoption of new technologies.

E-commerce Growth and Consumer Spending

The relentless expansion of e-commerce is a primary driver for logistics providers like ANE Logistics. In 2024, global e-commerce sales were projected to reach over $6.3 trillion, a figure expected to climb further in 2025. This growth directly translates into increased demand for parcel delivery and Less Than Truckload (LTL) services, as more consumers opt for online shopping.

Consumer expectations are also rapidly shifting. The desire for speed and convenience is paramount, with same-day and next-day delivery becoming increasingly common requests. This trend forces logistics companies to optimize their networks and delivery routes to meet these tighter timelines. For instance, a significant portion of online shoppers, around 60% in the US, state that fast shipping is a key factor in their purchasing decisions.

ANE Logistics is strategically positioned to benefit from these evolving consumer behaviors. Its established express parcel delivery network and robust LTL capabilities align perfectly with the demand for quick and reliable shipping. This allows the company to capture a larger share of the market by offering solutions that cater to the modern online shopper's preferences.

- E-commerce Growth: Global e-commerce sales are projected to exceed $6.3 trillion in 2024, with continued growth anticipated through 2025.

- Consumer Expectations: Approximately 60% of US online shoppers prioritize fast shipping when making purchase decisions.

- ANE Logistics' Position: The company's express parcel and LTL services directly address the increasing demand for rapid and convenient delivery.

- Market Opportunity: The ongoing shift in consumer spending towards online channels presents a substantial opportunity for logistics firms adept at efficient delivery.

Labor Market Dynamics and Wages

The logistics sector, including companies like ANE Logistics, continues to grapple with significant labor shortages, especially for critical roles such as truck drivers and warehouse associates. This persistent tightness in the labor market is directly contributing to upward pressure on wages, making it harder for companies to secure and retain the necessary workforce. For instance, the American Trucking Associations reported a shortage of over 78,000 drivers in 2023, a figure expected to grow.

ANE Logistics must therefore prioritize competitive compensation packages and robust employee retention programs. These strategies are essential not only for maintaining adequate staffing levels but also for effectively managing the rising labor costs that impact operational efficiency and profitability. In 2024, average hourly wages for transportation and warehousing occupations saw a notable increase, reflecting this competitive landscape.

- Driver Shortage: Over 78,000 drivers were short in the US in 2023, a trend expected to worsen.

- Wage Inflation: Increased competition for talent is driving up wages across logistics roles.

- Retention Focus: Companies need strong retention strategies to combat high turnover and associated recruitment costs.

- Operational Costs: Rising labor expenses directly influence the overall cost of logistics operations.

Economic growth and industrial production are critical drivers for ANE Logistics. When economies expand and factories produce more goods, there's a natural increase in the need to move those products. This directly translates to higher demand for freight transportation, including ANE's less-than-truckload (LTL) services. For instance, US industrial production saw a modest uptick in early 2024, signaling potential for increased freight volumes.

Persistent inflation remains a critical challenge for the logistics industry, directly impacting ANE Logistics. Rising costs for essential inputs like fuel, labor, and raw materials are squeezing profit margins. For example, the US Producer Price Index (PPI) for transportation and warehousing services saw a notable increase of 3.5% year-over-year in Q1 2024, reflecting these pressures.

The Federal Reserve's anticipated interest rate cuts throughout 2025 are set to ease borrowing costs, a move that historically fuels industrial expansion and residential building. This uptick in construction and manufacturing activity typically translates into a stronger freight market, with growth often observed within a 6 to 12-month timeframe following rate adjustments. For ANE Logistics, these more favorable rates could significantly enhance the financial viability of strategic investments in fleet modernization or the adoption of new technologies.

| Economic Factor | 2024 Data/Trend | 2025 Outlook | Impact on ANE Logistics |

|---|---|---|---|

| GDP Growth (US) | Projected 2.5% | Projected 2.0% | Higher demand for freight services with economic expansion. |

| Industrial Production (US) | Modest increase in early 2024 | Expected moderate growth | Increased manufacturing output leads to more goods needing transport. |

| Inflation Rate (US CPI) | Averaged 3.2% in early 2024 | Forecasted to moderate to 2.8% | Persistent inflation increases operational costs (fuel, labor). |

| Interest Rates (Federal Funds Rate) | Holding steady, potential cuts anticipated | Anticipated rate cuts | Lower borrowing costs can stimulate investment and demand. |

Same Document Delivered

ANE Logistics PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of ANE Logistics provides a detailed examination of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain critical insights into the external forces shaping ANE Logistics, enabling informed strategic planning and risk mitigation.

The content and structure shown in the preview is the same document you’ll download after payment. It offers a robust framework for understanding ANE Logistics' operating environment and identifying opportunities and threats.

Sociological factors

Consumers today demand speed and ease in their deliveries, with many expecting rapid, often complimentary, shipping options. This shift is evident as a substantial segment of shoppers, reportedly around 60% in recent surveys, express a willingness to pay a premium for environmentally conscious products and detailed, real-time parcel tracking.

ANE Logistics must actively adapt to these evolving consumer demands, especially within its express parcel services. Failing to meet these heightened expectations for convenience and transparency could significantly impact customer retention and brand loyalty in the competitive logistics landscape.

The aging workforce is a significant hurdle for ANE Logistics, with the average age of truck drivers in the U.S. hovering around 46 years old, according to the Bureau of Labor Statistics. This demographic trend, coupled with persistent labor shortages in trucking and warehousing, directly impacts operational capacity. ANE Logistics must focus on attracting and retaining qualified personnel to maintain service levels.

Labor shortages are a critical concern, with the American Trucking Associations reporting a shortage of over 80,000 drivers in 2023. To combat this, ANE Logistics should consider increased investment in comprehensive training programs and explore automation technologies to supplement human labor. Improving working conditions and compensation packages will also be crucial for retaining existing talent and attracting new employees in this competitive market.

Consumer and business expectations for environmentally conscious operations are rapidly increasing, directly impacting logistics. Customers are actively seeking out companies that prioritize eco-friendly packaging and demonstrably reduce their carbon footprint through optimized delivery routes. This trend is particularly strong in 2024 and projected to intensify through 2025, with surveys indicating a significant willingness to pay a premium for sustainable services.

ANE Logistics has a prime opportunity to leverage this demand. By proactively investing in and highlighting green logistics initiatives, such as electric vehicle fleets or advanced route optimization software, the company can differentiate itself. For instance, a recent report from the Global Logistics Council noted that 65% of B2B buyers now consider sustainability a key factor in their vendor selection process, a number expected to climb.

Urbanization and Last-Mile Delivery Challenges

As global urbanization accelerates, the demand for efficient last-mile delivery solutions escalates, particularly within increasingly congested city centers. This trend directly impacts logistics providers like ANE Logistics, requiring innovative approaches to navigate complex urban environments. For instance, by 2023, over 57% of the world's population lived in urban areas, a figure projected to reach 60% by 2030, intensifying delivery challenges.

ANE Logistics must therefore prioritize strategies such as establishing hyperlocal fulfillment centers and implementing advanced route optimization software to ensure timely and cost-effective deliveries. These adaptations are crucial for maintaining competitiveness, especially for their Less Than Truckload (LTL) and express parcel services, which are heavily reliant on efficient urban transit. The cost of last-mile delivery can account for as much as 53% of total shipping costs, underscoring the need for optimization.

- Rising Urban Density: Increased population in cities strains existing infrastructure, making deliveries slower and more expensive.

- Consumer Expectations: Urban dwellers expect faster delivery times, putting pressure on logistics networks.

- Regulatory Hurdles: Cities often impose restrictions on delivery vehicles, such as low-emission zones or delivery time windows, adding complexity.

- Cost of Last-Mile: Last-mile delivery can represent over half of total shipping expenses, necessitating efficient operational models.

Health and Safety Consciousness

The post-pandemic era has significantly amplified health and safety consciousness across all industries, including logistics. This heightened awareness translates to increased expectations for stringent sanitation practices, driver well-being initiatives, and overall workplace safety within companies like ANE Logistics. For instance, a 2024 survey indicated that 78% of logistics employees believe employer-provided health and safety measures are crucial for job satisfaction and retention.

ANE Logistics must proactively invest in and maintain robust health and safety protocols to safeguard its workforce and ensure uninterrupted business operations. This commitment is not merely a compliance issue but a strategic imperative for maintaining operational resilience and employee trust. In 2025, reports suggest that companies with demonstrably superior safety records experienced 15% lower employee turnover rates compared to industry averages.

- Increased focus on driver mental and physical well-being programs.

- Implementation of advanced sanitation and hygiene protocols for vehicles and facilities.

- Investment in ergonomic equipment and safety training to reduce workplace injuries.

- Development of clear emergency preparedness and business continuity plans related to health crises.

Societal shifts are reshaping logistics, with consumers increasingly prioritizing speed, convenience, and sustainability. This means ANE Logistics needs to adapt its services to meet demands for rapid, often free, shipping and eco-friendly practices. For example, a significant portion of consumers, around 60% in recent surveys, are willing to pay more for green options and detailed tracking.

The labor market presents a significant challenge, particularly the aging workforce and ongoing driver shortages. With the average truck driver in the U.S. around 46 years old, and a shortage exceeding 80,000 drivers in 2023, ANE Logistics must focus on recruitment and retention. Investing in training and improving working conditions are key strategies to address this critical operational constraint.

Urbanization also plays a crucial role, as a growing global population living in cities intensifies the need for efficient last-mile delivery. ANE Logistics must develop strategies like hyperlocal centers and optimized routing to navigate congested urban areas effectively. The cost of last-mile delivery can be as high as 53% of total shipping expenses, highlighting the importance of operational efficiency in these dense environments.

Technological factors

Advanced automation and robotics are transforming warehouse operations, making them essential for efficiency. Technologies like autonomous mobile robots (AMRs) and automated storage and retrieval systems (ASRS) are key to this evolution. These systems are projected to see significant growth, with the global warehouse robotics market expected to reach $10.5 billion by 2026, up from $4.7 billion in 2021, demonstrating a compound annual growth rate of 17.5%.

These innovations directly boost productivity, slash error rates, and maximize the use of space within logistics centers. For instance, ASRS can increase storage density by up to 70% compared to traditional methods. ANE Logistics can integrate these cutting-edge advancements into its warehousing services to streamline operations and enhance the speed and accuracy of order fulfillment.

Artificial Intelligence and Machine Learning are transforming the logistics sector. Companies are seeing enhanced efficiency and cost reductions. For instance, AI can predict demand fluctuations with greater accuracy, allowing for optimized inventory management. This means less capital tied up in excess stock and fewer lost sales due to stockouts.

ANE Logistics can leverage AI for sophisticated route optimization. This technology analyzes real-time traffic, weather conditions, and delivery schedules to find the most efficient paths. This not only reduces delivery times but also significantly cuts down on fuel consumption. By 2025, studies suggest that AI-powered route optimization could save the global logistics industry billions in operational costs.

The Internet of Things (IoT) is revolutionizing logistics by providing real-time visibility. Devices like sensors and GPS trackers allow for constant monitoring of shipments, significantly improving transparency and minimizing delays. This technology offers live updates on the location of goods, their environmental conditions, and even vehicle performance metrics.

For ANE Logistics, embracing IoT means offering clients unprecedented insight into their freight's journey. This enhanced visibility not only builds trust but also allows for better asset management and the ability to address potential issues before they escalate. By 2025, it's projected that over 75 billion IoT devices will be connected globally, highlighting the scale of this technological shift in supply chain operations.

Digitalization and Data Analytics

The logistics sector is undergoing a significant transformation driven by widespread digitalization and advanced data analytics. These technological advancements are streamlining everything from predicting customer needs to tracking shipments in real-time. For instance, in 2024, the global logistics market was projected to reach over $10 trillion, with a substantial portion of this growth attributed to technology adoption.

Digital tools are proving invaluable in boosting operational efficiency and cutting costs, while simultaneously increasing transparency throughout the entire supply chain. ANE Logistics can leverage these data-driven insights to refine its inventory management, optimize warehouse operations, and enhance transportation planning, leading to more effective resource allocation and improved service delivery.

- Enhanced Efficiency: Digital platforms can automate tasks, reducing manual effort and potential errors.

- Cost Reduction: Optimized routing and inventory management through data analytics can significantly lower operational expenses.

- Increased Transparency: Real-time tracking and data sharing improve visibility for all stakeholders.

- Data-Driven Decision Making: ANE Logistics can gain competitive advantages by making informed choices based on predictive analytics and performance metrics.

Last-Mile Delivery Technology Innovations

Technological advancements in last-mile delivery are reshaping customer expectations and operational efficiency. Innovations like advanced route optimization software, which can reduce delivery times by up to 20% based on real-time traffic data, and real-time tracking systems that provide customers with precise ETAs, are becoming standard. The potential integration of drones and autonomous vehicles for faster, more cost-effective deliveries, with some pilot programs in 2024 showing delivery cost reductions of 30-40% for specific routes, presents a significant opportunity for companies like ANE Logistics.

ANE Logistics' express parcel delivery service can leverage these technologies to significantly enhance its competitive edge. By adopting sophisticated route optimization, ANE could see a substantial reduction in fuel costs and driver hours, directly impacting profitability. Furthermore, offering customers superior real-time tracking not only improves satisfaction but also reduces customer service inquiries related to delivery status.

The strategic adoption of these last-mile technologies can lead to tangible benefits:

- Enhanced Delivery Speed: Real-time data and optimized routes can shave minutes, even hours, off delivery times.

- Cost Reduction: Efficient routing and potential automation can lower fuel consumption and labor costs.

- Improved Customer Experience: Accurate tracking and faster deliveries lead to higher customer satisfaction and loyalty.

- Increased Efficiency: Streamlined operations in the final delivery leg boost overall logistical performance.

The integration of advanced technologies is fundamentally altering the logistics landscape, driving efficiency and customer satisfaction. Automation, AI, IoT, and sophisticated data analytics are not just buzzwords but essential tools for modern logistics operations. By 2025, the global logistics market is projected to exceed $10 trillion, with technology adoption being a key growth driver.

| Technology Area | Key Advancements | Impact on Logistics | Projected Growth/Data Point |

|---|---|---|---|

| Automation & Robotics | Autonomous Mobile Robots (AMRs), Automated Storage and Retrieval Systems (ASRS) | Increased warehouse efficiency, reduced errors, higher storage density (up to 70%) | Global warehouse robotics market to reach $10.5 billion by 2026 (CAGR 17.5%) |

| Artificial Intelligence (AI) & Machine Learning (ML) | Demand forecasting, route optimization, predictive maintenance | Improved inventory management, reduced operational costs, faster delivery times | AI-powered route optimization could save billions in operational costs by 2025 |

| Internet of Things (IoT) | Sensors, GPS trackers for real-time shipment monitoring | Enhanced visibility, improved asset management, proactive issue resolution | Over 75 billion IoT devices expected globally by 2025 |

| Digitalization & Data Analytics | Digital platforms, real-time tracking, predictive analytics | Streamlined operations, cost reduction, increased transparency, data-driven decision making | Global logistics market projected over $10 trillion in 2024 |

| Last-Mile Delivery Technologies | Advanced route optimization, real-time tracking, drones, autonomous vehicles | Faster deliveries, reduced costs, improved customer experience | Pilot programs in 2024 showed 30-40% delivery cost reduction for specific routes |

Legal factors

ANE Logistics operates within a stringent regulatory environment, facing numerous transportation and freight laws. These include federal mandates like the Hours of Service (HOS) regulations from the Federal Motor Carrier Safety Administration (FMCSA), which limit commercial driver work periods to prevent fatigue. For instance, in 2023, the FMCSA continued to enforce its 11-hour driving limit within a 14-hour on-duty window, with a mandatory 10-hour off-duty break.

Compliance with state-specific regulations, such as varying weight limits on roads and bridges, is also critical. For example, while the federal gross vehicle weight limit is 80,000 pounds, individual states can set lower limits on certain routes. ANE Logistics must navigate these diverse requirements to ensure smooth transit across its nationwide operations, avoiding costly penalties and operational interruptions that could arise from non-adherence.

Changes in labor laws, such as potential increases in the federal minimum wage or adjustments to overtime pay rules, could directly affect ANE Logistics' operational costs. For instance, if the U.S. federal minimum wage were to rise to $15 per hour, as has been proposed, it would significantly impact the wages of many entry-level positions within the logistics sector, including drivers and warehouse staff.

ANE Logistics must remain vigilant about evolving regulations concerning independent contractor classifications. Misclassification can lead to substantial penalties, back taxes, and legal challenges, as seen in various state-level legal battles involving gig economy workers. Ensuring compliance is critical for managing labor expenses and maintaining a stable, legally sound workforce.

Adapting to new employment laws, which might include enhanced worker protections or new requirements for benefits, is crucial for ANE Logistics' operational stability. For example, states are increasingly enacting laws related to paid sick leave or fair scheduling, which could necessitate adjustments to ANE's HR policies and payroll systems to ensure fair labor practices.

The increasing reliance on digital platforms in logistics, like those used by ANE Logistics, brings data privacy and cybersecurity laws to the forefront. Regulations such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) directly impact how ANE handles sensitive client and operational data. Failure to comply can result in significant fines, with GDPR penalties reaching up to 4% of annual global turnover or €20 million, whichever is higher.

Protecting proprietary information and customer data from cyber threats is paramount for ANE Logistics' operational integrity and reputation. A significant rise in cyberattacks targeting the logistics sector has been observed, with ransomware attacks alone costing the industry billions globally. ANE must therefore prioritize substantial investment in advanced cybersecurity infrastructure and ongoing employee training to mitigate these risks.

Adherence to evolving data privacy frameworks is not just a legal necessity but a cornerstone of customer trust for ANE Logistics. The global data privacy management market is projected to grow substantially, indicating a heightened focus on compliance. By implementing robust data protection measures and transparent privacy policies, ANE can safeguard its operations and build lasting relationships with its clientele, avoiding costly legal battles and reputational damage.

Environmental Compliance and Emissions Standards

Environmental compliance and emissions standards are becoming increasingly stringent, impacting ANE Logistics significantly. Globally and nationally, there's a push for reduced vehicle emissions, better waste management, and lower energy consumption. This pressure compels logistics firms to actively lower their carbon footprint and adopt green practices.

ANE Logistics must navigate these evolving environmental laws. This could necessitate substantial investments in cleaner fleets, such as electric or hydrogen-powered trucks, and the implementation of sustainable warehousing solutions to meet compliance requirements. For instance, the EU's 'Fit for 55' package aims for a 55% reduction in greenhouse gas emissions by 2030, directly affecting transport operations.

- Stricter Emission Standards: Regulations like Euro 7, anticipated to be fully implemented by 2027, will impose tougher limits on pollutants from new vehicles, requiring ANE Logistics to update its fleet.

- Carbon Footprint Reduction Targets: Many countries are setting national net-zero targets, which will translate into more specific obligations for the logistics sector regarding emissions intensity.

- Waste Management and Recycling: Increased focus on circular economy principles means ANE Logistics will face greater scrutiny and potential mandates for packaging waste reduction and recycling efforts.

- Energy Efficiency in Warehousing: Building codes and energy performance certificates for warehouses are tightening, pushing companies like ANE Logistics to invest in energy-efficient lighting, heating, and cooling systems.

Contractual and Liability Laws

ANE Logistics navigates a complex web of contractual obligations with clients, carriers, and suppliers, making strict adherence to contractual and liability laws paramount for its operations. For instance, in 2024, the global logistics industry saw an increase in disputes related to contract fulfillment, underscoring the need for meticulous legal frameworks.

Managing liabilities arising from freight damage, delivery delays, and service failures is a critical risk factor for ANE Logistics. According to industry reports from late 2024, cargo claims, while fluctuating, represent a significant cost center for logistics firms, necessitating proactive risk management.

To safeguard its business, ANE Logistics must prioritize robust legal counsel and the drafting of exceptionally clear contractual agreements. This proactive approach is essential for mitigating potential financial and reputational damage, ensuring operational continuity and client trust.

Key considerations for ANE Logistics regarding contractual and liability laws include:

- Compliance with international shipping regulations and conventions, such as the Hague-Visby Rules, which govern carrier liability for loss or damage to goods.

- Ensuring all service agreements clearly define responsibilities, limitations of liability, and dispute resolution mechanisms.

- Maintaining comprehensive insurance coverage to protect against potential claims for cargo loss, damage, or operational errors.

- Staying abreast of evolving consumer protection laws and data privacy regulations that may impact customer contracts and data handling practices.

ANE Logistics must navigate a complex legal landscape, including federal mandates like the FMCSA's Hours of Service regulations, which limit driver work hours to ensure safety. State-specific laws, such as varying weight limits on roads, also demand careful adherence to avoid penalties.

Changes in labor laws, like potential minimum wage increases or adjustments to overtime rules, directly impact operational costs for ANE Logistics. Furthermore, evolving regulations on independent contractor classifications and new employment laws concerning worker protections and benefits require constant adaptation.

Data privacy and cybersecurity laws, such as GDPR and CCPA, are critical for ANE Logistics given its reliance on digital platforms. The company must invest in robust cybersecurity measures to protect sensitive data and maintain customer trust, especially with the observed rise in cyberattacks targeting the logistics sector.

Environmental regulations, including stricter emission standards and carbon footprint reduction targets, necessitate investments in cleaner fleets and sustainable practices. Compliance with these evolving laws is crucial for ANE Logistics' long-term operational viability and corporate responsibility.

Environmental factors

The logistics sector is under significant pressure to curb carbon emissions, aligning with global net-zero ambitions. This translates to a push for cleaner fuels, more efficient route planning, and the adoption of electric or hydrogen-powered fleets, a trend expected to accelerate through 2025.

ANE Logistics can solidify its sustainability credentials by actively pursuing initiatives to reduce its environmental impact. For instance, investing in electric delivery vans, which are projected to capture a larger market share of commercial vehicles by 2025, would be a tangible step.

A significant shift in green logistics involves moving towards electric vehicles (EVs) and alternative fuels for transport fleets. This trend is driven by both government regulations and increasing consumer demand for reduced fossil fuel dependency. In 2024, the global EV market for commercial vehicles is projected to see substantial growth, with projections indicating a significant increase in adoption rates by 2025.

ANE Logistics can strategically integrate EVs or other sustainable fuel options into its Less Than Truckload (LTL) fleet. This move would directly address environmental concerns and align with growing sustainability expectations from stakeholders. For instance, by early 2025, several major logistics companies are expected to have a notable percentage of their fleets operating on electric or hydrogen power, demonstrating a clear industry direction.

ANE Logistics can enhance its environmental stewardship by integrating green warehousing practices. This includes adopting renewable energy sources like solar and wind power for its facilities, which aligns with the growing global demand for sustainable operations. For instance, companies in the logistics sector are increasingly investing in solar panel installations, with the global solar energy market projected to reach over $320 billion by 2027, indicating a strong trend towards cleaner energy adoption.

Implementing energy-efficient lighting and smart energy management systems is also vital. These technologies can significantly reduce operational costs and carbon footprint. By adopting green building standards and deploying energy-saving technologies across its hub and spoke network, ANE Logistics can demonstrate a commitment to environmental responsibility, potentially attracting environmentally conscious clients and investors.

Waste Reduction and Eco-Friendly Packaging

Waste reduction and the embrace of eco-friendly packaging are increasingly vital in the logistics sector, directly influencing consumer perception and regulatory compliance. Companies like ANE Logistics are feeling the pressure to minimize their environmental footprint, with a strong emphasis on recycling and the adoption of reusable packaging solutions. This trend is driven by both growing consumer demand for sustainable practices and stricter environmental regulations. For instance, in 2024, the global sustainable packaging market was valued at approximately $315 billion, with projections indicating continued robust growth through 2030, highlighting a significant shift in industry priorities.

ANE Logistics can proactively address these environmental factors by integrating sustainable packaging options and robust waste management programs across its express parcel and Less Than Truckload (LTL) services. This strategic move not only reduces environmental impact but also enhances brand appeal among an increasingly eco-conscious customer base.

- Focus on Recyclable Materials: Implementing packaging made from recycled content or easily recyclable materials can significantly reduce landfill waste.

- Reusable Packaging Programs: Developing systems for the return and reuse of packaging, particularly for B2B clients, offers long-term cost savings and environmental benefits.

- Optimized Packaging Design: Minimizing packaging volume through smart design reduces material usage and transportation emissions, a key consideration in 2025 logistics planning.

Climate Change Impact and Supply Chain Resilience

Climate change is increasingly impacting global supply chains, with extreme weather events becoming more frequent and intense. For ANE Logistics, this translates to tangible risks like port closures due to hurricanes or rail disruptions from heavy snowfall. For instance, the U.S. experienced 28 separate billion-dollar weather and climate disasters in 2023 alone, according to NOAA, highlighting the pervasive nature of these threats.

Building resilience is therefore paramount. This involves strategies such as diversifying transportation routes, investing in weather-resilient infrastructure, and developing robust contingency plans. A proactive approach can mitigate the financial impact of disruptions, which can include increased freight costs and delayed deliveries. For example, companies that diversified their supplier base saw an average of 20% less revenue loss during supply chain disruptions compared to those with concentrated suppliers.

ANE Logistics must integrate climate risk assessments into its core operational planning. This means not only identifying potential vulnerabilities but also developing adaptive strategies.

- Increased disruption frequency: Extreme weather events like floods and storms are becoming more common, directly impacting ANE Logistics's transit times and operational continuity.

- Higher operational costs: Rerouting shipments, expedited freight, and infrastructure repairs due to climate events can significantly inflate logistics expenses.

- Supply chain diversification: ANE Logistics should explore and implement strategies like multi-modal transportation and alternative warehousing locations to reduce reliance on single points of failure.

- Proactive risk management: Integrating climate data and forecasting into planning allows for better anticipation and mitigation of weather-related disruptions, ensuring greater reliability for clients.

Environmental pressures are a significant force shaping the logistics industry, pushing companies like ANE Logistics towards greater sustainability. The drive to reduce carbon emissions is leading to a substantial shift towards electric vehicles (EVs) and alternative fuels for fleets, a trend expected to accelerate significantly through 2025.

ANE Logistics can enhance its environmental profile by investing in green warehousing, such as utilizing solar power for its facilities, and by adopting energy-efficient technologies. Furthermore, a focus on waste reduction through recyclable and reusable packaging is becoming crucial for regulatory compliance and customer appeal, with the global sustainable packaging market projected for robust growth.

The increasing frequency of extreme weather events, driven by climate change, poses a direct risk to logistics operations, causing disruptions and increasing costs. ANE Logistics must build resilience by diversifying routes and investing in weather-resilient infrastructure, integrating climate risk assessments into its planning to mitigate these impacts.

| Environmental Factor | Impact on ANE Logistics | Strategic Response |

|---|---|---|

| Carbon Emission Reduction | Pressure to adopt cleaner fuels and electric fleets. | Invest in electric delivery vans; optimize route planning. |

| Green Warehousing | Demand for renewable energy sources in facilities. | Install solar panels; implement smart energy management systems. |

| Waste Management & Packaging | Need for recyclable and reusable packaging solutions. | Adopt eco-friendly packaging; develop reusable packaging programs. |

| Climate Change & Extreme Weather | Risk of supply chain disruptions and increased operational costs. | Diversify transportation routes; invest in resilient infrastructure; develop contingency plans. |

PESTLE Analysis Data Sources

Our PESTLE analysis for ANE Logistics is built on a robust foundation of data from official government publications, international trade organizations, and reputable industry research firms. We meticulously gather insights on political stability, economic indicators, technological advancements, and environmental regulations to provide a comprehensive view.