ANE Logistics Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ANE Logistics Bundle

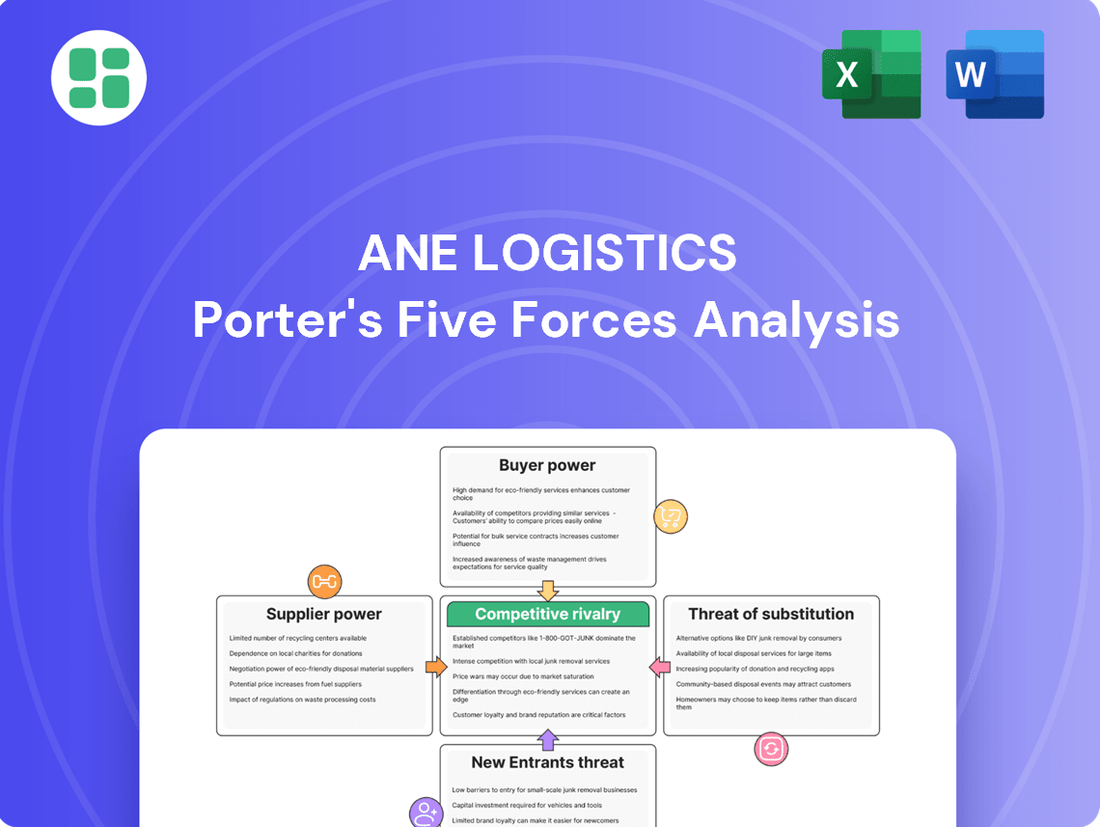

ANE Logistics operates within a dynamic industry shaped by several key competitive forces. Understanding the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry is crucial for strategic planning.

The complete report reveals the real forces shaping ANE Logistics ’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The logistics sector, including companies like ANE Logistics, continues to grapple with significant labor shortages, especially for essential roles like truck drivers and warehouse personnel. This scarcity directly translates into increased bargaining power for the available workforce.

These persistent shortages are fueling upward pressure on wages and benefits as companies compete fiercely to attract and retain qualified employees. For instance, the American Trucking Associations reported a shortage of over 78,000 drivers in 2023, a figure projected to grow. This competitive compensation environment directly impacts ANE Logistics' operational expenses.

Fuel is a major cost for ANE Logistics, and when fuel prices swing wildly, suppliers gain leverage. While 2024 offered some relief from peak fuel costs, geopolitical events and supply chain disruptions can still cause rapid price increases. This means ANE Logistics must constantly adapt its spending and how it prices its services to account for these unpredictable fuel expenses.

Suppliers of essential equipment like trucks, trailers, and cutting-edge logistics technology hold significant sway. The substantial upfront investment needed for these assets means ANE Logistics faces considerable procurement expenses. For instance, the average cost of a new Class 8 truck can range from $120,000 to $180,000, with specialized trailers adding tens of thousands more, making supplier relationships critical.

ANE Logistics' need for a modern, efficient fleet and advanced operational software translates into high capital outlays. This dependence on specific suppliers for critical operational components can create substantial switching costs, making it difficult and expensive to change providers. This can reduce ANE Logistics' leverage when negotiating prices or terms for vital equipment and technology.

Maintenance and Parts Supply Chain

The bargaining power of suppliers in ANE Logistics' maintenance and parts supply chain is significant, particularly concerning specialized components and timely service. Disruptions, like those seen in global logistics throughout 2023 and early 2024, can exacerbate this power. For instance, a shortage of specific diesel engine parts could allow manufacturers to command higher prices and longer lead times.

ANE Logistics relies on a consistent flow of maintenance services and spare parts to keep its extensive fleet operational. The criticality of specialized parts, such as those for advanced engine management systems or emission control units, means that few suppliers can offer replacements. This dependence grants these specialized suppliers considerable leverage in negotiating terms and pricing, directly impacting ANE's operational costs and efficiency.

- Criticality of Specialized Parts: ANE Logistics' need for specific, often proprietary, parts for its diverse fleet, which includes thousands of trucks and specialized vehicles, means that suppliers of these components hold substantial sway.

- Supply Chain Vulnerability: Global supply chain challenges, including geopolitical events and manufacturing delays, can create scarcity for essential parts, increasing supplier power and potentially driving up costs for ANE. For example, the automotive parts sector faced ongoing supply chain pressures in 2023, impacting availability and pricing.

- Service Provider Dependence: The reliance on authorized or specialized service providers for complex repairs and maintenance further concentrates bargaining power with these entities, as they possess the unique expertise and tools required.

- Impact on Operational Efficiency: Delays in obtaining critical spare parts can lead to extended vehicle downtime, directly affecting ANE Logistics' ability to meet delivery schedules and incurring significant opportunity costs.

Rising Insurance Premiums

Insurance providers are demonstrating increasing bargaining power, a trend directly impacting ANE Logistics. Premiums for trucking and logistics operations have seen significant upward movement, driven by factors like a rise in accident claims and evolving regulatory landscapes. For instance, commercial auto insurance rates saw an average increase of 15% to 20% in 2023, according to industry reports, and this trend is expected to continue into 2024.

This essential operational expense is largely unavoidable for logistics firms like ANE Logistics. Consequently, insurance companies wield considerable influence over the overhead costs of these businesses, as there are limited alternatives for comprehensive coverage. The necessity of insurance means that logistics companies often have to accept the terms and pricing set by insurers, reinforcing the suppliers' strong bargaining position.

- Rising Insurance Costs: Commercial trucking insurance premiums have been on an upward trajectory, with some sectors experiencing double-digit percentage increases annually.

- Contributing Factors: Increased accident frequency and severity, coupled with rising repair costs and litigation expenses, are key drivers behind these premium hikes.

- Limited Alternatives: The essential nature of insurance for operational continuity leaves logistics companies with little leverage to negotiate lower rates.

- Impact on Overhead: Higher insurance premiums directly translate to increased operating expenses for ANE Logistics, potentially impacting profitability.

The bargaining power of suppliers for ANE Logistics is substantial, driven by labor shortages, specialized equipment needs, and rising insurance costs. These factors allow suppliers to command higher prices and dictate terms, impacting ANE's operational expenses and efficiency. For example, the ongoing shortage of skilled truck drivers, estimated at over 78,000 in 2023, directly increases labor costs. Furthermore, the significant investment required for new Class 8 trucks, averaging $120,000 to $180,000, grants considerable leverage to truck manufacturers.

| Supplier Category | Key Factors Influencing Bargaining Power | Impact on ANE Logistics | Example Data (2023-2024) |

|---|---|---|---|

| Labor (Drivers, Warehouse Staff) | Critical labor shortages, high demand | Increased wages, benefits, recruitment costs | Driver shortage exceeded 78,000 in 2023 |

| Equipment (Trucks, Trailers) | High capital expenditure, specialized technology | Significant procurement costs, dependence on manufacturers | New Class 8 truck cost: $120,000 - $180,000 |

| Maintenance Parts & Services | Criticality of specialized parts, supply chain disruptions | Higher part prices, longer lead times, increased downtime | Automotive parts sector faced supply chain pressures in 2023 |

| Insurance | Rising accident claims, regulatory changes, limited alternatives | Increased premiums, higher operating overhead | Commercial auto insurance rates increased 15-20% in 2023 |

What is included in the product

Tailored exclusively for ANE Logistics, this analysis dissects the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes on its market position.

Effortlessly identify and mitigate competitive threats by visualizing the intensity of each Porter's Force, enabling proactive strategic adjustments.

Customers Bargaining Power

Customers, particularly large enterprises and online retailers, exhibit significant price sensitivity, actively pursuing reduced shipping costs. This is evident as the global logistics market, valued at approximately $9.6 trillion in 2023, features numerous players, allowing clients to readily compare offerings and negotiate favorable terms.

The ease with which customers can switch providers in a fragmented market like logistics, where many companies offer similar services, amplifies their bargaining power. This necessitates that ANE Logistics carefully calibrates its pricing strategies to remain competitive and retain its customer base, ensuring that cost pressures do not unduly impact its profitability margins.

Customers at ANE Logistics possess significant bargaining power due to the wide array of alternative freight options available. Beyond Less Than Truckload (LTL) services, clients can opt for Full Truckload (FTL), rail transport, or parcel delivery, each offering different cost-benefit trade-offs. This accessibility to diverse shipping methods directly enhances their ability to negotiate terms.

The ease with which customers can switch between these various transportation modes or even different providers arms them with considerable leverage. They can readily compare pricing, transit times, and service quality, which compels ANE Logistics to offer competitive rates and superior service to retain their business. For instance, in 2024, the freight industry saw continued price volatility, with LTL rates fluctuating based on capacity and demand, making customer comparisons even more critical.

To counter this, ANE Logistics must continuously refine its value proposition, clearly articulating what sets its services apart from the readily available alternatives. This differentiation is key to fostering customer loyalty and mitigating the inherent bargaining power that stems from a competitive market landscape.

The rise of digital freight platforms and integrated logistics management systems significantly reduces the effort and cost for customers to switch between logistics providers. These technologies provide unprecedented transparency and make it incredibly easy for businesses to compare pricing, service levels, and availability across multiple carriers. For instance, in 2024, the global digital freight forwarding market was valued at approximately $20 billion, indicating a substantial shift towards tech-enabled solutions that empower customer choice.

This ease of comparison directly translates to increased bargaining power for customers, as they can readily identify and move to competitors offering better terms or more suitable services. ANE Logistics must therefore focus on delivering exceptional customer service, building strong relationships, and offering value-added, integrated solutions that go beyond basic transportation to retain its client base in this increasingly fluid market.

Demand for Tailored Logistics Solutions

Large enterprise clients are increasingly vocal about their need for highly customized logistics and supply chain management. This demand translates directly into significant bargaining power for these customers. For instance, in 2024, major retail chains and e-commerce giants often negotiate favorable rates and service level agreements due to the sheer volume and specificity of their shipping requirements.

These sophisticated clients frequently require more than just standard transportation; they seek specialized services, seamless integration with their existing technology platforms, and highly flexible contract structures. This can include real-time tracking, dedicated fleet management, or complex warehousing solutions tailored to their unique product flows.

ANE Logistics can leverage its capacity to deliver these bespoke solutions as a key differentiator in a competitive market. However, meeting these exacting demands necessitates continuous adaptation and investment in flexible operational capabilities to align with each specific customer's evolving needs.

- Increased Customer Leverage: Large clients can negotiate better terms due to their significant shipping volumes and specialized service demands, impacting ANE Logistics' pricing and service offerings.

- Demand for Customization: Tailored solutions, including technology integration and flexible contracts, are becoming a standard expectation, requiring agile service delivery.

- Strategic Importance of Bespoke Services: ANE Logistics' ability to adapt and provide unique solutions can be a competitive advantage, but it also demands resource allocation to meet diverse client requirements.

Market Overcapacity and Freight Recession

Periods of market overcapacity, such as the freight recession experienced in early 2024, significantly weaken the bargaining power of customers. During these times, when there's an excess of available shipping capacity compared to demand, customers are empowered to negotiate more aggressively for reduced rates.

This shift creates a distinct buyer's market, directly impacting ANE Logistics' revenue per mile. For instance, the US trucking industry saw capacity utilization rates fluctuate, with some reports indicating increased available trailers in early 2024, which naturally puts downward pressure on pricing.

- Overcapacity Pressure: Periods of market overcapacity, like the freight recession in early 2024, directly translate to lower freight rates.

- Customer Negotiation Power: When capacity exceeds demand, customers gain leverage to negotiate for lower prices.

- Impact on Revenue: This buyer's market environment can significantly reduce ANE Logistics' revenue per mile.

- Industry Data: Early 2024 data suggested an increase in available trucking capacity, exacerbating this trend.

Customers wield considerable influence in the logistics sector due to the abundance of service providers and the ease of switching. This is amplified by the availability of diverse shipping modalities beyond standard LTL, such as FTL, rail, and parcel services, each offering distinct cost-benefit profiles. For instance, in 2024, the global logistics market continued to be highly competitive, with numerous companies vying for market share, allowing clients to readily compare and negotiate terms.

The increasing adoption of digital freight platforms further empowers customers by providing enhanced transparency and simplifying comparisons of pricing, service levels, and availability across carriers. This technological shift, with the digital freight forwarding market valued at approximately $20 billion in 2024, directly translates to greater customer leverage, compelling ANE Logistics to focus on superior service and value-added solutions to foster loyalty.

Large enterprise clients, in particular, exert significant bargaining power by demanding highly customized logistics and supply chain management solutions. Their substantial shipping volumes and specific requirements, often including technology integration and flexible contracts, allow them to negotiate favorable rates and service level agreements. ANE Logistics' ability to deliver these bespoke services is crucial for differentiation, though it necessitates ongoing investment in flexible operational capabilities to meet diverse client needs.

| Factor | Impact on ANE Logistics | Customer Leverage |

|---|---|---|

| Provider Proliferation | Intensifies price competition | High (easy to switch) |

| Service Modality Options | Requires flexible service offerings | High (can choose alternatives) |

| Digital Platforms | Increases transparency and comparison ease | High (identifies best terms) |

| Customization Demand | Necessitates tailored solutions and investment | High (large volumes, specific needs) |

Preview the Actual Deliverable

ANE Logistics Porter's Five Forces Analysis

This preview showcases the complete ANE Logistics Porter's Five Forces Analysis, offering a thorough examination of the competitive landscape within the logistics industry. The document you see here is precisely what you will receive immediately after purchase, ensuring a transparent and accurate representation of the valuable insights contained within. You can be confident that no placeholders or edited sections are present; this is the full, professionally formatted analysis ready for your strategic planning needs.

Rivalry Among Competitors

The less-than-truckload (LTL) freight sector is incredibly fragmented, featuring a vast number of competitors from national giants down to smaller, regional operators. This intense rivalry means ANE Logistics must constantly innovate and offer unique value propositions to stand out, rather than solely competing on price.

In 2024, the LTL market continued to see significant competition, with industry reports indicating hundreds of carriers actively vying for business. This dynamic landscape forces companies like ANE Logistics to focus on service quality, reliability, and specialized offerings to capture and retain market share in a fast-paced environment.

Competitive rivalry in the logistics sector is intensifying, largely fueled by a significant emphasis on technology and automation. Companies are pouring resources into artificial intelligence, robotics, and sophisticated real-time data analytics to gain an edge. ANE Logistics, by prioritizing these advanced technological investments, positions itself to meet this evolving challenge, understanding that innovation is paramount to maintaining market leadership.

The core of this competitive battleground lies in the ability to deliver superior operational visibility, enhanced efficiency, and predictive capabilities to clients. For instance, in 2024, the global logistics automation market was valued at approximately $35 billion and is projected to grow significantly, demonstrating the scale of investment and the strategic importance of these technologies. Companies that effectively leverage these tools can offer faster delivery times, reduced costs, and more resilient supply chains, directly impacting customer satisfaction and loyalty.

Competitors in the logistics sector actively seek to stand out by emphasizing superior service quality, unwavering reliability, expedited delivery times, and the breadth of their operational networks. This mirrors the very strengths that ANE Logistics cultivates, creating a dynamic competitive landscape where differentiation is key to capturing market share.

Firms such as ANE Logistics strategically employ hub-and-spoke network models. These systems are designed to streamline operations, reduce transit times, and facilitate comprehensive nationwide coverage, a critical factor for clients requiring broad logistical reach. For instance, in 2023, the average transit time for expedited shipments within the US logistics industry saw a slight improvement, reflecting the industry's focus on speed.

Maintaining a distinct advantage in this competitive arena necessitates continuous and substantial investment in both physical infrastructure and the consistent pursuit of operational excellence. Companies that prioritize upgrading their fleets, adopting advanced tracking technologies, and refining their sorting and distribution processes are better positioned to meet evolving customer demands and stay ahead of rivals.

Strategic Mergers and Acquisitions

The logistics industry is seeing a wave of consolidation, with mergers and acquisitions (M&A) becoming a key strategy for growth. Companies are actively acquiring others to broaden their geographic footprint, integrate advanced technologies, and fortify their supply chain networks. This ongoing consolidation directly fuels competitive rivalry by fostering the emergence of larger, more dominant players within the market.

ANE Logistics must remain keenly aware of these strategic M&A activities. For instance, in 2023, the global logistics M&A market saw significant activity, with major deals aimed at achieving scale and efficiency. Understanding these moves is crucial for ANE Logistics to effectively adjust its own competitive strategies and maintain its market position.

- Increased Market Concentration: M&A activity leads to fewer, larger competitors, intensifying direct competition.

- Enhanced Capabilities: Acquiring firms gain access to new technologies, routes, and customer bases, raising the bar for all players.

- Strategic Adaptation: ANE Logistics needs to analyze these trends to inform its own growth and investment decisions.

Adaptability to Evolving Customer Expectations

Competitive rivalry in the logistics sector is intensifying as companies strive to meet rapidly changing customer expectations. This includes a growing demand for expedited delivery times, real-time shipment tracking for increased transparency, and a stronger emphasis on sustainable, eco-friendly operations. For instance, in 2024, a significant percentage of consumers indicated they would switch providers for faster delivery options, putting pressure on all players to innovate their service models.

Logistics providers are actively differentiating themselves by showcasing their capacity to adapt to these evolving demands. This often translates into offering more flexible service packages and investing in greener fleet technologies and route optimization software to reduce environmental impact. Companies that can demonstrate agility in meeting these customer priorities are gaining a competitive edge.

- Increased Demand for Speed: Customer surveys in early 2024 revealed that over 60% of online shoppers prioritize same-day or next-day delivery.

- Transparency is Key: Real-time tracking features are no longer a luxury but a standard expectation, with 85% of customers expecting live updates on their shipments.

- Sustainability Matters: A growing segment of consumers, estimated at 45% in 2024, actively seek out and are willing to pay more for environmentally responsible shipping options.

- ANE Logistics' Response: ANE Logistics' strategic investments in advanced tracking systems and its commitment to optimizing delivery routes directly address these critical customer needs, positioning it favorably against competitors.

The competitive rivalry within the less-than-truckload (LTL) sector remains a defining characteristic for ANE Logistics. This intense competition stems from a highly fragmented market populated by numerous national, regional, and specialized carriers, all vying for market share. Companies must therefore focus on differentiation through service quality, technological innovation, and operational efficiency rather than solely on price.

In 2024, the LTL market continued to see robust competition, with hundreds of carriers actively competing. This dynamic environment necessitates a strong emphasis on service reliability and specialized offerings to retain clients. Investments in advanced technologies like AI and robotics are becoming crucial for gaining a competitive edge, with the global logistics automation market valued at approximately $35 billion in 2024.

| Key Competitive Factors | ANE Logistics' Position | Market Trend (2024) |

| Service Quality & Reliability | Core strength, focus on differentiation | Essential for customer retention |

| Technological Investment (AI, Automation) | Strategic priority for efficiency and visibility | Market valued at ~$35 billion, growing rapidly |

| Customer Expectations (Speed, Transparency, Sustainability) | Addressing through advanced tracking and route optimization | 60%+ consumers prioritize speed; 85% expect live tracking; 45% favor eco-friendly options |

SSubstitutes Threaten

For shippers needing to move larger volumes, dedicated Full Truckload (FTL) services can indeed serve as a direct substitute for Less Than Truckload (LTL) options, particularly when FTL pricing becomes more competitive. This is especially true if a client's freight volume grows to a point where consolidating shipments via LTL is no longer the most cost-effective choice. In 2024, the average cost per mile for FTL shipments saw fluctuations based on fuel prices and carrier capacity, making it crucial for ANE Logistics to clearly articulate the advantages of LTL for appropriately sized shipments.

For shipments where speed isn't the top priority, rail and intermodal transport present a compelling, cost-effective alternative to Less Than Truckload (LTL) services. This is especially true for heavy or bulky items, making them indirect substitutes for ANE Logistics' core offerings.

In 2024, the U.S. freight rail industry moved approximately 1.2 billion tons of goods, highlighting its significant role in long-haul transportation. Intermodal volume, which combines rail and trucking, also saw robust activity, demonstrating the continued appeal of these combined services for certain cargo types.

For shipments where time is the absolute priority, air cargo and specialized expedited shipping options present a significant substitute threat to ANE Logistics. These alternatives, while carrying a higher price tag, offer superior speed for urgent, high-value, or time-critical goods.

While ANE Logistics provides express parcel delivery, its Less-Than-Truckload (LTL) services are particularly vulnerable when customers prioritize speed over cost. The decision for a shipper often boils down to a direct trade-off between the expense of air freight and the delivery timeline required.

In 2024, the global air cargo market continued its robust performance, with IATA reporting a significant increase in demand, indicating a strong preference for speed. This trend highlights the ongoing competitive pressure from air freight on traditional LTL services like those offered by ANE Logistics, especially for time-sensitive shipments.

In-House Logistics and Private Fleets

Large enterprises might choose to handle their logistics internally, operating private fleets. This approach gives them more command over their supply chain and can be financially advantageous for companies with steady, high-volume shipping requirements, thereby bypassing third-party LTL services.

ANE Logistics needs to prove its operations are more efficient and less expensive than these in-house solutions to remain competitive. For instance, companies like Walmart have extensively invested in their own private fleet, operating thousands of trucks to manage a significant portion of their distribution network, demonstrating the scale of this threat.

- Cost Comparison: ANE Logistics must offer pricing that undercuts the total cost of ownership for a private fleet, including vehicle acquisition, maintenance, fuel, and driver salaries.

- Efficiency Benchmarking: The company needs to showcase faster transit times or more reliable delivery schedules than what large companies can achieve with their own resources.

- Scalability and Flexibility: ANE Logistics can highlight its ability to scale services up or down more easily than companies managing fixed assets, offering a flexible solution for fluctuating demand.

Parcel and Small Package Carriers

For very small Less Than Truckload (LTL) shipments, traditional parcel and small package carriers present a significant threat of substitution. This is particularly true with the continued expansion of e-commerce, which fuels demand for efficient individual package delivery. These services often boast competitive pricing structures and robust, established networks capable of handling a high volume of individual parcels, directly impacting ANE Logistics' market for smaller LTL freight.

The competitive pricing and extensive reach of parcel carriers for individual packages mean ANE Logistics' core LTL model, which focuses on consolidating multiple smaller shipments, must consistently demonstrate its value proposition. For instance, in 2024, the US parcel delivery market was valued at over $150 billion, showcasing the sheer scale and competitive intensity of these substitute services. ANE Logistics needs to ensure its pricing and service efficiency for its target freight sizes remain attractive compared to these alternatives.

The threat of substitutes is amplified by the increasing capabilities and network density of major parcel players. As e-commerce continues its growth trajectory, these carriers are further investing in infrastructure and technology to optimize last-mile delivery. This means ANE Logistics must continuously innovate and maintain cost-effectiveness within its LTL consolidation strategy to effectively counter the allure of parcel services for smaller shipments.

- Parcel carriers offer competitive pricing for individual packages.

- E-commerce growth fuels demand for parcel services, a direct substitute for small LTL.

- ANE Logistics must remain cost-competitive for its target freight size against parcel alternatives.

The threat of substitutes for ANE Logistics' Less Than Truckload (LTL) services is multifaceted. While dedicated Full Truckload (FTL) can be a substitute for larger volumes, rail and intermodal offer cost-effectiveness for heavy goods, and air cargo provides speed for urgent shipments. Furthermore, companies operating private fleets and parcel carriers for smaller shipments also represent significant competitive alternatives.

In 2024, the U.S. parcel delivery market, valued at over $150 billion, underscores the intense competition from parcel carriers for smaller shipments. This growth, fueled by e-commerce, means ANE Logistics must maintain cost-competitiveness and highlight its value proposition for consolidated LTL freight.

The choice between LTL and substitutes often hinges on a shipper's priorities: cost versus speed, volume, and control. ANE Logistics must leverage its strengths in consolidation and network efficiency to counter the advantages offered by these diverse substitute services.

| Substitute Type | Primary Advantage | ANE Logistics' Counter-Strategy |

|---|---|---|

| Full Truckload (FTL) | Cost-effective for high volumes | Highlight LTL efficiency for smaller, consolidated shipments. |

| Rail/Intermodal | Cost-effective for heavy/bulky goods | Emphasize speed and flexibility for less time-sensitive LTL. |

| Air Cargo | Speed for urgent/high-value goods | Focus on cost savings for non-urgent LTL shipments. |

| Private Fleets | Control and integration for large enterprises | Offer superior efficiency, scalability, and cost savings vs. ownership. |

| Parcel Carriers | Competitive pricing for individual packages | Demonstrate value in consolidation for shipments exceeding parcel limits. |

Entrants Threaten

Establishing a nationwide Less-Than-Truckload (LTL) logistics operation comparable to ANE Logistics requires a massive initial capital outlay. This includes acquiring and maintaining a substantial fleet of trucks and trailers, building or leasing extensive terminal and warehouse networks across the country, and investing in sophisticated tracking and management technology. For instance, a new, fully equipped LTL terminal can cost upwards of $10 million to construct, and a fleet of 500 tractors and trailers could easily exceed $75 million in 2024 alone.

These considerable upfront costs act as a significant deterrent for potential new entrants. The sheer scale of investment needed to compete effectively means only well-capitalized companies or those with access to substantial financing can even consider entering the market. This financial barrier effectively limits the number of new players that can realistically challenge established companies like ANE Logistics, thus reducing the threat of new entrants.

The sheer complexity of building and optimizing a nationwide hub-and-spoke network, coupled with advanced supply chain management, presents a formidable barrier for new entrants. ANE Logistics has invested years and substantial capital into refining these intricate operations, making it difficult for newcomers to match their established efficiency and reach. For instance, in 2024, the logistics industry saw significant investment in AI-driven route optimization, a technology that requires deep expertise to implement effectively.

The logistics sector is heavily regulated, with rules covering everything from driver safety and emissions to international trade compliance. For instance, in 2024, the International Maritime Organization's (IMO) updated greenhouse gas strategy continues to push for cleaner shipping fuels, adding complexity for any new operator.

New companies entering the market must invest heavily in legal expertise and operational systems to meet these diverse and often changing requirements. This compliance burden, which can include obtaining specific licenses and certifications, significantly increases the upfront capital and ongoing operational costs for potential entrants.

Navigating this intricate web of regulations, such as adhering to varying customs procedures across different countries or meeting new data privacy laws impacting shipment tracking, can be a substantial barrier. The time and financial resources needed to achieve and maintain compliance can deter new players, thereby reducing the threat of new entrants to established companies like ANE Logistics.

Brand Recognition and Customer Trust

Established logistics providers like ANE Logistics enjoy a significant advantage through strong brand recognition and deep-seated customer trust, cultivated over years of reliable service. This makes it challenging for newcomers to penetrate the market. For instance, in 2024, the global logistics market, valued at over $9.7 trillion, is dominated by established players who have invested heavily in building their reputations.

New entrants face the daunting task of not only matching existing service levels but also investing substantially in marketing and sales to build comparable brand awareness and customer loyalty. This barrier is particularly high in sectors where trust and consistent performance are paramount, such as time-sensitive freight or specialized cargo handling.

Building a reputation for dependable and efficient logistics operations is a time-consuming and resource-intensive endeavor. New companies must demonstrate a track record of on-time deliveries, minimal damage, and responsive customer support to even begin competing with incumbents like ANE Logistics.

- Brand Recognition: ANE Logistics benefits from established brand equity, making it easier to attract and retain customers compared to unknown new entrants.

- Customer Trust: Long-standing relationships built on proven reliability create a significant hurdle for new companies needing to prove their trustworthiness.

- Marketing Investment: New entrants must allocate considerable capital to marketing and advertising to build awareness and communicate their value proposition effectively.

- Operational Proof: Demonstrating consistent operational excellence and reliability is crucial for new logistics firms to gain traction in a competitive landscape.

Technological and Data Infrastructure Demands

The technological landscape of modern logistics presents a formidable hurdle for new entrants. Companies like ANE Logistics leverage sophisticated systems, including AI-powered route optimization and IoT sensors for real-time cargo monitoring. For instance, the global logistics market, valued at approximately $9.7 trillion in 2023, is increasingly driven by these technological advancements, with investments in digital transformation expected to accelerate.

Establishing a comparable technological and data infrastructure requires substantial capital outlay. New players would need to invest heavily in advanced software, hardware, and the expertise to manage them, making it difficult to compete with established firms that have already made these significant investments.

- High Capital Investment: Developing or acquiring AI, IoT, and advanced SCM software demands significant financial resources, often in the tens or hundreds of millions of dollars for comprehensive solutions.

- Expertise Gap: New entrants may struggle to attract and retain the specialized talent needed to implement and manage complex logistics technology.

- Integration Challenges: Integrating new technological systems with existing operational workflows and data streams can be costly and time-consuming.

- Data Security and Management: Robust data infrastructure is crucial for security and analytics, adding another layer of complexity and expense for newcomers.

The threat of new entrants for ANE Logistics is considerably low due to the immense capital required to establish a comparable nationwide Less-Than-Truckload (LTL) operation. For instance, building a new LTL terminal can cost over $10 million, and acquiring a fleet of 500 tractors and trailers could surpass $75 million in 2024, presenting a significant financial barrier.

Furthermore, the complexity of building and optimizing a nationwide hub-and-spoke network, coupled with the need for advanced supply chain management technology like AI-driven route optimization, demands substantial investment and expertise. New entrants must also navigate a heavily regulated environment, with compliance costs for safety, emissions, and international trade adding further financial strain.

Established brand recognition and customer trust, built over years of reliable service, create another substantial hurdle. New companies must invest heavily in marketing and demonstrate a proven track record of operational excellence to gain traction against incumbents like ANE Logistics. The high cost of technology adoption and integration further solidifies this barrier.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for ANE Logistics is built upon a foundation of industry-specific market research reports, financial statements from publicly traded logistics companies, and government trade data. We also incorporate insights from logistics industry associations and competitor news releases to provide a comprehensive view of the competitive landscape.