Arab National Bank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Arab National Bank Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Arab National Bank's future. This comprehensive PESTLE analysis provides the strategic intelligence you need to anticipate market shifts and capitalize on emerging opportunities. Download the full version now to gain a competitive edge.

Political factors

The Saudi Arabian government's stability provides a crucial foundation for the banking sector. Vision 2030, a monumental plan for economic transformation, is actively being implemented, aiming to reduce oil dependency and foster growth in non-oil sectors. This strategic direction directly impacts financial institutions like Arab National Bank (ANB).

ANB benefits from this stable political climate and the clear national agenda. Vision 2030's focus on economic diversification, which includes significant investment in infrastructure, tourism, and technology, creates new avenues for banking services and lending. For instance, the Public Investment Fund (PIF), a key driver of Vision 2030, managed assets worth approximately $778 billion as of early 2024, signaling substantial capital deployment that banks can support.

The Saudi Central Bank (SAMA) is the primary architect of Saudi Arabia's financial landscape, dictating monetary policy and interest rate trajectories. For Arab National Bank (ANB), SAMA's directives on capital adequacy, liquidity management, and lending practices are paramount, directly shaping its operational framework and risk appetite. In 2023, SAMA maintained its key policy rates in line with global trends, with the repo rate standing at 5.00% and the reverse repo rate at 4.50%, influencing ANB's cost of funds and lending margins.

The broader geopolitical landscape in the Middle East continues to present a complex environment that can influence investor confidence and economic activity within Saudi Arabia. While Arab National Bank (ANB) has a strong domestic focus, regional tensions or conflicts can indirectly affect critical areas like trade finance and foreign investment, potentially impacting the bank's asset quality and growth prospects. For instance, heightened regional instability in late 2024 and early 2025 has led to increased volatility in oil prices, a key driver for the Saudi economy and thus for banking sector performance.

Maintaining regional stability is therefore crucial for the long-term health and predictable growth of the banking sector. A stable Middle East fosters greater cross-border trade and encourages foreign direct investment, both of which directly benefit financial institutions like ANB. Conversely, disruptions can lead to capital flight and reduced lending opportunities, creating headwinds for the bank's strategic objectives.

Government Spending and Infrastructure Projects

Saudi Arabia's Vision 2030 continues to fuel substantial government spending on transformative infrastructure and giga-projects. These initiatives, such as NEOM and the Red Sea Project, are designed to diversify the economy and stimulate significant economic activity. For instance, the Public Investment Fund (PIF) committed SAR 2 trillion (approximately $533 billion) to domestic projects in 2023, a substantial portion of which flows into infrastructure development.

This robust government investment creates a fertile ground for corporate banking services. Arab National Bank (ANB) is well-positioned to leverage these opportunities by providing crucial financing solutions. These include project finance for large-scale developments, syndicated loans to spread risk across multiple financial institutions, and expert advisory services to navigate the complexities of these mega-projects. Such engagement directly bolsters ANB's corporate banking portfolio and contributes significantly to its revenue streams.

- Vision 2030 Giga-Projects: Continued government investment in projects like NEOM and Red Sea Global offers significant financing potential.

- PIF Investment: The Public Investment Fund's substantial domestic project commitments, exceeding SAR 2 trillion in 2023, directly translate to banking opportunities.

- ANB's Role: ANB can secure revenue through project finance, syndicated loans, and advisory services tailored to these large-scale infrastructure endeavors.

Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) Regulations

Arab National Bank (ANB), like all financial institutions in Saudi Arabia, must rigorously comply with Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) regulations. This commitment is crucial for maintaining trust and avoiding substantial fines. The Saudi Central Bank (SAMA) actively enforces these rules, requiring banks to implement sophisticated systems for customer due diligence and transaction monitoring.

These regulations significantly influence ANB's operational costs and risk management frameworks. For instance, the Kingdom’s Financial Intelligence Unit (FIU) mandates the reporting of suspicious transactions, a process that necessitates ongoing investment in technology and personnel. Failure to comply can result in severe financial penalties and damage to the bank's reputation, as seen in global trends where non-compliant institutions have faced multi-million dollar fines.

- Regulatory Compliance Investment: Banks are expected to allocate significant resources to technology and training for AML/CTF compliance.

- Due Diligence Requirements: Enhanced Know Your Customer (KYC) procedures are mandatory, impacting customer onboarding processes.

- Suspicious Activity Reporting: Robust systems for identifying and reporting suspicious transactions are essential for SAMA oversight.

- Reputational Risk: Non-compliance carries a high risk of reputational damage, affecting customer confidence and market standing.

The Saudi government's commitment to Vision 2030 continues to shape the political landscape, driving economic diversification and creating opportunities for financial institutions. The Public Investment Fund (PIF) is a key engine for this transformation, with its assets under management reaching approximately $778 billion by early 2024, signaling substantial capital deployment that banks can support. This strategic focus on non-oil sectors directly influences the banking sector's growth trajectory.

The Saudi Central Bank (SAMA) plays a pivotal role in regulating the financial sector, with its monetary policy decisions directly impacting banks like Arab National Bank. In 2023, SAMA maintained its key policy rates, with the repo rate at 5.00%, influencing lending margins and the cost of funds for ANB. Furthermore, strict adherence to Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) regulations, enforced by SAMA, necessitates ongoing investment in compliance systems and personnel.

Regional geopolitical stability remains a critical factor influencing investor confidence and economic activity within Saudi Arabia. While ANB has a strong domestic focus, regional tensions can indirectly affect trade finance and foreign investment, potentially impacting asset quality. For instance, heightened regional instability in late 2024 and early 2025 has led to increased oil price volatility, a key driver for the Saudi economy and, consequently, the banking sector's performance.

What is included in the product

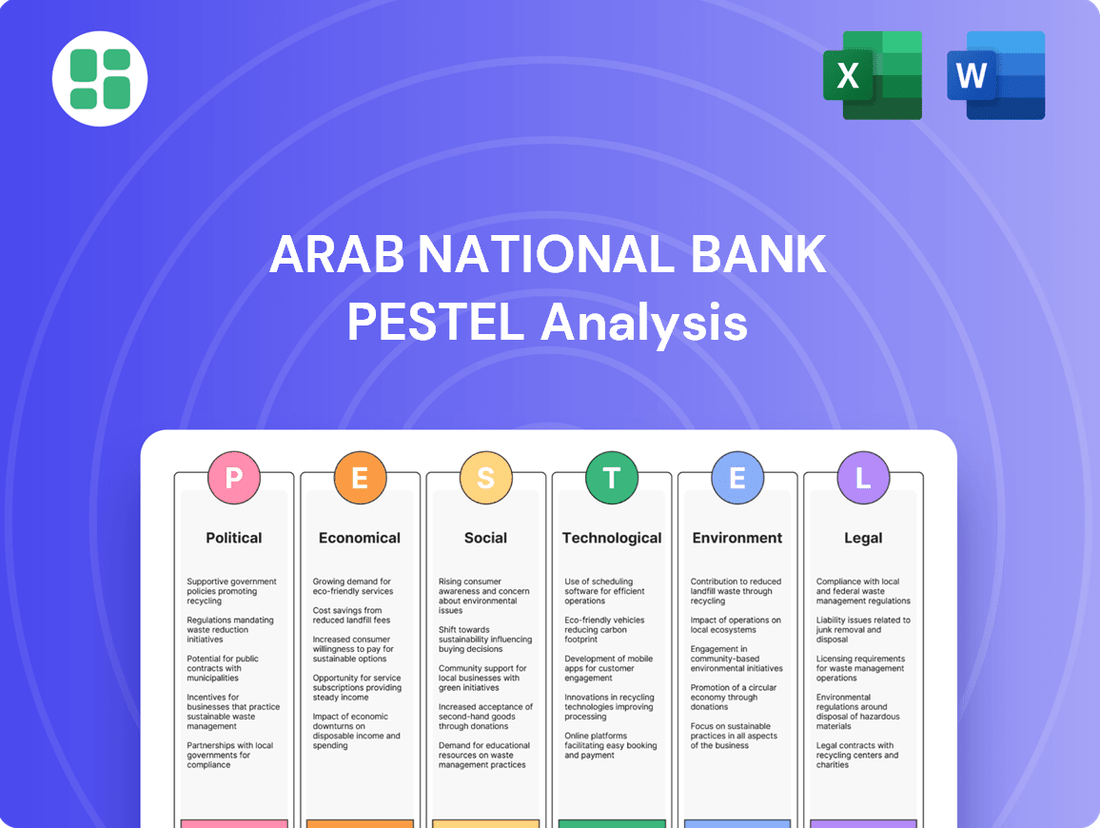

This PESTLE analysis thoroughly examines the external macro-environmental factors impacting Arab National Bank, detailing how Political, Economic, Social, Technological, Environmental, and Legal forces present both challenges and strategic opportunities.

It provides actionable insights for stakeholders, leveraging current data and forward-looking trends to inform decision-making and competitive strategy within the banking sector.

This PESTLE analysis for Arab National Bank acts as a pain point reliever by providing a clear, summarized version of external factors for easy referencing during strategy meetings.

It alleviates the pain of complex data by offering a visually segmented breakdown by PESTEL categories, enabling quick interpretation and informed decision-making.

Economic factors

Saudi Arabia's economy is deeply tied to oil, so global price swings directly affect government spending, bank liquidity, and economic expansion. For Arab National Bank (ANB), sustained low oil prices can mean fewer government deposits, slower loan expansion, and potentially more bad loans, especially in industries hit by government cutbacks.

For instance, the average Brent crude oil price hovered around $83 per barrel in early 2024, a significant improvement from earlier lows but still subject to volatility. Higher oil prices generally stimulate economic activity and improve the profitability of the banking sector, benefiting ANB through increased lending opportunities and a healthier deposit base.

The Saudi Central Bank (SAMA) closely monitors the US Federal Reserve's monetary policy, often aligning its own interest rates. This direct linkage means that when the Fed adjusts rates, SAMA typically follows suit, influencing borrowing and lending costs for institutions like Arab National Bank (ANB).

For ANB, these interest rate shifts directly impact its net interest margin (NIM), a key measure of profitability. Higher rates can boost NIM if the bank's assets reprice faster than its liabilities, but they also increase the cost of funding and can dampen loan demand from consumers and businesses.

In 2024 and into 2025, the global interest rate environment remains a critical factor. For instance, if the US Federal Reserve maintains its benchmark rate around the 5.25%-5.50% range, SAMA's policy rate, the repo rate, is likely to stay elevated, impacting ANB's funding costs and lending strategies.

Inflation significantly impacts the real value of money, influencing how much consumers can buy and how they choose to invest. For instance, Saudi Arabia's inflation rate was 2.3% in May 2024, a slight increase from previous months, which directly affects the purchasing power of individuals and the cost of goods and services.

High inflation can diminish the purchasing power of retail clients, potentially making it harder for them to repay loans. Simultaneously, it can increase the bank's operational expenses. For example, rising energy and technology costs, driven by inflation, could directly impact ANB's overhead.

Arab National Bank (ANB) needs to closely track inflation. In 2024, the Saudi Central Bank (SAMA) has maintained its benchmark repo rate at 5.00% and reverse repo rate at 4.50%, a stance that influences lending rates. ANB must strategically adjust its lending rates and manage its assets and liabilities to maintain the stability and attractiveness of its financial products amidst these economic shifts.

Economic Growth Rates and Diversification

Saudi Arabia's economic growth is a key driver for the Arab National Bank (ANB). The Kingdom's Vision 2030 initiative is successfully diversifying the economy away from oil, which directly impacts the demand for banking services. A stronger, more varied economy means more businesses are expanding, people are working, and confidence is high, all of which boost ANB's lending, deposit base, and income from fees. For example, Saudi Arabia's GDP grew by an estimated 4.5% in 2023, with non-oil sectors showing particular strength.

This economic diversification creates new avenues for growth for ANB. As the nation transitions towards a knowledge-based economy, there's a rising need for specialized financial products and services. This includes support for technology startups, venture capital, and investment banking, areas where ANB can leverage its expertise. The development of new industries, such as tourism and entertainment, also generates increased demand for corporate and retail banking solutions.

- Saudi Arabia's non-oil GDP growth was robust in 2023, contributing significantly to overall economic expansion.

- Vision 2030 reforms are actively encouraging foreign investment and private sector development, creating a favorable environment for banking.

- The increasing focus on digital transformation and innovation within the Saudi economy presents opportunities for ANB to offer advanced financial technologies.

- Growth in sectors like manufacturing and logistics, fueled by diversification efforts, translates to higher demand for trade finance and corporate lending.

Foreign Direct Investment (FDI) and Capital Flows

The Saudi Arabian government's proactive stance on attracting Foreign Direct Investment (FDI) is significantly shaping the financial landscape. Initiatives aimed at liberalizing regulations and offering incentives are bolstering capital market development, directly influencing the volume of financial transactions. For Arab National Bank (ANB), this translates into increased demand for its corporate and investment banking services.

Increased FDI directly fuels economic projects, creating a fertile ground for ANB to expand its offerings. The bank is well-positioned to provide crucial trade finance, corporate lending, and expert advisory services to a growing number of international businesses establishing or expanding their presence in Saudi Arabia. For instance, Saudi Arabia's Vision 2030 aims to attract significant FDI, with targets for non-oil FDI to reach 5.5% of GDP by 2030, up from 3.7% in 2023, according to the Ministry of Investment.

Stable and robust capital flows are the bedrock of a healthy financial system, and this is particularly true for ANB. These flows are essential for maintaining adequate liquidity within the bank and, more broadly, for underpinning market confidence. Saudi Arabia saw its net FDI inflows reach approximately $10 billion in the first half of 2024, a notable increase from the same period in 2023, highlighting the positive impact of government policies on capital movement.

- Government initiatives to boost FDI are enhancing capital market activity, increasing opportunities for ANB's corporate and investment banking divisions.

- Saudi Arabia's Vision 2030 targets a substantial rise in non-oil FDI, projected to reach 5.5% of GDP by 2030, up from 3.7% in 2023.

- The bank can leverage increased FDI to offer trade finance, corporate lending, and advisory services to international firms entering the Saudi market.

- Stable capital flows, evidenced by a rise in net FDI inflows to around $10 billion in H1 2024, are vital for ANB's liquidity and overall market confidence.

Saudi Arabia's economic performance, heavily influenced by oil prices and diversification efforts, directly impacts ANB's operational environment. The Kingdom's GDP growth, projected to be around 2.5% in 2024 according to IMF estimates, reflects a continued, albeit moderated, expansion driven by non-oil sectors. This economic backdrop shapes lending demand and deposit growth for ANB.

Monetary policy, particularly interest rate decisions by the Saudi Central Bank (SAMA), influences ANB's net interest margins and borrowing costs. SAMA's repo rate has remained at 5.00% as of mid-2024, mirroring global trends and impacting the cost of funds for the bank. Inflation, with Saudi Arabia's rate at 2.3% in May 2024, affects consumer purchasing power and operational expenses for ANB.

Government initiatives like Vision 2030 are fostering economic diversification, creating new opportunities for ANB in areas like technology and tourism financing. Foreign Direct Investment (FDI) is also a critical economic factor, with Saudi Arabia aiming to significantly increase non-oil FDI, which reached 3.7% of GDP in 2023, presenting avenues for corporate and investment banking growth for ANB.

| Economic Factor | 2023 Data/Estimate | 2024 Projection/Estimate | Impact on ANB |

|---|---|---|---|

| GDP Growth | 4.5% (Actual) | ~2.5% (IMF Estimate) | Influences lending demand and deposit growth. |

| Brent Crude Oil Price (Average) | ~$83/barrel (Early 2024) | Volatile, subject to global demand/supply. | Affects government spending, liquidity, and economic expansion. |

| Saudi Inflation Rate | ~2.3% (May 2024) | Expected to remain moderate. | Impacts purchasing power and operational costs. |

| SAMA Repo Rate | 5.00% (As of mid-2024) | Likely to remain stable, influenced by Fed. | Affects funding costs and net interest margins. |

| Non-Oil FDI as % of GDP | 3.7% (2023) | Targeting 5.5% by 2030. | Drives demand for corporate and investment banking services. |

Same Document Delivered

Arab National Bank PESTLE Analysis

The preview you see here is the exact Arab National Bank PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying, covering Political, Economic, Social, Technological, Legal, and Environmental factors impacting the bank, delivered exactly as shown, no surprises.

The content and structure shown in the preview, detailing the comprehensive PESTLE analysis for Arab National Bank, is the same document you’ll download after payment.

Sociological factors

Saudi Arabia's demographic landscape is characterized by a youthful population, with a significant proportion under the age of 30. This presents a substantial opportunity for the Arab National Bank (ANB) to expand its retail banking services. For instance, the Kingdom's population growth rate was approximately 2.1% in 2024, underscoring the expanding customer base.

ANB should focus on developing tailored products and digital platforms to cater to this young demographic's needs, including personal loans, mortgages, and innovative digital banking solutions. The increasing number of young adults entering the job market in 2024 and 2025 will naturally drive demand for credit and investment products, creating a fertile ground for ANB's growth.

Saudi consumers are rapidly embracing digital banking, with a significant portion now preferring online and mobile platforms over traditional branch visits. This shift is fueled by a growing demand for convenience and speed in financial transactions.

Arab National Bank (ANB) must prioritize ongoing investment in its digital offerings, including its mobile app and online services, to cater to these evolving preferences. For instance, by the end of 2024, digital transactions in Saudi Arabia are projected to see substantial year-over-year growth, underscoring the need for ANB to stay ahead.

The expectation for seamless, user-friendly digital experiences is a primary driver for innovation in the financial sector, pushing banks like ANB to continuously enhance their digital payment solutions and overall online presence to maintain a competitive edge.

Saudi Arabia's deeply ingrained cultural values, rooted in Islamic tradition, significantly shape consumer behavior and financial product demand. This cultural orientation translates into a substantial market for Sharia-compliant banking services, which ANB actively addresses by offering products like Murabaha (cost-plus financing), Ijarah (leasing), and Takaful (Islamic insurance).

ANB's commitment to Islamic finance principles is not merely a product offering but a cornerstone of its market strategy, fostering trust and ensuring broad acceptance among the Saudi populace. In 2023, Islamic banking assets in Saudi Arabia were estimated to represent a significant portion of the total banking sector, underscoring the critical importance of Sharia compliance for institutions like ANB to maintain their competitive edge and customer loyalty.

Employment Rates and Income Levels

National employment rates and income levels are crucial for the Arab National Bank (ANB). Higher employment means more people have money to bank with, borrow, and invest. For instance, in Saudi Arabia, the overall unemployment rate was reported at 5.7% in Q4 2023, a positive trend for consumer financial health. Rising average incomes directly translate to an increased capacity for ANB's retail customers to manage debt and utilize banking services.

When employment is strong and incomes are climbing, ANB typically sees a decrease in loan defaults and a surge in demand for various financial products, from mortgages to wealth management. The Kingdom's Vision 2030 initiatives, focused on economic diversification and job creation, are particularly beneficial for ANB's retail banking sector. These efforts aim to create sustainable employment opportunities, bolstering the bank's customer base.

Key indicators impacting ANB's retail segment include:

- Saudi Arabia's unemployment rate: A declining trend supports increased consumer spending and borrowing capacity.

- Average household income growth: Directly correlates with the ability of customers to service loans and invest.

- Job creation in diversified sectors: Indicates a broadening of the customer base and reduced reliance on single industries.

Social Reforms and Women's Participation in the Workforce

Recent social reforms in Saudi Arabia are significantly boosting women's engagement in the workforce, a trend that directly benefits Arab National Bank (ANB). This expanding demographic of working women represents a growing customer base eager for financial services tailored to their needs. For instance, by mid-2024, women's participation in the Saudi labor market had reached approximately 37%, a notable increase from previous years, indicating a substantial market segment for ANB to tap into.

ANB can capitalize on this shift by developing specialized financial products and services. This includes offering women-centric financial advisory, personal loans designed for female entrepreneurs, and investment products that align with their financial goals. Such initiatives not only cater to a burgeoning market but also promote broader financial inclusion and contribute to the Kingdom's economic diversification efforts. The bank also benefits internally by accessing a more diverse talent pool, bringing varied perspectives to its operations.

- Increased Female Labor Force Participation: Saudi Arabia's Vision 2030 aims to increase women's participation in the workforce, with figures showing a steady upward trend, creating a larger pool of potential banking customers.

- Demand for Tailored Financial Products: Working women are increasingly seeking financial solutions that address their specific needs, from savings and investment to credit and insurance.

- Economic Empowerment and Inclusion: ANB's focus on this demographic can drive economic empowerment for women and foster greater financial inclusion across the nation.

- Diversified Talent Acquisition: The bank can leverage this social change to attract and retain a more diverse workforce, enhancing its internal capabilities and market understanding.

Saudi Arabia's cultural emphasis on family and community influences banking behaviors, with many transactions and decisions involving family input. This social fabric means ANB should consider family-centric banking packages and potentially financial literacy programs for households. The strong sense of community can also be leveraged through localized marketing efforts and community engagement initiatives.

The growing awareness of social responsibility and ethical investing among Saudi consumers presents an opportunity for ANB to highlight its corporate social responsibility (CSR) initiatives and ethical investment options. Consumers are increasingly scrutinizing the social impact of the institutions they engage with, making transparency and ethical practices key differentiators for banks like ANB.

The Kingdom's drive towards economic diversification, as outlined in Vision 2030, is fostering a more dynamic and entrepreneurial society. This shift encourages a greater demand for business banking services, startup financing, and investment advisory, areas where ANB can expand its offerings to support emerging businesses and entrepreneurs.

Technological factors

Digital transformation is fundamentally altering the banking landscape, compelling Arab National Bank (ANB) to prioritize substantial investments in sophisticated digital platforms, user-friendly mobile applications, and comprehensive online services. This strategic shift is designed to elevate customer satisfaction, optimize operational efficiency, and broaden the accessibility of ANB's offerings via digital touchpoints.

For instance, in 2024, ANB continued its focus on enhancing its digital channels, aiming to capture a larger share of the growing digital banking market in Saudi Arabia, which saw a significant increase in mobile banking adoption. Staying ahead in digital innovation is paramount for ANB to maintain its competitive edge, ensuring customer loyalty and attracting a new, digitally-native customer base.

The burgeoning FinTech sector presents a dynamic landscape for Arab National Bank (ANB). Companies like stc pay, a prominent Saudi FinTech, have seen substantial growth, processing billions of transactions and highlighting the demand for digital financial services. This trend compels ANB to either enhance its digital offerings or forge strategic alliances to remain competitive.

FinTechs, with their focused expertise in areas such as digital payments and lending, are challenging traditional banking models. For instance, the Saudi Central Bank's (SAMA) sandbox initiative has fostered numerous innovative FinTech solutions, indicating a market ripe for disruption. ANB can leverage this by integrating these specialized services or developing its own agile digital platforms.

To maintain market leadership and broaden its customer base, ANB has opportunities to collaborate with or acquire successful FinTech entities. This approach allows ANB to quickly adopt cutting-edge technologies, improve customer experience, and tap into new revenue streams, as seen with other regional banks partnering with digital payment providers.

The intensifying digital landscape of banking presents significant cybersecurity threats. For Arab National Bank (ANB), a data breach could severely damage its reputation and erode customer trust. In 2024, the global financial sector saw a substantial rise in sophisticated cyberattacks, with losses estimated in the billions.

To counter these risks, ANB must prioritize investments in advanced cybersecurity infrastructure and threat detection systems. Ongoing employee training is also crucial to safeguard sensitive customer data and maintain the integrity of financial transactions. Adherence to evolving data protection regulations, such as those concerning cross-border data flows, is non-negotiable for continued operational compliance and customer confidence.

Artificial Intelligence (AI) and Automation Integration

Arab National Bank (ANB) is increasingly integrating Artificial Intelligence (AI) and automation to boost efficiency and customer experience. These technologies are crucial for enhancing operational agility, personalizing customer interactions, and strengthening risk management frameworks. For instance, AI-powered tools can streamline credit assessment processes and detect fraudulent activities more effectively.

The bank's strategic focus on digital transformation includes significant investments in AI and automation. This commitment is expected to yield substantial cost savings and improve decision-making across various banking functions. By automating routine tasks, ANB can reallocate resources to more strategic initiatives and complex problem-solving.

- AI-driven fraud detection systems can reduce losses by a significant margin, with some studies indicating potential reductions of up to 30% in false positives.

- Automation of back-office processes, such as data entry and reconciliation, can improve processing times by as much as 50%.

- Personalized banking services, powered by AI, can lead to increased customer loyalty and a potential 10-15% uplift in customer engagement.

- The global AI in banking market is projected to grow substantially, reaching over $30 billion by 2025, highlighting the widespread adoption of these technologies.

Payment System Innovations

The payments landscape is rapidly evolving, with innovations like real-time payments, QR code transactions, and the widespread adoption of digital wallets. For Arab National Bank (ANB), this necessitates ongoing investment in infrastructure upgrades to seamlessly support these emerging methods. The bank's ability to integrate with national payment systems such as mada and SARIE, alongside strategic international partnerships, is crucial for delivering efficient transaction services and staying competitive.

Key payment system innovations impacting ANB include:

- Real-time Payment Networks: Facilitating instant fund transfers, demanding robust and responsive banking systems.

- QR Code Technology: Enabling quick and contactless payments, requiring integration with merchant platforms.

- Digital Wallet Expansion: Growing use of mobile payment solutions, necessitating secure and user-friendly digital interfaces.

- Cross-border Payment Solutions: Demand for faster and cheaper international remittances, driving partnerships with fintechs and global payment providers.

Technological advancements are reshaping banking for Arab National Bank (ANB), driving a need for continuous investment in digital platforms and mobile applications. The bank's commitment to digital innovation is critical for enhancing customer experience and expanding its market reach, especially as digital banking adoption surged in Saudi Arabia during 2024.

The rise of FinTechs, exemplified by companies like stc pay, underscores the demand for agile financial solutions, pushing ANB to either innovate rapidly or seek strategic partnerships. Saudi Arabia's FinTech sandbox initiative has already fostered numerous new solutions, indicating a market ripe for disruption and integration.

To combat growing cybersecurity threats, ANB must invest in advanced security measures and employee training, a crucial step given the global rise in sophisticated cyberattacks affecting financial institutions in 2024.

The integration of Artificial Intelligence (AI) and automation is a key strategic focus for ANB, aiming to improve operational efficiency, personalize customer interactions, and strengthen risk management. For instance, AI-powered fraud detection systems can significantly reduce losses, with potential reductions in false positives reaching up to 30%.

| Technology Area | Impact on ANB | Key Data/Trend (2024/2025) |

|---|---|---|

| Digital Transformation | Enhanced customer experience, operational efficiency | Increased mobile banking adoption in Saudi Arabia |

| FinTech Integration | Competitive pressure, partnership opportunities | Growth in digital payment solutions |

| Cybersecurity | Reputational risk, data protection needs | Rise in sophisticated cyberattacks globally |

| AI & Automation | Improved efficiency, personalized services, risk management | AI in banking market projected to exceed $30 billion by 2025 |

| Payment Innovations | Need for infrastructure upgrades, support for new methods | Growth in real-time payments and digital wallets |

Legal factors

Arab National Bank (ANB) operates under the stringent regulatory framework established by the Saudi Central Bank (SAMA). These regulations, which encompass licensing, capital adequacy, risk management, and consumer protection, are crucial for maintaining financial stability and public trust. For instance, SAMA's Basel III implementation mandates specific capital ratios, with Saudi banks generally maintaining ratios well above the minimum requirements, reflecting a strong capital position as of early 2024.

Adherence to these evolving legal requirements is paramount for ANB's continued operation and reputation. SAMA's oversight includes regular audits and compliance checks to ensure banks are meeting their obligations, such as anti-money laundering (AML) and counter-terrorist financing (CTF) standards. In 2023, SAMA continued its focus on enhancing digital banking security and data privacy regulations, impacting how ANB manages customer information and online transactions.

The Personal Data Protection Law (PDPL) in Saudi Arabia, overseen by the Saudi Data & AI Authority (SDAIA), directly influences how Arab National Bank (ANB) handles customer information, from collection to sharing. ANB must adhere to these strict privacy mandates to safeguard sensitive data and maintain customer confidence.

Failure to comply with PDPL can result in significant financial penalties, underscoring the critical need for ANB to implement strong data governance and advanced cybersecurity protocols. These measures are paramount for protecting customer data and ensuring operational integrity.

Consumer protection laws in Saudi Arabia, such as those enforced by the Saudi Central Bank (SAMA), mandate fair lending practices, clear disclosure of fees and terms, and robust dispute resolution processes for financial institutions like Arab National Bank (ANB). For instance, SAMA’s Consumer Protection Principles, updated in 2023, emphasize transparency and fairness in all dealings, directly impacting how ANB markets its loans and deposit products to retail customers. Non-compliance can lead to significant fines and a loss of customer trust, as evidenced by SAMA’s ongoing oversight of the banking sector.

Anti-Competition Laws and Market Regulations

Saudi Arabia's commitment to fostering a competitive financial landscape is evident in its robust anti-competition laws and market regulations. These legal frameworks are designed to prevent the formation of monopolies and ensure a level playing field for all participants in the banking sector. For Arab National Bank (ANB), adherence to these regulations is paramount, particularly concerning its business operations, any potential mergers or acquisitions, and strategic collaborations. Failure to comply can lead to significant antitrust investigations and penalties, underscoring the importance of proactive legal counsel and diligent practice management.

These regulations are not merely punitive; they are foundational to creating a dynamic and healthy financial market that ultimately benefits consumers and businesses alike through increased choice and potentially better service offerings. For instance, the General Authority for Competition (GAC) in Saudi Arabia actively monitors market activities to ensure fair play. In 2023, the GAC reviewed numerous merger control notifications, signaling its active role in enforcing competition principles. ANB must therefore continually assess its market position and strategic moves against these evolving regulatory standards to maintain operational integrity and avoid legal entanglements.

- Monopoly Prevention: Saudi laws explicitly prohibit business practices that stifle competition or create dominant market positions.

- Merger Control: ANB's proposed mergers or acquisitions require pre-approval from regulatory bodies to assess their impact on market competition.

- Fair Practices: Regulations mandate fair pricing, transparency, and non-discriminatory treatment of customers and competitors.

- Regulatory Oversight: The General Authority for Competition (GAC) actively enforces these laws, with penalties for non-compliance that can include substantial fines.

International Financial Reporting Standards (IFRS) Compliance

Arab National Bank (ANB), as a publicly traded entity, is legally bound to adhere to International Financial Reporting Standards (IFRS) for its financial reporting. This mandate is critical for fostering transparency and ensuring that its financial statements are comparable and accurate, thereby bolstering investor trust and facilitating effective regulatory supervision. ANB's 2024 financial reports, for instance, would reflect IFRS compliance, impacting its accounting methodologies and the depth of its disclosures.

The adoption and consistent application of IFRS directly influence ANB's internal accounting procedures, the nature of information it discloses to the public, and the subsequent financial analysis performed by stakeholders. For example, changes in IFRS, such as those related to revenue recognition or lease accounting, necessitate adjustments in ANB's operational and reporting frameworks.

- IFRS Adoption: ANB must align its accounting policies with IFRS pronouncements to ensure global comparability.

- Disclosure Requirements: Compliance mandates extensive disclosures, providing investors with detailed insights into ANB's financial health and risk exposures.

- Impact on Financial Analysis: Analysts rely on IFRS-compliant statements for accurate valuation and performance assessment of ANB.

- Regulatory Oversight: Adherence to IFRS is a key component of the regulatory framework governing financial institutions like ANB in its operating jurisdictions.

Arab National Bank (ANB) operates under Saudi Arabia's robust legal framework, heavily influenced by the Saudi Central Bank (SAMA). SAMA's regulations, including capital adequacy and risk management, are critical; for example, Saudi banks generally exceed Basel III capital ratios, as seen in early 2024 data. ANB must also comply with the Personal Data Protection Law (PDPL), which governs customer data handling and carries significant penalties for non-compliance, impacting ANB's cybersecurity and data governance strategies.

Consumer protection laws, enforced by SAMA, mandate fair practices in lending and transparency in fees, as highlighted by SAMA's 2023 consumer protection principles. Furthermore, anti-competition laws, overseen by the General Authority for Competition (GAC), require ANB to avoid monopolistic practices and seek approval for mergers, with GAC actively reviewing market activities as demonstrated in 2023 merger control notifications.

ANB must also adhere to International Financial Reporting Standards (IFRS) for all financial reporting, ensuring global comparability and transparency for investors, a requirement reflected in its 2024 financial statements. This adherence impacts ANB's accounting methods and disclosure depth, crucial for financial analysis and regulatory oversight.

Environmental factors

Arab National Bank (ANB) faces growing pressure to embed Environmental, Social, and Governance (ESG) principles into its core strategies, impacting everything from investment choices to lending criteria and overall brand image. This global and local shift means ANB must demonstrate a commitment to sustainability, considering the environmental and social ramifications of its financial activities and internal operations.

The bank is actively evaluating sustainability risks within its loan portfolios, recognizing the financial implications of climate change and social inequalities. For instance, by mid-2024, major global banks reported significant increases in ESG-linked loans, signaling a trend ANB is likely aligning with to mitigate risks and capitalize on sustainable finance opportunities.

Climate change poses significant risks to the Saudi Arabian economy, potentially impacting sectors like agriculture and tourism through water scarcity and extreme weather, which in turn affects the loan portfolios of institutions like Arab National Bank (ANB). For instance, the Kingdom's Vision 2030 emphasizes reducing oil dependency, making climate resilience crucial for economic stability.

In response, ANB is actively developing and promoting green finance solutions. These include financing for solar power projects, a key area for Saudi Arabia's renewable energy drive, and sustainable real estate developments. This strategy not only supports national environmental objectives but also appeals to a growing segment of investors focused on environmental, social, and governance (ESG) criteria.

By offering green finance, ANB aims to mitigate its exposure to climate-related financial risks and capitalize on the expanding market for sustainable investments. Saudi Arabia's commitment to net-zero emissions by 2060 further underscores the strategic importance of these initiatives for the banking sector.

Arab National Bank's (ANB) strategic alignment with the UN's Sustainable Development Goals (SDGs) is increasingly crucial for its long-term viability and reputation. By integrating SDGs into its financing and operational frameworks, ANB can actively contribute to global sustainability efforts. For instance, financing projects that promote clean energy (SDG 7) or support sustainable cities and communities (SDG 11) directly translates corporate responsibility into tangible impact.

ANB's commitment to responsible consumption and production (SDG 12) through its lending practices can also foster a more sustainable economy. As of early 2024, financial institutions globally are facing growing pressure from investors and regulators to demonstrate clear progress on ESG (Environmental, Social, and Governance) metrics, with SDG alignment serving as a key performance indicator.

Resource Scarcity and Energy Efficiency

Operational efficiency at Arab National Bank (ANB), particularly concerning resource consumption in its branches and data centers, is becoming a significant focus. The bank's commitment to reducing its environmental footprint extends to optimizing water and energy usage. This focus is driven by both cost-saving opportunities and a growing emphasis on corporate environmental responsibility.

Implementing energy-efficient technologies and practices offers a dual benefit: it lowers operational expenses and supports broader environmental sustainability goals. For instance, upgrading to LED lighting or optimizing cooling systems in data centers can yield substantial savings. ANB, like other financial institutions, faces increasing scrutiny regarding its direct environmental impact, moving beyond its financing portfolios.

Recent trends highlight the financial sector's increasing attention to resource management. For example, the global banking sector's commitment to net-zero emissions by 2050, as seen in initiatives like the Net-Zero Banking Alliance, underscores the importance of internal operational efficiency. While specific ANB data for 2024/2025 on resource consumption isn't publicly detailed, the industry trend points towards significant investment in green building certifications and energy management systems. This proactive approach is vital for maintaining stakeholder trust and regulatory compliance.

- Energy Efficiency Investments: Banks globally are increasing investments in energy-efficient technologies for their facilities.

- Operational Cost Reduction: Implementing efficiency measures can lead to direct savings on utility bills, estimated to be significant for large branch networks.

- Environmental Footprint: Financial institutions are increasingly evaluated on their direct environmental impact, not just their financed emissions.

- Sustainability Reporting: Expect enhanced transparency in ANB's sustainability reports detailing resource consumption and efficiency improvements in the coming years.

Reputational Risk from Environmental Non-Compliance

Arab National Bank (ANB) faces reputational risk if it fails to address environmental concerns or comply with environmental regulations. This can lead to public criticism and legal issues. For instance, a 2024 report highlighted that financial institutions with poor environmental, social, and governance (ESG) scores saw a 5% lower return on equity compared to their peers with strong ESG performance.

Negative perceptions about environmental responsibility can significantly impact ANB's ability to attract and retain customers, investors, and skilled employees. Research from 2025 indicates that 65% of consumers are more likely to choose a bank that demonstrates strong environmental commitment.

To mitigate these risks, ANB must proactively manage its environmental impact and report transparently. This approach is vital for maintaining stakeholder trust and a favorable brand image. In 2024, banks that published detailed sustainability reports experienced a 10% increase in customer loyalty.

- Reputational Damage: Non-compliance can lead to public backlash and loss of trust.

- Investor Deterrence: Negative environmental perceptions can deter ESG-focused investors.

- Talent Acquisition: A poor environmental record can make it harder to attract top talent.

- Customer Loyalty: Proactive environmental management enhances customer retention and acquisition.

Climate change poses significant risks to Saudi Arabia's economy, impacting sectors like agriculture and tourism through water scarcity and extreme weather. The Kingdom's Vision 2030 emphasizes reducing oil dependency, making climate resilience crucial for economic stability.

ANB is developing green finance solutions, including financing for solar power projects and sustainable real estate. This strategy supports national environmental objectives and appeals to ESG-focused investors.

Operational efficiency, particularly in resource consumption at branches and data centers, is a growing focus for ANB. This is driven by cost savings and corporate environmental responsibility.

Banks globally are increasing investments in energy-efficient technologies. For instance, the global banking sector's commitment to net-zero emissions by 2050, as seen in the Net-Zero Banking Alliance, highlights the importance of internal operational efficiency.

| Environmental Factor | Impact on ANB | Mitigation/Opportunity | Data Point (2024/2025 Trend) |

|---|---|---|---|

| Climate Change Risks | Impacts loan portfolios through extreme weather, water scarcity affecting sectors like agriculture and tourism. | Develop green finance, support renewable energy projects, align with Vision 2030's climate resilience goals. | Saudi Arabia aims for net-zero emissions by 2060, driving demand for green finance. |

| Resource Consumption | Operational costs and direct environmental footprint of branches and data centers. | Invest in energy-efficient technologies (e.g., LED lighting, optimized cooling), improve water usage. | Global banks are increasing investments in green building certifications and energy management systems. |

| Regulatory & Investor Pressure | Reputational risk from non-compliance or poor ESG performance. | Proactive environmental management, transparent sustainability reporting, focus on SDG alignment. | 65% of consumers in 2025 are more likely to choose banks with strong environmental commitment. |

PESTLE Analysis Data Sources

Our Arab National Bank PESTLE Analysis is grounded in data from official Saudi Arabian government agencies, international financial institutions like the IMF and World Bank, and reputable industry-specific reports. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the bank.