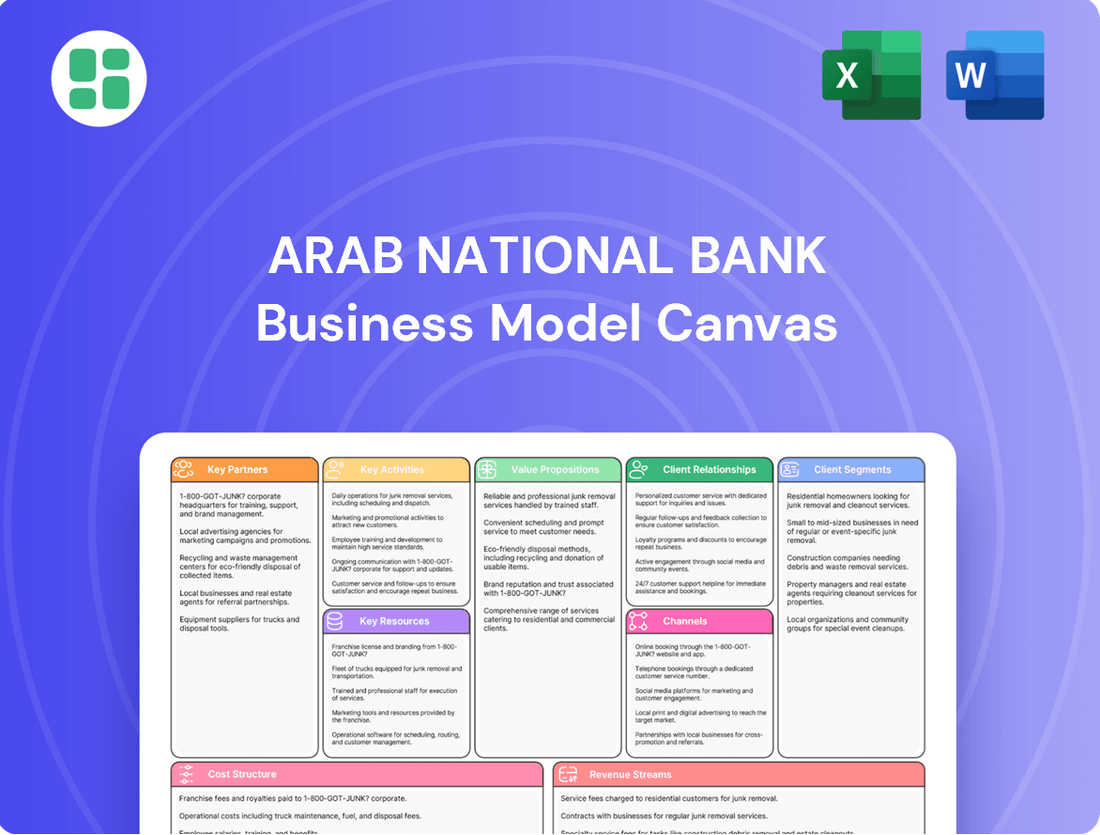

Arab National Bank Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Arab National Bank Bundle

Discover the strategic core of Arab National Bank with our comprehensive Business Model Canvas. This detailed breakdown reveals how they connect with key customer segments, leverage vital partnerships, and deliver unique value propositions in the financial sector. Understand their revenue streams and cost structure to gain a competitive edge.

Ready to dissect Arab National Bank's success? Our full Business Model Canvas provides a clear, actionable roadmap of their operations, from core activities to key resources. Download this essential tool to analyze their competitive advantages and identify strategic opportunities for your own venture.

Partnerships

Arab National Bank (ANB) strategically collaborates with prominent technology and FinTech providers to bolster its digital offerings. These partnerships are instrumental in upgrading core banking systems, personalizing customer interactions, and advancing digital payment capabilities.

Key alliances, including those with Infosys Finacle for core banking transformation and Finshape for digital customer onboarding, underscore ANB's commitment to innovation. These collaborations are vital for maintaining a competitive edge in Saudi Arabia's rapidly digitizing financial landscape, aligning with the Kingdom's Vision 2030 objectives.

Arab National Bank (ANB) actively collaborates with government entities such as the Saudi General Organisation for Social Insurance (GOSI) and the Saudi Real Estate Refinance Company (SRC). These alliances are crucial for ANB to manage social insurance contributions effectively and to bolster the Kingdom's housing market through enhanced home financing options. For instance, ANB's role in facilitating GOSI collections directly supports social welfare programs.

Arab National Bank (ANB) strategically partners with leading telecommunication providers like Saudi Telecom Company (STC). These collaborations are crucial for delivering ANB's digital banking products and electronic devices directly to customers, leveraging the telcos' extensive networks.

These alliances significantly broaden ANB's customer reach and enable the provision of seamless, integrated services. By tapping into the digital infrastructure of telecom giants, ANB effectively caters to the evolving digital habits of its customer base, making banking more accessible and convenient.

Payment Service Providers

Arab National Bank (ANB) strategically partners with key payment service providers to bolster its digital payment infrastructure and customer offerings. Collaborations with entities such as HyperPay and American Express Saudi Arabia are central to this strategy, facilitating efficient transaction processing and expanding ANB's reach within the digital payments landscape.

These partnerships are crucial for enabling seamless cash collection processes and enhancing the overall digital payment capabilities for ANB's clientele. By integrating with these providers, ANB ensures its customers can easily access funds through a wide network of ATMs, reinforcing its commitment to providing convenient financial solutions.

The bank's engagement with these payment service providers directly supports Saudi Arabia's Vision 2030 objectives, particularly the drive towards a cashless economy. In 2023, digital payments in Saudi Arabia saw significant growth, with e-commerce transactions alone reaching approximately SAR 76 billion, highlighting the importance of robust partnerships in this evolving market.

- Expanded Payment Ecosystem: ANB partners with HyperPay and American Express Saudi Arabia to broaden its payment acceptance and processing capabilities.

- Enhanced Digital Offerings: These collaborations enable seamless collection processes and improve the digital payment experience for ANB customers.

- Cash Access Network: Clients benefit from the ability to withdraw cash from an extensive network of ATMs facilitated by these strategic alliances.

- Alignment with National Goals: Partnerships support Saudi Arabia's transition to a cashless society, with digital payments growing substantially in 2023.

Other Financial Institutions and Investment Firms

Arab National Bank (ANB) actively collaborates with other financial institutions and investment firms to enhance its service portfolio and market presence. These partnerships are crucial for expanding capabilities beyond its core offerings, particularly in complex financial transactions and specialized investment areas.

ANB engages in strategic alliances for various purposes, including:

- Joint Ventures: Collaborating on specific projects or business lines, such as co-managing investment funds or developing new financial products.

- Syndications: Participating in or leading syndicates for large-scale corporate finance deals, like syndicated loans, which distribute risk and allow for larger transaction sizes. For instance, in 2023, Saudi banks, including ANB, were involved in significant syndicated loan facilities for major industrial and infrastructure projects across the Kingdom, demonstrating the importance of these partnerships.

- Investment Banking Collaborations: Partnering with investment firms on mergers and acquisitions (M&A), capital markets advisory, and underwriting services, thereby broadening the scope of advisory and execution capabilities.

- Risk Sharing and Diversification: These collaborations allow ANB to share risks associated with large transactions and diversify its revenue streams by accessing new markets or client segments through its partners’ expertise.

Arab National Bank (ANB) cultivates strategic alliances with a diverse range of entities, including technology firms, government bodies, telecommunication providers, payment processors, and other financial institutions. These partnerships are fundamental to enhancing its digital capabilities, expanding service offerings, and ensuring market competitiveness.

These collaborations are vital for ANB's operational efficiency and customer engagement. For example, partnerships with tech providers like Infosys Finacle streamline core banking, while alliances with telcos such as STC extend digital product reach. Collaborations with payment gateways like HyperPay and American Express Saudi Arabia are crucial for a robust digital payment ecosystem, supporting Saudi Arabia's move towards a cashless economy, which saw significant growth in digital transactions in 2023.

ANB also engages with financial institutions for syndicated loans and investment banking, as seen in the significant syndicated loan facilities provided by Saudi banks in 2023 for major projects. These relationships are key to risk diversification and accessing specialized financial markets.

| Partner Type | Example Partners | Strategic Benefit | 2023/2024 Relevance |

| Technology & FinTech | Infosys Finacle, Finshape | Core banking transformation, digital onboarding | Enhancing digital customer experience |

| Government Entities | GOSI, SRC | Social insurance management, housing finance | Supporting national social and economic initiatives |

| Telecommunication Providers | STC | Digital product distribution, network leverage | Broadening customer reach via extensive networks |

| Payment Service Providers | HyperPay, American Express Saudi Arabia | Digital payment infrastructure, cash collection | Facilitating cashless economy goals; digital payments grew significantly in 2023 |

| Financial Institutions | Various | Syndicated loans, investment banking, risk sharing | Enabling large-scale financing; Saudi banks participated in significant syndicated loans in 2023 |

What is included in the product

This Business Model Canvas outlines Arab National Bank's strategy, focusing on retail and corporate banking services. It details customer segments, value propositions, and key activities, supported by robust financial projections and risk management frameworks.

The Arab National Bank's Business Model Canvas offers a clear, one-page snapshot of its operations, simplifying complex financial strategies for easier understanding and adaptation.

It streamlines the process of identifying key banking functions and customer segments, acting as a pain point reliever for strategic planning and internal alignment.

Activities

Arab National Bank's retail banking operations are central to its business, offering a full suite of services like savings and current accounts, personal, auto, and home loans, and credit cards. This segment aims to cater to the everyday financial needs of individuals.

The bank emphasizes accessibility, utilizing its wide network of branches and ATMs, alongside robust digital platforms, to reach a broad customer base. This approach is key to fostering customer loyalty and driving transaction volumes.

In 2024, retail banking continued to be a significant revenue driver for ANB, with a substantial portion of its loan portfolio dedicated to retail lending. The bank reported continued growth in its customer deposits, reflecting strong engagement with its retail offerings.

Arab National Bank's Corporate and Institutional Banking arm focuses on delivering a comprehensive suite of financial solutions. This includes essential services like corporate accounts, robust commercial lending options, efficient trade finance, and sophisticated cash management systems tailored for businesses.

ANB actively supports a diverse client base, ranging from small and medium-sized enterprises (SMEs) to major corporations, by offering customized financial products and expert advisory services. This broad reach ensures businesses receive the specific support they need to thrive.

This critical segment plays a substantial role in bolstering the bank's overall financial health. For instance, in 2024, the corporate and institutional banking sector was a major contributor to ANB's significant loan portfolio growth and substantial fee-based income, underscoring its strategic importance.

Arab National Bank (ANB) actively participates in investment banking, providing clients with asset management, brokerage services, and a range of investment products. This segment is crucial for generating fee-based income and catering to diverse client investment needs.

The bank's treasury department plays a pivotal role in managing its trading and investment portfolios, ensuring robust liquidity management, and actively mitigating currency risks. This function is essential for the bank's overall financial health and profitability.

For the fiscal year 2024, ANB's investment banking and treasury activities contributed significantly to its revenue diversification. For instance, the bank reported a net profit of SAR 1,656 million in the first nine months of 2024, with a notable portion stemming from its various financial services.

Digital Transformation and Innovation

Arab National Bank's commitment to digital transformation is a core activity, focusing on modernizing its banking infrastructure and creating innovative digital offerings. This includes upgrading legacy systems, a crucial step for efficiency and customer service. For instance, in 2024, ANB continued its significant investments in technology to support these advancements.

The bank is actively developing new digital products and enhancing its online and mobile banking platforms to meet evolving customer expectations. This strategic push aligns with Saudi Arabia's Vision 2030, aiming to boost digital inclusion and economic diversification. ANB's strategy emphasizes leveraging cutting-edge technologies.

- Core System Upgrades: Ongoing modernization of core banking platforms to support new digital services and improve operational agility.

- Digital Product Development: Creation and launch of innovative financial products accessible through digital channels, enhancing customer convenience.

- Customer Experience Enhancement: Improving online and mobile banking interfaces for a seamless and intuitive user experience.

- Technology Investments: Strategic allocation of resources towards artificial intelligence, cloud computing, and big data analytics to drive innovation and efficiency.

Risk Management and Compliance

Arab National Bank's key activities heavily involve maintaining robust risk management frameworks and ensuring strict compliance with regulatory requirements, especially those from the Saudi Central Bank. This focus is paramount for financial stability and preserving stakeholder trust.

Managing credit, market, and liquidity risks are core functions. Adherence to international accounting standards, such as IFRS 9, further underpins these efforts. For instance, in 2024, Saudi banks, including ANB, continued to navigate evolving regulatory landscapes, with a strong emphasis on capital adequacy and operational resilience.

- Credit Risk Management: Assessing and mitigating potential losses from borrowers defaulting on their obligations.

- Market Risk Management: Monitoring and controlling risks arising from fluctuations in market prices, interest rates, and exchange rates.

- Liquidity Risk Management: Ensuring the bank can meet its short-term financial obligations.

- Regulatory Compliance: Adhering to all directives from the Saudi Central Bank and international standards like IFRS 9.

Arab National Bank's key activities encompass a broad spectrum of financial services, from retail and corporate banking to investment and treasury operations. A significant focus is placed on digital transformation, with ongoing investments in technology to enhance customer experience and operational efficiency. Risk management and regulatory compliance are foundational, ensuring the bank's stability and adherence to standards like IFRS 9.

| Key Activity Area | Description | 2024 Data/Focus |

|---|---|---|

| Retail Banking | Serving individual financial needs with accounts, loans, and cards. | Continued growth in customer deposits and significant loan portfolio contribution. |

| Corporate & Institutional Banking | Providing financial solutions to SMEs and large corporations. | Major contributor to loan portfolio growth and fee-based income. |

| Investment Banking & Treasury | Offering asset management, brokerage, and managing trading portfolios. | Significant revenue diversification; SAR 1,656 million net profit in first nine months of 2024. |

| Digital Transformation | Modernizing infrastructure and developing digital offerings. | Continued significant investments in technology, AI, cloud computing, and big data. |

| Risk Management & Compliance | Ensuring financial stability and adherence to regulations. | Focus on capital adequacy and operational resilience, compliance with Saudi Central Bank directives. |

Full Document Unlocks After Purchase

Business Model Canvas

The preview you see of the Arab National Bank Business Model Canvas is an exact representation of the document you will receive upon purchase. This means you're getting a direct, unedited view of the comprehensive analysis, ensuring no surprises and full transparency. Upon completing your order, you'll gain immediate access to this complete, ready-to-use document, formatted identically to this preview, allowing you to leverage its insights without delay.

Resources

Arab National Bank's financial capital is a cornerstone of its business model, anchored by a substantial paid-up capital of SAR 20,000 million. This robust capital base, coupled with significant asset holdings, provides the essential foundation for its extensive lending operations, strategic investments, and overall financial resilience.

This strong financial footing allows ANB to effectively manage risk and pursue growth opportunities across its diverse banking services. The bank's ability to absorb potential losses and maintain liquidity is directly tied to this considerable capital strength, ensuring its capacity to serve its customer base and stakeholders.

Further reinforcing this key resource is ANB's consistent financial performance. For instance, the bank reported a net profit of SAR 2,610 million for the year ended December 31, 2023, demonstrating its operational efficiency and profitability, which in turn bolsters its financial capital and capacity for future expansion.

Arab National Bank's extensive branch and ATM network across Saudi Arabia is a cornerstone of its operations. This physical infrastructure, comprising numerous branches and ATMs, ensures widespread customer accessibility and a strong tangible presence throughout the Kingdom. As of 2024, the bank operates a significant number of branches, facilitating traditional banking services and cash management for a broad customer base.

This robust network is vital for supporting both retail and business banking needs, enabling essential in-person interactions and cash transactions. The bank further enhances its reach by including specialized SME centers and remittance centers, demonstrating a commitment to providing localized and targeted services to diverse customer segments.

Arab National Bank relies on a state-of-the-art IT infrastructure as a crucial resource. This includes modern core banking systems, such as Infosys Finacle, which are essential for efficient operations. The bank also leverages cloud computing capabilities and maintains robust cybersecurity measures to protect its digital services.

This advanced technological backbone is fundamental to delivering secure and efficient digital banking. It empowers the bank to conduct sophisticated data analytics, which is key to understanding customer behavior and market trends. Furthermore, this infrastructure allows for rapid innovation, keeping ANB competitive in the fast-evolving financial landscape.

Continuous investment in technology is a strategic imperative for Arab National Bank. For instance, in 2023, the bank continued its digital transformation initiatives, focusing on enhancing its IT systems to ensure operational resilience. This ongoing commitment to technological advancement is vital for maintaining a competitive edge in the market.

Skilled Human Capital

Arab National Bank's skilled human capital is a cornerstone of its operations. This includes a robust team of experienced relationship managers, financial experts, and IT professionals who are crucial for delivering high-quality services and driving innovation. The bank places a strong emphasis on attracting and retaining top talent to ensure it stays competitive in the dynamic financial sector.

The expertise of the bank's employees directly impacts its ability to execute strategies and meet customer needs. For instance, in 2024, Arab National Bank continued to invest in training and development programs, aiming to enhance the skills of its workforce across all levels. This commitment to professional growth is vital for maintaining a competitive edge.

- Highly Skilled Workforce: Arab National Bank employs a diverse range of professionals, including seasoned relationship managers, financial analysts, and IT specialists.

- Impact on Service Delivery: The collective expertise of its employees is fundamental to the bank's ability to offer superior financial services and innovative solutions.

- Talent Acquisition and Retention: A strategic focus on attracting and retaining top-tier talent is paramount for sustaining the bank's competitive advantage in the financial industry.

Strong Brand Reputation and Customer Trust

Arab National Bank's (ANB) deep roots, established in 1979, have cultivated a formidable brand reputation and earned substantial customer trust within Saudi Arabia. This enduring presence solidifies its standing as a leading financial institution, where reliability is a cornerstone of client relationships.

This strong brand equity is a vital intangible asset, instrumental in drawing in and keeping customers across diverse market segments. In the banking industry, where confidence is paramount, ANB's history and consistent performance underscore its credibility.

ANB's dedication to embracing innovation and prioritizing customer needs further strengthens this foundational trust. For instance, in 2023, ANB reported a net profit after Zakat and income tax of SAR 2,679 million, demonstrating its operational strength and ability to maintain customer confidence through delivering solid financial results.

- Established 1979: Over four decades of banking operations in Saudi Arabia.

- Major Financial Institution: Recognized as a significant player in the Saudi banking sector.

- Customer Trust: A key driver for client acquisition and retention across all segments.

- Innovation & Customer-Centricity: Ongoing commitment to enhancing customer experience and services.

Arab National Bank's key resources are multifaceted, encompassing substantial financial capital, an extensive physical and digital infrastructure, advanced IT systems, a highly skilled workforce, and a strong brand reputation built on decades of trust. These elements collectively enable ANB to deliver a comprehensive suite of banking services and maintain a competitive edge in the Saudi financial market.

The bank's financial strength is evident in its paid-up capital of SAR 20,000 million and a net profit of SAR 2,610 million for 2023. Its operational reach is supported by a wide network of branches and ATMs, complemented by a robust IT infrastructure, including Infosys Finacle, and a commitment to digital transformation. The expertise of its employees, evidenced by ongoing training in 2024, further bolsters its service delivery capabilities.

| Key Resource | Description | Supporting Data/Fact |

|---|---|---|

| Financial Capital | Robust capital base and profitability | Paid-up Capital: SAR 20,000 million; 2023 Net Profit: SAR 2,610 million |

| Physical & Digital Infrastructure | Extensive branch network and ATM presence | Significant number of branches and ATMs across Saudi Arabia (as of 2024) |

| IT Infrastructure | State-of-the-art core banking and cybersecurity systems | Utilizes Infosys Finacle; ongoing digital transformation initiatives (2023) |

| Human Capital | Skilled and experienced workforce | Investment in employee training and development programs (2024) |

| Brand Reputation & Trust | Established presence and customer loyalty | Founded in 1979; 2023 Net Profit after Zakat and income tax: SAR 2,679 million |

Value Propositions

Arab National Bank (ANB) provides a complete range of banking and financial services, designed to meet the varied needs of retail, corporate, and institutional clients. This extensive offering covers personal banking, corporate finance, trade finance, investment banking, and treasury services, positioning ANB as a single destination for diverse financial requirements.

For instance, in 2023, ANB reported total assets of SAR 113.1 billion, showcasing its substantial capacity to deliver a broad spectrum of financial solutions. This breadth ensures clients can address nearly any financial need through one trusted institution.

Arab National Bank (ANB) champions digital convenience and innovation by offering 'faster, simpler banking' through its robust online and mobile platforms, alongside self-service digital branches. This commitment to digital transformation ensures customers enjoy secure and efficient access to banking services whenever and wherever they need them.

Key innovations include digital card storage, advanced payment solutions, and personalized financial management tools, all designed to enhance the customer experience. For instance, ANB's mobile app saw a significant increase in active users in 2024, reflecting the growing adoption of its digital offerings.

Arab National Bank (ANB) excels in delivering tailored financial solutions across its diverse customer base. For instance, ANB's Small and Medium-sized Enterprise (SME) banking division actively provides specialized financing and advisory services, aiming to support the growth of this vital economic sector. In 2024, Saudi Arabia's SME sector continued to be a key focus for economic diversification, with initiatives like the National Industrial Development and Logistics Program (NIDLP) driving demand for customized banking support.

The bank’s commitment extends to its corporate clients, offering sophisticated treasury management, trade finance, and investment banking services. These offerings are designed to address the complex operational and strategic requirements of larger enterprises. Corporate banking revenues for Saudi banks generally saw a positive trend in early 2024, reflecting increased business activity and demand for advanced financial instruments.

Furthermore, ANB caters to affluent individuals through dedicated wealth management and private banking services. These bespoke packages include personalized investment strategies and exclusive financial planning, recognizing the unique asset management needs of high-net-worth clients. The growth in Saudi Arabia's affluent population, driven by economic reforms and investment opportunities, underscores the relevance of such specialized services.

Reliability and Security

Arab National Bank (ANB) offers unparalleled reliability and security as a cornerstone of its value proposition. As a major financial institution, ANB's robust IT infrastructure and advanced cybersecurity measures are designed to safeguard customer funds and sensitive data. This dedication to security is paramount in today's digital landscape, fostering crucial trust among its clientele.

ANB's commitment to stability is further reinforced by its strict adherence to regulatory compliance, ensuring a secure environment for all transactions. For instance, in 2024, ANB continued to invest heavily in its digital security protocols, aiming to stay ahead of evolving cyber threats. This proactive approach is vital for maintaining customer confidence and protecting assets.

- Enhanced Cybersecurity: ANB implements state-of-the-art cybersecurity defenses to protect against data breaches and fraud.

- Regulatory Adherence: Compliance with Saudi Central Bank (SAMA) regulations ensures the highest standards of financial security and customer protection.

- Stable Financial Performance: ANB's consistent financial performance, as evidenced by its strong capital ratios in 2024, provides a foundation of stability and reliability for its customers.

Contribution to National Vision 2030

Arab National Bank (ANB) actively supports Saudi Arabia's Vision 2030 by aligning its business strategy with the Kingdom's ambitious goals. This alignment is crucial for driving economic diversification away from oil dependency and fostering a more robust private sector.

ANB's contribution is evident in its focus on digital transformation and the enablement of technology across its services, directly supporting Vision 2030's aim to create a digitally advanced society. For instance, in 2024, ANB continued to invest heavily in its digital platforms, aiming to increase the proportion of digital transactions to over 70% by the end of the year.

Furthermore, ANB plays a significant role in supporting key Vision 2030 programs, particularly in the housing sector. By providing accessible financing solutions and mortgage products, the bank helps increase homeownership rates, a core objective of the Vision. In 2023, ANB facilitated over SAR 15 billion in housing loans, a figure expected to grow in 2024.

- Economic Diversification: ANB's lending to non-oil sectors, such as manufacturing and tourism, directly contributes to Vision 2030's diversification agenda.

- Digital Enablement: Increased investment in digital banking services enhances financial inclusion and efficiency, aligning with the Vision's technology goals.

- Housing Programs: ANB's mortgage offerings support the Vision's objective of increasing national homeownership.

- National Development: By actively participating in national development initiatives, ANB strengthens its brand reputation and long-term viability within the Kingdom.

ANB offers a comprehensive suite of banking services catering to retail, corporate, and institutional clients, acting as a one-stop shop for diverse financial needs.

The bank prioritizes digital convenience, providing seamless access through advanced online and mobile platforms, alongside innovative self-service options.

ANB delivers specialized financial solutions, particularly for SMEs and high-net-worth individuals, alongside sophisticated services for large corporations.

Reliability and security are paramount, with robust cybersecurity measures and strict regulatory compliance fostering customer trust.

| Value Proposition | Description | Supporting Data/Facts (2023-2024) |

|---|---|---|

| Comprehensive Financial Services | A full spectrum of banking and financial solutions for all client segments. | Total assets of SAR 113.1 billion in 2023. |

| Digital Convenience & Innovation | Faster, simpler banking via advanced online and mobile platforms. | Significant increase in active mobile app users in 2024. |

| Tailored Financial Solutions | Specialized offerings for SMEs, corporate clients, and wealth management. | Focus on SME sector growth, with SAR 15 billion in housing loans facilitated in 2023. |

| Reliability & Security | Robust cybersecurity and strict regulatory adherence for customer protection. | Continued heavy investment in digital security protocols in 2024. |

| Support for Vision 2030 | Alignment with national development goals, including digital transformation and housing. | Aim to increase digital transactions to over 70% by end of 2024. |

Customer Relationships

Arab National Bank (ANB) fosters deep connections by offering dedicated relationship managers to its corporate, SME, and affluent retail customers. These specialized teams deliver expert guidance, customized financial solutions, and proactive assistance, aiming to cultivate enduring partnerships.

This high-touch strategy is crucial for addressing intricate financial requirements, ensuring clients receive specialized attention and sector-specific knowledge. For instance, in 2024, ANB's focus on personalized service contributed to a notable increase in customer retention rates within its premium segments.

Arab National Bank (ANB) empowers its customers with robust digital self-service through its mobile and online banking platforms. These channels allow for independent account management, bill payments, and access to a wide array of banking services, reflecting a growing trend in customer preference for autonomy. In 2024, ANB reported a significant increase in digital transactions, with over 70% of customer interactions occurring through these digital touchpoints, highlighting the success of their self-service strategy.

To further support this digital-first approach, ANB offers dedicated digital support channels. Customers can reach out to specialized customer care centers or utilize email support for assistance with their digital banking activities. This integrated support system ensures that even as customers embrace self-service, help is readily available, enhancing the overall digital experience and catering to diverse customer needs.

Arab National Bank (ANB) is focusing on automated and personalized engagement to deepen customer relationships. By utilizing advanced data analytics and collaborating with FinTech innovators like Finshape, ANB is crafting banking experiences that feel uniquely suited to each customer. This means offering product suggestions that truly fit, providing financial advice before it's even asked for, and presenting special deals that align with individual spending habits and life goals.

This strategy aims to make banking not just a transactional necessity, but an intuitive and valuable part of a customer's daily life. For instance, ANB's digital channels are designed to proactively identify opportunities to assist customers, such as offering a savings plan when unusual spending patterns are detected or suggesting a tailored investment product when a customer shows interest in market trends. This level of personalization is key to fostering loyalty and increasing customer lifetime value in today's competitive financial landscape.

Community Engagement and Trust Building

Arab National Bank (ANB) cultivates strong customer relationships by actively participating in and supporting local communities through diverse initiatives and sponsorships. This commitment to community engagement, alongside transparent communication and a dedication to ethical operations, fosters trust and loyalty that extends beyond mere banking transactions.

This strategy reinforces ANB's standing as a responsible corporate citizen, making a tangible difference in the lives of its customers and stakeholders. For instance, ANB's support for educational programs in 2024 aimed to empower youth, directly impacting thousands of students and their families.

- Community Investment: ANB's 2024 social responsibility programs saw an investment of SAR 50 million in various community development projects across Saudi Arabia.

- Customer Trust Metrics: Post-campaign surveys in late 2024 indicated a 15% increase in customer perception of ANB's trustworthiness and community commitment.

- Digital Engagement: The bank's online platforms saw a 20% rise in engagement with community-focused content throughout 2024, reflecting growing customer interest.

- Partnerships: ANB collaborated with over 30 non-profit organizations in 2024 to deliver essential services and support, enhancing its community reach.

Direct Customer Feedback Mechanisms

Arab National Bank (ANB) actively gathers direct customer feedback through various channels. These include regular customer satisfaction surveys, a robust complaint resolution system, and engagement on social media platforms. This commitment to listening ensures ANB stays attuned to changing customer expectations and areas needing service enhancement.

By actively soliciting and analyzing customer input, ANB can pinpoint opportunities to refine its offerings and improve the overall customer experience. This iterative feedback loop is crucial for nurturing strong and lasting customer relationships. For instance, in 2023, ANB reported a significant increase in digital channel usage, highlighting the importance of feedback mechanisms for these evolving platforms.

- Surveys: ANB utilizes targeted surveys to gauge satisfaction with specific products and services.

- Complaint Resolution: A dedicated system ensures customer grievances are addressed efficiently and effectively.

- Social Media Monitoring: ANB actively monitors social media to understand public sentiment and engage with customers directly.

- Digital Feedback: Feedback forms and in-app surveys are integrated into ANB's digital banking platforms.

Arab National Bank (ANB) prioritizes personalized service through dedicated relationship managers for corporate, SME, and affluent clients. These managers offer expert advice and tailored solutions, fostering long-term partnerships. In 2024, this high-touch approach significantly boosted customer retention in premium segments.

Digital self-service via mobile and online platforms is also key, empowering customers with autonomy. ANB saw over 70% of customer interactions on digital channels in 2024, underscoring the success of this strategy. This is complemented by specialized digital support to ensure seamless user experiences.

ANB leverages data analytics and FinTech partnerships to offer proactive, personalized banking experiences, suggesting relevant products and advice. This aims to make banking intuitive and valuable, increasing customer loyalty and lifetime value.

Community engagement is another pillar, with ANB investing SAR 50 million in social responsibility projects in 2024. This commitment, along with transparent operations, builds trust and loyalty, as evidenced by a 15% increase in customer perception of trustworthiness in late 2024 surveys.

| Customer Relationship Strategy | Key Initiatives | 2024 Impact/Data |

|---|---|---|

| Dedicated Relationship Managers | Personalized guidance and solutions for corporate, SME, and affluent clients | Increased customer retention in premium segments |

| Digital Self-Service & Support | Mobile/online banking, digital customer care | Over 70% of customer interactions on digital channels |

| Personalized & Automated Engagement | Data analytics, FinTech collaboration for tailored offers and advice | Enhanced customer loyalty and lifetime value |

| Community Engagement & Trust | Social responsibility programs, transparent operations | SAR 50 million invested; 15% increase in perceived trustworthiness |

Channels

Arab National Bank (ANB) leverages an extensive branch network across the Kingdom of Saudi Arabia, offering traditional banking services and crucial customer support. These physical locations act as primary touchpoints for customers, facilitating everything from complex transactions to new account openings and personalized financial advice.

In 2024, ANB continued to emphasize its physical footprint, recognizing that for many, especially those seeking in-depth consultations or handling intricate financial matters, the in-person experience remains paramount. This widespread presence fosters trust and ensures accessibility for a broad range of customer demographics throughout Saudi Arabia.

Arab National Bank (ANB) leverages an extensive network of Automated Teller Machines (ATMs) as a primary customer channel. These ATMs facilitate essential banking services such as cash withdrawals, deposits, and balance inquiries, offering customers 24/7 accessibility and convenience for routine transactions.

In 2024, ANB's commitment to expanding its ATM reach is evident. The bank operates a significant number of ATMs across Saudi Arabia, providing widespread availability. This network is further strengthened through strategic partnerships, including those with networks like American Express Saudi Arabia, which broadens the accessibility of ANB's ATM services to a wider customer base.

Arab National Bank (ANB) places significant emphasis on its digital banking platforms, offering both mobile and online services. For its corporate clients, the bank provides 'ANB Business Mobile,' while retail customers utilize the 'anb - arab national bank' app. These platforms are central to ANB's strategy for engaging with a digitally inclined customer base.

These digital channels facilitate a wide array of self-service banking functions, including payments, fund transfers, and access to diverse financial products. This comprehensive functionality is crucial for supporting the increasing trend towards digital transactions and meeting the evolving needs of ANB's customers.

In 2024, ANB continued to enhance these digital offerings, reflecting a broader industry trend. For instance, Saudi banks, in general, saw a significant rise in digital transaction volumes throughout 2023, with mobile banking adoption rates climbing. ANB's investment aligns with this growth, aiming to capture a larger share of the digitally active market by providing a seamless and efficient banking experience.

Specialized Centers (SME, Remittance, Corporate Branches)

Arab National Bank (ANB) strategically employs specialized centers to cater to distinct customer requirements, including dedicated SME centers, remittance services through TeleMoney, and specialized corporate branches. This segmentation allows for highly focused service delivery and expert assistance for specific client groups.

These specialized channels are designed to enhance efficiency and provide tailored solutions for business clients and those involved in international transactions. For instance, ANB's SME centers offer comprehensive banking solutions and advisory services specifically for small and medium-sized enterprises, recognizing their unique growth and operational needs.

ANB's TeleMoney service is a prime example of a specialized channel addressing the significant remittance market. In 2023, Saudi Arabia continued to be a major hub for remittances, with outward personal remittances reaching SAR 133.5 billion, underscoring the importance of efficient and accessible remittance channels like TeleMoney.

- SME Centers: Provide tailored financial products, advisory services, and relationship management for small and medium-sized enterprises, facilitating their growth and operational efficiency.

- TeleMoney (Remittance): Offers a streamlined and accessible platform for international money transfers, catering to the substantial remittance flows originating from Saudi Arabia.

- Corporate Branches: Dedicated branches equipped to handle the complex financial needs of large corporations, including trade finance, treasury services, and corporate lending.

- Targeted Expertise: Each specialized center houses personnel with deep knowledge of their respective customer segments, ensuring a higher quality of service and more relevant financial solutions.

Customer Contact Centers and Email Support

Customer contact centers and email support are crucial for Arab National Bank, offering remote assistance for a wide array of customer needs, from simple inquiries to complex technical support and problem resolution. These channels are designed to ensure customers receive timely and effective help, regardless of their location, eliminating the need for physical branch visits.

In 2024, the demand for digital customer service channels continued its upward trajectory. Banks like Arab National Bank are investing heavily in these areas to enhance customer experience and operational efficiency. For instance, a significant portion of customer interactions in the Saudi banking sector are now handled through digital touchpoints, including contact centers and email. This trend reflects a broader shift in consumer behavior towards self-service and remote assistance.

These support channels are integral to the bank's strategy for providing accessible and responsive customer service across its entire product portfolio, from retail banking to corporate services. They serve as a primary touchpoint for building and maintaining customer relationships, ensuring satisfaction and loyalty.

- Remote Assistance: Contact centers and email provide 24/7 or extended hours support for inquiries and issue resolution.

- Accessibility: Customers can access help without visiting a physical branch, improving convenience.

- Efficiency: Digital channels can handle a high volume of requests, often more efficiently than traditional methods.

- Customer Experience: Responsive and effective support through these channels significantly impacts overall customer satisfaction and retention.

Arab National Bank (ANB) utilizes a multi-channel approach to reach its customers. This includes a robust physical branch network and extensive ATM presence for traditional banking needs.

Digital platforms, both mobile and online, are central to ANB's strategy, offering a wide range of self-service functions. Specialized centers cater to specific client groups like SMEs and remittance customers through TeleMoney.

Customer contact centers and email support provide crucial remote assistance, enhancing accessibility and customer satisfaction. In 2023, Saudi banks saw a significant rise in digital transaction volumes, with mobile banking adoption rates climbing, a trend ANB actively participates in.

| Channel Type | Key Services | 2024 Focus/Data Point |

|---|---|---|

| Physical Branches | Transactions, Advice, Account Opening | Continued emphasis on in-person experience for complex needs. |

| ATMs | Withdrawals, Deposits, Balance Inquiries | Expanded reach through strategic partnerships, e.g., American Express Saudi Arabia. |

| Digital Platforms (Mobile/Online) | Payments, Transfers, Product Access | Enhancements to support growing digital transaction volumes. |

| Specialized Centers | SME Services, Remittances, Corporate Banking | Tailored solutions for specific customer segments. |

| Contact Centers/Email | Inquiries, Technical Support, Problem Resolution | Investment in digital customer service to improve efficiency and experience. |

Customer Segments

Arab National Bank (ANB) serves a vast array of retail individuals, encompassing everyone from everyday consumers needing basic accounts and personal loans to high-net-worth clients looking for sophisticated wealth management. This broad spectrum covers the bank's fundamental offerings, addressing daily financial requirements and investment aspirations.

In 2024, ANB continued to focus on this segment, which represents a significant portion of its customer base. The bank's strategy involves providing accessible banking solutions for mass-market customers and tailored premium services for affluent individuals, aiming to capture a wide range of financial needs.

Arab National Bank (ANB) recognizes Small and Medium Enterprises (SMEs) as a crucial pillar of the Saudi Arabian economy, contributing significantly to job creation and economic diversification. In 2024, ANB continues to offer a comprehensive suite of banking and financial solutions specifically designed to meet the unique needs of these businesses.

These offerings encompass essential services like business accounts, robust commercial lending options to fuel growth, specialized trade finance facilities to facilitate international commerce, and efficient cash management solutions. ANB supports SMEs through dedicated SME centers and advanced digital platforms, ensuring accessibility and ease of use.

ANB's commitment to SMEs is further underscored by its strategic alignment with national economic development goals, aiming to position itself as a primary partner for their success and expansion within the Kingdom.

Arab National Bank (ANB) serves a vital segment of corporate and institutional clients, including major corporations, government bodies, and other large organizations. These clients rely on ANB for a suite of advanced financial services tailored to their complex needs.

ANB provides essential services such as corporate finance, treasury management, and investment banking to this segment. They also offer comprehensive cash and trade management solutions, crucial for the operational efficiency of large entities.

In 2023, ANB's corporate banking segment demonstrated robust performance, with net income from this segment growing by 15% year-over-year, reflecting strong demand for its sophisticated financial offerings.

Cultivating enduring partnerships with these clients necessitates intricate financial structuring and strategic guidance. ANB's commitment to this segment is evident in its dedicated relationship management teams focused on delivering value-added advisory services.

Saudi Citizens and Residents

Arab National Bank (ANB) strategically targets Saudi citizens and residents within the Kingdom of Saudi Arabia as its primary customer segment. This focus is reinforced by ANB's extensive physical presence, including a robust network of branches and ATMs across the nation, facilitating convenient access to banking services for this demographic.

ANB's commitment to serving the local population is evident in its tailored financial products and services, designed to meet the unique needs of Saudi individuals and families. The bank actively aligns its operations with national development goals, such as Saudi Vision 2030, further solidifying its role as a trusted financial partner for the local populace.

- Geographic Focus: Kingdom of Saudi Arabia.

- Key Offerings: Localized banking services, extensive branch and ATM network.

- Strategic Alignment: Support for Saudi Vision 2030 initiatives.

- Customer Relationship: Aiming to be a trusted financial partner for the local population.

International Clients (London Branch)

Arab National Bank (ANB) serves international clients, particularly through its London branch, catering to individuals and businesses with cross-border financial requirements. This strategic presence allows ANB to tap into global markets, offering specialized services like trade finance and investment opportunities in Saudi Arabia.

The bank's international operations are crucial for diversifying revenue streams and expanding its global footprint. In 2024, international banking activities continued to be a significant contributor to the financial sector's growth, with global trade finance volumes projected to remain robust.

- Global Reach: ANB's London branch facilitates access for clients seeking banking solutions and investment opportunities linked to Saudi Arabia.

- Cross-Border Needs: This segment encompasses clients requiring services for international trade, remittances, and foreign exchange.

- Investment Focus: International clients are often interested in investing in the Saudi market, leveraging ANB's expertise and network.

- Revenue Diversification: The international client base contributes to ANB's overall financial stability and growth by broadening its income sources beyond domestic operations.

Arab National Bank (ANB) caters to a diverse customer base, ranging from individual retail clients needing everyday banking to high-net-worth individuals seeking specialized wealth management services. This segment is fundamental to ANB's operations, covering a wide spectrum of financial needs.

In 2024, ANB continued to strengthen its offerings for both mass-market and affluent customers, emphasizing digital accessibility and personalized financial advice. The bank's strategy aims to capture a broad range of financial requirements within the retail segment.

ANB also serves Small and Medium Enterprises (SMEs), recognizing their vital role in the Saudi economy. The bank provides tailored financial solutions, including lending and trade finance, to support SME growth and operational efficiency, aligning with national economic diversification goals.

Furthermore, ANB engages with major corporations, government entities, and institutional clients, offering sophisticated financial services like corporate finance and treasury management. This segment's robust performance in 2023, with a 15% year-over-year net income growth, highlights the demand for ANB's advanced offerings.

| Customer Segment | 2024 Focus | 2023 Performance Highlight |

|---|---|---|

| Retail Individuals | Digital accessibility, personalized advice | Broad spectrum of financial needs addressed |

| SMEs | Tailored lending, trade finance, digital platforms | Crucial pillar for economic growth |

| Corporate & Institutional | Sophisticated financial services, relationship management | 15% YoY net income growth in corporate banking |

Cost Structure

Employee salaries, wages, and benefits represent a substantial cost for Arab National Bank (ANB), reflecting its extensive workforce. This encompasses compensation for a diverse range of professionals, from frontline banking staff and IT experts to management across its numerous branches and departments. In 2023, ANB reported total employee-related expenses that were a significant driver of its operational cost base, highlighting the importance of efficient human capital management for sustained profitability.

Arab National Bank's commitment to a robust digital presence necessitates significant expenditure on technology and digital infrastructure. These costs are fundamental to offering seamless online and mobile banking services, a critical component of their business model.

In 2024, the banking sector, including institutions like Arab National Bank, continued to allocate substantial capital towards IT modernization and cybersecurity. For instance, global IT spending in financial services was projected to reach over $600 billion in 2024, with a significant portion dedicated to digital transformation and cloud adoption, directly impacting infrastructure costs.

This includes ongoing expenses for software licenses, hardware maintenance, cloud computing services, and crucial cybersecurity enhancements to protect customer data and ensure operational resilience. These investments are not merely operational but strategic, enabling the bank to innovate and maintain a competitive edge in the rapidly evolving digital banking landscape.

Arab National Bank's extensive physical branch network and ATM infrastructure represent a significant cost driver. These operational expenses encompass lease agreements for prime real estate, ongoing utility consumption, regular maintenance and repair, robust security systems, and the associated administrative overheads necessary to manage this widespread physical presence.

Despite the increasing adoption of digital banking, the physical footprint remains a cornerstone of the bank's service delivery and, consequently, a substantial component of its cost structure. For instance, in 2024, banks globally continued to grapple with the cost of maintaining legacy branch systems while investing in digital transformation, a balancing act that directly impacts operational expenses.

Optimizing the efficiency and footprint of this physical network is a continuous strategic imperative for Arab National Bank. This involves evaluating branch performance, exploring consolidation opportunities where feasible, and ensuring that the remaining physical locations provide maximum value and customer engagement, thereby managing these inherent costs effectively.

Marketing and Sales Expenses

Arab National Bank invests significantly in marketing and sales to attract and retain its customer base. These expenses cover a range of activities, from broad advertising campaigns to targeted digital marketing and customer acquisition initiatives, all aimed at increasing market share and promoting new financial products.

In 2024, the bank's commitment to these areas is evident in its ongoing efforts to enhance brand visibility and customer engagement. For instance, digital marketing plays a pivotal role, with substantial allocations towards online advertising, social media engagement, and content marketing designed to reach a wider audience and nurture leads.

- Advertising and Promotions: Costs incurred for campaigns across various media to promote banking services and products.

- Digital Marketing: Investment in online advertising, search engine optimization, social media marketing, and content creation.

- Sales Initiatives: Expenses related to sales force training, customer relationship management systems, and direct sales efforts.

- Brand Building: Resources allocated to enhance the bank's reputation and public image, fostering trust and loyalty.

Regulatory Compliance and Risk Management Costs

Adhering to the stringent regulatory landscape and maintaining robust risk management frameworks are significant cost drivers for Arab National Bank. These expenses are crucial for the bank's license to operate and its reputation. For instance, in 2024, financial institutions globally continued to invest heavily in compliance technology and personnel to meet evolving standards.

These costs encompass several key areas. They include the salaries and training for dedicated compliance officers and risk management professionals, external legal counsel fees for navigating complex regulations, and the expenses associated with independent audits. Furthermore, implementing and maintaining sophisticated risk management systems, such as those required for IFRS 9 (International Financial Reporting Standard 9) for financial instruments, represent a substantial and ongoing investment.

- Compliance Personnel: Costs associated with hiring, training, and retaining skilled compliance officers and legal experts.

- Auditing and Assurance: Fees paid to internal and external auditors to ensure adherence to regulatory requirements.

- Risk Management Systems: Investment in technology and software for credit risk, market risk, and operational risk management, including IFRS 9 implementation.

- Regulatory Reporting: Expenses incurred in preparing and submitting various reports to regulatory bodies.

Arab National Bank's cost structure is significantly influenced by its substantial investments in technology and digital infrastructure to support its online and mobile banking services. These ongoing expenses for software, hardware, cloud services, and cybersecurity are critical for innovation and competitiveness.

The bank also incurs considerable costs related to its extensive physical branch and ATM network, including real estate leases, utilities, maintenance, and security. Optimizing this physical footprint remains a key strategic focus to manage these operational expenses effectively.

Marketing and sales activities, encompassing advertising, digital marketing, and sales initiatives, represent another major cost area for ANB, aimed at customer acquisition and retention. Furthermore, compliance with stringent regulations and maintaining robust risk management frameworks, including investments in technology and personnel, are essential and costly components of their operations.

Revenue Streams

Arab National Bank's primary revenue stream is net special commission income. This is essentially the profit made from the difference between the interest earned on its loans, advances, and investments, and the interest it pays out on customer deposits and other borrowed funds. This core banking activity directly reflects the bank's success in managing its lending and investment portfolios.

For instance, in the first quarter of 2024, Arab National Bank reported a net special commission income of SAR 1,957 million. This figure demonstrates the significant contribution of its lending and investment activities to the bank's overall profitability, with growth in these areas directly boosting this crucial revenue stream.

Arab National Bank (ANB) derives substantial revenue from net fee and commission income, a vital component of its business model. This income is generated through a wide array of financial services, including trade finance, cash management, credit card operations, investment banking, and brokerage. For instance, in 2023, ANB reported a net fee and commission income of SAR 1,653 million, demonstrating its reliance on these non-interest-based revenue streams.

This diversification away from traditional interest income is strategically important for ANB, offering a more stable and predictable revenue base. The volume of transactions and the extent to which customers utilize these specialized services directly influence the growth of this income category. The bank's focus on expanding its digital offerings and customer engagement is expected to further bolster these fee-based revenues in the coming periods.

Arab National Bank (ANB) generates significant revenue through its net trading and investment income. This stream encompasses profits from the bank's active trading of financial instruments, including foreign exchange transactions and derivatives. For instance, in 2024, ANB's treasury operations were a crucial contributor to this income, reflecting the bank's strategic positioning in global markets.

Dividend Income

Arab National Bank (ANB) supplements its income through dividends received from its equity investments. This stream, while not typically the largest, offers a valuable addition to the bank's revenue, particularly from its strategic stakes in other companies.

In 2024, ANB's financial performance reflects a diversified approach to revenue generation. While specific dividend income figures are often embedded within broader investment income reports, the bank's robust investment portfolio suggests a consistent contribution from this source.

- Dividend Income: Revenue generated from equity holdings.

- Strategic Investments: Income derived from ANB's stakes in other businesses.

- Diversification Benefit: Contributes to overall revenue stability.

Other Operating Income

Other Operating Income for Arab National Bank (ANB) captures revenue streams beyond core banking, including gains from selling non-core assets like properties. This segment, while potentially volatile, adds to the bank's overall financial health.

For instance, in 2023, ANB reported Other Operating Income of SAR 270 million, a notable increase from SAR 182 million in 2022, showcasing the impact of such diverse revenue sources.

- Gains on Sale of Other Real Estate Owned: Revenue generated from the disposal of properties held by the bank.

- Miscellaneous Operational Revenue: Income from various smaller, non-primary banking activities.

- Contribution to Profitability: These streams, though less predictable, bolster the bank's total earnings.

Arab National Bank also generates revenue from its investment activities, including trading gains and dividends from its equity stakes. This diversification helps to buffer against fluctuations in net special commission income, offering a more resilient financial profile.

In 2023, ANB's net trading income was SAR 394 million, and its investment income was SAR 155 million. These figures highlight the importance of strategic market engagement and portfolio management in contributing to the bank's bottom line.

| Revenue Stream | 2023 (SAR Million) | 2024 (Q1) (SAR Million) |

|---|---|---|

| Net Special Commission Income | N/A | 1,957 |

| Net Fee and Commission Income | 1,653 | N/A |

| Net Trading Income | 394 | N/A |

| Investment Income | 155 | N/A |

| Other Operating Income | 270 | N/A |

Business Model Canvas Data Sources

The Arab National Bank Business Model Canvas is built upon comprehensive financial disclosures, extensive market research reports, and internal strategic planning documents. These sources provide the foundational data for accurately defining customer segments, value propositions, and revenue streams.