All Nippon Airways Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

All Nippon Airways Bundle

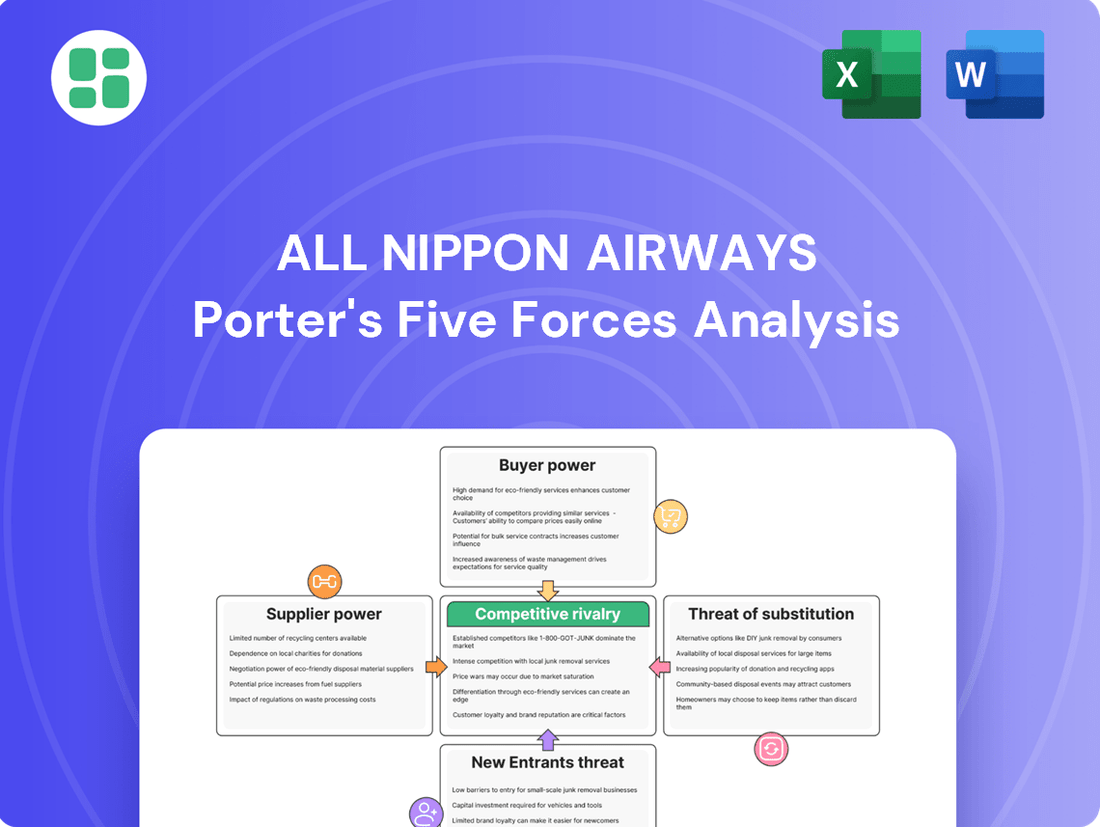

All Nippon Airways navigates a complex competitive landscape, facing significant pressure from rivals and the constant threat of new entrants. Understanding the bargaining power of both suppliers and buyers is crucial for their operational success.

The complete report reveals the real forces shaping All Nippon Airways’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Suppliers like Boeing and Airbus wield considerable bargaining power over aircraft manufacturers such as All Nippon Airways (ANA). This is largely due to the industry's duopolistic structure, which restricts airlines' options and consequently inflates the cost of new aircraft. For instance, in 2023, the global commercial aircraft market was dominated by these two giants, with Boeing and Airbus accounting for the vast majority of new aircraft deliveries.

ANA's strategic fleet planning, including long-term orders and essential maintenance agreements, is significantly shaped by these dominant suppliers. The substantial capital investment and extended lead times associated with acquiring new aircraft further bolster the suppliers' leverage in negotiations.

Fuel is a significant expense for airlines like All Nippon Airways (ANA), with jet fuel costs often representing 20-30% of operating expenses. In 2024, global oil prices have remained volatile, influenced by geopolitical tensions and production decisions, directly impacting the bargaining power of fuel suppliers. This reliance on a concentrated group of major oil producers means suppliers hold considerable sway over pricing.

While ANA, like other major carriers, engages in fuel hedging strategies to mitigate price volatility, these strategies have limitations and cannot entirely eliminate exposure. The global nature of oil markets and the potential for supply disruptions, whether due to political instability or logistical challenges, further amplify the leverage held by fuel suppliers, making it a critical factor in ANA's cost structure.

Labor unions, particularly those representing highly skilled personnel like pilots and maintenance technicians, hold considerable sway within the airline sector. In 2024, the persistent demand for these specialized roles, coupled with unionization, allows them to negotiate effectively on compensation and working conditions. This can translate into significant cost pressures for airlines like All Nippon Airways, as demonstrated by historical instances of labor disputes impacting flight schedules and financial performance.

Airport Operators and Air Traffic Control

Airport operators and air traffic control (ATC) providers often function as monopolies or tight oligopolies within their geographic areas. This inherent market structure grants them significant leverage in dictating terms, including landing fees, gate usage charges, and air navigation service fees. For All Nippon Airways (ANA), as with any airline, these services are indispensable for daily operations, leaving little room for negotiation or alternative sourcing, thus making ANA vulnerable to price hikes and operational impositions.

For instance, in 2023, airport charges at major hubs like Tokyo Haneda (HND) and Narita (NRT) represent a substantial operational cost for airlines. While specific figures vary, these fees can constitute a notable percentage of an airline's cost base. Regulatory bodies, such as Japan's Ministry of Land, Infrastructure, Transport and Tourism, play a crucial role in overseeing these charges, aiming to balance the financial needs of airport operators with the economic viability of airlines. However, the essential nature of these services means that even with regulation, suppliers retain considerable bargaining power.

- Monopolistic/Oligopolistic Nature: Airport operators and ATC services are typically sole providers or part of a very limited group in a given region.

- Essential Services: Airlines cannot operate without access to airports and air traffic control.

- Limited Substitutability: There are few, if any, viable alternatives for airlines to access these critical operational necessities.

- Regulatory Influence: Government regulations often shape the pricing and operational frameworks, but the fundamental power imbalance often remains.

Maintenance, Repair, and Overhaul (MRO) Providers

Specialized Maintenance, Repair, and Overhaul (MRO) providers hold considerable sway over All Nippon Airways (ANA). These entities often possess unique, proprietary knowledge and crucial certifications essential for maintaining aircraft safety and airworthiness, making them indispensable partners.

While ANA might possess some in-house MRO capabilities, its reliance on external specialists for specific, complex components or heavy maintenance checks remains significant. This dependency grants these MRO providers a strong negotiating position.

- Proprietary Knowledge: MRO providers often develop specialized repair techniques and tooling that are not readily available elsewhere.

- Regulatory Compliance: Certifications from aviation authorities are mandatory, limiting the pool of qualified MRO suppliers.

- High Switching Costs: Transitioning to a new MRO provider can be time-consuming and expensive due to re-tooling and re-training requirements.

- Impact on Operations: Delays in MRO services can directly impact flight schedules and revenue for ANA.

The bargaining power of suppliers for All Nippon Airways (ANA) is significant across several key areas. The duopolistic nature of aircraft manufacturers like Boeing and Airbus grants them substantial leverage, as seen in the high costs and long lead times for new aircraft acquisitions. Similarly, fuel suppliers, often major oil producers, can exert considerable influence on ANA's operating expenses due to volatile global oil prices, which in 2024 continue to be affected by geopolitical factors.

Labor unions, particularly for skilled aviation professionals, also possess strong bargaining power, negotiating favorable compensation and working conditions. Furthermore, airport operators and air traffic control services, often operating as regional monopolies, dictate essential fees like landing charges, leaving airlines with limited negotiation options.

Specialized Maintenance, Repair, and Overhaul (MRO) providers also hold considerable sway due to their proprietary knowledge and necessary certifications, making them critical yet powerful partners for ANA's operational needs.

What is included in the product

This analysis reveals the competitive landscape for All Nippon Airways, examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the airline industry.

Instantly visualize competitive pressures from rivals, new entrants, suppliers, buyers, and substitutes to proactively address All Nippon Airways' strategic challenges.

Customers Bargaining Power

Leisure travelers are acutely aware of prices, often choosing the cheapest option, particularly for domestic and shorter international trips. This price sensitivity is amplified by the ease of online price comparison tools, which significantly boosts their bargaining power. For instance, in 2024, the average airfare for domestic leisure travel in Japan saw fluctuations, with budget carriers often setting the benchmark, forcing established airlines like ANA to remain highly competitive.

The ability for consumers to easily compare fares across numerous Online Travel Agencies (OTAs) and airline websites directly empowers them. This transparency compels ANA to frequently offer competitive pricing and targeted promotions to capture this price-conscious segment. Loyalty programs, while helpful in fostering repeat business, only partially counteract this inherent price sensitivity among a broad base of leisure customers.

Large corporate clients wield significant bargaining power over All Nippon Airways (ANA) through direct negotiations for travel agreements. These deals often involve substantial travel volumes and long-term commitments, allowing corporations to secure discounted rates, bulk purchase benefits, and tailored services. For instance, in 2024, major corporations continued to leverage their spending power to negotiate favorable terms, impacting ANA's revenue per passenger.

Online Travel Agencies (OTAs) like Expedia and Booking.com significantly boost customer bargaining power by providing easy comparison of flight information and prices. This aggregation makes it simpler for travelers to find the best deals, putting pressure on airlines like All Nippon Airways (ANA) to remain competitive.

While OTAs offer broader distribution, they also impose commission fees, which can directly impact ANA's revenue per ticket. For example, in 2024, industry reports indicated that OTA commissions could range from 10% to 30% of the booking value, a substantial cost for airlines.

To counter this, ANA actively promotes direct bookings through its own website and app. This strategy aims to reduce the airline's dependence on intermediaries and retain a larger portion of the revenue generated from each passenger.

Availability of Information and Transparency

Customers today have vast amounts of information at their fingertips. Websites and apps allow easy comparison of flight prices, schedules, and amenities across numerous airlines. For instance, in 2024, platforms like Google Flights and Skyscanner provide real-time data, making it simple for travelers to find the best deals.

This transparency significantly increases the bargaining power of customers. They can readily see which airlines offer the most competitive pricing or the most convenient routes. This forces airlines like All Nippon Airways (ANA) to be more price-conscious and service-oriented to maintain customer loyalty.

- Informed Decisions: Passengers can easily research reviews and compare service quality before booking.

- Price Sensitivity: Access to real-time pricing data makes customers highly sensitive to fare differences.

- Switching Costs: Low switching costs mean customers can easily choose a competitor if unsatisfied.

- Demand for Value: Transparency drives demand for airlines that consistently offer good value for money.

Switching Costs are Low

For many travelers, especially those in economy class, the financial and practical hurdles to switching airlines are minimal. This ease of transition significantly amplifies customer leverage.

Beyond the allure of frequent flyer programs, which often have tiered benefits, there are few substantial impediments that lock passengers into a particular carrier. This lack of strong customer lock-in is a key factor in their increased bargaining power.

- Low Switching Costs: The ability to easily choose a different airline for each trip empowers customers.

- Limited Lock-in: Beyond loyalty points, few significant barriers prevent passengers from selecting a competitor.

- Impact on Airlines: This dynamic forces airlines like All Nippon Airways to compete more aggressively on price and service to retain passengers.

- 2024 Data Context: In 2024, the airline industry continued to see intense competition, with many passengers prioritizing cost and convenience over brand loyalty, especially for short-haul or non-business travel.

Customers, particularly leisure travelers, exert significant bargaining power due to readily available price comparison tools and low switching costs. In 2024, the proliferation of Online Travel Agencies (OTAs) and flight aggregators like Skyscanner and Google Flights provided unprecedented transparency, enabling passengers to easily identify the most competitive fares. This ease of comparison, coupled with minimal penalties for changing airlines, forces carriers like All Nippon Airways (ANA) to maintain aggressive pricing strategies and focus on delivering value to attract and retain passengers.

| Factor | Impact on ANA | 2024 Context |

|---|---|---|

| Price Transparency | Increased pressure to offer competitive fares | Widespread use of flight comparison sites |

| Low Switching Costs | Reduced customer loyalty, easier to lose passengers | Passengers often choose based on price for non-business travel |

| Information Access | Customers well-informed about alternatives | Online reviews and detailed amenity comparisons common |

Same Document Delivered

All Nippon Airways Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces Analysis for All Nippon Airways, detailing the competitive landscape, threat of new entrants, bargaining power of buyers and suppliers, and the threat of substitutes. The document you see here is the exact, professionally formatted analysis you will receive immediately after purchase, ensuring full transparency and immediate usability for your strategic planning needs.

Rivalry Among Competitors

All Nippon Airways (ANA) contends with formidable domestic rivals, most notably Japan Airlines (JAL). This intense competition, particularly in the full-service airline sector, has historically shaped a duopolistic market structure within Japan. Both carriers actively vie for market share through strategic investments in new aircraft, service improvements, and expanded route networks.

The rivalry isn't confined to domestic travel; it significantly impacts international routes, the quality of premium services offered, and the appeal of their respective loyalty programs. For instance, as of early 2024, both ANA and JAL are heavily investing in next-generation aircraft like the Airbus A350 and Boeing 787, aiming for greater fuel efficiency and passenger comfort.

The rise of low-cost carriers (LCCs), such as Peach Aviation (partially owned by ANA) and Jetstar Japan, has significantly ramped up competition, especially in the domestic and regional international leisure travel segments. These LCCs are attracting price-sensitive travelers with their lower fares, compelling full-service airlines like ANA to either match pricing or highlight their superior services and extensive network benefits.

Global network competition on international routes is intense for All Nippon Airways (ANA). Major full-service carriers from Asia, Europe, and North America, many bolstered by strong alliances, directly challenge ANA's market share. This rivalry is particularly sharp in the profitable business and premium leisure travel segments, where airlines differentiate on service, route availability, and loyalty programs.

Capacity Management and Pricing Wars

All Nippon Airways (ANA) faces intense competition, particularly in capacity management and pricing. Airlines frequently increase their flight capacity and engage in aggressive pricing, especially when demand dips or to capture market share. This often triggers price wars, which can significantly harm the profitability of all airlines involved.

Balancing the number of available seats with actual travel demand is a perpetual challenge for ANA. This delicate act is heavily influenced by fluctuating economic conditions and evolving travel trends. For instance, during the first half of fiscal year 2024, ANA reported a significant increase in passenger revenue compared to the previous year, driven by a recovery in international travel, yet the competitive landscape necessitates careful capacity planning to avoid oversupply.

- Price Wars: Aggressive pricing strategies by competitors can force ANA into matching lower fares, impacting revenue per passenger.

- Capacity Management: Overcapacity can lead to empty seats, increasing per-seat costs and reducing profitability.

- Demand Fluctuations: Economic downturns or global events can rapidly shift travel demand, making capacity planning difficult.

- Market Share Battles: Competitors actively add capacity and adjust prices to gain or maintain market share, intensifying rivalry.

High Fixed Costs and Perishable Inventory

The airline industry, including All Nippon Airways (ANA), operates with substantial fixed costs. These include the significant capital outlay for aircraft, ongoing maintenance, and a large, skilled labor force. For instance, a new wide-body aircraft can cost upwards of $300 million.

Compounding this is the nature of perishable inventory: an empty seat on a flight represents lost revenue that can never be recovered. This inherent characteristic places immense pressure on airlines to achieve high load factors, meaning they must fill as many seats as possible on every flight.

This drive to fill seats often translates into aggressive pricing strategies, especially during off-peak periods or on less popular routes. Airlines may offer heavily discounted fares to avoid flying with empty seats, even if the profit margin per seat is minimal. For example, in 2023, the average load factor for major global airlines hovered around 80-85%, indicating the constant effort to maximize capacity utilization.

- High Capital Investment: Aircraft purchases and maintenance represent a significant barrier to entry and ongoing expense for airlines.

- Perishable Inventory: Unsold seats on a flight are a permanent loss of potential revenue.

- Load Factor Pressure: Airlines are driven to fill a high percentage of seats to cover fixed costs, often leading to competitive pricing.

- Intensified Rivalry: The need to maximize load factors directly fuels price competition among carriers.

The competitive rivalry for All Nippon Airways (ANA) is fierce, driven by both domestic giants like Japan Airlines (JAL) and a growing number of low-cost carriers (LCCs). This dynamic forces constant innovation in fleet, service, and pricing strategies.

The presence of LCCs, such as Peach Aviation and Jetstar Japan, intensifies competition, particularly on domestic and regional routes, by offering lower fares that pressure full-service carriers.

Globally, ANA faces competition from major international airlines, especially in premium travel segments, where differentiation through service quality and network reach is crucial.

The airline industry's high fixed costs and perishable inventory create pressure for high load factors, leading to aggressive pricing and capacity management battles among rivals.

| Competitor Type | Key Characteristics | Impact on ANA |

|---|---|---|

| Full-Service Domestic (e.g., JAL) | Similar service offerings, extensive networks, loyalty programs | Direct competition for market share, price sensitivity |

| Low-Cost Carriers (LCCs) | Lower fares, basic service, focus on price-sensitive travelers | Erosion of market share on leisure routes, pressure on yields |

| Global Full-Service Carriers | Extensive international networks, premium services, alliances | Competition on international routes, particularly for business travelers |

SSubstitutes Threaten

Japan's extensive and efficient Shinkansen network presents a significant threat of substitutes to All Nippon Airways (ANA) for domestic travel. For routes such as Tokyo to Osaka, the bullet train offers comparable travel times, especially when considering city-center to city-center convenience and the time saved avoiding airport procedures. In 2023, the Shinkansen network carried over 350 million passengers, highlighting its substantial reach and appeal as an alternative to air travel for many journeys.

The rise of sophisticated video conferencing and the normalization of remote work present a significant threat to All Nippon Airways (ANA). For business travel, virtual meetings are a direct substitute, offering substantial cost and time savings that can reduce demand for corporate passenger segments. For instance, a typical round-trip business flight can cost thousands of dollars, plus employee time, whereas a virtual meeting incurs minimal direct costs.

For shorter domestic journeys, private vehicles and intercity buses present more economical options compared to flying, especially for travelers prioritizing cost savings or traveling in groups. These alternatives, while less time-efficient, offer greater convenience and direct access to locations not serviced by airports. In 2024, the average cost of a domestic flight in Japan was approximately ¥15,000, whereas bus fares for similar distances could be as low as ¥3,000-¥5,000.

Cruise Ships and Ferries

For certain leisure travel segments, particularly within Japan or for regional international destinations, cruise ships and ferries can serve as substitutes for air travel. These options appeal to tourists seeking a more relaxed journey or specific destination experiences, offering a different pace and style of travel compared to the speed of air transport.

These substitutes primarily compete on the basis of the overall travel experience and cost, rather than the speed of transit. For instance, in 2024, the Japanese ferry market saw continued demand for inter-island travel, with companies like MOL Ferry Co., Ltd. reporting steady passenger volumes, demonstrating the enduring appeal of sea-based transport for specific routes and traveler preferences.

- Leisure Segment Competition: Cruise ships and ferries offer an alternative travel experience for leisure-focused travelers, especially for domestic or regional trips within Japan.

- Experience vs. Speed: These substitutes compete on the quality of the journey and overall cost, not on the rapid transit times typically associated with airlines.

- Market Presence: In 2024, the ferry sector, exemplified by operators like MOL Ferry, continued to serve a significant portion of regional travel demand, indicating a persistent substitute threat for short-haul leisure air travel.

Global Economic Conditions and Travel Intent

Broader economic downturns significantly impact travel intent, acting as a powerful substitute for air travel. When economies falter, disposable incomes shrink, leading consumers to cut back on discretionary spending like airfare. For instance, a global recession could see a substantial portion of the population opting for domestic travel or even foregoing trips altogether.

Shifts in consumer behavior, such as a growing preference for sustainability, also present a substitute. Increased environmental awareness might encourage individuals to reduce their carbon footprint by choosing alternative transportation or embracing staycation trends. This macro-level change can directly reduce demand for services offered by airlines like All Nippon Airways (ANA).

In 2024, global economic uncertainty, marked by persistent inflation and geopolitical tensions, has already influenced travel patterns. Some reports indicated a slowdown in booking growth for leisure travel in certain regions as consumers became more price-sensitive. This suggests that the threat of substitutes, driven by economic conditions and evolving consumer priorities, remains a significant factor for ANA.

- Economic Downturns: Reduced disposable income forces consumers to prioritize essential spending over travel.

- Sustainability Concerns: Growing environmental awareness leads to a preference for lower-impact travel options or local tourism.

- Staycations: The appeal of domestic or local holidays increases as an alternative to international air travel.

- Consumer Behavior Shifts: A general move towards less frequent or shorter trips can be observed during periods of economic uncertainty.

The threat of substitutes for All Nippon Airways (ANA) is multifaceted, encompassing high-speed rail, private transportation, and even virtual alternatives. For domestic routes, Japan's Shinkansen network is a formidable competitor, offering convenience and comparable travel times for city-center to city-center journeys. In 2023, the Shinkansen transported over 350 million passengers, underscoring its significant market penetration.

Moreover, the increasing adoption of remote work and advanced video conferencing technologies directly substitutes for business travel, eliminating associated costs and time. For shorter trips, buses and private vehicles provide more economical options, especially for budget-conscious travelers or groups. For instance, in 2024, domestic flight costs averaged around ¥15,000, while bus fares for similar distances were considerably lower, ranging from ¥3,000 to ¥5,000.

| Substitute Type | Key Advantages | 2024 Data/Context |

| High-Speed Rail (Shinkansen) | City-center convenience, comparable travel times for certain routes | Carried over 350 million passengers in 2023 |

| Buses & Private Vehicles | Lower cost, direct access to more locations | Bus fares ¥3,000-¥5,000 vs. average domestic flight ¥15,000 |

| Video Conferencing | Cost and time savings for business travel | Increasing normalization of remote work |

Entrants Threaten

Establishing a new airline is incredibly capital-intensive. Think about needing billions just to acquire a fleet of modern aircraft, build maintenance hangars, and set up sophisticated IT and reservation systems. For instance, a new wide-body aircraft can cost upwards of $300 million. This massive upfront cost is a formidable barrier.

These prohibitive financial requirements effectively deter most potential new entrants from even considering a challenge to established carriers like All Nippon Airways. Securing the financing for such large-scale operations, especially for a significant number of aircraft, presents a major hurdle that few new companies can overcome.

Stringent regulatory hurdles and the necessity for numerous licenses act as significant barriers to entry in the airline industry. Globally, aviation is a sector governed by extensive regulations, demanding compliance with rigorous safety standards, airworthiness certifications, and operating permits. For instance, in 2024, obtaining approvals from bodies like the Federal Aviation Administration (FAA) or the European Union Aviation Safety Agency (EASA) involves a deeply complex, lengthy, and costly undertaking. This intricate web of compliance, including route authorities and safety protocols, deters potential new airlines from entering the market, thereby protecting established players like All Nippon Airways.

All Nippon Airways (ANA) benefits from significant brand loyalty and powerful network effects, making the threat of new entrants relatively low. Decades of operation have cultivated strong brand recognition and trust among consumers, further bolstered by extensive customer loyalty programs. In 2023, ANA reported a load factor of 71.5% on its domestic routes, demonstrating consistent passenger demand and preference for established carriers.

New airlines would face immense challenges in replicating ANA's vast network, encompassing numerous domestic and international routes, which is crucial for offering competitive connectivity and flight frequency. The sheer scale of ANA's operations, including its fleet size and partnerships, creates substantial barriers. For instance, in the fiscal year ending March 2024, ANA operated over 300 aircraft, a scale difficult for newcomers to match quickly.

Limited Access to Airport Slots and Infrastructure

Major airports, particularly in bustling hubs like Tokyo Narita (NRT) and Haneda (HND), operate with severely restricted landing and take-off slots. These coveted slots are predominantly held by established carriers, creating a formidable barrier for any new airline aiming to enter the market. In 2024, for instance, Haneda's slot capacity remained a critical bottleneck, with airlines vying for limited availability, often requiring significant negotiation or the acquisition of existing routes to gain access.

Securing desirable slots is crucial for new entrants to establish competitive flight schedules and build a viable network. Without them, offering attractive routes and frequencies becomes nearly impossible, hindering growth and market penetration. This scarcity extends beyond just landing rights; access to essential infrastructure such as maintenance hangars and gate space is equally constrained, further complicating operational setup for newcomers.

- Limited Slot Availability: Major airports like Tokyo Narita and Haneda have a finite number of landing and take-off slots.

- Incumbent Advantage: Existing airlines often hold the majority of these valuable slots.

- Infrastructure Constraints: Access to maintenance hangars and gate space is also difficult for new entrants.

- Impact on Operations: This limits the ability of new airlines to create competitive schedules and networks.

Economies of Scale and Experience Curve

Established airlines like All Nippon Airways (ANA) leverage significant economies of scale. For instance, ANA's vast fleet allows for bulk purchasing of fuel, aircraft parts, and maintenance services, leading to lower per-unit costs. In 2024, the airline industry continued to see intense competition on price, making cost efficiency a critical differentiator.

The experience curve also plays a crucial role. ANA's decades of operational experience translate into optimized route planning, efficient crew management, and superior customer service protocols. New entrants would face a substantial learning curve, requiring significant investment to match ANA's operational expertise and efficiency, thereby increasing their initial cost burden.

- Economies of Scale: ANA benefits from bulk purchasing power for fuel, aircraft, and services, reducing per-unit costs.

- Experience Curve: Decades of operational expertise lead to optimized processes and efficiency, a difficult advantage for new entrants to replicate.

- Cost Disadvantage for New Entrants: Startups lack the scale and experience, facing higher operational costs and a steep learning curve.

- Impact on Profitability: This initial cost disadvantage directly hinders the profitability and competitiveness of new airlines entering the market.

The threat of new entrants for All Nippon Airways (ANA) is relatively low due to substantial capital requirements, stringent regulations, and established network advantages. The immense cost of acquiring aircraft, estimated at over $300 million per wide-body jet, and navigating complex regulatory approvals in 2024, like those from the FAA or EASA, create significant barriers.

Furthermore, limited airport slot availability at major hubs such as Haneda, often held by incumbents, severely restricts new airlines' ability to establish competitive flight schedules. ANA's operational scale, with over 300 aircraft in its fleet by March 2024, and its extensive route network, built over decades, are difficult and costly for newcomers to replicate.

| Barrier Type | Description | Impact on New Entrants | Example Data (2024) |

|---|---|---|---|

| Capital Intensity | High cost of aircraft acquisition and infrastructure. | Deters entry due to massive upfront investment. | Wide-body aircraft cost: $300M+ |

| Regulatory Hurdles | Complex safety, licensing, and operating permits. | Lengthy and costly compliance processes. | FAA/EASA approval complexity. |

| Network Effects & Brand Loyalty | Established routes, loyalty programs, and customer trust. | Difficult to attract customers from established carriers. | ANA's 71.5% domestic load factor (2023). |

| Airport Slot Scarcity | Limited landing and take-off slots at key airports. | Hinders competitive scheduling and network development. | Haneda slot availability remains critical. |

| Economies of Scale & Experience Curve | Lower per-unit costs and operational efficiencies. | New entrants face higher costs and a steep learning curve. | ANA's fleet size (300+ aircraft, FY2024). |

Porter's Five Forces Analysis Data Sources

Our All Nippon Airways Porter's Five Forces analysis is built upon a foundation of comprehensive data, including ANA's official annual reports, industry-specific publications from aviation research firms, and publicly available regulatory filings. This ensures a robust understanding of the competitive landscape.