All Nippon Airways Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

All Nippon Airways Bundle

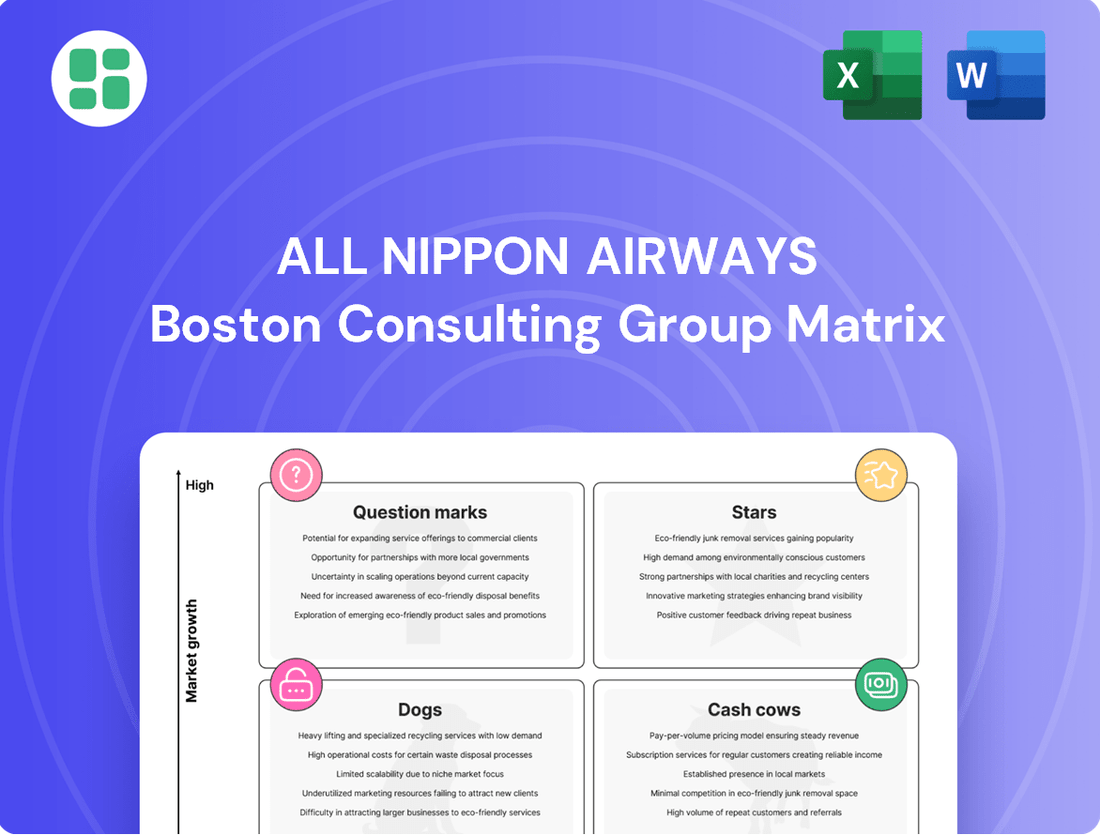

Curious about All Nippon Airways' strategic positioning? This glimpse into their BCG Matrix hints at a dynamic portfolio, but to truly grasp their market standing—identifying Stars, Cash Cows, Dogs, and Question Marks—you need the full picture. Unlock a comprehensive breakdown of their product lines and gain actionable insights to inform your own business strategy.

Don't settle for a partial view. The complete All Nippon Airways BCG Matrix report provides detailed quadrant placements, data-driven recommendations, and a clear roadmap for optimizing their investments and product decisions. Purchase the full version to gain a strategic advantage in the competitive airline industry.

Stars

All Nippon Airways (ANA) is strategically expanding its European network, with new routes to Milan, Stockholm, and Istanbul slated for late 2024 and early 2025. These additions, serviced by fuel-efficient Boeing 787 Dreamliners, underscore a commitment to capturing burgeoning demand for Japan-Europe travel.

This aggressive route expansion positions ANA to solidify its standing as a key player in international air travel, suggesting these new European markets represent significant growth opportunities. For instance, Japan-Europe passenger traffic has shown a steady recovery post-pandemic, with projections for continued growth through 2025.

All Nippon Airways (ANA) is strategically targeting premium international travel segments, evident in its investment in advanced aircraft configurations like the Boeing 787-9s, which feature a substantial premium cabin layout. This focus on routes such as Milan highlights a strong market position and growth in the lucrative business and luxury travel sectors.

ANA's commitment to this high-yield segment is further underscored by its investment in XPERISUS, a luxury travel startup. This move signals a clear strategy to capture the high-spending traveler demographic, a market segment known for its significant growth potential and profitability.

All Nippon Airways (ANA) is strategically expanding its low-cost carrier (LCC) presence with Peach and AirJapan, both targeting significant growth in Asian international routes for fiscal year 2025. This aggressive push is designed to capitalize on robust inbound tourism to Japan and the broader trend of increasing regional travel.

AirJapan, which commenced operations in early 2024, is a key component of this expansion, focusing specifically on international routes. By leveraging these LCCs, ANA aims to capture a larger share of the high-growth Asian travel market, offering more accessible options for a wider range of travelers.

International Cargo Business Expansion

The acquisition of Nippon Cargo Airlines (NCA) in August 2025 is a pivotal moment for All Nippon Airways (ANA), significantly bolstering its international cargo network and operational capacity. This strategic move is designed to create a more balanced revenue stream, reducing reliance solely on passenger traffic and capitalizing on the robust global demand for air freight services.

ANA's expanded cargo operations are particularly well-positioned to leverage the growing tri-nation trade routes, especially those connecting Asia and China with North America. This expansion aligns with ANA's long-term vision for sustainable growth in the competitive international air cargo market.

- Network Expansion: The integration of NCA's fleet and routes broadens ANA's global reach, offering enhanced connectivity for businesses shipping goods worldwide.

- Revenue Diversification: ANA aims to achieve a more stable financial performance by increasing the contribution of its cargo division to overall revenue, aiming for a 40% cargo revenue share by 2027.

- Market Demand: The acquisition directly addresses the increasing demand for efficient air cargo solutions, particularly for high-value goods and time-sensitive shipments between major economic hubs.

- Operational Synergies: By combining resources, ANA expects to realize significant operational efficiencies and cost savings, improving the profitability of its cargo business.

Digital Transformation & AI Integration in Operations

All Nippon Airways (ANA) is heavily investing in digital transformation and AI to boost operational efficiency. Their adoption of advanced IT solutions, such as Lufthansa Systems' Lido Flight 4D, is a prime example. This system is designed for next-generation flight planning, real-time monitoring, and inflight support, aiming to optimize flight operations.

These digital initiatives, including the development of virtual travel platforms like ANA NEO and ANA Granwhale, underscore ANA's focus on high-growth areas. By leveraging technology, ANA seeks to improve customer engagement and attract a broader traveler base, while simultaneously reducing operational costs.

ANA's commitment to digital innovation is evident in its strategic investments. For instance, in 2023, ANA announced plans to integrate AI and data analytics into various aspects of its operations, from predictive maintenance to personalized customer service.

- Lido Flight 4D Adoption: Enhances flight planning and inflight support for greater efficiency.

- ANA NEO & ANA Granwhale: Virtual platforms designed to boost customer engagement and attract new travelers.

- AI and Data Analytics Investment: Focus on predictive maintenance and personalized customer experiences.

- Operational Efficiency Gains: Aim to reduce costs and improve overall service quality through technology.

Stars in the BCG Matrix represent high-growth, high-market-share segments for All Nippon Airways (ANA). These are typically new, promising routes or services where ANA has a strong competitive advantage. For example, ANA's expansion into premium European markets and its investment in luxury travel startups like XPERISUS can be considered Star components. These initiatives are characterized by significant investment to maintain growth and market leadership.

ANA's strategic focus on these high-potential areas aims to capture future market share and establish dominance. The success of these Star segments is crucial for the company's long-term growth trajectory and overall portfolio balance. By nurturing these Stars, ANA positions itself for sustained profitability and competitive advantage in the evolving aviation landscape.

What is included in the product

This BCG Matrix overview for All Nippon Airways offers tailored analysis of its product portfolio, highlighting which units to invest in, hold, or divest.

A clear BCG Matrix visualizes ANA's portfolio, easing the pain of strategic resource allocation by highlighting growth opportunities and underperforming segments.

Cash Cows

All Nippon Airways' core domestic passenger routes, such as the bustling Haneda-Fukuoka and Haneda-Sapporo corridors, are quintessential Cash Cows. These routes operate within a mature, highly stable market where ANA enjoys a commanding presence, consistently delivering significant and reliable cash flow with minimal need for aggressive marketing spend.

The inherent strength of these routes lies in their established demand and the enduring loyalty ANA commands from its customer base. For instance, in the fiscal year ending March 2024, ANA reported a robust domestic passenger load factor, underscoring the consistent utilization of these key routes.

All Nippon Airways' established long-haul international passenger routes, particularly those connecting Japan to major North American cities and key European hubs like Paris and Munich, represent significant cash cows. These routes consistently demonstrate high profitability, driven by robust load factors and sustained demand from both business and leisure travelers. In 2024, ANA reported strong performance on these segments, contributing substantially to overall revenue and operating profit.

All Nippon Airways' (ANA) maintenance and ground handling services function as a Cash Cow within its BCG matrix. These operations provide essential support not only for ANA's own fleet but also for other airlines, tapping into a consistent demand within the aviation sector. This segment benefits from the mature and indispensable nature of aviation infrastructure support.

In 2023, the global aviation maintenance, repair, and overhaul (MRO) market was valued at approximately $93 billion, with projections indicating steady growth. ANA's involvement in this market, serving a diverse client base beyond its internal needs, solidifies its position as a reliable revenue generator. The essentiality of these services ensures a stable demand, even amidst industry fluctuations.

ANA Mileage Club and Loyalty Programs (ANA X)

ANA Mileage Club, operated by ANA X, functions as a robust cash cow within All Nippon Airways' portfolio. This loyalty program is adept at maximizing customer lifetime value by fostering engagement through points and exclusive benefits.

The program boasts a substantial and dedicated membership base, which translates into consistent revenue streams. These revenues are generated through a variety of strategic partnerships and ongoing customer interactions, necessitating minimal incremental investment for its upkeep.

- Revenue Generation: ANA Mileage Club contributes significantly to ANA's overall revenue through mileage accrual, redemption, and co-branded credit card partnerships.

- Customer Loyalty: The program cultivates a highly loyal customer base, driving repeat business and increasing customer lifetime value.

- Low Investment Needs: As a mature program, it requires relatively low capital expenditure for maintenance and continued operation.

- Partnership Ecosystem: ANA X leverages a wide network of airline and non-airline partners to expand the utility of miles, thereby enhancing program appeal and revenue potential.

General International Passenger Cargo (Belly-hold)

All Nippon Airways' (ANA) general international passenger cargo, often referred to as belly-hold cargo, represents a classic Cash Cow within its business portfolio. This segment benefits from a stable, high market share due to its integration with ANA's extensive passenger flight network.

While the demand for dedicated freighter cargo can be quite volatile, belly-hold cargo provides a consistent revenue stream. It effectively monetizes the available cargo space on passenger aircraft, operating within a mature, low-growth market segment. This strategy allows ANA to maximize the utility of its existing assets, turning potential empty space into a reliable source of income.

For the fiscal year ending March 2024, ANA reported significant contributions from its cargo operations. Specifically, the airline's air cargo revenue, which includes belly-hold capacity, demonstrated resilience.

- Belly-hold cargo leverages existing passenger flight infrastructure, ensuring consistent revenue generation.

- This segment operates in a mature, low-growth market, characteristic of a Cash Cow.

- ANA's cargo division, including belly-hold, contributed substantially to overall financial performance in FY2024, reflecting its stable revenue-generating capabilities.

- The strategy maximizes asset utilization by filling available space on passenger flights.

All Nippon Airways' (ANA) domestic passenger routes, particularly those connecting major cities like Tokyo (Haneda) to Osaka and Fukuoka, exemplify Cash Cows. These routes benefit from established demand and ANA's strong market position, generating consistent revenue with relatively low marketing investments. In fiscal year 2024, ANA's domestic passenger segment continued to show strong performance, indicating the maturity and stability of these key routes.

The airline's international cargo operations, specifically belly-hold cargo on its passenger flights, also function as a Cash Cow. This segment effectively monetizes available space on its extensive passenger network, providing a reliable revenue stream irrespective of dedicated freighter market fluctuations. ANA's cargo revenue in FY2024 remained a stable contributor to the company's financial results.

| ANA Business Segment | BCG Category | Key Characteristics | FY2024 Relevance |

|---|---|---|---|

| Domestic Passenger Routes (e.g., HND-FUK) | Cash Cow | Mature market, high demand, strong brand loyalty, low investment needs | Consistent revenue generation, robust load factors |

| International Belly-Hold Cargo | Cash Cow | Leverages existing passenger network, stable demand, asset utilization | Reliable income stream, contribution to overall cargo revenue |

| ANA Mileage Club | Cash Cow | High customer lifetime value, strong partnerships, minimal incremental investment | Sustained revenue from loyalty program activities |

Delivered as Shown

All Nippon Airways BCG Matrix

The All Nippon Airways BCG Matrix you are previewing is the complete, unadulterated document you will receive upon purchase, offering a direct insight into its strategic depth and analytical rigor. This preview showcases the exact BCG Matrix report, meticulously crafted to provide actionable insights into ANA's business portfolio, ensuring you get precisely what you need for informed decision-making. Rest assured, the purchased file will be identical to this preview, free from any watermarks or demo limitations, ready for immediate integration into your strategic planning processes. This comprehensive BCG Matrix analysis of All Nippon Airways is designed for clarity and professional application, empowering you with the data to navigate the competitive aviation landscape effectively.

Dogs

All Nippon Airways (ANA) may identify certain underperforming regional domestic routes as potential Dogs within its BCG Matrix. These routes often struggle with low passenger demand and limited growth potential, leading to a small market share and profitability. For instance, routes with consistently low passenger loads, perhaps serving smaller, less populated areas, might fall into this category.

These routes could be kept operational for strategic reasons, such as maintaining network breadth or fulfilling social obligations to regional communities. However, they often consume resources without generating significant returns, acting as cash traps. In 2023, some smaller regional airports in Japan reported passenger traffic declines compared to pre-pandemic levels, highlighting the challenges faced by such routes.

All Nippon Airways (ANA) might have certain legacy ancillary services or highly niche offerings that haven't kept pace with evolving customer expectations or digital advancements. These could be services with a small customer base and minimal growth potential, draining resources without contributing substantially to profitability.

For instance, consider outdated in-flight entertainment options or specialized baggage handling services that are rarely utilized. In 2024, the airline industry saw a significant shift towards personalized digital experiences and sustainable practices. Services that don't align with these trends, like physical amenity kits that could be replaced by digital vouchers or on-demand services, would likely be in the Dogs quadrant.

All Nippon Airways (ANA) has faced challenges on specific international routes where load factors have remained stubbornly low. These routes often grapple with a combination of factors, including geopolitical tensions and fierce competition, which eat into profitability. For instance, certain European routes have been particularly affected by overflight restrictions. These restrictions not only inflate operating expenses due to longer flight paths but also dampen commercial demand, making it harder to fill seats.

Non-core, Sub-scale Investments from Past Ventures

Non-core, sub-scale investments from past ventures within All Nippon Airways (ANA) would be categorized as Dogs in the BCG Matrix. These are typically smaller, experimental projects or ventures that did not achieve significant market share or demonstrate robust growth potential. For instance, a past foray into a niche online travel booking platform that failed to attract a substantial user base would fit this description.

These ventures often represent a drain on resources without contributing meaningfully to the company's overall performance. By 2024, ANA has been actively streamlining its portfolio, divesting from or winding down such underperforming assets to focus on core competencies. For example, if a past venture involved a small, regional airline subsidiary that consistently reported losses and had limited expansion prospects, it would be a prime candidate for the Dog category.

- Underperforming Ventures: Investments in ancillary services or partnerships that failed to generate significant revenue or customer engagement.

- Limited Market Share: Projects unable to capture a meaningful portion of their target market, indicating a lack of competitive advantage.

- Resource Drain: Ventures that consume capital and management attention without delivering commensurate returns, impacting overall profitability.

- Strategic Re-evaluation: ANA's ongoing strategy involves identifying and addressing these sub-scale investments to optimize resource allocation and enhance core business performance.

Certain Legacy Aircraft Models with High Operating Costs

Certain legacy aircraft models within All Nippon Airways' (ANA) fleet, particularly those with lower fuel efficiency and higher maintenance demands, could be categorized as Dogs in a BCG matrix analysis. For instance, older Boeing 777-200s, while still operational, may incur higher per-flight operating expenses compared to newer, more advanced aircraft. ANA's ongoing fleet modernization, which includes retiring older models and introducing more fuel-efficient aircraft like the Airbus A320neo family, directly addresses the declining market share and low growth potential associated with these older, less profitable assets.

- Older aircraft models with high operating costs.

- Lower fuel efficiency and disproportionately high maintenance needs.

- ANA's fleet modernization strategy to replace older aircraft.

- Potential for these models to have low market share and low growth.

All Nippon Airways (ANA) may classify certain underperforming regional domestic routes as Dogs within its BCG Matrix. These routes often struggle with low passenger demand and limited growth potential, resulting in a small market share and profitability. For example, routes serving smaller, less populated areas with consistently low passenger loads would fit this category.

These routes might be kept operational for strategic reasons, such as maintaining network breadth or fulfilling social obligations to regional communities. However, they often consume resources without generating significant returns, acting as cash traps. In 2023, some smaller regional airports in Japan saw passenger traffic declines compared to pre-pandemic levels, underscoring the challenges these routes face.

Certain legacy ancillary services or niche offerings within ANA that haven't adapted to evolving customer expectations or digital advancements could also be considered Dogs. These services typically have a small customer base and minimal growth potential, draining resources without contributing substantially to profitability. For instance, outdated in-flight entertainment or specialized baggage handling services that are rarely used would fall here.

By 2024, the airline industry has seen a pronounced shift towards personalized digital experiences and sustainable practices. Services that do not align with these trends, such as physical amenity kits that could be replaced by digital vouchers or on-demand services, would likely be categorized as Dogs.

| Category | Description | ANA Example (Hypothetical) | Market Share | Market Growth |

| Dogs | Low market share, low growth potential, often cash drains. | Underperforming regional routes, legacy ancillary services. | Low | Low |

Question Marks

New long-haul routes to emerging markets like Milan, Stockholm, and Istanbul are currently positioned as Stars for All Nippon Airways (ANA) within the BCG matrix framework. These routes represent high-growth potential, aligning with the characteristics of Stars, but they are also in their nascent stages of development.

Despite operating in markets with substantial growth prospects, ANA's market share on these new European routes is presently low due to their recent introduction. Significant investment in marketing and operations is necessary to build brand recognition and capture a larger share, aiming to transition them into strong cash cows.

For instance, by the end of 2024, passenger traffic between Europe and Asia was projected to continue its robust recovery, with new routes like those to Istanbul, a major transit hub, offering considerable upside. ANA's strategic expansion into these cities reflects a proactive approach to capitalizing on these developing markets, even with the initial high investment requirements.

AirJapan, a new international airline brand launched by All Nippon Airways (ANA) in early 2024, is strategically focusing on key Asian markets. Its initial routes include Bangkok, Seoul, and Singapore, all destinations experiencing robust inbound travel demand. These routes are considered to have high growth potential within the burgeoning Asian travel sector.

As a new entrant, AirJapan's market share on these specific Asian routes is currently low, reflecting the early stage of its operations. Despite the high growth potential, the brand is in a position that requires significant investment to build brand recognition and capture a larger customer base, aiming to transition these routes into Stars within the ANA portfolio.

ANA Pay, the airline's mobile payment service, has achieved a significant milestone, surpassing one million members. This growth highlights the increasing consumer adoption of digital payment solutions within the travel industry. ANA is actively working to integrate smaller mile redemptions into everyday transactions, aiming to boost customer engagement and loyalty.

While digital transformation is a recognized high-growth sector, the specific financial viability and broad market penetration of niche loyalty innovations like ANA Pay are still in their nascent stages. This positions ANA Pay as a potential star in the BCG matrix, requiring continued investment to solidify its market position and profitability.

Investments in Sustainable Aviation Fuel (SAF) Technology and Production

All Nippon Airways' (ANA) investments in Sustainable Aviation Fuel (SAF) technology and production position it within the question mark category of the BCG matrix. The company is actively pursuing sustainability, with SAF being a key component of its decarbonization strategy. For instance, ANA has committed to increasing its SAF usage, aiming for 10% of its fuel supply by 2030, a significant undertaking given current market availability.

While the demand for SAF is experiencing rapid growth, fueled by global environmental regulations and corporate sustainability targets, its production infrastructure and widespread adoption remain in early stages. ANA's direct involvement in SAF production is limited, emphasizing its role as a user and promoter rather than a primary manufacturer. This necessitates substantial research and development, alongside crucial strategic alliances with SAF producers to secure supply and drive technological advancements.

- High Growth Potential: The global SAF market is projected to grow significantly, with estimates suggesting it could reach over $15 billion by 2027, driven by mandates and airline commitments.

- Nascent Market: Despite growth, SAF currently accounts for a very small fraction of total aviation fuel consumption, estimated to be less than 1% globally.

- Investment in R&D and Partnerships: ANA's strategy involves investing in research for new SAF production pathways and forming partnerships with technology providers and fuel suppliers to ensure future availability.

- Strategic Importance: Securing a stable and cost-effective supply of SAF is critical for ANA to meet its long-term environmental goals and maintain competitiveness in a sustainability-focused aviation industry.

Specific New Regional Domestic Routes by ANA Wings

ANA Wings, All Nippon Airways’ regional arm, is strategically introducing 16 new domestic routes from Tokyo Haneda starting in 2025. This expansion is powered by the introduction of new turboprop aircraft, aiming to tap into underserved regional markets. These routes represent new ventures for ANA, where its current market share is minimal, demanding significant investment to establish a presence and achieve profitability.

These new routes are categorized as Stars within the BCG matrix for ANA Wings. They are in nascent markets with high growth potential but currently low market share. For instance, the airline is investing in aircraft like the ATR 72-600 to service these routes, which require substantial capital outlay to build brand recognition and passenger volume.

- New Routes: 16 domestic routes from Tokyo Haneda commencing in 2025.

- Aircraft Investment: Deployment of new turboprop aircraft to service these routes.

- Market Position: Entering regions with low existing ANA market share, requiring development investment.

- Growth Potential: Targeting potentially high-growth regional markets as Stars in the BCG portfolio.

All Nippon Airways' (ANA) investments in Sustainable Aviation Fuel (SAF) technology and production are firmly placed in the question mark category of the BCG matrix. The airline is actively pursuing decarbonization, with SAF being a cornerstone of its strategy, aiming to increase SAF usage to 10% of its fuel supply by 2030. This ambitious goal highlights the significant investment and development required in this nascent, high-growth area.

While the demand for SAF is rapidly increasing due to global environmental regulations and corporate sustainability targets, its production infrastructure and widespread adoption are still in early stages. ANA's direct involvement in SAF production is limited, positioning it more as a user and promoter, necessitating substantial research and development and strategic alliances with SAF producers to secure supply and drive technological advancements.

The global SAF market is projected for substantial growth, potentially exceeding $15 billion by 2027, driven by mandates and airline commitments. However, SAF currently represents a very small fraction of total aviation fuel consumption, estimated at less than 1% globally. ANA's strategy includes investing in research for new SAF production pathways and forming partnerships to ensure future availability and cost-effectiveness, which is critical for meeting its long-term environmental goals.

| BCG Category | ANA Initiative | Market Growth | Market Share | Investment Needs |

|---|---|---|---|---|

| Question Mark | Sustainable Aviation Fuel (SAF) Investment | High (projected >$15B by 2027) | Low (<1% of total aviation fuel) | High (R&D, partnerships, infrastructure) |

BCG Matrix Data Sources

Our All Nippon Airways BCG Matrix is informed by comprehensive data, including financial statements, route performance metrics, and industry growth forecasts.