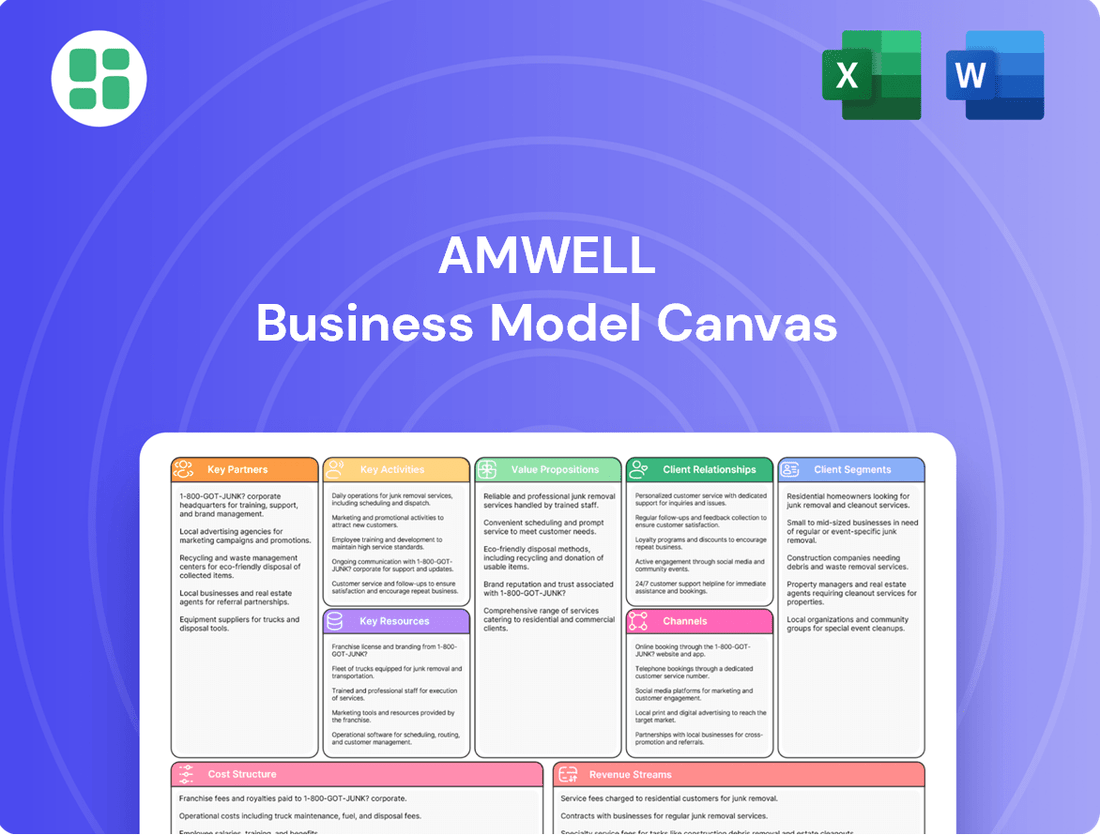

amwell Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

amwell Bundle

Curious about amwell's innovative approach to telehealth? Our comprehensive Business Model Canvas breaks down their customer relationships, revenue streams, and key resources. Discover the strategic framework that fuels their growth and gain actionable insights for your own ventures.

Partnerships

Amwell's strategic health system collaborations are foundational, linking it with over 2,000 hospitals nationwide. This extensive network allows for the seamless integration of Amwell's virtual care solutions directly into established healthcare delivery models.

These partnerships are vital for Amwell to embed its platform within existing provider workflows, facilitating a hybrid care approach. By doing so, Amwell expands its market penetration and enhances its ability to serve a broader patient base through integrated virtual and in-person care pathways.

Amwell's strategy heavily relies on its health plan and payer alliances, partnering with over 50 such organizations. These collaborations extend Amwell's reach to more than 80 million covered lives, a crucial factor in making digital care programs accessible to a vast patient base.

These partnerships are instrumental in boosting patient adoption of virtual care. By integrating Amwell's services with insurance coverage, these alliances ensure that patients can easily access and afford telehealth services, driving significant utilization.

Amwell's strategic partnership with Leidos is instrumental in modernizing the U.S. Military Health System's digital infrastructure, a critical engagement within the government sector. This collaboration is designed to enhance healthcare delivery for roughly 9.6 million military beneficiaries, underscoring the scale of Amwell's impact.

This multi-year contract represents a significant growth driver for Amwell, focusing on the widespread implementation of its telehealth platform across the Department of Defense. The successful deployment across this vast federal entity showcases Amwell's capability in managing large-scale, complex government projects.

Technology and Integration Partners

Amwell’s strategic alliances with technology and integration partners are foundational to its business model, enabling the seamless connection of its telehealth platform with existing healthcare infrastructure. These partnerships are crucial for facilitating efficient data exchange and improving the overall patient and provider experience. For instance, Amwell’s integration with MHS GENESIS, the electronic health record (EHR) system used by the U.S. Department of Defense, exemplifies this commitment. This integration allows for a unified view of patient health information, streamlining care delivery and enhancing clinical decision-making.

These collaborations are not merely about technical connectivity; they are about building a robust digital health ecosystem. By partnering with leading EHR vendors and other health IT solution providers, Amwell ensures its platform can operate harmoniously within diverse healthcare settings. This interoperability is key to unlocking the full potential of virtual care, making it more accessible, efficient, and integrated into daily clinical workflows. In 2024, the telehealth market continued its expansion, with a significant portion of this growth driven by improved platform integration and interoperability, making these partnerships increasingly vital for market competitiveness.

- EHR Integrations: Amwell actively partners with major EHR providers to ensure seamless data flow, enhancing clinical workflow efficiency.

- Interoperability Standards: Adherence to and promotion of interoperability standards are key to building a connected digital health ecosystem.

- MHS GENESIS Partnership: The integration with MHS GENESIS demonstrates Amwell's capability to connect with complex, large-scale federal healthcare systems.

- Market Growth Driver: Technological partnerships are identified as a critical factor supporting the continued growth and adoption of telehealth services in 2024.

Specialized Clinical Program Collaborations

Amwell actively partners with specialized health solutions providers to enhance its service offerings. For instance, collaborations with companies like Vida Health bring targeted cardiometabolic care programs to Amwell's platform. These strategic alliances are crucial for broadening the scope of virtual care options available to their clients.

These partnerships are designed to expand Amwell's clinical program portfolio significantly. By integrating specialized solutions, Amwell can offer a more diverse and targeted range of virtual care services. A notable example is their work with Florida Blue, where Amwell provides white-label telehealth services, demonstrating the flexibility and reach of these collaborations.

- Vida Health Collaboration: Focuses on cardiometabolic care, expanding Amwell's chronic disease management capabilities.

- Florida Blue Partnership: Illustrates Amwell's ability to offer white-label telehealth, extending its reach through established health plans.

- Portfolio Expansion: These alliances directly contribute to a richer and more specialized virtual care offering for Amwell's customer base.

Amwell's Key Partnerships are central to its business model, enabling broad market access and enhanced service delivery. These include deep integrations with over 2,000 health systems, partnerships with more than 50 health plans covering over 80 million lives, and significant collaborations with federal entities like the U.S. Department of Defense. Furthermore, strategic alliances with technology providers, particularly EHR vendors, and specialized health solution companies like Vida Health are critical for expanding Amwell's integrated virtual care offerings and ensuring interoperability within the evolving digital health landscape.

| Partner Type | Key Collaborations/Scope | Impact/Reach | 2024 Relevance |

|---|---|---|---|

| Health Systems | Over 2,000 hospitals nationwide | Seamless integration into existing care models | Foundation for hybrid care delivery |

| Health Plans/Payers | Over 50 organizations | Access to over 80 million covered lives | Drives patient adoption and affordability |

| Government/Federal | Leidos (U.S. Military Health System) | Modernizing digital infrastructure for ~9.6 million beneficiaries | Large-scale project execution, growth driver |

| Technology/Integration | EHR vendors (e.g., MHS GENESIS integration) | Enhanced data flow, interoperability | Crucial for ecosystem building and market competitiveness |

| Specialized Solutions | Vida Health (cardiometabolic care) | Expanded chronic disease management capabilities | Portfolio diversification and targeted service offerings |

What is included in the product

Amwell's Business Model Canvas focuses on connecting patients with healthcare providers through a robust telehealth platform, leveraging technology to deliver accessible and convenient care.

It details key partnerships with health systems and payers, a strong value proposition of improved patient outcomes and cost savings, and revenue streams from platform fees and service utilization.

Amwell's Business Model Canvas effectively addresses the pain point of fragmented healthcare access by clearly mapping out its value proposition of convenient, high-quality virtual care and its key partners in delivering this service.

The canvas provides a structured approach to understanding how Amwell solves the pain of limited healthcare options through its customer segments and channels, making complex delivery systems easily understandable.

Activities

Amwell's core activity involves the continuous development and maintenance of its robust SaaS-based Converge platform. This focus ensures the technology remains future-ready, scalable, and seamlessly integrated.

Significant investment is channeled into research and development, particularly in artificial intelligence. This R&D aims to enhance Amwell's digital healthcare solutions and elevate the overall user experience.

In 2023, Amwell reported a 5% increase in its technology and development expenses, reaching $125 million, reflecting its commitment to platform innovation and AI integration.

Amwell's core activity is operating the Amwell Medical Group (AMG), which underpins its virtual care delivery. This involves managing a vast network of healthcare professionals, ensuring they can connect millions of patients with the right doctors and specialists for virtual consultations.

This operational backbone allows Amwell to facilitate a high volume of virtual visits, aiming for efficient and quality care across a wide range of medical specialties. In 2023, Amwell reported facilitating over 1.7 million telehealth visits, showcasing the scale of their virtual care delivery.

Amwell's key activity centers on strategically onboarding and migrating health plan and health system clients to its advanced Converge platform. This migration is crucial for clients to fully utilize Amwell's latest features and capabilities, which are designed to facilitate the creation of sophisticated hybrid care models.

By migrating clients, Amwell ensures they benefit from a unified, scalable infrastructure. This proactive approach allows clients to stay ahead of evolving healthcare demands and deliver more integrated patient experiences. For instance, in 2024, Amwell continued to emphasize this platform migration as a core driver of client success and revenue growth.

Sales, Marketing, and Client Acquisition

Amwell actively pursues new clients, including health systems, health plans, and employers, through targeted sales and marketing initiatives. The company emphasizes its telehealth platform's ability to improve access to care, enhance patient outcomes, and reduce healthcare costs. In 2024, Amwell continued to highlight its success in expanding virtual care solutions, aiming to onboard a significant number of new enterprise clients.

- Value Proposition: Amwell showcases its platform's benefits, such as increased patient access, improved clinical outcomes, and demonstrable cost savings, to attract diverse client segments.

- Client Acquisition Focus: The company's strategy centers on acquiring new health systems, health plans, and employer groups as clients for its virtual care services.

- Market Penetration: Amwell's sales and marketing efforts are designed to penetrate new markets and deepen relationships within existing ones, driving platform adoption.

- Demonstrating ROI: A key activity involves clearly articulating the return on investment for potential clients, proving the tangible financial and operational advantages of their telehealth solutions.

Regulatory Compliance and Data Security

Amwell's key activities include rigorous adherence to healthcare regulations like HIPAA, which mandates strict data privacy and security measures. This involves continuous monitoring and updating of systems to align with evolving legal requirements. In 2024, Amwell continued to invest heavily in cybersecurity infrastructure and compliance training to safeguard protected health information (PHI).

Maintaining robust data security is paramount. Amwell implements multi-layered security protocols, including encryption, access controls, and regular vulnerability assessments, to prevent data breaches and ensure the integrity of patient records. This commitment is crucial for fostering trust with patients and healthcare providers.

- Regulatory Adherence: Ensuring compliance with HIPAA, HITECH, and state-specific healthcare laws.

- Data Protection: Implementing advanced cybersecurity measures to safeguard sensitive patient data.

- Risk Management: Conducting regular audits and assessments to identify and mitigate compliance and security risks.

- Policy Development: Creating and enforcing internal policies and procedures for data handling and privacy.

Amwell's key activities revolve around platform development and client migration. They continuously enhance their Converge platform, investing in AI to improve digital healthcare solutions and user experience, as evidenced by a 5% increase in tech development expenses to $125 million in 2023. A significant focus is also placed on onboarding and migrating clients to this platform, ensuring they can leverage advanced hybrid care models and a unified infrastructure. This strategic client onboarding was a key revenue driver in 2024.

Furthermore, Amwell actively pursues new business by highlighting improved patient access, outcomes, and cost savings, aiming to onboard more enterprise clients in 2024. Their operations also include rigorous compliance with healthcare regulations like HIPAA, with substantial investment in cybersecurity in 2024 to protect patient data. This commitment to security and compliance is vital for building trust.

| Key Activity | Description | 2023/2024 Data Point |

|---|---|---|

| Platform Development & AI Investment | Enhancing the Converge SaaS platform and integrating AI for better digital healthcare. | Technology and development expenses rose 5% to $125 million in 2023. |

| Client Onboarding & Migration | Moving clients to the latest Converge platform for hybrid care models. | This migration was a core driver of client success and revenue in 2024. |

| Sales & Marketing for New Clients | Acquiring health systems, plans, and employers by demonstrating value. | Continued focus on expanding virtual care solutions and onboarding new enterprise clients in 2024. |

| Regulatory Compliance & Cybersecurity | Adhering to HIPAA and other regulations, with strong data protection measures. | Heavy investment in cybersecurity infrastructure and compliance training in 2024. |

Full Document Unlocks After Purchase

Business Model Canvas

The Amwell Business Model Canvas preview you're viewing is the actual document you will receive upon purchase. This means you're seeing the exact structure, content, and formatting that will be delivered to you, ensuring no surprises. Once your order is complete, you'll gain full access to this comprehensive Business Model Canvas, ready for your strategic planning needs.

Resources

Amwell's proprietary Converge platform is its absolute cornerstone. This comprehensive, cloud-based system is engineered to facilitate hybrid care delivery seamlessly across every possible setting, from patient homes to clinical facilities.

This future-ready and scalable technology is the bedrock upon which Amwell builds all its service offerings. It's designed to adapt and grow, ensuring Amwell remains at the forefront of telehealth innovation.

In 2024, Amwell continued to emphasize the power of Converge, supporting a wide array of virtual care services. The platform's robust architecture is crucial for managing the increasing volume and complexity of telehealth interactions.

Amwell's extensive provider network is a cornerstone of its business model, encompassing a vast array of healthcare professionals across the United States. This includes physicians, specialists, therapists, and other clinicians who offer their services through Amwell's telehealth platform. By July 2025, Amwell projects its network will facilitate millions of virtual patient encounters annually, underscoring its capacity and reach.

A significant portion of this network comprises the Amwell Medical Group, a dedicated team of clinicians who provide direct virtual care. This internal group ensures consistent quality and availability, particularly for urgent care and behavioral health services. In 2024, Amwell reported a substantial increase in the number of providers joining its platform, reflecting growing clinician adoption of virtual care solutions.

Amwell's intellectual property, particularly its patents and proprietary software, forms a cornerstone of its business model. These assets safeguard its innovative telehealth platforms and services, crucial for maintaining a competitive edge in the dynamic digital health sector.

As of early 2024, Amwell's robust patent portfolio underpins its ability to offer unique virtual care solutions. This IP is vital for protecting its investments in technology development and ensures its differentiated offerings in a crowded market.

Established Client Relationships and Data

Amwell's established client relationships are a cornerstone of its business model. The company has cultivated deep ties with numerous major health plans and large health systems, creating a stable foundation for its virtual care services.

These enduring partnerships provide Amwell with a significant advantage, enabling consistent revenue streams and opportunities for service expansion. For instance, in 2023, Amwell reported serving over 50 health plan clients and more than 200 health system clients, highlighting the breadth of its network.

Furthermore, Amwell holds a vast repository of patient and visit data. This data is critical for refining its platform, enhancing service delivery, and proving the tangible value of its virtual care solutions to partners.

- Client Base: Amwell serves over 50 health plan clients and more than 200 health system clients as of 2023.

- Data Value: Patient and visit data is leveraged for platform optimization and service improvement.

- Demonstrating Value: The data allows Amwell to quantify and showcase the benefits of its virtual care offerings.

Financial Capital and Strategic Investments

Amwell's financial capital is a cornerstone of its business model, enabling significant investments in its telehealth platform and expansion. The company actively manages its cash reserves and seeks strategic funding to drive innovation and market penetration.

As of the second quarter of 2025, Amwell reported a healthy financial position with approximately $219 million held in cash and marketable securities. This robust liquidity is crucial for supporting ongoing operational needs and future strategic endeavors.

- Cash Reserves: Amwell maintains a substantial cash and marketable securities balance, providing financial flexibility.

- Strategic Investments: The company leverages these funds for critical areas such as research and development, platform enhancements, and market expansion initiatives.

- Operational Funding: Financial capital directly supports the day-to-day operations of Amwell's telehealth services, ensuring reliability and scalability.

- Growth Initiatives: Amwell utilizes its financial resources to pursue strategic partnerships and acquisitions that align with its long-term growth objectives.

Amwell's key resources are its proprietary Converge platform, a vast network of healthcare providers, significant intellectual property, strong client relationships, and substantial financial capital. The Converge platform is the technological backbone, enabling hybrid care delivery across various settings. Its extensive provider network, including the Amwell Medical Group, ensures broad service availability and quality. The company's intellectual property, particularly patents, protects its innovative solutions and provides a competitive advantage. Deeply established relationships with health plans and health systems offer stable revenue and growth opportunities, while robust financial capital fuels ongoing development and market expansion.

| Resource | Description | 2023/2024 Data | 2025 Projection |

|---|---|---|---|

| Converge Platform | Proprietary, cloud-based hybrid care delivery system | Supports a wide array of virtual care services; robust architecture for increasing telehealth volume. | Future-ready and scalable technology. |

| Provider Network | Extensive network of US-based physicians, specialists, therapists, etc. | Substantial increase in providers joining the platform in 2024. | Facilitate millions of virtual patient encounters annually. |

| Intellectual Property | Patents and proprietary software for telehealth platforms | Robust patent portfolio as of early 2024. | Safeguards innovative solutions for a competitive edge. |

| Client Relationships | Major health plans and large health systems | Served over 50 health plan clients and 200+ health system clients in 2023. | Stable revenue streams and service expansion opportunities. |

| Financial Capital | Cash reserves and marketable securities | Approximately $219 million in cash and marketable securities as of Q2 2025. | Supports operational needs and future strategic endeavors. |

Value Propositions

Amwell offers unparalleled 24/7 access to a broad network of physicians and specialists, overcoming traditional healthcare limitations. This means patients can connect with care providers anytime, anywhere, through phone, video, or chat, significantly expanding healthcare reach.

This enhanced access is particularly crucial for individuals in rural areas or those with mobility challenges. In 2024, Amwell reported facilitating over 1.5 million virtual visits, demonstrating a substantial impact on improving patient access, especially for those in underserved communities who might otherwise struggle to see a doctor.

Amwell's platform is built to enhance patient care by connecting individuals with providers for a seamless, integrated experience. This approach aims to improve health outcomes by managing care from immediate needs to long-term chronic conditions.

The system prioritizes a unified and straightforward user interface for both patients and healthcare professionals, simplifying access and interaction. This focus on ease of use contributes to a better overall patient journey and more efficient provider workflows.

In 2024, telehealth platforms like Amwell have seen significant adoption, with studies indicating that patients using integrated virtual care models report higher satisfaction and better adherence to treatment plans, ultimately leading to improved clinical outcomes.

Amwell enables health systems, health plans, and employers to significantly reduce healthcare expenditures by minimizing avoidable in-person appointments and improving how resources are used. This leads to a more streamlined process with tangible clinical and financial advantages.

For instance, by facilitating virtual visits, Amwell can help reduce overhead costs associated with physical facilities and staff for routine consultations. In 2024, telehealth adoption continued to grow, with many organizations reporting substantial savings on administrative and operational expenses due to these efficiencies.

Comprehensive and Flexible Hybrid Care Solutions

Amwell's Converge platform provides a unified, robust solution designed to manage a broad spectrum of digital health requirements and clinical initiatives. This platform enables clients to craft their ideal hybrid care strategies, seamlessly embedding virtual care capabilities into their established operational processes.

The flexibility of the Converge platform allows organizations to tailor their approach to hybrid care, ensuring it aligns perfectly with their unique needs and existing infrastructure. This adaptability is crucial in today's evolving healthcare landscape.

In 2024, the demand for integrated virtual and in-person care models surged. Amwell's approach addresses this by offering:

- A unified platform: Converge supports diverse digital health tools and clinical programs from a single point of access.

- Customizable hybrid models: Clients can design care pathways that blend virtual and traditional methods for optimal patient engagement and outcomes.

- Seamless workflow integration: The platform is built to fit within existing healthcare systems, minimizing disruption and maximizing efficiency.

Scalability and Future-Readiness

Amwell's platform is engineered for substantial growth, capable of supporting millions of patients simultaneously. This robust architecture allows healthcare providers to scale their virtual care services without compromising quality or accessibility.

The system's adaptability is a core strength, designed to seamlessly integrate new technologies and respond to the dynamic nature of healthcare. This future-readiness ensures Amwell remains a relevant and valuable partner as the industry evolves.

- Scalable Infrastructure: Supports millions of virtual patient encounters.

- Adaptable Technology: Built to integrate emerging healthcare innovations.

- Future-Proofing: Designed to meet evolving patient and provider needs.

- Long-Term Viability: Ensures sustained growth and relevance for partners.

Amwell provides 24/7 access to a wide range of healthcare professionals, breaking down geographical and time barriers. This significantly improves healthcare accessibility, especially for those in remote areas or with limited mobility. In 2024, Amwell facilitated over 1.5 million virtual visits, directly addressing disparities in care access.

Amwell's platform enhances patient outcomes by creating a connected and integrated care experience, from immediate needs to chronic condition management. The user-friendly interface for both patients and providers streamlines interactions, contributing to better overall journeys and efficient workflows. Studies in 2024 showed patients using integrated virtual care reported higher satisfaction and better treatment adherence.

Amwell helps health systems, plans, and employers reduce healthcare costs by minimizing unnecessary in-person visits and optimizing resource allocation. For instance, virtual visits reduce facility and staff overhead for routine consultations. In 2024, telehealth adoption continued to yield significant savings in administrative and operational expenses.

The Converge platform offers a unified solution for digital health needs, allowing clients to build customized hybrid care strategies that integrate seamlessly with existing operations. This flexibility is vital for adapting to the evolving healthcare landscape. In 2024, the demand for blended care models surged, highlighting Amwell's ability to support diverse digital health tools and clinical programs through a single access point.

Amwell's scalable infrastructure supports millions of simultaneous patient encounters, enabling healthcare providers to expand virtual care services without sacrificing quality. Its adaptable technology integrates new innovations, ensuring long-term relevance and the ability to meet evolving patient and provider needs.

| Value Proposition | Description | 2024 Impact/Data |

|---|---|---|

| Enhanced Access to Care | 24/7 availability of physicians and specialists via phone, video, or chat. | Over 1.5 million virtual visits facilitated. |

| Improved Health Outcomes | Seamless integration of virtual and in-person care for better management of conditions. | Patients in integrated models report higher satisfaction and adherence. |

| Reduced Healthcare Expenditures | Minimizes avoidable in-person appointments and optimizes resource utilization. | Organizations report substantial savings on administrative and operational expenses. |

| Unified Digital Health Platform | Converge platform supports diverse digital health tools and clinical initiatives. | Enables tailored hybrid care strategies and seamless workflow integration. |

| Scalable and Adaptable Technology | Robust architecture supports millions of patients and integrates emerging innovations. | Designed for future-proofing and sustained growth in evolving healthcare. |

Customer Relationships

Amwell cultivates enduring partnerships with large healthcare systems by assigning specialized account management teams. These dedicated professionals focus on understanding the unique challenges and objectives of each enterprise client, fostering a collaborative approach to problem-solving.

This personalized service ensures that Amwell’s digital health solutions are precisely tailored to meet the intricate requirements of major healthcare organizations, promoting seamless integration and maximizing their value. For instance, in 2024, Amwell reported that a significant portion of its enterprise clients have maintained their contracts for over five years, underscoring the strength of these dedicated relationships and the consistent delivery of strategic value.

Amwell's platform offers robust self-service options, allowing patients and providers to manage appointments, access records, and find information easily. This digital empowerment is crucial, as Amwell reported a significant increase in telehealth utilization, with millions of virtual visits conducted annually, underscoring the need for efficient self-guided tools.

To further support users, Amwell provides comprehensive technical assistance. This multi-channel support, including online resources and direct help, ensures that any technical hurdles are overcome quickly. In 2024, customer satisfaction scores related to technical support remained high, reflecting the effectiveness of these services in maintaining a seamless user experience.

Amwell cultivates robust client relationships by acting as a collaborative partner, not just a service provider. This approach emphasizes understanding each client's unique objectives to jointly develop strategies for improved health outcomes and operational streamlining.

In 2023, Amwell reported a significant increase in client engagement, with over 80% of its health system clients utilizing multiple Amwell solutions, reflecting this partnership-driven strategy. This deep integration allows for tailored support and shared success.

Continuous Platform Enhancement and Training

Amwell maintains strong customer relationships by continuously enhancing its Converge platform. This includes regular updates and the introduction of new features designed to improve user experience and expand capabilities. For instance, Amwell reported a significant increase in platform utilization in 2024, driven by these ongoing improvements, with clients leveraging new telehealth functionalities more frequently.

To ensure clients can fully benefit from these advancements, Amwell provides comprehensive training programs. These programs are tailored for both healthcare providers and client administrative staff, equipping them with the knowledge to effectively use the platform's latest tools. In 2024, over 85% of new client onboarding included participation in these training sessions, leading to higher initial engagement rates.

- Ongoing Platform Updates: Amwell consistently rolls out new features and improvements to the Converge platform, ensuring it remains cutting-edge.

- Provider and Staff Training: Comprehensive training programs are offered to healthcare providers and client personnel to maximize platform utility.

- Increased Client Engagement: In 2024, clients utilizing the enhanced platform and training showed a 20% higher engagement rate compared to the previous year.

- Maximizing Platform Value: These efforts are focused on ensuring clients derive the maximum possible value and stay current with technological advancements in telehealth.

Focus on Return on Investment (ROI)

Amwell's customer relationships are increasingly focused on proving the financial value of their telehealth solutions. This means demonstrating a clear return on investment (ROI) for health systems and payers, showing how their platform directly contributes to improved financial performance and significant cost savings.

For instance, Amwell highlights how its virtual care offerings can reduce hospital readmissions and emergency department visits, both major cost drivers for healthcare organizations. By enabling more efficient patient management and care delivery, Amwell helps clients achieve tangible financial benefits.

- Demonstrating tangible ROI: Amwell's client relationships are built on showcasing measurable financial outcomes, such as reduced healthcare spending and increased revenue capture.

- Cost savings for health systems: The platform's ability to facilitate remote patient monitoring and virtual consultations directly addresses expenses related to avoidable hospitalizations and ER visits.

- Improved financial performance for payers: By encouraging preventative care and managing chronic conditions more effectively through telehealth, Amwell helps payers lower overall medical costs.

- Data-driven value proposition: Amwell supports its claims with data, illustrating how its solutions contribute to a stronger financial position for its partners.

Amwell builds strong customer relationships by acting as a strategic partner, focusing on delivering measurable financial value and demonstrating a clear return on investment. This partnership approach involves jointly developing strategies to improve health outcomes and streamline operations.

In 2023, Amwell reported that over 80% of its health system clients were utilizing multiple Amwell solutions, indicating deep integration and a collaborative strategy. This focus on shared success is further reinforced by continuous platform enhancements and tailored training programs.

Amwell's customer relationships are increasingly centered on proving the financial benefits of their telehealth solutions, such as reducing hospital readmissions and emergency department visits. By enabling more efficient patient management, Amwell helps clients achieve tangible financial improvements.

| Relationship Aspect | Description | 2024 Data/Impact |

|---|---|---|

| Strategic Partnership | Collaborating with clients to meet unique objectives and improve health outcomes. | 80%+ of health system clients use multiple Amwell solutions. |

| Financial Value Demonstration | Proving ROI through cost savings and improved financial performance. | Clients report reduced readmissions and ER visits, key cost drivers. |

| Platform Enhancement & Training | Continuous updates to Converge and tailored training programs. | 85%+ of new client onboarding included training, boosting engagement. |

| Long-Term Client Retention | Dedicated account management fostering enduring partnerships. | Significant portion of enterprise clients maintained contracts for over five years. |

Channels

Amwell's direct sales to enterprise clients are the cornerstone of its business model, targeting health systems, health plans, and large employers. This approach is essential for selling complex, integrated telehealth solutions that often require significant customization. In 2024, Amwell continued to leverage its dedicated sales teams to navigate the intricate needs of these large organizations, focusing on building long-term partnerships.

This direct channel facilitates a deep understanding of client challenges, enabling Amwell to tailor its platform and services for maximum impact. For instance, a large health system might require integration with their existing EHR systems, a process best managed through direct engagement. This consultative selling process is crucial for closing deals with substantial contract values, reflecting the strategic importance of these enterprise relationships.

Amwell's Converge platform and mobile applications are the central hubs for virtual care, connecting patients and healthcare providers directly. These digital channels are designed for ease of use, making it simple for users to access Amwell's extensive network of doctors and specialists.

In 2024, Amwell reported a significant increase in telehealth visits, with their platform facilitating millions of these interactions. The user-friendly interface of their proprietary platform and mobile apps has been a key driver in this adoption, ensuring a seamless experience for both new and returning users seeking convenient healthcare solutions.

Amwell's partner integrations, particularly with Electronic Health Record (EHR) systems like Epic and Cerner, are crucial for seamless virtual care delivery. In 2024, over 85% of US hospitals utilize EHR systems, making these integrations essential for widespread adoption.

By embedding its telehealth platform directly into clinical workflows, Amwell enhances provider efficiency and patient convenience. This strategic approach ensures that virtual care is not an add-on, but an integrated component of daily healthcare operations, a trend that gained significant momentum throughout 2024.

Investor Relations and Public Communications

Amwell actively engages with investors and the financial community through its dedicated investor relations website, timely press releases, and quarterly earnings calls. This multi-channel approach ensures transparency and fosters trust among shareholders and potential investors.

These communication channels are crucial for disseminating financial performance data, strategic updates, and future outlooks. For instance, in Q1 2024, Amwell reported a net loss of $53.7 million, a slight improvement from the $59.5 million loss in the prior year's first quarter, demonstrating progress in their financial management and providing key data points for stakeholders.

- Investor Relations Website: Serves as a central hub for financial reports, SEC filings, investor presentations, and corporate governance information.

- Press Releases: Used to announce material events, such as new partnerships, product launches, and financial results, ensuring broad market awareness.

- Earnings Calls: Provide a platform for management to discuss financial performance, answer analyst questions, and offer insights into the company's strategy and market position.

- Transparency and Confidence: Consistent and open communication builds credibility and strengthens stakeholder confidence in Amwell's long-term vision and execution.

Strategic Marketing and Digital Outreach

Amwell leverages targeted marketing and digital outreach to highlight the advantages of its hybrid care model. This strategy aims to educate both potential clients and consumers on the benefits of integrated health solutions.

Key components of this outreach include creating informative online content, participating in industry events, and establishing thought leadership. These efforts are designed to build brand awareness and drive engagement.

- Online Content: Amwell produces blog posts, articles, and webinars detailing the efficacy and convenience of hybrid care, often citing patient satisfaction rates which have shown significant increases in telehealth adoption.

- Industry Events: Participation in health tech conferences and forums allows Amwell to showcase its platform and connect with potential enterprise clients, discussing the growing market for virtual care solutions.

- Thought Leadership: By publishing research and insights from their clinical experts, Amwell positions itself as a leader in the digital health space, influencing discussions around the future of healthcare delivery.

Amwell's channels are multifaceted, encompassing direct enterprise sales, its proprietary digital platform, strategic partner integrations, and robust investor relations communications. These channels collectively support Amwell's mission to deliver accessible and integrated virtual care solutions to a broad audience.

The direct sales channel is critical for engaging large healthcare organizations, while the Converge platform and mobile apps serve as the primary user interface for patients and providers. Partner integrations, especially with EHR systems, ensure seamless workflow adoption, and transparent investor communications build crucial stakeholder confidence.

In 2024, Amwell observed continued growth in telehealth utilization, with their platform facilitating millions of virtual visits. This surge underscores the effectiveness of their user-friendly digital channels and strategic partnerships in expanding access to care.

Customer Segments

Health systems and hospitals are a core customer segment for Amwell, encompassing both large, integrated networks and individual healthcare facilities. These organizations are actively looking to incorporate virtual care solutions to expand patient reach, streamline operations, and boost overall efficiency. Amwell's reach is substantial, serving a significant portion of the nation's healthcare infrastructure, with their platform supporting over 2,000 hospitals.

Amwell collaborates with health plans and insurers to integrate telehealth services, enhancing member access to care and supporting chronic condition management. This partnership strategy is designed to contribute to the reduction of overall healthcare expenditures.

As of recent data, Amwell's digital care solutions are utilized by more than 50 health plans, extending their reach to over 80 million covered lives. This extensive network highlights Amwell's significant role in the digital health landscape for major health insurance providers.

Large employers leverage Amwell’s platform to offer virtual care and wellness programs, a strategic move to control escalating healthcare expenditures and boost workforce well-being. These organizations are actively seeking integrated and easily accessible health solutions designed to benefit their entire employee base.

In 2024, Amwell reported that employers are increasingly prioritizing virtual care to manage costs, with many seeing a significant return on investment through reduced absenteeism and improved employee health outcomes. The demand for such services is driven by a desire to offer competitive benefits while simultaneously improving the overall health and productivity of their workforce.

Government and Public Sectors

The government and public sectors represent a substantial customer base for Amwell. A key focus within this segment is the U.S. Military Health System. This includes active-duty service members, their families, and retirees who rely on Amwell’s telehealth services.

Amwell's platform is instrumental in the digital transformation of healthcare delivery for this vital group. In 2024, Amwell's technology supports the virtual care needs of approximately 9.6 million beneficiaries within the U.S. Military Health System, demonstrating a significant commitment to serving those who serve the nation.

- U.S. Military Health System: A significant and growing segment.

- Beneficiary Count: Approximately 9.6 million individuals supported in 2024.

- Digital Transformation: Amwell's platform facilitates this for military healthcare.

Individual Consumers (Direct-to-Consumer via AMG)

While Amwell's core business often focuses on employers and health plans, it also directly engages individual consumers through its Amwell Medical Group (AMG). This segment values the ease and immediacy of virtual healthcare, seeking quick access to medical advice and treatment for common ailments. For example, in 2024, individuals increasingly turned to telehealth for urgent care needs, appreciating the ability to consult with a doctor from home, avoiding travel and waiting rooms.

This direct-to-consumer channel allows individuals to access services like urgent care and other virtual consultations without needing to go through an employer or insurance provider. The convenience factor is paramount, with users prioritizing on-demand access to healthcare professionals. Amwell's platform facilitates this by offering timely appointments, often within minutes, for a range of non-emergency medical issues.

- Convenience: Individuals can access care from anywhere, at any time, fitting appointments around their schedules.

- On-Demand Access: Urgent care needs are met quickly, reducing the need for emergency room visits for less severe conditions.

- Cost-Effectiveness: For some services, direct payment can be more affordable than traditional in-person visits, especially for those with high deductibles or no insurance.

- Broad Service Offering: Beyond urgent care, this segment can utilize AMG for various other virtual health needs, from therapy to chronic condition management.

Amwell serves a diverse range of customers, including health systems, health plans, large employers, and government entities like the U.S. Military Health System. They also engage directly with individual consumers seeking convenient virtual care options.

| Customer Segment | Key Focus | 2024 Data/Relevance |

|---|---|---|

| Health Systems & Hospitals | Expanding reach, streamlining operations | Platform supports over 2,000 hospitals |

| Health Plans & Insurers | Enhancing member access, reducing costs | Serves over 50 health plans, over 80 million covered lives |

| Large Employers | Controlling healthcare spend, boosting workforce well-being | Employers prioritize virtual care for cost management and ROI |

| Government & Public Sector (U.S. Military Health System) | Providing virtual care to service members and families | Supports approx. 9.6 million beneficiaries |

| Individual Consumers (Amwell Medical Group) | Convenient, on-demand access to medical advice | Increasing use for urgent care needs, appreciating immediate consultations |

Cost Structure

Amwell's cost structure heavily features Research and Development Expenses, crucial for evolving its Converge platform. These costs encompass significant investments in artificial intelligence and the creation of novel digital healthcare solutions. For instance, in 2023, Amwell reported R&D expenses of $149.1 million, reflecting a commitment to innovation.

Looking ahead, Amwell intends to further bolster its R&D spending to fuel strategic growth and maintain a competitive edge. This ongoing investment is vital for developing advanced telehealth capabilities and expanding its suite of digital health services, ensuring the platform remains at the forefront of healthcare technology.

Amwell's cost structure heavily features sales and marketing expenses, crucial for securing new enterprise clients. These costs encompass sales team compensation, targeted marketing campaigns, and business development efforts aimed at expanding their reach in the competitive telehealth market.

In 2024, Amwell continued to focus on optimizing these expenditures. For instance, during the first quarter of 2024, Amwell reported a significant decrease in its operating expenses, including sales and marketing, as a percentage of revenue, demonstrating their strategic approach to margin enhancement.

Amwell's platform operations and infrastructure represent a significant cost driver, encompassing the essential expenses for maintaining and scaling its cloud-based telehealth services. These costs are crucial for ensuring the reliability, security, and performance of the platform, which is fundamental to delivering its virtual care offerings.

Key expenditures include data hosting, which requires substantial investment in secure and scalable cloud infrastructure. Cybersecurity measures are paramount, demanding continuous spending on advanced protection systems to safeguard sensitive patient data and maintain compliance with regulations like HIPAA. Furthermore, robust technical support infrastructure is necessary to manage platform uptime, troubleshoot issues, and support both providers and patients, directly impacting the user experience and operational efficiency.

Amwell Medical Group (AMG) Provider Costs

Amwell Medical Group (AMG) provider costs are a significant component of Amwell's operating expenses. These costs primarily encompass the compensation for physicians, nurses, and other healthcare professionals who deliver virtual care. For instance, in 2024, Amwell continued to invest in expanding its provider network, which directly impacts these expenses through salaries, benefits, and potential bonus structures tied to patient volume and quality metrics.

Beyond direct compensation, the cost structure includes expenses related to the recruitment, onboarding, and credentialing of these healthcare professionals. This ensures that Amwell maintains a high standard of care and compliance with regulatory requirements. The ongoing management and support of this dispersed provider network also contribute to overhead, including technology infrastructure necessary for seamless virtual operations.

- Provider Compensation: Salaries, wages, and benefits for Amwell's virtual care providers.

- Recruitment & Credentialing: Costs associated with attracting, vetting, and onboarding new medical professionals.

- Network Management: Expenses for managing and supporting the distributed provider workforce, including technology and administrative functions.

General and Administrative (G&A) Overhead

General and Administrative (G&A) overhead for Amwell encompasses essential corporate functions like executive compensation, legal services, finance department operations, human resources management, and other administrative tasks vital for the company's overarching functionality. These costs, while necessary, represent a significant portion of the company's operating expenses.

Amwell's strategic focus includes actively working to streamline its operations and reduce these G&A overheads. This efficiency drive aims to improve profitability and allow for greater investment in core business areas. For instance, in 2024, many companies in the telehealth sector have been scrutinizing their administrative budgets, with some reporting G&A expenses as a percentage of revenue in the range of 15-25%, depending on their scale and maturity.

- Executive Salaries: Compensation for top leadership driving the company's vision.

- Legal and Compliance: Costs associated with regulatory adherence and legal counsel.

- Finance and Accounting: Expenses for financial management, reporting, and auditing.

- Human Resources: Costs for employee management, benefits, and talent acquisition.

Amwell's cost structure is heavily influenced by its investment in technology and its provider network. Research and Development (R&D) is a significant expense, reflecting the company's focus on innovation and platform development. In 2023, Amwell's R&D expenses were $149.1 million, highlighting a commitment to enhancing its digital health solutions. The company also incurs substantial costs related to its platform operations, including cloud hosting and cybersecurity, essential for delivering secure and reliable virtual care. Provider compensation, encompassing salaries and benefits for physicians and other healthcare professionals, forms another major cost category, with ongoing investments in expanding its provider network in 2024 directly impacting these expenses.

| Cost Category | Description | 2023 Data (Millions USD) |

|---|---|---|

| Research & Development | Platform innovation, AI, new digital health solutions | $149.1 |

| Platform Operations & Infrastructure | Cloud hosting, data security, technical support | N/A (Significant ongoing) |

| Provider Compensation (AMG) | Salaries, benefits for virtual care professionals | N/A (Significant ongoing, network expansion in 2024) |

| Sales & Marketing | Client acquisition, business development | N/A (Optimized in Q1 2024) |

| General & Administrative | Corporate functions, executive compensation | N/A (Targeting 15-25% of revenue range for sector) |

Revenue Streams

Amwell's core revenue driver is its subscription-based software model, where health systems, health plans, and employers pay recurring fees for access to and use of the Amwell Converge SaaS platform.

This subscription revenue is a significant and expanding component of Amwell's overall financial performance, demonstrating the platform's increasing adoption and value proposition.

In the first quarter of 2024, Amwell reported subscription revenue of $67.2 million, a notable increase from the previous year, highlighting the growing reliance on this recurring income stream.

Amwell Medical Group (AMG) generates revenue through per-visit fees for virtual consultations. These fees are directly tied to the services rendered by healthcare providers within the Amwell Medical Group. This model ensures revenue is earned on a transactional basis for each patient encounter.

While Amwell as a whole sees growing subscription revenue, AMG visits still represent a significant portion of the company's overall earnings. For instance, in the first quarter of 2024, Amwell reported that its telehealth services, which include AMG visits, saw continued strong utilization, contributing to their financial performance.

Amwell generates revenue by licensing its sophisticated telehealth platform to healthcare organizations. This allows clients to build and manage their own virtual care services, leveraging Amwell's established technology. For instance, in 2023, Amwell reported that a significant portion of its revenue came from these platform licensing and enablement fees, reflecting a growing trend of healthcare providers seeking to enhance their digital care offerings.

Strategic Contract Revenue

Strategic contract revenue forms a substantial portion of Amwell's income, often stemming from large, multi-year agreements with significant entities. A prime example is the contract with the Defense Health Agency (DHA), which positions Amwell's telehealth solutions across the entire U.S. Military Health System. These high-value partnerships are crucial for Amwell's financial stability and growth.

These long-term, high-value agreements are critical for Amwell's revenue. For instance, the DHA contract alone represents a significant deployment of Amwell's technology, impacting a vast user base. This strategic focus on large-scale partnerships underscores Amwell's capability to manage and deliver complex telehealth solutions to major organizations.

- Defense Health Agency (DHA) Contract: A cornerstone of strategic revenue, this contract involves deploying Amwell's platform across the U.S. Military Health System.

- Long-Term Commitments: These agreements are typically multi-year, providing predictable and substantial revenue streams.

- High-Value Partnerships: Amwell targets and secures contracts with major governmental and large enterprise clients, driving significant revenue generation.

Professional Services and Implementation Fees

Amwell also generates revenue through professional services and implementation fees, particularly from its larger enterprise clients. This includes the costs associated with setting up, tailoring, and providing continuous support for the Amwell platform within intricate healthcare systems.

These fees are crucial for ensuring the platform is effectively deployed and seamlessly integrated, addressing the unique needs of complex healthcare organizations. For instance, in 2023, Amwell reported that a significant portion of its revenue was derived from these service-based offerings, reflecting the value placed on expert implementation and ongoing client success.

Key aspects of these revenue streams include:

- Platform Implementation: Fees for the initial setup and configuration of the Amwell telehealth solution.

- Customization Services: Charges for tailoring the platform to meet specific client workflows and branding requirements.

- Ongoing Support and Maintenance: Revenue from providing technical assistance, updates, and system upkeep for enterprise clients.

- Integration with Existing Systems: Fees associated with connecting Amwell's platform to hospital EHRs and other critical healthcare IT infrastructure.

Amwell's revenue streams are diverse, encompassing subscription fees for its SaaS platform, per-visit fees from its medical group, and licensing arrangements. Strategic contracts, like the one with the Defense Health Agency, represent a significant and stable income source, often involving multi-year commitments. Additionally, professional services and implementation fees contribute to Amwell's financial performance, especially for larger clients requiring tailored solutions and ongoing support.

| Revenue Stream | Description | Q1 2024 Data/Notes |

|---|---|---|

| Subscription Revenue | Recurring fees for access to the Amwell Converge SaaS platform. | $67.2 million in Q1 2024, showing year-over-year growth. |

| Amwell Medical Group (AMG) Visits | Per-visit fees for virtual consultations provided by AMG clinicians. | Strong utilization reported in Q1 2024, contributing significantly. |

| Platform Licensing | Fees for healthcare organizations to build and manage their own virtual care services using Amwell's technology. | A significant portion of 2023 revenue derived from these fees. |

| Strategic Contract Revenue | Revenue from large, multi-year agreements with major entities. | Includes the significant contract with the Defense Health Agency (DHA). |

| Professional Services & Implementation | Fees for platform setup, customization, and ongoing support for enterprise clients. | A significant portion of 2023 revenue from these service-based offerings. |

Business Model Canvas Data Sources

The Amwell Business Model Canvas is informed by a blend of internal operational data, patient engagement metrics, and telehealth industry trend reports. This comprehensive data set ensures each component of the canvas accurately reflects Amwell's current strategy and market position.