amwell Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

amwell Bundle

See how Amwell's telehealth services are positioned across the BCG Matrix, identifying potential Stars, Cash Cows, Dogs, and Question Marks. This initial glimpse offers a strategic overview, but to truly unlock Amwell's market potential and make informed investment decisions, you need the complete picture. Purchase the full BCG Matrix report for in-depth analysis and actionable insights.

Stars

Amwell's collaboration with Leidos to modernize the U.S. Military Health System (MHS) represents a substantial growth driver, with full system rollout anticipated by early Q3 2025. This strategic initiative leverages Amwell's telehealth capabilities within a large and stable government market.

This contract is projected to contribute significantly to Amwell's revenue, solidifying its position in the government health sector. The successful implementation within the MHS is expected to validate Amwell's technology and operational efficiency, creating valuable case studies that can be leveraged to attract commercial clients.

Amwell's Converge™ platform represents a significant strategic move, acting as a centralized SaaS hub for its diverse healthcare offerings and third-party integrations. This platform is crucial for driving growth as clients transition to its unified digital-first approach.

The adoption rate of Converge™ is a key performance indicator, with over 70% of Amwell's total visits occurring on the platform by the second quarter of 2024. This strong migration signifies increasing client reliance on Converge™ for enhanced efficiency and a streamlined healthcare experience.

Amwell is making a significant pivot to subscription-based software revenue, aiming for this recurring model to comprise nearly 60% of its total revenue by 2025. This strategic shift is bolstered by substantial client wins, such as the DHA program, signaling a future characterized by high growth and improved profit margins.

The expansion of subscription revenue is a key driver expected to boost Amwell's gross margins substantially. For instance, in the first quarter of 2024, Amwell reported that its subscription and platform revenue grew by 12% year-over-year, reaching $91.4 million, demonstrating the tangible impact of this strategy.

Chronic Care Management Solutions

Chronic Care Management Solutions are a significant growth area for Amwell, reflecting the broader trend in the global telehealth market. The increasing prevalence of chronic conditions like diabetes and hypertension drives the demand for continuous monitoring and virtual care. Amwell's strategic partnerships, such as the one with DarioHealth for its cardiometabolic program, highlight its commitment to this high-potential segment.

Amwell's approach in chronic care management focuses on integrated digital clinical programs. These programs utilize connected devices and data analytics to offer personalized patient experiences, aiming to improve outcomes for individuals managing long-term health issues. This focus positions Amwell to capitalize on the growing need for efficient and accessible chronic disease support.

- Growing Demand: The telehealth market for chronic disease management is experiencing robust growth, with projections indicating continued expansion.

- Amwell's Expansion: Amwell is actively investing in and expanding its digital clinical programs, specifically targeting chronic conditions.

- Partnership Impact: Collaborations, like the one with DarioHealth, enhance Amwell's capabilities in delivering specialized chronic care solutions.

- Data-Driven Care: The emphasis on connected devices and data-driven patient experiences is a key differentiator in improving chronic condition management.

Behavioral Health Services

Behavioral health services represent a significant growth area for Amwell, driven by the escalating demand for accessible mental healthcare. Digital mental health visits are a leading trend in telemedicine, with a substantial 41% of mental health visits occurring virtually by the third quarter of 2024. This surge underscores the market's embrace of virtual solutions for mental well-being.

Amwell's comprehensive suite of behavioral health services, encompassing online therapy and psychiatry, directly addresses this critical need. Furthermore, the company's strategic expansion into international markets via its SilverCloud offering positions it to capitalize on global demand for digital mental health support. This segment is characterized by a critical unmet need in healthcare, fostering strong market adoption for Amwell's innovative solutions.

- Digital mental health visits reached 41% of total mental health visits by Q3 2024.

- Amwell provides online therapy and psychiatry services.

- SilverCloud is Amwell's offering for international behavioral health expansion.

- The behavioral health segment addresses a critical unmet need in healthcare.

Amwell's work with the U.S. Military Health System (MHS) positions it as a Star within the BCG matrix. This large-scale government contract, with full rollout expected by early Q3 2025, leverages Amwell's telehealth platform in a stable, high-growth market. The success here not only drives significant revenue but also serves as a powerful validation for its technology.

The Converge™ platform, achieving over 70% of Amwell's total visits by Q2 2024, is another key indicator of its Star status. This unified digital-first approach is gaining strong client adoption, signaling Amwell's leadership in modernizing healthcare delivery.

The company's strategic shift towards subscription-based revenue, aiming for nearly 60% by 2025, further solidifies its Star position. This recurring revenue model, bolstered by significant wins like the MHS program, promises sustained high growth and improved profitability.

Amwell's investments in chronic care management and behavioral health, supported by strategic partnerships and a growing digital adoption rate (41% of mental health visits were virtual by Q3 2024), represent significant growth opportunities. These segments address critical healthcare needs, further cementing Amwell's position as a market leader.

| Segment | Growth Rate | Market Share | Amwell's Position |

|---|---|---|---|

| Military Health System (MHS) Modernization | High | Significant | Star |

| Converge™ Platform Adoption | High | Growing | Star |

| Subscription Revenue Shift | High | Increasing | Star |

| Chronic Care Management | High | Expanding | Star |

| Behavioral Health Services | High | Expanding | Star |

What is included in the product

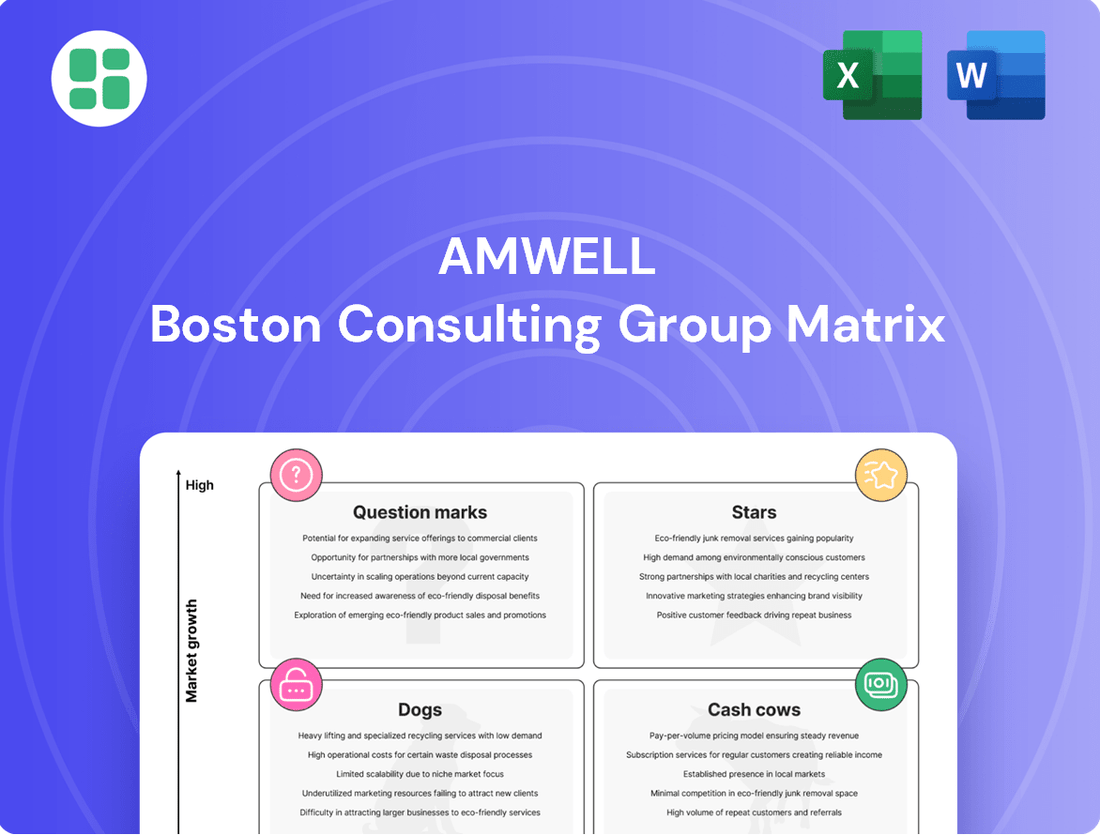

The Amwell BCG Matrix analyzes its product portfolio by market share and growth rate.

It guides strategic decisions on investing in Stars, milking Cash Cows, developing Question Marks, and divesting Dogs.

The Amwell BCG Matrix provides a clear, one-page overview of your portfolio, instantly relieving the pain of unclear strategic direction.

Cash Cows

Amwell's deep roots in the healthcare sector are a significant asset, with nearly twenty years of experience supporting the digital care needs of 50 health plans. This translates to servicing over 80 million covered lives, a testament to their widespread adoption and market penetration. These established partnerships with major health plans and numerous large health systems create a reliable and consistent revenue stream, a hallmark of a cash cow business.

The longevity of these relationships points to a mature market segment where Amwell has secured a strong and stable market share in telehealth. Their business-to-business, enterprise-focused strategy further reinforces these enduring connections, ensuring ongoing demand for their services.

Amwell Medical Group (AMG) operates a broad network of healthcare providers across the United States, a key component of Amwell's BCG Matrix. This network is designed to generate consistent revenue from patient visits, acting as a stable income source.

While the volume of these visits might see some seasonal or occasional dips, the deep-rooted provider network and a loyal patient following ensure a predictable and reliable cash flow for Amwell. This steady income stream is crucial for funding other, more growth-oriented ventures within the company.

For instance, in the first quarter of 2024, Amwell reported a 10% increase in total revenue, with its telehealth services, including those facilitated by AMG, forming a significant portion of this growth. This demonstrates the ongoing importance of AMG's revenue-generating capabilities.

Amwell's core virtual urgent care services represent its cash cows within the BCG matrix. These foundational offerings have been a consistent revenue generator for the company, providing immediate access to medical consultations for a wide range of common ailments.

The urgent care segment of the telehealth market, while still experiencing growth, is considered relatively mature. This maturity allows Amwell to capitalize on its established presence and brand recognition, leading to predictable revenue streams with a lower proportional need for aggressive market expansion investments.

In 2024, Amwell reported that its virtual urgent care services continued to be a significant contributor to its overall revenue, demonstrating the enduring strength of this segment. The company's ability to offer convenient and accessible care for everyday health concerns solidifies its position as a reliable service provider.

Integrated Digital Care Enablement Platform

Amwell's Integrated Digital Care Enablement Platform functions as a robust, established offering, enabling virtual visits and seamless integration with existing healthcare systems. This core functionality provides significant utility to enterprise clients, forming a stable revenue base.

The platform's maturity means it requires less marketing investment, contributing to its status as a cash cow. Amwell reported a 12% increase in total revenue for the first quarter of 2024, reaching $150.1 million, with their telehealth services forming a significant portion of this growth.

- Core Functionality: Facilitates virtual visits and integrates with existing client systems.

- Revenue Stream: Provides a reliable and stable revenue stream from established enterprise clients.

- Investment Needs: Requires less promotional investment due to its mature market position.

- Market Position: Serves as the backbone for various Amwell services, indicating deep client integration.

Proprietary Technologies and Infrastructure

Amwell's proprietary technologies and robust infrastructure, cultivated over nearly two decades, are the bedrock of its service delivery, offering a significant competitive edge. These established technological assets, including their secure platform and extensive EHR integrations, consistently generate value by enhancing efficiency and reliability for their current client base. This translates into stable cash flow, as extensive new development isn't typically required for ongoing operations.

These technological assets function as cash cows because they represent a mature, high-quality offering that generates substantial income with relatively low investment needs for maintenance and incremental improvements. For instance, Amwell's platform supports millions of virtual visits annually, demonstrating its scalability and the ongoing value derived from its initial technological investments.

- Proprietary Technology: Amwell's secure, HIPAA-compliant platform is a key asset.

- Infrastructure: Nearly two decades of development have built a reliable service delivery network.

- EHR Integrations: Seamless integration with Electronic Health Records enhances client efficiency.

- Stable Cash Flow: These assets generate consistent revenue with minimal incremental investment for current services.

Amwell's core virtual urgent care services are its established cash cows. These offerings provide consistent revenue from a mature market segment where Amwell has strong brand recognition and a significant market share. This stability allows for predictable income with lower investment needs for expansion.

The company's Integrated Digital Care Enablement Platform also acts as a cash cow. Its maturity means it requires less promotional investment, contributing to its status as a reliable revenue generator. Amwell's first quarter 2024 revenue of $150.1 million, a 12% increase, highlights the ongoing strength of these core telehealth services.

Amwell's deep client relationships with over 50 health plans, covering more than 80 million lives, solidify its cash cow status. These long-standing partnerships ensure a steady revenue stream from enterprise clients who rely on Amwell's established virtual care solutions. This consistent demand fuels the company's financial stability.

Amwell's proprietary technology and robust infrastructure, developed over nearly two decades, are also key cash cows. These assets, including secure platforms and extensive EHR integrations, generate stable cash flow with minimal ongoing development costs. The platform supports millions of virtual visits annually, showcasing its enduring value.

| Business Segment | BCG Category | Key Characteristics | 2024 Performance Indicator |

|---|---|---|---|

| Virtual Urgent Care | Cash Cow | Mature market, strong brand recognition, predictable revenue | Significant contributor to Q1 2024 revenue growth |

| Integrated Digital Care Enablement Platform | Cash Cow | Established offering, low promotional investment, stable client base | Supported 12% total revenue increase in Q1 2024 |

| Long-Term Health Plan Partnerships | Cash Cow | Deep client integration, consistent revenue stream, high client retention | Servicing over 80 million covered lives |

| Proprietary Technology & Infrastructure | Cash Cow | Mature, reliable, low incremental investment, high utilization | Supports millions of virtual visits annually |

Delivered as Shown

amwell BCG Matrix

The Amwell BCG Matrix preview you're viewing is precisely the document you will receive upon purchase, offering a complete and unwatermarked strategic analysis. This means you're seeing the final, ready-to-use report, complete with all data and formatting, directly from the source. No hidden surprises or demo content—just the actionable insights you need for informed decision-making. This preview guarantees that the purchased Amwell BCG Matrix will be identical to what you see now, ensuring immediate applicability for your business planning.

Dogs

Amwell's divestiture of its psychiatric care business signals a strategic shift, likely stemming from its position as a Question Mark or Dog in the BCG Matrix. This move suggests the business had limited growth potential or struggled to gain significant market share within the competitive telehealth landscape.

The company's decision to sell this segment, aiming to streamline operations and bolster its balance sheet, underscores a focus on core platform strengths. For instance, Amwell reported a net loss of $104.8 million in the first quarter of 2024, highlighting the need for strategic divestitures to improve financial performance.

Amwell's 2024 financial performance saw a dip, largely attributed to reduced usage in some non-core specialty care services. This suggests that certain niche areas within their telehealth offerings might be struggling to capture market share or are experiencing a decline in patient demand for Amwell's specific solutions.

Within Amwell's extensive telehealth portfolio, some specialized care segments may not have achieved the expected market penetration or are facing significant competitive pressures. These underperforming areas, characterized by low growth and low relative market share, could be categorized as 'dogs' in a strategic portfolio analysis.

Legacy Point Solutions, in the context of Amwell's BCG Matrix, likely represent offerings that existed before the company's strategic shift towards the Converge platform. These could be standalone services or older technologies that catered to specific needs but are now being phased out due to lack of integration and limited future growth prospects.

While Amwell is actively migrating clients to its unified Converge platform, any remaining clients on these legacy systems would be considered 'dogs'. This classification stems from their low market share and low growth potential, requiring ongoing maintenance and support without contributing significantly to Amwell's strategic objectives or future revenue streams.

Services with Declining Visit Volume

In Amwell's BCG Matrix, services with declining visit volume are categorized as Dogs. While overall telehealth usage remains robust, Amwell saw a slight dip in total visits during Q1 2024 compared to the prior year. This was attributed, in part, to disruptions from major client migrations to their Converge platform and the significant impact of the Change Healthcare cyberattack.

Any specific service lines or client segments within Amwell that are experiencing a consistent decrease in patient visits, independent of these strategic shifts or external events, would fall into the Dog quadrant. This designation signifies that these services likely face low market growth and potentially declining demand.

For instance, if a particular specialty telehealth service, unrelated to the client migration or cyberattack disruptions, showed a sustained year-over-year decline in utilization by mid-2024, it would be a prime candidate for the Dog category. This suggests the market for that specific offering might be shrinking or facing intense competition that Amwell is not effectively capturing.

- Declining Visit Volume: A key indicator for Dog services, showing a consistent downward trend in patient interactions.

- Market Stagnation/Decline: These services operate in markets where demand is either not growing or is actively shrinking.

- Strategic Impact: While Q1 2024 saw disruptions from client migrations and the Change Healthcare cyberattack affecting overall numbers, true Dogs would show decline independent of these events.

- Low Market Share & Growth: Dogs typically possess both low relative market share and operate in low-growth markets, indicating a challenging position.

Offerings with High Client Concentration Risk

Amwell's reliance on a few major clients presents a significant concentration risk. For instance, Elevance Health alone represented 27% of Amwell's revenue in 2024. This heavy dependence on a limited client base, especially if those clients are not experiencing growth or could potentially shift their business, could categorize certain Amwell offerings as 'dogs' within a BCG Matrix analysis. The potential loss of such a key client could disproportionately affect Amwell's overall financial performance.

Offerings that are heavily tied to a single, non-expanding client face substantial instability. If such a client decides to reduce their engagement or switch providers, an Amwell offering catering exclusively to them would be vulnerable. This scenario highlights the 'dog' quadrant characteristics: low market share growth and potential for revenue decline due to client-specific risks.

- Client Concentration: Elevance Health's 27% revenue contribution in 2024 underscores Amwell's dependence on a few large clients.

- 'Dog' Characteristics: Offerings reliant on a single, stagnant client risk becoming 'dogs' due to instability and lack of diversification.

- Revenue Impact: The potential loss of a major client could severely impact Amwell's revenue streams for specific, concentrated offerings.

Services with declining visit volume are considered Dogs in Amwell's BCG Matrix. While overall telehealth usage is strong, Amwell experienced a slight dip in total visits in Q1 2024. This was partly due to client migrations and the Change Healthcare cyberattack. True Dogs would show decline independent of these events.

Offerings tied to a single, non-growing client are unstable. If such a client reduces engagement or switches providers, an Amwell offering catering exclusively to them becomes vulnerable. This scenario reflects 'dog' characteristics: low market share growth and potential revenue decline due to client-specific risks.

Elevance Health's 27% revenue contribution in 2024 highlights Amwell's dependence on a few large clients. Offerings reliant on a single, stagnant client risk becoming 'dogs' due to instability and lack of diversification, potentially impacting revenue streams significantly if a major client is lost.

| BCG Quadrant | Characteristics | Amwell Example/Consideration |

|---|---|---|

| Dogs | Low market share, low market growth | Legacy systems, specialized services with declining utilization, offerings tied to a single, non-expanding client. |

| Financial Indicator | Net Loss (Q1 2024) | $104.8 million |

| Client Concentration Risk | Reliance on major clients | Elevance Health (27% of 2024 revenue) |

Question Marks

Amwell's new digital health programs, particularly those integrating GLP-1 therapies through partnerships like the one with Vida Health, are positioned as question marks in the BCG matrix. These initiatives are focused on high-growth areas like obesity and diabetes management, tapping into a market that saw significant expansion in 2024 with increased awareness and prescription of GLP-1 medications. For instance, the market for obesity drugs alone was projected to reach tens of billions of dollars by the late 2020s, highlighting the substantial potential.

Currently, these programs are in their nascent stages, requiring substantial investment for development and integration. Their market share is still being established, and user adoption rates are critical determinants of future success. Amwell's strategy here involves building out capabilities in a rapidly evolving digital health landscape, aiming to capture a significant portion of this burgeoning market.

The telehealth market is rapidly incorporating AI and ML for smarter diagnostics and patient care. Amwell, while enhancing its platform, is venturing into new territory with explicit AI-driven diagnostic tools. This positions them in a high-growth segment with significant potential for market share capture.

The global AI in healthcare market was valued at approximately $15.4 billion in 2023 and is projected to grow substantially, with some estimates reaching over $180 billion by 2030. Amwell's move into AI diagnostics aligns with this trend, targeting a segment expected to see significant investment and adoption as these technologies mature and prove their efficacy in clinical settings.

Amwell's expansion into Canada, launched in September 2024, signifies a strategic move into a high-growth international market. This initiative, featuring an integrated virtual care offering with AI diagnostics and enhanced data interoperability, is supported by a government grant, underscoring its potential.

While this represents a promising area for future revenue, Amwell's current market share in Canada is minimal. This nascent stage necessitates substantial investment to build brand recognition and operational infrastructure, positioning it as a potential 'Question Mark' in the BCG Matrix.

Virtual Nursing Solutions

Amwell's virtual nursing solutions fit into the question mark category of the BCG matrix. These offerings aim to combat nurse burnout and improve workflow efficiency by leveraging existing virtual care technologies. This is a relatively new and developing area within the broader virtual care market, directly addressing the significant challenge of healthcare staffing shortages.

While the demand for such solutions is substantial, Amwell's presence and market share in this specific niche are likely still in their nascent stages. This positions virtual nursing solutions as a strategic area that requires further investment and development to capture potential market growth and solidify its position.

- Addressing Nurse Burnout: Reports in 2024 continued to highlight critical levels of nurse burnout, with surveys indicating over 60% of nurses experiencing significant stress and exhaustion.

- Market Potential: The virtual nursing market is projected to see substantial growth, with estimates suggesting it could reach billions of dollars in the coming years as healthcare systems increasingly adopt remote care models.

- Strategic Investment: Amwell's focus on transforming existing technologies for virtual nursing signifies a strategic move to capitalize on this emerging demand, requiring continued R&D and market penetration efforts.

Integration with Wearable Devices and mHealth Apps

The telehealth market is experiencing significant growth, fueled by advancements in mHealth applications and wearable devices that boost patient engagement and improve care delivery. Amwell's platform is positioned to integrate with this data, offering potential for expanded services.

While Amwell currently connects with wearable data, a deeper strategic push into leveraging these devices for continuous remote patient monitoring, particularly for conditions beyond existing chronic care programs, could unlock new, high-growth service categories. This area represents a potential opportunity for Amwell to capture a larger market share.

- Market Growth: The global mHealth market was valued at over $50 billion in 2023 and is projected to grow significantly, with wearables being a key driver.

- Amwell's Position: Amwell's platform facilitates data integration from various sources, including wearables, but its current market share in deeply integrated, continuous monitoring solutions is nascent.

- Strategic Opportunity: Expanding into continuous remote patient monitoring using wearables could create new revenue streams and differentiate Amwell in a competitive landscape.

- Investment Consideration: Investing in deeper integration capabilities and developing specialized continuous monitoring programs could move Amwell's offerings in this space from a question mark to a star in the BCG matrix.

Amwell's new digital health programs, particularly those integrating GLP-1 therapies and AI-driven diagnostics, are positioned as question marks in the BCG matrix. These initiatives are focused on high-growth areas like obesity and diabetes management, tapping into a market that saw significant expansion in 2024. For instance, the market for obesity drugs alone was projected to reach tens of billions of dollars by the late 2020s, highlighting the substantial potential.

Currently, these programs are in their nascent stages, requiring substantial investment for development and integration. Their market share is still being established, and user adoption rates are critical determinants of future success. Amwell's strategy here involves building out capabilities in a rapidly evolving digital health landscape, aiming to capture a significant portion of this burgeoning market.

Amwell's expansion into Canada, launched in September 2024, signifies a strategic move into a high-growth international market. While this represents a promising area for future revenue, Amwell's current market share in Canada is minimal. This nascent stage necessitates substantial investment to build brand recognition and operational infrastructure, positioning it as a potential Question Mark in the BCG Matrix.

Amwell's virtual nursing solutions fit into the question mark category of the BCG matrix. While the demand for such solutions is substantial, Amwell's presence and market share in this specific niche are likely still in their nascent stages. This positions virtual nursing solutions as a strategic area that requires further investment and development to capture potential market growth and solidify its position.

| Initiative | Market Growth | Current Market Share | Investment Needs | BCG Classification |

| GLP-1 Therapy Programs | High (Obesity drug market billions) | Low/Nascent | High (Development, Integration) | Question Mark |

| AI-Driven Diagnostics | Very High (Global AI in healthcare market projected to exceed $180B by 2030) | Low/Nascent | High (R&D, Clinical Validation) | Question Mark |

| Canadian Expansion | High (International market entry) | Minimal | High (Brand Building, Operations) | Question Mark |

| Virtual Nursing Solutions | High (Addressing staffing shortages) | Low/Nascent | High (Technology Refinement, Market Penetration) | Question Mark |

| Wearable Data Integration for Continuous Monitoring | High (mHealth market over $50B in 2023) | Low/Nascent | High (Deeper Integration, Program Development) | Question Mark |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data, including Amwell's financial disclosures, market growth trends, and competitive landscape analysis, to provide strategic insights.