Ameris Bank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ameris Bank Bundle

Gain a critical advantage with our comprehensive PESTLE analysis of Ameris Bank. Uncover how evolving political landscapes, economic shifts, and technological advancements are directly impacting their operations and future growth. Equip yourself with actionable intelligence to anticipate challenges and seize opportunities.

Dive deep into the external forces shaping Ameris Bank's strategic direction. Our expertly crafted PESTLE analysis provides a clear roadmap of the political, economic, social, technological, legal, and environmental factors at play. Empower your decision-making with these essential insights – download the full report now.

Political factors

Government policy significantly shapes Ameris Bank's operating environment. Fiscal and monetary policies directly influence lending rates, capital requirements, and market stability. For example, the Federal Reserve's monetary policy decisions, such as potential interest rate adjustments in 2025, will impact Ameris Bank's net interest margins and loan demand.

Political stability within the Southeastern U.S., Ameris Bank's core operating area, directly influences sustained economic expansion and business sentiment. Instability could lead to slower loan growth and deposit fluctuations, impacting the bank's financial performance.

Global geopolitical shifts and evolving trade agreements introduce a layer of unpredictability. These factors can sway investor confidence and consumer spending habits, ultimately affecting Ameris Bank's loan demand and the overall growth of its deposit base.

Ameris Bancorp explicitly acknowledged in its 2024 annual report that a variety of factors, including political conditions, can cause actual financial outcomes to deviate significantly from projected results, highlighting the material impact of these external forces.

Increased government spending on infrastructure and community development in the Southeast, a key region for Ameris Bank, is a significant political factor. For instance, the Bipartisan Infrastructure Law, enacted in late 2021, allocates substantial funds for projects like road, bridge, and broadband expansion across the US, with a notable focus on southeastern states. This influx of capital is expected to boost economic activity, directly benefiting Ameris Bank through increased demand for both commercial and personal loans as businesses expand and individuals find new employment opportunities.

Regulatory Scrutiny and Enforcement

Ameris Bank, like all financial institutions, operates under intense regulatory oversight. This scrutiny primarily focuses on consumer protection, ensuring fair lending, and combating money laundering. A significant event in 2024 involved Ameris Bank settling allegations of redlining, which resulted in the establishment of a community homeownership program designed to address past practices and foster greater financial inclusion.

This regulatory action underscores the critical need for robust compliance frameworks within the banking sector. The potential for enforcement actions directly impacts operational strategies and how banks engage with the communities they serve. For Ameris Bank, this settlement likely necessitated adjustments to lending policies and increased investment in community outreach initiatives to rebuild trust and demonstrate commitment to equitable practices.

Key areas of regulatory focus for banks in 2024-2025 include:

- Fair Lending Compliance: Ensuring loan application and approval processes are free from discriminatory practices.

- Consumer Protection: Adherence to regulations safeguarding consumers from predatory practices and ensuring transparency in financial products.

- Anti-Money Laundering (AML) and Know Your Customer (KYC): Implementing stringent measures to prevent illicit financial activities.

- Capital Adequacy and Risk Management: Maintaining sufficient capital reserves and robust risk management systems to withstand economic volatility.

Taxation Policies

Changes in corporate tax rates directly influence Ameris Bank's bottom line. For instance, if federal corporate tax rates were to decrease from the current 21% in the US, it would boost the bank's net income, potentially allowing for greater reinvestment or shareholder returns. Conversely, an increase in taxes specifically targeting financial institutions could significantly pressure profitability.

Favorable tax environments are crucial for banks like Ameris. For example, tax credits for certain types of lending, such as small business or affordable housing initiatives, can incentivize specific banking activities and improve the bank's financial health. The Tax Cuts and Jobs Act of 2017, which lowered the US corporate tax rate, demonstrated this effect, providing a boost to many financial institutions.

The bank's ability to retain earnings and invest in future growth is closely tied to taxation policies. A lower effective tax rate means more capital is available for expanding services, technology upgrades, or acquisitions. For 2024, analysts project that effective tax rates for major US banks will remain relatively stable, but any legislative shifts could alter this outlook.

Consider these impacts:

- Corporate Tax Rate Fluctuations: A reduction in the US federal corporate tax rate from 21% would directly increase Ameris Bank's retained earnings.

- Financial Sector-Specific Taxes: New or increased taxes on financial transactions or specific banking activities could negatively impact Ameris Bank's operating income.

- Tax Incentives: Government incentives for lending to underserved markets can improve profitability and community impact.

- Impact on Shareholder Returns: Lower taxes generally allow for increased dividends or share buybacks, enhancing shareholder value.

Government policy significantly shapes Ameris Bank's operating environment, influencing everything from lending rates to capital requirements. For instance, potential interest rate adjustments by the Federal Reserve in 2025 could directly impact Ameris Bank's net interest margins and loan demand. The bank's core operating region, the Southeastern U.S., benefits from increased government spending on infrastructure, like the Bipartisan Infrastructure Law, which is expected to boost economic activity and loan demand.

Ameris Bank, like all financial institutions, faces intense regulatory scrutiny, particularly concerning fair lending and consumer protection. A notable event in 2024 involved Ameris Bank settling redlining allegations, leading to the creation of a community homeownership program. This underscores the critical need for robust compliance, with key areas for 2024-2025 including fair lending, consumer protection, AML/KYC, and capital adequacy.

Changes in corporate tax rates directly affect Ameris Bank's profitability. A reduction in the US federal corporate tax rate from 21% would increase retained earnings, while sector-specific taxes could pressure income. Tax incentives for lending to underserved markets, such as those seen in the wake of the Tax Cuts and Jobs Act of 2017, can improve financial health and community impact.

Ameris Bancorp's 2024 annual report acknowledged that political conditions can cause financial outcomes to deviate from projections, highlighting the material impact of these external forces on the bank's performance.

What is included in the product

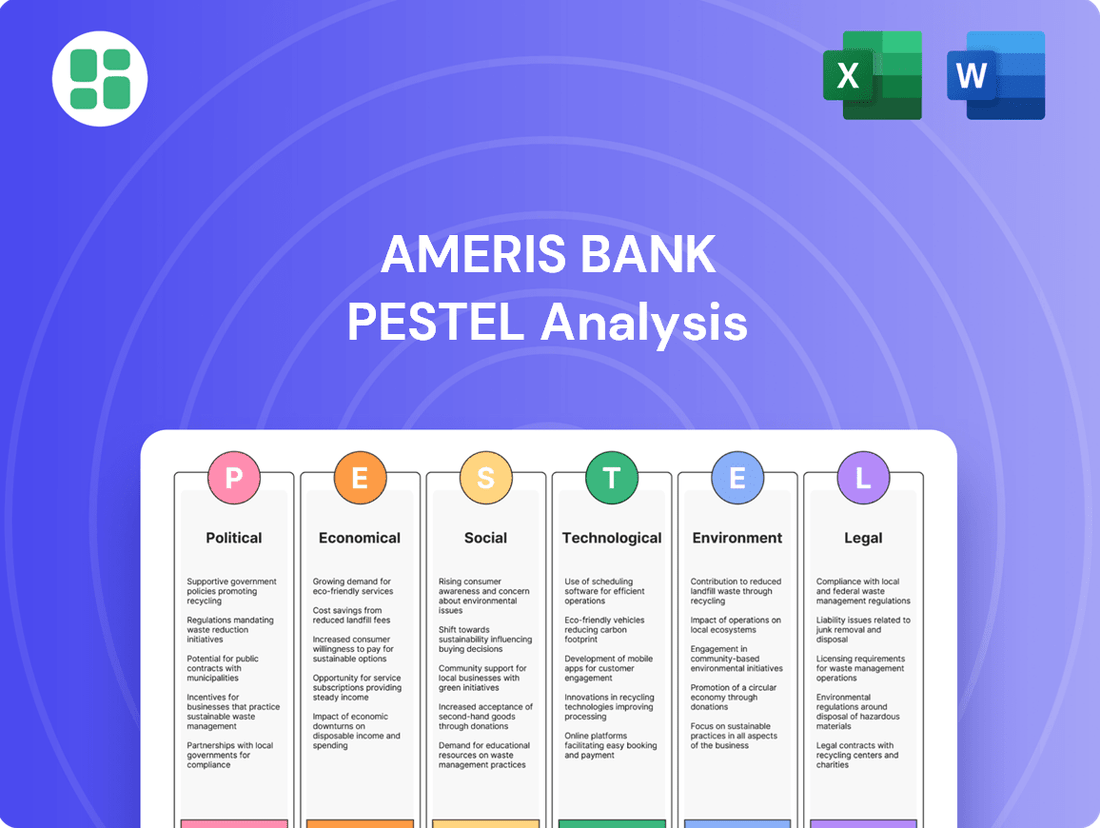

This PESTLE analysis of Ameris Bank examines the influence of Political, Economic, Social, Technological, Environmental, and Legal factors on its operations.

It provides a comprehensive overview of external forces that shape Ameris Bank's strategic landscape, highlighting potential threats and opportunities.

Ameris Bank's PESTLE analysis provides a clear, summarized version of the full analysis, making it easy to reference during meetings or presentations, thus relieving the pain point of sifting through complex data.

Economic factors

The prevailing interest rate environment directly shapes Ameris Bank's net interest margin (NIM), a crucial measure of its profitability. Following rate cuts by the Federal Reserve in late 2024, forecasts for 2025 suggest a continuation of these reductions, though at a more moderate pace. This dynamic necessitates astute balance sheet management to effectively navigate the impact on both deposit costs and loan yields, thereby safeguarding NIM.

Ameris Bank's strategic focus on the Southeastern U.S. is a significant advantage, as this region is consistently demonstrating robust economic expansion. This growth is fueled by a combination of increasing population and vibrant business activity.

This regional strength directly benefits Ameris Bank by fostering strong demand for loans and a healthy inflow of deposits, both crucial for the bank's financial health. For instance, Ameris Bancorp highlighted substantial loan growth in major Southeastern markets such as Atlanta and Florida during 2024, underscoring this trend.

Inflationary pressures directly impact Ameris Bank's customer base by eroding purchasing power. While inflation moderated throughout 2024, with the US CPI falling from a peak of 9.1% in June 2022 to around 3.1% by early 2025, its persistence influences consumer confidence.

This sustained, albeit lower, inflation can lead to cautious spending habits as consumers prioritize essential goods. Consequently, demand for discretionary banking services and loan products may remain subdued through 2025.

Adding to this, consumer debt levels reached record highs in 2024, exceeding $17 trillion. This elevated debt burden is likely to constrain consumer spending further in 2025, as households allocate more income towards debt repayment rather than new purchases or investments, impacting deposit growth and loan origination for Ameris Bank.

Unemployment Rates and Labor Market Health

Low unemployment rates, a hallmark of a healthy economy, generally translate to increased consumer confidence and a stronger capacity for borrowing. This positive environment directly benefits financial institutions like Ameris Bank by reducing the likelihood of loan defaults. For instance, the U.S. unemployment rate hovered around 3.9% in early 2024, reflecting a resilient labor market.

A robust labor market within Ameris Bank's key operating regions is crucial. It underpins the credit quality of the bank's loan portfolio and simultaneously fuels demand for a wide array of banking services, from mortgages to business loans. This symbiotic relationship highlights the direct impact of employment trends on Ameris Bank's performance.

Looking ahead, projections suggest a slight uptick in unemployment for 2025. While the exact figures are still developing, this anticipated shift could influence consumer spending and borrowing patterns. For example, some economic forecasts for 2025 anticipate the U.S. unemployment rate to potentially reach around 4.1%.

- Low Unemployment Boosts Confidence: Historically, unemployment rates below 4% have correlated with high consumer confidence and increased spending power.

- Labor Market Supports Loan Quality: A strong job market in regions where Ameris Bank operates directly enhances the creditworthiness of its borrowers.

- Demand for Services: Employment growth drives demand for various banking products, including personal loans, business financing, and wealth management services.

- Projected 2025 Shift: Anticipated modest increases in unemployment for 2025 may necessitate adjustments in lending strategies and risk management.

Real Estate Market Conditions

The real estate market's condition is a critical factor for Ameris Bank, influencing its loan portfolios. A robust market with appreciating property values generally means lower credit risk for the bank's mortgage and commercial loans. Conversely, a declining market can increase the number of loans that are not being paid back as expected and decrease the value of the properties the bank holds as collateral.

Looking ahead to 2025, mortgage rates are anticipated to stay at higher levels. This sustained elevation in borrowing costs could dampen housing affordability, potentially leading to reduced demand in the residential real estate sector.

- Residential Market: Continued high mortgage rates in 2025 may lead to slower home sales and potentially stagnant or declining price growth in some regions, impacting Ameris Bank's mortgage origination volume and the value of its residential loan collateral.

- Commercial Market: The health of commercial real estate, particularly office and retail spaces, is influenced by economic activity and remote work trends. A downturn here could increase default rates on commercial loans held by Ameris Bank.

- Interest Rate Impact: Elevated mortgage rates, projected to persist through 2025, directly affect borrower capacity and market demand, creating a more challenging environment for real estate transactions and loan performance.

The economic landscape for Ameris Bank in 2024-2025 is characterized by moderating inflation, a resilient but potentially shifting labor market, and persistent higher interest rates impacting real estate. While the US CPI has fallen significantly from its 2022 peak, its continued presence influences consumer behavior and spending habits. The bank's strong presence in the growing Southeastern U.S. region provides a tailwind, but elevated consumer debt levels could temper loan demand and deposit growth. Anticipated slight increases in unemployment for 2025 and sustained higher mortgage rates present challenges for loan quality and origination volumes.

| Economic Factor | 2024 Data/Trend | 2025 Projection/Trend | Impact on Ameris Bank |

|---|---|---|---|

| Inflation (US CPI) | Moderated to ~3.1% by early 2025 (from 9.1% in June 2022) | Expected to remain at lower, but persistent levels | Erodes purchasing power; can dampen consumer confidence and discretionary spending. |

| Unemployment Rate (US) | Hovered around 3.9% in early 2024 | Slight uptick anticipated, potentially around 4.1% | Low rates support loan quality and demand; slight increase could impact consumer spending and borrowing. |

| Interest Rates (Federal Reserve) | Rate cuts began in late 2024 | Continued, more moderate rate reductions anticipated | Affects Net Interest Margin (NIM); higher rates persist for mortgages, impacting affordability and loan origination. |

| Consumer Debt Levels | Exceeded $17 trillion in 2024 | Likely to constrain consumer spending further | Limits discretionary spending and investment, potentially impacting deposit growth and loan demand. |

| Real Estate Market (Mortgage Rates) | Higher levels persisted | Anticipated to remain elevated | Dampens housing affordability, potentially slowing sales and impacting mortgage origination and collateral values. |

Full Version Awaits

Ameris Bank PESTLE Analysis

The preview shown here is the exact Ameris Bank PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use. This comprehensive report delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Ameris Bank. You'll gain valuable insights into the strategic landscape affecting the institution.

Sociological factors

The Southeastern United States, Ameris Bank's primary operational region, continues to be a hotspot for population growth. For instance, states like Florida, Georgia, and the Carolinas have consistently outpaced the national average in population increases. This influx of new residents, often younger families and professionals, directly translates to a larger potential customer base for Ameris Bank's retail and commercial banking offerings.

This demographic expansion, particularly in burgeoning urban and suburban centers, presents a significant opportunity for Ameris Bank to deepen its market penetration. As of recent estimates, the Southeast is projected to see continued population gains throughout 2024 and into 2025, driven by factors like a lower cost of living compared to other regions and a favorable business climate. Ameris Bank's strategic expansion of its branch network, with new locations opening in high-growth corridors, directly aligns with capitalizing on these demographic shifts.

Consumers are increasingly shifting towards digital and mobile banking, with a significant portion of transactions now conducted online or via smartphone apps. Ameris Bank recognizes this trend and is investing in its digital infrastructure to provide seamless online and mobile experiences, ensuring it remains competitive while still serving customers through its physical branches in key locations.

In 2024, Ameris Bank continued its commitment to technological advancement, allocating substantial capital to enhance its digital platforms. This focus aims to improve user experience, streamline processes, and offer innovative digital solutions that align with evolving customer expectations for convenience and accessibility.

Efforts to boost financial literacy and inclusion are key for banks like Ameris Bank to grow their customer base. By making financial services more accessible and understandable, more people can participate in the economy.

Ameris Bank's commitment to this is clear through actions like their down payment assistance programs, which help more individuals and families achieve homeownership. In 2023 alone, Ameris Bank provided over $10 million in down payment assistance, directly impacting hundreds of new homeowners.

Furthermore, their grants supporting heirs' property work are vital. This initiative, which saw a 15% increase in grant funding in 2024, helps individuals overcome legal and financial hurdles to property ownership, particularly in underserved communities, fostering economic stability and wealth building.

Community Engagement and Corporate Social Responsibility (CSR)

Ameris Bank's commitment to community engagement and Corporate Social Responsibility (CSR) significantly shapes its public image and customer loyalty. By actively participating in financial wellness, education, and mental health programs, the bank demonstrates a dedication beyond profit. These initiatives foster trust, a critical asset in the banking sector.

In 2023, Ameris Bank reported investing over $1.8 million in community initiatives, including sponsorships for local non-profits and educational scholarships. Their latest CSR report highlights a 15% increase in employee volunteer hours compared to the previous year, underscoring a tangible commitment to social impact.

- Community Investment: Ameris Bank's 2023 community investment reached $1.8 million, supporting various local programs.

- Employee Engagement: A 15% rise in employee volunteer hours in 2023 reflects a growing dedication to CSR.

- Financial Literacy Programs: The bank's financial wellness initiatives reached over 5,000 individuals in the past year.

- Reputation Building: Strong CSR efforts are directly linked to enhanced brand reputation and customer retention.

Workforce Demographics and Talent Acquisition

The availability of skilled banking professionals and a diverse workforce are critical for Ameris Bank's human capital. In 2024, the banking sector continues to face a shortage of experienced talent, particularly in areas like cybersecurity and digital banking. Ameris Bancorp's success hinges on its ability to attract and retain individuals with specialized skills.

Attracting and retaining top talent in a competitive market demands more than just competitive salaries. Ameris Bank must offer robust benefits packages and cultivate a positive work environment. In 2024, employee well-being programs and opportunities for professional development are key differentiators for employers.

Ameris Bancorp specifically highlights its vital and talented management team and bankers as a core strength. This emphasis reflects the understanding that experienced leadership and skilled frontline staff are essential for navigating the complexities of the financial industry and driving customer satisfaction. The bank's ability to maintain this talent pool directly impacts its operational efficiency and market position.

Key considerations for Ameris Bank's workforce include:

- Talent Pool Availability: Assessing the depth of skilled banking professionals in its operating regions, with a particular focus on in-demand digital and risk management expertise.

- Competitive Compensation and Benefits: Benchmarking compensation and benefits against industry standards to ensure attractiveness to potential hires and retention of current employees.

- Work Culture: Fostering an inclusive and supportive work environment that promotes employee engagement and loyalty, crucial for reducing turnover.

- Management and Banker Expertise: Continuously investing in the development and retention of its management and banking staff, recognizing their direct impact on client relationships and business growth.

Societal attitudes toward financial institutions and banking practices are evolving, with a growing emphasis on ethical conduct and community impact. Consumers increasingly favor banks that demonstrate social responsibility and transparency. Ameris Bank's proactive engagement in financial literacy and community support initiatives, such as its down payment assistance programs which provided over $10 million in 2023, directly addresses these societal expectations.

The bank's commitment to heirs' property grants, seeing a 15% funding increase in 2024, further aligns with societal needs for economic inclusion and wealth building in underserved communities. This focus on tangible social good not only enhances Ameris Bank's reputation but also fosters deeper customer loyalty.

Technological factors

The digital banking landscape is evolving at an unprecedented pace, fundamentally changing customer expectations for financial services. Ameris Bank recognizes this shift and has prioritized enhancing its digital and mobile platforms to ensure seamless, secure, and user-friendly experiences for account management, payments, and loan applications. This focus is critical for maintaining competitiveness in the modern financial ecosystem.

In 2024, Ameris Bank demonstrated its commitment to technological advancement through significant investments aimed at bolstering its digital infrastructure. These investments are designed to equip the bank with the capabilities needed to meet the growing demand for accessible and efficient online and mobile banking solutions, ensuring a robust digital presence for its customers.

As banking increasingly moves online, strong cybersecurity is crucial for Ameris Bank to protect customer information and money from cyberattacks. The bank needs to constantly improve its security systems to prevent data breaches and keep customer confidence high. In 2024, banks are significantly increasing their spending on cybersecurity, with some reports indicating budget increases of 15-20% to address evolving threats.

The adoption of Artificial Intelligence (AI) and automation is fundamentally reshaping the banking landscape, offering Ameris Bank significant opportunities to boost operational efficiency and elevate customer experiences. For instance, AI-powered chatbots can handle a substantial volume of customer inquiries, freeing up human staff for more complex tasks. Furthermore, personalized recommendations driven by AI can lead to increased customer engagement and loyalty.

Implementing these advanced technologies is crucial for streamlining internal processes, thereby reducing operational costs and providing Ameris Bank with a distinct competitive advantage. The banking sector is prioritizing investments in AI and automation, with global spending on AI in financial services projected to reach tens of billions of dollars annually by 2025, highlighting its strategic importance.

Fintech Innovation and Competition

Fintech innovation continues to reshape the financial landscape, presenting Ameris Bank with both significant opportunities and competitive pressures. The rise of agile fintech firms offering specialized services, from digital payments to automated investing, necessitates a strategic response. For instance, the global fintech market was projected to reach over $1.1 trillion by 2025, highlighting the scale of this disruption. Ameris Bank must actively monitor these evolving trends to identify potential partnerships or internal development pathways.

The competitive environment is intensifying as fintech companies gain traction by leveraging technology to offer more streamlined and cost-effective solutions. This can range from peer-to-peer lending platforms to AI-driven wealth management tools. In 2024, several major banks announced strategic investments in or acquisitions of fintech startups to enhance their digital offerings and customer experience, signaling a broader industry trend towards integration rather than outright competition.

- Fintech Market Growth: The global fintech market is experiencing rapid expansion, with projections indicating continued strong growth through 2025 and beyond.

- Digital Transformation Imperative: Banks like Ameris must embrace digital transformation to remain competitive against nimble fintech disruptors.

- Partnership Opportunities: Collaborating with fintech startups can provide access to cutting-edge technology and new customer segments.

- Customer Expectations: Evolving customer demands for seamless digital experiences are a primary driver for fintech adoption and bank adaptation.

Data Analytics and Business Intelligence

Ameris Bank's strategic use of data analytics and business intelligence is a significant technological factor. By leveraging big data, the bank gains deeper insights into customer behavior, market trends, and potential risks. This allows for more informed decisions, leading to personalized product offerings and more effective marketing campaigns. For instance, in 2024, financial institutions that invested heavily in data analytics saw an average increase of 15% in customer retention rates.

These data-driven approaches are vital for optimizing operations and maximizing returns. Ameris Bank can refine its risk management models and identify new growth opportunities by analyzing vast datasets. This focus on analytics directly supports strategic planning and enhances the bank's competitive edge in the evolving financial landscape.

Key benefits of this technological factor for Ameris Bank include:

- Enhanced Customer Understanding: Detailed analysis of customer data allows for tailored financial products and services.

- Improved Risk Management: Predictive analytics help identify and mitigate potential financial risks more effectively.

- Optimized Marketing: Data insights enable targeted marketing strategies, leading to higher conversion rates and better ROI.

- Informed Strategic Decisions: Real-time data analysis supports agile decision-making and long-term business planning.

Technological advancements are reshaping how Ameris Bank operates and interacts with customers. The bank is investing in digital platforms and cybersecurity to meet evolving expectations and protect against threats. AI and data analytics are key to improving efficiency, personalizing services, and making smarter business decisions.

The bank's focus on digital transformation is crucial, especially with the rapid growth of fintech. By embracing new technologies, Ameris Bank aims to stay competitive and offer enhanced customer experiences. Global spending on AI in financial services is expected to climb significantly, underscoring the strategic importance of these investments.

| Technology Area | 2024 Investment Focus | Projected Impact | Industry Trend (2024-2025) |

|---|---|---|---|

| Digital Platforms | Mobile banking enhancements, seamless user experience | Increased customer engagement, improved transaction efficiency | Continued demand for intuitive digital interfaces |

| Cybersecurity | Advanced threat detection, data protection protocols | Enhanced customer trust, reduced risk of breaches | Significant budget increases (15-20% reported) for security upgrades |

| AI & Automation | Chatbots, personalized recommendations, process streamlining | Operational cost reduction, improved customer service, data-driven insights | Global AI spending in finance projected for tens of billions annually by 2025 |

| Data Analytics | Customer behavior analysis, predictive modeling | Better risk management, targeted marketing, personalized offerings | Institutions investing in analytics saw ~15% increase in customer retention in 2024 |

Legal factors

Ameris Bank navigates a stringent regulatory landscape, encompassing federal and state banking rules on capital, liquidity, and lending. For instance, compliance with the Current Expected Credit Losses (CECL) methodology, with its phase-in to regulatory capital concluding on December 31, 2024, is essential. Failure to adhere to these mandates, such as those outlined by the Federal Reserve or state banking authorities, can result in significant penalties and jeopardize the bank's operating authority.

Consumer protection laws, such as those governing fair lending and data privacy, significantly shape Ameris Bank's operational landscape. Compliance with these regulations is paramount, influencing everything from product development to marketing outreach.

Ameris Bank's commitment to adhering to these consumer protection mandates was underscored by a $9 million settlement in 2024. This settlement stemmed from prior redlining allegations and directly led to the establishment of the Ameris Choice homeownership program, demonstrating a tangible response to regulatory scrutiny.

Ameris Bank, like all financial institutions, operates under stringent Anti-Money Laundering (AML) and sanctions laws. These regulations are crucial for preventing illicit financial activities and ensuring global financial stability. For example, the Bank Secrecy Act (BSA) in the United States mandates that financial institutions report suspicious activities, and failure to comply can result in significant penalties. In 2023, the Financial Crimes Enforcement Network (FinCEN) reported over 300,000 Suspicious Activity Reports (SARs), highlighting the volume of activity financial institutions monitor.

Maintaining robust internal controls and effective reporting mechanisms is paramount for Ameris Bank to detect and prevent money laundering and terrorist financing. Non-compliance can lead to severe penalties, including substantial fines and reputational damage. The U.S. Department of Justice collected over $5 billion in fines related to financial crimes in 2023, underscoring the financial risks associated with regulatory breaches.

These AML and sanctions requirements are not static; they represent ongoing, evolving regulatory demands. Ameris Bank must continuously adapt its systems and processes to meet new directives and stay ahead of emerging threats in the financial landscape, ensuring its operations remain compliant and secure.

Data Privacy Regulations

Data privacy regulations are increasingly critical for Ameris Bank, especially as digital customer interactions grow. Laws such as the California Consumer Privacy Act (CCPA) and the potential for new federal privacy legislation mean the bank must rigorously protect customer data. Adherence to strict data handling protocols is not just a legal requirement but also vital for maintaining customer trust and preventing costly legal penalties. This focus on data privacy is intrinsically linked to the bank's broader cybersecurity strategy, aiming to safeguard sensitive information.

The evolving landscape of data privacy presents specific challenges and opportunities for financial institutions like Ameris Bank:

- Compliance Costs: Staying abreast of and implementing new data privacy laws can incur significant compliance costs, including technology upgrades and staff training.

- Customer Trust: Demonstrating robust data protection measures can enhance customer loyalty and attract new clients who prioritize privacy.

- Reputational Risk: Data breaches or privacy violations can severely damage Ameris Bank's reputation, leading to customer attrition and regulatory scrutiny.

- Competitive Advantage: Proactive and transparent data privacy practices can differentiate Ameris Bank from competitors, positioning it as a trusted financial partner.

Employment and Labor Laws

Ameris Bank, like all employers, operates under a complex web of federal and state employment and labor laws. These regulations cover everything from minimum wage requirements and overtime pay to workplace safety standards and anti-discrimination statutes. For instance, the Fair Labor Standards Act (FLSA) dictates pay for non-exempt employees, and failure to comply can lead to significant penalties. In 2024, the U.S. Department of Labor continued to emphasize enforcement in areas like wage and hour violations, impacting financial institutions.

Adhering to these legal frameworks is crucial for Ameris Bank to foster a fair and equitable work environment and, importantly, to avoid costly litigation and reputational damage. This includes ensuring compliance with laws such as the Civil Rights Act of 1964, which prohibits employment discrimination based on race, color, religion, sex, or national origin, and the Americans with Disabilities Act (ADA), requiring reasonable accommodations for qualified individuals with disabilities. The bank's commitment to its teammates means prioritizing these legal obligations.

Furthermore, employee benefits, such as health insurance and retirement plans, are heavily regulated by laws like the Employee Retirement Income Security Act (ERISA). Ameris Bank must ensure its benefit offerings and administration meet these stringent requirements. As of early 2025, regulatory bodies continue to scrutinize compliance in benefit plan management, underscoring the importance of robust internal controls and legal counsel.

Key legal considerations for Ameris Bank include:

- Wage and Hour Compliance: Ensuring accurate payment of wages and overtime according to federal and state laws, such as the FLSA.

- Anti-Discrimination and Equal Opportunity: Upholding laws like the Civil Rights Act and ADA to prevent discrimination and ensure equal opportunities for all employees.

- Workplace Safety: Adhering to Occupational Safety and Health Administration (OSHA) standards to provide a safe working environment.

- Employee Benefits Administration: Complying with ERISA regulations for the proper management of retirement and health benefit plans.

Ameris Bank's operations are heavily influenced by evolving legal and regulatory frameworks. The bank must navigate compliance with federal and state banking laws, including capital and liquidity requirements, with the CECL methodology's full regulatory capital impact concluding by December 31, 2024. Consumer protection laws, such as fair lending and data privacy, are also critical, as evidenced by Ameris Bank's 2024 settlement for redlining allegations, which spurred the creation of the Ameris Choice homeownership program.

The bank also faces stringent Anti-Money Laundering (AML) and sanctions regulations, including the Bank Secrecy Act (BSA). In 2023, FinCEN received over 300,000 Suspicious Activity Reports, highlighting the extensive monitoring required. Furthermore, data privacy laws like the CCPA necessitate robust data protection measures to maintain customer trust and avoid penalties, a challenge that saw U.S. states introducing or amending 17 comprehensive privacy laws in 2023. Employment laws, including the FLSA and ADA, also demand careful adherence to ensure fair labor practices and a safe workplace, with the Department of Labor increasing enforcement on wage and hour violations in 2024.

| Legal Area | Key Regulations/Considerations | 2023/2024 Impact/Data | Ameris Bank Relevance |

|---|---|---|---|

| Banking Regulation | Capital, Liquidity, Lending Rules; CECL | CECL phase-in concludes Dec 31, 2024 | Ensuring capital adequacy and compliance with accounting standards |

| Consumer Protection | Fair Lending, Data Privacy | $9M settlement for redlining allegations (2024) | Maintaining fair lending practices, protecting customer data |

| AML & Sanctions | BSA, Suspicious Activity Reporting | FinCEN received >300k SARs (2023) | Preventing illicit financial activities, robust internal controls |

| Data Privacy | CCPA, potential federal laws | 17 US states enacted comprehensive privacy laws (2023) | Protecting customer data, building trust |

| Employment Law | FLSA, ADA, OSHA | Increased DOL enforcement on wage/hour violations (2024) | Ensuring fair wages, safe workplace, equal opportunity |

Environmental factors

Ameris Bank's footprint in the Southeastern U.S. places it directly in the path of escalating climate change impacts. The region is experiencing a heightened frequency and intensity of extreme weather events, such as hurricanes and heavy rainfall, which pose significant physical risks. For instance, the National Oceanic and Atmospheric Administration (NOAA) reported that the U.S. experienced 28 separate billion-dollar weather and climate disasters in 2023, a number that has been trending upwards.

These events directly threaten Ameris Bank's operations and financial health. Increased severe weather can devalue collateral, particularly real estate, which is a core asset for many loans. Furthermore, disruptions to infrastructure and economic activity can impair borrowers' capacity to meet their loan obligations, leading to potential increases in non-performing loans. In 2024, the Federal Reserve Bank of Richmond noted that climate-related risks are becoming a more prominent consideration for financial institutions in their risk management frameworks.

Ameris Bank faces increasing demands from investors, regulators, and the public to adopt and transparently report on Environmental, Social, and Governance (ESG) standards. This trend reflects a broader shift in the financial sector towards prioritizing sustainability and corporate responsibility.

The bank recognizes the significance of embedding ethical, environmental, and social considerations into its core operations and strategic planning, aligning with its commitment to socially responsible banking practices. For instance, in 2023, Ameris Bank reported a 5% increase in its community reinvestment initiatives, demonstrating a tangible commitment to social impact.

Ameris Bank can capitalize on the growing sustainable finance market by offering green lending products. This includes financing for environmentally conscious projects like renewable energy installations and energy-efficient building upgrades. For instance, in 2024, the global green bond market reached an estimated $1.5 trillion, indicating strong investor appetite for sustainable investments.

By embracing green lending, Ameris Bank can attract environmentally conscious customers and align with increasing market demand for ESG (Environmental, Social, and Governance) compliant investments. This strategic move positions the bank to benefit from the projected 15% annual growth rate of the sustainable finance sector through 2030.

Resource Management and Operational Footprint

Ameris Bank is focusing on minimizing its environmental impact through smart resource management. This includes efforts to reduce energy consumption across its branches and data centers, a crucial step as the financial sector increasingly acknowledges its role in sustainability. For instance, many banks are investing in energy-efficient building upgrades and exploring renewable energy sources for their operations.

Adopting eco-friendly practices is key to limiting Ameris Bank's carbon footprint. Initiatives like promoting paperless transactions and encouraging mobile banking are vital. In 2024, the banking industry saw a significant push towards digital services, with mobile banking adoption rates continuing to climb, thereby reducing the need for paper and physical infrastructure. Ameris Bank's commitment to these digital solutions directly contributes to a more sustainable operational model.

- Energy Efficiency: Implementing smart thermostats and LED lighting in branches to cut electricity usage.

- Waste Reduction: Transitioning to digital statements and internal communications to decrease paper waste.

- Water Conservation: Installing low-flow fixtures in facilities to reduce water consumption.

- Digital Transformation: Enhancing mobile banking platforms to encourage paperless customer interactions.

Regulatory and Reporting Requirements on Climate Risk

Emerging regulatory requirements are increasingly compelling financial institutions like Ameris Bank to proactively assess and disclose climate-related financial risks. This shift is driven by a growing understanding of how environmental factors can impact financial stability. For instance, the U.S. Securities and Exchange Commission (SEC) has proposed rules requiring public companies, including banks, to report on their climate-related risks and emissions.

To navigate this evolving landscape, Ameris Bank will likely need to develop robust frameworks for identifying, measuring, and managing climate-related risks across its lending and investment portfolios. This involves integrating climate considerations into existing risk management processes and potentially establishing new methodologies. Such efforts are crucial for ensuring compliance with anticipated regulations and for maintaining investor confidence.

- Mandatory Disclosures: Banks may soon be required to publicly report on their exposure to climate risks, similar to how they report on credit or market risks.

- Risk Management Integration: Developing internal systems to quantify and mitigate risks associated with physical climate events (e.g., floods, storms) and transition risks (e.g., policy changes, technological shifts) will be essential.

- Portfolio Assessment: A key focus will be assessing how climate change impacts the bank's loan portfolio, including sectors like agriculture, real estate, and energy.

- Regulatory Alignment: Ameris Bank will need to stay abreast of evolving guidance from bodies like the Federal Reserve and international regulators regarding climate risk management.

Ameris Bank, operating in the Southeastern U.S., faces increased physical risks from escalating climate change impacts like hurricanes and heavy rainfall, as evidenced by the 28 billion-dollar weather disasters in the U.S. in 2023. These events can devalue collateral and impair borrowers' ability to repay loans, potentially increasing non-performing loans, a concern noted by the Federal Reserve Bank of Richmond in 2024.

The bank is responding to growing demands for ESG compliance by embedding sustainability into its operations and strategic planning, as shown by its 5% increase in community reinvestment initiatives in 2023. Ameris Bank is also poised to benefit from the growing sustainable finance market, with the global green bond market reaching an estimated $1.5 trillion in 2024, and a projected 15% annual growth rate for the sustainable finance sector through 2030.

Ameris Bank is actively minimizing its environmental footprint through resource management, including energy consumption reduction in branches and data centers, and promoting digital services to reduce paper waste. This aligns with industry trends, as seen in the climb of mobile banking adoption rates in 2024, contributing to a more sustainable operational model.

Emerging regulations, such as proposed SEC rules for climate-related risk and emissions reporting, are compelling institutions like Ameris Bank to develop robust risk management frameworks. This includes integrating climate considerations into lending and investment portfolios to ensure compliance and maintain investor confidence.

| Environmental Factor | Impact on Ameris Bank | 2023-2024 Data/Trends |

| Extreme Weather Events | Increased risk of collateral devaluation, loan defaults. | 28 billion-dollar weather disasters in U.S. in 2023 (NOAA). |

| ESG Demand | Opportunity for green lending, attracting ESG-conscious investors. | Global green bond market ~$1.5 trillion (2024); Sustainable finance sector growth ~15% annually. |

| Operational Footprint | Need to reduce energy consumption and waste. | Rise in mobile banking adoption (2024) supports paperless initiatives. |

| Regulatory Scrutiny | Requirement for climate risk assessment and disclosure. | Proposed SEC rules for climate-related disclosures. |

PESTLE Analysis Data Sources

Our Ameris Bank PESTLE Analysis is meticulously constructed using data from reputable financial institutions, government economic reports, and leading industry publications. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors impacting the banking sector.