Ameris Bank Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ameris Bank Bundle

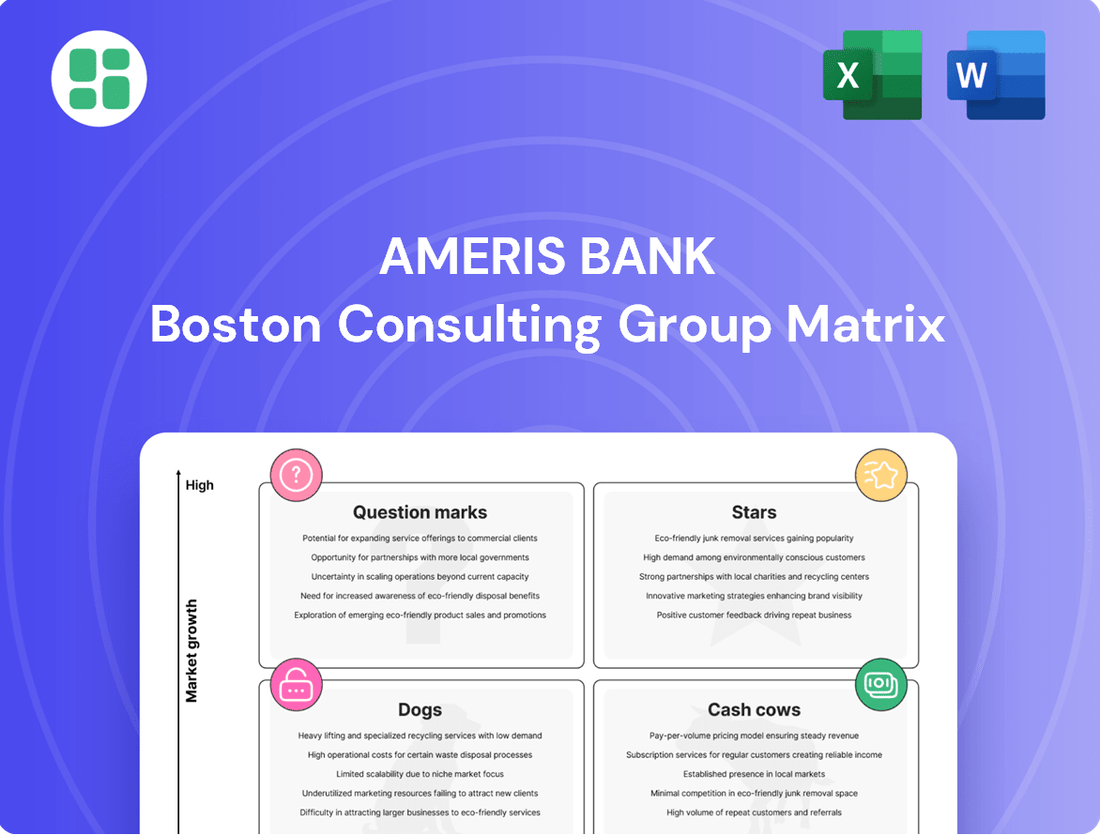

Curious about Ameris Bank's strategic product positioning? Our BCG Matrix preview offers a glimpse into how their offerings might be categorized as Stars, Cash Cows, Dogs, or Question Marks. To truly understand their competitive landscape and unlock actionable growth strategies, dive into the full report.

The complete Ameris Bank BCG Matrix provides a detailed breakdown of each product's market share and growth rate, offering crucial insights for resource allocation. Don't miss out on this essential tool for informed decision-making; purchase the full version for a comprehensive strategic advantage.

Stars

Ameris Bank's mortgage origination stands out as a robust performer, securing a spot in the Top 10 banks nationwide for retail mortgage volume in the first quarter of 2024.

This strong market position in mortgage lending, despite its sensitivity to interest rate fluctuations, showcases Ameris Bank's strategic acumen. The bank's success is further underscored by an 8% increase in mortgage dollar volume during Q1 2024, a notable achievement when many competitors experienced downturns, signaling a distinct competitive edge and leadership within the sector.

Ameris Bank is significantly enhancing its digital banking capabilities, focusing on business efficiency tools like online bill pay and wire transfers. This strategic push, with content updates as recent as July 2025, reflects the booming digital financial services sector. These offerings are poised to become stars in the BCG matrix due to increasing customer adoption of digital platforms.

Ameris Bank is strategically targeting commercial real estate (CRE) lending in growth markets, particularly within the dynamic Southeast region. This focused approach allows them to capitalize on thriving sub-sectors despite broader market challenges. The bank's commitment to this strategy is underscored by the recent appointment of a new head of wholesale banking to specifically drive growth in commercial real estate.

Expansion of Specialized Lending Channels

Ameris Bank's expansion into specialized lending channels, such as insurance premium financing, positions it in potentially high-growth, high-share market segments. This diversification beyond traditional Southeast financial centers allows the bank to tap into niche commercial and industrial loan opportunities nationwide.

These specialized areas can be viewed as stars in the BCG matrix if they exhibit strong market growth and Ameris has established a significant market share. For instance, the insurance premium finance market has seen consistent growth, with industry reports indicating a steady increase in volume. In 2024, the market size for insurance premium financing in the US was estimated to be in the tens of billions of dollars, reflecting substantial demand.

- Insurance Premium Financing: This segment taps into a recurring revenue stream tied to insurance policies, offering stability and growth potential.

- Specialized Commercial Loans: Targeting specific industries or business needs allows Ameris to build deep expertise and capture market share in underserved niches.

- Nationwide Reach: Expanding beyond its core Southeast footprint broadens the customer base and revenue opportunities for these specialized lending channels.

Strategic Deposit Growth Initiatives

Ameris Bank's strategic deposit growth initiatives in 2024 have demonstrably paid off, reflecting a robust core funding strategy. The bank's new deposit acquisition program, launched in 2024, successfully attracted new customers and strengthened existing relationships. This resulted in a significant increase in total deposits, exceeding one billion dollars for the year.

This strong performance is particularly evident in the growth of noninterest-bearing deposits, which constituted 30.8% of total deposits as of Q1 2025. This substantial noninterest-bearing deposit base is a critical asset, providing a stable and cost-effective funding source essential for supporting loan expansion, especially in the current rising interest rate environment.

- Deposit Acquisition Program: Launched in 2024, targeting new customer acquisition and deepening existing relationships.

- Total Deposit Growth: Achieved an increase of over $1 billion in total deposits during 2024.

- Noninterest-Bearing Deposits: Represented 30.8% of total deposits in Q1 2025, indicating a strong core funding base.

- Market Share Impact: Contributes to market share in a fundamental banking product crucial for overall growth.

Ameris Bank's digital banking enhancements and specialized lending areas, like insurance premium financing, are positioned as Stars in the BCG matrix. These segments benefit from high market growth and Ameris's increasing market share, driven by strategic investments and a nationwide expansion. The insurance premium finance market alone was valued in the tens of billions in 2024, indicating significant growth potential that Ameris is actively tapping into.

| BCG Category | Business Segment | Market Growth | Market Share | Strategic Rationale |

|---|---|---|---|---|

| Stars | Digital Banking Services | High (Booming digital financial services sector) | Growing (Increasing customer adoption) | Invest for growth and market leadership; enhance efficiency tools. |

| Stars | Insurance Premium Financing | High (Consistent industry growth) | Significant (Tens of billions in US market volume 2024) | Invest to maintain and grow share; leverage recurring revenue. |

| Stars | Specialized Commercial Loans | High (Niche opportunities in underserved markets) | Growing (Capturing share in specific industries) | Invest to build expertise and expand nationwide reach. |

What is included in the product

This BCG Matrix overview offers strategic insights into Ameris Bank's business units, highlighting which to invest in, hold, or divest.

The Ameris Bank BCG Matrix provides a clear visual, relieving the pain of strategic uncertainty by categorizing business units for focused decision-making.

Cash Cows

Ameris Bank's traditional checking and savings accounts are its bedrock, holding a strong market share, especially in its core Southeastern markets. These are mature products, meaning they don't require heavy marketing spend, allowing them to generate steady profits.

In 2024, Ameris Bank saw its total deposits climb by over a billion dollars, a testament to the enduring appeal and stability of these core offerings. The bank also maintained a healthy level of noninterest-bearing deposits, further highlighting the low-cost funding these accounts provide.

Ameris Bank's established retail branch network in the Southeast, comprising 164 financial centers, represents a significant Cash Cow. This extensive physical presence is key to fostering customer relationships and attracting deposits.

Despite the mature nature of branch banking, this network enjoys a strong local market share, generating consistent revenue through customer loyalty and cross-selling. For instance, as of the first quarter of 2024, Ameris Bank reported total deposits of $17.0 billion, a testament to the effectiveness of its branch network in attracting and retaining customer funds.

The existing infrastructure demands minimal new investment for upkeep, allowing it to contribute substantially to the bank's overall profitability. This stability makes it a reliable source of cash flow for Ameris Bank.

Ameris Bank's seasoned residential real estate mortgage portfolio functions as a classic Cash Cow. This existing book of mortgages, particularly in stable or mature markets, delivers consistent interest income, acting as a reliable revenue generator. While new mortgage origination might be a Star for growth, this established portfolio represents a low-growth, high-market-share asset.

For instance, as of the first quarter of 2024, Ameris Bancorp reported total loans of $18.5 billion, with a significant portion comprised of residential real estate mortgages. This segment, characterized by predictable cash flows and lower reinvestment needs compared to newer, high-growth areas, underscores its Cash Cow status within the BCG matrix.

Mature Commercial and Industrial (C&I) Loan Relationships

Ameris Bank's mature Commercial and Industrial (C&I) loan relationships represent a significant cash cow. These are established, long-term partnerships with businesses operating in stable industries within Ameris Bank's service footprint. This segment generates dependable interest income, forming a bedrock of consistent profitability.

While Ameris Bank actively seeks new C&I loan opportunities, its existing portfolio in mature sectors functions as a powerful cash cow. These relationships, built over time, require less intensive marketing and acquisition efforts, leading to lower operational costs and higher, predictable returns. For instance, in 2024, Ameris Bancorp (the parent company) reported a robust net interest margin, partly fueled by its strong loan portfolio, including C&I segments.

- Stable Income Generation: Mature C&I loans provide a predictable stream of interest income due to their long-standing nature and the stability of the underlying businesses.

- Lower Acquisition Costs: Existing relationships minimize the need for extensive marketing and client acquisition, thereby reducing operational expenses.

- Foundation for Profitability: This segment acts as a primary driver of consistent profits, supporting other growth initiatives within the bank.

- Contribution to Net Interest Margin: The reliable interest earned from these loans significantly bolsters Ameris Bank's net interest margin, a key profitability metric.

Treasury and Cash Management Services for Businesses

Ameris Bank's Treasury and Cash Management Services are a cornerstone of its offerings to business clients, acting as a significant Cash Cow. These services are crucial for established businesses, providing essential functions that foster deep, long-term relationships and generate consistent, recurring fee income for the bank.

With a high adoption rate among its existing commercial client base, these mature services are a substantial contributor to Ameris Bank's non-interest income. The bank benefits from these offerings without requiring significant new investment, making them a highly efficient revenue stream.

- Recurring Fee Income: These services generate predictable revenue streams, bolstering the bank's financial stability.

- Client Retention: Essential for business operations, these services create sticky client relationships, reducing churn.

- Non-Interest Income Driver: A significant portion of Ameris Bank's revenue comes from these fee-based services, diversifying its income sources.

- Operational Efficiency: As a mature offering, the incremental investment required to maintain and grow these services is relatively low.

Ameris Bank's core checking and savings accounts are its bedrock, holding a strong market share, especially in its core Southeastern markets. These are mature products, meaning they don't require heavy marketing spend, allowing them to generate steady profits. In 2024, Ameris Bank saw its total deposits climb by over a billion dollars, a testament to the enduring appeal and stability of these core offerings.

The bank's established retail branch network in the Southeast, comprising 164 financial centers, represents a significant Cash Cow. This extensive physical presence is key to fostering customer relationships and attracting deposits. Despite the mature nature of branch banking, this network enjoys a strong local market share, generating consistent revenue through customer loyalty and cross-selling.

Ameris Bank's seasoned residential real estate mortgage portfolio functions as a classic Cash Cow. This existing book of mortgages, particularly in stable or mature markets, delivers consistent interest income, acting as a reliable revenue generator. As of the first quarter of 2024, Ameris Bancorp reported total loans of $18.5 billion, with a significant portion comprised of residential real estate mortgages.

Mature Commercial and Industrial (C&I) loan relationships represent a significant cash cow. These are established, long-term partnerships with businesses operating in stable industries within Ameris Bank's service footprint, generating dependable interest income. In 2024, Ameris Bancorp reported a robust net interest margin, partly fueled by its strong loan portfolio, including C&I segments.

| Product/Service | BCG Category | Key Characteristics | 2024 Data Point |

| Checking & Savings Accounts | Cash Cow | High market share, low growth, stable profits | Total Deposits over $1 billion increase |

| Retail Branch Network | Cash Cow | Mature, high market share, consistent revenue | 164 financial centers in Southeast |

| Residential Real Estate Mortgages (Existing Portfolio) | Cash Cow | Steady interest income, low reinvestment needs | Significant portion of $18.5 billion total loans |

| Commercial & Industrial (C&I) Loans (Mature Relationships) | Cash Cow | Dependable interest income, low acquisition costs | Contributed to robust net interest margin |

Delivered as Shown

Ameris Bank BCG Matrix

The Ameris Bank BCG Matrix preview you are viewing is the exact, fully formatted document you will receive upon purchase. This comprehensive report, meticulously crafted for strategic insight, contains no watermarks or demo content, ensuring immediate professional usability. Once acquired, you'll gain instant access to this analysis-ready file, perfect for informing your business planning and competitive strategy.

Dogs

Ameris Bank's underperforming legacy technology systems likely fall into the Dogs category of the BCG Matrix. These are systems that are costly to maintain and no longer contribute to competitive advantage or growth. For instance, many financial institutions in 2024 are still grappling with the expense of supporting older core banking platforms that hinder the rollout of new digital services. These systems often require specialized, expensive IT support and can lead to slower transaction processing and a less seamless customer experience.

Some of Ameris Bank's physical branches might be considered non-strategic or underutilized. These are typically branches located in areas experiencing population decline or those with consistently low customer transaction volumes. For instance, a branch in a rural community with a shrinking customer base and high overhead costs might fall into this category.

These underperforming locations can tie up valuable capital and resources. If a branch consistently shows low profitability and doesn't align with Ameris Bank's strategic growth markets, it might be a candidate for closure or consolidation. In 2024, many regional banks faced pressure to optimize their physical footprints, with some closing branches that no longer met efficiency targets.

Certain low-volume, high-cost specialized lending programs at Ameris Bank would likely fall into the Dogs category of the BCG Matrix. These are programs that haven't captured significant market share and demand substantial resources to maintain, offering little return. For instance, a highly specialized commercial loan for a declining industry that requires extensive due diligence and compliance, while only generating a handful of clients, exemplifies this.

In 2024, Ameris Bank might have observed that these niche programs, perhaps a unique form of agricultural financing or a very specific small business loan product, represented less than 1% of their total loan portfolio. Despite this low contribution, the administrative costs associated with underwriting, managing, and servicing these specialized loans could be disproportionately high, potentially exceeding 5% of the revenue they generate. This scenario clearly indicates a lack of growth and profitability, fitting the profile of a Dog.

Outdated or Unpopular Consumer Products

Ameris Bank might classify outdated or unpopular consumer products as Dogs within its BCG Matrix. These could include legacy checking accounts with minimal digital features or loan products that haven't kept pace with market demand. For instance, a checking account with no mobile deposit or bill pay options would likely fall into this category.

Maintaining such products can be a drain on resources. In 2024, many financial institutions are streamlining their product portfolios to reduce IT maintenance costs and compliance burdens associated with older systems. Holding onto products with declining adoption, like a basic savings account that offers no competitive interest rates compared to high-yield online options, represents a missed opportunity for growth and efficiency.

- Declining Adoption: Products experiencing a consistent drop in customer usage and new account openings.

- Lack of Competitive Features: Offerings that are significantly behind competitors in terms of functionality, rates, or digital integration.

- Irrelevance to Target Demographic: Products that no longer align with the evolving needs and preferences of Ameris Bank's customer base.

- High Maintenance Costs: Legacy systems and compliance requirements for outdated products that outweigh their revenue generation.

Inefficient Internal Processes or Departments

Inefficient internal processes or departments at Ameris Bank, those with low efficiency ratios and no direct contribution to core revenue or strategic growth, would likely be categorized as Dogs in the BCG Matrix. These areas represent a drain on resources without generating proportional returns. For instance, a back-office processing unit experiencing significant delays, perhaps reflected in a 2023 operational cost per transaction that is 15% higher than industry benchmarks, would fit this description.

These Dog segments consume capital and management attention that could be better allocated to Stars or Question Marks with higher growth potential. In 2024, Ameris Bank’s focus on digital transformation aims to address such inefficiencies. However, any remaining departments with persistently high error rates or lengthy turnaround times, impacting customer satisfaction or increasing operational expenses, would be considered Dogs.

- High operational costs in non-revenue generating departments.

- Low productivity metrics compared to industry peers.

- Lack of clear strategic alignment or growth potential.

- Resource allocation that yields minimal or negative returns.

Dogs in Ameris Bank's portfolio represent business units or products with low market share and low growth potential. These are often legacy systems, underperforming branches, or niche products that consume resources without significant returns. For example, in 2024, many banks are divesting from or consolidating physical locations that demonstrate consistently low customer traffic and profitability, a common trait of Dog segments. These areas require careful management to either improve their performance or be phased out to reallocate capital to more promising ventures.

| Category | Description | Potential Ameris Bank Examples (2024) | Key Characteristics |

|---|---|---|---|

| Dogs | Low market share, low growth | Legacy IT systems, underperforming branches, niche loan products with low adoption | High maintenance costs, low revenue contribution, declining customer interest |

Question Marks

Ameris Bank's engagement in emerging fintech partnerships and digital innovation ventures places them firmly in the Question Mark category of the BCG Matrix. These initiatives, driven by a commitment to digital transformation, aim to leverage new technologies and collaborate with fintech companies to elevate customer digital experiences. For instance, in 2024, many regional banks are investing heavily in AI-powered customer service bots and personalized digital banking platforms, reflecting this trend.

While these ventures possess high growth potential within the dynamic fintech sector, their current market share is likely minimal due to their nascent stage. The significant capital required to scale these digital innovations, coupled with the inherent uncertainty of market adoption and competitive response, underscores their Question Mark status. For example, a recent industry report indicated that while investment in digital banking solutions by mid-sized banks surged by 25% in 2023, the market penetration of truly novel digital offerings remains below 10% for many institutions.

While Ameris Bank's core strength lies in the Southeast, its reach extends nationwide via specific lending operations. This existing national footprint provides a foundation for potential expansion into new geographic markets. For instance, exploring areas with strong economic growth and underserved banking needs could unlock significant opportunities.

Entering high-growth markets beyond its established Southeast presence offers substantial upside potential. However, this would necessitate considerable investment to build brand awareness and capture market share against entrenched competitors. For example, a new market entry might require substantial marketing spend and localized product development to gain traction.

Ameris Bank's specialized ESG/Green Financing Products likely fall into the Question Mark category of the BCG Matrix. The global sustainable finance market is experiencing significant growth; for instance, sustainable debt issuance reached an estimated $1.5 trillion globally in 2023, a substantial increase from previous years.

While there's a burgeoning demand for green loans, social bonds, and sustainability-linked financing, Ameris Bank's specific product suite in this area may still be in its early stages of development or market penetration. Capturing a substantial share of this rapidly expanding market will necessitate considerable investment in tailored product creation, robust marketing strategies, and building expertise in ESG assessment and reporting.

Advanced Data Analytics and AI-driven Advisory Services

Developing advanced data analytics and AI-driven advisory services is a significant investment for banks like Ameris. These initiatives aim to offer highly personalized financial advice and proactive risk management, tapping into a burgeoning market. While the potential for high growth is evident, these capabilities are often in their nascent stages for many institutions, characterized by considerable upfront development costs and a currently limited market footprint.

For Ameris Bank, this translates to a position likely within the 'Question Marks' category of the BCG Matrix. The bank is investing heavily in these areas, recognizing their future potential, but the immediate return on investment and market share are still developing. By mid-2024, the global market for AI in financial services was projected to reach over $20 billion, highlighting the competitive landscape and the imperative for banks to innovate in this space.

- High Investment: Significant capital is allocated to building and refining AI and data analytics platforms.

- Early Market Adoption: Customer uptake and market penetration for these advanced advisory services are still in the early phases.

- Future Growth Potential: The long-term revenue and market share gains from these capabilities are anticipated to be substantial.

- Development Costs: Initial costs associated with technology acquisition, talent, and data infrastructure are considerable.

New Commercial Lending Niches (e.g., Specific Tech or Healthcare)

Ameris Bank's strategic expansion into new commercial lending niches, such as specialized technology sectors or specific healthcare sub-segments, aligns with a BCG Matrix approach where these areas would be considered 'Stars'. This involves identifying high-growth industries where the bank can establish a strong foothold. For instance, the digital health sector experienced significant investment in 2024, with venture capital funding reaching billions globally, presenting a prime opportunity for Ameris to develop expertise and capture market share.

By making targeted investments in talent and tailored financial products for these emerging industries, Ameris Bank positions itself to capitalize on future growth. The bank's recent key hires in specialized fields underscore this commitment. For example, a focus on renewable energy technology lending could tap into a market projected for substantial expansion, driven by global sustainability initiatives and government incentives.

- Targeting high-growth tech niches like AI startups or cybersecurity firms.

- Developing specialized lending products for the rapidly evolving biotech and medical device industries.

- Investing in market research and talent acquisition to understand and serve these new sectors effectively.

- Leveraging data analytics to identify emerging trends and potential lending opportunities within these niches.

Ameris Bank's ventures into emerging fintech partnerships and digital innovation are categorized as Question Marks. These initiatives aim to enhance customer digital experiences through new technologies and collaborations, reflecting a broader industry trend where many regional banks increased investments in AI-powered customer service and personalized digital platforms by 25% in 2023. Despite high growth potential, their minimal current market share and substantial scaling capital requirements, coupled with market adoption uncertainties, solidify their Question Mark status, as market penetration for novel digital offerings remained below 10% for many institutions by the end of 2023.

BCG Matrix Data Sources

Our Ameris Bank BCG Matrix leverages internal financial statements, market share data, and industry growth reports to accurately assess business unit performance.