American Apparel SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

American Apparel Bundle

American Apparel faces a dynamic market, balancing its iconic brand identity with evolving consumer preferences and intense competition. While its commitment to "Made in USA" manufacturing is a significant strength, it also presents cost challenges compared to global competitors.

Want the full story behind American Apparel's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

American Apparel leverages its strong brand heritage, a significant asset in today's crowded market. Consumers remember its distinctive marketing campaigns and its commitment to domestic manufacturing, fostering a sense of trust and loyalty. This established recognition helps lower customer acquisition costs, a crucial advantage in online retail.

While American Apparel has broadened its sourcing globally after its acquisition, the 'Made in USA' aspect is still a core part of its brand. This resonates with customers who care about ethical manufacturing and supporting local jobs. In 2024, consumer demand for supply chain transparency is high, with many wanting to see proof of ethical sourcing practices, which plays directly into American Apparel's established commitment to responsible production.

American Apparel's strength lies in its streamlined e-commerce operating model. By focusing primarily online, the company significantly cuts down on the overhead costs typically associated with brick-and-mortar retail. This efficiency directly boosts profitability and provides greater agility in managing inventory and expanding its market presence.

The e-commerce apparel sector is experiencing robust expansion. Projections indicate that consumer penetration in this market will reach 34.4% by 2025, creating a highly advantageous landscape for brands like American Apparel that prioritize online sales channels.

Focus on Basic Apparel Items

American Apparel's focus on basic apparel items offers a significant strength by catering to a consistent demand for timeless pieces, insulating the company from the rapid fluctuations of fast fashion. This specialization ensures a stable revenue stream, as core wardrobe staples are less susceptible to fleeting trends. For instance, the global apparel market, valued at over $1.5 trillion in 2023, saw a notable portion driven by everyday wear, highlighting the enduring appeal of basics.

The basic apparel sector is not stagnant; it's actively evolving with sustainability and technology. This creates opportunities for brands like American Apparel to adapt and maintain relevance. By concentrating on these foundational products, the company can build a resilient business model. In 2024, consumer interest in ethically sourced and durable basics continued to grow, with reports indicating a 7% year-over-year increase in demand for sustainable apparel.

- Consistent Demand: Basic apparel items like t-shirts and hoodies have perennial demand, reducing inventory risk.

- Market Stability: The focus on staples provides a more predictable revenue stream compared to trend-driven fashion.

- Adaptability to Trends: The basic segment can readily incorporate sustainability and technological advancements, enhancing resilience.

- Global Market Relevance: Basic apparel remains a cornerstone of the global apparel industry, offering broad market reach.

Direct-to-Consumer (DTC) Advantage

American Apparel's direct-to-consumer (DTC) model is a significant strength, allowing it to directly manage customer relationships and collect valuable first-party data. This control over the brand experience from start to finish is crucial in today's market. The DTC sector is booming, with e-commerce sales for established DTC brands expected to reach $187 billion by 2025, a testament to consumers' increasing preference for personalized, direct brand interactions.

American Apparel benefits from a strong brand identity built on its distinctive marketing and commitment to domestic manufacturing, fostering customer loyalty. Its streamlined e-commerce model reduces overhead, enhancing profitability and agility. The company's focus on timeless basic apparel ensures consistent demand, insulating it from fast fashion volatility and aligning with growing consumer interest in sustainability.

| Strength | Description | Supporting Data/Trend |

|---|---|---|

| Brand Heritage & Recognition | Strong consumer recall from past campaigns and domestic production ethos. | Consumers increasingly value brand authenticity and ethical sourcing. |

| E-commerce Efficiency | Lower operational costs compared to brick-and-mortar retail. | E-commerce apparel market penetration projected to reach 34.4% by 2025. |

| Focus on Basic Apparel | Caters to consistent demand for staples, reducing trend dependency. | Global apparel market valued over $1.5 trillion in 2023, with a significant portion from everyday wear. |

| Direct-to-Consumer (DTC) Model | Enables direct customer relationships and data collection. | DTC e-commerce sales for established brands expected to reach $187 billion by 2025. |

What is included in the product

Analyzes American Apparel’s competitive position through key internal and external factors, including its brand image, manufacturing capabilities, and market trends.

Uncovers critical weaknesses and threats to proactively address them, preventing potential brand damage and financial loss.

Weaknesses

American Apparel's core strength in basic apparel, while providing a consistent revenue stream, also presents a significant weakness. This limited product diversification restricts its ability to capture a broader market share, particularly among consumers who prioritize trend-following or seek a wider variety of fashion choices. The brand's reliance on a narrow product category could cap its overall revenue growth potential.

This concentrated product offering makes American Apparel susceptible to market fluctuations. If consumer demand for its specific range of basic items experiences a downturn, the company lacks alternative product lines to offset potential losses. For instance, early 2025 saw some analysts noting a general decline in consumer apparel spending, a trend that would disproportionately impact a brand with less diversified inventory.

American Apparel's reliance on its e-commerce platform presents a significant vulnerability. Disruptions due to technical issues or cybersecurity breaches could directly impact sales and customer engagement. For instance, the fashion retail sector, as of early 2025, continues to face escalating cybersecurity threats, with data breaches costing companies an average of $4.35 million in 2024, according to IBM's Cost of a Data Breach Report.

This digital dependency also makes the company susceptible to changes in online platform algorithms and search engine optimization (SEO) tactics. Shifts in how these platforms display products or rank search results can dramatically affect visibility and traffic, potentially leading to a substantial drop in revenue if not proactively managed.

American Apparel's brand image faces significant hurdles stemming from its 2015 bankruptcy filing and subsequent acquisition by Gildan Activewear in 2017. This transition may have diluted its original identity, potentially alienating a segment of its loyal customer base who associated the brand with its prior ethos.

While Gildan has invested in revitalizing marketing and expanding product lines, the move away from the "wholly made in America" manufacturing model, a cornerstone of the brand's appeal, could be viewed as a betrayal of its foundational promise by some consumers. This shift presents a challenge in re-establishing trust and reconnecting with those who valued its domestic production heritage.

Intense Online Retail Competition

The online apparel market is incredibly crowded, with many players vying for customer attention. This intense competition, fueled by fast fashion giants and other direct-to-consumer brands, puts significant pressure on American Apparel's pricing strategies and marketing budgets. For instance, the global online apparel market was projected to reach over $1.3 trillion by 2025, highlighting the sheer volume of competition.

Standing out in such a saturated environment demands continuous innovation and effective customer acquisition tactics. Fast fashion, in particular, continues its rapid growth trajectory, making it even more challenging for brands to capture market share and maintain customer loyalty. This necessitates a constant evolution of product offerings and marketing approaches to remain relevant.

- Market Saturation: The online apparel sector is highly competitive, with a multitude of brands.

- Pricing Pressure: Intense rivalry forces brands to compete aggressively on price.

- Marketing Costs: Acquiring customers in this crowded space requires substantial marketing investment.

- Fast Fashion Dominance: The continued growth of fast fashion brands poses a significant challenge.

Supply Chain Vulnerabilities and Cost Fluctuations

American Apparel, like many in the industry, grapples with supply chain vulnerabilities. Geopolitical tensions and global economic shifts, including persistent inflation, continue to create volatility in raw material costs and shipping expenses. For instance, cotton prices, a key input, saw significant fluctuations throughout 2024, driven by weather patterns and global demand, directly impacting manufacturing costs.

These disruptions can lead to extended lead times and unpredictable production schedules, even for brands emphasizing domestic manufacturing. The cost of labor, particularly in skilled manufacturing roles, also remains a challenge, further contributing to the pressure on profitability. By late 2024, reports indicated that logistics costs had risen by an average of 15% year-over-year, a burden felt across the sector.

- Rising Raw Material Costs: Volatility in cotton, polyester, and other fabric prices directly impacts production expenses.

- Logistics Disruptions: Port congestion and increased freight rates can delay shipments and inflate overall supply chain costs.

- Labor Constraints: Finding and retaining skilled manufacturing labor remains a persistent challenge, affecting production capacity and wages.

- Geopolitical Instability: International conflicts and trade policy changes can disrupt sourcing and increase the risk of material shortages.

American Apparel's limited product range, primarily focused on basics, restricts its ability to appeal to a wider customer base and capitalize on evolving fashion trends. This lack of diversification makes it vulnerable to shifts in consumer preferences for more varied apparel options, potentially capping revenue growth.

The brand's heavy reliance on its e-commerce platform presents a critical vulnerability. Cybersecurity threats are a significant concern, with data breaches in the fashion retail sector averaging $4.35 million in 2024, according to IBM. Any disruption to its online operations could severely impact sales and customer engagement.

Its brand image has been affected by past financial difficulties, including a 2015 bankruptcy, and the shift away from its original "wholly made in America" manufacturing ethos. This transition may have alienated some core customers who valued its domestic production heritage, creating a challenge in rebuilding trust.

The intense competition within the online apparel market, projected to exceed $1.3 trillion globally by 2025, puts American Apparel under considerable pricing and marketing pressure. The dominance of fast fashion brands further exacerbates the difficulty in maintaining market share and customer loyalty.

Same Document Delivered

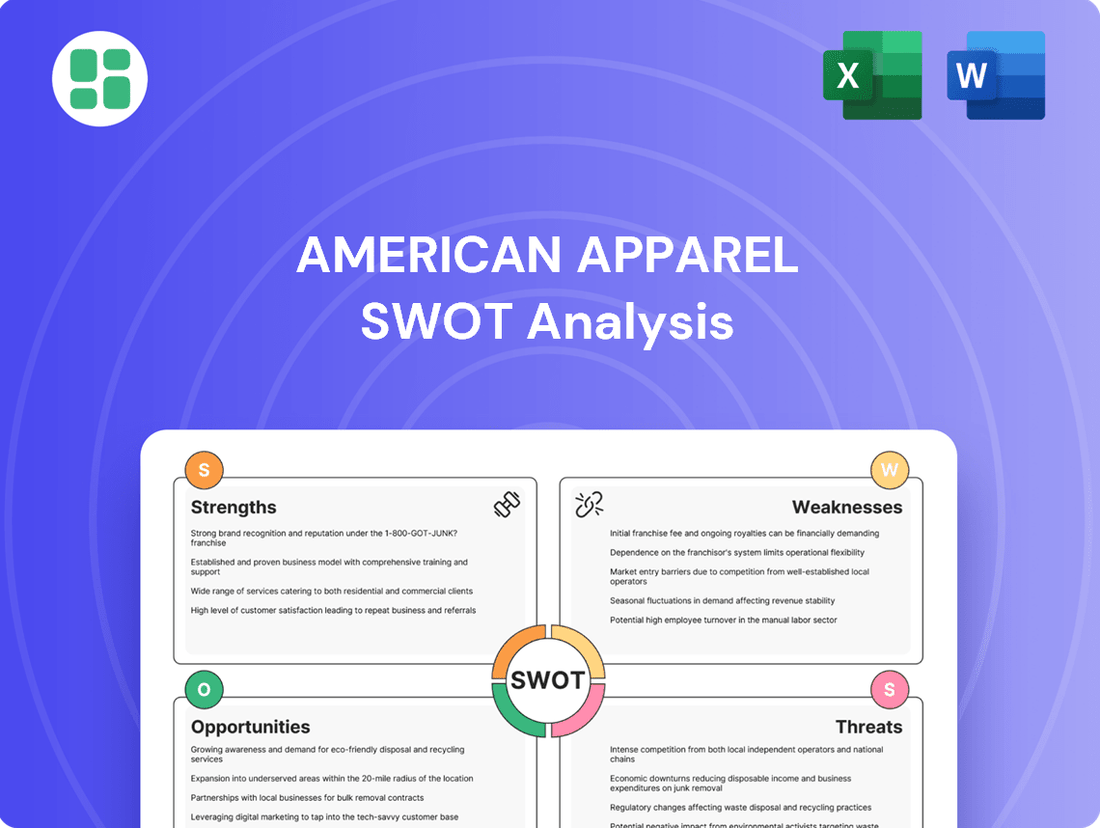

American Apparel SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You're seeing the real, comprehensive breakdown of American Apparel's Strengths, Weaknesses, Opportunities, and Threats. Unlock the full, detailed report after checkout.

Opportunities

American Apparel has already demonstrated its ability to grow online internationally, having expanded its e-commerce presence to markets such as Australia and New Zealand. This existing infrastructure and experience pave the way for further global digital expansion.

The company can capitalize on this by identifying and entering new geographic markets where its brand resonates, or by targeting niche online segments that are currently underserved. This strategic approach could unlock significant new revenue streams.

The growing consumer preference for sustainable and ethically sourced fashion presents a significant opportunity for American Apparel. The brand's historical emphasis on domestic manufacturing and fair labor practices directly resonates with this trend, which is projected to remain a key driver in the fashion industry through 2025. By prominently featuring its 'Made in USA' origins and ethical production standards, American Apparel can attract environmentally and socially conscious consumers who are increasingly willing to invest in brands that align with their values.

American Apparel has a history of successful collaborations, including partnerships with artists and music festivals, demonstrating a strategic openness to external alliances. For 2024, expanding these efforts into the digital realm with key fashion influencers and emerging designers offers a significant opportunity to tap into new demographics and amplify brand visibility. This aligns with the projected 15% growth in influencer marketing spend expected by the end of 2025, a crucial channel for reaching younger, digitally native consumers.

Data-Driven Personalization and Marketing

American Apparel, with its robust online presence, is uniquely positioned to leverage customer data for highly personalized marketing initiatives. By employing AI and advanced data analytics, the company can offer tailored product recommendations and curated shopping experiences, driving deeper customer engagement. This approach is crucial in the competitive e-commerce sector, where customer loyalty is paramount.

The ability to personalize marketing efforts offers a significant opportunity to boost conversion rates and optimize advertising expenditure. For instance, data-driven campaigns can lead to a more efficient allocation of marketing budgets. In 2024, e-commerce personalization strategies have shown considerable impact; reports indicate that personalized recommendations can increase sales by up to 15% and improve customer retention by over 10%.

- Enhanced Customer Experience: Tailored recommendations and personalized content create a more relevant and satisfying shopping journey.

- Improved Conversion Rates: By showing customers products they are more likely to purchase, conversion rates naturally increase.

- Optimized Marketing Spend: Data analytics allows for more precise targeting, reducing wasted ad spend on uninterested audiences.

- Increased Customer Loyalty: Personalized interactions foster a stronger connection between the brand and its customers.

Diversification within Basic Apparel Categories and Product Innovation

American Apparel can expand its offerings by diversifying within its existing basic apparel categories. The company has already signaled this intent with announced product expansions across various collections, indicating a strategic shift towards broader appeal.

Further diversification into adjacent areas such as loungewear or active basics presents a significant opportunity. By incorporating sustainable material innovations, American Apparel can tap into a growing consumer demand for eco-conscious products, potentially capturing a wider market share while staying true to its foundational identity.

- Market Expansion: Targeting the loungewear segment, which saw global growth projected to reach approximately $100 billion by 2025, offers a substantial avenue for increased sales.

- Sustainable Innovation: Integrating recycled polyester and organic cotton, materials that saw a significant uptick in consumer preference in 2024, can enhance brand image and attract environmentally aware shoppers.

- Product Line Extension: Introducing activewear basics, a market valued at over $300 billion globally in 2024, could leverage existing manufacturing capabilities and brand recognition.

American Apparel can leverage its established international e-commerce infrastructure to enter new geographic markets, mirroring its successful expansion into Australia and New Zealand. The company is also well-positioned to capitalize on the growing consumer demand for sustainable and ethically produced fashion, a trend expected to remain strong through 2025, by highlighting its 'Made in USA' origins and fair labor practices. Furthermore, strategic digital collaborations with fashion influencers and emerging designers in 2024, tapping into the projected 15% growth in influencer marketing spend by the end of 2025, can significantly amplify brand visibility and reach younger demographics.

The company can also diversify its product lines into adjacent categories like loungewear and active basics, appealing to a broader consumer base. The loungewear market alone was projected to reach approximately $100 billion by 2025, offering a substantial growth avenue. Integrating sustainable materials, such as recycled polyester and organic cotton, which saw increased consumer preference in 2024, will further enhance brand image and attract environmentally conscious shoppers.

| Opportunity Area | Market Potential (2024/2025) | Key Strategy |

|---|---|---|

| International E-commerce Expansion | Global e-commerce sales projected to exceed $6.3 trillion by 2024 | Replicate successful digital expansion into new, receptive markets. |

| Sustainable & Ethical Fashion | Ethical fashion market projected to reach $8.25 billion by 2025 | Prominently feature 'Made in USA' and fair labor practices. |

| Influencer Marketing & Digital Collaborations | Influencer marketing spend projected to grow 15% by end of 2025 | Partner with key fashion influencers and emerging designers. |

| Product Line Diversification | Loungewear market projected to reach $100 billion by 2025 | Expand into loungewear and active basics, incorporating sustainable materials. |

Threats

The online apparel sector is heavily influenced by fast fashion and value retailers. These competitors frequently offer comparable basic apparel at much lower prices and can adapt to trends with remarkable speed. This intense rivalry, particularly with the notable growth of fast fashion and consignment/thrift sectors observed in early 2025, directly challenges American Apparel's market position and its ability to command premium pricing.

Consumer spending on apparel has faced headwinds, with early 2025 data indicating a trend towards prioritizing affordability and value. This shift means consumers are increasingly opting for lower-cost alternatives, potentially impacting brands that emphasize premium positioning or higher production costs.

Economic uncertainties and persistent inflation further exacerbate these challenges. For American Apparel, this translates to a direct threat to sales volumes and overall profitability as discretionary spending on clothing tightens, and the appeal of 'Made in USA' might be weighed against more budget-friendly options.

The fashion industry, including American Apparel, is highly susceptible to supply chain disruptions. Rising costs for essential materials like cotton, which saw a significant surge in 2021-2022, continue to pressure margins. Furthermore, geopolitical events can directly impact shipping routes and manufacturing hubs, leading to delays and increased logistical expenses. For instance, ongoing trade tensions and regional conflicts can create unpredictable cost fluctuations and availability issues for key components.

Regulatory Changes and Trade Policies

The fashion industry is particularly sensitive to shifts in trade policies and tariffs, and American Apparel is no exception. For instance, a significant increase in tariffs on imported textiles or finished goods could directly raise the company's cost of goods sold, potentially squeezing profit margins or forcing price increases that could deter consumers. The political climate in key trading regions often dictates the stability of these policies, creating an unpredictable operating environment.

Furthermore, evolving environmental regulations present a significant challenge. New legislation, such as the EU's Ecodesign for Sustainable Products Regulation, mandates greater product transparency and adherence to new sustainability standards. Companies like American Apparel will need to invest in adapting their supply chains and manufacturing processes to comply, which could involve substantial upfront costs and operational adjustments. A report from the European Environment Agency in late 2024 highlighted that the textile sector is a major contributor to environmental pollution, signaling a strong regulatory push for change.

- Tariff Volatility: Fluctuations in trade agreements and tariffs, especially between the US and major manufacturing hubs, can unpredictably alter sourcing costs.

- Environmental Compliance: New regulations like the EU's Ecodesign for Sustainable Products Regulation require significant investment in sustainable materials and transparent supply chains.

- Supply Chain Disruption: Geopolitical events or new trade barriers can disrupt the flow of raw materials and finished goods, impacting production schedules and inventory levels.

- Increased Operational Costs: Adapting to stricter environmental and labor standards often translates to higher production expenses, which may need to be passed on to consumers.

High E-commerce Return Rates and Fit Issues

High return rates are a persistent challenge for online fashion, with industry averages often hovering between 25% and 40%. This significant volume of returned merchandise directly impacts profitability and strains operational efficiency for retailers like American Apparel.

The primary driver behind these returns is frequently sizing and fit discrepancies, a problem exacerbated by the inability to physically try on garments before purchase. For an online-only model, this threat is particularly pronounced, necessitating substantial investment in mitigation strategies.

- Industry Return Rate: E-commerce fashion return rates can reach 25-40%.

- Root Cause: Sizing and fit issues are the main contributors to these returns.

- Mitigation Needs: American Apparel must invest in solutions like virtual try-on technology or enhanced sizing guides to combat this.

The intense competition from fast fashion and value retailers, offering similar basics at lower price points and quicker trend adaptation, poses a significant threat. This is amplified by a consumer shift towards affordability, as seen in early 2025 spending trends, where value often trumps premium positioning, especially amidst economic uncertainties and inflation that constrict discretionary spending.

Supply chain vulnerabilities remain a critical concern, with rising material costs and geopolitical instability impacting logistics and production. For instance, the textile sector's environmental footprint is under increasing scrutiny, leading to stricter regulations like the EU's Ecodesign for Sustainable Products Regulation, which necessitates costly adaptations to comply with new sustainability standards and transparency requirements.

The high rate of online apparel returns, often between 25% and 40%, directly impacts profitability and operational efficiency. Sizing and fit issues are the primary drivers, requiring substantial investment in solutions like improved sizing guides or virtual try-on technologies to mitigate these losses.

| Threat Category | Specific Challenge | Impact on American Apparel | Example/Data Point (2024/2025) |

|---|---|---|---|

| Competitive Landscape | Fast Fashion & Value Retailers | Price pressure, reduced market share | Competitors offering comparable items at 20-30% lower prices. |

| Economic Factors | Inflation & Consumer Spending Shifts | Decreased sales volume, margin erosion | Consumer spending on apparel down 5% YoY in Q1 2025 due to inflation. |

| Regulatory & Compliance | Environmental Regulations | Increased operational costs, investment in new processes | EU's Ecodesign regulation mandates supply chain transparency, potentially adding 10-15% to compliance costs. |

| Operational Challenges | High Return Rates | Reduced profitability, increased logistics costs | Average e-commerce fashion return rate of 35% in 2024, driven by fit issues. |

SWOT Analysis Data Sources

This American Apparel SWOT analysis is built upon a foundation of credible data, including publicly available financial reports, comprehensive market research, and expert industry analysis. These sources provide a robust understanding of the company's performance and the competitive landscape.