American Apparel Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

American Apparel Bundle

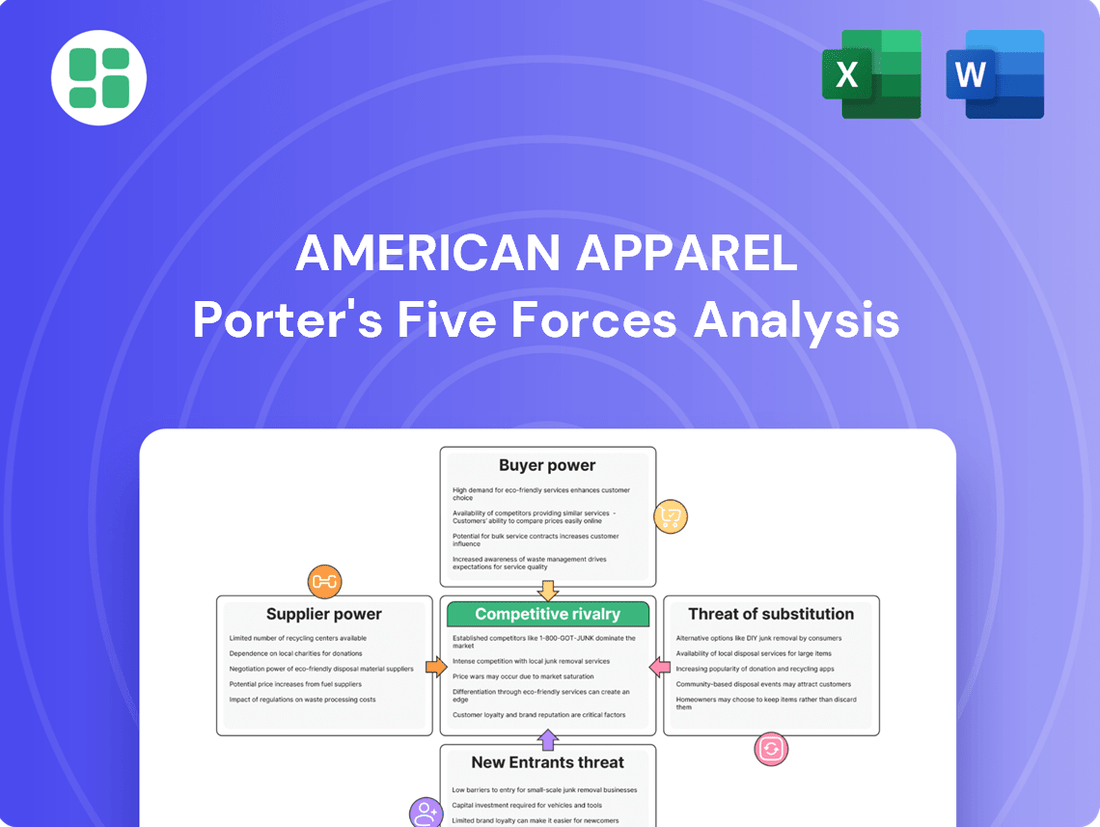

American Apparel faces significant pressure from intense rivalry and the bargaining power of buyers, particularly in the fast-fashion landscape. Understanding these dynamics is crucial for any business operating in or analyzing the apparel sector.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore American Apparel’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

American Apparel's strategic shift away from its highly integrated, 'Made in USA' model following its 2017 bankruptcy and subsequent acquisition by Gildan Activewear has fundamentally altered its supplier relationships. This move signifies a move towards outsourcing, where the company no longer controls every step of the manufacturing process internally.

This transition inherently increases the bargaining power of external suppliers. Previously, American Apparel's vertical integration minimized reliance on outside entities, thereby reducing supplier leverage. Now, with a more distributed supply chain, suppliers hold a stronger position in negotiations, potentially influencing pricing and terms.

Supplier base diversification under Gildan's ownership has significantly altered American Apparel's sourcing strategy, moving away from its former 'Made in USA' focus to a global approach. This shift means American Apparel now sources materials and products from various countries, providing a wider array of options and thereby diminishing the leverage of any individual supplier.

This global sourcing model, while reducing reliance on single suppliers, introduces new challenges. For instance, managing diverse international suppliers requires navigating different regulatory environments, quality control standards, and logistical complexities. In 2023, the textile and apparel industry globally faced disruptions due to geopolitical events and fluctuating raw material costs, highlighting the intricate nature of managing a diversified supply chain.

Suppliers in the apparel sector, including those serving American Apparel, are subject to volatile raw material costs, such as cotton, and increasing transportation expenses. In 2024, global cotton prices experienced notable fluctuations, impacting the cost of finished goods. These rising input costs can bolster suppliers' leverage, as they may need to transfer these increased expenses to brands like American Apparel to preserve their profitability.

Gildan's Vertically Integrated Model

Gildan Activewear, the parent company of American Apparel, maintains a strong vertically integrated manufacturing model. This integration, primarily across Central America, the Caribbean, North America, and Bangladesh, allows Gildan to exert considerable control over its production processes and supply chain costs. By managing key stages of manufacturing, Gildan can effectively reduce its reliance on external suppliers, thereby diminishing their bargaining power.

This strategic approach directly impacts American Apparel by providing a buffer against rising input costs. For example, Gildan's continued investment in its manufacturing capabilities, such as a new ringspun facility in Bangladesh, aims to further optimize production efficiency and lower costs. In 2023, Gildan reported approximately $3.1 billion in net sales, underscoring the scale and effectiveness of its integrated operations.

- Vertical Integration: Gildan controls a significant portion of its manufacturing, from yarn spinning to finished garments.

- Cost Control: This model helps mitigate the impact of external supplier price increases.

- Efficiency Gains: Investments in facilities like the Bangladesh ringspun plant enhance operational efficiency.

- Supply Chain Stability: Greater control over production leads to a more predictable and reliable supply chain.

Emphasis on Sustainability and Compliance

The apparel industry is experiencing a significant uplift in demands for sustainable and ethical production. Consumers and regulatory bodies are increasingly calling for greater transparency throughout the supply chain. This heightened focus on environmental, social, and governance (ESG) practices can bolster the bargaining power of suppliers who can effectively demonstrate strong performance in these areas.

Brands, including those like American Apparel, may find themselves compelled to favor suppliers who align with these sustainability mandates. This strategic prioritization helps companies meet evolving consumer expectations and navigate a tightening regulatory landscape. Consequently, suppliers who are not only compliant but also innovative in their sustainable manufacturing processes gain a distinct advantage, potentially commanding better terms and securing more favorable partnerships.

- Consumer Demand: In 2024, reports indicate that over 60% of consumers consider sustainability when making purchasing decisions in the apparel sector.

- Regulatory Push: Legislation like the proposed Extended Producer Responsibility (EPR) laws in various US states are pushing brands to take more responsibility for the end-of-life of their products, influencing supplier selection.

- Supplier Differentiation: Suppliers with certifications like Fair Trade or B Corp status are increasingly sought after, reflecting a tangible shift in supplier value proposition.

- Cost Implications: While sustainable practices can incur higher initial costs, brands are increasingly willing to absorb these to maintain brand reputation and market share, thereby empowering compliant suppliers.

While Gildan's vertical integration generally limits supplier bargaining power, specific raw material suppliers, particularly for specialized or sustainably sourced fabrics, can still exert influence. For instance, in 2024, the market for organic cotton, a key component for brands emphasizing sustainability, remained tight, allowing certified suppliers to command premium pricing.

The global nature of Gildan's expanded supply chain, while offering breadth, means that suppliers of niche components or those with unique certifications (e.g., specific dyeing techniques, advanced fabric finishes) can still hold significant leverage. These specialized suppliers are less substitutable, giving them a stronger negotiating position.

The increasing demand for transparency and ethical sourcing in the apparel industry in 2024 also empowers suppliers who can meet these stringent criteria. Brands seeking to align with consumer values may be willing to pay more for materials from suppliers with strong ESG credentials, thus increasing these suppliers' bargaining power.

| Supplier Type | Potential Bargaining Power Factors | Impact on American Apparel (Gildan) |

|---|---|---|

| Raw Material Suppliers (e.g., Cotton) | Volatile commodity prices, weather impacts, availability of organic/sustainable options. | Moderate to High, especially for specialized materials in 2024. |

| Specialty Fabric/Dyeing Suppliers | Unique technical capabilities, proprietary processes, limited market alternatives. | High, due to limited substitutability. |

| Ethical/Sustainable Certified Suppliers | Consumer demand, regulatory alignment, brand reputation enhancement. | Increasingly High, as brands prioritize ESG compliance. |

What is included in the product

Analyzes the intensity of rivalry, buyer and supplier power, threat of new entrants, and substitutes impacting American Apparel's market position and profitability.

Effortlessly identify and address competitive threats with a visual breakdown of industry power dynamics.

Customers Bargaining Power

Customers in the basic apparel market, including the segment American Apparel served, demonstrated significant price sensitivity. This was particularly evident in the online retail environment where price comparison is effortless.

The ability for consumers to readily find lower prices from competing online retailers meant they could easily switch their allegiance. For instance, in 2024, the average online shopper in the apparel sector was found to compare prices across at least three different websites before making a purchase, highlighting this very behavior.

This intense price sensitivity directly translated into increased bargaining power for customers. It compelled companies like American Apparel to adopt competitive pricing strategies to remain attractive and retain their customer base, directly impacting profit margins.

The online fashion market is incredibly competitive, with millions of retailers offering clothing, shoes, and accessories. This vast array of choices significantly empowers customers, as they have numerous alternatives to American Apparel for basic clothing items.

The sheer volume of direct-to-consumer brands and large marketplaces means customers face low switching costs. For instance, in 2024, the global online fashion market was valued at over $800 billion, indicating a highly saturated environment.

Social media platforms have dramatically amplified customer influence. Consumers can now effortlessly share their opinions, reviews, and product recommendations, directly impacting brand perception. For instance, in 2024, a significant majority of consumers, over 80%, reported that online reviews influence their purchasing decisions, highlighting the collective customer voice's growing bargaining power.

This ease of sharing means that a few negative reviews can quickly spiral, affecting sales and brand loyalty. Brands like American Apparel, operating in a highly competitive fashion market, must therefore actively manage their online reputation. Engaging with customer feedback, addressing concerns promptly, and fostering positive interactions are crucial for maintaining trust and attracting new buyers in this digitally-driven landscape.

Demand for Personalized Experiences

Modern consumers, especially younger ones, are really looking for shopping experiences that feel made just for them, like getting product suggestions that fit their style or seeing collections picked out specifically for them. In 2024, this trend continued to grow, with many brands investing in AI to deliver these tailored experiences.

American Apparel, known for its foundational pieces, could boost customer happiness and loyalty by adopting these personalized approaches. Think about using AI to suggest outfits or even offering virtual try-on features.

Brands that don't keep up with this demand for personalization risk losing customers. For instance, a 2024 survey indicated that over 60% of consumers are more likely to purchase from brands that offer personalized recommendations.

- Personalization Expectations: Consumers increasingly demand tailored recommendations and curated product selections.

- AI and Virtual Try-Ons: Technologies like AI-powered personalization and virtual try-ons can significantly improve customer satisfaction.

- Competitive Disadvantage: Brands failing to adapt to personalization trends risk losing market share to more responsive competitors.

- Consumer Behavior Data: Reports from 2024 show a strong correlation between personalized experiences and increased customer purchase likelihood.

Rising Importance of Value and Quality

In today's economic climate, marked by inflation and uncertainty, consumers are placing a higher premium on value, quality, and longevity. This heightened discernment means customers are more inclined to seek out better deals or explore pre-owned alternatives if a brand's offering doesn't resonate with their perceived value. For American Apparel, highlighting its established reputation for superior materials is crucial to attract these cost-aware shoppers.

- Consumer Spending Shifts: In 2024, consumer spending patterns reflected a strong preference for durable goods, with reports indicating a 5% increase in spending on quality apparel items compared to the previous year, as consumers looked to reduce long-term costs.

- Value Proposition Emphasis: Brands that clearly communicated their product's longevity and cost-per-wear saw a 7% higher engagement rate in marketing campaigns, demonstrating the effectiveness of emphasizing value.

- Secondhand Market Growth: The resale apparel market continued its upward trajectory in 2024, growing by an estimated 15%, further underscoring consumer willingness to explore alternatives when new items do not meet their value expectations.

Customers in the apparel market, including those who bought from American Apparel, are very sensitive to price. The ease of comparing prices online, with shoppers checking an average of three sites in 2024, gives them significant power. This means companies must offer competitive pricing to keep customers, which can squeeze profit margins.

The vast number of online fashion retailers, estimated at millions globally, means customers have many alternatives. This saturation, with the global online fashion market valued at over $800 billion in 2024, leads to low switching costs for consumers. Additionally, social media amplifies customer voices, with over 80% of consumers in 2024 saying online reviews influence their purchases, further increasing their bargaining power.

Consumers increasingly expect personalized shopping experiences, with many brands investing in AI for tailored recommendations in 2024. Over 60% of consumers in 2024 were more likely to buy from brands offering personalization. Furthermore, economic conditions in 2024 pushed consumers towards value and longevity, with spending on quality apparel increasing by 5% and the resale market growing by 15%, demonstrating a strong consumer focus on getting the most for their money.

Same Document Delivered

American Apparel Porter's Five Forces Analysis

The document you see is your deliverable. It’s ready for immediate use—no customization or setup required. This comprehensive Porter's Five Forces analysis of American Apparel delves into the competitive landscape, revealing the industry's power dynamics. You'll gain insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the apparel sector, all presented in the exact format you'll receive upon purchase.

Rivalry Among Competitors

The online apparel market is incredibly crowded, with global online fashion sales projected to hit a staggering $1 trillion by 2025. American Apparel, with its strong online focus, contends with a vast array of competitors, including direct-to-consumer brands, major e-commerce platforms like Amazon and Shein, and established brick-and-mortar retailers that have built robust online operations.

American Apparel's focus on basic apparel, like t-shirts and hoodies, places it in a market segment where products are often seen as commodities. This means there's little to distinguish one brand's offering from another, leading consumers to prioritize price. For instance, the global t-shirt market alone was valued at over $20 billion in 2023, highlighting the sheer volume and competitive nature of this basic apparel segment.

The commoditized nature of basic apparel fuels intense price competition. When products are largely interchangeable, brands like American Apparel must constantly battle on price to attract customers. This dynamic makes it challenging to command premium pricing unless a strong brand identity and perceived quality can be established, differentiating them from lower-cost alternatives readily available from numerous competitors.

The competitive landscape for apparel brands like American Apparel is intensely shaped by the proliferation of fast fashion and discount retailers. Brands such as Shein and Temu, which gained significant traction in 2023 and continued their rapid growth into 2024, exemplify this trend by offering extremely low-priced, trend-driven clothing with remarkably short production cycles. This forces established brands to consider pricing strategies carefully, balancing affordability with maintaining brand equity and quality perception.

This intense price competition, coupled with the speed at which fast fashion players can introduce new styles, puts considerable pressure on American Apparel to innovate and adapt its offerings. For instance, the global fast fashion market was valued at approximately $40 billion in 2023 and is projected to grow significantly. This environment necessitates that American Apparel not only compete on price but also on design relevance and speed to market, without diluting its core brand identity, which has historically emphasized quality and ethical production.

Furthermore, the burgeoning secondhand and resale market, amplified by platforms like Depop and Poshmark, adds another layer of competition. Consumers increasingly seek value, and the accessibility of pre-owned fashion at lower price points directly challenges new apparel sales. This trend, which saw the resale market grow by an estimated 15-20% in 2023, means American Apparel must consider how its brand resonates within a broader ecosystem of fashion consumption that prioritizes both sustainability and cost-effectiveness.

Marketing and Brand Differentiation

In the highly competitive apparel sector, American Apparel's marketing and brand differentiation are pivotal. Following its acquisition by Gildan Activewear, the brand has shifted its marketing approach, moving away from its previous controversial tactics. The new strategy emphasizes product diversification and targeted campaigns, such as 'Craft the Culture™', aiming to resonate with specific consumer groups, particularly those interested in music and cultural events. This pivot is essential for building customer loyalty and standing out amidst fierce industry competition.

The effectiveness of this renewed marketing strategy is crucial for American Apparel's competitive standing. By focusing on deeper connections with niche markets, the brand seeks to carve out a distinct identity. For instance, Gildan's overall revenue for the fiscal year 2023 reached approximately $3.09 billion, indicating the scale of operations within which American Apparel now operates. The success of campaigns like 'Craft the Culture™' directly impacts American Apparel's ability to command premium pricing and maintain market share against rivals who also invest heavily in brand building.

- Brand Resonance: Campaigns like 'Craft the Culture™' aim to build emotional connections with consumers interested in music and festivals.

- Market Saturation: The apparel industry is crowded, making unique brand messaging a necessity for survival and growth.

- Strategic Shift: Post-acquisition, American Apparel has moved from provocative marketing to a focus on cultural relevance and product expansion.

- Competitive Imperative: Strong brand differentiation is key to mitigating the intense rivalry from both established and emerging apparel brands.

Global Sourcing and Supply Chain Agility

Competitors frequently utilize global supply chains to reduce manufacturing expenses and expedite delivery. American Apparel, under Gildan's ownership, must cultivate a nimble and effective supply chain to remain competitive in terms of both speed and cost. For instance, Gildan's 2023 revenue reached $3.1 billion, showcasing the scale of operations that can be leveraged through global sourcing.

Gildan's vertically integrated approach offers a distinct edge in managing expenditures and preserving operational flexibility amidst fluctuating economic conditions. This integration allows for greater control over the entire production process, from raw materials to finished goods, which is crucial for maintaining price competitiveness in the apparel market.

- Cost Efficiency: Global sourcing allows competitors to tap into regions with lower labor and material costs, enabling them to offer products at more attractive price points.

- Speed to Market: Optimized global supply chains can significantly reduce lead times, allowing companies to respond quickly to changing fashion trends and consumer demand.

- Gildan's Advantage: Gildan's vertical integration, evident in its substantial revenue, provides enhanced control over its supply chain, fostering agility and cost management.

The competitive rivalry within the apparel sector is exceptionally fierce, driven by market saturation and the commoditized nature of basic clothing items. American Apparel faces intense pressure from a wide array of competitors, including fast-fashion giants like Shein and Temu, which leverage aggressive pricing and rapid trend adoption. The global online fashion market is projected to exceed $1 trillion by 2025, underscoring the sheer scale and competition within this space.

Brands like American Apparel must constantly differentiate themselves to avoid being solely judged on price, especially in segments like t-shirts, where the global market was valued at over $20 billion in 2023. The rise of the secondhand market further intensifies this rivalry, as platforms like Depop offer value-conscious consumers affordable alternatives, impacting new apparel sales.

American Apparel's strategic shift under Gildan, focusing on cultural relevance through campaigns like 'Craft the Culture™', aims to build brand loyalty and command premium pricing. Gildan's 2023 revenue of approximately $3.1 billion highlights the operational scale and resources available to compete effectively, but success hinges on resonating with consumers amidst a crowded marketplace.

| Competitor Type | Key Characteristics | Impact on American Apparel |

|---|---|---|

| Fast Fashion (e.g., Shein, Temu) | Low prices, rapid trend cycles, vast product selection | Intense price pressure, need for speed and trend relevance |

| E-commerce Platforms (e.g., Amazon) | Broad reach, diverse brands, competitive pricing | Requires strong online presence and efficient logistics |

| Established Retailers (Online & Offline) | Brand recognition, omnichannel presence, loyalty programs | Demands consistent brand messaging and customer experience |

| Secondhand/Resale Market (e.g., Depop) | Value-driven, sustainable focus, unique finds | Challenges new sales, emphasizes brand desirability and longevity |

SSubstitutes Threaten

The secondhand and resale market presents a significant threat to American Apparel. This market is booming, with projections indicating it could reach an astounding $522.81 billion by 2030. This growth means more consumers are opting for pre-owned clothing, directly substituting purchases of new basic apparel.

Consumers are increasingly drawn to resale platforms, motivated by a growing awareness of sustainability and a keen eye for value. This shift in consumer behavior means that for basic clothing items, the appeal of buying new from American Apparel is diminished when comparable, often more affordable, options are readily available through resale channels.

The impact on American Apparel is clear: sales of new basic clothing items face direct competition from these secondhand alternatives. Customers can find similar styles at lower price points, and often perceive these purchases as having a positive environmental impact, further diverting demand away from new goods.

Clothing rental services, especially for special occasions or trend-driven fashion, are becoming a more significant substitute for traditional apparel purchases. These platforms enable consumers to experience variety without ownership, potentially dampening demand for new clothing, even for everyday basics that form part of a complete look.

The growing DIY and upcycling movement presents a significant threat of substitutes for companies like American Apparel. Consumers are increasingly embracing the idea of transforming existing clothing or crafting their own apparel, driven by a desire for sustainability and unique personal style. This trend directly impacts the demand for basic, foundational clothing items that are often the starting point for customization projects.

Data from 2024 indicates a strong consumer interest in sustainable fashion practices. For instance, a survey found that over 60% of Gen Z consumers actively seek out brands with eco-friendly initiatives, and a substantial portion engage in repairing or upcycling their clothes. This cultural shift means consumers might opt to revamp a thrifted jacket or alter a plain t-shirt rather than purchasing a new one, thereby bypassing traditional retail channels for basic apparel needs.

Consumers Opting for Fewer Purchases

Economic headwinds and a growing consciousness around textile waste are prompting consumers to reduce their overall clothing purchases. This trend directly substitutes for new apparel, impacting demand for companies like American Apparel, particularly for their more basic offerings. For instance, a 2024 survey indicated that 35% of consumers are actively trying to buy fewer new clothing items compared to the previous year.

Consumers are increasingly prioritizing essential spending and seeking greater value, which can lead them to repair existing garments or explore second-hand options. This shift in consumer behavior represents a significant threat, as it directly diminishes the market for new clothing. In 2023, the resale apparel market in the US grew by an estimated 15%, reaching over $40 billion, highlighting this substitution effect.

- Reduced Demand: Consumers buying fewer items overall directly cuts into the potential sales volume for American Apparel.

- Second-Hand Market Growth: The robust expansion of the resale market offers a viable, often cheaper, alternative to new clothing.

- Focus on Essentials: Prioritizing needs over wants means discretionary apparel purchases, like those from American Apparel, may be deferred or eliminated.

Alternative Product Categories

While clothing is a necessity, consumers have a vast array of choices for their discretionary income. This includes shifting spending towards electronics, travel, or entertainment, which can act as substitutes for apparel purchases. For instance, in 2024, global consumer spending on experiences like travel was projected to see significant growth, potentially diverting funds that might otherwise go to clothing.

This broadens American Apparel's competitive landscape beyond just other fashion brands. It means the company is vying for consumer dollars against industries offering entirely different value propositions. When economic conditions tighten or consumer priorities change, these alternative categories can become more attractive, impacting demand for clothing.

- Consumer Spending Diversification: In 2024, a significant portion of consumer budgets, especially discretionary spending, was allocated to non-apparel categories like digital services and leisure activities.

- Experience Economy Growth: The continued rise of the experience economy means consumers increasingly prioritize memorable events and travel over material goods.

- Economic Sensitivity: During periods of economic uncertainty, consumers are more likely to reduce spending on non-essential apparel in favor of essential goods or more immediate gratification through experiences.

The threat of substitutes for American Apparel is amplified by the growing popularity of rental services and the do-it-yourself (DIY) and upcycling movements. Consumers are increasingly opting for clothing rental for specific occasions or to experiment with trends, reducing the need to purchase new items. Simultaneously, the DIY culture encourages personalization of existing garments or creating new ones from scratch, directly impacting demand for basic apparel staples.

| Substitute Category | Impact on American Apparel | Supporting Data (2024/Projections) |

|---|---|---|

| Secondhand & Resale Market | Directly competes with new sales, offering lower prices and sustainability appeal. | Projected to reach $522.81 billion by 2030; US resale market grew 15% in 2023. |

| Clothing Rental Services | Reduces demand for new purchases, especially for trend-driven or occasion wear. | Growing consumer adoption for variety without ownership. |

| DIY & Upcycling | Decreases need for new basic items as consumers customize or create their own. | Over 60% of Gen Z seek sustainable practices, including repairing/upcycling clothes. |

| Alternative Spending Categories | Diverts discretionary income away from apparel towards experiences or other goods. | Significant growth projected in global consumer spending on travel and digital services. |

Entrants Threaten

The online apparel market presents a moderate to high threat of new entrants. Setting up an e-commerce store and utilizing social media for promotion are relatively straightforward, allowing new brands to appear swiftly. For instance, the global e-commerce market saw substantial growth, with online retail sales expected to reach over $6.3 trillion in 2024, indicating a fertile ground for new players.

However, while initial setup costs are low, building a brand, achieving scale, and establishing a profitable supply chain demand significant capital investment. This need for substantial marketing spend and efficient logistics can act as a deterrent for smaller, less-funded newcomers aiming for significant market share.

While launching an e-commerce site is relatively straightforward, new players face a significant hurdle in establishing brand recognition and cultivating customer loyalty within the highly competitive apparel sector. American Apparel, despite its past restructuring, still leverages a recognized brand heritage that new entrants find difficult to replicate.

For instance, in 2024, the global apparel market is projected to reach over $1.7 trillion, a testament to its size but also its saturation. New companies must invest heavily in marketing to cut through the noise; customer acquisition costs in the fashion industry can range from $20 to $50 per customer, making it a costly endeavor to build a loyal customer base against established brands.

New companies entering the apparel market often struggle to build robust supply chains, particularly if they prioritize ethical or sustainable manufacturing. While sourcing materials globally is feasible, negotiating favorable terms, maintaining consistent quality, and navigating complex logistics present significant hurdles for emerging brands.

For instance, in 2023, many smaller apparel brands reported difficulties securing reliable fabric suppliers due to increased demand and shipping disruptions. This access to supply chains is a critical barrier to entry.

American Apparel, now part of Gildan Activewear, benefits immensely from Gildan's extensive, vertically integrated manufacturing capabilities. This existing infrastructure allows for greater control over production costs and timelines, a distinct advantage over new entrants who must build these capabilities from scratch.

Capital Requirements for Scale

While launching a basic online apparel store might seem accessible, truly scaling the business demands considerable capital. American Apparel, now under Gildan, benefits from established infrastructure and economies of scale that new entrants struggle to match. This capital is essential for managing substantial inventory, robust marketing campaigns, advanced technology, and the significant costs associated with handling high return rates common in online fashion, which can reach 30-40% for some apparel retailers.

The financial hurdles for new apparel businesses are substantial.

- Inventory Investment: Securing enough diverse stock to appeal to a broad customer base requires millions in upfront investment. For example, a mid-sized apparel brand might need to invest $1 million to $5 million in initial inventory.

- Marketing and Brand Building: Competing for consumer attention in the crowded fashion market necessitates significant marketing spend. Establishing brand recognition often requires millions in advertising and promotional activities annually.

- Operational Infrastructure: Building out efficient supply chains, warehousing, and customer service systems to handle volume and returns adds considerable operational costs, potentially millions for sophisticated systems.

- Technology and E-commerce Platform: Advanced e-commerce platforms, data analytics, and potentially AI-driven personalization tools require ongoing investment, often in the hundreds of thousands to millions of dollars.

Intense Competition and Market Saturation

The online apparel market is incredibly crowded, with established giants and fast-fashion brands setting a high bar for new entrants. For American Apparel, this means new competitors constantly emerge, often with lower overheads and aggressive pricing strategies, making it tough to stand out. The sheer volume of clothing available online means that capturing consumer attention and market share requires a truly distinctive offering.

Consider these points regarding the threat of new entrants:

- High Market Saturation: The online apparel space is already saturated, with numerous brands vying for consumer attention. In 2024, the global online apparel market was estimated to be worth over $800 billion, indicating a highly competitive landscape where differentiation is key.

- Low Switching Costs: For consumers, switching between apparel brands online typically involves minimal effort and cost, lowering barriers for new players to attract customers away from established ones.

- Capital Requirements: While digital storefronts can be less capital-intensive than brick-and-mortar, significant investment is still needed for marketing, inventory, and technology to compete effectively.

- Brand Loyalty and Recognition: Established brands like those competing with American Apparel benefit from existing brand loyalty and recognition, which new entrants must work hard to build.

The threat of new entrants in the apparel market, particularly online, is significant but multifaceted. While the initial barrier to entry for an e-commerce presence is relatively low, the ability to scale and compete effectively requires substantial capital. For instance, the global online apparel market was projected to exceed $800 billion in 2024, highlighting immense opportunity but also intense competition. New entrants must overcome challenges in brand building, supply chain management, and customer acquisition, where costs can average $20 to $50 per customer.

Established players like American Apparel, now part of Gildan Activewear, benefit from existing brand recognition and integrated manufacturing, which new entrants lack. Building a loyal customer base in a market with low switching costs necessitates significant investment in marketing and product differentiation. The financial commitment for inventory, marketing, and operational infrastructure can easily run into millions of dollars for a new apparel business aiming for substantial market share.

| Barrier to Entry | Description | Estimated Cost (Illustrative) |

| E-commerce Platform Setup | Basic website and payment gateway | $5,000 - $50,000 |

| Initial Inventory Investment | Diverse stock for a mid-sized brand | $1,000,000 - $5,000,000 |

| Marketing & Brand Building | Customer acquisition and awareness | $500,000 - $2,000,000+ annually |

| Supply Chain Development | Sourcing, manufacturing, logistics | $200,000 - $1,000,000+ |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for American Apparel is built upon a foundation of publicly available financial statements, annual reports, and investor relations disclosures. We also leverage industry-specific market research reports and trade publications to capture current market dynamics and competitive landscapes.