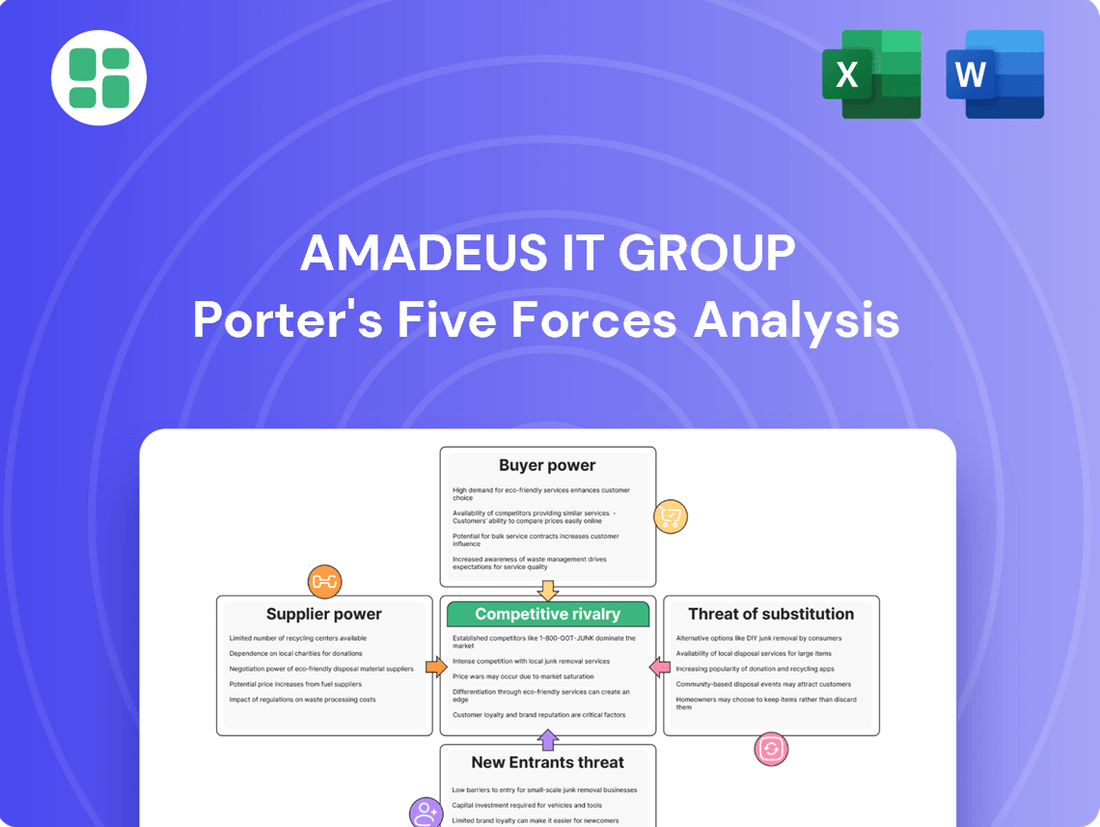

Amadeus IT Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Amadeus IT Group Bundle

Amadeus IT Group operates in a highly competitive landscape, facing significant bargaining power from its airline and travel agency customers. The threat of new entrants, while somewhat mitigated by high switching costs and technological barriers, remains a factor to consider. Understanding these dynamics is crucial for strategic planning.

The complete report reveals the real forces shaping Amadeus IT Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Amadeus IT Group's reliance on proprietary technology and data providers is a key factor in supplier bargaining power. These suppliers offer specialized IT solutions, including advanced analytics, cloud infrastructure, and cybersecurity, which are critical to Amadeus's operations. For instance, in 2024, the global IT services market, which includes these specialized areas, was projected to reach over $1.5 trillion, highlighting the significant scale and value of these suppliers.

The unique nature of these technological offerings and the substantial costs associated with switching vendors can grant these suppliers considerable leverage. As Amadeus operates within an increasingly complex IT landscape, the pool of vendors capable of providing such specialized and often proprietary solutions may be limited. This concentration of expertise can empower suppliers to negotiate more favorable terms, impacting Amadeus's operational costs and flexibility.

Amadeus relies on a diverse range of software and hardware, from critical database systems to powerful servers, to run its global distribution systems and IT solutions. The suppliers of these essential enterprise-grade components, particularly those whose products are industry benchmarks or involve complex integration, can exert moderate bargaining power. For instance, major cloud infrastructure providers or enterprise software giants often hold significant sway due to the critical nature of their offerings and the potential switching costs involved.

Amadeus IT Group, as a technology leader, relies on a workforce of highly skilled engineers, developers, data scientists, and cybersecurity professionals. The intense global demand for these specialized roles means that top talent often commands significant leverage regarding salary, benefits, and working conditions.

Competition for these sought-after individuals from other major technology firms, including those in the cloud computing and artificial intelligence sectors, directly impacts Amadeus's recruitment costs. For instance, in 2024, the average salary for a senior software engineer in the tech industry saw an increase of approximately 8-12% year-over-year in many key markets, a trend that directly affects Amadeus's operational expenses.

Connectivity and Network Infrastructure Providers

The bargaining power of suppliers for connectivity and network infrastructure providers is significant for Amadeus IT Group. Amadeus's operations are fundamentally dependent on reliable, high-speed global network access to process travel bookings and manage data flows. Major telecommunications and cloud service providers, especially those with extensive international networks, can wield considerable influence due to the critical nature of their services.

The reliance on a few key providers for essential network infrastructure means Amadeus has limited alternatives if these suppliers increase prices or reduce service quality. For instance, in 2024, global cloud infrastructure spending was projected to reach over $300 billion, highlighting the market dominance of a few major players. This concentration can translate into higher input costs for Amadeus, directly affecting its operational expenses and profitability.

- Critical Dependence: Amadeus's core business relies on uninterrupted global network connectivity for real-time travel transactions.

- Supplier Concentration: The market for global high-speed networking and cloud services is often dominated by a few large providers.

- Cost Impact: Increases in pricing or service disruptions from these suppliers can directly impact Amadeus's operational efficiency and financial performance.

- Limited Substitutes: Finding readily available, equally reliable, and globally extensive alternative network providers can be challenging for Amadeus.

Payment Processing and Financial Service Providers

Amadeus IT Group relies heavily on payment processing and financial service providers to facilitate its vast number of transactions. These providers, including banks and payment gateways, hold significant bargaining power. This power can manifest through various means, such as setting transaction fees, imposing service charges, or dictating compliance with evolving regulatory frameworks. For instance, in 2023, the global digital payment market was valued at over $10 trillion, highlighting the scale of these operations and the influence of the entities that manage them.

The bargaining power of suppliers in this segment is influenced by several factors:

- Concentration of Suppliers: A limited number of large financial institutions or payment networks can consolidate their power, potentially leading to less favorable terms for Amadeus.

- Switching Costs: High costs associated with changing payment processors or financial service providers can lock Amadeus into existing relationships, reducing its leverage.

- Importance of Service: The critical nature of secure and efficient payment processing means Amadeus cannot easily compromise on the quality or reliability of these services, giving suppliers an advantage.

- Amadeus's Leverage: Despite supplier power, Amadeus's sheer transaction volume, processing billions of transactions annually, provides it with considerable leverage to negotiate more favorable terms and pricing structures.

The bargaining power of suppliers for Amadeus IT Group is moderate, primarily influenced by the critical nature of their specialized IT solutions and the costs associated with switching. While Amadeus relies on these providers for essential services like cloud infrastructure and cybersecurity, the market for such advanced offerings sees some competition. In 2024, the global IT services market was valued at over $1.5 trillion, indicating a substantial ecosystem of suppliers.

Suppliers of proprietary technology and data solutions can exert considerable influence due to the unique nature of their offerings and the high switching costs involved. This is particularly true for specialized IT components that are integral to Amadeus's complex operational framework. The limited availability of equally capable alternatives can empower these suppliers to negotiate terms that may impact Amadeus's cost structure.

Amadeus's reliance on key software and hardware vendors, especially those providing industry-standard enterprise-grade solutions, grants these suppliers a moderate level of bargaining power. The integration complexity and potential disruption associated with changing core technology platforms mean Amadeus must carefully manage these relationships. For instance, major cloud providers, a critical component of modern IT infrastructure, often hold significant sway due to their market position and the extensive investments required to migrate services.

| Supplier Type | Bargaining Power Level | Key Factors Influencing Power | Example Impact on Amadeus |

| Specialized IT Solutions Providers | Moderate to High | Proprietary technology, high switching costs, limited alternatives | Potential for increased costs for critical software licenses and cloud services |

| Core Software & Hardware Vendors | Moderate | Industry-standard offerings, integration complexity, potential vendor lock-in | Negotiation leverage on pricing for enterprise databases and server infrastructure |

| Skilled IT Workforce | Moderate to High | High demand for specialized skills, competition from tech giants | Increased recruitment and retention costs for engineers and data scientists |

| Network & Connectivity Providers | High | Critical dependence on global networks, supplier concentration, high infrastructure costs | Vulnerability to price increases for essential data transmission services |

| Payment Processing & Financial Services | Moderate to High | Supplier concentration, high switching costs, critical service nature | Transaction fee structures and compliance requirements dictated by financial institutions |

What is included in the product

This analysis unpacks the competitive landscape for Amadeus IT Group, detailing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes on its market position.

Amadeus IT Group's Porter's Five Forces analysis provides a clear, one-sheet summary of all five forces—perfect for quick decision-making by alleviating the pain of complex market assessments.

Customers Bargaining Power

Amadeus's most significant customers are large airline groups and global hotel chains. These entities wield considerable bargaining power because they represent substantial revenue streams for Amadeus. For instance, in 2023, the travel distribution segment, which includes these major players, was a core contributor to Amadeus's revenue.

This leverage allows these powerful customers to negotiate for competitive pricing, demand tailored solutions that fit their specific operational needs, and set stringent service level agreements. Their ability to influence Amadeus's terms is further strengthened by the existence of other Global Distribution System (GDS) providers in the market, offering them alternative options.

Major online travel agencies (OTAs) and large traditional travel agency networks hold significant bargaining power with Amadeus IT Group, as they represent a substantial portion of its distribution revenue. In 2024, the dominance of players like Booking.com and Expedia means they can leverage their scale to negotiate favorable commission rates and demand preferential access to Amadeus's vast travel content. This concentrated purchasing power allows these entities to push for better terms or even explore alternative distribution channels if their demands are not met, directly impacting Amadeus's profitability.

While customers possess bargaining power, the significant switching costs associated with changing Global Distribution System (GDS) providers or complex IT infrastructures can effectively mitigate this influence for Amadeus IT Group. These costs are substantial, encompassing the intricate process of migrating reservation systems, the expense of retraining personnel on new platforms, and the technical challenges of integrating new application programming interfaces (APIs). This inherent customer lock-in provides Amadeus with a degree of insulation against aggressive price negotiations or demands for unfavorable terms.

Customer Segmentation and Diversification

Amadeus IT Group’s customer base is highly segmented, ranging from major global airlines and hotel chains to smaller, independent travel agencies and corporate travel departments. This broad distribution means no single customer or small group of customers holds significant sway over Amadeus’s pricing or terms. For example, in 2023, Amadeus continued to secure new contracts with a variety of travel providers, indicating a healthy spread of its client portfolio.

The company’s diversification across different sectors within the travel and tourism industry, including airlines, hotels, airports, and travel agencies, further mitigates customer power. This breadth means that a downturn or negotiation pressure from one segment, like airlines, is less likely to cripple Amadeus due to its strong relationships in other areas. This strategy is evident in Amadeus's ongoing expansion into new markets and service offerings, broadening its appeal and reducing dependency on any one customer type.

- Diverse Client Portfolio: Amadeus serves a wide array of customers, preventing any single entity from dominating negotiations.

- Reduced Reliance: The company’s business model is not dependent on a few large clients, limiting individual customer leverage.

- Industry Diversification: Amadeus’s presence across airlines, hotels, airports, and agencies spreads risk and weakens the bargaining power of any one segment.

- Strategic Partnerships: Amadeus actively cultivates relationships across the travel ecosystem, solidifying its position and reducing customer concentration.

Direct Booking and Disintermediation Trends

The rise of direct bookings by consumers with airlines and hotels, a trend often referred to as disintermediation, can indeed diminish the leverage of traditional travel agencies who are Amadeus's customers. This shift means fewer bookings might flow through these intermediaries, potentially weakening their negotiating position with Amadeus.

However, Amadeus is not a passive observer in this trend. The company actively supports direct booking capabilities for airlines and hotels through its IT solutions. This strategic pivot allows Amadeus to serve a different set of customers—the airlines and hotels themselves—while still participating in the direct booking ecosystem. For instance, Amadeus's Altéa platform provides airlines with the technology to manage direct sales, and its Hotel IT solutions empower hotels to optimize their own booking channels.

- Direct Booking Growth: While specific 2024 figures are still emerging, the trend of direct bookings has been steadily increasing, with many airlines reporting over 50% of their bookings coming directly from their own websites or apps.

- Amadeus's Dual Role: Amadeus's ability to provide technology for both travel agencies and direct booking channels for suppliers (airlines, hotels) mitigates the impact of disintermediation on its overall business model.

- Adaptability: By offering solutions that facilitate direct bookings, Amadeus demonstrates adaptability, transforming a potential threat into an opportunity to expand its service offerings and customer base.

Major online travel agencies (OTAs) and large traditional travel agency networks hold significant bargaining power with Amadeus IT Group, as they represent a substantial portion of its distribution revenue. In 2024, the dominance of players like Booking.com and Expedia means they can leverage their scale to negotiate favorable commission rates and demand preferential access to Amadeus's vast travel content. This concentrated purchasing power allows these entities to push for better terms or even explore alternative distribution channels if their demands are not met, directly impacting Amadeus's profitability.

While customers possess bargaining power, the significant switching costs associated with changing Global Distribution System (GDS) providers or complex IT infrastructures can effectively mitigate this influence for Amadeus IT Group. These costs are substantial, encompassing the intricate process of migrating reservation systems, the expense of retraining personnel on new platforms, and the technical challenges of integrating new application programming interfaces (APIs). This inherent customer lock-in provides Amadeus with a degree of insulation against aggressive price negotiations or demands for unfavorable terms.

Amadeus serves a wide array of customers, preventing any single entity from dominating negotiations. The company’s presence across airlines, hotels, airports, and agencies spreads risk and weakens the bargaining power of any one segment. For example, in 2023, Amadeus continued to secure new contracts with a variety of travel providers, indicating a healthy spread of its client portfolio.

| Customer Segment | Revenue Contribution (Illustrative) | Bargaining Power Factor |

| Major Airlines | High | Significant volume, potential for direct booking alternatives |

| Large OTAs (e.g., Expedia, Booking.com) | High | Concentrated purchasing, ability to negotiate terms |

| Hotel Chains | Medium-High | Volume, increasing focus on direct channels |

| Smaller Agencies/Corporate Travel | Low-Medium | Lower individual volume, higher switching costs |

Preview the Actual Deliverable

Amadeus IT Group Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis of Amadeus IT Group, detailing the competitive landscape and strategic positioning within the travel technology sector. You're looking at the actual document; once you complete your purchase, you’ll get instant access to this exact file, providing actionable insights into the industry's dynamics.

Rivalry Among Competitors

The competitive rivalry within the Global Distribution System (GDS) market is characterized by its oligopolistic nature, with Amadeus, Sabre, and Travelport (now integrated with WEX) being the dominant forces. This concentration means that competition is primarily focused on securing contracts with airlines and travel agencies, often leading to aggressive pricing strategies and continuous innovation in service offerings to capture market share in this mature industry.

Amadeus contends with a multitude of specialized technology providers who offer niche solutions beyond the traditional Global Distribution System (GDS). These companies focus on specific areas like airline passenger services, hotel management systems, airport operational software, and payment processing. Their highly focused innovation can present a significant challenge to Amadeus's broader product portfolio in these individual segments.

The competitive landscape is further intensified by the fragmented nature of these specialized markets. For instance, in 2024, the global travel technology market saw continued growth, with many smaller, agile companies carving out significant market share in their respective niches. This fragmentation means Amadeus must constantly innovate and adapt to stay ahead of numerous specialized competitors, each potentially offering a superior solution in a particular area of travel technology.

Some major travel companies, particularly large airlines and hotel chains, have the financial muscle and strategic vision to build their own IT systems for bookings, distribution, and managing operations. This approach, though expensive and challenging, lessens their dependence on companies like Amadeus, acting as a competitive force. For instance, in 2024, several major carriers continued to invest heavily in proprietary booking engines, aiming for greater control and customization.

Innovation and Technology Race

The travel technology sector is characterized by an intense innovation and technology race, particularly in areas like artificial intelligence, machine learning, and advanced data analytics. Amadeus IT Group, like its competitors, must continuously invest in research and development to enhance offerings such as personalized travel recommendations and more efficient booking systems. This constant push for technological advancement creates a dynamic environment where staying ahead requires significant capital outlay and a keen focus on future trends.

This technological arms race means that the pace of new product development and feature releases is a critical differentiator. Companies that fail to innovate risk falling behind, as customers increasingly expect seamless, data-driven travel experiences. For instance, Amadeus's commitment to R&D is reflected in its reported expenditure, which plays a crucial role in maintaining its competitive edge.

- Amadeus IT Group's R&D investment: In 2023, Amadeus continued its significant investment in R&D, a core component of its strategy to maintain leadership in travel technology.

- Key innovation areas: Focus remains on AI, machine learning, cloud computing, and data analytics to drive efficiency and personalization in the travel ecosystem.

- Competitive imperative: The rapid pace of technological change necessitates ongoing innovation to avoid market share erosion.

Pricing Pressure and Contract Renewals

The competitive landscape often results in significant pricing pressure during contract negotiations, particularly for large, long-term deals with airlines and major travel agencies. Competitors frequently offer aggressive terms to win or retain business, forcing Amadeus to balance profitability with market share. The cyclical nature of major contract renewals intensifies this rivalry.

- Intense Bidding Wars: During 2024, Amadeus likely faced aggressive bidding from rivals like Sabre and Travelport, especially as major airline contracts came up for renewal. These negotiations often see competitors offering substantial discounts to capture market share.

- Impact on Margins: This pricing pressure directly impacts Amadeus's profitability. For instance, a large airline contract renewal might see Amadeus conceding on price to retain the business, potentially reducing its segment operating margin for that period.

- Strategic Importance of Renewals: The renewal cycles are critical. A successful renewal secures a stable revenue stream and reinforces Amadeus's position, while a loss can significantly disrupt financial projections and market standing.

The competitive rivalry in the travel technology sector is fierce, with Amadeus facing intense pressure from both established GDS players and specialized technology providers. This dynamic is fueled by a constant innovation race, particularly in areas like AI and data analytics, where significant R&D investment is crucial. Pricing pressure during contract negotiations with major travel companies also intensifies competition, impacting profitability.

| Competitor | 2023 Revenue (Approx. USD Billions) | Key Focus Areas | Competitive Threat to Amadeus |

|---|---|---|---|

| Sabre | ~2.5 | GDS, Travel Agency Solutions, Airline IT | Direct GDS competitor, strong airline relationships |

| Travelport (WEX) | ~1.5 (as part of WEX) | GDS, Travel Agency Solutions | Similar GDS offerings, potential for integration synergies |

| Specialized Tech Providers | Varies (fragmented market) | Niche solutions (e.g., NDC, payments, loyalty) | Disruptive innovation in specific segments |

SSubstitutes Threaten

A significant threat to Amadeus's business model arises from airlines and hotels pushing travelers to book directly through their own digital platforms. This disintermediation strategy aims to cut out intermediaries like Global Distribution Systems (GDS) and travel agencies, thereby reducing reliance on services like those provided by Amadeus.

While this direct booking trend poses a challenge, it's important to note that Amadeus is not entirely excluded. The company actually provides the foundational technology that powers many of these direct booking channels for airlines and hotels. This dual role means Amadeus can still benefit from this shift, even as it navigates the evolving distribution landscape.

For instance, in 2024, the travel industry continued to see a strong push towards direct bookings. While specific figures for Amadeus's technology provision to these direct channels are not publicly detailed, the overall growth in digital travel sales, which often leverage such underlying technologies, indicates a substantial market. The trend is driven by the desire for both suppliers and consumers to streamline the booking process and potentially reduce costs.

Meta-search engines and aggregators like Google Flights and Skyscanner present a significant threat by offering consumers a consolidated view of travel options, often bypassing traditional Global Distribution Systems (GDS). This trend empowers travelers to compare prices and book directly, potentially diminishing the perceived necessity of GDS-powered intermediaries for many bookings. In 2024, the travel booking landscape continues to be dominated by online channels, with aggregators playing a crucial role in price discovery and consumer choice.

Emerging technologies like blockchain for travel bookings and decentralized distribution platforms pose a significant threat of substitutes to Amadeus's core Global Distribution System (GDS) model. These innovations could offer more direct and transparent connections between travelers and providers, potentially bypassing traditional intermediaries and their associated fees. For instance, a decentralized platform could allow a hotel to list rooms directly, cutting out the need for a GDS.

Manual Processes and Traditional Methods

While manual booking processes and direct communication with suppliers might seem like alternatives for very small or niche travel providers, they present a largely impractical substitute for Amadeus's advanced systems. The sheer volume and complexity of modern travel bookings make these traditional methods inefficient and unscalable for most businesses. This limits the threat of substitutes for Amadeus's primary enterprise clientele.

The threat of substitutes for Amadeus IT Group primarily stems from the potential for alternative distribution channels or technologies that bypass traditional Global Distribution Systems (GDS). However, the entrenched nature of GDS in the travel ecosystem, coupled with the significant investment required to build and maintain comparable systems, makes direct substitution a low probability for major players.

- Limited Practicality: For the vast majority of travel agencies, especially those operating at scale, manual processes are simply too time-consuming and error-prone to be a viable substitute for Amadeus's integrated solutions.

- Industry Dependence: The travel industry's reliance on standardized booking protocols and the network effects of GDS platforms create a high barrier to entry for substitute solutions.

- Efficiency Gap: Amadeus's systems offer significant efficiencies in areas like fare management, inventory control, and customer data integration, which manual methods cannot replicate.

In-House Systems Development by Travel Providers

Large travel companies, such as major airlines or hotel chains, could opt to build their own internal IT systems for critical functions like booking and inventory management. This would directly reduce their reliance on Amadeus's offerings. While this is a significant investment, requiring substantial capital and technical expertise, it remains a potential threat for the biggest industry players.

For instance, a company like Expedia Group, with its vast resources, might evaluate the cost-benefit of developing proprietary reservation software versus continuing to use third-party providers. The feasibility of in-house development is directly tied to a company's scale and strategic priorities. In 2024, the ongoing push for digital transformation across all industries means that such strategic IT investments are more likely to be considered by leading travel conglomerates.

This threat is amplified if several major travel providers simultaneously decide to pursue in-house development. Such a coordinated shift could significantly impact Amadeus's market share. The competitive landscape in 2024 continues to favor integrated, efficient technology solutions, making the decision to self-develop a complex strategic calculation for large travel entities.

The threat of substitutes for Amadeus IT Group largely revolves around alternative methods of travel distribution that bypass traditional Global Distribution Systems (GDS). While direct booking by airlines and hotels is a significant trend, Amadeus often provides the underlying technology for these channels, mitigating the direct substitution risk. Meta-search engines also present a challenge by consolidating options, but GDS remains crucial for complex fare structures and inventory management.

Emerging decentralized platforms could offer more direct connections, but their widespread adoption and integration capabilities are still developing as of 2024. For most travel agencies, manual booking is impractical due to inefficiency, and the industry's reliance on standardized GDS protocols creates high barriers for new entrants. Large players might consider in-house solutions, but this requires substantial investment and technical expertise.

| Threat of Substitute | Description | 2024 Relevance |

| Direct Airline/Hotel Bookings | Travelers booking directly via provider websites. | Continued strong trend, but Amadeus often powers these sites. |

| Meta-Search Engines (e.g., Google Flights) | Aggregators comparing prices across multiple providers. | High relevance for price discovery, potentially reducing GDS reliance for simple searches. |

| Decentralized/Blockchain Platforms | New technologies enabling direct, transparent connections. | Emerging threat, adoption still in early stages as of 2024. |

| In-house IT Systems (Large Providers) | Major travel companies developing proprietary booking engines. | Potential threat for very large entities, but high investment barrier. |

Entrants Threaten

Entering the travel technology and Global Distribution System (GDS) market demands substantial capital. Amadeus, for instance, invests heavily in maintaining its complex IT infrastructure, which processes billions of transactions annually. This significant financial commitment, including the development and upkeep of sophisticated software and a global network of data centers, creates a formidable barrier for any new player aiming to compete.

Amadeus thrives on powerful network effects; the more airlines, hotels, and travel agencies use its platform, the more valuable it becomes for everyone involved. This creates a significant hurdle for newcomers who would need to replicate this vast ecosystem from the ground up, a feat that is incredibly difficult and time-consuming.

Furthermore, Amadeus has cultivated deep, long-standing relationships with major travel providers. These established partnerships are not easily disrupted, acting as a formidable barrier that deters potential new entrants from gaining traction in the market.

The global travel industry presents a formidable challenge for new entrants due to a dense web of regulations. Companies must navigate a complex landscape including data privacy laws like GDPR, which mandates strict handling of customer information, and industry-specific standards set by bodies such as IATA. Successfully complying with these diverse and evolving requirements demands substantial investment in legal counsel and operational adjustments, acting as a significant deterrent.

Technology Complexity and Expertise

The sheer technological complexity of building and maintaining a global distribution system (GDS) presents a significant barrier for potential new entrants. Amadeus, for instance, invests heavily in real-time processing, robust cybersecurity, and increasingly, AI/ML capabilities to stay ahead.

This requires a deep bench of highly specialized technical talent, a resource that is not easily acquired or replicated. The talent pool for professionals skilled in areas like complex distributed systems and advanced data analytics is inherently limited, making it exceedingly difficult for newcomers to assemble the necessary expertise to compete effectively.

- High R&D Investment: Amadeus reported €936 million in Research and Development expenses in 2023, highlighting the significant ongoing investment needed to maintain technological leadership.

- Specialized Skill Requirements: GDS platforms demand expertise in areas such as distributed systems, high-availability computing, and advanced data security, which are scarce and expensive.

- Talent Acquisition Challenges: Attracting and retaining top-tier tech talent capable of developing and managing such sophisticated systems is a major hurdle for any new player.

Brand Recognition and Trust

Amadeus IT Group benefits significantly from high brand recognition and trust, cultivated over decades within the travel industry. This reputation for reliability, security, and continuous innovation presents a substantial barrier for potential new entrants. In 2024, establishing a comparable level of credibility with major airlines, hotel chains, and travel agencies would require immense investment and time, making it difficult for newcomers to gain traction.

The threat of new entrants is mitigated by the significant switching costs associated with Amadeus's established customer base. Airlines and travel providers are deeply integrated with Amadeus's systems, and migrating to a new platform would involve substantial financial outlay, operational disruption, and training expenses. These entrenched relationships and the associated costs make it less likely for new players to lure away existing Amadeus clients.

- Brand Equity: Amadeus's long-standing presence has fostered deep-seated trust, a critical asset in a sector reliant on secure and uninterrupted transactions.

- Customer Loyalty: High switching costs, estimated to be in the millions for major travel enterprises, lock in existing clients and deter new competitors.

- Industry Integration: Amadeus's comprehensive suite of solutions is deeply embedded in the operational fabric of the travel ecosystem, creating a formidable moat.

The threat of new entrants into Amadeus IT Group's market is considerably low. The immense capital required for infrastructure, coupled with strong network effects and deep-seated customer relationships, creates substantial barriers. Navigating complex regulations and securing specialized talent further solidifies Amadeus's competitive position, making it exceptionally challenging for newcomers to gain a foothold.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High investment needed for IT infrastructure, R&D, and global network. | Significant hurdle due to the scale of investment required. |

| Network Effects | Value increases with more users (airlines, agencies). | New entrants struggle to build a comparable ecosystem. |

| Customer Relationships | Long-standing partnerships with major travel providers. | Difficult for new players to displace established integrations. |

| Regulatory Compliance | Adherence to data privacy (GDPR) and industry standards (IATA). | Demands substantial legal and operational investment. |

| Technological Complexity | Requires expertise in distributed systems, cybersecurity, AI/ML. | High demand for scarce, specialized technical talent. |

| Brand Recognition & Trust | Decades of building a reliable reputation. | New entrants need significant time and investment to build credibility. |

| Switching Costs | High financial and operational costs for customers to change providers. | Existing clients are locked in, deterring new entrants. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Amadeus IT Group is built upon a foundation of verified data, including Amadeus's annual reports, industry-specific market research from firms like IDC and Gartner, and relevant regulatory filings. This ensures a comprehensive understanding of the competitive landscape.