Amadeus IT Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Amadeus IT Group Bundle

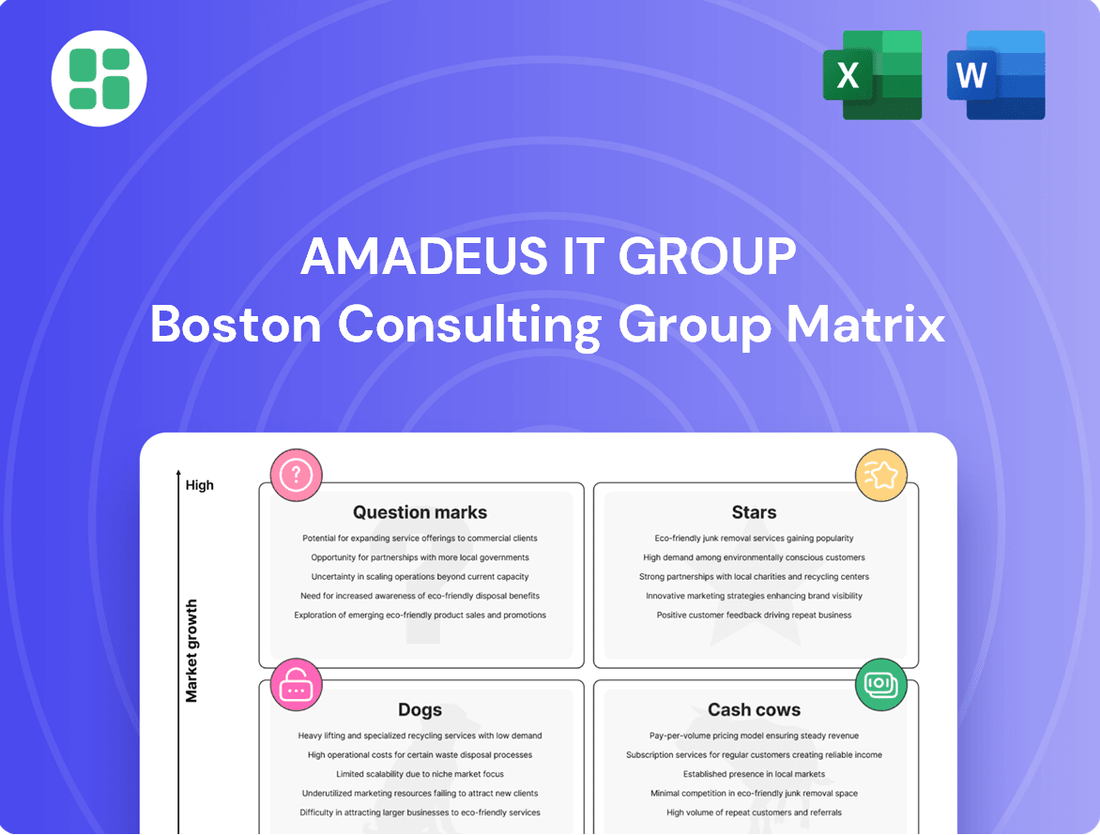

Curious about Amadeus IT Group's strategic positioning? Our BCG Matrix preview offers a glimpse into their product portfolio, highlighting potential Stars, Cash Cows, Dogs, or Question Marks. Don't miss out on the full picture; purchase the complete BCG Matrix for a comprehensive breakdown and actionable insights to guide your investment decisions.

Stars

Amadeus is making significant strides with its NDC-enabled travel platform, experiencing triple-digit growth in NDC bookings. While still a fraction of overall bookings, this rapid expansion signals a strong market shift towards modern retailing capabilities. By the end of 2024, Amadeus had activated 31 out of 70 signed NDC agreements, demonstrating a robust pipeline for future growth and airline integration.

Amadeus's Air IT solutions, exemplified by Amadeus Nevio, are a powerhouse in the industry. In the fourth quarter of 2024, this segment experienced a robust 15% revenue increase, capping off a strong full year with 16% growth.

Securing major contracts, such as the one with Air France-KLM for Amadeus Nevio, highlights the market's confidence in their cutting-edge platforms. These advanced IT solutions are fundamental to modern airline operations, driving efficiency and digital transformation.

The hospitality solutions segment of Amadeus IT Group is a clear star in their portfolio. This area saw impressive revenue increases, climbing by almost 11% in the fourth quarter of 2024 and a solid 12% for the entire year. This robust performance indicates strong market demand and successful execution.

Key strategic wins, like the partnership with Accor for their Central Reservation System, underscore the growing trust and adoption of Amadeus's offerings within the hospitality industry. These collaborations are crucial for expanding market reach and solidifying Amadeus's position.

This segment represents a vital avenue for Amadeus to diversify its business and secure future growth. Its consistent upward trajectory makes it a significant contributor to the company's overall financial health and strategic direction.

Airport IT Solutions & Biometrics

Amadeus IT Group is heavily investing in Airport IT Solutions & Biometrics, recognizing its pivotal role in modernizing air travel. The company acquired Vision-Box in early 2024, significantly bolstering its biometrics expertise and aligning with the industry's drive for seamless passenger journeys.

This strategic move addresses the increasing demand for efficient and secure airport operations. By 2024-2025, substantial investments are anticipated across the sector for advanced airport technologies, with biometrics at the forefront of enhancing passenger experience and operational flow.

- Market Growth: The global airport biometrics market was valued at approximately $1.5 billion in 2023 and is projected to grow significantly, driven by security enhancements and passenger convenience.

- Amadeus's Strategy: The Vision-Box acquisition positions Amadeus to capitalize on this growth, offering integrated solutions for passenger identification and boarding.

- Industry Trend: Airports worldwide are prioritizing touchless travel solutions, making biometrics a key technology for the future of air travel.

AI-Driven Innovation & Cloud Migration

Amadeus is making significant strides in AI and cloud migration, a key component of its growth strategy. A notable development is their partnership with Google Cloud, announced in 2023, which aims to accelerate their multi-cloud strategy and foster AI innovation. This collaboration is crucial for enhancing their technological capabilities and staying ahead in the competitive travel industry.

The company is actively using artificial intelligence to revolutionize the travel experience. This includes developing personalized travel planning tools, creating smart itineraries that adapt to traveler needs, and streamlining operational processes for greater efficiency. For instance, Amadeus's AI initiatives are designed to improve search relevance and booking conversion rates, directly impacting revenue and customer satisfaction.

- AI Investment: Amadeus is channeling substantial resources into AI research and development, recognizing its transformative potential.

- Cloud Partnership: The strategic alliance with Google Cloud is central to their multi-cloud adoption and AI-driven product development.

- Personalization: AI is being deployed to offer tailored travel recommendations and dynamic itinerary adjustments for a more personalized customer journey.

- Efficiency Gains: Operational improvements through AI are expected to reduce costs and enhance service delivery across their platforms.

Amadeus's hospitality solutions are a standout performer within the company's portfolio. This segment experienced nearly 11% revenue growth in Q4 2024, concluding the full year with a robust 12% increase. This consistent upward trend highlights strong market demand and successful strategic execution in this area.

Key partnerships, such as the one with Accor for their Central Reservation System, underscore the increasing trust and adoption of Amadeus's offerings in the hospitality sector. These collaborations are vital for expanding market reach and solidifying Amadeus's position as a leader.

This segment is a critical driver for Amadeus's business diversification and future growth. Its impressive financial performance makes it a significant contributor to the company's overall health and strategic direction.

The Airport IT Solutions & Biometrics division is a significant growth area for Amadeus, driven by the acquisition of Vision-Box in early 2024. This move bolsters their biometrics capabilities, aligning with the industry's push for seamless passenger journeys.

The global airport biometrics market, valued at approximately $1.5 billion in 2023, is experiencing substantial growth. Amadeus's investment positions them to capitalize on this trend, offering integrated solutions for passenger identification and boarding.

Airports worldwide are prioritizing touchless travel, making biometrics a key technology for enhancing passenger experience and operational flow. Amadeus's strategic focus on this area is expected to yield significant returns.

| Segment | Q4 2024 Revenue Growth | Full Year 2024 Revenue Growth | Key Drivers |

|---|---|---|---|

| Hospitality Solutions | ~11% | 12% | Accor partnership, strong market demand |

| Airport IT Solutions & Biometrics | N/A (Acquisition early 2024) | N/A | Vision-Box acquisition, global biometrics market growth |

What is included in the product

The Amadeus IT Group BCG Matrix offers a tailored analysis of its product portfolio, categorizing offerings into Stars, Cash Cows, Question Marks, and Dogs.

A clear Amadeus IT Group BCG Matrix visualizes business unit performance, easing the pain of uncertain strategic allocation.

Cash Cows

Amadeus's Global Distribution System (GDS) for air travel is a true cash cow for the company. It commands the largest market share globally, holding over 40% of the industry's revenue. This dominance translates into consistent and substantial cash flow, making it the bedrock of Amadeus's financial strength.

In 2024, this core business segment was responsible for a significant 48% of Amadeus's total revenue. The GDS market itself is quite mature, meaning growth is slower, but it also boasts very high barriers to entry. This protects Amadeus's leading position and ensures its continued profitability from this segment.

Amadeus's core Passenger Service Systems (PSS), like the widely adopted Altéa suite, represent a significant revenue and profit driver for the company. These mission-critical IT solutions are essential for major airlines worldwide, underpinning their operations and customer interactions.

The stability of this segment stems from high transaction volumes and the nature of long-term contracts, providing a predictable and recurring revenue stream. In 2023, Amadeus reported that its Airline IT segment, which includes PSS, generated €2,146 million in revenue, highlighting its substantial contribution to the group's overall financial performance.

Amadeus's Established Travel Agency Solutions are a clear Cash Cow within the BCG Matrix. The vast majority of travel agencies worldwide rely on Amadeus's platform for booking and managing travel. This extensive user base translates into a predictable and substantial revenue stream generated from transaction fees.

This segment benefits from a powerful network effect; as more agencies use Amadeus, the platform becomes more valuable to all users, reinforcing its dominance. In 2024, Amadeus reported that its Travel Agency Solutions segment continued to be a bedrock of its financial performance, contributing significantly to overall group revenue and profitability.

Hotel Central Reservation Systems (CRS)

Amadeus's Central Reservation Systems (CRS) for hotels are mature, well-established products that represent a significant cash cow for the company. These systems are critical for hotel operations, managing bookings, inventory, and distribution across various channels. Their reliability and widespread adoption ensure a consistent and substantial revenue stream.

The company's recent partnerships, such as the one with Accor, underscore the continued relevance and demand for Amadeus's CRS solutions. These collaborations reinforce Amadeus's position in the hospitality IT market, generating predictable cash flow. For instance, in 2023, Amadeus reported that its Travel segment, which includes its hospitality solutions, saw continued growth, driven by increased travel volumes and the adoption of its technology platforms.

- Amadeus's CRS are foundational for hotel distribution, providing stable revenue.

- Partnerships with major hotel groups like Accor bolster its market position.

- The hospitality IT segment benefits from the consistent demand for these reservation systems.

- Amadeus's Travel segment, encompassing CRS, demonstrated robust performance in 2023.

Payments Solutions (Outpayce)

Amadeus's Payments Solutions, branded as Outpayce, is solidifying its position as a cash cow within the company's portfolio. While the segment continues to experience growth, its increasing profitability is a key indicator of its mature, high-generating status. Strategic moves, such as the acquisition of Voxel in 2024, have significantly bolstered Outpayce's capabilities, particularly in areas like hotel payments, further cementing its role as a substantial cash contributor.

The strategic emphasis on delivering seamless travel payment experiences across diverse customer segments is a primary driver of Outpayce's success. This focus cultivates high-margin fintech services and fosters robust revenue streams directly tied to transaction volumes. For instance, Amadeus reported that its payments business processed a significant volume of transactions in 2024, contributing substantially to overall revenue and profitability.

- Growing Cash Generation: Outpayce is transitioning into a significant cash generator for Amadeus IT Group.

- Strategic Acquisitions: Acquisitions like Voxel in 2024 have enhanced Outpayce's capabilities, particularly in hotel payments.

- High-Margin Services: The business focuses on frictionless travel payments, leading to high-margin fintech services.

- Transaction-Driven Revenue: Outpayce benefits from strong revenue streams directly linked to transaction volumes.

Amadeus's Central Reservation Systems (CRS) for hotels are mature, well-established products that represent a significant cash cow for the company. These systems are critical for hotel operations, managing bookings, inventory, and distribution across various channels. Their reliability and widespread adoption ensure a consistent and substantial revenue stream.

The company's recent partnerships, such as the one with Accor, underscore the continued relevance and demand for Amadeus's CRS solutions. These collaborations reinforce Amadeus's position in the hospitality IT market, generating predictable cash flow. For instance, in 2023, Amadeus reported that its Travel segment, which includes its hospitality solutions, saw continued growth, driven by increased travel volumes and the adoption of its technology platforms.

Amadeus's Payments Solutions, branded as Outpayce, is solidifying its position as a cash cow within the company's portfolio. While the segment continues to experience growth, its increasing profitability is a key indicator of its mature, high-generating status. Strategic moves, such as the acquisition of Voxel in 2024, have significantly bolstered Outpayce's capabilities, particularly in areas like hotel payments, further cementing its role as a substantial cash contributor.

The strategic emphasis on delivering seamless travel payment experiences across diverse customer segments is a primary driver of Outpayce's success. This focus cultivates high-margin fintech services and fosters robust revenue streams directly tied to transaction volumes. For instance, Amadeus reported that its payments business processed a significant volume of transactions in 2024, contributing substantially to overall revenue and profitability.

| Segment | BCG Classification | 2023 Revenue (EUR millions) | Key Drivers | Outlook |

| Global Distribution System (GDS) | Cash Cow | N/A (Part of Travel segment) | Largest market share (>40%), high barriers to entry | Stable, mature market |

| Airline IT (incl. PSS) | Cash Cow | 2,146 | Mission-critical for airlines, long-term contracts | Continued strong performance |

| Travel Agency Solutions | Cash Cow | N/A (Part of Travel segment) | Extensive user base, network effect | Predictable revenue |

| Central Reservation Systems (CRS) - Hotels | Cash Cow | N/A (Part of Travel segment) | Critical for hotel operations, partnerships (e.g., Accor) | Consistent cash flow |

| Payments Solutions (Outpayce) | Cash Cow | N/A (Growing, but mature high-generation status) | High-margin fintech, transaction volumes, strategic acquisitions (Voxel) | Substantial cash contributor |

Full Transparency, Always

Amadeus IT Group BCG Matrix

The Amadeus IT Group BCG Matrix preview you are viewing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks, no demo content, and no hidden surprises – just a professionally crafted strategic analysis ready for your immediate use. You can confidently use this preview as a direct representation of the comprehensive BCG Matrix report you will gain access to, enabling you to make informed strategic decisions for Amadeus IT Group. This ensures you are investing in a complete and actionable resource that reflects the exact quality and detail of the final product.

Dogs

Certain older, less adopted legacy IT systems that have not been modernized or integrated into Amadeus's newer platforms might represent Dogs. These could be niche solutions for specific, non-growing travel segments that require ongoing maintenance without significant revenue generation. Identifying these specifically requires internal product portfolio analysis.

Underperforming regional operations, particularly in markets with low penetration and a stagnant or declining travel industry, represent Amadeus IT Group's potential Dogs in the BCG Matrix. These segments often incur ongoing operational costs with minimal prospect for growth, making them candidates for strategic review or divestment. For instance, if a specific European region saw its travel market grow by only 1.5% in 2024, while Amadeus's market share remained flat, it would fit this category.

Outdated ancillary products, those built for older travel industry models, struggle to meet today's evolving demands. These offerings, if they have a low market share and aren't seeing new investment, can become resource drains. For instance, Amadeus's legacy booking systems, while foundational, might require significant upkeep for minimal new revenue if not modernized.

Non-Core, Divested Assets

Non-core, divested assets in Amadeus IT Group's BCG Matrix represent ventures that, despite initial acquisition, did not align strategically or achieve expected performance. These are typically smaller, underperforming units that are eventually sold off to streamline operations and focus on core competencies. For instance, if Amadeus acquired a niche software provider that failed to integrate with its main travel technology platforms, it would likely be categorized here.

These divested assets are characterized by their lack of synergy with Amadeus's primary business lines and their consistent underperformance, draining resources without contributing significantly to overall growth. The decision to divest is driven by a need to optimize the company's portfolio and reallocate capital to more promising areas.

- Lack of Strategic Fit: These assets do not contribute to Amadeus's core mission of providing travel technology solutions.

- Underperformance: They consistently fail to meet financial or operational targets.

- Divestment Rationale: Selling these assets allows Amadeus to focus on high-growth areas and improve overall profitability.

Unsuccessful Pilot Programs/Ventures

Amadeus IT Group's portfolio might include pilot programs in emerging travel technology sectors that, while innovative, haven't yet gained significant traction. These ventures, often characterized by substantial initial investment but limited market uptake, could represent potential question marks if they fail to demonstrate a clear path towards commercial viability. For instance, a pilot for a novel AI-driven personalized itinerary generator, launched in 2023, might be under review if its user adoption rates in 2024 haven't met projected targets, suggesting a need for strategic reassessment.

Such initiatives often require ongoing resource allocation without a guaranteed return, placing them in a category where their future strategic importance is uncertain. The company's 2024 financial reports would likely detail R&D expenditures, and a closer look might reveal specific investments in these less successful pilot programs. Without a clear strategy for scaling or pivoting, these ventures risk becoming drains on resources.

- Unproven Market Acceptance: Pilot programs in highly specialized or nascent markets may struggle to achieve broad adoption, even with strong underlying technology.

- Resource Allocation Without Clear ROI: Continued investment in ventures that haven't demonstrated a viable business model or market share growth can be a sign of a question mark.

- Failure to Scale: Early-stage initiatives that cannot transition from a pilot phase to a scalable product or service often remain in a state of uncertainty.

- Strategic Re-evaluation Needed: Ventures that consistently underperform against key metrics may require a decision on whether to divest, pivot, or continue investing with a revised strategy.

Dogs in Amadeus IT Group's portfolio represent products or services with low market share and low growth potential. These are often legacy systems or outdated offerings that require maintenance but generate minimal revenue. For example, a specific legacy booking module that saw a 2% decline in transaction volume in 2024, while the overall market grew by 5%, would be a prime candidate.

These segments can drain resources that could be better allocated to more promising areas of the business. Divested assets or underperforming regional operations that fail to gain traction also fall into this category. Amadeus's strategic focus is on modernizing its offerings and divesting non-core or underperforming units to optimize its business model.

| Category | Description | Example | 2024 Market Share (Est.) | 2024 Growth Rate (Est.) |

|---|---|---|---|---|

| Dogs | Low market share, low growth | Outdated ancillary product | < 5% | < 2% |

| Dogs | Low market share, low growth | Legacy IT system for niche segment | < 3% | < 1% |

Question Marks

Amadeus is democratizing its advanced AI-driven predictive models, including those for flight offer selection and trip delay predictions, through open APIs. This strategic move targets startups and innovators, recognizing the burgeoning AI-driven future of travel.

While the potential for AI in travel is immense, Amadeus's market share among external developers and new companies utilizing these specific AI APIs is still in its early stages, indicating significant room for growth in this high-potential segment.

Amadeus is actively investing in sustainability-focused travel solutions, exemplified by its Amadeus Travel Impact Suite. This suite aims to empower travelers and travel providers to make more environmentally conscious decisions, a key trend in the current market.

While the demand for sustainable travel options is on the rise, Amadeus's market share and direct revenue from these specific sustainability solutions are still in their nascent stages of development. The company is building out its offerings in this crucial growth area.

Airports are gearing up for a significant tech upgrade in their operational control centers over the next five years, aiming for more sophisticated and collaborative systems. Amadeus is investing in these next-generation APOC technologies, laying the groundwork for future airport efficiency. However, the adoption of these cutting-edge, specialized solutions is still in its nascent stages, with market penetration currently low.

Emerging Payments Platform Innovations

Emerging payments platform innovations, particularly those addressing niche travel payment needs or integrating with rapidly evolving fintech trends, are currently positioned as Question Marks for Amadeus IT Group within the BCG Matrix framework. These solutions, while holding significant future potential, demand substantial investment to scale and achieve widespread market acceptance. For instance, the growth in cross-border e-commerce payments for travel services, estimated to reach over $1.5 trillion by 2027, presents an opportunity, but requires Amadeus to innovate rapidly to capture this market share.

These innovative payment solutions are characterized by their high growth potential but currently low market share. Amadeus's investment in these areas is crucial for future revenue streams, especially as consumer preferences shift towards seamless, digital payment experiences. The global digital payments market is projected to grow at a compound annual growth rate of over 12% through 2028, highlighting the imperative to invest in these emerging platforms.

- Focus on frictionless payment experiences for ancillary travel services.

- Develop solutions for the growing demand in Buy Now, Pay Later (BNPL) for travel bookings.

- Integrate with emerging digital wallets and cryptocurrency payment options where feasible and regulated.

- Target specific B2B payment challenges within the travel ecosystem, such as corporate travel expense management.

Specific Geographic Market Expansions

Amadeus IT Group's strategic expansion into new, high-growth geographic markets, particularly in emerging economies in Asia and Africa, positions them to capture future market share. These regions, while showing robust growth in air travel and tourism, represent nascent markets for Amadeus's specific product lines, meaning their current market penetration is low. Significant investment will be necessary to establish a dominant presence and capitalize on the growth potential.

- Emerging Market Focus: Amadeus is targeting regions like Southeast Asia and Sub-Saharan Africa, where air passenger traffic is projected to grow significantly. For instance, IATA forecasts a 5.0% annual growth rate for African airlines between 2022 and 2026.

- Investment Requirements: To build market share in these developing regions, Amadeus needs to invest in local infrastructure, sales teams, and tailored product offerings, which can be substantial.

- Product Line Penetration: While Amadeus might be strong in global distribution systems, their market share in newer areas for specific solutions like NDC (New Distribution Capability) or their cloud-based offerings could be minimal, necessitating focused development.

- Competitive Landscape: Entering these markets requires understanding and competing with local players and established global competitors who may already have a foothold, demanding agile strategies and competitive pricing.

Emerging payment platforms and new geographic markets represent Amadeus IT Group's Question Marks. These areas offer high growth potential but currently have low market share, requiring significant investment to scale and gain traction.

The focus is on developing innovative payment solutions, like BNPL, and expanding into high-growth regions such as Southeast Asia and Sub-Saharan Africa, where air passenger traffic is set to increase substantially.

These ventures demand substantial investment in local infrastructure, sales teams, and tailored product offerings to build market share against established competitors.

The global digital payments market's projected growth and IATA's forecasts for African air travel underscore the strategic importance of these investments for Amadeus's future revenue streams.

| BCG Category | Amadeus IT Group Focus Area | Market Attractiveness | Current Market Share | Strategic Implication |

|---|---|---|---|---|

| Question Mark | Emerging Payments Platforms | High (e.g., Global digital payments market projected to grow over 12% annually through 2028) | Low | Requires significant investment to scale and achieve widespread adoption. Focus on frictionless experiences and integration with new digital wallets. |

| Question Mark | New Geographic Markets (Asia, Africa) | High (e.g., IATA forecasts 5.0% annual growth for African airlines 2022-2026) | Low | Demands investment in local infrastructure, sales, and tailored products to build market presence against competitors. |

BCG Matrix Data Sources

Our BCG Matrix for Amadeus IT Group is built on a foundation of robust data, including Amadeus's official financial reports, industry analyst research, and market growth forecasts for the travel technology sector.