Altisource Portfolio Solutions PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Altisource Portfolio Solutions Bundle

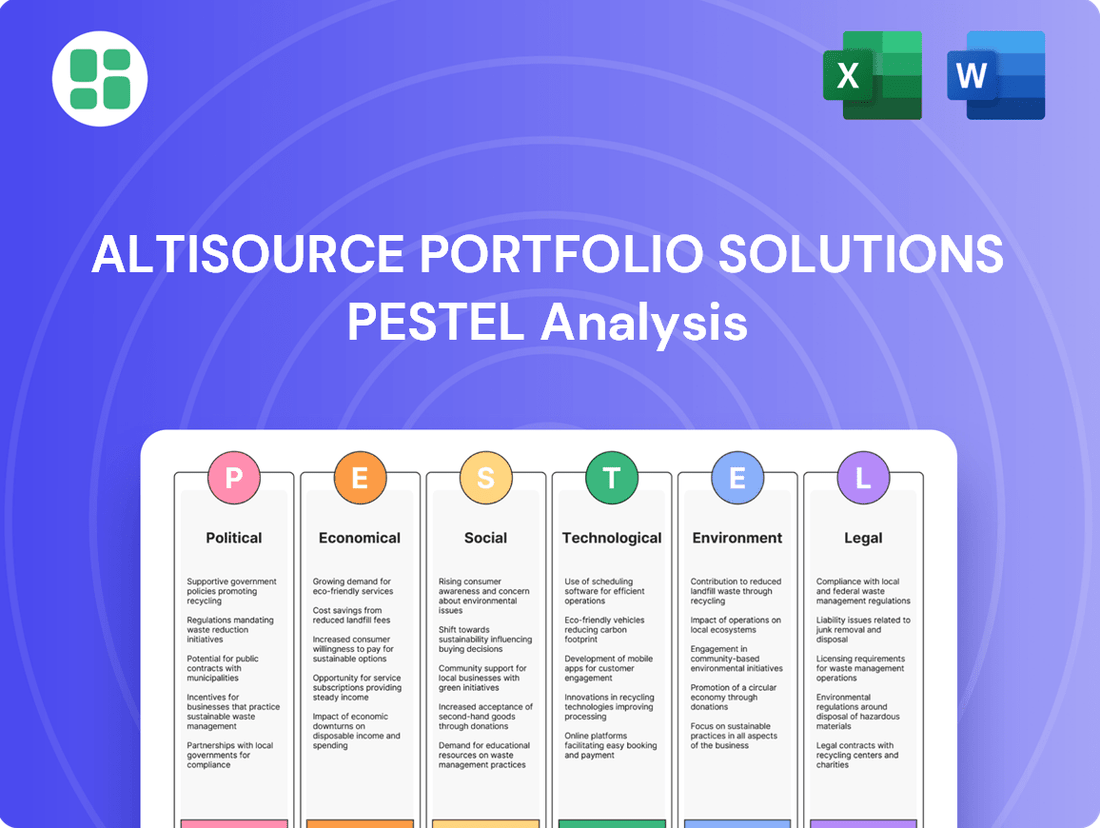

Navigate the complex landscape impacting Altisource Portfolio Solutions by understanding the political, economic, social, technological, legal, and environmental forces at play. Our PESTLE analysis offers a comprehensive overview, highlighting key trends and their potential influence on the company's strategic direction and market position. Don't get left behind; gain the critical intelligence you need to anticipate challenges and seize opportunities.

Unlock actionable insights into the external factors shaping Altisource Portfolio Solutions's future. From evolving regulations to shifting economic climates, our meticulously researched PESTLE analysis provides the clarity essential for informed decision-making. Elevate your strategic planning and competitive edge – download the full report now for immediate access to expert-level market intelligence.

Political factors

Government housing policies significantly shape the real estate landscape. Initiatives like the Inflation Reduction Act's energy-efficient home improvement credits, which extended through 2032, aim to boost renovation and, by extension, mortgage activity. Changes in federal housing subsidies or programs designed to increase homeownership directly influence the volume of transactions Altisource handles in loan origination and property disposition.

The stability of regulatory frameworks governing mortgage servicing and real estate operations is paramount for Altisource Portfolio Solutions. Unpredictable shifts in these regulations, such as potential changes to foreclosure laws or data privacy requirements, can trigger significant compliance costs and operational disruptions. For instance, the Consumer Financial Protection Bureau (CFPB) consistently updates its guidance, impacting how mortgage servicers handle borrower communications and loss mitigation, as seen in their 2024 directives on servicing standards.

Government-imposed foreclosure moratoriums and homeowner relief programs, often implemented during economic instability, directly affect Altisource's core business by reducing the volume of properties requiring foreclosure management. For instance, during the COVID-19 pandemic, the CARES Act provided significant forbearance options, delaying foreclosures and impacting servicers. This trend can shift operational focus and revenue generation away from distressed asset management.

International Trade and Geopolitical Relations

Altisource's global footprint, with significant operations in countries like Luxembourg, makes it susceptible to shifts in international trade policies and geopolitical stability. For instance, the ongoing trade disputes between major economies could lead to increased tariffs or restrictions on cross-border data flows, directly impacting Altisource's operational efficiency and cost structure.

Changes in international agreements, such as those affecting financial services or data privacy, can significantly alter the regulatory landscape for Altisource. As of early 2024, the European Union continues to refine its digital single market initiatives, which could influence how Altisource manages data across its European operations.

- Trade Tensions: Ongoing trade friction, particularly between the US and China, can indirectly affect global economic sentiment and investment flows, potentially impacting Altisource's client base and market opportunities.

- Data Localization Laws: Increasing adoption of data localization requirements by various nations necessitates careful management of data storage and processing, adding complexity and cost for global service providers like Altisource.

- Geopolitical Instability: Regional conflicts or political unrest can disrupt supply chains, affect talent availability, and create uncertainty in investment climates, all of which are critical considerations for Altisource's international business strategy.

- Regulatory Harmonization: Efforts towards regulatory harmonization within blocs like the EU can create opportunities but also require continuous adaptation to evolving compliance standards impacting cross-border financial services.

Consumer Protection Legislation

New and evolving consumer protection laws, especially those impacting mortgage servicing and real estate dealings, can place more stringent demands on Altisource's business. These regulations often focus on greater transparency, safeguarding customer data, and ensuring fair lending. For instance, the Consumer Financial Protection Bureau (CFPB) has been actively reviewing and proposing rules to curb certain contract terms and increase oversight on what they term 'junk fees' within the mortgage sector. These proposed changes, expected to be finalized in 2024 or 2025, aim to enhance consumer fairness and could necessitate adjustments in Altisource's service models.

Compliance with these mandates is paramount for Altisource to avoid legal repercussions and maintain its operational integrity. Such adherence directly affects the company's expenses and how it delivers its services. The CFPB's ongoing focus on fee transparency, as seen in their 2023 inquiries and potential rulemakings, underscores the critical need for companies like Altisource to adapt their practices to meet heightened consumer protection standards.

Key areas of impact include:

- Data Privacy: Stricter regulations on how consumer data is collected, stored, and utilized, potentially increasing compliance costs and requiring enhanced security measures.

- Transparency in Fees: New rules may mandate clearer disclosure of all fees associated with mortgage servicing and real estate transactions, impacting revenue models and operational processes.

- Fair Lending Practices: Continued scrutiny on lending and servicing practices to prevent discriminatory outcomes, requiring robust internal controls and auditing.

Government housing policies significantly impact Altisource's operational volume, with initiatives like extended energy-efficient home improvement credits potentially boosting mortgage activity through 2032. Shifts in federal housing subsidies or programs aimed at increasing homeownership directly influence transaction volumes in loan origination and property disposition.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Altisource Portfolio Solutions across Political, Economic, Social, Technological, Environmental, and Legal dimensions, offering actionable insights for strategic decision-making.

A PESTLE analysis of Altisource Portfolio Solutions provides a clear, summarized view of external factors impacting the business, serving as a pain point reliever by simplifying complex market dynamics for strategic decision-making.

Economic factors

Interest rate fluctuations, especially concerning mortgage rates, significantly impact Altisource Portfolio Solutions' operating environment. When interest rates rise, borrowing becomes more expensive, which typically cools demand in the housing market. This can translate to fewer mortgage originations and refinancings, directly affecting Altisource's business volumes.

Higher mortgage rates, such as the projected rates remaining above 6.5% through 2025, create affordability challenges for potential homebuyers. This dampens overall housing demand and can lead to slower property value appreciation, impacting the volume of transactions Altisource facilitates. Furthermore, elevated rates typically reduce the incentive for homeowners to refinance existing mortgages, a key service area for many mortgage technology and service providers.

The health of the housing market significantly impacts Altisource Portfolio Solutions. A strong market with appreciating home prices generally benefits their origination and property disposition services. Conversely, a weaker market might increase the need for their default and foreclosure management solutions.

Looking ahead to 2025, home prices are projected to continue their upward trend, though the pace of appreciation is expected to moderate compared to 2024. While housing inventory is gradually increasing, it still hasn't reached the levels seen before the COVID-19 pandemic, which could influence market dynamics.

Inflationary pressures can directly impact Altisource's operational expenses, potentially raising costs for labor and technology. Furthermore, elevated inflation can dampen consumer purchasing power and affect the affordability of mortgages, influencing the demand for Altisource's services.

The U.S. economy has demonstrated notable resilience, with inflation figures generally hovering in the 2-3% range as of early 2024. This level of inflation, while requiring careful management, has not severely constrained consumer spending or mortgage market activity.

Broader economic growth trends or periods of recession have a significant correlation with housing market dynamics and consumer financial well-being. A robust economy typically fosters a healthier mortgage market, whereas an economic downturn can lead to increased loan delinquencies and foreclosures, thereby impacting Altisource's counter-cyclical business segments.

Unemployment Rates and Consumer Income

Unemployment rates and consumer income are critical for Altisource Portfolio Solutions, as they directly impact homeowners' ability to manage mortgage payments. An increase in joblessness or a slowdown in wage growth can translate to higher mortgage delinquencies and foreclosures, thereby boosting demand for Altisource's default management services. For example, the U.S. unemployment rate saw a slight increase to 3.9% in April 2024, up from 3.8% in March 2024, according to the Bureau of Labor Statistics. Despite this, average hourly earnings have continued to show year-over-year growth.

Conversely, a robust labor market with low unemployment and rising incomes generally supports a healthier housing market, which can influence the volume of distressed properties. In May 2024, the U.S. added 272,000 jobs, indicating continued labor market strength, while wage growth remained steady. This environment can lead to fewer defaults but may still create opportunities in loan servicing and real estate disposition.

- U.S. Unemployment Rate: 3.9% (April 2024)

- U.S. Job Growth: 272,000 jobs added (May 2024)

- Wage Growth: Continued year-over-year increases in average hourly earnings.

- Impact on Altisource: Higher unemployment can increase demand for default management, while strong income growth supports a stable housing market.

Credit Availability and Lending Standards

The accessibility of credit significantly shapes the real estate market, directly impacting Altisource's origination support services. When credit is readily available and lending standards are more lenient, mortgage originations tend to increase, benefiting companies like Altisource. Conversely, tighter credit conditions can dampen market activity.

In the first quarter of 2025, a slight uptick in mortgage default risk was observed. This rise is attributed to increased borrower and broader economic risks, which can lead to more cautious lending practices. Such a trend directly affects Altisource's business, as it relies on a healthy and active mortgage market.

Altisource's performance is inherently linked to the credit market's capacity and willingness to lend across the entire mortgage lifecycle. The company's origination support services, for instance, are directly influenced by how easily consumers and businesses can secure financing for real estate transactions.

- Credit Availability: Easier access to credit fuels higher mortgage origination volumes.

- Lending Standards: Stricter standards can reduce market activity and impact Altisource's service demand.

- Q1 2025 Risk: A marginal increase in mortgage default risk suggests potential tightening of credit in the near future.

- Market Linkage: Altisource's business is sensitive to the overall health and lending capacity of the credit market.

Economic factors significantly influence Altisource Portfolio Solutions, with interest rates and inflation being key drivers. Rising mortgage rates, projected to stay above 6.5% through 2025, impact housing affordability and refinancing activity. Inflationary pressures can increase operational costs and reduce consumer spending power, affecting demand for Altisource's services.

The labor market's health, indicated by unemployment rates and wage growth, directly correlates with mortgage performance. While the U.S. unemployment rate saw a slight increase to 3.9% in April 2024, job growth remained robust in May 2024, suggesting continued labor market strength.

Credit availability and lending standards are crucial for Altisource's origination support. A slight uptick in mortgage default risk in Q1 2025 suggests potential tightening of credit, which could impact market activity.

| Economic Factor | Data Point | Impact on Altisource |

|---|---|---|

| Mortgage Rates | Projected > 6.5% through 2025 | Reduced demand for originations/refinancing, affordability challenges. |

| Inflation | Generally 2-3% (early 2024) | Increased operational costs, potential impact on consumer spending. |

| Unemployment Rate | 3.9% (April 2024) | Higher unemployment can increase demand for default management. |

| Job Growth | 272,000 jobs added (May 2024) | Supports stable housing market, potentially fewer defaults. |

| Mortgage Default Risk | Slight uptick (Q1 2025) | Suggests potential credit tightening, impacting origination volumes. |

What You See Is What You Get

Altisource Portfolio Solutions PESTLE Analysis

The preview you see here is the exact Altisource Portfolio Solutions PESTLE Analysis document you’ll receive after purchase. It is fully formatted and professionally structured, offering a comprehensive overview of the political, economic, social, technological, legal, and environmental factors impacting the company. You can trust that what you're previewing is the actual, ready-to-use file you'll be working with.

Sociological factors

Demographic shifts are significantly reshaping the housing market. As Gen Z and Millennials gain more economic influence, their preferences are driving demand for different housing types and mortgage solutions. This is evident as a significant portion of Gen Z, around 60% according to some 2024 surveys, are considering or actively pursuing homeownership, often through creative means like taking on additional jobs or co-buying with family to manage affordability challenges.

These evolving homeownership aspirations require companies like Altisource to adapt their service offerings. Understanding that younger generations may prioritize flexibility, digital accessibility, and potentially smaller or more urban living spaces is key. For example, the median age of first-time homebuyers in the US has been trending upwards, reaching close to 35 in recent years, highlighting the need for tailored financial products that address these generational financial realities.

Consumers increasingly expect digital convenience across all services, including real estate and mortgage processes. This means Altisource must prioritize seamless online applications, virtual property viewings, and digital communication channels to stay competitive.

The demand for proptech solutions is surging, with a significant portion of homebuyers now preferring to conduct their property search and transaction entirely online. For instance, a 2024 survey indicated that over 70% of millennials and Gen Z actively use digital tools for their real estate needs, a trend that directly impacts Altisource's platform development.

Public sentiment towards mortgage servicing and foreclosure industries heavily influences companies like Altisource. In 2024, ongoing economic uncertainties and media coverage, particularly concerning housing affordability and borrower protections, continue to shape this perception. A significant portion of consumers, as indicated by surveys from late 2023 and early 2024, express concern about predatory practices and a lack of transparency in these sectors.

This negative public perception can translate into increased regulatory pressure and a demand from Altisource's clients for partners who demonstrate a strong commitment to consumer fairness. For instance, regulatory bodies in 2024 have intensified their focus on servicing standards, leading to higher compliance costs and a need for robust consumer-centric processes.

Altisource's strategic focus on assisting clients with regulatory compliance is crucial in navigating this landscape. By ensuring adherence to evolving consumer protection laws and industry best practices, Altisource can help its clients mitigate reputational risks and foster trust, thereby counteracting negative public sentiment.

Urbanization and Suburbanization Trends

Urbanization and suburbanization trends significantly shape regional housing markets, influencing demand for Altisource's services. In 2024, a notable trend continued with a segment of homebuyers prioritizing affordability and space, leading to sustained interest in suburban and exurban areas, even those with emerging climate-related challenges. This migration pattern is crucial for Altisource to monitor as it impacts where its real estate disposition and servicing solutions are most needed.

Understanding these population movements is key for Altisource to align its strategies with evolving market demands.

- Suburban Growth: Continued preference for larger homes and perceived affordability in suburban areas fuels demand for related real estate services.

- Climate Migration Nuance: Despite growing climate awareness, some migration into climate-vulnerable areas persists in 2025 due to economic factors.

- Regional Dynamics: Shifts in population density directly affect the volume and location of distressed properties and servicing needs.

Financial Literacy and Debt Levels

The financial literacy of the general population directly impacts mortgage delinquency rates, a key area for Altisource Portfolio Solutions. In 2024, a significant portion of the US population still struggles with basic financial concepts, potentially leading to more precarious borrowing habits. For instance, a 2023 survey indicated that over 30% of Americans found it difficult to understand financial terms, which can translate to higher default risks.

Prevailing household debt levels are also a critical sociological factor influencing Altisource’s business. As of Q1 2024, total household debt in the US reached a new record, exceeding $17.7 trillion. High debt burdens, coupled with potential economic downturns, can exacerbate mortgage defaults, thereby increasing demand for Altisource’s loan servicing and default management solutions.

- Financial Literacy Impact: Lower financial literacy correlates with a higher propensity for consumers to take on unsustainable debt, increasing the likelihood of mortgage defaults.

- Debt Burden: Rising household debt levels, a persistent trend through early 2024, create a more vulnerable consumer base susceptible to loan delinquencies.

- Altisource's Role: By managing loan lifecycles and offering default resolution services, Altisource indirectly supports consumer financial health and mitigates the negative societal impact of widespread defaults.

Societal attitudes towards homeownership and debt significantly influence Altisource's operational environment. Growing awareness of housing affordability issues, highlighted by a 2024 survey showing 65% of potential first-time buyers expressing concern, pushes demand for flexible mortgage solutions. Furthermore, increasing consumer demand for transparency and fairness in financial dealings, a sentiment amplified by media coverage in early 2024, necessitates robust ethical practices from service providers like Altisource.

The rising household debt levels, exceeding $17.7 trillion by Q1 2024, create a more vulnerable consumer base. This trend, coupled with persistent financial literacy gaps, as evidenced by a 2023 report indicating over 30% of Americans struggle with financial terms, directly impacts mortgage delinquency rates. Altisource's ability to manage loan lifecycles and offer default resolution services becomes critical in mitigating the societal impact of widespread defaults.

| Sociological Factor | 2024/2025 Data Point | Impact on Altisource |

|---|---|---|

| Homeownership Aspirations | 65% of potential first-time buyers concerned about affordability (2024 survey) | Drives demand for flexible mortgage and servicing solutions. |

| Consumer Expectations | Increased demand for transparency and fairness in financial dealings (early 2024 sentiment) | Requires robust ethical practices and clear communication. |

| Household Debt Levels | Exceeded $17.7 trillion (Q1 2024) | Increases vulnerability to defaults, boosting demand for default management. |

| Financial Literacy | 30%+ Americans struggle with financial terms (2023 report) | Correlates with higher default risk, emphasizing need for loan servicing. |

Technological factors

The mortgage and real estate industries are heavily influenced by digital transformation and automation, directly impacting Altisource's operations. Companies are increasingly adopting automated solutions for tasks like loan origination, servicing, and property management to boost efficiency and cut expenses. For instance, in 2024, the global mortgage technology market was projected to reach over $20 billion, indicating a strong demand for such advancements.

Altisource's strategic emphasis on developing and offering integrated platforms directly addresses this technological shift. These platforms are designed to streamline the entire mortgage lifecycle, from application to servicing, offering clients a more cohesive and efficient experience. This focus positions Altisource to capitalize on the ongoing digital evolution within its core markets.

The financial services industry, including mortgage and real estate, is seeing a significant uplift from AI and ML. These technologies are enhancing predictive analytics and data processing, allowing companies like Altisource to gain deeper market insights. For instance, AI can automate tasks like property valuation and fraud detection, streamlining operations and reducing errors.

In 2024, the global AI market was projected to reach over $200 billion, with significant investment flowing into financial applications. Altisource can harness AI for intelligent automation in areas such as loan origination and servicing, improving efficiency and customer experience. This includes optimizing pricing strategies and identifying emerging market trends to better serve clients and manage risk.

Altisource's reliance on handling sensitive financial and personal data throughout the mortgage lifecycle makes robust data security and protection against cybersecurity threats absolutely critical. The company's operations, from loan origination to servicing, involve extensive data flows, making it a prime target.

The escalating sophistication of cyberattacks, including ransomware and phishing schemes, demands ongoing, substantial investment in advanced security infrastructure and proactive threat detection protocols. For instance, the global average cost of a data breach reached $4.45 million in 2024, according to IBM's Cost of a Data Breach Report, highlighting the potential financial fallout.

Failure to adequately safeguard this data can result in severe financial penalties due to regulatory non-compliance, such as GDPR or CCPA violations, and catastrophic reputational damage. Maintaining client trust is paramount, as even a single breach can erode confidence and lead to significant business loss.

Blockchain Technology Adoption

Blockchain technology is increasingly being recognized for its capacity to boost transparency, security, and efficiency within real estate dealings, especially concerning record management and smart contracts. For instance, a report by Grand View Research projected the global blockchain in real estate market size to reach USD 1.44 billion by 2025, indicating significant growth potential. This technology's ability to simplify property transfers and potentially lessen reliance on intermediaries could reshape conventional transaction workflows.

While blockchain adoption in real estate is still in its developmental stages, its implications for companies like Altisource are substantial. Altisource may need to investigate how integrating blockchain into its existing platforms could lead to more secure and efficient service offerings, potentially reducing operational costs and enhancing customer trust. The company's strategic approach to embracing such innovations will be crucial in navigating the evolving technological landscape.

Key areas where blockchain could impact Altisource's operations include:

- Enhanced Security: Immutable ledgers can secure property titles and transaction histories, reducing fraud risks.

- Streamlined Transactions: Smart contracts can automate processes like escrow and payment, speeding up closings.

- Increased Transparency: All parties involved can access a shared, verifiable record of the transaction.

Cloud Computing and Scalable Infrastructure

Altisource's reliance on cloud computing is a significant technological factor, allowing for highly scalable and flexible infrastructure. This adaptability is crucial for meeting fluctuating market demands and diverse client requirements. For instance, in 2024, cloud adoption continued its upward trajectory, with businesses leveraging it for enhanced agility and cost efficiency, a trend directly benefiting service providers like Altisource.

This robust cloud infrastructure is instrumental in the rapid deployment of new services and ensures uninterrupted business continuity. It also facilitates efficient data management, a critical component for Altisource's operations across its various business lines. The ability to manage vast datasets securely and efficiently underpins the trust clients place in their platforms.

Scalable solutions are paramount for Altisource, enabling them to effectively handle the substantial transaction volumes and data loads generated by their clients. As of early 2025, the global cloud computing market is projected to exceed $1 trillion, underscoring the widespread recognition of its benefits in supporting large-scale operations and innovation.

- Scalability: Cloud platforms allow Altisource to easily adjust computing resources up or down based on client demand, ensuring optimal performance and cost management.

- Flexibility: This enables rapid iteration and deployment of new features and services, keeping Altisource competitive in a fast-evolving market.

- Business Continuity: Cloud-based disaster recovery and backup solutions are vital for maintaining service availability, even during unforeseen disruptions.

- Data Management: Efficiently processing and storing large volumes of data is a core capability, supporting Altisource's analytics and operational services.

Technological advancements are reshaping the mortgage and real estate sectors, driving demand for automation and digital solutions. Altisource's focus on integrated platforms aligns with this trend, aiming to streamline the entire mortgage lifecycle. The increasing integration of AI and machine learning is enhancing predictive analytics and data processing, offering opportunities for more efficient operations and deeper market insights.

The critical need for robust cybersecurity is amplified by the sensitive data Altisource handles, with data breach costs escalating. Blockchain technology presents potential for increased transparency and security in real estate transactions, though its adoption is still nascent. Cloud computing provides Altisource with the scalability and flexibility essential for managing large transaction volumes and ensuring business continuity.

| Technology Area | 2024/2025 Market Projection/Data | Impact on Altisource |

|---|---|---|

| Mortgage Technology | Projected over $20 billion (2024) | Drives demand for automated solutions, impacting efficiency and cost. |

| Artificial Intelligence (AI) | Projected over $200 billion (2024) | Enhances predictive analytics, fraud detection, and operational efficiency. |

| Cybersecurity (Data Breach Cost) | Average $4.45 million (2024) | Necessitates significant investment in security infrastructure and protocols. |

| Blockchain in Real Estate | Projected USD 1.44 billion by 2025 | Offers potential for enhanced security, transparency, and streamlined transactions. |

| Cloud Computing | Exceeds $1 trillion (early 2025 projection) | Provides scalability, flexibility, and business continuity for operations. |

Legal factors

Mortgage servicing operations for companies like Altisource are significantly shaped by a dense web of federal and state regulations. Key agencies, including the Consumer Financial Protection Bureau (CFPB) and various state licensing bodies, set the rules for loan management, borrower communication, and loss mitigation processes. For instance, the CFPB's Servicemember Civil Relief Act (SCRA) rules and Regulation X, which governs mortgage servicing, require specific procedures for handling delinquent borrowers. Failure to comply can result in substantial penalties.

The regulatory landscape is not static; it's constantly evolving, with anticipated changes in 2025 likely to further refine operational protocols. These updates often focus on enhancing consumer protections and ensuring fair treatment of borrowers, particularly during times of financial hardship. Staying ahead of these regulatory shifts is paramount for maintaining operational efficiency and avoiding legal entanglements, as compliance directly impacts how loans are managed and serviced.

Altisource, dealing with extensive sensitive personal and financial data, faces strict data privacy and security laws. This includes regulations like GDPR, relevant due to its Luxembourg operations, and U.S. state laws such as the California Consumer Privacy Act (CCPA). These regulations govern data collection, storage, processing, and protection, carrying substantial compliance obligations and penalties for violations.

The increasing focus on secure data handling is further highlighted by enhanced licensing requirements for digital mortgage operations. For instance, in 2024, many U.S. states continued to refine their data security mandates for financial institutions, with some imposing new breach notification timelines and data minimization principles. Non-compliance can lead to significant fines; for example, GDPR violations can reach up to 4% of global annual revenue.

The legal landscape for foreclosures is a patchwork, with each state and jurisdiction having its own rules. This directly influences how quickly and affordably properties can be sold, which is a core part of Altisource's business. Any adjustments to these laws or how courts interpret them can significantly impact Altisource's operations and the efficiency of their foreclosure management services.

Looking at recent trends, the number of foreclosures initiated nationwide saw a dip in 2024 when compared to the previous year. While there was a modest uptick in early 2025, these figures are still notably lower than what was observed before the pandemic. This environment shapes the demand and nature of services like those provided by Altisource.

Consumer Protection Acts

Broader consumer protection acts, extending beyond mortgage-specific regulations, significantly impact Altisource Portfolio Solutions' operations. These laws are designed to curb deceptive practices and guarantee equitable treatment for consumers engaging in financial and real estate dealings. For instance, the Consumer Financial Protection Bureau (CFPB) actively enforces regulations like the Fair Credit Reporting Act and the Truth in Lending Act, which govern how companies handle consumer data and credit transactions. Failure to comply can result in substantial fines and reputational damage.

Maintaining consumer trust and mitigating legal risks are paramount, especially with evolving legislative landscapes. There's a growing trend towards proposals that aim to ban restrictive contract clauses, which could affect how Altisource structures its agreements. In 2023, the CFPB reported a significant increase in consumer complaints related to mortgage servicing and debt collection, highlighting the heightened scrutiny on these sectors.

Key consumer protection areas relevant to Altisource include:

- Truthfulness in Advertising: Ensuring all marketing and service descriptions are accurate and not misleading to consumers.

- Fair Debt Collection Practices: Adhering to strict guidelines on how debts are collected, preventing harassment or unfair tactics.

- Data Privacy and Security: Protecting sensitive consumer financial information in line with regulations such as the Gramm-Leach-Bliley Act.

- Contractual Fairness: Avoiding the use of clauses that unfairly disadvantage consumers or limit their rights.

Anti-Money Laundering (AML) and Sanctions Compliance

Altisource, operating in the financial services sector, faces stringent Anti-Money Laundering (AML) regulations and must navigate complex international sanctions lists. Failure to comply can result in significant penalties and reputational damage. For instance, in 2023, the U.S. Treasury's Office of Foreign Assets Control (OFAC) continued to enforce sanctions, impacting financial transactions globally, requiring companies like Altisource to maintain vigilant screening processes.

To mitigate these risks, Altisource must implement and maintain robust internal controls and thorough due diligence procedures. This ensures its platforms are not exploited for illicit financial activities. The Bank Secrecy Act (BSA) in the United States, for example, mandates comprehensive AML programs, including customer identification and suspicious activity reporting, with fines for non-compliance reaching millions of dollars.

- Regulatory Scrutiny: Financial regulators worldwide, including FinCEN in the US and the FCA in the UK, actively monitor compliance with AML and sanctions laws.

- Due Diligence Requirements: Companies must conduct Know Your Customer (KYC) checks and ongoing monitoring to identify and report suspicious transactions.

- Evolving Landscape: Legal frameworks surrounding AML and sanctions are constantly updated, necessitating continuous adaptation of compliance strategies.

- Financial Penalties: Non-compliance can lead to substantial fines; for example, several major banks faced multi-million dollar penalties in 2024 for AML deficiencies.

The mortgage servicing sector, where Altisource operates, is heavily regulated by federal and state laws, including those from the CFPB and state licensing bodies, impacting loan management and borrower interactions. Anticipated regulatory changes in 2025 are expected to further emphasize consumer protection, requiring continuous adaptation of operational protocols to avoid penalties.

Data privacy is a critical legal concern, with U.S. state laws like CCPA and international regulations such as GDPR (relevant due to Luxembourg operations) governing data handling. Enhanced state-level data security mandates in 2024, including breach notification timelines, underscore the significant fines for non-compliance, potentially reaching 4% of global annual revenue for GDPR violations.

Foreclosure laws vary significantly by state, directly affecting the speed and cost of property sales, a core service for Altisource. While foreclosure initiations saw a dip in 2024 and a modest uptick in early 2025, these numbers remain below pre-pandemic levels, influencing service demand.

Broader consumer protection laws, enforced by bodies like the CFPB, govern fair debt collection and data handling, with non-compliance leading to fines and reputational damage. Proposals to ban restrictive contract clauses and a rise in consumer complaints in 2023 highlight increased scrutiny on mortgage servicing and debt collection practices.

Environmental factors

Climate change is directly impacting real estate. We're seeing more frequent and intense natural disasters like floods, wildfires, and severe storms. This makes properties riskier and harder to insure, affecting their value. For Altisource, this means properties in its management portfolio and the mortgages it services face higher risk profiles.

The financial implications are significant. For instance, in 2024, the U.S. experienced a record number of billion-dollar weather and climate disasters, totaling 22 events by mid-year, according to NOAA data. This trend directly influences property valuations and the cost of mortgage servicing for companies like Altisource.

Homebuyers are increasingly factoring in severe weather risks when making purchasing decisions. They are more aware of the long-term implications of living in areas prone to climate-related events, which can affect property desirability and resale value, adding another layer of complexity for real estate asset management.

The increasing focus on sustainability and green building standards is reshaping the real estate landscape, impacting development and investment decisions. While Altisource's primary business lines may not be directly tied to physical property construction, these trends can indirectly affect market dynamics and property valuations, which are crucial for their servicing operations.

The real estate industry's substantial contribution to global carbon emissions, estimated to be around 40%, is a key driver for adopting more environmentally conscious practices. This push for sustainability can influence the types of properties that gain favor and command higher values, potentially impacting the loan portfolios Altisource manages.

Environmental due diligence is becoming a bigger deal in property deals. This means properties are being checked more closely for any contamination or environmental problems that could cause future headaches. For Altisource, which deals with a lot of real estate, this directly affects how they evaluate the risks associated with the assets they manage, especially when selling them.

The rules are getting tougher, and new issues are popping up, like PFAS chemicals. These stricter regulations and the identification of these new contaminants are making the environmental checks for properties more complicated and thorough than they used to be.

Energy Efficiency Regulations in Buildings

Energy efficiency regulations for buildings are tightening, impacting property values and operational expenses. For Altisource, while not a direct property manager, the energy performance of properties in its disposition portfolios could influence their marketability and necessitate compliance with evolving standards. For instance, the U.S. Department of Energy's Building Technologies Office is actively promoting energy-saving measures, with residential buildings accounting for 20% of total U.S. primary energy consumption in 2023, highlighting the significance of these regulations.

Key trends like smart home technology and net-zero energy buildings are gaining traction, driven by these regulations and consumer demand for sustainability. These advancements can lead to reduced utility costs and enhanced property appeal. By 2025, it's projected that the global smart home market will exceed $150 billion, indicating a strong shift towards energy-conscious building solutions.

- Regulatory Impact: Stricter energy efficiency standards can increase the cost of renovations for older properties but also boost the value of compliant, modern buildings.

- Marketability Factor: Energy-efficient properties are becoming more attractive to buyers and renters, potentially improving disposition timelines and sale prices for Altisource.

- Technological Integration: Smart thermostats and energy management systems are increasingly integrated into new constructions and retrofits, aiming for reduced carbon footprints.

- Net-Zero Trend: The move towards net-zero energy buildings, where a building produces as much energy as it consumes, is a significant long-term trend influenced by policy and environmental awareness.

Resource Scarcity and Water Management

Water scarcity and the need for efficient resource management are increasingly shaping real estate markets, especially in areas prone to drought. For instance, by 2025, projections indicate that over two-thirds of the world's population could face water shortages, a trend that directly impacts development feasibility and ongoing operational costs in affected regions. These environmental pressures can elevate maintenance expenses and cast doubt on the long-term viability of properties, indirectly influencing the broader real estate landscape where Altisource Portfolio Solutions operates.

These environmental factors can translate into tangible financial impacts for Altisource's clients and the company itself.

- Increased operational costs: Properties in water-stressed areas may require investment in water-efficient landscaping, plumbing, and irrigation systems, adding to maintenance budgets.

- Development limitations: New construction projects might face stricter regulations regarding water usage or be outright prohibited in severely water-scarce locations.

- Property valuation shifts: Properties with robust water management strategies or those located in areas with reliable water access could see an increase in value compared to those without.

Environmental regulations are tightening, impacting property valuations and operational costs. For Altisource, this means increased scrutiny on environmental due diligence for properties within its servicing portfolio, especially concerning contamination and evolving standards like PFAS. The push for energy efficiency, with residential buildings consuming 20% of U.S. primary energy in 2023, also influences property marketability and potential renovation needs.

Climate change is a growing concern, with 2024 seeing a record 22 billion-dollar weather disasters in the U.S. by mid-year. This elevates risk profiles for serviced mortgages and properties managed by Altisource, affecting insurance costs and property desirability as buyers consider climate risks.

Water scarcity is another critical factor, with projections suggesting two-thirds of the world could face shortages by 2025. This can increase operational costs for properties needing water-efficient solutions and impact development feasibility in affected regions, indirectly influencing Altisource's asset management.

| Environmental Factor | Impact on Real Estate | Relevance to Altisource |

|---|---|---|

| Climate Change & Natural Disasters | Increased property risk, higher insurance costs, reduced property values in vulnerable areas. | Higher risk for serviced mortgages and managed properties; potential for increased defaults and losses. |

| Energy Efficiency Regulations | Increased renovation costs for older properties, higher value for compliant buildings, potential for reduced operational expenses. | Affects marketability and disposition value of properties in its portfolio; potential need for compliance upgrades. |

| Water Scarcity | Higher maintenance costs for water-efficient systems, development limitations in drought-prone areas, potential value increase for water-resilient properties. | Impacts operational costs and long-term viability of properties within its servicing and management scope. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Altisource Portfolio Solutions is built on a robust foundation of data from official government publications, reputable financial news outlets, and leading industry analysis firms. We meticulously gather information on regulatory changes, economic indicators, technological advancements, and societal trends to provide a comprehensive overview.