Altisource Portfolio Solutions Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Altisource Portfolio Solutions Bundle

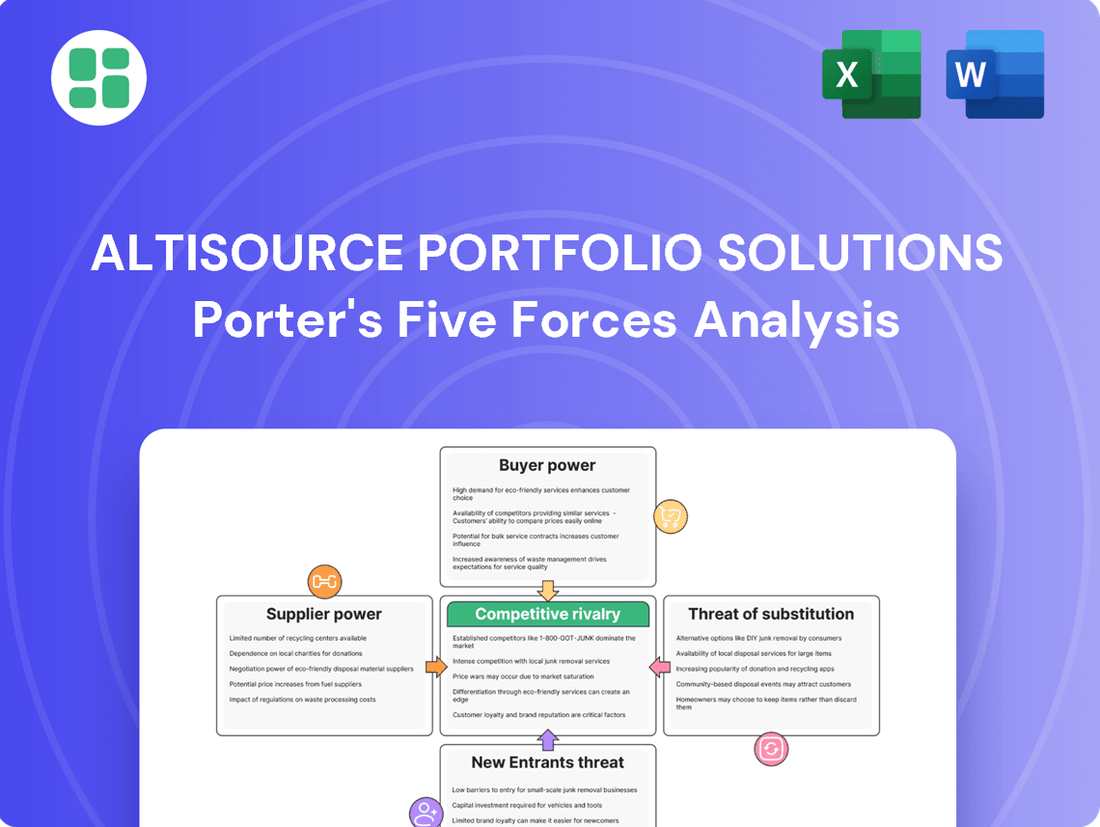

Altisource Portfolio Solutions navigates a competitive landscape shaped by moderate buyer power and significant threat of substitutes within the mortgage servicing industry. Understanding the intensity of rivalry and supplier bargaining power is crucial for strategic positioning.

The complete report reveals the real forces shaping Altisource Portfolio Solutions’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The mortgage and real estate technology sector, though expanding, is built upon specialized software, advanced data analytics, and AI/ML capabilities. A small group of highly specialized vendors for these crucial technologies or data sources can significantly enhance their bargaining power over companies like Altisource Portfolio Solutions.

This concentration means Altisource might face elevated costs for essential tools or be subject to less favorable contract terms from these key technology providers, impacting its operational expenses and flexibility.

Altisource relies on a diverse set of inputs, from IT infrastructure and specialized real estate data to legal and field services. The availability of substitute inputs significantly impacts supplier power.

If few alternatives exist for these critical inputs, or if the cost and complexity of switching suppliers are high, Altisource faces increased supplier bargaining power. For instance, a proprietary data analytics platform that is crucial for Altisource's operations, with no readily available substitutes, would grant its provider considerable leverage.

Suppliers who provide core technology platforms for loan origination, servicing, or foreclosure management are absolutely vital to Altisource's ability to operate smoothly and deliver services effectively. When a supplier's offering is a key component of Altisource's overall solutions, that supplier naturally gains more leverage. This is especially the case if the services they provide are unique or hard for Altisource to replicate elsewhere.

Threat of Forward Integration by Suppliers

Suppliers, particularly those providing cutting-edge AI and data analytics, could integrate forward by directly offering their services to mortgage servicers and real estate professionals. This move would significantly boost their bargaining power and create a direct competitive challenge for Altisource. The increasing digitalization across the industry amplifies this particular threat.

For instance, a supplier of advanced predictive analytics for loan default could leverage its technology to offer a standalone service to lenders, bypassing Altisource's platform. This forward integration is a growing concern as the mortgage industry continues to embrace technological solutions. In 2024, the market for AI in financial services saw substantial growth, with companies actively seeking to streamline operations through advanced analytics.

- Forward Integration Risk: Suppliers developing sophisticated AI/ML or data analytics tools may choose to offer these services directly to Altisource's customer base.

- Increased Bargaining Power: If suppliers become direct competitors, their leverage over Altisource in terms of pricing and terms would substantially increase.

- Digitalization Trend: The ongoing digital transformation in the mortgage and real estate sectors makes it easier for tech-savvy suppliers to enter the market as direct service providers.

- Competitive Landscape: This threat is particularly relevant given the increasing investment in AI within the financial services sector, with many firms aiming to disintermediate existing service providers.

Cost of Switching Suppliers

The cost of switching suppliers for Altisource Portfolio Solutions is a significant factor influencing supplier bargaining power. Migrating core technology or data from one provider to another is not a simple task; it often involves substantial expenses related to data migration, integrating new systems with existing infrastructure, and retraining employees on new platforms. These complexities create high switching costs.

These elevated switching costs directly empower existing suppliers. When it's expensive and time-consuming for Altisource to change providers, its flexibility is diminished. This lack of flexibility means suppliers can often dictate terms more effectively, knowing that Altisource faces considerable hurdles in seeking alternatives. This is particularly true in industries where companies rely on deeply integrated technology platforms.

For instance, in the mortgage servicing technology sector, where Altisource operates, a supplier providing a critical loan origination system or a core data analytics platform might have considerable leverage. If Altisource were to switch such a system, the costs could easily run into millions of dollars when accounting for system downtime, data reconciliation, and the learning curve for staff. This financial and operational barrier strengthens the supplier’s position.

- High Switching Costs: Altisource faces significant expenses when changing core technology or data suppliers, including data migration, system integration, and employee retraining.

- Reduced Flexibility: Increased switching costs limit Altisource's ability to change suppliers, thereby enhancing the bargaining power of existing providers.

- Industry Dependence: This dynamic is common in industries heavily reliant on integrated technology platforms, where vendor lock-in can be substantial.

Suppliers of specialized mortgage technology and data analytics hold significant power over Altisource Portfolio Solutions due to the sector's reliance on niche capabilities. For example, a provider of proprietary AI-driven default prediction models, crucial for Altisource's operations, can command higher prices and dictate terms if few viable alternatives exist. This leverage is amplified if these suppliers consider forward integration, directly offering their services to Altisource's client base, a trend gaining traction as the financial services industry embraces digitalization.

The cost and complexity associated with switching critical technology or data providers present a substantial barrier for Altisource, thereby strengthening the bargaining power of existing suppliers. These switching costs encompass data migration, system integration, and employee retraining, which can easily reach millions of dollars for core platforms like loan origination systems. This vendor lock-in effect limits Altisource's flexibility and allows suppliers to negotiate more favorable terms.

| Supplier Characteristic | Impact on Altisource | Example in 2024 |

|---|---|---|

| Specialized Technology/Data | High Bargaining Power | AI for loan default prediction; proprietary analytics platforms |

| Forward Integration Risk | Increased Competition & Leverage | Tech suppliers offering direct services to lenders |

| High Switching Costs | Reduced Flexibility, Supplier Leverage | Migrating core loan origination systems (millions in costs) |

What is included in the product

This analysis of Altisource Portfolio Solutions examines the intensity of rivalry, buyer and supplier power, threat of new entrants, and the availability of substitutes to understand its competitive environment.

Altisource's Porter's Five Forces analysis is a pain point reliever by providing a clear, one-sheet summary of all five forces, perfect for quick decision-making.

Customers Bargaining Power

Altisource's customer base is diverse, encompassing mortgage servicers, investors, and real estate professionals. However, if a substantial portion of its revenue is concentrated among a few major clients, those clients gain significant leverage. This was evident in Altisource's Q2 2025 results, where Onity, their largest customer, represented a significant revenue contribution, indicating their considerable bargaining power.

Customers' switching costs are a significant factor in moderating their bargaining power with Altisource Portfolio Solutions. For mortgage servicers and investors, the integration of Altisource's platforms can involve substantial upfront expenses related to setup, data migration, and employee training. These high switching costs, particularly when changing core servicing technology, make it less feasible for customers to readily switch to a competitor, thereby reducing their leverage.

Customers of Altisource Portfolio Solutions, particularly large financial institutions, possess significant bargaining power when they can readily access substitute services or develop in-house solutions. For instance, a major bank might evaluate the cost-effectiveness of building its own loan servicing platform versus continuing to outsource to Altisource. This potential for self-sufficiency or switching to a competitor directly influences their leverage in negotiations.

The mortgage industry, while complex, is not immune to the trend of insourcing. Many large players have the capital and technical expertise to bring certain functions in-house. In 2024, the ongoing digital transformation across financial services has made it more feasible for these institutions to invest in proprietary technology, thereby reducing their reliance on third-party providers like Altisource and amplifying customer bargaining power.

Price Sensitivity of Customers

In the competitive mortgage and real estate sectors, customers are acutely aware of pricing. This price sensitivity is amplified by economic factors like shifting interest rates and mortgage origination volumes, pushing clients to seek the most cost-effective solutions from providers like Altisource.

For instance, during periods of rising interest rates, such as those experienced in 2023 and continuing into early 2024, the demand for mortgage services can contract. This contraction often intensifies the pressure on service providers to offer more competitive pricing to retain or attract business.

- Increased Demand for Cost Reduction: Economic downturns or periods of high inflation can make customers more focused on minimizing expenses, directly impacting their willingness to pay premium prices for services.

- Impact of Interest Rates: Fluctuations in mortgage interest rates directly influence the volume of mortgage originations, a key market for Altisource, thereby affecting customer bargaining power.

- Competitive Landscape: A crowded market with numerous service providers means customers have more options, giving them greater leverage to negotiate better terms and prices.

Customers' Information Asymmetry

Customers who are well-informed about market pricing, what competitors offer, and the actual cost of Altisource's services naturally hold more sway. This knowledge allows them to push for better terms.

Having access to detailed industry benchmarks and competitive quotes really strengthens a customer's position when they're negotiating prices. It gives them a solid foundation for their demands.

This level of transparency is key; it puts customers in a much stronger position during discussions. They can effectively leverage information to their advantage.

- Informed Customers: Buyers with deep knowledge of pricing and competitor offerings can negotiate more effectively.

- Benchmark Access: Availability of industry benchmarks and competitive bids empowers customers.

- Negotiation Leverage: Transparency regarding costs and alternatives increases customer bargaining power.

Altisource's customers, particularly large financial institutions, exert significant bargaining power due to their ability to switch providers or develop in-house solutions. This is exacerbated by the industry trend of insourcing, a movement that gained traction in 2024 as digital transformation made proprietary technology more feasible for major players, thereby reducing their dependence on third-party services like Altisource and strengthening customer leverage.

The bargaining power of Altisource's customers is also influenced by price sensitivity, which is heightened by economic conditions such as fluctuating interest rates and mortgage origination volumes. For example, the rising interest rate environment observed through 2023 and into early 2024 intensified pressure on service providers to offer competitive pricing to retain business, directly impacting customer negotiation leverage.

Well-informed customers, armed with knowledge of market pricing, competitor offerings, and Altisource's service costs, naturally possess greater negotiation power. The availability of industry benchmarks and competitive quotes further solidifies their position, allowing them to effectively leverage information for better terms.

Same Document Delivered

Altisource Portfolio Solutions Porter's Five Forces Analysis

This preview shows the exact Porter's Five Forces Analysis of Altisource Portfolio Solutions you'll receive immediately after purchase, offering a comprehensive examination of competitive rivalry, the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, and the threat of substitute products. Understand the strategic landscape of Altisource with this detailed, professionally written document, ensuring you get precisely the insights you need to inform your business decisions.

Rivalry Among Competitors

The mortgage and real estate technology and services sector is populated by a varied group of competitors, encompassing large, diversified business service providers alongside nimble, specialized proptech companies. This broad spectrum ensures a dynamic competitive landscape.

Altisource Portfolio Solutions navigates this environment alongside significant players such as Kiavi, Fidelity National Financial, and CoreLogic. These companies, each with their unique strengths and market approaches, contribute to the intensity of competition.

The diversity in competitor scale, the breadth of their service portfolios, and their specific geographic market focuses collectively amplify the rivalry within the industry. This multifaceted competition requires constant adaptation and innovation from all participants.

The mortgage industry faced headwinds in 2024, but forecasts suggest a rebound in 2025 with origination volumes expected to rise. This potential market expansion could temper competitive intensity. However, the sector is also bracing for an uptick in loan delinquencies and foreclosures, which may heighten competition for ancillary services.

Altisource Portfolio Solutions strives to stand out by offering integrated platforms that manage the entire mortgage lifecycle. However, intense competition arises if rivals provide comparable end-to-end solutions or excel in specific niche markets with compelling advantages, potentially triggering price wars.

The key to maintaining a competitive edge lies in Altisource's capacity to deliver distinct, value-adding services that competitors cannot easily replicate. For instance, in 2024, the mortgage servicing market saw continued innovation, with companies like Mr. Cooper and LoanCare investing heavily in technology to enhance customer experience and operational efficiency, directly challenging Altisource's integrated model.

High Fixed Costs and Exit Barriers

Companies in the mortgage and real estate services industry, like Altisource, often face substantial fixed costs. These are tied to essential investments in technology, robust infrastructure, and navigating complex regulatory landscapes. For instance, developing and maintaining advanced loan origination software or secure data management systems requires significant upfront and ongoing capital expenditure.

High exit barriers can further exacerbate competitive rivalry. These barriers might include specialized, difficult-to-liquidate assets or substantial long-term contractual obligations that make it costly and impractical for firms to leave the market. Even when industry conditions are unfavorable, these factors can force companies to continue operating, leading to intensified competition among remaining players.

- High Fixed Costs: Significant investments in technology and compliance are common.

- Exit Barriers: Specialized assets and long-term contracts make exiting difficult.

- Intensified Rivalry: Companies remain in the market despite downturns, increasing competition.

Strategic Stakes and Aggressiveness of Competitors

Competitors in the mortgage technology and services sector are showing significant aggression, particularly as the market stabilizes and continues its digital transformation. This intensity is fueled by a high strategic stake in capturing and retaining market share through aggressive pricing strategies, rapid innovation, and strategic mergers and acquisitions. For instance, the ongoing push for technological advancement, especially in areas like artificial intelligence and automation, underscores a fierce competition to maintain a cutting-edge advantage.

The drive for technological superiority is a critical battleground. Companies are investing heavily in AI and automation to streamline processes, reduce costs, and enhance customer experience. This arms race for innovation means that firms not keeping pace risk falling behind significantly. In 2024, we've seen increased M&A activity as companies look to acquire new technologies or expand their service offerings, indicating a clear strategy to consolidate power and gain a competitive edge.

- Aggressive Market Share Pursuit: Competitors are actively vying for market share through competitive pricing and enhanced service offerings.

- Technological Arms Race: Significant investment in AI and automation is a key differentiator, driving innovation and efficiency.

- Mergers and Acquisitions: Strategic M&A activity in 2024 highlights a consolidation trend aimed at strengthening market position and technological capabilities.

- High Strategic Stakes: The evolving market landscape presents substantial opportunities and risks, making competitive advantage crucial for long-term success.

Competitive rivalry within the mortgage and real estate technology and services sector is intense, driven by a diverse range of players from large corporations to specialized proptech firms. Altisource Portfolio Solutions faces formidable competition from entities like Kiavi and CoreLogic, each employing distinct strategies to capture market share. This dynamic landscape is further shaped by substantial fixed costs associated with technology and compliance, alongside high exit barriers such as specialized assets and long-term contracts, which keep firms engaged even during market downturns.

The pursuit of technological superiority, particularly in AI and automation, is a critical battleground, with significant investment in these areas defining competitive advantage. Strategic mergers and acquisitions in 2024 underscore a trend towards consolidation, aiming to bolster market positions and technological capabilities. For example, the mortgage servicing market in 2024 saw continued innovation from companies like Mr. Cooper, investing in technology to enhance customer experience, directly challenging integrated models.

The mortgage industry, despite facing challenges in 2024, is projected to rebound in 2025, potentially moderating some competitive pressures. However, an anticipated rise in loan delinquencies and foreclosures could intensify competition for ancillary services. Altisource's ability to offer unique, value-added services that are difficult for rivals to replicate is crucial for maintaining its edge amidst this fierce competition.

| Competitor | Key Offerings | 2024 Focus Areas |

|---|---|---|

| Kiavi | Lending and servicing solutions | Digital platform enhancement, investor relations |

| Fidelity National Financial | Title insurance, transaction services | Integration of services, cybersecurity |

| CoreLogic | Data analytics, property intelligence | AI-driven insights, cloud migration |

| Mr. Cooper | Mortgage servicing, origination | Customer experience technology, operational efficiency |

| LoanCare | Loan servicing | Automation, compliance solutions |

SSubstitutes Threaten

Large mortgage servicers and financial institutions are increasingly considering bringing core mortgage lifecycle services back in-house. This trend represents a significant substitute for outsourcing providers like Altisource, particularly for functions where these entities believe they can achieve better cost-efficiency and tighter control. For instance, in 2024, many top-tier financial institutions reported increased investment in their internal technology and operational capabilities for loan origination and servicing.

The ability of major players to develop proprietary technology or leverage existing infrastructure makes in-house processing a viable alternative. They might view this as a strategic move to retain direct oversight of sensitive data and customer relationships, thereby reducing reliance on third-party vendors. This internal focus can also lead to more tailored solutions that align precisely with their business objectives.

Emerging technologies, particularly advanced AI and robotic process automation, present a growing threat of substitutes for Altisource Portfolio Solutions. These innovations can automate many of the manual and data-intensive tasks currently handled by human service providers, directly impacting the need for outsourced solutions in areas like loan servicing and property management. For instance, the global robotic process automation market was valued at approximately $2.0 billion in 2023 and is projected to reach over $12.0 billion by 2030, indicating a rapid adoption rate of these substitute technologies.

The emergence of new digital marketplaces and alternative business models presents a significant threat of substitutes for Altisource Portfolio Solutions. These platforms can offer clients novel ways to access real estate and mortgage services, potentially bypassing traditional providers. For instance, the growth of proptech companies offering direct-to-consumer mortgage origination or property management solutions could siphon off business. In 2024, the digital mortgage market continued its expansion, with an increasing percentage of applications initiated online, highlighting a shift in consumer preference towards more accessible digital channels.

Regulatory Changes Favoring Simpler Processes

Regulatory shifts that simplify processes can significantly impact Altisource. For instance, if new regulations in 2024 or 2025 mandate standardized data formats for mortgage servicing, it could reduce the perceived value of Altisource's complex, end-to-end solutions. This would make it easier for financial institutions to handle tasks in-house or with less specialized providers.

Streamlined compliance, a trend observed in various financial sectors, directly challenges the need for highly specialized third-party services that Altisource offers. As regulatory burdens lessen, the competitive advantage derived from navigating intricate compliance landscapes diminishes, potentially opening the door for simpler, more cost-effective alternatives.

Consider the potential impact of a hypothetical scenario: if a major regulatory body, like the CFPB, were to issue new guidelines in late 2024 simplifying foreclosure notification processes, it could directly reduce the demand for Altisource's specialized default servicing technology. This simplification would empower clients to manage these tasks internally, diminishing the need for external expertise.

- Simplified Regulatory Environments: If regulations become less complex, clients might find it easier to manage tasks internally or with less specialized vendors, reducing reliance on Altisource's comprehensive solutions.

- Standardized Processes: The adoption of standardized industry processes, potentially driven by new regulations, could decrease the need for Altisource's proprietary technologies and expertise.

- Reduced Compliance Burden: Streamlined compliance requirements can lessen the necessity for highly specialized third-party services, making in-house solutions or simpler vendor offerings more attractive.

Lower-Cost, Fragmented Service Providers

Clients may opt to break apart Altisource's bundled services, seeking out specialized, less expensive providers for specific functions. This unbundling strategy, while potentially leading to operational inefficiencies, can attract clients focused on cost savings or desiring greater oversight of individual operational components.

The market for mortgage servicing and origination support is quite fragmented, with numerous smaller players offering specialized services. For instance, in 2024, the U.S. mortgage servicing market includes a wide array of companies, many of which focus on specific niches like default management or loan boarding, often at competitive price points.

- Fragmented Market: Numerous smaller, specialized service providers exist, capable of handling individual tasks.

- Cost Sensitivity: Clients may prioritize lower costs over integrated solutions, leading them to unbundle services.

- Control Preference: Some clients prefer granular control over specific processes, which unbundling facilitates.

- Niche Providers: Specialized firms can offer targeted expertise at potentially lower price points than comprehensive solutions.

The threat of substitutes for Altisource Portfolio Solutions is amplified by the increasing capacity of large mortgage servicers to bring core functions in-house, driven by investments in technology and operational capabilities. This trend was evident in 2024 as many financial institutions bolstered their internal resources for loan origination and servicing, aiming for greater cost-efficiency and control over sensitive data.

The rise of automation technologies, particularly AI and robotic process automation, presents a direct substitute for many of Altisource's services. The global RPA market's projected growth, from approximately $2.0 billion in 2023 to over $12.0 billion by 2030, underscores the increasing adoption of these capabilities, which can automate tasks previously outsourced.

Furthermore, new digital marketplaces and proptech companies offer alternative business models, potentially bypassing traditional providers like Altisource. The continued expansion of the digital mortgage market in 2024, with a growing share of online applications, highlights consumer preference for more accessible digital channels, posing a substitute threat.

Simplified regulatory environments and standardized processes also reduce the need for specialized third-party services. If regulations, for example, simplify foreclosure notification processes as seen with potential CFPB guidelines in late 2024, it could empower clients to manage these tasks internally, diminishing demand for Altisource's expertise.

The fragmented nature of the mortgage servicing market, with numerous smaller niche providers offering specialized services at competitive price points, also contributes to the threat of substitutes. Clients may choose to unbundle Altisource's integrated offerings, opting for more cost-effective, specialized solutions for specific functions.

| Substitute Type | Description | Impact on Altisource | 2024/2025 Trend Example |

|---|---|---|---|

| In-house capabilities | Financial institutions bringing core mortgage lifecycle services back in-house. | Reduced demand for outsourced services. | Increased investment in internal tech/operations by top-tier institutions. |

| Automation Technologies (AI/RPA) | Automating manual and data-intensive tasks. | Directly replaces human service provider roles. | Global RPA market projected to grow significantly, indicating rapid adoption. |

| Digital Marketplaces/Proptech | New platforms offering direct-to-consumer mortgage/real estate services. | Siphons off business from traditional providers. | Expansion of digital mortgage market with increasing online applications. |

| Simplified Regulations | Less complex compliance requirements. | Reduces the value of specialized third-party expertise. | Potential for simplified foreclosure notification processes. |

| Niche Service Providers | Smaller firms specializing in specific mortgage functions. | Attracts cost-sensitive clients seeking unbundled services. | Fragmented market with competitive pricing for specialized tasks. |

Entrants Threaten

Entering the mortgage and real estate technology and services sector, where Altisource operates, demands significant upfront capital. Companies need to invest heavily in developing sophisticated technology platforms, robust IT infrastructure, and acquiring vast amounts of data. For instance, building a competitive mortgage servicing platform can easily cost tens of millions of dollars in initial development and ongoing maintenance.

This high capital requirement acts as a substantial barrier to entry. New players must be prepared to fund extensive research and development, secure necessary licenses, and ensure compliance with stringent financial regulations. The sheer scale of investment needed deters many smaller or less-resourced companies from entering the market, thus protecting established players like Altisource.

The mortgage and real estate sectors are awash in regulations, demanding new players to master intricate licensing, data privacy, and consumer protection statutes. For instance, the Secure and Fair Enforcement for Mortgage Licensing Act (SAFE Act) mandates specific licensing for mortgage loan originators, adding a layer of complexity.

Successfully meeting these rigorous compliance standards demands substantial investment in time and resources, acting as a formidable barrier for potential new entrants. The cost of compliance, including legal fees and specialized personnel, can easily run into hundreds of thousands of dollars before a single service is offered.

Established players like Altisource have cultivated deep-rooted relationships with major mortgage servicers, investors, and real estate professionals over years of operation. This makes it difficult for newcomers to gain traction.

New entrants would struggle to build the necessary trust and secure access to these crucial clients, hindering their ability to establish effective distribution channels. For instance, in 2024, the mortgage servicing sector continued to consolidate, with larger, established firms holding a significant majority of market share, making it harder for new, unproven entities to break in.

Economies of Scale and Experience Curve

Incumbent firms like Altisource Portfolio Solutions often leverage significant economies of scale in crucial areas such as technology development, data processing, and overall operational efficiency. For instance, in 2024, companies with established large-scale data analytics platforms could process millions of loan applications at a fraction of the cost per unit compared to a new entrant needing to build similar infrastructure. This cost advantage makes it difficult for newcomers to compete on price.

New entrants would face substantial hurdles in achieving comparable cost efficiencies without first securing a considerable market volume. This initial cost disadvantage can be a major deterrent. Furthermore, the cumulative experience gained by established players over many years translates into a refined understanding of market dynamics, regulatory landscapes, and customer needs, providing a significant competitive edge that is hard to replicate quickly.

- Economies of Scale: Large incumbents benefit from reduced per-unit costs in technology and operations.

- Experience Curve: Years of operation build expertise and process efficiencies difficult for new entrants to match.

- Cost Disadvantage for Newcomers: Start-ups would need massive initial investment to achieve similar cost structures.

- Barriers to Entry: The combination of scale and experience creates a substantial barrier for potential new competitors.

Proprietary Technology and Intellectual Property

Altisource's integrated platforms, like Hubzu and Equator, are built on proprietary technology and specialized solutions. These aren't easily replicated, making it difficult and expensive for newcomers to build similar capabilities from the ground up. This technological moat significantly deters new entrants.

The significant investment required to develop comparable technology acts as a substantial barrier to entry. For instance, the ongoing development and refinement of AI and automation within these platforms further elevate this hurdle. New competitors would face a steep climb to match Altisource's technological sophistication and operational efficiency.

- Proprietary Platforms: Hubzu and Equator offer integrated, specialized technology solutions.

- High Development Costs: Replicating Altisource's technology from scratch is costly and time-consuming for new entrants.

- Innovation Barrier: Advancements in AI and automation within Altisource's systems further increase the entry barrier.

The threat of new entrants in Altisource Portfolio Solutions' market space is generally low due to substantial barriers. High capital requirements for technology development, regulatory compliance, and building client relationships necessitate significant upfront investment, deterring many potential competitors.

Established players benefit from economies of scale and an experience curve, making it difficult for newcomers to match cost efficiencies and market knowledge. Proprietary technology platforms further solidify this advantage, increasing the cost and complexity for any new company attempting to enter the market.

In 2024, the mortgage servicing sector continued to see consolidation, with larger firms dominating market share, underscoring the difficulty for unproven entities to gain traction. The cost of regulatory compliance, including licensing and data privacy, can easily reach hundreds of thousands of dollars before operations even begin.

Altisource's integrated platforms, like Hubzu and Equator, represent a significant technological moat, with ongoing AI and automation advancements further raising the entry barrier.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Altisource Portfolio Solutions leverages a comprehensive mix of data, including Altisource's SEC filings, investor presentations, and industry-specific market research reports. We also incorporate data from financial news outlets and competitor analyses to provide a robust view of the competitive landscape.