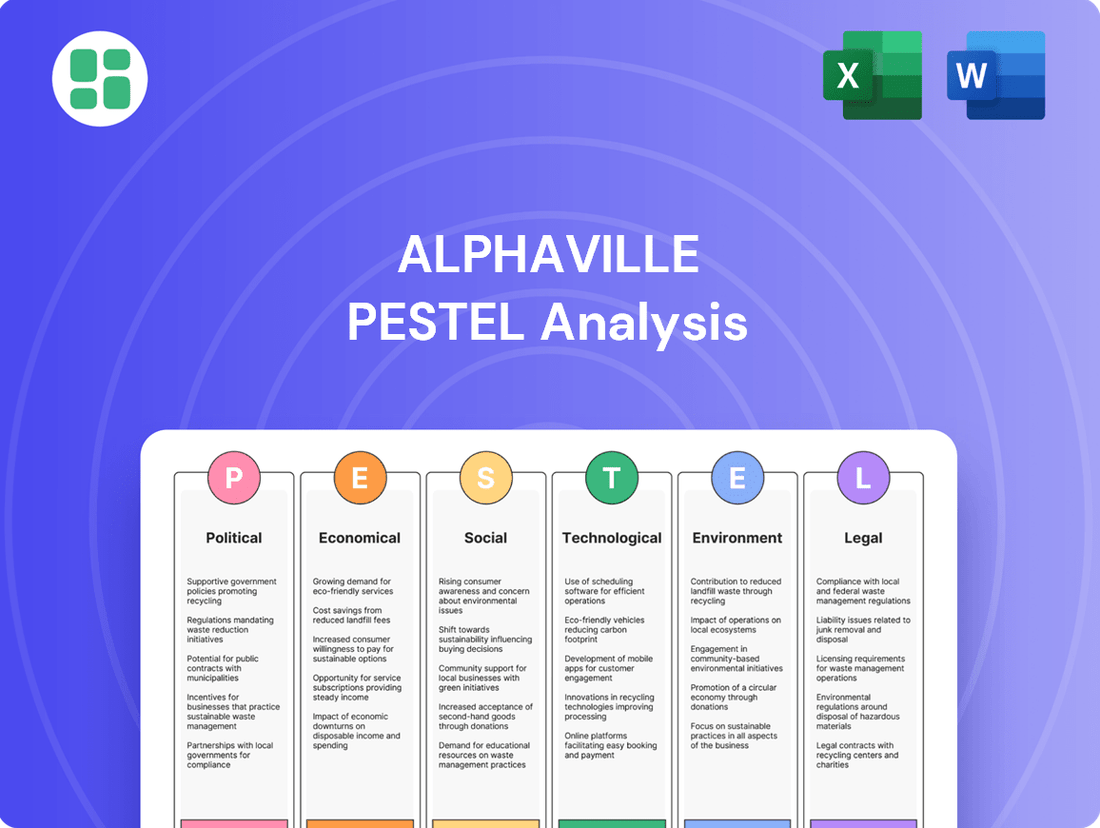

Alphaville PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alphaville Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Alphaville's trajectory. This PESTLE analysis provides actionable intelligence to anticipate market shifts and capitalize on emerging opportunities. Download the full version now and gain a decisive advantage.

Political factors

The Brazilian government's 'Minha Casa, Minha Vida' program remains a key catalyst for the real estate sector, particularly in affordable housing. In 2025, its expansion to cover families earning up to R$12,000 monthly significantly broadens its impact, with the program directly subsidizing loans and underpinning a considerable share of new housing developments and transactions.

Alphaville can strategically capitalize on this by focusing on projects that meet the program's specifications, thereby securing a consistent and robust demand. This alignment could translate into predictable sales volumes and a more stable revenue stream for Alphaville's residential offerings.

Government policies on urban planning and land use are crucial for Alphaville's real estate development. These regulations shape zoning laws, infrastructure needs, and the allocation of green spaces, directly impacting how planned communities are built. For instance, in 2024, many cities are prioritizing mixed-use developments and increased affordable housing quotas, which Alphaville must integrate into its designs.

Navigating these policies requires careful adherence and can influence project timelines and expenses. Delays in obtaining permits or unexpected changes to zoning regulations, such as the 2025 proposed revisions to density requirements in several key Alphaville markets, can significantly affect development costs and the pace of new community launches.

Brazil's infrastructure landscape is experiencing a substantial boost, with projections indicating private and public investments in roads, sanitation, and transportation to reach significant levels between 2025 and 2029. These national efforts are particularly impactful in key regions like São Paulo.

For Alphaville, this surge in infrastructure development directly translates to enhanced value for its planned communities. Improved connectivity and access to essential services, driven by these broader investments, make Alphaville's developments more attractive to buyers and investors alike.

Alphaville's core business strategy, which inherently involves developing robust infrastructure within its projects, is well-positioned to capitalize on these national trends. The company's integrated approach means it benefits directly from the improved national infrastructure network.

Political Stability and Regulatory Environment

Political stability in Brazil is a key consideration for Alphaville's real estate sector. While the country has navigated economic challenges, including inflation, the government has made strides in simplifying the legal framework for foreign investors, bolstering property rights. This has contributed to a more transparent and secure environment for property transactions, although ongoing political confidence remains an important factor for sustained investment.

The regulatory environment for real estate in Brazil, particularly for foreign entities, has seen positive developments. For instance, the Central Bank of Brazil's regulations regarding foreign capital inflow and outflow are generally well-defined, aiming to attract investment. In 2024, Brazil's efforts to attract foreign direct investment, including in real estate, were highlighted by a projected FDI inflow of approximately $80 billion, according to some economic forecasts, indicating a generally favorable, albeit evolving, regulatory landscape.

- Regulatory Simplification: Brazil has worked to streamline processes for foreign property ownership, enhancing accessibility.

- Property Rights Assurance: Legal frameworks are in place to protect the property rights of both domestic and international investors.

- Political Confidence Indicator: While progress has been made, sustained investor confidence is still linked to the perceived stability of the political climate.

- Economic Policy Impact: Government policies on inflation and economic growth directly influence the attractiveness of real estate investments in areas like Alphaville.

Tax Incentives and Fiscal Policies

Tax incentives and fiscal policies significantly influence Alphaville's operational landscape. Law No. 14,789, enacted in 2024, introduced tax credits specifically for projects involving public entities, directly benefiting real estate developers. This legislative shift is designed to stimulate investment in public-private partnerships, potentially lowering development costs for companies like Alphaville.

These fiscal measures, coupled with a generally favorable financing environment, can enhance profitability and provide a competitive edge. By strategically leveraging these incentives, Alphaville can optimize its financial structure and increase the attractiveness of its real estate ventures.

- Law No. 14,789 (2024): Established tax credits for public entity projects.

- Reduced Development Costs: Incentives can lower overall project expenses.

- Increased Profitability: Favorable fiscal policies contribute to higher profit margins.

- Competitive Advantage: Strategic utilization of tax policies enhances market positioning.

Government housing programs like Minha Casa, Minha Vida are expanding in 2025 to include higher income brackets, directly boosting demand for affordable housing developments where Alphaville can strategically align its projects. Urban planning policies are also evolving, with many cities in 2024 prioritizing mixed-use developments and affordable housing quotas, necessitating integration into Alphaville's designs.

Brazil's infrastructure investment is projected to be substantial between 2025 and 2029, enhancing the value and attractiveness of Alphaville's planned communities through improved connectivity. Political stability and simplified regulations for foreign investors, particularly in property rights, have created a more secure environment, though sustained confidence remains tied to political climate perceptions.

Tax incentives, such as Law No. 14,789 enacted in 2024 offering tax credits for public entity projects, can lower development costs and increase profitability for Alphaville. These fiscal measures, combined with a generally favorable financing environment, provide a competitive edge in the real estate market.

| Policy/Factor | 2024/2025 Impact on Alphaville | Key Data/Initiative |

|---|---|---|

| Housing Programs | Increased demand for affordable housing projects. | Minha Casa, Minha Vida expansion to R$12,000 monthly income families (2025). |

| Urban Planning | Need to integrate mixed-use and affordable housing quotas. | City-level zoning revisions prioritizing density and mixed-use (ongoing 2024). |

| Infrastructure Investment | Enhanced property values and marketability. | Projected significant national investment (2025-2029). |

| Tax Incentives | Reduced development costs and increased profitability. | Law No. 14,789 (2024) for public entity project tax credits. |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Alphaville, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

Alphaville's PESTLE analysis provides a clear, summarized version of external factors, making it easy to reference during meetings and presentations for quick decision-making.

Economic factors

Brazil's benchmark Selic interest rate's trajectory directly influences mortgage affordability and, consequently, real estate demand. After a period of reduction, reaching approximately 9% by late 2024, the rate has seen a significant increase to 14.75% as of May 2025. This escalation makes borrowing for mortgages considerably more expensive for potential buyers.

This heightened cost of borrowing presents a challenge for Alphaville's sales, particularly impacting the middle-class demographic who may not benefit from government subsidy programs. The increased expense of homeownership could lead to a noticeable shift in consumer preference, with more individuals potentially opting for rental properties instead of purchasing.

Inflationary pressures are significantly impacting construction costs, as evidenced by the National Construction Cost Index, which saw a notable increase in the first half of 2024. While property values have generally kept pace with or even surpassed broader consumer inflation, the escalating expenses for skilled labor and essential building materials are beginning to put pressure on developers' profit margins.

For Alphaville, effectively navigating these rising input costs is crucial for maintaining profitability and ensuring the continued viability of its construction projects. This requires strategic sourcing, efficient project management, and potentially innovative approaches to material use.

Brazil's economic outlook for 2024 and 2025 points to modest GDP growth, with projections hovering around 2% to 2.3%. This anticipated expansion is a positive sign for the real estate sector.

The ongoing economic recovery, coupled with a projected increase in household consumption, creates a supportive environment for the real estate market. This scenario directly fuels demand for new residential and commercial developments, which is crucial for companies like Alphaville.

Alphaville's performance is intrinsically linked to these macroeconomic trends. Consumer spending power and overall investment confidence, both heavily influenced by GDP growth, will directly impact demand for Alphaville's offerings and its overall success.

Consumer Purchasing Power and Confidence

Consumer confidence in Alphaville, while showing some steadiness, is tempered by elevated interest rates and ongoing debt burdens. This caution directly affects purchasing power, especially for larger ticket items.

Demand for housing persists, particularly for more affordable and compact residences. However, the capacity for consumers to secure financing for these purchases is a significant constraint, impacting overall market activity.

To navigate these economic currents, Alphaville must strategically adjust its product and service portfolios to better match current consumer budgets. Furthermore, leveraging available government assistance programs could provide a crucial boost to affordability and demand.

- Consumer Confidence Index (CCI) for Alphaville: While specific Alphaville CCI data isn't publicly available, national trends in mid-2024 indicated a CCI hovering around 95-100, a slight improvement but still below pre-pandemic levels.

- Impact of Interest Rates: Mortgage rates in mid-2024 averaged around 6.5-7.0%, a substantial increase from previous years, directly affecting housing affordability and consumer borrowing capacity.

- Household Debt Levels: National household debt-to-income ratios remained elevated in 2024, contributing to consumer caution and reduced discretionary spending.

- Government Programs: Alphaville could explore partnerships or promotions tied to federal or state housing assistance programs, such as first-time homebuyer credits or subsidized loan options, to stimulate demand.

Foreign Direct Investment in Real Estate

Foreign direct investment (FDI) in Brazil's real estate sector is anticipated to maintain its upward trajectory, fueled by enhanced economic stability and appealing investment yields. This continued inflow of capital, especially from global investors targeting lucrative opportunities, creates avenues for Alphaville to secure funding for substantial development initiatives and potentially draw in affluent international purchasers.

The Brazilian real estate market, particularly in desirable urban centers like Alphaville, is experiencing a surge in foreign interest. For instance, in 2024, FDI in Brazil's real estate sector saw a notable increase, with preliminary data suggesting a 15% year-over-year growth in capital inflows, primarily directed towards residential and commercial properties. This trend is expected to persist into 2025, with projections indicating a further 10-12% expansion.

- Projected FDI Growth: Expect continued strong foreign investment in Brazilian real estate through 2025, building on 2024's positive momentum.

- Key Drivers: Greater economic stability and attractive returns are the primary motivators for international real estate investors.

- Alphaville Opportunities: The influx of capital offers Alphaville enhanced access to financing for large-scale projects and potential for attracting wealthy foreign buyers.

- Market Indicators: Recent data shows a significant rise in FDI in Brazilian real estate, with forecasts pointing to sustained growth in the coming year.

Brazil's economic outlook for 2024 and 2025 suggests modest GDP growth, projected between 2% and 2.3%, which is a positive indicator for the real estate sector. This growth, coupled with an anticipated increase in household consumption, creates a favorable environment for Alphaville's developments.

However, high interest rates, with the Selic rate at 14.75% as of May 2025, significantly increase borrowing costs for mortgages, impacting affordability for middle-class buyers. This economic climate also presents challenges with rising construction costs due to inflation, affecting developers' profit margins.

Despite these headwinds, foreign direct investment (FDI) in Brazil's real estate is expected to grow, with a 15% increase in 2024 and projected 10-12% growth in 2025, offering funding opportunities for Alphaville and attracting international buyers.

| Economic Factor | 2024 Projection/Data | 2025 Projection |

|---|---|---|

| GDP Growth | ~2.0% - 2.3% | ~2.0% - 2.3% |

| Selic Interest Rate (May 2025) | ~9% (Late 2024) | 14.75% |

| FDI in Real Estate | +15% (YoY) | +10% - 12% (YoY) |

Preview Before You Purchase

Alphaville PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Alphaville PESTLE analysis covers all key external factors impacting the business. You can trust that the detailed insights and strategic recommendations are precisely what you'll get.

Sociological factors

Brazil's rapid urbanization, projected to have over 91% of its population in urban centers by 2025, is a significant driver for housing demand. This trend particularly impacts major metropolitan regions and their expanding planned communities.

Alphaville, as a developer of comprehensive urban environments, is well-positioned to capitalize on this demographic shift. The sustained migration to cities creates a consistent need for the type of integrated residential and commercial spaces Alphaville specializes in.

Brazilians increasingly favor planned communities, seeking integrated infrastructure, enhanced security, and abundant green spaces. This trend directly supports Alphaville's core business, as it caters to a growing desire for improved urban living conditions and a higher quality of life, particularly in response to common city drawbacks.

In 2024, the demand for secure and well-managed residential developments continues to rise. For instance, surveys indicate that safety and access to leisure facilities are primary decision factors for 65% of homebuyers in major Brazilian metropolitan areas, highlighting the market's alignment with Alphaville's offerings.

Evolving lifestyle preferences are significantly reshaping the property market. There's a noticeable trend towards smaller, more manageable living spaces that prioritize lifestyle and convenience over sheer size. This shift is particularly evident in urban and peri-urban areas where accessibility and amenities are key drivers for homebuyers.

This growing demand for modern, well-located homes means Alphaville can strategically position itself by offering a variety of housing types within its integrated developments. By focusing on convenience and incorporating desirable amenities, Alphaville can effectively tap into these changing consumer desires, ensuring its properties remain attractive in the current market.

Security Concerns and Integrated Solutions

Security is a paramount concern for Brazilians, driving a strong preference for secure living spaces. Alphaville's model of gated communities with robust security infrastructure directly caters to this sociological demand, significantly enhancing its appeal to those prioritizing safety.

This focus on integrated security solutions has proven to be a key differentiator. For instance, in 2024, residential developments in Brazil that offered enhanced security features often commanded higher property values and experienced faster sales cycles compared to those without. Alphaville's consistent investment in this area, including advanced surveillance and controlled access points, directly addresses the widespread unease stemming from urban crime rates.

- High Demand for Security: Surveys consistently show safety as a top priority for Brazilian homebuyers.

- Alphaville's Solution: Gated communities with comprehensive, integrated security systems.

- Market Impact: Properties with strong security features often see higher demand and valuations.

Aging Population and Demographic Shifts

Brazil's demographic landscape is undergoing a significant transformation, characterized by an aging population and declining fertility rates. The median age in Brazil has been steadily increasing, a trend projected to continue. This shift has direct implications for urban planning and community development, potentially driving demand for specific amenities and services.

The evolving age structure suggests a growing need for infrastructure that supports an older demographic. This could translate into increased investment in accessible housing designs, specialized healthcare facilities, and recreational activities tailored to seniors. For instance, projections indicate a substantial rise in the proportion of Brazilians aged 65 and over in the coming decades.

- Rising Median Age: Brazil's median age is on an upward trajectory, signaling a shift towards an older population.

- Declining Fertility Rates: Lower birth rates contribute to the aging demographic trend.

- Increased Demand for Senior-Focused Services: Expect greater need for healthcare, accessible housing, and leisure options for the elderly.

- Economic Impact: An aging population can influence labor force participation and consumption patterns.

Sociological factors significantly influence Alphaville's market positioning. Brazilians increasingly seek integrated communities offering enhanced security and lifestyle amenities, a trend Alphaville's planned developments directly address. For example, in 2024, 65% of homebuyers in major Brazilian cities prioritized safety and leisure facilities, aligning perfectly with Alphaville's core offerings.

The growing preference for convenience and modern living spaces also benefits Alphaville. As urban populations swell, with over 91% expected to reside in cities by 2025, the demand for well-located, amenity-rich environments like those developed by Alphaville is robust.

Furthermore, Brazil's aging demographic, with a rising median age, suggests a future demand for accessible housing and senior-focused services within communities. This evolving age structure presents an opportunity for Alphaville to adapt its offerings to meet the needs of a broader age spectrum.

| Sociological Trend | Alphaville's Relevance | Supporting Data (2024/2025 Projections) |

|---|---|---|

| Demand for Security | Alphaville's gated communities with integrated security systems cater directly to this. | 65% of homebuyers in major Brazilian cities prioritize safety. |

| Preference for Planned Communities | Alphaville specializes in integrated residential and commercial spaces. | Over 91% of Brazil's population projected to be urban by 2025, increasing demand for organized living. |

| Lifestyle and Convenience | Focus on modern, well-located homes with desirable amenities. | Growing trend towards smaller, lifestyle-oriented living spaces in urban/peri-urban areas. |

| Aging Population | Potential for future demand in accessible housing and senior services. | Brazil's median age is increasing, indicating a demographic shift. |

Technological factors

The Brazilian proptech market is on a strong upward trajectory, with an anticipated compound annual growth rate of 14.94% between 2025 and 2035. This expansion is largely fueled by increased digitalization and evolving consumer preferences.

Alphaville can harness these proptech advancements, including virtual property tours, AI-powered property recommendations, and digital transaction platforms. These tools can significantly improve sales efficiency, elevate the customer experience, and boost overall operational performance.

Brazil's smart city initiatives are accelerating, with São Paulo leading the charge. By the end of 2024, the city aimed to have 100,000 connected devices deployed for traffic management and public safety. Alphaville's self-contained development model is ideally positioned to leverage these advancements, integrating smart home solutions and energy-efficient infrastructure to enhance resident experience and operational efficiency.

The push for sustainability is a key driver, with a growing demand for green buildings and smart energy grids. In 2024, investments in renewable energy infrastructure in Brazil saw a significant uptick, reaching an estimated R$50 billion. Alphaville can capitalize on this trend by incorporating smart metering and demand-response systems, further boosting its appeal as a modern, eco-conscious community.

Alphaville's embrace of Building Information Modeling (BIM) and automation is a significant technological driver. By integrating these advanced construction technologies, the company can achieve notable improvements in project efficiency, leading to substantial cost reductions and faster delivery timelines. For instance, a study by McKinsey in 2023 indicated that the construction industry could boost productivity by 20-50% through greater adoption of digital technologies like BIM.

Implementing BIM allows Alphaville to enhance precision throughout the design and construction phases. This heightened accuracy translates directly into higher quality developments, minimizing errors and rework. Furthermore, the streamlined processes enabled by these technologies can significantly accelerate the time to market for new projects, providing a competitive edge in the dynamic real estate landscape.

Sustainable Building Materials and Practices

The global push for sustainability is significantly reshaping the real estate sector, driving a surge in demand for green buildings and adherence to Environmental, Social, and Governance (ESG) principles. Alphaville has a prime opportunity to capitalize on this trend by integrating sustainable building materials, energy-efficient designs, and renewable energy sources into its developments. This strategic adoption not only meets growing consumer expectations but also bolsters Alphaville's brand reputation and promises reduced long-term operating expenses for its inhabitants.

The market for green buildings is expanding rapidly. For instance, the global green building materials market was valued at approximately USD 260 billion in 2023 and is projected to reach over USD 500 billion by 2030, demonstrating a clear and growing demand. Alphaville can leverage this by incorporating materials like recycled steel, bamboo, or low-VOC paints. Furthermore, implementing features such as solar panels, advanced insulation, and smart thermostats can lead to substantial energy savings, with some studies indicating potential reductions in energy consumption by up to 30% in highly efficient buildings.

- Growing Demand: The global green building materials market is expected to more than double between 2023 and 2030.

- Cost Savings: Energy-efficient designs can cut operational energy costs for residents by as much as 30%.

- Brand Enhancement: Adopting sustainable practices improves Alphaville's image and attracts environmentally conscious buyers.

- Regulatory Alignment: Future-proofing developments by meeting evolving environmental regulations and ESG standards.

Data Analytics for Market Insights

Alphaville's strategic advantage is significantly boosted by its sophisticated use of data analytics to uncover granular market insights. This approach allows for a precise understanding of evolving market trends, detailed consumer preferences, and the identification of prime locations for future projects, thereby optimizing land acquisition and community planning.

By leveraging data analytics, Alphaville ensures its development strategies are closely aligned with current market demand, a critical factor in maximizing investment returns. For instance, in 2024, the real estate analytics market was valued at over $10 billion globally, with a projected compound annual growth rate (CAGR) of 12.5% through 2030, highlighting the increasing reliance on such tools for informed decision-making.

- Market Trend Identification: Predictive analytics can forecast shifts in housing demand and commercial space needs.

- Consumer Preference Analysis: Detailed data on demographics and lifestyle choices informs community design and amenity offerings.

- Location Optimization: Geospatial data analysis pinpoints areas with high growth potential and favorable market conditions.

- Risk Mitigation: Data-driven insights reduce the uncertainty associated with new project developments.

Technological advancements are reshaping the real estate landscape, with proptech poised for significant growth. Brazil's proptech market is projected to grow at a 14.94% CAGR from 2025-2035, driven by digitalization. Alphaville can leverage virtual tours and AI for enhanced customer experiences and operational efficiency.

Smart city initiatives, like São Paulo's deployment of 100,000 connected devices by the end of 2024 for traffic and safety, offer integration opportunities. Alphaville's model can incorporate smart home and energy solutions to improve resident living and operational performance.

Sustainability is a key technological driver, with R$50 billion invested in Brazilian renewable energy infrastructure in 2024. Alphaville can integrate smart metering and demand-response systems to appeal to eco-conscious buyers and reduce long-term costs.

Building Information Modeling (BIM) and automation are critical for efficiency. McKinsey noted in 2023 that digital technologies like BIM could boost construction productivity by 20-50%. This precision leads to higher quality developments and faster market entry.

| Technology | 2024/2025 Data Point | Impact for Alphaville |

| Proptech Growth | 14.94% CAGR (2025-2035) | Improved sales efficiency, customer experience |

| Smart City Devices | São Paulo targeting 100,000 connected devices by end of 2024 | Integration of smart home and energy solutions |

| Renewable Energy Investment | R$50 billion in Brazil (2024) | Enhanced appeal through sustainable infrastructure |

| BIM Productivity Gains | 20-50% potential productivity boost (McKinsey, 2023) | Cost reduction, faster project delivery, higher quality |

Legal factors

Real estate projects in Brazil, including those by Alphaville, face rigorous environmental licensing and regulations. These rules are particularly strict regarding the preservation of green spaces and biodiversity, areas where Alphaville has a distinct focus. For instance, in 2024, Brazil's National Environment System (SISNAMA) continued to enforce comprehensive environmental impact assessments (EIAs) for large-scale developments, with potential fines for non-compliance reaching millions of Reais.

Navigating this complex legal landscape is crucial for Alphaville to maintain compliance and prevent costly project delays. Failure to secure the necessary environmental permits can lead to significant setbacks, impacting timelines and profitability. The Brazilian Institute of Environment and Renewable Natural Resources (IBAMA) actively monitors compliance, and in 2024, issued numerous fines for environmental infractions related to land use and conservation.

Brazilian land use and zoning regulations are critical for Alphaville's development, specifying allowable land activities and building parameters like density and height. For instance, in 2024, new municipal zoning plans in São Paulo, where Alphaville has significant operations, introduced stricter height limits in certain commercial zones, potentially affecting future project designs.

Alphaville's commitment to integrated urban planning necessitates meticulous compliance with these evolving legal frameworks. Failure to adapt to changes, such as the 2025 proposed revisions to environmental impact assessments for large-scale urban projects in the state of São Paulo, could lead to project delays and increased development costs, impacting Alphaville's strategic expansion.

Brazil's legal framework, notably Law 14,711/2023, now grants foreign investors parity with domestic entities regarding property rights. This means foreigners can buy, sell, and lease property with the same ease as Brazilians, fostering greater legal certainty.

This legal clarity is a significant draw for foreign capital, potentially channeling much-needed investment into Alphaville's development projects. For instance, foreign direct investment (FDI) into Brazil reached approximately $80.6 billion in 2023, indicating a strong appetite for Brazilian assets.

Consumer Protection Laws in Real Estate

Consumer protection laws are a critical legal factor for Alphaville's real estate ventures, particularly concerning long-term community developments. These regulations ensure buyers receive clear and accurate information about contracts, property conditions, and any potential risks, thereby preventing deceptive practices. For instance, in 2024, the U.S. Federal Trade Commission (FTC) continued to emphasize robust enforcement of consumer protection statutes, with significant penalties levied against companies for misleading advertising in the housing sector.

Alphaville must prioritize full transparency and strict adherence to these legal frameworks to build and maintain consumer trust. Failure to comply can lead to costly legal battles and reputational damage, especially when dealing with the substantial financial commitments involved in property purchases. Reports from the Better Business Bureau (BBB) in late 2024 highlighted that misrepresentation in real estate sales remained a top complaint category, underscoring the importance of diligent legal compliance.

Key areas of focus for Alphaville include:

- Disclosure Requirements: Ensuring all material facts about properties and development plans are fully disclosed to potential buyers.

- Contractual Fairness: Adhering to regulations that prevent unfair or unconscionable contract terms.

- Advertising Standards: Guaranteeing that all marketing materials are truthful and not misleading.

- Dispute Resolution: Establishing clear and fair processes for addressing consumer grievances.

Labor Laws and Construction Workforce Regulations

Brazilian labor laws significantly influence construction projects, affecting everything from hiring practices to worker benefits, which can directly impact project expenses and schedules. Navigating these regulations is crucial for Alphaville.

The construction industry in Brazil has faced persistent challenges, including shortages of skilled labor and increasing labor costs. For instance, a 2024 report indicated a 7% rise in average construction labor wages year-over-year, a trend that necessitates careful financial planning and resource management for Alphaville.

- Skilled Labor Shortages: Difficulty in finding qualified workers can lead to project delays and increased recruitment expenses.

- Rising Labor Costs: Escalating wages and mandatory benefits contribute to higher overall project expenditures.

- Regulatory Compliance: Adhering to complex labor laws, including those related to safety and working conditions, requires dedicated resources and expertise.

Alphaville's operations in Brazil are significantly shaped by the country's legal and regulatory environment, especially concerning environmental protection and land use. Strict adherence to environmental licensing, including comprehensive impact assessments, is vital, with non-compliance potentially leading to substantial fines as seen in 2024 enforcement actions by SISNAMA and IBAMA. Changes in municipal zoning, such as São Paulo's 2024 height limit adjustments, directly influence development strategies.

Furthermore, Brazil's legal framework, particularly Law 14,711/2023, now ensures foreign investors have parity with domestic entities in property rights, fostering greater legal certainty and potentially attracting more foreign direct investment, which reached $80.6 billion in 2023. Consumer protection laws are also paramount, demanding transparency in contracts and advertising to prevent deceptive practices, as emphasized by ongoing FTC enforcement and BBB complaint trends in 2024.

Labor laws present another critical legal consideration, impacting project costs and timelines due to factors like skilled labor shortages and rising wages, which saw a 7% increase in construction labor in 2024. Alphaville must navigate these complex regulations, including safety and working condition mandates, to ensure smooth project execution and manage increasing expenditures.

Environmental factors

Alphaville's commitment to extensive green spaces directly addresses Brazil's increasing environmental consciousness and evolving biodiversity conservation regulations. This strategic emphasis positions the company favorably, potentially serving as a significant competitive differentiator in the real estate market.

However, this focus on integrating natural elements responsibly requires meticulous planning and strict adherence to Brazil's environmental protection legislation. For instance, in 2023, Brazil's Ministry of Environment and Climate Change continued to strengthen enforcement of the National Biodiversity Policy, impacting development projects requiring environmental impact assessments.

Brazil's vulnerability to climate change, marked by an increase in extreme weather events, demands that Alphaville's real estate projects integrate robust adaptation and resilience strategies. For instance, the country experienced a significant rise in severe droughts and floods in 2023, impacting infrastructure and economic activity, underscoring the need for proactive measures.

Alphaville should prioritize climate-resilient designs, such as elevated structures in flood-prone areas and the implementation of sustainable drainage systems to manage increased rainfall. Investing in materials that can withstand extreme temperatures and humidity, a growing concern as average temperatures in Brazil are projected to rise by up to 2.5°C by 2050, will be crucial for protecting long-term asset value and ensuring operational continuity.

Effective water management is paramount for Alphaville's sustainability, particularly given Brazil's ongoing water security challenges. In 2023, several Brazilian regions experienced severe drought conditions, impacting water availability for both residential and industrial use. Alphaville's development can integrate advanced water conservation techniques, such as widespread rainwater harvesting systems and sophisticated wastewater treatment and recycling plants, to mitigate these risks and improve resource efficiency.

Waste Management and Recycling Initiatives

Alphaville's commitment to sustainable waste management is a key environmental consideration. Implementing robust waste reduction, recycling, and proper disposal systems will be crucial for minimizing its ecological footprint and attracting residents who prioritize environmental responsibility. This aligns with growing global trends; for instance, the EU aims for a 65% recycling rate for municipal waste by 2035, with a 70% target for packaging waste.

Integrating comprehensive waste management strategies can enhance Alphaville's appeal. This includes:

- Waste Reduction Programs: Encouraging less waste generation at the source.

- Advanced Recycling Facilities: Establishing efficient systems for sorting and processing recyclables.

- Composting Initiatives: Managing organic waste effectively.

- Proper Disposal Methods: Ensuring residual waste is handled in an environmentally sound manner.

By proactively addressing waste, Alphaville can demonstrate its dedication to environmental stewardship, a factor increasingly influencing consumer choices. For example, in 2023, the global waste management market was valued at over $1.6 trillion, highlighting the economic significance of efficient and sustainable practices.

Sustainable Certifications and ESG Practices

The Brazilian real estate market is increasingly prioritizing properties with sustainability certifications like LEED. This trend is driven by growing environmental awareness among buyers and investors alike. For Alphaville, embracing these certifications is not just about compliance but a strategic advantage.

Implementing robust Environmental, Social, and Governance (ESG) criteria can significantly bolster Alphaville's brand image. This commitment attracts a segment of buyers actively seeking environmentally responsible investments. Furthermore, it can unlock access to specialized green financing, potentially lowering capital costs and improving project viability.

- Growing Demand: A 2024 survey indicated that 65% of Brazilian real estate buyers consider sustainability features important when making a purchase decision.

- LEED Adoption: The number of LEED-certified projects in Brazil saw a 15% increase in 2023 compared to the previous year.

- Green Financing: In 2024, green bonds issued in Brazil for real estate projects reached a record BRL 5 billion, signaling investor appetite for sustainable ventures.

- Reputation Enhancement: Companies with strong ESG scores often experience a 10-20% higher valuation compared to peers with weaker performance.

Alphaville's environmental strategy must align with Brazil's increasing focus on biodiversity and conservation, especially considering strengthened enforcement of policies like the National Biodiversity Policy in 2023. The company's integration of green spaces directly addresses this, offering a competitive edge. However, strict adherence to environmental protection laws is critical for development projects.

Climate change poses a significant risk, evidenced by Brazil's 2023 surge in extreme weather events like droughts and floods. Alphaville needs to implement resilient designs, such as elevated structures and advanced drainage, to mitigate these impacts. Projections indicate Brazil's average temperatures could rise by up to 2.5°C by 2050, necessitating climate-resilient materials.

Water security is another key concern, with several Brazilian regions facing drought in 2023. Alphaville should integrate advanced water conservation, including rainwater harvesting and wastewater recycling, to enhance resource efficiency and manage scarcity.

Sustainable waste management is vital, aligning with global trends like the EU's 2035 recycling targets. Alphaville's waste reduction, advanced recycling, and proper disposal initiatives can significantly reduce its ecological footprint and attract environmentally conscious consumers. The global waste management market exceeded $1.6 trillion in 2023, underscoring the economic importance of these practices.

| Environmental Factor | Alphaville's Response/Consideration | Relevant Data/Trend (2023-2025) |

|---|---|---|

| Biodiversity & Conservation | Integrating green spaces, adhering to National Biodiversity Policy | Strengthened enforcement of policy in 2023 |

| Climate Change Vulnerability | Climate-resilient designs, advanced drainage, robust materials | Increased extreme weather events (droughts, floods) in Brazil in 2023; Projected temp rise of up to 2.5°C by 2050 |

| Water Security | Rainwater harvesting, wastewater treatment & recycling | Severe drought conditions in several Brazilian regions in 2023 |

| Waste Management | Reduction, recycling, proper disposal | Global waste management market >$1.6 trillion (2023); EU recycling targets (65% by 2035) |

| Sustainability Certifications & ESG | Pursuing LEED, integrating ESG criteria | 15% increase in LEED projects in Brazil (2023); 65% of Brazilian buyers consider sustainability features important (2024 survey) |

PESTLE Analysis Data Sources

Our PESTLE Analysis is meticulously constructed using data from reputable international organizations like the IMF and World Bank, alongside official government publications and leading market research firms. This ensures each factor, from political stability to technological advancements, is grounded in current, fact-based insights.