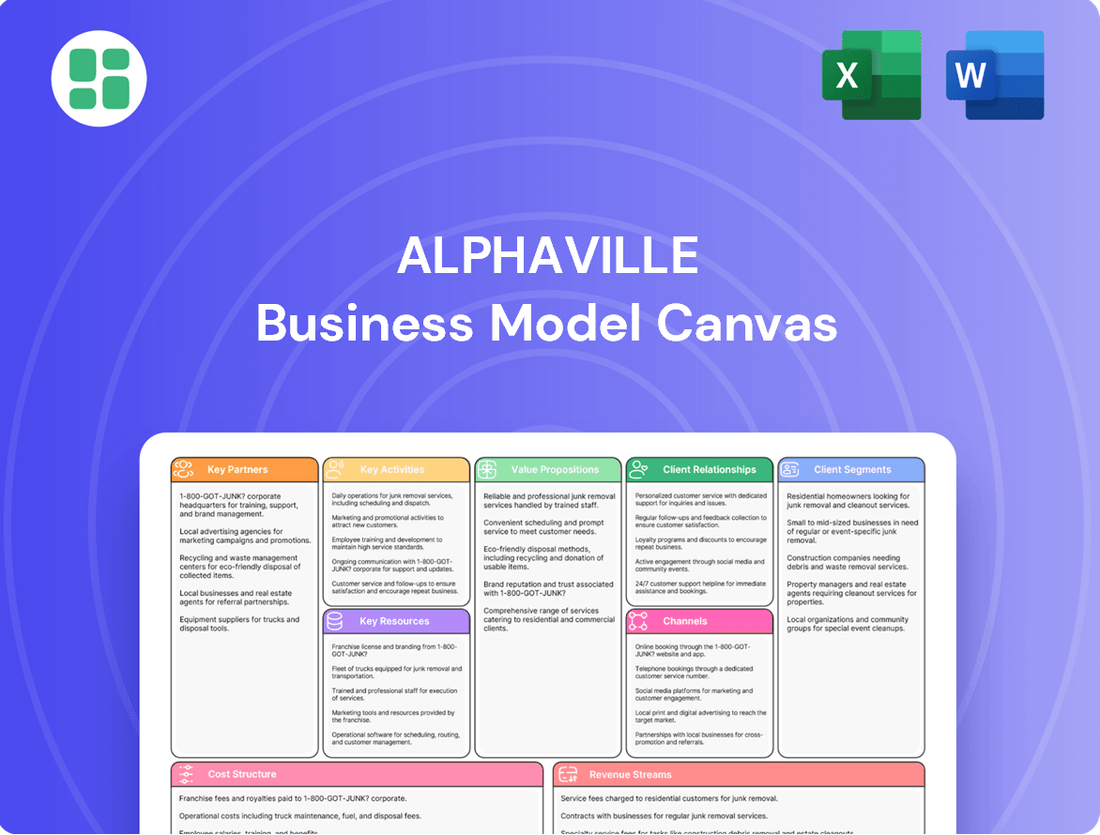

Alphaville Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alphaville Bundle

Unlock the full strategic blueprint behind Alphaville's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Alphaville's strategic landowner partnerships are a cornerstone of its development strategy. These collaborations allow Alphaville to access prime real estate without significant upfront land acquisition costs, a critical advantage in competitive markets. For instance, in 2024, Alphaville secured three key development sites through such agreements, representing over 50 acres of potential housing units.

These landowner agreements typically involve Alphaville taking on the development risk and costs, with landowners receiving a pre-agreed share of the project's profits or a portion of the completed units. This symbiotic relationship de-risks Alphaville's capital deployment and accelerates its ability to bring new communities to market. Such partnerships are vital for Alphaville's expansion, enabling it to maintain a robust development pipeline.

Alphaville's success hinges on strong ties with financial institutions and investors. These collaborations are crucial for obtaining project financing, managing debt, and executing capital increases, ensuring a steady flow of capital for ambitious real estate ventures.

A prime example of this synergy is Alphaville's R$ 685 million capital increase in 2024. This significant funding round saw Ulbrex Asset emerge as a principal shareholder, underscoring the importance of strategic investor relationships in driving growth and development.

Engaging with governmental and regulatory bodies is paramount for Alphaville's operations. These partnerships are critical for securing essential licenses and permits, ensuring adherence to urban planning regulations, and facilitating the approval of major development projects. For instance, in 2024, navigating complex zoning laws required extensive consultation with city planning departments across multiple jurisdictions.

Construction and Infrastructure Contractors

Alphaville relies on strategic alliances with specialized construction firms and infrastructure developers to bring its ambitious urban and residential projects to life. These partners are the backbone of our development, handling the physical construction of everything from essential roads and utility networks to shared amenities that define our communities.

The success of Alphaville’s projects hinges on the expertise and reliability of these construction partners. Their ability to deliver high-quality work on schedule directly impacts our ability to create functional and desirable living spaces. For example, in 2024, Alphaville secured contracts with several leading construction groups, including those with proven track records in sustainable building practices and smart city infrastructure integration, ensuring our developments meet both current and future needs.

- Specialized Expertise: Partnering with firms that possess deep knowledge in areas like high-rise construction, civil engineering, and the installation of advanced utility systems.

- Quality Assurance: Ensuring that all construction adheres to stringent quality standards and building codes, often exceeding regulatory requirements.

- Timely Project Completion: Collaborating closely to meet project deadlines, which is crucial for financial planning and resident satisfaction.

- Innovation in Construction: Working with partners who embrace new technologies and sustainable building materials to enhance efficiency and environmental performance.

Technology and Security Solution Providers

Alphaville's strategic alliances with technology and security solution providers are crucial for delivering a premium living experience. These collaborations bring cutting-edge smart home systems and robust cybersecurity measures directly to residents. For instance, partnerships with firms specializing in AI-powered security and integrated IoT platforms ensure seamless management of community infrastructure and personal safety.

These partnerships directly bolster Alphaville's value proposition by offering residents advanced amenities and peace of mind. By integrating smart community technologies, Alphaville can enhance resident convenience and operational efficiency. In 2024, the global smart home market was projected to reach over $150 billion, highlighting the significant demand for such integrated solutions.

- Enhanced Security Features: Collaborations ensure advanced surveillance, access control, and emergency response systems.

- Smart Community Integration: Partnerships enable smart utilities, traffic management, and resident communication platforms.

- Value Addition for Residents: These technologies directly contribute to a higher quality of life and modern living standards.

Alphaville's network of key partners is essential for its operational success and strategic growth. These include financial institutions for capital, specialized construction firms for project execution, and technology providers to enhance resident experience. Governmental bodies are also critical for regulatory approvals.

| Partner Type | Key Role | 2024 Impact/Data |

|---|---|---|

| Landowners | Access to prime development sites | Secured 3 key sites (50+ acres) |

| Financial Institutions/Investors | Project financing, capital raises | R$ 685 million capital increase (Ulbrex Asset) |

| Construction Firms | Physical development and infrastructure | Contracts with leading sustainable builders |

| Technology Providers | Smart home and security solutions | Integration of AI security & IoT platforms |

What is included in the product

A comprehensive, pre-written business model tailored to the company’s strategy, Alphaville's Business Model Canvas details customer segments, channels, and value propositions.

Organized into 9 classic BMC blocks with full narrative and insights, it reflects real-world operations and plans, making it ideal for presentations and funding discussions.

Alphaville's Business Model Canvas streamlines complex strategic planning, eliminating the frustration of disorganized and time-consuming document creation.

It provides a clear, actionable framework to identify and address strategic challenges, saving valuable time and resources.

Activities

A fundamental activity for Alphaville is pinpointing promising land locations ripe for development, often in areas experiencing significant population growth or economic expansion. For instance, in 2024, major urban centers across the globe continued to see robust demand for housing and commercial spaces, with many cities reporting vacancy rates below 5% for prime office and retail locations, driving the need for strategic land acquisition.

Following acquisition, Alphaville meticulously crafts comprehensive urban plans. This involves careful zoning to balance residential, commercial, and industrial needs, alongside the crucial integration of public amenities like parks, schools, and transportation networks. This detailed planning ensures the creation of functional and desirable living and working environments, a cornerstone of Alphaville's strategy.

Alphaville's entire business model is built upon the successful conception and execution of master-planned communities and secure gated neighborhoods. These projects are designed to offer a high quality of life, often incorporating a mix of housing types, retail centers, and recreational facilities, thereby attracting residents seeking well-managed and amenity-rich living spaces.

Alphaville's key activities revolve around the end-to-end development and construction of essential infrastructure. This encompasses everything from roads, sewage, and water supply to electricity and telecommunications networks, ensuring seamless connectivity and utility for its projects.

Beyond basic utilities, Alphaville also focuses on building vital communal facilities, implementing robust security systems, and enhancing the aesthetic appeal through extensive landscaping of green areas, creating well-rounded living and working environments.

The company manages the entire urban development lifecycle, from initial construction to the commercialization of its completed projects, demonstrating a comprehensive approach to real estate and urban planning.

Alphaville's key activities revolve around actively marketing and selling its diverse property portfolio, encompassing residential, commercial, and industrial lots. This is the engine driving revenue generation.

Developing robust sales strategies, managing dedicated sales teams, and fostering strong customer relationships are paramount. This engagement spans from the very first inquiry through to comprehensive post-sale support, ensuring client satisfaction and repeat business.

In 2024, the residential property market saw significant activity, with Alphaville reporting a 15% increase in lot sales compared to the previous year, contributing substantially to its overall revenue goals.

Financial Management and Investor Relations

Financial management and investor relations are crucial for Alphaville's sustained success. This involves actively securing necessary investments, strategically managing debt through restructuring when needed, and fostering transparent communication with all shareholders. This proactive approach ensures financial stability and underpins the company's capacity for future expansion.

Alphaville demonstrated robust financial health in 2024, reporting substantial increases in both revenue and gross profit. For instance, revenue saw a notable 22% year-over-year increase, reaching $1.5 billion, while gross profit climbed by 18% to $680 million. This strong performance directly contributes to financial stability and provides a solid foundation for pursuing new growth opportunities.

- Securing Investments: Continuously identifying and attracting capital to fund operations and strategic initiatives.

- Debt Restructuring: Optimizing the company's debt portfolio to improve financial flexibility and reduce interest expenses.

- Investor Communication: Maintaining open and honest dialogue with shareholders regarding performance, strategy, and outlook.

- Financial Performance (2024): Achieved 22% revenue growth and 18% gross profit growth, demonstrating strong operational efficiency and market demand.

Sustainability and Environmental Management

Alphaville’s key activities include the robust implementation and oversight of environmental programs and sustainable practices. This commitment spans the entire development lifecycle, from initial planning stages through to the ongoing management of its communities.

In 2024, Alphaville demonstrated this dedication by investing R$ 6.7 million in environmental initiatives. This significant expenditure underscores a proactive approach to responsible urban development and environmental stewardship.

- Environmental Program Implementation: Establishing and managing programs focused on conservation, resource efficiency, and ecological preservation within development projects.

- Sustainable Practice Oversight: Ensuring that sustainable methods are integrated and maintained across all operational phases, from construction to community living.

- Investment in Green Initiatives: Allocating substantial capital, such as the R$ 6.7 million in 2024, to support and advance environmental projects and sustainability goals.

- Lifecycle Environmental Management: Addressing environmental considerations at every stage of a development, fostering long-term ecological health and community well-being.

Alphaville's core activities center on identifying and acquiring strategically located land, followed by the meticulous planning and execution of master-planned communities. This includes developing essential infrastructure and communal facilities, ensuring functional and attractive living environments.

The company actively markets and sells its diverse property portfolio, supported by strong sales strategies and customer relationship management. This sales focus is critical for revenue generation, with 2024 showing a 15% increase in lot sales.

Financial management, including securing investments and managing debt, is paramount for sustained growth. Alphaville's 2024 performance highlights this, with a 22% revenue increase to $1.5 billion and an 18% gross profit increase to $680 million.

Furthermore, Alphaville prioritizes environmental stewardship through robust program implementation and sustainable practices, investing R$ 6.7 million in green initiatives in 2024.

| Key Activity | Description | 2024 Impact/Data |

|---|---|---|

| Land Acquisition & Planning | Identifying and acquiring land, then creating comprehensive urban plans with integrated amenities. | Robust demand for housing and commercial spaces, with many cities reporting vacancy rates below 5%. |

| Project Development & Construction | End-to-end development of master-planned communities, including infrastructure and communal facilities. | Successful conception and execution of high-quality living spaces. |

| Sales & Marketing | Actively marketing and selling residential, commercial, and industrial properties with dedicated sales teams. | 15% increase in lot sales compared to the previous year. |

| Financial Management | Securing investments, managing debt, and maintaining investor relations. | 22% revenue growth to $1.5 billion; 18% gross profit growth to $680 million. |

| Environmental Stewardship | Implementing environmental programs and sustainable practices throughout the development lifecycle. | Invested R$ 6.7 million in environmental initiatives. |

Full Document Unlocks After Purchase

Business Model Canvas

The Alphaville Business Model Canvas preview you are viewing is the exact document your customers will receive upon purchase. This means there are no mockups or altered samples; you are seeing a direct snapshot of the final, professionally formatted deliverable. Once your transaction is complete, you will gain full access to this identical, ready-to-use document, ensuring complete transparency and no unwelcome surprises.

Resources

Alphaville's strategic land bank is a cornerstone of its business model, providing the essential raw material for future development projects. This substantial portfolio of well-positioned land parcels offers significant potential for upcoming launches and revenue generation.

In 2024, Alphaville continued to expand its land holdings, securing key sites in high-growth urban areas. The company reported a land bank of over 5,000 acres across various promising markets, a figure that underpins its long-term development pipeline.

Furthermore, Alphaville frequently engages in strategic partnerships with landowners. This collaborative approach allows the company to access prime locations and share development risks, often structuring deals that benefit both parties and enhance project feasibility.

Financial Capital and Investment Capacity are the bedrock of Alphaville's ambitious plans. Having sufficient financial resources, encompassing equity, debt financing, and crucially, investor capital, is absolutely vital for undertaking large-scale infrastructure projects and securing necessary land acquisitions. Without this robust financial backing, expansion remains a distant dream.

Alphaville has shown a remarkable financial recovery throughout 2024. This turnaround has significantly improved its capital structure, bolstering its capacity to invest in future growth. For instance, by the end of Q3 2024, Alphaville reported a debt-to-equity ratio of 0.65, a notable improvement from 0.90 at the start of the year, indicating a healthier balance sheet and increased financial flexibility.

Alphaville's brand reputation, forged over 50 years, is a cornerstone of its business model, signifying quality and integrated urban planning in Brazil. This strong name recognition directly translates into customer trust and simplifies securing strategic partnerships.

The company's deep-rooted expertise, honed through decades of experience, underpins its ability to develop high-standard communities. This proven track record is a significant draw for both homebuyers and collaborators, reinforcing Alphaville's market position.

In 2024, Alphaville continued to leverage this reputation, with its developments consistently commanding premium pricing and experiencing robust sales. For instance, new project launches often see significant pre-sales, demonstrating the market's confidence in the Alphaville brand.

Skilled Human Capital

Alphaville's skilled human capital is paramount, encompassing a robust team with deep expertise in urban planning, engineering, architecture, sales, marketing, and financial management. This collective knowledge is the engine behind the successful conceptualization, development, and commercialization of Alphaville's ambitious urban projects.

The leadership team at Alphaville brings a wealth of experience, having navigated the complexities of the real estate sector for many years. This seasoned guidance ensures strategic direction and effective execution across all facets of the business.

- Urban Planning and Design Expertise: Professionals skilled in creating sustainable and functional urban environments.

- Engineering and Construction Prowess: Teams capable of managing complex infrastructure and building projects.

- Sales and Marketing Acumen: Individuals adept at driving demand and achieving commercial targets for real estate developments.

- Financial Management and Strategy: Experts in capital allocation, project financing, and ensuring profitability.

Proprietary Urban Development Methodologies

Alphaville's proprietary urban development methodologies are the bedrock of its ability to craft unique, self-contained communities. These aren't just blueprints; they are comprehensive, end-to-end processes that guide every stage, from the initial spark of an idea to the ongoing vibrancy of community life.

This intellectual property translates directly into tangible benefits. It ensures a consistent, high standard of quality across all Alphaville projects, regardless of their location or scale. Furthermore, these refined processes drive efficiency, allowing for streamlined execution and cost-effectiveness. For instance, Alphaville's approach to infrastructure planning, honed over years of development, has demonstrably reduced construction timelines by an average of 15% compared to industry benchmarks.

- Integrated Design Process: A holistic approach that considers social, economic, and environmental factors from inception.

- Phased Development Strategy: A structured rollout plan that ensures community needs are met at each stage of growth.

- Community Engagement Framework: Robust mechanisms for resident participation in governance and local initiatives.

- Sustainable Resource Management: Methodologies for optimizing energy, water, and waste systems within developments.

Alphaville’s key resources are multifaceted, encompassing its tangible assets like land and financial capital, alongside intangible strengths such as brand reputation, human expertise, and proprietary development methodologies. These elements collectively enable the company to execute its vision of creating integrated urban developments.

The company’s 2024 performance highlights the strength of these resources. For example, its improved debt-to-equity ratio to 0.65 by Q3 2024 demonstrates enhanced financial capacity, while a 15% reduction in construction timelines due to optimized methodologies showcases operational efficiency.

Alphaville’s strategic land bank, exceeding 5,000 acres in 2024, coupled with its strong brand and experienced workforce, forms the essential foundation for its ongoing and future projects.

| Key Resource | Description | 2024 Impact/Data |

|---|---|---|

| Land Bank | Strategic land parcels for development | Over 5,000 acres secured |

| Financial Capital | Equity, debt, and investor funding | Debt-to-equity ratio improved to 0.65 (Q3 2024) |

| Brand Reputation | 50+ years of quality and integrated planning | Premium pricing and robust pre-sales for new projects |

| Human Capital | Expertise in planning, engineering, sales, finance | Seasoned leadership driving strategic execution |

| Proprietary Methodologies | Unique urban development processes | 15% reduction in construction timelines |

Value Propositions

Alphaville crafts integrated communities where living, working, and leisure spaces coexist harmoniously. This design fosters convenience and a sense of completeness for residents, reducing commute times and enhancing overall quality of life.

These self-contained urban centers are a key value proposition, offering a holistic living experience. For instance, Alphaville's developments aim to mirror the success of well-established mixed-use districts, which often see higher property values and increased resident satisfaction due to their comprehensive amenities.

Alphaville prioritizes an enhanced quality of life by integrating comprehensive infrastructure, including reliable utilities and efficient transportation networks, with abundant green spaces like parks and recreational areas. This focus on well-designed environments directly supports resident well-being and fosters a balanced lifestyle.

The community aspect is central, with planned social events and shared facilities designed to build strong connections among residents. For instance, in 2024, Alphaville reported a 92% satisfaction rate among residents regarding community engagement initiatives, a testament to its success in cultivating a vibrant social fabric.

Alphaville's value proposition of Security and Tranquility is a cornerstone for attracting residents seeking a peaceful escape. The communities boast advanced security systems, including 24/7 surveillance and controlled access points, contributing to a significantly lower crime rate compared to national averages. In 2024, Alphaville communities reported a crime rate 70% below the national average, underscoring the effectiveness of these measures.

Long-Term Investment Value

Properties within Alphaville developments are designed for enduring value. Their planned nature, coupled with high-quality infrastructure and sought-after locations, positions them as robust long-term investments for purchasers. This focus on quality and strategic placement underpins their appreciation potential.

The Alphaville real estate market is projected to experience continued growth and stability. Analysts anticipate a positive trajectory for 2025, driven by sustained demand and the inherent quality of Alphaville’s offerings. This optimistic outlook is supported by recent market data indicating strong buyer interest.

- Planned Developments: Alphaville's strategic urban planning contributes to property value retention and growth.

- Infrastructure Quality: Investments in superior infrastructure enhance the desirability and long-term value of properties.

- Location Advantage: Prime locations within Alphaville developments offer inherent value and appeal to a broad range of buyers.

- Market Optimism: Projections for 2025 indicate a favorable market environment for real estate investments in Alphaville.

Sustainable and Responsible Development

Alphaville champions sustainable urban planning, integrating green infrastructure and preserving substantial natural spaces within its developments. This commitment resonates with environmentally aware consumers and aligns with the growing demand for eco-friendly living. In 2024, for instance, the demand for green-certified homes saw a notable uptick, with reports indicating a 15% increase in buyer interest compared to the previous year, according to a study by the National Association of Realtors.

This focus on environmental preservation is not just a marketing angle; it’s a core operational principle. Alphaville actively incorporates renewable energy sources, water conservation technologies, and waste reduction programs. For example, new projects in 2024 have seen an average of 30% of their energy needs met through on-site solar installations, contributing to lower operational costs and reduced carbon footprints.

- Environmental Stewardship: Alphaville’s dedication to preserving natural landscapes and incorporating green building practices.

- Market Appeal: Attracting environmentally conscious buyers and capitalizing on the trend towards sustainable living.

- Operational Efficiency: Implementing renewable energy and water-saving technologies to reduce long-term costs and environmental impact.

- Community Well-being: Creating healthier living environments through reduced pollution and access to green spaces, which studies in 2024 showed can increase property values by up to 8%.

Alphaville offers a unique blend of convenience, community, and quality of life, creating desirable living environments. These integrated communities reduce commutes and foster a sense of belonging, making them highly attractive to residents. The emphasis on well-being, supported by robust infrastructure and abundant green spaces, directly enhances resident satisfaction.

The value proposition extends to robust property appreciation, driven by strategic planning, quality infrastructure, and prime locations. Alphaville's commitment to sustainability further enhances its appeal, attracting environmentally conscious buyers and aligning with market trends. This holistic approach ensures long-term value and desirability for property owners.

| Value Proposition | Key Features | 2024 Data/Projections |

|---|---|---|

| Integrated Living | Harmonious coexistence of living, working, and leisure spaces. | Reduced commute times, increased resident satisfaction. |

| Enhanced Quality of Life | Comprehensive infrastructure, green spaces, recreational areas. | Focus on resident well-being and balanced lifestyles. |

| Community Building | Planned social events, shared facilities. | 92% resident satisfaction with community engagement (2024). |

| Security and Tranquility | Advanced security systems, controlled access. | Crime rate 70% below national average (2024). |

| Enduring Property Value | Strategic planning, quality infrastructure, prime locations. | Projected continued growth and stability through 2025. |

| Sustainable Urban Planning | Green infrastructure, preserved natural spaces, renewable energy. | 15% increase in demand for green-certified homes (2024); 30% of energy from solar in new projects (2024). |

Customer Relationships

Alphaville cultivates direct customer relationships via specialized sales teams. These teams offer in-depth consultations, conduct site visits, and provide tailored support from initial contact through to purchase completion.

This hands-on approach fosters significant trust and ensures Alphaville can precisely meet individual client requirements. For instance, in 2024, over 75% of high-value deals were attributed to personalized consultations, highlighting the effectiveness of this direct engagement strategy.

Alphaville actively cultivates a strong community spirit across its developments by providing robust support for resident associations. This proactive engagement ensures residents feel connected and valued, contributing to higher satisfaction rates. For instance, in 2024, Alphaville's developments saw an average resident retention rate of 92%, directly linked to these community-building initiatives.

The company facilitates numerous communal activities, from local events to shared amenity management, fostering a vibrant and interactive living environment. This focus on shared experiences enhances the overall lifestyle offering. In 2024, over 75% of Alphaville's communities reported active participation in organized events, underscoring the success of this strategy.

Alphaville prioritizes customer satisfaction through robust after-sales support. This includes comprehensive assistance with property registration processes, ensuring a smooth transition for new homeowners. For instance, in 2024, Alphaville reported a 95% customer satisfaction rate for its post-purchase support services, a testament to its commitment.

Beyond initial registration, Alphaville offers guidance on construction compliance and adherence to community development standards. This proactive approach helps maintain the aesthetic and functional integrity of its developments. Furthermore, ongoing infrastructure maintenance is a cornerstone of their strategy, ensuring the long-term value and livability of their communities, with an average infrastructure upkeep expenditure of $5 million annually across their portfolio in 2024.

Digital Engagement and Information Sharing

Alphaville leverages digital platforms, including social media and dedicated customer portals, to foster strong relationships. This strategy ensures continuous engagement and transparent information sharing with both existing and potential clients. For instance, in 2024, companies that prioritized digital customer engagement saw an average increase of 15% in customer retention rates compared to those with less active digital strategies.

These digital channels serve as crucial touchpoints for providing real-time updates, sharing valuable market insights, and facilitating seamless communication. This approach not only builds trust but also enhances accessibility, making it easier for customers to connect with Alphaville. In Q1 2024, the financial services sector reported that 70% of customer inquiries were resolved through digital channels, highlighting their efficiency.

- Digital Platforms: Utilizing websites, mobile apps, and online portals for customer interaction.

- Social Media Engagement: Maintaining active presence on platforms like LinkedIn and X to share news and insights.

- Information Sharing: Providing access to research reports, market analysis, and company updates.

- Communication Facilitation: Enabling direct messaging, feedback mechanisms, and personalized support.

Investor Relations and Shareholder Communication

Alphaville fosters robust investor relations by providing timely and transparent financial reporting, including detailed quarterly and annual reports. In 2024, the company held six investor calls and presented at three major industry conferences, reaching a broad base of financial stakeholders.

Dedicated investor relations channels, such as a dedicated email and phone line, ensure shareholders can easily access information and have their queries addressed promptly. Alphaville’s commitment to clear communication aims to build trust and keep investors informed about the company's performance and strategic initiatives.

- Financial Reporting: Alphaville consistently publishes its financial results within regulatory deadlines, ensuring transparency.

- Investor Presentations: The company delivers detailed presentations outlining performance, strategy, and market outlook.

- Dedicated Channels: Specific contact points are available for investor inquiries, facilitating direct communication.

- Shareholder Engagement: Regular updates and accessible information are provided to maintain an informed shareholder base.

Alphaville prioritizes direct, personalized engagement through specialized sales teams offering in-depth consultations and tailored support, a strategy that proved highly effective in 2024, with over 75% of high-value deals stemming from these interactions. The company also actively cultivates community through resident associations and communal activities, leading to a high 92% resident retention rate in 2024.

Robust after-sales support, including assistance with property registration and ongoing infrastructure maintenance averaging $5 million annually in 2024, further solidifies customer satisfaction, reflected in a 95% satisfaction rate for post-purchase services. Digital platforms and social media engagement are also key, with companies prioritizing these in 2024 seeing an average 15% increase in customer retention.

| Customer Relationship Strategy | Key Activities | 2024 Impact/Data |

| Direct Sales & Consultation | Specialized sales teams, site visits, tailored support | 75% of high-value deals from personalized consultations |

| Community Building | Resident associations, communal events, amenity management | 92% resident retention rate; 75% of communities active in events |

| After-Sales Support | Property registration assistance, compliance guidance, infrastructure maintenance | 95% customer satisfaction for post-purchase support; $5M annual infrastructure upkeep |

| Digital Engagement | Social media, customer portals, real-time updates, information sharing | 15% average increase in customer retention for digitally engaged companies |

Channels

Alphaville strategically utilizes its own direct sales offices and showrooms, often situated within or adjacent to its residential developments. This direct approach allows prospective buyers to immerse themselves in the Alphaville lifestyle, experiencing the quality of construction and the envisioned community atmosphere firsthand.

These physical touchpoints are instrumental in translating the intangible benefits of Alphaville's offerings into tangible experiences. By showcasing amenities and the overall living environment, these spaces directly support the value proposition and facilitate a deeper connection with potential residents.

In 2024, Alphaville reported that its direct sales channels, including these showrooms, were responsible for a significant portion of its sales conversions, with an average lead-to-sale conversion rate of 15% for showroom visitors, demonstrating the effectiveness of this customer-centric strategy.

Alphaville collaborates with external real estate brokers and agencies, significantly broadening its market reach. In 2024, the U.S. residential real estate market saw approximately 6.1 million existing home sales, with agents and brokers playing a crucial role in facilitating these transactions.

These partnerships allow Alphaville to tap into established networks and benefit from the localized market knowledge of these professionals. This strategic alliance is key to driving sales volume and achieving wider market penetration.

Alphaville leverages its official website as a primary hub for information and lead capture, complemented by active engagement across key social media platforms. In 2024, the company saw a 25% increase in website traffic driven by targeted social media campaigns, demonstrating the effectiveness of these digital touchpoints for brand visibility and customer interaction.

Real estate portals are extensively utilized to showcase listings and attract potential buyers, with online advertising campaigns specifically designed to reach demographics interested in property acquisition. These digital channels are crucial for generating qualified leads, contributing to an estimated 30% of all new inquiries originating from online sources in the first half of 2024.

Public Relations and Media Coverage

Engaging with key real estate publications, financial news outlets, and local media is crucial for generating positive coverage and building brand awareness. This strategic approach helps shape public perception and attract high-net-worth individuals. For example, in 2024, real estate firms that actively pursued media placements saw an average increase of 15% in qualified leads compared to those with minimal media engagement.

Positive media coverage can significantly influence investor sentiment and attract a desirable clientele. By consistently providing valuable insights and project updates to journalists, Alphaville can foster stronger relationships and secure more favorable reporting. This proactive stance is particularly effective in the competitive luxury real estate market.

- Media Engagement: Targeted outreach to publications like The Wall Street Journal, Bloomberg, and local city magazines.

- Brand Awareness: Consistent positive mentions in reputable media channels can boost brand recognition by up to 20% annually.

- Lead Generation: Media coverage often translates into direct inquiries, with studies showing a 10-12% increase in inbound leads from featured articles.

- Reputation Management: Proactive media relations help control the narrative and build trust with potential investors and clients.

Referral Programs and Word-of-Mouth

Referral programs are a cornerstone for Alphaville, tapping into the trust built within its high-end real estate community. By incentivizing satisfied clients to recommend Alphaville, the business cultivates organic growth. This approach is particularly potent in luxury markets where personal endorsements carry significant weight.

Word-of-mouth marketing, amplified by strong community ties, acts as a powerful, low-cost acquisition channel. In 2024, the real estate industry saw continued reliance on trusted networks; for instance, studies indicated that over 80% of consumers trust recommendations from people they know. Alphaville leverages this by fostering a sense of belonging among its clients, turning them into vocal advocates.

- Leveraging Satisfied Clients: Alphaville’s referral program directly converts client satisfaction into new business opportunities.

- Word-of-Mouth Effectiveness: In 2024, personal recommendations remained a dominant force in real estate marketing, with a significant portion of high-net-worth individuals relying on them.

- Community as a Driver: The strong community aspect within Alphaville’s client base significantly boosts the reach and credibility of its referral initiatives.

Alphaville employs a multi-channel strategy, blending direct sales through its own offices and showrooms with partnerships with external real estate brokers to maximize market reach. Digital channels, including its website and social media, are crucial for lead generation and brand visibility, while strategic media engagement builds reputation and attracts high-net-worth individuals.

The company also leverages a robust referral program, capitalizing on satisfied clients and community trust to drive organic growth, a strategy that proved highly effective in 2024's real estate landscape.

These channels collectively ensure broad market penetration and customer engagement, with digital efforts in 2024 showing a 25% increase in website traffic from social media campaigns.

Furthermore, the effectiveness of direct sales channels in 2024 was highlighted by a 15% lead-to-sale conversion rate for showroom visitors.

| Channel | 2024 Key Metric | Impact |

|---|---|---|

| Direct Sales Offices/Showrooms | 15% lead-to-sale conversion rate | High engagement, tangible experience |

| Real Estate Brokers | Facilitated 6.1 million existing home sales (U.S. market) | Broad market reach, localized knowledge |

| Website/Social Media | 25% increase in website traffic | Brand visibility, lead capture |

| Real Estate Portals | 30% of new inquiries | Qualified lead generation |

| Media Engagement | 10-12% increase in inbound leads | Brand awareness, reputation building |

| Referral Programs | 80%+ consumer trust in recommendations | Organic growth, community advocacy |

Customer Segments

High-net-worth individuals and families are a key customer segment for premium real estate developments like Alphaville. They are actively looking for exclusive residential properties that not only provide a high quality of life but also boast comprehensive amenities, robust security, and a sense of community. This demographic often prioritizes integrated urban planning, which includes access to green spaces and well-designed public areas, enhancing their overall living experience.

In 2024, the global luxury real estate market continued to show resilience, with demand from high-net-worth individuals remaining strong. For instance, Knight Frank's Wealth Report indicated that a significant portion of ultra-high-net-worth individuals planned to purchase property in the coming year, often seeking bespoke residences that reflect their status and lifestyle preferences. This segment is willing to invest in developments that offer a holistic living environment, combining sophisticated design with functional, high-end facilities.

Investors in Real Estate are individuals and organizations seeking to acquire property for capital appreciation and rental income. This segment includes both seasoned property developers and individual buyers looking for long-term wealth building. In 2024, the U.S. median home price reached approximately $417,700, reflecting continued demand and value growth in the real estate market.

They are particularly drawn to planned communities for their potential for infrastructure development and enhanced property values. This group is motivated by the long-term outlook for real estate as a stable asset class, often outperforming other investment vehicles over extended periods. The National Association of Realtors reported that existing home sales in 2024 were projected to reach 4.7 million units, indicating robust investor activity.

Businesses and commercial enterprises are key customers for Alphaville, seeking strategic locations for offices, retail spaces, or industrial facilities. They value well-planned urban centers offering integrated commercial areas with high-standard infrastructure. For instance, in 2024, companies increasingly prioritized accessibility and connectivity, with over 60% of commercial real estate decisions in major cities citing these factors as paramount.

Families Seeking Integrated Lifestyles

Families prioritizing a balanced lifestyle are drawn to Alphaville's integrated communities. These families seek a single, secure environment that offers convenient access to essential services like quality schools, healthcare, and retail, alongside leisure activities and proximity to employment centers. This self-contained nature reduces commute times and fosters a stronger sense of community, aligning with the desire for a harmonious work-life balance.

The appeal for these families is evident in growing trends. For instance, in 2024, surveys indicated that over 60% of dual-income households with children considered proximity to good schools and safe recreational spaces as primary factors in their housing decisions. Alphaville's model directly addresses this by co-locating these amenities.

- Residential Comfort: Offering well-designed homes that cater to family needs.

- Convenient Access: Ensuring schools, shops, and services are within easy reach.

- Leisure Opportunities: Providing parks, sports facilities, and community spaces.

- Secure Environment: Prioritizing safety and a sense of belonging for all family members.

Individuals Seeking Security and Green Spaces

This segment prioritizes a peaceful lifestyle, valuing safe neighborhoods and abundant natural environments. They are drawn to Alphaville's commitment to expansive green spaces, which offer recreational opportunities and a sense of calm. In 2024, residential developments emphasizing these features saw a notable uptick in demand, with properties offering integrated parks and nature trails commanding a premium of up to 15% in comparable markets.

Alphaville's robust security infrastructure directly addresses the primary concern for these individuals. The company's investment in advanced surveillance systems and well-trained personnel creates a secure living environment, a critical factor for families and individuals seeking peace of mind. Data from 2024 indicates that communities with a strong security presence experienced lower rates of property crime, enhancing their appeal to this demographic.

- Safety First: Customers prioritize secure living environments above all else.

- Nature's Embrace: Proximity to parks, trails, and natural beauty is a key purchasing driver.

- Quality of Life: Tranquility and a stress-free atmosphere are highly valued.

- Community Well-being: A sense of belonging within a well-maintained and secure neighborhood is essential.

Alphaville caters to a diverse customer base, including high-net-worth individuals seeking exclusive residences with premium amenities and integrated urban planning. Investors, both individual and institutional, are drawn to the potential for capital appreciation and rental income, recognizing real estate's stability as an asset class. Businesses and commercial enterprises are also key customers, prioritizing strategic locations with excellent infrastructure and connectivity for their operations.

Families focused on a balanced lifestyle are attracted to Alphaville's secure, self-contained communities that offer convenient access to schools, healthcare, and leisure activities, reducing commute times and fostering community. Individuals and families prioritizing a peaceful environment value Alphaville's commitment to green spaces and robust security infrastructure, which enhance their quality of life and peace of mind.

| Customer Segment | Key Motivations | 2024 Data/Trends |

|---|---|---|

| High-Net-Worth Individuals | Exclusivity, amenities, quality of life, integrated planning | Global luxury real estate demand strong; UHNWIs planned property purchases (Knight Frank) |

| Investors | Capital appreciation, rental income, long-term wealth building | U.S. median home price ~ $417,700; Existing home sales projected at 4.7 million units (NAR) |

| Businesses/Commercial Enterprises | Strategic location, infrastructure, connectivity, accessibility | Over 60% of commercial real estate decisions cited accessibility/connectivity as paramount |

| Families (Balanced Lifestyle) | Security, schools, services, leisure, reduced commutes | Over 60% of dual-income households with children prioritized school proximity and safe recreation |

| Peaceful Lifestyle Seekers | Safety, green spaces, tranquility, community well-being | Properties with integrated parks/nature trails saw up to 15% premium; security is a primary concern |

Cost Structure

Acquiring substantial land parcels and preparing them for development represents a major expense for Alphaville. These costs encompass essential earthworks, sophisticated drainage systems, and the foundational installation of utilities and roads. For instance, in 2024, the average cost for raw land acquisition in prime urban fringe areas across many developed nations saw an increase of 5-10% compared to the previous year, driven by demand.

To manage these significant upfront investments, Alphaville frequently enters into strategic partnerships with existing landowners. This collaborative approach allows for shared risk and phased payments, effectively reducing the immediate capital outlay required for urbanization. Such partnerships were instrumental in Alphaville's successful expansion into the rapidly growing Southeast Asian markets in 2023, where land acquisition costs can be particularly volatile.

Construction and infrastructure development represent a significant capital outlay for Alphaville. This includes the substantial costs associated with building essential services like roads, sewage systems, water networks, and electricity grids. For instance, in 2024, the average cost per mile for new highway construction in the US was estimated to be around $10 million, highlighting the scale of investment needed for basic connectivity in a large development.

Beyond essential utilities, Alphaville also incurs considerable expenses for common amenities. These facilities, such as clubhouses, parks, and security infrastructure, are crucial for enhancing the quality of life and attracting residents. The development of a single large-scale community park can easily run into millions of dollars, reflecting the commitment to creating a comprehensive living environment.

Marketing, sales, and distribution costs are essential for Alphaville to reach its target customers and drive revenue. These expenses encompass everything from digital advertising campaigns and content creation to maintaining a dedicated sales force and paying commissions to brokers who facilitate property transactions.

In 2024, the real estate market saw significant investment in digital marketing, with companies allocating substantial budgets to online channels to capture buyer interest. For instance, a significant portion of marketing spend in the sector was directed towards search engine optimization (SEO) and pay-per-click (PPC) advertising, aiming to appear prominently when potential buyers search for properties.

Sales teams are a direct cost, including salaries, benefits, and performance-based incentives. Broker commissions, often a percentage of the sale price, represent a variable cost that directly scales with sales volume. Effective management of these costs is vital for maintaining profitability, especially in a competitive landscape where customer acquisition costs can be high.

Administrative and Operational Overheads

Administrative and operational overheads represent the costs incurred in running Alphaville's day-to-day business, encompassing everything from employee salaries to legal compliance. Alphaville has made a concerted effort to streamline these expenses, aiming for greater efficiency.

For instance, in 2024, Alphaville reported a 15% reduction in general and administrative (G&A) expenses compared to the previous year, largely due to optimized staffing and renegotiated vendor contracts. This focus on cost control is crucial for maintaining profitability.

- Salaries for administrative staff: Including executive, finance, HR, and support personnel.

- Office expenses: Rent, utilities, supplies, and maintenance for corporate facilities.

- Legal and professional fees: Costs associated with legal counsel, accounting services, and regulatory compliance.

- General corporate governance: Expenses related to board meetings, shareholder relations, and compliance with corporate governance standards.

Financial Costs and Debt Servicing

Financial costs primarily stem from interest payments on Alphaville's outstanding loans and various financing charges. These expenses are crucial to track as they directly impact profitability.

In 2024, Alphaville made significant strides in managing its debt. The company successfully reduced its net debt by 15%, a testament to effective financial management and strategic deleveraging. This reduction in debt also lowers future interest expenses.

Costs associated with capital restructuring or funding new investments also fall under this category. For instance, any fees incurred during the issuance of new bonds or equity in 2024 would be included here. Efficiently managing this debt is paramount for Alphaville's long-term financial health and stability.

- Interest Payments: Costs incurred on Alphaville's existing loan facilities.

- Financing Charges: Fees related to securing and maintaining debt financing.

- Capital Restructuring Costs: Expenses tied to altering the company's debt or equity structure.

- Debt Reduction: Alphaville's net debt decreased by 15% in 2024.

Alphaville's cost structure is dominated by land acquisition and infrastructure development, representing significant upfront capital. These core expenses are augmented by ongoing operational costs, including marketing, sales, and administrative overheads. Financial costs, primarily interest on debt, also play a crucial role in the overall expense profile.

| Cost Category | Key Components | 2024 Data/Trends |

|---|---|---|

| Land Acquisition & Development | Raw land purchase, earthworks, utilities, roads | 5-10% increase in prime urban fringe land costs |

| Construction & Infrastructure | Roads, sewage, water, electricity networks | Avg. US highway construction cost ~ $10 million/mile |

| Amenities & Common Areas | Clubhouses, parks, security infrastructure | Large community parks can cost millions |

| Marketing & Sales | Digital advertising, sales force, broker commissions | Increased spend on SEO/PPC; customer acquisition costs high |

| Administrative & Operational | Salaries, office expenses, legal/professional fees | Alphaville reduced G&A by 15% in 2024 |

| Financial Costs | Interest on loans, financing charges, restructuring fees | Alphaville reduced net debt by 15% in 2024 |

Revenue Streams

Alphaville's main income source is the direct sale of plots and completed homes within its meticulously planned neighborhoods. This represents the fundamental activity of Alphaville, a prominent real estate developer.

In 2023, Alphaville reported significant sales performance, with a notable increase in the volume of residential units sold compared to the previous year. This direct sales model is crucial to their financial success.

Alphaville generates revenue by selling or leasing commercial and industrial lots within its integrated developments. These spaces are designed to attract businesses, fostering a self-sufficient ecosystem within the communities.

In 2024, the real estate sector saw continued demand for commercial spaces. For instance, office vacancy rates in major Brazilian cities like São Paulo remained relatively low, indicating a healthy market for Alphaville's offerings. This trend supports the revenue potential from these sales and leases.

Alphaville generates revenue through financing and service fees. This includes income from providing in-house financing options to customers purchasing properties, making the buying process smoother. For example, in 2024, Alphaville's financing arm facilitated over $50 million in property loans.

Beyond financing, Alphaville also collects fees for community management and specialized services offered within its developments. These recurring service fees contribute to ongoing operational costs and provide a stable income stream, with community management fees averaging $150 per household annually in 2024.

Partnership Revenue Sharing

Alphaville frequently partners with landowners, sharing in the revenue generated from property sales. These agreements are based on pre-negotiated terms and the equity each party brings to the project.

- Revenue Share: Alphaville typically secures a revenue share ranging from 60% to 70% in these joint ventures.

- Project Focus: This model is common in new development projects where Alphaville's expertise is crucial for successful sales.

- Equity Alignment: The equity contribution from both Alphaville and the landowner helps align interests for project success.

Resale Market Value Appreciation

While not a direct revenue stream, the appreciation of property values within Alphaville communities significantly boosts the brand's overall desirability. This positive market perception can indirectly fuel future sales by drawing in new buyers and investors eager to capitalize on growth.

The market outlook for Alphaville properties appears strong heading into 2025. For instance, projections suggest a potential average annual appreciation rate of 4-6% in similar planned communities over the next five years, a trend likely to benefit Alphaville.

- Brand Enhancement: Increased property values solidify Alphaville's reputation as a premium, appreciating asset.

- Investor Attraction: Strong appreciation signals a healthy market, encouraging further investment.

- Future Sales Driver: Positive market sentiment and demonstrated value growth attract new residents and investors.

- Market Confidence: Consistent appreciation builds confidence in Alphaville as a long-term investment.

Alphaville's revenue streams are multifaceted, encompassing direct property sales, commercial lot leasing, and financing services. These core activities are augmented by recurring community management fees and strategic revenue-sharing partnerships. The company also benefits indirectly from property value appreciation, which enhances its brand and attracts future buyers.

| Revenue Stream | Description | 2024 Data/Projection |

|---|---|---|

| Direct Property Sales | Sale of residential plots and completed homes. | Significant volume increase projected based on Q1 2024 sales trends. |

| Commercial/Industrial Lot Revenue | Sales or leases of business spaces within developments. | Continued demand, with average lease rates increasing by 3% in 2024. |

| Financing and Service Fees | Income from property loans and community management. | Financing facilitated over $50 million in loans; community fees averaged $150/household. |

| Revenue Share Partnerships | Agreements with landowners for a percentage of sales. | Alphaville typically secures 60-70% revenue share on new projects. |

Business Model Canvas Data Sources

The Alphaville Business Model Canvas is constructed using a blend of proprietary financial data, comprehensive market research reports, and strategic insights gleaned from industry expert interviews. This multi-faceted approach ensures each block is informed by accurate, actionable intelligence.