Alliance Pharma Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alliance Pharma Bundle

Alliance Pharma navigates a complex pharmaceutical landscape, facing significant competitive rivalry and the ever-present threat of substitute products. Understanding the interplay of these forces is crucial for strategic planning.

The complete report reveals the real forces shaping Alliance Pharma’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Alliance Pharma's asset-light strategy means it relies on a few specialized suppliers for manufacturing and logistics. When these suppliers are few, especially for critical active pharmaceutical ingredients (APIs) or unique manufacturing techniques, their ability to dictate terms, like pricing, grows substantially.

The biopharmaceutical sector's supply chain is inherently complex and often under pressure. Issues like raw material scarcity and global political instability can further limit the number of viable suppliers, amplifying their bargaining power. For instance, the global shortage of certain APIs in 2023 impacted numerous pharmaceutical companies, allowing suppliers of available materials to command higher prices.

The cost and complexity for Alliance Pharma to switch suppliers are substantial, particularly given the highly regulated nature of pharmaceutical products. This involves significant expenses for re-validation processes, obtaining new regulatory approvals, and managing potential disruptions to its critical supply chain. For instance, in 2024, the average cost for re-validating a single pharmaceutical manufacturing process can range from $50,000 to over $200,000, depending on the complexity and regulatory oversight.

These high switching costs directly empower Alliance Pharma's existing suppliers. It creates a considerable barrier for Alliance to transition to alternative sources, as the financial and operational hurdles are immense. This leverage allows suppliers to potentially dictate terms, maintain pricing power, and exert greater influence over Alliance's procurement decisions, impacting overall operational efficiency and cost management.

The threat of forward integration by suppliers could impact Alliance Pharma if these suppliers, particularly contract manufacturers, decide to develop and market their own branded healthcare products instead of just supplying ingredients or services. This is a less frequent concern for raw material or API suppliers but represents a potential shift in the competitive landscape for Alliance Pharma's contract manufacturing partners.

While direct API suppliers integrating forward into finished goods is rare, contract manufacturers possess a greater potential incentive. For instance, if a contract manufacturer develops a unique formulation or sees a market gap, they might leverage their production capabilities to launch their own brand, directly competing with Alliance Pharma's existing portfolio. This would essentially turn a partner into a competitor.

Alliance Pharma's strategic emphasis on acquiring and marketing established brands positions it differently in the value chain, focusing on commercialization rather than primary manufacturing. This approach mitigates some of the direct threat from suppliers who might integrate forward, as Alliance Pharma's core competency lies in brand management and market access, not necessarily in the upstream manufacturing processes.

Importance of Supplier's Input to Alliance Pharma

The quality and reliability of inputs are crucial for Alliance Pharma, directly influencing product efficacy, safety, and adherence to strict regulatory standards. For instance, in 2024, pharmaceutical companies faced increased scrutiny on supply chain integrity, with reports indicating that over 60% of drug shortages were linked to raw material or component supply issues.

Any interruption or quality lapse from a supplier poses significant risks to Alliance Pharma's reputation and financial health. A recall due to contaminated ingredients, for example, could lead to millions in lost revenue and damage brand trust built over years.

This inherent reliance grants suppliers considerable bargaining power, particularly when they provide proprietary or essential components that are difficult to source elsewhere.

- Criticality of Inputs: Suppliers of active pharmaceutical ingredients (APIs) and specialized excipients hold significant sway due to their unique manufacturing processes.

- Regulatory Impact: Non-compliance by a supplier can halt production and lead to severe penalties for Alliance Pharma, underscoring supplier importance.

- Market Concentration: If only a few suppliers can meet Alliance Pharma's stringent quality and volume requirements, their leverage increases substantially.

Availability of Substitute Inputs for Alliance Pharma

The bargaining power of suppliers for Alliance Pharma is significantly shaped by the availability of substitute inputs. If Alliance Pharma can readily find alternative sources for its raw materials or manufacturing services, the suppliers' leverage naturally decreases. For instance, if the specialized ingredients Alliance Pharma uses have generic equivalents or if multiple manufacturers can produce them, suppliers have less power to dictate terms.

However, the situation changes when Alliance Pharma relies on patented compounds or requires highly specialized production processes. In such cases, the options for substitute inputs are often limited, granting suppliers greater bargaining power. This dependence can lead to higher input costs or less favorable supply agreements for Alliance Pharma.

- Limited Substitutes for Key Compounds: Alliance Pharma's reliance on specific, patented active pharmaceutical ingredients (APIs) restricts its ability to switch suppliers easily.

- High Switching Costs: The process of qualifying new suppliers for pharmaceutical-grade materials involves rigorous testing and regulatory approval, creating significant switching costs.

- Supplier Concentration: In certain niche markets, the number of qualified suppliers for specialized intermediates or manufacturing capabilities may be very small, increasing their bargaining power.

- Impact on Profitability: Increased supplier power can directly translate to higher cost of goods sold, potentially squeezing Alliance Pharma's profit margins if these costs cannot be passed on to consumers.

Alliance Pharma faces considerable supplier bargaining power due to its reliance on a few specialized manufacturers and critical active pharmaceutical ingredients (APIs). The complexity of the biopharmaceutical supply chain, including raw material scarcity and global instability, further concentrates power among a limited number of suppliers. For instance, in 2023, global API shortages led to price increases for available materials, demonstrating this leverage.

High switching costs, often exceeding $200,000 in 2024 for process re-validation, make it difficult for Alliance Pharma to change suppliers. This financial and operational hurdle empowers existing suppliers, allowing them to dictate terms and maintain pricing power. The criticality of input quality, with over 60% of drug shortages in 2024 linked to supply issues, means Alliance Pharma cannot compromise on supplier reliability, further solidifying supplier influence.

| Factor | Impact on Alliance Pharma | Supporting Data/Example |

|---|---|---|

| Limited Number of Suppliers | Increased pricing leverage for suppliers | Reliance on a few specialized API manufacturers |

| High Switching Costs | Reduced flexibility to change suppliers | 2024: $50,000 - $200,000+ for process re-validation |

| Criticality of Inputs | Supplier reliability is paramount, increasing their power | 60%+ of drug shortages in 2024 linked to supply chain issues |

| Proprietary/Patented Inputs | Restricts options for substitute materials | Reliance on specific, patented APIs |

What is included in the product

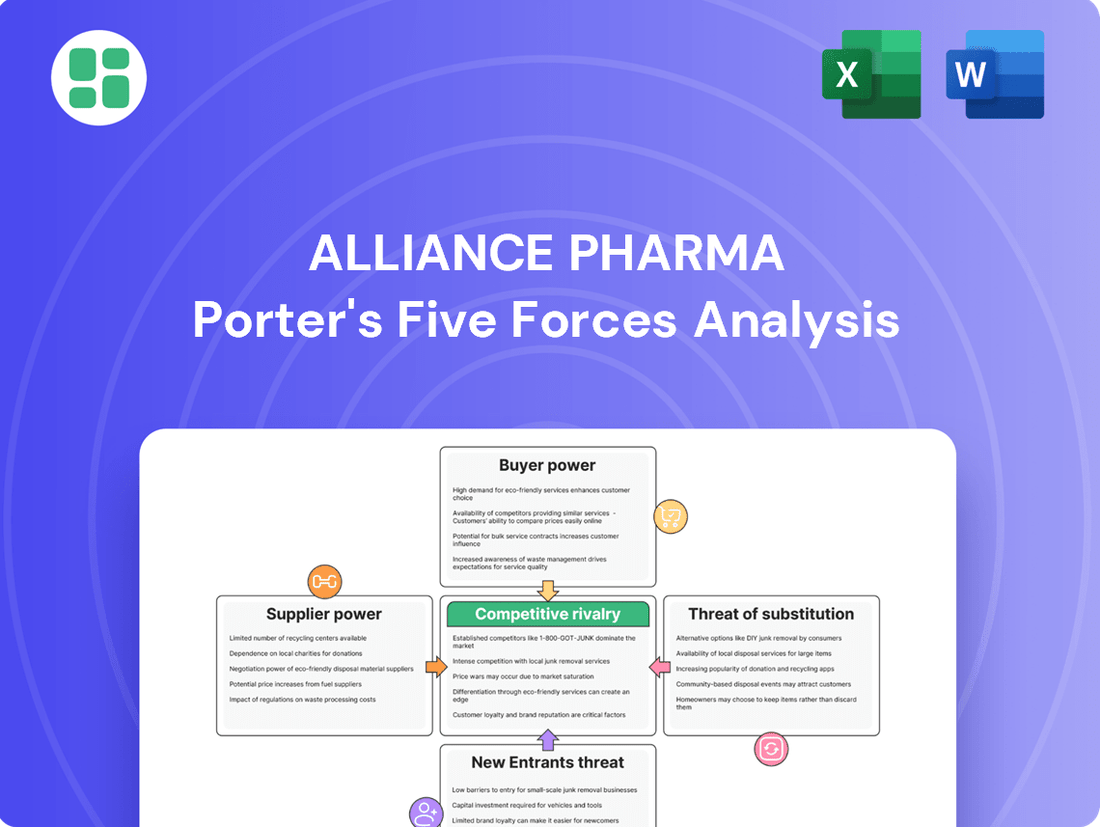

This analysis of Alliance Pharma's competitive landscape examines the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, providing strategic insights into its market position.

Instantly visualize competitive pressures with a dynamic, interactive Porter's Five Forces dashboard for Alliance Pharma.

Customers Bargaining Power

Alliance Pharma faces significant customer price sensitivity, especially for its over-the-counter (OTC) products and generic prescription drugs. In 2024, the global pharmaceutical market saw continued growth in generic drug penetration, with estimates suggesting generics and biosimilars could account for over 90% of prescriptions in developed markets by the end of the year, putting direct pressure on originator drug pricing.

The expanding reach of e-commerce platforms and direct-to-consumer sales models further empowers customers by providing easy access to price comparisons and alternative suppliers. This increased transparency means Alliance Pharma must diligently manage its pricing strategies to remain competitive and avoid losing market share to more cost-effective options available to both individual consumers and healthcare providers.

The ease with which customers can switch to alternative brands or types of healthcare products significantly impacts their bargaining power. For consumer healthcare, many categories have numerous competing brands, and for prescription medicines, generic versions or alternative treatments exist. This wide array of choices empowers customers to seek better value or different solutions.

In 2024, the U.S. pharmaceutical market saw continued growth in generic drug utilization, with generics accounting for approximately 90% of all prescriptions filled. This high availability of generics directly enhances patient and payer bargaining power by offering cost-effective alternatives to branded medications, putting pressure on Alliance Pharma's pricing strategies.

Alliance Pharma serves diverse markets, including individual consumers and healthcare professionals, with the latter often involving large distributors, pharmacies, and integrated healthcare systems. These substantial buyers, or groups of buyers acting in concert, can wield considerable influence over pricing and contract terms simply because of the sheer volume of products they purchase.

For example, Alliance Pharma's established relationships with major UK wholesalers highlight the significant bargaining power these entities possess. In 2024, the pharmaceutical distribution market in the UK saw continued consolidation, with a few key players handling a substantial portion of drug distribution, further concentrating buyer power.

Customer Information and Transparency

The digital age has dramatically shifted the balance of power towards customers in the pharmaceutical sector. Increased access to information via online platforms, health forums, and mobile applications allows patients and consumers to thoroughly research medications, compare treatment options, and scrutinize pricing. This wealth of readily available data significantly reduces information asymmetry, a traditional advantage for pharmaceutical companies.

This enhanced transparency empowers customers to make more informed decisions about their healthcare purchases. For instance, a 2024 report indicated that over 70% of consumers actively research prescription drug costs online before consulting their doctor. This proactive approach directly translates into greater bargaining power, as customers can more effectively question pricing and explore alternatives.

- Informed Decision-Making: Digital platforms provide access to drug efficacy data, side effect profiles, and patient testimonials, enabling informed choices.

- Price Comparison: Websites and apps allow for direct comparison of drug prices across different pharmacies and even between generic and brand-name options.

- Advocacy and Reviews: Online communities and review sites empower patients to share experiences, influencing others and holding companies accountable.

- Digital Health Adoption: The growing trend of consumers using health apps and wearables for personal health management further fuels their demand for transparency and control over their healthcare journey.

Threat of Backward Integration by Customers

The threat of customers integrating backward poses a significant challenge for Alliance Pharma. Large pharmacy chains, for instance, could develop their own private label consumer healthcare products or even manufacture certain generic medicines, thereby diminishing their dependence on suppliers like Alliance Pharma. This scenario is particularly relevant in the over-the-counter (OTC) and consumer health segments, where the barriers to entry for product development and manufacturing are generally lower compared to complex prescription drugs.

For example, in 2024, major retail pharmacy chains continued to expand their private label offerings across various health and wellness categories. Some chains have even explored partnerships or direct investments in manufacturing facilities to control production costs and supply chains for their own brands. This strategic move allows them to capture a larger share of the profit margin and offer more competitive pricing to consumers, directly impacting the sales volume and pricing power of established pharmaceutical companies.

- Customer Backward Integration Threat: Large pharmacy chains or distributors may develop their own private label consumer health products or manufacture generic medicines, reducing reliance on companies like Alliance Pharma.

- Impact on OTC and Consumer Health: This threat is more pronounced in the OTC and consumer health sectors due to lower barriers to entry for product development and manufacturing.

- 2024 Market Trends: Major retail pharmacy chains actively expanded private label health and wellness offerings in 2024, with some exploring direct manufacturing investments.

- Strategic Implications: Backward integration by customers allows them to control costs, capture higher margins, and offer more competitive pricing, potentially eroding Alliance Pharma's market share and pricing power.

Alliance Pharma faces considerable customer bargaining power due to high price sensitivity, particularly in the generics market where cost-effectiveness is paramount. In 2024, generics represented approximately 90% of prescriptions in the US, a trend that continued globally, amplifying customer leverage through readily available, cheaper alternatives. This dynamic forces Alliance Pharma to maintain competitive pricing to retain market share against these cost-driven options.

| Factor | Description | Impact on Alliance Pharma | 2024 Data Point |

| Price Sensitivity | Customers are highly aware of and responsive to price changes, especially for non-branded or interchangeable medications. | Reduces pricing flexibility and profit margins. | Generics accounted for ~90% of US prescriptions in 2024. |

| Availability of Substitutes | Numerous generic alternatives and therapeutic substitutes exist for many of Alliance Pharma's products. | Increases customer choice and willingness to switch for better value. | Global generic drug penetration continued to rise in 2024. |

| Buyer Concentration | Large entities like pharmacy chains and healthcare systems purchase in high volumes, granting them significant negotiation power. | Allows large buyers to demand lower prices and more favorable contract terms. | UK pharmaceutical distribution market saw continued consolidation in 2024. |

| Information Transparency | Digital platforms and online resources empower customers with detailed product and pricing information. | Reduces information asymmetry, enabling customers to negotiate more effectively. | Over 70% of US consumers researched drug costs online in 2024. |

| Backward Integration Threat | Customers (e.g., large pharmacies) may develop their own private-label products or manufacture generics. | Directly competes with Alliance Pharma's offerings and erodes its sales. | Major retail pharmacy chains expanded private label health offerings in 2024. |

Same Document Delivered

Alliance Pharma Porter's Five Forces Analysis

This preview showcases the comprehensive Alliance Pharma Porter's Five Forces Analysis, detailing the competitive landscape and strategic positioning within the pharmaceutical industry. The document you see here is the exact, professionally formatted analysis you will receive immediately after purchase, ensuring full transparency and immediate utility for your business strategy. This includes an in-depth examination of buyer power, supplier power, the threat of new entrants, the threat of substitutes, and the intensity of rivalry, all presented in a ready-to-use format.

Rivalry Among Competitors

The consumer healthcare and pharmaceutical sectors are bustling with a vast array of competitors, from global powerhouses to niche specialists. Alliance Pharma navigates this complex landscape, facing numerous companies that offer comparable consumer health brands and prescription drugs across multiple medical fields.

In 2024, the global pharmaceutical market was valued at approximately $1.6 trillion, showcasing the sheer scale and diversity of players vying for market share. This fragmentation means Alliance Pharma must constantly differentiate its offerings to stand out.

The consumer healthcare market is on a strong growth trajectory, with projections indicating substantial expansion driven by an aging global population and the increasing adoption of digital health solutions. For instance, the global digital health market was valued at approximately USD 211 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of over 16% through 2030.

While this robust industry growth generally offers ample room for all participants, potentially softening direct competitive rivalry, it doesn't eliminate it. Intense competition for market share remains a significant factor, particularly in established product categories where differentiation is key.

Alliance Pharma's strategy of acquiring and marketing established consumer healthcare brands and prescription medicines suggests a reliance on existing brand recognition. This focus can foster customer loyalty, creating a buffer against intense price competition, especially in segments where brand trust is paramount. For instance, in 2024, the global consumer healthcare market continued to see strong demand for trusted brands, with key players reporting steady revenue growth driven by consumer preference for familiar and effective products.

However, the consumer healthcare landscape is not without its challenges. Many of Alliance Pharma's product categories likely face pressure from lower-cost generic alternatives and the increasing prevalence of private label brands. This necessitates ongoing investment in marketing, product innovation, and demonstrating clear product differentiation to maintain market share and pricing power. The pharmaceutical sector, for example, saw significant growth in generic drug penetration in 2024, underscoring the need for strong brand equity and unique product benefits.

Exit Barriers for Competitors

High exit barriers significantly influence competitive rivalry within the pharmaceutical industry. These barriers, often stemming from specialized assets and stringent regulatory requirements, can trap even underperforming companies in the market, thereby prolonging intense competition.

In 2024, the pharmaceutical sector continues to grapple with substantial costs related to regulatory compliance, including the rigorous approval processes for new drugs and ongoing post-market surveillance. Furthermore, the specialized nature of manufacturing facilities, whether in-house or outsourced, and the complex procedures for discontinuing product lines represent considerable financial commitments that deter quick exits.

- Regulatory Compliance Costs: Companies face ongoing expenses for adhering to FDA and EMA regulations, which can run into millions annually per product.

- Specialized Asset Write-offs: Decommissioning or repurposing highly specialized pharmaceutical manufacturing equipment often incurs significant losses.

- Contractual Obligations: Long-term supply agreements and licensing deals can create financial penalties for early termination, acting as a deterrent to exiting.

- Brand and Reputation Management: A poorly managed exit can damage a company's reputation, impacting future business ventures and partnerships.

Mergers, Acquisitions, and Strategic Alliances

Mergers, acquisitions, and strategic alliances are significant drivers of competitive rivalry within the consumer healthcare and pharmaceutical industries. Alliance Pharma's own history, including its recent acquisition by Aegros Bidco Ltd. in early 2024, exemplifies this trend. This ongoing consolidation reshapes market dynamics, potentially increasing the market power of larger entities and altering the strategic priorities of remaining players.

The impact of such transactions on rivalry can be profound. For instance, a major acquisition can lead to fewer, but larger, competitors, intensifying competition on factors like innovation, pricing, and market access. This activity, seen across the sector, means Alliance Pharma must continuously adapt its strategies to navigate a landscape where consolidation is a common theme, directly influencing the intensity of competitive pressures.

- Increased Consolidation: The pharmaceutical sector saw significant M&A activity in 2023, with global deal values reaching hundreds of billions of dollars, indicating a trend towards fewer, larger players.

- Strategic Acquisitions: Alliance Pharma's acquisition by Aegros Bidco Ltd. in early 2024 is a direct example of how companies leverage M&A to gain market share and expand their portfolios.

- Shifting Competitive Landscape: Such deals can lead to a redistribution of market power, forcing remaining companies to re-evaluate their competitive strategies to maintain or improve their standing.

The competitive rivalry within the pharmaceutical and consumer healthcare sectors is fierce, characterized by a vast number of players ranging from global giants to specialized firms. Alliance Pharma operates in a market where differentiation through brand trust and product innovation is crucial, especially with the rise of generics and private labels. For instance, in 2024, the global pharmaceutical market, valued at approximately $1.6 trillion, underscores the intensity of this competition.

High exit barriers, such as substantial regulatory compliance costs and specialized asset write-offs, keep even struggling companies in the market, thereby sustaining intense rivalry. This means Alliance Pharma must consistently demonstrate value to maintain its position. The ongoing consolidation through mergers and acquisitions, exemplified by Alliance Pharma's own acquisition in early 2024, further reshapes the competitive landscape, often leading to larger, more powerful entities.

| Metric | 2023 Data | 2024 Projection/Status | Impact on Rivalry |

| Global Pharmaceutical Market Value | ~$1.5 trillion | ~$1.6 trillion | Indicates large market with many players |

| Digital Health Market Growth (CAGR) | ~16% (through 2030) | Continued strong growth | Creates new competitive avenues and pressures |

| Generic Drug Penetration | Significant growth | Continued high penetration | Increases price pressure on branded products |

| M&A Activity in Pharma | Hundreds of billions USD (global deal values) | Continued high activity | Leads to market consolidation and larger competitors |

SSubstitutes Threaten

The threat of substitutes for Alliance Pharma is significant, particularly in the consumer healthcare segment. Generic over-the-counter (OTC) drugs, alternative therapies like herbal remedies, and even simple lifestyle modifications can offer similar benefits at a lower price point or with greater convenience, directly impacting Alliance Pharma's market share and pricing power.

In the prescription medicine market, the threat escalates dramatically once patents expire. For instance, the introduction of generics for a blockbuster drug can lead to a rapid decline in sales, often exceeding 80% within the first year of generic availability, as seen with many oncology and cardiovascular medications. This forces companies like Alliance Pharma to either diversify their product pipeline or focus on niche markets to mitigate such impacts.

Customer willingness to switch to substitutes for Alliance Pharma’s products hinges on several factors. Brand loyalty plays a significant role, as does the perceived effectiveness and ease of access to alternative treatments. Awareness of these alternatives is also crucial; for instance, in 2024, the global digital health market was valued at over $300 billion, indicating a growing consumer comfort with non-traditional healthcare solutions.

The availability of generic and biosimilar drugs poses a significant threat to Alliance Pharma. Once a brand-name drug's patent expires, generic versions, which are chemically identical and often much cheaper, can enter the market. For instance, in 2023, the U.S. Food and Drug Administration (FDA) approved a record number of generic drugs, highlighting this trend.

Biosimilars, while not identical, are highly similar versions of biologic medicines, offering comparable efficacy and safety at a lower cost. This 'generic erosion' directly impacts the revenue streams of pharmaceutical companies like Alliance Pharma, especially for their high-value prescription medicines that are nearing or have recently lost patent protection.

Non-Pharmaceutical Alternatives and Lifestyle Changes

For many common health concerns, consumers increasingly turn to non-pharmaceutical solutions. These include lifestyle adjustments like improved diet and regular exercise, alongside the growing popularity of herbal remedies and digital health tools such as fitness trackers and wellness apps. This trend is fueled by a heightened consumer focus on overall well-being and preventative care.

The market for wellness and preventative health is expanding rapidly. For instance, the global digital health market was valued at approximately $207 billion in 2023 and is projected to reach over $1 trillion by 2030, indicating a significant shift towards these alternatives. This growth directly challenges traditional pharmaceutical approaches for managing conditions like mild hypertension or sleep disturbances.

- Diet and Exercise: Proven to manage conditions like type 2 diabetes and cardiovascular disease, reducing reliance on medication.

- Herbal Remedies: Consumers are increasingly using supplements and botanicals for conditions ranging from anxiety to digestive issues.

- Digital Health Solutions: Wearables and health apps provide monitoring and guidance, empowering self-management of chronic conditions.

- Mind-Body Practices: Yoga, meditation, and acupuncture are gaining traction as complementary therapies for pain and stress management.

Regulatory Environment for Substitutes

Changes in regulatory pathways significantly impact the threat of substitutes for Alliance Pharma. For instance, the Rx-to-OTC switch of certain prescription medications can rapidly introduce new, accessible substitutes into the consumer healthcare market, intensifying competitive pressure. In 2024, several key pharmaceutical markets continued to explore or implement streamlined processes for such switches, aiming to broaden consumer access and potentially lower prices for common ailments.

Furthermore, regulatory shifts that simplify the approval or marketing of alternative health solutions, like natural health products or digital health tools, can also bolster their viability as substitutes. A notable trend observed in 2024 was the increasing scrutiny and, in some regions, the relaxation of regulations for certain digital therapeutics and wellness applications, allowing them to compete more directly with traditional pharmaceutical offerings for specific health needs.

- Rx-to-OTC Switches: Increased regulatory flexibility for prescription-to-over-the-counter transitions can create new, direct substitutes for Alliance Pharma's products.

- Digital Health & Natural Products: Evolving regulations for digital health tools and natural health products enhance their market accessibility and substitutability.

- Market Impact: These regulatory changes in 2024 have the potential to fragment market share and necessitate strategic adjustments in product development and marketing for established pharmaceutical companies.

The threat of substitutes for Alliance Pharma is substantial, particularly from generic drugs and alternative health solutions. The increasing consumer embrace of digital health tools, as evidenced by the global digital health market's valuation exceeding $300 billion in 2024, highlights a growing willingness to explore non-traditional treatments.

Once patents expire, generic and biosimilar versions of Alliance Pharma's prescription drugs emerge as potent substitutes, often driving down prices and sales significantly. For example, the FDA's record number of generic drug approvals in 2023 underscores this competitive pressure.

Furthermore, lifestyle changes like improved diet and exercise, alongside the growing popularity of herbal remedies, offer consumers accessible alternatives for managing common health issues, directly challenging the market position of many pharmaceutical products.

Regulatory shifts, such as streamlined Rx-to-OTC switches and evolving regulations for digital therapeutics, are also expanding the landscape of viable substitutes, forcing companies like Alliance Pharma to adapt strategically.

Entrants Threaten

The pharmaceutical and consumer healthcare sectors are characterized by substantial regulatory barriers. For instance, the U.S. Food and Drug Administration (FDA) approval process for new drugs is notoriously lengthy and expensive, often taking over a decade and costing hundreds of millions of dollars, making it a significant deterrent for new companies.

Compliance with stringent safety standards, Good Manufacturing Practices (GMP), and intellectual property laws further escalates the initial investment required. These extensive requirements, including rigorous clinical trials and post-market surveillance, demand considerable financial and human capital, effectively limiting the number of new entrants capable of meeting these demands.

The pharmaceutical industry demands enormous capital for research, development, rigorous clinical trials, manufacturing, and extensive marketing campaigns. For example, bringing a new drug to market can cost upwards of $2 billion, a significant hurdle for any new player.

Even with an asset-light strategy like Alliance Pharma's, substantial funds are necessary for acquiring established brands and building new ones. This high financial barrier effectively deters many potential entrants from entering the competitive pharmaceutical landscape.

Established pharmaceutical giants like Alliance Pharma leverage significant economies of scale in drug development, manufacturing, and global distribution. This allows them to spread high fixed costs over a larger volume, resulting in lower per-unit production costs. For instance, in 2024, major pharmaceutical companies reported R&D expenditures often exceeding billions of dollars, a hurdle nearly impossible for a new entrant to match immediately.

The experience curve further solidifies this advantage; as companies like Alliance Pharma gain more experience in producing and marketing drugs, their processes become more efficient, leading to further cost reductions. A new entrant would need substantial initial investment and time to climb this curve, making it difficult to compete on price or profitability against incumbents who have already optimized their operations for decades.

Brand Loyalty and Switching Costs for Customers

Alliance Pharma benefits from significant brand loyalty, particularly in the consumer healthcare sector where established brands foster trust and repeat purchases. This makes it challenging for new entrants to gain traction. For instance, in 2024, the global consumer healthcare market continued to show resilience, with strong performance in established categories, indicating that consumer preference for familiar brands remains a powerful force.

While not always overtly financial, switching costs for consumers can be present due to habit or perceived efficacy of existing products. Alliance Pharma's strategy of acquiring and nurturing trusted brands directly capitalizes on these customer attachments, creating a substantial barrier to entry for newcomers seeking to disrupt established market positions.

- Established brands in consumer healthcare often command higher consumer trust, leading to repeat purchases and reduced price sensitivity.

- The psychological comfort and familiarity associated with long-standing brands act as a significant, albeit often unquantified, switching cost for consumers.

- Alliance Pharma's acquisition strategy focuses on brands with proven customer loyalty, thereby reinforcing this barrier against potential new entrants.

Access to Distribution Channels

New pharmaceutical companies face substantial hurdles in securing access to established distribution channels, such as pharmacies, retail outlets, and healthcare providers. Existing, larger players often possess deep-rooted relationships and robust logistical networks that are difficult and costly for newcomers to replicate or penetrate.

Alliance Pharma's established international presence and its consistent supply to major pharmaceutical wholesalers highlight its strong integration within these critical distribution pathways. This embeddedness provides a significant competitive advantage, making it challenging for new entrants to gain comparable market reach.

- Distribution Channel Barriers: New entrants struggle to access established pharmacy, retailer, and healthcare provider networks due to existing players' long-standing relationships and infrastructure.

- Alliance Pharma's Advantage: Alliance Pharma's international operations and supply to major wholesalers demonstrate its deep integration into these vital channels, creating a barrier for competitors.

- Cost of Entry: Building or acquiring comparable logistical capabilities and forging new distribution relationships represents a significant financial and time investment for emerging pharmaceutical companies.

The threat of new entrants for Alliance Pharma is considerably low due to high capital requirements and extensive regulatory hurdles. For instance, bringing a new drug to market can cost upwards of $2 billion, a figure that deters many potential competitors. The lengthy FDA approval process, often taking over a decade, further amplifies this barrier.

Established players like Alliance Pharma benefit from significant economies of scale, with R&D expenditures in the billions for major companies in 2024, making it difficult for newcomers to compete on cost. Additionally, strong brand loyalty in consumer healthcare, where established brands maintain consumer trust, creates substantial switching costs for customers, reinforcing Alliance Pharma's market position.

Access to distribution channels is another significant barrier. Alliance Pharma's deep integration into international distribution networks and its consistent supply to major wholesalers make it challenging for new entrants to achieve comparable market reach. Building similar logistical capabilities requires substantial financial and time investment.

| Barrier Type | Description | Impact on New Entrants | Alliance Pharma's Position |

|---|---|---|---|

| Capital Requirements | Drug development, clinical trials, and marketing cost billions. | Extremely high, limiting the number of well-funded entrants. | Leverages scale, established R&D pipeline. |

| Regulatory Hurdles | Lengthy FDA approval processes (often 10+ years) and stringent safety standards. | Significant time and resource drain, high failure risk. | Experienced in navigating complex regulatory landscapes. |

| Brand Loyalty & Switching Costs | Consumer trust in established brands creates repeat purchases. | Difficult to displace established brands; requires significant marketing investment. | Acquires and nurtures trusted brands with proven loyalty. |

| Distribution Access | Established relationships with pharmacies, retailers, and healthcare providers. | Challenging to penetrate existing networks; requires building new infrastructure. | Strong international presence and established supply chains. |

Porter's Five Forces Analysis Data Sources

Our Alliance Pharma Porter's Five Forces analysis is built upon a foundation of robust data, including Alliance Pharma's annual reports, SEC filings, and investor presentations. We supplement this with industry-specific market research reports and pharmaceutical trade publications to capture a comprehensive view of the competitive landscape.