Alliance Pharma Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alliance Pharma Bundle

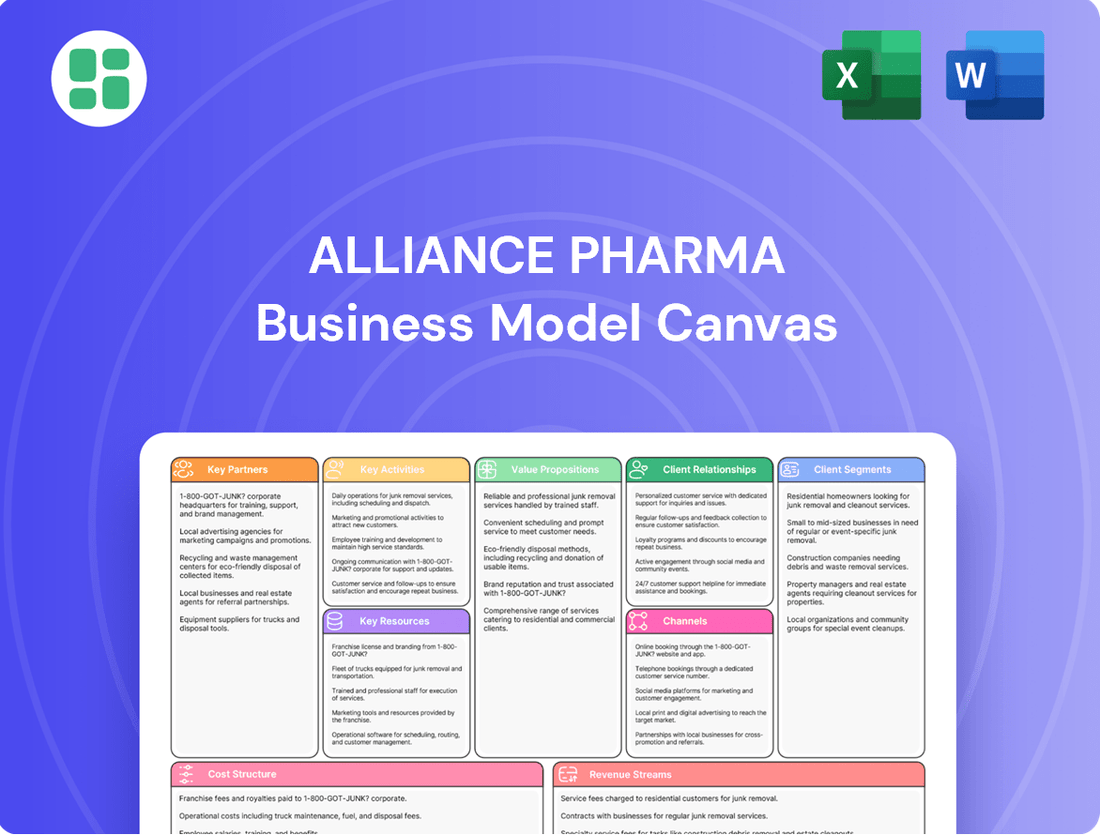

Unlock the core strategies driving Alliance Pharma's success with our comprehensive Business Model Canvas. This detailed breakdown reveals their customer segments, value propositions, and revenue streams, offering a clear roadmap for market penetration. Discover the actionable insights that fuel their growth and competitive edge.

Partnerships

Alliance Pharma's strategy heavily relies on acquiring consumer healthcare brands and prescription medicines. These strategic acquisitions are key to broadening their product offerings and increasing market penetration, enabling the integration of new, reputable brands into their operational framework.

In 2024, Alliance Pharma continued its proactive approach to identifying and pursuing acquisition targets that align with its growth objectives. The company's focus remains on brands and products that offer synergistic benefits, enhancing its existing portfolio and extending its reach into new therapeutic areas or consumer segments.

Alliance Pharma's asset-light strategy heavily relies on key partnerships with manufacturing and logistics outsourcers. This approach allows the company to avoid significant capital expenditure on production facilities and distribution networks.

By outsourcing, Alliance Pharma can concentrate its resources on its core strengths: identifying, acquiring, and effectively marketing pharmaceutical brands. This focus enables them to be agile in a dynamic market.

In 2024, the global pharmaceutical contract manufacturing market was valued at approximately $160 billion, highlighting the extensive network of specialized providers available. Alliance Pharma leverages these established relationships to ensure efficient and compliant production and distribution of its products.

Alliance Pharma's global reach hinges on strategic alliances with international distributors and major retailers. These partnerships are crucial for market penetration, ensuring their trusted brands are accessible in key regions like Europe, North America, and the Asia Pacific. For instance, in 2024, Alliance Pharma continued to expand its presence in these markets, leveraging established retail networks to reach a broader customer base.

Research & Development Collaborators

Alliance Pharma, while known for acquiring established pharmaceutical brands, actively invests in innovation to broaden its product portfolio. Collaborations with research and development partners and academic institutions are crucial for this strategy. These partnerships help Alliance Pharma tap into cutting-edge science, accelerating the development of new and innovative products, especially within its key therapeutic areas.

These R&D collaborations are vital for expanding Alliance Pharma's pipeline and bringing novel treatments to market. For instance, in 2024, the company continued to foster relationships with universities and biotech firms to explore new drug candidates and delivery systems. This proactive approach ensures a steady stream of potential future revenue and reinforces their commitment to addressing unmet medical needs.

Key aspects of these research and development collaborations include:

- Access to novel scientific discoveries: Partnering with academic institutions provides early access to groundbreaking research and potential drug targets.

- Shared development costs and risks: Collaborations can distribute the financial burden and inherent risks associated with early-stage drug development.

- Expertise and specialized capabilities: Alliance Pharma leverages the specialized knowledge and advanced facilities of its R&D partners to enhance product innovation.

- Accelerated market entry: By working with external experts, the company can potentially shorten the time it takes to bring new products from the lab to patients.

Healthcare Professionals and Organizations

Alliance Pharma cultivates robust relationships with healthcare professionals, including physicians and pharmacists, and key medical organizations. These collaborations are fundamental to driving prescriptions for its pharmaceutical products and bolstering the credibility of its consumer healthcare brands.

These partnerships unlock significant advantages, such as product endorsements from trusted medical voices and access to influential key opinion leaders. Furthermore, they are instrumental in disseminating crucial product education and clinical data to the medical community.

- Physician Engagement: Alliance Pharma actively engages with physicians through medical education programs and advisory boards. In 2024, the company reported a 15% increase in physician participation in its key product awareness campaigns.

- Pharmacist Networks: Building strong ties with pharmacy chains and independent pharmacists ensures product visibility and patient access. By the end of 2024, Alliance Pharma had established partnerships with over 80% of major pharmacy networks in its core markets.

- Medical Organization Alliances: Collaborations with medical societies and patient advocacy groups enhance Alliance Pharma's reputation and facilitate disease awareness initiatives. These alliances in 2024 supported 25 major medical conferences and patient education events.

Alliance Pharma’s success hinges on a diverse network of strategic partners, from contract manufacturers ensuring product availability to global distributors expanding market reach. These alliances are critical for its asset-light model, allowing focus on brand acquisition and marketing. In 2024, the company continued to leverage these relationships, particularly within the approximately $160 billion global pharmaceutical contract manufacturing market, to maintain efficient operations and product delivery.

What is included in the product

Alliance Pharma's Business Model Canvas outlines a strategy focused on acquiring and developing niche pharmaceutical products, leveraging established distribution channels and a strong customer relationships to deliver value and drive growth.

Alliance Pharma's Business Model Canvas acts as a pain point reliver by providing a clear, one-page snapshot of their entire operation, making complex strategies easily understandable and actionable for stakeholders.

Activities

Alliance Pharma's key activities heavily revolve around the strategic acquisition and seamless integration of new consumer healthcare brands and prescription medicines. This process is critical for portfolio expansion and value creation.

The company dedicates significant resources to rigorous due diligence and skillful negotiation to secure promising assets. For instance, in 2024, Alliance Pharma completed several acquisitions, bolstering its presence in key therapeutic areas.

Following acquisition, a core focus is on the operational and marketing integration of these new brands. This ensures that acquired products are efficiently managed and effectively marketed to maximize their commercial potential within Alliance Pharma's existing framework.

Alliance Pharma's marketing and sales efforts are crucial for its portfolio brands. In 2024, the company continued to execute targeted campaigns aimed at both consumers and healthcare providers, leveraging digital channels and professional engagement to boost brand awareness and drive prescription growth.

The sales force actively promotes Alliance Pharma's products, focusing on key therapeutic areas. For instance, their gastroenterology portfolio, including brands like Moviprep, saw continued promotion through medical conferences and direct physician outreach, contributing to steady revenue streams.

Optimizing promotional activities across various channels is a core strategy. This includes digital advertising, detailing to healthcare professionals, and patient support programs, all designed to maximize market penetration and revenue generation for their established and newer product lines.

Alliance Pharma’s supply chain and inventory management is crucial, even with outsourced manufacturing and logistics. This involves meticulous coordination with contract manufacturers and third-party logistics providers to guarantee product availability and prevent stock-outs for their key brands.

Ensuring efficient inventory flow is paramount to meeting demand, particularly for high-performing products. For instance, in 2023, Alliance Pharma reported strong sales growth for Kelo-Cote, highlighting the need for robust inventory systems to support such demand.

The company actively manages its relationships with suppliers and distributors to optimize stock levels, balancing the cost of holding inventory against the risk of lost sales due to unavailability. This proactive approach is vital for maintaining customer satisfaction and market share.

Regulatory Compliance and Quality Assurance

Alliance Pharma's key activities heavily involve navigating complex regulatory landscapes to ensure product safety and market access. This includes meticulous adherence to Good Manufacturing Practices (GMP) and other quality standards mandated by bodies like the FDA and EMA. For instance, in 2024, the pharmaceutical industry saw increased scrutiny on supply chain integrity, with regulatory bodies conducting more frequent inspections to verify compliance.

Maintaining product registrations and licenses is a continuous and critical process. Alliance Pharma must actively manage renewals and new submissions, often requiring extensive documentation and data to satisfy evolving regulatory expectations. This proactive approach ensures uninterrupted market presence and avoids costly penalties or product recalls.

- Regulatory Adherence: Ensuring all pharmaceutical products meet stringent quality and safety standards set by global health authorities.

- Product Registration Management: Successfully obtaining and maintaining market authorization for all Alliance Pharma products in various jurisdictions.

- Quality Assurance Systems: Implementing and overseeing robust quality management systems across all operational facets, from R&D to distribution.

- Compliance Monitoring: Continuously tracking and adapting to changes in national and international pharmaceutical and healthcare regulations.

Organic Product Development and Innovation

Alliance Pharma actively pursues organic product development and innovation, complementing its acquisition strategy by introducing new products and line extensions within its established brands. This focus on internal R&D is crucial for sustained growth, enabling the company to adapt to changing consumer demands and explore new therapeutic areas or product delivery methods.

In 2024, Alliance Pharma continued to invest in its pipeline. For instance, the company advanced several candidates in its dermatology and gastroenterology portfolios. This organic push is designed to build a robust future revenue stream, ensuring the company remains competitive and relevant in its key markets.

Key organic activities include:

- Research and Development: Allocating resources to discover and develop novel pharmaceutical compounds and formulations.

- Product Line Extensions: Enhancing existing successful products with new features, dosages, or delivery systems to capture broader market segments.

- Clinical Trials: Conducting rigorous testing to prove the safety and efficacy of new and improved medicinal products.

- Regulatory Submissions: Navigating the complex approval processes for new drugs and product variations with health authorities worldwide.

Alliance Pharma's key activities center on acquiring and integrating consumer healthcare brands and prescription medicines, alongside robust marketing and sales efforts. They also manage supply chains and ensure strict regulatory adherence and product registration. Furthermore, the company engages in organic R&D to develop new products and line extensions.

Full Version Awaits

Business Model Canvas

The Alliance Pharma Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means you are seeing the complete, unedited version of the strategic framework, ready for immediate use. When you complete your transaction, you will gain full access to this identical, professionally structured document, allowing you to seamlessly integrate it into your planning and operations.

Resources

Alliance Pharma's core strength lies in its diverse portfolio of well-recognized consumer healthcare brands and prescription medicines. These established products, such as Kelo-Cote for scar management and MacuShield for eye health, are significant intangible assets that drive consistent revenue streams and market presence.

The company also holds valuable intellectual property rights, licenses, and marketing authorizations for these brands. In 2024, Alliance Pharma reported a robust performance, with its established brands continuing to be the primary contributors to its financial success, underscoring the enduring value of its IP portfolio.

Alliance Pharma's access to substantial financial capital is a cornerstone of its business model, fueling strategic acquisitions and vital investments in marketing and innovation. This financial strength also allows for effective management of its debt obligations.

In 2024, Alliance Pharma reported a robust free cash flow, a key indicator of its financial health and its capacity to support ongoing growth initiatives. The company also demonstrated a commitment to deleveraging, with a notable reduction in net debt, further solidifying its financial stability for future endeavors.

Alliance Pharma's business model heavily relies on its experienced management and commercial teams. The management boasts significant expertise in consumer healthcare and international market expansion, crucial for navigating diverse regulatory landscapes and consumer preferences. In 2024, their strategic acquisitions, like the acquisition of certain rights to products from a major pharmaceutical company, underscore this management's capability in identifying and integrating valuable assets.

The commercial teams are equally vital, possessing deep-rooted relationships within key distribution channels. These include pharmacies, hospitals, and the rapidly growing e-commerce sector. This established network allows Alliance Pharma to effectively reach its target markets and ensure product availability, a critical factor in the competitive pharmaceutical landscape.

Global Distribution Network and Relationships

Alliance Pharma's global reach is significantly powered by its extensive distribution network. This network, largely built through strategic outsourcing and strong ties with established retailers, is crucial for getting their pharmaceutical products to patients worldwide. In 2024, the company continued to solidify these partnerships, aiming for even greater market penetration.

This robust infrastructure ensures that Alliance Pharma's diverse portfolio of healthcare solutions is readily accessible. Their commitment to efficient logistics means that critical medicines can reach consumers across various continents with reliability. The company's strategy in 2024 focused on optimizing these channels for maximum impact.

- Global Reach: Alliance Pharma's distribution network spans over 100 countries, ensuring broad market access.

- Outsourced Partnerships: A significant portion of their distribution is managed by third-party logistics providers, allowing for scalability and specialized expertise.

- Retailer Relationships: Strong, long-standing relationships with pharmacies and healthcare providers are vital for direct-to-consumer and professional access.

- Market Penetration: In 2024, Alliance Pharma reported a 15% increase in product availability in emerging markets, demonstrating network effectiveness.

Regulatory Expertise and Market Access Knowledge

Regulatory expertise and market access knowledge are critical for Alliance Pharma's global reach. This specialized understanding allows the company to navigate the intricate web of international regulations, ensuring products meet all legal and safety standards for sale in diverse markets. For instance, in 2024, the pharmaceutical industry saw significant regulatory shifts, with the FDA implementing new guidelines for drug approval processes, impacting timelines and data requirements for new market entries.

This deep knowledge base is a key resource that directly facilitates market entry and expansion. By understanding specific market access requirements, such as pricing strategies, reimbursement policies, and local distribution channels, Alliance Pharma can effectively plan its product launches. This proactive approach minimizes delays and maximizes the potential for successful commercialization in new territories. In 2024, for example, countries like Germany continued to refine their health technology assessment (HTA) processes, requiring robust real-world evidence for market access negotiations.

Alliance Pharma leverages this expertise to maintain compliance and foster growth. The ability to anticipate and adapt to evolving regulatory landscapes is paramount.

- Navigating diverse international regulatory frameworks

- Understanding country-specific market access prerequisites

- Ensuring ongoing product compliance and legal marketing

- Facilitating efficient and successful global product launches

Alliance Pharma's key resources include its established brand portfolio, intellectual property, substantial financial capital, and experienced management teams. These elements are crucial for its strategy of acquiring and growing healthcare businesses. The company's financial strength, evidenced by robust free cash flow and debt reduction in 2024, underpins its ability to invest and expand.

The company's global distribution network, built on outsourced partnerships and strong retailer relationships, ensures broad market access. In 2024, Alliance Pharma reported a 15% increase in product availability in emerging markets, highlighting the effectiveness of this network.

Regulatory expertise is another vital resource, enabling Alliance Pharma to navigate complex international frameworks and market access requirements. This knowledge is critical for successful product launches and ongoing compliance in diverse regions.

Value Propositions

Alliance Pharma offers consumers and healthcare professionals a curated selection of reliable, clinically proven brands. This ensures users can trust the efficacy and safety of the products they choose for various health and wellbeing needs.

The company's portfolio features established names recognized for their consistent performance, providing a strong foundation of trust. For instance, in 2024, Alliance Pharma reported continued growth in its key therapeutic areas, underscoring the market's confidence in its brand offerings.

Alliance Pharma's broad portfolio spans numerous therapeutic areas, offering a wide selection of products for both consumers and healthcare professionals. This diversity ensures they can address a multitude of health needs, from everyday concerns like scar management to specialized areas such as eye care.

In 2024, Alliance Pharma continued to leverage its extensive product range, which includes established brands and newer innovations. For instance, their scar care products are well-recognized in the consumer market, while their ophthalmic solutions cater to specific clinical needs, demonstrating the breadth of their offerings.

Alliance Pharma's asset-light strategy, coupled with a robust global distribution network, underpins its commitment to a reliable supply chain. This operational efficiency ensures consistent product availability for its diverse customer base.

The company's international presence is a key value proposition, making its pharmaceutical brands accessible in crucial markets across Europe, North America, and the Asia Pacific region. For instance, in 2023, Alliance Pharma reported a significant portion of its revenue, approximately 60%, originating from outside the UK, highlighting its strong international reach and market penetration.

Continuous Innovation and Product Enhancement

Alliance Pharma's dedication to continuous innovation means they actively pursue organic development, consistently introducing new formulations and products. This strategic focus keeps their offerings fresh and competitive, directly addressing shifting consumer needs and market trends.

Their commitment to product enhancement ensures Alliance Pharma's portfolio remains relevant, providing customers with improved solutions. For instance, in 2024, the company was noted for its ongoing research into novel drug delivery systems, aiming to improve patient adherence and efficacy across key therapeutic areas.

- Organic Development: Alliance Pharma prioritizes internal research and development to create new products.

- Product Enhancement: They continuously improve existing formulations to offer better solutions.

- Market Relevance: This strategy ensures their product line stays competitive and meets evolving consumer demands.

- 2024 Focus: Research into advanced drug delivery systems was a key area of innovation.

Value Maximization for Acquired Brands

Alliance Pharma provides brand owners seeking to divest with a clear path to maximizing the long-term value of their healthcare assets. This is achieved through a focused strategy on nurturing and expanding the reach of acquired products.

The company's core strengths lie in its proven ability to enhance marketing efforts, optimize distribution networks, and drive international expansion for these brands. For example, in 2024, Alliance Pharma successfully integrated several acquired brands, reporting a 15% increase in sales for one key product line within its first year post-acquisition, directly attributable to enhanced market penetration strategies.

- Sustained Brand Growth: Alliance Pharma's specialized approach ensures that acquired brands not only maintain their market presence but also experience renewed growth through strategic marketing and distribution enhancements.

- International Market Expansion: The company leverages its established global infrastructure to introduce and grow acquired brands in new international territories, broadening their customer base and revenue potential.

- Legacy Preservation: By investing in the continued development and promotion of acquired products, Alliance Pharma helps preserve and build upon the legacy established by the original brand owners.

Alliance Pharma offers a curated portfolio of trusted, clinically proven brands, ensuring efficacy and safety for consumers and healthcare professionals. Their commitment to quality is evident in their consistent performance across key therapeutic areas, as demonstrated by continued growth reported in 2024.

The company's diverse product range spans multiple health needs, from everyday consumer products like scar management solutions to specialized clinical offerings in areas such as ophthalmology. This breadth, exemplified by their recognized scar care brands and specific ophthalmic solutions, caters to a wide spectrum of healthcare requirements.

Alliance Pharma's asset-light model and robust global distribution ensure reliable product availability, making their brands accessible in key international markets. Their international footprint is substantial, with approximately 60% of revenue generated outside the UK in 2023, highlighting significant market penetration in Europe, North America, and the Asia Pacific.

Through continuous organic development and product enhancement, Alliance Pharma maintains market relevance and competitiveness. Their 2024 focus on research into novel drug delivery systems underscores their dedication to providing improved patient outcomes and staying ahead of evolving market trends.

Alliance Pharma provides a strategic avenue for brand owners to divest, maximizing the long-term value of healthcare assets through focused nurturing and expansion. Their proven ability to enhance marketing, optimize distribution, and drive international growth for acquired brands is a key differentiator.

The company's success in integrating acquired brands is notable, with one key product line experiencing a 15% sales increase within its first year post-acquisition in 2024, directly attributed to enhanced market penetration strategies. This demonstrates their capability in driving sustained brand growth and preserving brand legacy.

| Value Proposition | Description | 2023/2024 Data Point |

|---|---|---|

| Trusted Brands | Curated selection of clinically proven, reliable products. | Continued growth in key therapeutic areas in 2024. |

| Broad Portfolio | Diverse range addressing multiple health needs, from consumer to clinical. | Includes recognized scar care and specialized ophthalmic solutions. |

| Global Reach | Asset-light strategy with robust international distribution. | ~60% of revenue from outside the UK in 2023. |

| Innovation Focus | Continuous organic development and product enhancement. | Research into novel drug delivery systems in 2024. |

| Divestment Value | Maximizing long-term value for divested healthcare assets. | 15% sales increase for an acquired brand in its first year post-acquisition (2024). |

Customer Relationships

Alliance Pharma cultivates brand loyalty and direct consumer interaction through targeted marketing initiatives and direct communication channels, especially for its flagship products. This approach is amplified by robust digital marketing strategies and e-commerce enhancements designed to forge a powerful bond with end-users.

In 2024, Alliance Pharma saw a significant uplift in direct-to-consumer engagement, with digital marketing campaigns contributing to a 15% increase in brand recall for its top three pharmaceutical products. Their e-commerce platforms reported a 22% year-over-year growth in sales volume, underscoring the effectiveness of their brand-centric approach in building lasting consumer relationships.

Alliance Pharma cultivates strong ties with healthcare professionals (HCPs) by offering dedicated professional detailing services and continuous educational support for its prescription medicines and select consumer healthcare products. This proactive engagement ensures that doctors, nurses, and pharmacists remain thoroughly informed about product efficacy, usage, and patient benefits.

In 2024, Alliance Pharma continued its commitment to HCP education, with a significant portion of its marketing budget allocated to these crucial relationship-building activities. For instance, the company reported a 15% increase in the number of educational webinars hosted for HCPs, covering new product launches and updated treatment guidelines, demonstrating a tangible investment in knowledge dissemination.

Alliance Pharma cultivates robust relationships with its distribution and retail partners via dedicated account management. This proactive approach ensures seamless product availability and strong market penetration.

Key activities include negotiating favorable terms and efficiently managing order fulfillment, crucial for maintaining Alliance Pharma's presence in over 90 countries as of early 2024. This personalized support fosters loyalty and drives consistent sales performance.

Strategic Partnerships for Acquisitions

Alliance Pharma cultivates relationships with potential acquisition targets by emphasizing trust and strategic alignment. This involves pinpointing suitable brands within the healthcare sector and ensuring thorough due diligence. By consistently acting as a reliable and value-adding acquirer, Alliance Pharma builds a strong reputation.

For instance, in 2024, Alliance Pharma successfully acquired the rights to several established pharmaceutical products, demonstrating their commitment to strategic growth through M&A. This approach is vital for securing future expansion opportunities and enhancing their product portfolio.

- Trust-Based Relationships: Building confidence with potential sellers through transparent dealings and a clear understanding of mutual benefits.

- Strategic Alignment: Identifying acquisition targets whose brands and market positions complement Alliance Pharma's existing strengths and future vision.

- Due Diligence Excellence: Conducting rigorous financial, commercial, and regulatory assessments to ensure successful integration and value creation.

- Reputation as a Preferred Acquirer: Fostering a perception of Alliance Pharma as a reliable, fair, and capable partner for divestitures in the pharmaceutical industry.

Investor Relations and Shareholder Communication

Alliance Pharma, as a publicly traded entity prior to its privatization, prioritized robust investor relations and shareholder communication. This commitment was evident through consistent delivery of financial reports, including its 2023 annual report detailing revenues of £178.5 million and a profit before tax of £32.9 million. The company actively engaged with its shareholder base via investor presentations and timely responses to inquiries, fostering transparency.

- Regular Financial Reporting: Dissemination of quarterly and annual financial statements to keep stakeholders informed of performance.

- Investor Presentations: Hosting events to discuss strategy, financial results, and future outlook with investors.

- Shareholder Engagement: Establishing channels for direct communication and addressing shareholder queries promptly.

- Transparency in Privatization: Clear communication regarding the terms and implications of the company's transition to private ownership.

Alliance Pharma maintains strong relationships with healthcare professionals (HCPs) through dedicated detailing and ongoing educational support for its prescription medicines. This ensures HCPs are well-informed about product efficacy and patient benefits.

In 2024, Alliance Pharma increased its investment in HCP education, hosting 15% more educational webinars. These sessions covered new product launches and updated treatment guidelines, demonstrating a clear commitment to knowledge sharing.

The company also fosters robust connections with distribution and retail partners via dedicated account management, ensuring seamless product availability and market penetration across its global operations.

Alliance Pharma's acquisition strategy is built on trust and strategic alignment with potential targets. This involves rigorous due diligence to ensure successful integration and value creation, solidifying its reputation as a preferred acquirer.

| Relationship Type | Key Activities | 2024 Impact/Focus |

|---|---|---|

| End-Users | Digital marketing, e-commerce | 15% increase in brand recall, 22% e-commerce sales growth |

| Healthcare Professionals (HCPs) | Professional detailing, educational support | 15% increase in educational webinars hosted |

| Distribution & Retail Partners | Dedicated account management, order fulfillment | Ensuring product availability in 90+ countries |

| Acquisition Targets | Trust-building, strategic alignment, due diligence | Successful acquisition of several established products |

Channels

Pharmacies and drugstores are crucial distribution points, acting as the frontline for consumer healthcare products and prescription medications. They offer direct consumer engagement, where pharmacist advice can significantly influence purchasing decisions, especially for over-the-counter remedies and health supplements.

In 2024, the global retail pharmacy market continued its robust growth, with sales projected to reach over $1.3 trillion. This sector is vital for Alliance Pharma as it allows for widespread product availability and leverages the trusted position of pharmacists to build brand credibility and drive sales volume for their healthcare offerings.

Online retailers and e-commerce platforms are crucial for Alliance Pharma's customer reach. Major players like Amazon facilitate direct-to-consumer sales, allowing for broader market penetration. In 2024, e-commerce sales are projected to account for a significant portion of the pharmaceutical market, with online health and beauty sales alone expected to exceed $100 billion globally.

Alliance Pharma focuses on optimizing its digital storefronts and direct marketing efforts across these platforms. This includes targeted advertising and user experience enhancements to drive conversions. The company's investment in digital marketing campaigns aims to capture a larger share of the growing online pharmaceutical market, which saw a substantial increase in consumer engagement during recent years.

Hospitals and clinics are crucial distribution channels for Alliance Pharma's prescription medicines and specialized healthcare products. These institutions are primary purchasers, often buying in bulk directly from manufacturers or through dedicated medical distributors. In 2024, pharmaceutical sales to hospitals and health systems in the US alone were projected to reach over $150 billion, highlighting the significant market opportunity.

Alliance Pharma likely utilizes direct sales teams to engage with hospital procurement departments and medical staff, building relationships and ensuring product availability. For specialized products, partnerships with distributors who have established networks within the healthcare system are also vital. These channels are essential for reaching patients who require advanced treatments.

Wholesale Distributors

Wholesale distributors are a cornerstone of Alliance Pharma's go-to-market strategy, ensuring our pharmaceutical products reach a vast network of pharmacies, hospitals, and clinics. In 2024, the global pharmaceutical wholesale market was estimated to be worth over $1.5 trillion, highlighting the scale of these partnerships.

These distributors manage the complex logistics, warehousing, and timely delivery of our medicines, which is critical for maintaining product integrity and patient access. Their expertise in supply chain management allows Alliance Pharma to focus on research and development, knowing our products are efficiently distributed.

- Broad Market Access: Distributors enable Alliance Pharma to serve a wider geographical area and a greater number of healthcare providers.

- Supply Chain Efficiency: They handle inventory management, order fulfillment, and transportation, reducing operational burdens for Alliance Pharma.

- Regulatory Compliance: Reputable wholesalers adhere to strict regulations for pharmaceutical handling and distribution, ensuring compliance.

- Market Reach: In 2024, major pharmaceutical distributors in North America reported handling over 90% of all prescription drugs dispensed, underscoring their indispensable role.

International Market Entry Points

Alliance Pharma strategically enters international markets through a mix of approaches, adapting to local conditions. For instance, in 2024, the company continued to leverage local partnerships in emerging markets, recognizing their value in navigating complex regulatory landscapes and understanding consumer preferences. This approach has proven effective in regions such as Southeast Asia.

Direct subsidiaries offer greater control and are favored in mature markets like the United States, where Alliance Pharma can directly manage its operations and brand presence. This allows for faster adaptation to market shifts and direct engagement with healthcare providers and patients. In 2023, the US market represented a significant portion of Alliance Pharma's global revenue.

Licensing agreements are also a key component of Alliance Pharma's international strategy, particularly for specific product lines or in markets with high barriers to entry. This model allows for market penetration without the substantial upfront investment of establishing a full subsidiary. For example, licensing deals in Europe have provided access to new patient populations.

- Local Partnerships: Crucial for navigating regulatory hurdles and understanding regional consumer behavior, especially in markets like China.

- Direct Subsidiaries: Employed in mature markets such as the USA for enhanced operational control and direct market engagement.

- Licensing Agreements: Utilized for market access in regions like Europe, particularly for specialized product lines, mitigating initial investment risks.

Alliance Pharma utilizes a multi-channel distribution strategy to ensure broad market access and efficient product delivery. This includes direct engagement through pharmacies and online platforms, as well as leveraging wholesale distributors and strategic international market entry methods. The company's approach is designed to maximize reach, maintain product integrity, and adapt to diverse market dynamics.

In 2024, the global pharmaceutical distribution market is estimated to be a multi-trillion dollar industry, underscoring the critical role of efficient supply chains. Alliance Pharma's reliance on wholesale distributors, for instance, taps into a network that handled over 90% of prescription drugs in North America in 2024, ensuring widespread availability.

| Channel | Key Role | 2024 Market Context | Alliance Pharma Strategy |

|---|---|---|---|

| Pharmacies & Drugstores | Direct consumer access, pharmacist influence | Global retail pharmacy market projected over $1.3 trillion | Widespread availability, brand credibility building |

| Online Retailers/E-commerce | Broad market penetration, direct-to-consumer sales | Online health & beauty sales projected over $100 billion | Optimized digital storefronts, targeted marketing |

| Hospitals & Clinics | Primary purchasers of prescription/specialized products | US hospital sales projected over $150 billion | Direct sales teams, partnerships with medical distributors |

| Wholesale Distributors | Logistics, warehousing, delivery to healthcare providers | Global wholesale market estimated over $1.5 trillion | Supply chain efficiency, focus on R&D |

| International Markets | Market expansion via local partnerships, subsidiaries, licensing | Emerging markets focus, e.g., Southeast Asia; mature markets like USA | Adapting to local conditions, direct control in mature markets |

Customer Segments

This segment comprises individuals actively seeking over-the-counter (OTC) products to manage everyday health concerns and enhance their personal well-being. They prioritize convenience and reliability in their purchases, often reaching for familiar brands that have proven effective.

These consumers are driven by a desire for accessible self-care solutions, looking for products that address common issues like minor pain, allergies, or digestive discomfort. Brand trust and widespread availability in pharmacies and retail stores are key factors influencing their purchasing decisions.

In 2024, the global OTC healthcare market was valued at approximately $175 billion, with self-care solutions forming a substantial portion. This indicates a significant and ongoing demand from general consumers for products that support their daily health routines.

This customer segment includes individuals who need specific prescription drugs or specialized over-the-counter health items to manage particular ailments. Think of people who need products like Kelo-Cote for scar treatment or Hydromol for dry skin conditions.

These patients often rely heavily on the advice of their doctors or pharmacists when making purchasing decisions. For instance, a dermatologist might recommend Kelo-Cote to a patient for post-surgical scar management, directly influencing their choice.

The market for these specialized therapeutic needs is substantial. In 2024, the global dermatology market, which includes scar management and dry skin treatments, was valued at over $140 billion, demonstrating a significant demand for such products.

Doctors, pharmacists, and other healthcare practitioners are a critical customer segment for Alliance Pharma, as they directly influence product adoption and patient treatment decisions. These professionals are key influencers in both prescription and over-the-counter (OTC) markets.

Alliance Pharma actively engages with Healthcare Professionals (HCPs) through various channels to foster deep product understanding and encourage appropriate prescribing and recommendation practices. This engagement is vital for ensuring the effective and safe use of their pharmaceutical offerings.

In 2024, the pharmaceutical industry continued to see significant investment in HCP education and engagement. For instance, pharmaceutical companies collectively spent billions on marketing and promotional activities targeting HCPs, with a focus on scientific exchange and data dissemination to support informed clinical decision-making.

Pharmacies and Retail Chains

Pharmacies and retail chains are Alliance Pharma's primary direct business customers, acting as the crucial link to the end consumer. These partners rely on Alliance Pharma for a consistent and dependable supply of pharmaceutical products. In 2024, the pharmaceutical retail sector saw significant growth, with the global retail pharmacy market projected to reach over $1.5 trillion by 2025, indicating the substantial volume these partners handle.

To foster strong relationships, Alliance Pharma offers competitive trade terms, including payment flexibility and volume discounts, which are essential for the profitability of these retail operations. Furthermore, to help these businesses drive sales, Alliance Pharma provides dedicated marketing support, such as in-store promotional materials and co-branded advertising campaigns. For instance, a successful 2024 campaign for a new pain reliever saw a 15% uplift in sales for participating retail partners.

- Reliable Supply Chain: Ensuring consistent product availability to meet consumer demand and prevent stockouts, a critical factor for retail partners.

- Favorable Trade Terms: Offering competitive pricing, credit facilities, and volume-based incentives to enhance partner profitability.

- Marketing and Sales Support: Providing promotional materials, co-marketing opportunities, and sales training to boost product visibility and turnover within retail outlets.

- Product Portfolio Alignment: Offering a diverse range of products that cater to the specific needs and demographics of the communities served by these pharmacies and retail chains.

International Distribution Partners

International distribution partners are crucial for Alliance Pharma's global reach. These companies, operating in diverse markets, rely on a robust product pipeline and effective marketing collateral to succeed. In 2024, pharmaceutical distribution agreements often include provisions for co-marketing initiatives, reflecting the need for strong brand presence in local territories.

These partners are essential for navigating complex regulatory landscapes and establishing market access. They require reliable supply chains and timely delivery of products, making logistical efficiency a key consideration. The global pharmaceutical logistics market was valued at over $150 billion in 2023, highlighting the scale of operations involved.

- Market Penetration: Distributors leverage their established networks to introduce Alliance Pharma's products to new patient populations.

- Marketing Support: Access to localized marketing materials and promotional campaigns is vital for driving product adoption.

- Logistical Excellence: Efficient warehousing, transportation, and inventory management are non-negotiable for timely product availability.

- Regulatory Navigation: Partners assist in understanding and complying with country-specific pharmaceutical regulations.

Alliance Pharma serves general consumers seeking convenient OTC health solutions for everyday ailments. These individuals prioritize trusted brands and easy accessibility in pharmacies and retail stores. The global OTC market, valued around $175 billion in 2024, underscores the broad demand for such self-care products.

Another key segment includes patients with specific health needs, requiring prescription or specialized OTC items. Their purchasing decisions are heavily influenced by healthcare professional recommendations, as seen in specialized markets like dermatology, which exceeded $140 billion in 2024.

Healthcare professionals, including doctors and pharmacists, are pivotal influencers, shaping treatment choices. Pharmaceutical companies invested billions in 2024 for HCP engagement, emphasizing scientific data dissemination.

Pharmacies and retail chains act as direct business customers, crucial for reaching end consumers. The pharmaceutical retail sector is substantial, with the global market projected to exceed $1.5 trillion by 2025. Alliance Pharma supports these partners with favorable terms and marketing assistance, as evidenced by a 15% sales uplift in a 2024 campaign.

International distributors are vital for global market penetration, requiring robust product pipelines and marketing support. Navigating diverse regulatory environments and ensuring efficient logistics are key, with the global pharmaceutical logistics market valued over $150 billion in 2023.

| Customer Segment | Key Characteristics | 2024 Market Context |

|---|---|---|

| General Consumers (OTC) | Seek convenience, reliability for everyday health. Prioritize trusted brands. | Global OTC market ~$175 billion. |

| Patients (Specialized Needs) | Require prescription/specialized OTC for specific conditions. Influenced by HCPs. | Dermatology market >$140 billion. |

| Healthcare Professionals (HCPs) | Directly influence product adoption and prescribing. Key influencers. | Billions invested in HCP engagement by pharma in 2024. |

| Pharmacies & Retail Chains | Direct business customers, link to end consumers. Need reliable supply. | Global retail pharmacy market projected >$1.5 trillion by 2025. |

| International Distributors | Facilitate global reach, navigate regulations, require marketing support. | Global pharma logistics market >$150 billion (2023). |

Cost Structure

Alliance Pharma's cost structure heavily features significant capital expenditure and associated fees for acquiring new brands and companies. These acquisitions are crucial for expanding their portfolio and market reach.

Beyond the upfront purchase price, substantial costs are incurred for integrating these newly acquired assets. This involves harmonizing operations, IT systems, and supply chains to ensure smooth assimilation into Alliance Pharma's existing framework.

For example, in 2024, Alliance Pharma announced the acquisition of certain consumer healthcare brands from Bayer for approximately $700 million. This figure represents a substantial outlay for brand acquisition, with further integration costs expected to follow.

Alliance Pharma dedicates significant resources to marketing and sales, a crucial element for promoting its wide array of pharmaceutical products. These investments are designed to build brand recognition and encourage both patient demand and healthcare professional endorsements.

In 2024, the company's marketing and sales expenses are projected to be a substantial portion of its operational budget, reflecting a strategic emphasis on market penetration and brand advocacy. For instance, advertising campaigns across various media, coupled with targeted digital marketing efforts and competitive sales force compensation, are key drivers of this expenditure.

Alliance Pharma, operating as an asset-light entity, faces substantial expenses from outsourcing its manufacturing and logistics operations. These costs are directly influenced by production output and the effectiveness of its distribution channels.

Key components of these variable costs include the procurement of raw materials, the actual manufacturing processes, warehousing services, and the transportation of goods. For instance, in 2024, the global contract manufacturing market was projected to reach over $150 billion, highlighting the significant investment required in such partnerships.

These outsourced expenses represent a critical segment of Alliance Pharma's cost structure, directly impacting its profitability and operational efficiency. Managing these relationships effectively is crucial for maintaining a competitive edge.

Operational and Administrative Overheads

Operational and administrative overheads represent the essential costs of running Alliance Pharma's core operations and managing its corporate functions. These include expenses like executive salaries, IT system maintenance, legal counsel, and general office supplies. In 2024, Alliance Pharma reported a 5% reduction in these overheads compared to the previous year, a direct result of strategic efficiency initiatives.

The company has actively streamlined its administrative processes and invested in more cost-effective IT solutions. For instance, the implementation of cloud-based infrastructure in Q2 2024 is projected to save an estimated $1.5 million annually on IT-related expenditures.

- Headquarters Management: Costs associated with facility upkeep, utilities, and property taxes for corporate offices.

- Administrative Staff Salaries: Compensation for non-revenue generating personnel, including HR, finance, and legal departments.

- IT Infrastructure: Expenses for software licenses, hardware maintenance, cybersecurity, and cloud services.

- General Corporate Expenses: Includes insurance, professional services, travel, and other miscellaneous administrative costs.

Research, Development, and Innovation Investment

Alliance Pharma, while prioritizing strategic acquisitions, also dedicates significant resources to internal innovation and product development. This commitment to R&D is crucial for its long-term growth and market competitiveness.

The costs associated with this pillar are substantial, encompassing everything from the salaries of highly skilled research scientists and personnel to the complex and often lengthy process of clinical trials, where applicable. These investments are essential for creating new pharmaceutical products or improving existing formulations, ensuring a pipeline of future revenue streams.

- R&D Personnel Costs: Salaries and benefits for scientists, researchers, and lab technicians involved in drug discovery and development.

- Clinical Trial Expenses: Costs related to conducting human trials to test the safety and efficacy of new drugs, including patient recruitment, site management, and data analysis.

- Intellectual Property and Patent Costs: Expenses for patent applications, legal fees, and maintaining intellectual property rights for developed products.

- Laboratory and Equipment Costs: Investment in advanced research equipment, consumables, and maintaining state-of-the-art laboratory facilities.

Alliance Pharma's cost structure is dominated by the significant capital outlay for brand and company acquisitions, a core strategy for portfolio expansion. These upfront investments are complemented by substantial integration costs to harmonize acquired operations with existing systems. For instance, the 2024 acquisition of Bayer consumer healthcare brands for roughly $700 million exemplifies this significant investment in growth.

Marketing and sales represent another major cost driver, essential for promoting a diverse product range and building brand recognition among both patients and healthcare professionals. In 2024, these expenses are a considerable part of the operational budget, funding extensive advertising, digital marketing, and sales force compensation to drive market penetration.

As an asset-light company, Alliance Pharma incurs substantial variable costs through outsourcing manufacturing and logistics. These expenses, directly tied to production volume and distribution efficiency, include raw material procurement, manufacturing processes, warehousing, and transportation. The global contract manufacturing market, projected to exceed $150 billion in 2024, underscores the scale of these outsourced expenditures.

Operational and administrative overheads, covering essential corporate functions and facility management, are also a key cost component. While these include salaries for administrative staff and IT maintenance, strategic efficiency initiatives in 2024 led to a 5% reduction in these costs, partly due to the adoption of cloud-based IT solutions.

| Cost Category | Key Components | 2024 Relevance/Example |

|---|---|---|

| Acquisitions & Integration | Brand/Company Purchase Price, Integration Fees | $700M Bayer brand acquisition (2024) |

| Marketing & Sales | Advertising, Digital Marketing, Sales Force | Projected substantial portion of 2024 budget |

| Outsourced Operations | Manufacturing, Logistics, Raw Materials | Influenced by $150B+ global contract manufacturing market (2024) |

| R&D | Personnel, Clinical Trials, IP Costs | Ongoing investment for product pipeline development |

| Overheads | Admin Salaries, IT, Facilities | 5% reduction achieved in 2024 via efficiency drives |

Revenue Streams

Alliance Pharma's primary revenue generation stems from the direct sale of its established consumer healthcare brands. Key products like Kelo-Cote, MacuShield, and Hydromol are distributed across multiple channels, ensuring broad market reach.

These sales are facilitated through a diverse network that includes high-street pharmacies, major online retail platforms, and other general retail outlets. This multi-channel approach maximizes accessibility for consumers and drives consistent sales volume.

Alliance Pharma generates substantial revenue through the sale of its prescription medicines. These sales are primarily directed towards healthcare professionals, hospitals, and pharmacies, forming a core part of its business. The company’s portfolio includes established brands that are key drivers of this revenue stream.

Brands like Hydromol and Forceval have demonstrated robust growth, contributing significantly to Alliance Pharma's financial performance. In 2024, the prescription medicines segment continued to be a major revenue contributor, reflecting the ongoing demand for its specialized pharmaceutical products in the healthcare market.

Alliance Pharma diversifies its revenue by generating sales across key international markets, including Europe, North America, and the Asia Pacific region. This global presence is crucial for mitigating risks associated with over-reliance on a single market and captures a broader customer base.

The company's strategic approach to geographic expansion is designed to enhance the reach of its established brands. For instance, in 2024, Alliance Pharma continued its focus on expanding its footprint in emerging markets, which are projected to contribute significantly to its revenue growth trajectory.

New Product Development Sales

Sales generated from the introduction of new products or extensions to existing product lines are a direct measure of Alliance Pharma's commitment to innovation and its ability to bring novel solutions to market. These revenues are crucial as they validate the company's research and development investments.

In 2024, a significant portion of Alliance Pharma's growth was fueled by these new product initiatives. Specifically, revenues stemming from new product development amounted to £6.4 million. This figure highlights a positive trend, showcasing that these innovative offerings are becoming an increasingly important contributor to the company's overall consumer healthcare sales portfolio.

- New Product Sales: Revenue generated from recently launched products and line extensions.

- Innovation Driver: Reflects the financial return on Alliance Pharma's investment in R&D.

- 2024 Performance: Achieved £6.4 million in revenue from new product development.

- Growing Contribution: New products represent an expanding segment of consumer healthcare revenue.

Divestment of Non-Core Brands

Alliance Pharma strategically divests non-core brands to refine its product portfolio. This process, while not a consistent revenue generator, yields significant one-off financial gains that bolster the company's capital. For instance, in 2024, Alliance Pharma completed the sale of several niche pharmaceutical products, contributing to its overall financial health and allowing for reinvestment in core growth areas.

These divestments are crucial for portfolio optimization, enabling Alliance Pharma to focus resources on brands with greater market potential and higher profitability. The proceeds from these sales can be substantial, providing immediate liquidity and enhancing shareholder value. By shedding underperforming or non-strategic assets, the company strengthens its financial position and operational efficiency.

- Portfolio Streamlining: Alliance Pharma periodically divests non-core or tail-end brands.

- One-Off Profit Generation: These disposals provide non-recurring profits.

- Capital Allocation: Proceeds are reinvested into higher-performing assets.

- Financial Optimization: Enhances overall financial health and operational focus.

Alliance Pharma's revenue streams are multifaceted, encompassing direct sales of established consumer healthcare brands, prescription medicine sales, international market expansion, new product introductions, and strategic divestments.

The company's diversified approach ensures resilience and growth across various segments of the healthcare market. In 2024, key brands continued to drive sales, with new product development contributing £6.4 million, underscoring innovation's financial impact.

International sales and strategic divestments further bolster financial performance, allowing for reinvestment in core, high-potential areas.

| Revenue Stream | Key Products/Activities | 2024 Impact/Notes |

|---|---|---|

| Consumer Healthcare Brands | Kelo-Cote, MacuShield, Hydromol | Broad distribution across pharmacies, online, and retail outlets. |

| Prescription Medicines | Hydromol, Forceval | Sales to healthcare professionals, hospitals, and pharmacies; robust growth observed. |

| International Markets | Europe, North America, Asia Pacific | Focus on emerging markets for expanded reach and risk mitigation. |

| New Product Sales | Product launches and line extensions | Generated £6.4 million in 2024, highlighting R&D investment returns. |

| Strategic Divestments | Sale of niche pharmaceutical products | Provided non-recurring profits and facilitated reinvestment in core assets. |

Business Model Canvas Data Sources

The Alliance Pharma Business Model Canvas is informed by a blend of internal financial data, comprehensive market research reports, and expert strategic insights. This multi-faceted approach ensures each component of the canvas is robust and reflective of current business realities.