Alight Solutions Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alight Solutions Bundle

Alight Solutions navigates a complex landscape shaped by intense rivalry, significant buyer power, and the ever-present threat of substitutes. Understanding these forces is crucial for any stakeholder looking to grasp Alight's strategic positioning and future growth potential.

The complete report reveals the real forces shaping Alight Solutions’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Alight Solutions' bargaining power of suppliers is significantly influenced by supplier concentration, particularly in critical technology areas. The company relies heavily on major cloud infrastructure providers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP). These providers are highly concentrated, meaning a few dominant players control a large share of the market, giving them considerable leverage.

Furthermore, the specialized nature of HR and payroll software components, including advanced AI and automation tools, means certain vendors possess unique offerings and intellectual property. This specialization can grant these suppliers significant power. For instance, if a key AI analytics provider for Alight's platform experiences high demand or faces supply chain issues, it could impact Alight's service delivery and costs.

This dependency on concentrated and specialized suppliers can increase Alight's operational costs or restrict its strategic flexibility. Suppliers might leverage their position to increase prices or alter contract terms, directly impacting Alight's profitability and its ability to innovate or adapt its service offerings efficiently.

Switching Alight's cloud infrastructure or critical software components is a significant undertaking. It involves intricate data migration, re-integrating systems, and the risk of service interruptions during the transition. These complexities directly translate to higher switching costs for Alight.

The elevated switching costs empower Alight's current suppliers. This leverage is particularly pronounced due to the deep integration of these technologies within Alight's proprietary Worklife® platform, making a change even more challenging and expensive.

Suppliers providing highly specialized or proprietary HR technology components, like advanced AI for benefits administration or predictive analytics for workforce management, hold significant bargaining power. Alight Solutions, while developing its own platforms, relies on integrating third-party tools, making it susceptible to the unique functionalities offered by these suppliers, particularly in rapidly advancing areas like AI and automation.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into Alight's core HR tech services is generally low, as it represents a significant departure from their primary business models. However, a subtle shift is occurring with major cloud infrastructure providers. For instance, in 2024, companies like Amazon Web Services (AWS) and Microsoft Azure continue to expand their platform capabilities, offering more integrated solutions that could potentially encroach on the specialized service delivery Alight provides. This expansion, while not direct forward integration, could increase their leverage by offering a more comprehensive, albeit less specialized, alternative, potentially challenging Alight's role as the central integrator of HR technology and services.

This dynamic could indirectly impact Alight's bargaining power. As cloud providers enhance their offerings, they might bundle services in ways that reduce the perceived need for third-party integrators for certain functionalities. This would necessitate Alight to continuously innovate and demonstrate the unique value proposition of its integrated approach to remain competitive. The increasing complexity of HR technology ecosystems also means that while direct forward integration by tech suppliers is unlikely to be a widespread threat, the strategic expansion of cloud service portfolios warrants close monitoring by Alight.

- Low Likelihood of Direct Forward Integration: Large technology suppliers typically focus on their core competencies, making a full pivot to offering direct HR tech services a substantial strategic and financial undertaking.

- Subtle Influence from Cloud Providers: Expansion of services by major cloud infrastructure providers like AWS and Microsoft Azure in 2024 could offer bundled solutions, potentially diminishing the need for specialized integration services.

- Challenge to Alight's Integration Role: Increased self-service capabilities or integrated offerings from technology partners could challenge Alight's position as the primary orchestrator of HR technology solutions for its clients.

Volume of Purchases

Alight Solutions' considerable purchasing volume, stemming from its extensive client base that includes many of the world's largest organizations and millions of individuals, significantly influences its bargaining power with suppliers. This scale allows Alight to negotiate more favorable terms and pricing for the technology and services it procures.

For instance, in 2023, Alight managed benefits for over 36 million individuals, a testament to its vast operational scale. This sheer volume of managed services translates into substantial procurement power, enabling the company to secure better service level agreements and cost efficiencies from its technology partners and service providers.

- Significant Client Base: Alight serves a large number of Fortune 500 companies, providing a consolidated demand for supplier services.

- Negotiating Leverage: The aggregated purchasing volume allows Alight to negotiate from a position of strength, potentially securing discounts and preferential treatment.

- Cost Efficiencies: By leveraging its scale, Alight can drive down the cost of critical technology and service inputs, positively impacting its overall profitability.

Alight Solutions faces moderate bargaining power from its suppliers, primarily due to the concentration in critical technology sectors like cloud infrastructure and specialized HR software. While Alight's significant purchasing volume provides leverage, the specialized nature of some components and the high switching costs associated with integrating these technologies into its Worklife® platform empower certain suppliers.

Major cloud providers, such as AWS and Microsoft Azure, exert considerable influence due to their market dominance and the deep integration of their services into Alight's operations. For example, in 2024, these providers continue to enhance their offerings, potentially presenting bundled solutions that could indirectly challenge Alight's role as a primary integrator, though direct forward integration into HR tech services remains unlikely.

The bargaining power of suppliers is balanced by Alight's substantial scale; in 2023, Alight managed benefits for over 36 million individuals, including many Fortune 500 companies. This vast client base translates into significant procurement power, enabling Alight to negotiate favorable terms and cost efficiencies from its technology partners.

| Supplier Characteristic | Impact on Alight | Example/Data Point |

|---|---|---|

| Supplier Concentration (Cloud) | High Leverage for Suppliers | Reliance on AWS, Microsoft Azure, Google Cloud |

| Supplier Specialization (HR Tech) | High Leverage for Suppliers | Unique AI/automation tools for benefits administration |

| Switching Costs | High for Alight | Complex data migration, system re-integration for Worklife® platform |

| Alight's Purchasing Volume | High Leverage for Alight | Managed over 36 million individuals in 2023 |

| Forward Integration Threat (Cloud Providers) | Low direct threat, subtle influence | 2024: Expanded cloud services potentially offer bundled alternatives |

What is included in the product

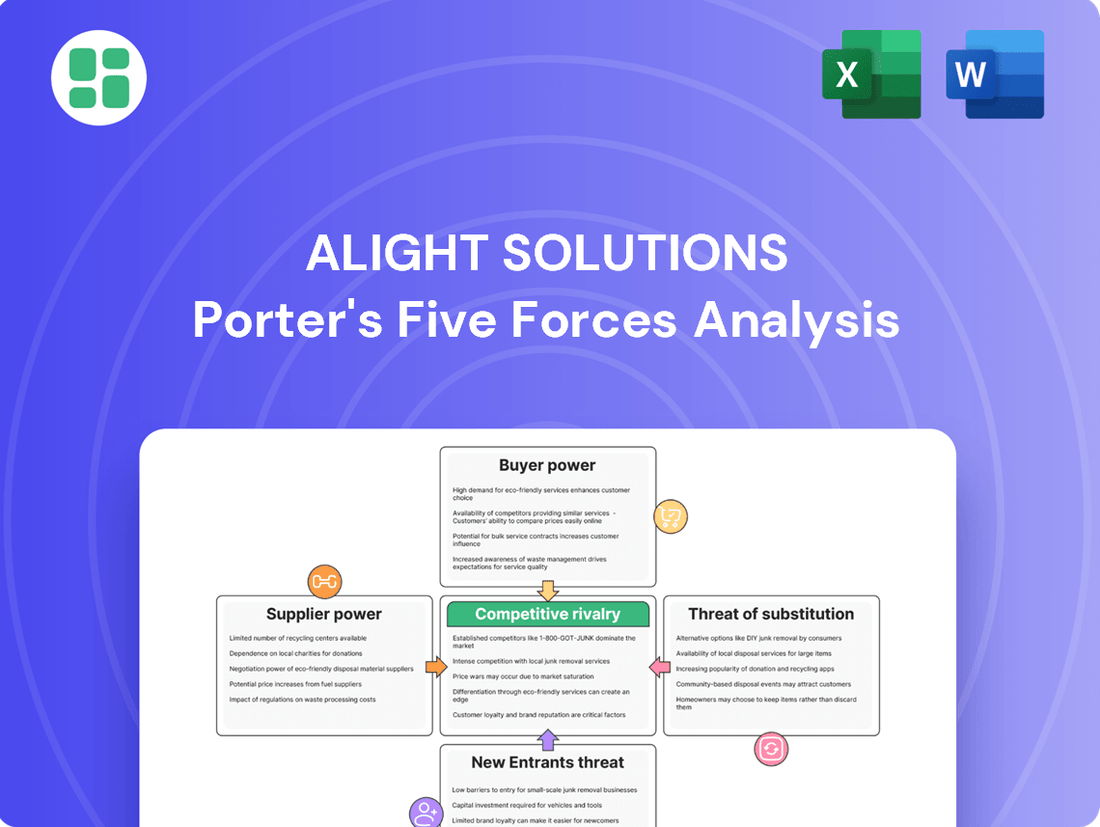

This analysis delves into the competitive landscape for Alight Solutions, examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the HR solutions industry.

Instantly visualize competitive pressures with a dynamic, interactive dashboard, simplifying complex market dynamics for strategic clarity.

Customers Bargaining Power

Alight Solutions' customer base is heavily weighted towards large, enterprise-level organizations. These major clients, often Fortune 500 companies, represent substantial contract values, giving them considerable leverage in negotiations. For instance, in 2023, Alight's revenue was approximately $3.5 billion, with a significant portion derived from these large accounts.

The sheer size of these customers means they can influence pricing, demand tailored service packages, and even threaten to switch providers if their needs aren't met. This concentration within the high-value segment amplifies the bargaining power of these individual clients, as losing even one could have a noticeable impact on Alight's revenue streams.

Customers face substantial switching costs when transitioning between comprehensive HR and benefits administration providers. This process typically involves the complex migration of sensitive data, the intricate reconfiguration of existing systems, and the essential retraining of employees on new platforms. These hurdles significantly reduce a customer's inclination to seek alternative solutions.

Customers, particularly large enterprises, exhibit significant price sensitivity when procuring HR and benefits administration solutions. Alight Solutions faces pressure to offer competitive pricing, especially as clients aim to optimize talent management and achieve business objectives efficiently. For instance, in 2024, the HR outsourcing market continued to see intense competition, with many providers vying for market share, which inherently drives pricing discussions.

Availability of Substitutes and Alternatives

The bargaining power of Alight Solutions' customers is significantly influenced by the availability of substitutes and alternatives. Customers can readily switch to other major HR technology and services providers like Workday, ADP, or UKG, as well as smaller, niche vendors that may offer specialized solutions. Furthermore, the option to manage HR functions internally provides a baseline alternative, directly impacting Alight's pricing and service flexibility.

The human resource outsourcing market is robust and expanding, offering a wide array of choices for businesses seeking to manage their HR operations. The proliferation of integrated Human Capital Management (HCM) platforms further amplifies customer options. For instance, the global HCM market was valued at approximately $23.6 billion in 2023 and is projected to grow, indicating a competitive landscape where customers have considerable leverage due to the sheer volume of available solutions.

- Availability of Substitutes: Customers can opt for competitors like Workday, ADP, UKG, or specialized HR service providers.

- In-house HR: The option to maintain HR functions internally acts as a significant alternative, limiting Alight's pricing power.

- Market Growth: The expanding human resource outsourcing market, valued in the tens of billions of dollars annually, provides numerous alternative vendors and solutions.

- HCM Platforms: The rise of integrated HCM platforms offers customers comprehensive alternatives, increasing their ability to negotiate terms.

Customer's Information Asymmetry

Customers are increasingly well-informed, diminishing information asymmetry. The digital age, with its readily available market data and industry benchmarks, allows clients to thoroughly research offerings and pricing. This transparency empowers them to negotiate more effectively with providers like Alight Solutions.

The ease of accessing comparative data means clients can readily identify the best value propositions. For instance, in the HR technology sector, platforms offering detailed feature comparisons and transparent pricing models are becoming standard, enabling customers to wield greater bargaining power.

- Informed Decisions: Customers can now easily compare Alight Solutions' offerings against competitors, scrutinizing pricing and service levels.

- Reduced Information Gap: The proliferation of online reviews, case studies, and industry reports significantly narrows the information gap between buyers and sellers.

- Enhanced Negotiation: Armed with comprehensive data, clients are better positioned to negotiate favorable terms and pricing, putting pressure on providers to remain competitive.

Alight Solutions' large enterprise clients possess significant bargaining power due to their substantial contract values and the availability of numerous alternative HR service providers. These major customers, often representing a considerable portion of Alight's revenue, can leverage their size to demand competitive pricing and customized solutions, impacting Alight's profitability.

The HR outsourcing market is highly competitive, with alternatives like Workday, ADP, and UKG, alongside internal HR management, providing customers with considerable leverage. This market, projected to continue its growth beyond its 2023 valuation of approximately $23.6 billion for global HCM, ensures customers have ample choices, further strengthening their negotiating position.

| Factor | Impact on Alight Solutions | Evidence/Data |

|---|---|---|

| Customer Concentration | High bargaining power for large clients | Significant revenue derived from large enterprise accounts. |

| Availability of Substitutes | Limits pricing power | Competitors like Workday, ADP, UKG; internal HR management. |

| Switching Costs | Reduces customer inclination to switch | Complex data migration, system reconfiguration, employee retraining. |

| Customer Information | Enhanced negotiation capabilities | Easy access to market data, industry benchmarks, and competitor comparisons. |

Same Document Delivered

Alight Solutions Porter's Five Forces Analysis

This preview showcases the comprehensive Alight Solutions Porter's Five Forces Analysis, detailing the competitive landscape of the benefits administration industry. You're looking at the actual document; once you complete your purchase, you’ll get instant access to this exact file, including in-depth assessments of buyer power, supplier power, threat of new entrants, threat of substitutes, and industry rivalry.

Rivalry Among Competitors

The HR technology and services arena is teeming with competitors, creating a dynamic and often intense environment for Alight Solutions. Major players like ADP, Workday, and UKG command significant market share, offering comprehensive suites of HR solutions.

Beyond these giants, a multitude of specialized firms and agile startups vie for attention, focusing on specific niches such as payroll processing, benefits administration, or employee wellbeing programs. This broad spectrum of providers, from enterprise-level to boutique, underscores the market's diversity and the constant need for Alight to innovate and differentiate its offerings.

The human capital management and HR outsourcing sectors are booming. The global HR tech market, for instance, is anticipated to reach an impressive $37.5 billion by 2027, demonstrating robust expansion.

This rapid growth, fueled by digital transformation and the increasing adoption of AI and cloud-based solutions, offers ample room for numerous companies to thrive and capture market share, potentially softening intense rivalry.

Alight Solutions distinguishes itself with its Worklife® platform, a unified cloud-based system designed to manage the entire employee lifecycle, from benefits and payroll to HR and wellbeing. This integrated approach aims to provide a seamless experience for both employers and employees.

In 2023, Alight reported revenue of $3.4 billion, underscoring the significant scale of its operations. The company continues to invest in innovation, particularly in AI-driven tools and user experience enhancements, to maintain its competitive edge.

The market for HR and benefits administration is highly competitive, with rivals also focusing on technological advancements and broad service portfolios. Alight's strategy hinges on its ability to consistently deliver superior, integrated solutions that address evolving workforce needs.

High Exit Barriers

High exit barriers significantly contribute to intense competitive rivalry within the HR technology and services sector. Companies face substantial hurdles when considering leaving the market, largely due to the immense capital already invested.

These barriers stem from deep investments in proprietary technology infrastructure, the cultivation of long-term, intricate client relationships, the acquisition and retention of highly specialized talent, and the development of deep expertise in regulatory compliance. For instance, the cost of developing and maintaining sophisticated HR platforms, often involving cloud computing and data analytics, represents a considerable sunk cost. In 2024, many HR tech firms continued to invest heavily in AI and machine learning capabilities, further increasing these initial outlays.

Consequently, businesses are compelled to persevere and compete vigorously, rather than incur the steep financial penalties and loss of market position associated with exiting. The inability to easily divest these specialized assets means firms must find ways to remain profitable and relevant within the existing competitive landscape.

- Significant sunk costs in technology infrastructure

- Deeply entrenched client relationships

- Need for specialized and difficult-to-replicate talent

- Substantial losses associated with abandoning compliance expertise

Market Share and Customer Loyalty

Alight Solutions boasts a strong market position, serving many of the world's largest organizations with a significant portion of its projected revenue secured under contract, demonstrating robust customer retention. In 2023, Alight reported that approximately 85% of its revenue was derived from recurring contracts, highlighting this customer stickiness.

Despite this loyalty, the competitive landscape is intense, with rivals actively pursuing market share through innovation in features, aggressive pricing, and enhanced service offerings. For instance, in early 2024, a key competitor launched a new AI-driven benefits personalization tool, directly challenging Alight's offerings.

- High Contracted Revenue: Alight's strong retention, with a substantial percentage of projected revenue under contract, indicates a solid base of loyal clients.

- Aggressive Competition: Competitors are actively seeking to gain market share by introducing new features and adjusting pricing strategies.

- Focus on Employee Experience: The increasing importance of employee experience and advancements in AI capabilities are key battlegrounds for customer loyalty.

- Dynamic Market: Maintaining and growing customer loyalty is paramount in this rapidly evolving sector.

Competitive rivalry in the HR technology and services sector is fierce, driven by a crowded market and significant investments. Alight Solutions faces strong competition from established players like ADP and Workday, as well as numerous specialized firms. The market's rapid growth, projected to reach $37.5 billion by 2027, offers opportunities but also intensifies the battle for market share.

High exit barriers, including substantial sunk costs in technology and entrenched client relationships, compel companies to compete aggressively rather than withdraw. For instance, continued investment in AI capabilities in 2024 by HR tech firms escalates these initial outlays, making it difficult to leave the market.

| Competitor | 2023 Revenue (Est.) | Key Offerings |

|---|---|---|

| ADP | $17.2 billion | Payroll, HR management, benefits administration |

| Workday | $7.4 billion | Cloud-based HR, finance, and planning software |

| UKG | $3.1 billion | Human capital management, workforce management |

| Alight Solutions | $3.4 billion | HR and benefits administration, payroll, cloud solutions |

SSubstitutes Threaten

Organizations can opt to handle their HR, payroll, and benefits administration internally instead of using an external service like Alight Solutions. This approach gives them more direct oversight but usually demands substantial internal resources, specialized knowledge, and technology investments. For larger companies, this often translates into a less adaptable and generally less efficient solution.

The intricate nature of regulatory compliance and the critical need for data security significantly magnify the challenges associated with maintaining in-house HR systems. For example, in 2024, the average cost for a company to manage its HR functions internally, including software, personnel, and compliance, can easily exceed what outsourcing providers charge, especially when considering the specialized expertise required for evolving labor laws and data privacy regulations.

Generic software solutions, like basic ERP or standalone payroll systems, present a threat by offering some HR functionalities at a lower initial cost. These options might appeal to smaller businesses or those with simpler needs, potentially diverting some market share from specialized providers. For instance, a company might choose a widely adopted ERP system that includes a payroll module, foregoing a dedicated HR and benefits platform.

However, these substitutes often lack the specialized depth and seamless integration crucial for complex benefits administration and global payroll management. While a generic solution might handle basic employee data, it frequently falls short in areas like intricate benefit plan configurations, compliance with diverse regulatory landscapes, and advanced analytics. This can lead to higher long-term costs due to inefficiencies and potential compliance issues, making them less attractive for larger or more complex organizations.

While manual processes and traditional methods for HR, payroll, and benefits management persist in some smaller organizations, their viability as substitutes for advanced cloud-based solutions like Alight's is rapidly diminishing. The drive for enhanced efficiency, accuracy, and compliance, especially in light of evolving regulations, makes these older methods increasingly impractical. For instance, the global HR outsourcing market was valued at approximately $30 billion in 2023 and is projected to grow significantly, indicating a strong market shift towards digitized and outsourced solutions.

Consulting Firms Offering Similar Services

Management consulting firms and specialized HR agencies present a notable threat by offering advisory and implementation services for benefits, payroll, and HR strategy. While they might not match Alight's integrated technology, their strategic guidance can steer clients toward alternative technology solutions.

These consulting firms can substitute for the strategic and advisory aspects of Alight's services. For instance, in 2024, the HR consulting market saw significant growth, with many firms expanding their digital transformation and HR technology advisory practices, directly competing for the strategic planning phase of client engagements.

- Strategic Advisory Competition: Consulting firms can advise on HR technology selection, potentially leading clients away from Alight's platform.

- Implementation Services: These firms also offer implementation support, covering areas where Alight provides integrated solutions.

- Market Influence: Their recommendations can sway client technology choices, impacting Alight's market share in specific service areas.

Emerging Technologies Enabling Internal Solutions

The growing sophistication of AI and automation, coupled with accessible cloud platforms, presents a theoretical threat by enabling companies to develop their own advanced HR solutions internally. This could potentially reduce reliance on external providers.

However, the practical execution of such internal initiatives faces significant hurdles. The sheer complexity of integrating disparate HR systems, maintaining regulatory compliance across various jurisdictions, and providing ongoing, robust support often outweighs the perceived benefits of in-house development. For instance, in 2024, many businesses found that the cost and specialized expertise required for maintaining compliance with evolving data privacy regulations like GDPR and CCPA made outsourcing to dedicated providers more financially prudent.

Specialized providers like Alight Solutions offer economies of scale and deep domain expertise that are difficult and expensive to replicate internally. Their ability to manage complex integrations and ensure continuous compliance provides a more attractive and cost-effective long-term value proposition compared to the substantial investment and ongoing operational challenges of building and maintaining a fully functional internal HR technology suite.

- Internal HR Tech Development Challenges: Companies face high costs and specialized expertise needs for integrating systems and ensuring compliance.

- Compliance Burden: Evolving data privacy regulations (e.g., GDPR, CCPA) in 2024 made in-house compliance management particularly demanding.

- Economies of Scale: Specialized providers offer cost advantages through their scale and dedicated focus on HR solutions.

- Long-Term Value: Outsourcing to experts like Alight often proves more cost-effective than the significant investment and ongoing operational costs of internal solutions.

The threat of substitutes for Alight Solutions primarily comes from companies handling HR, payroll, and benefits internally, or from generic software solutions. While internal management offers more control, it demands significant resources and specialized knowledge, often proving less adaptable and efficient than outsourcing. For instance, in 2024, internal HR management costs, including software and compliance, frequently surpassed outsourcing fees due to the need for expertise in evolving labor laws and data privacy.

Generic software, like basic ERP systems with payroll modules, offers a lower initial cost and may appeal to smaller businesses. However, these often lack the specialized depth and seamless integration required for complex benefits administration and global payroll, leading to potential long-term inefficiencies and compliance issues.

Management consulting firms also pose a threat by offering strategic HR guidance and implementation services, potentially steering clients toward alternative technology solutions. In 2024, the HR consulting market saw growth in digital transformation and HR technology advisory, directly competing for the strategic planning phase of client engagements.

The practical challenges of developing and maintaining sophisticated internal HR solutions, especially regarding compliance with regulations like GDPR and CCPA in 2024, often make outsourcing to specialized providers like Alight more financially prudent due to their economies of scale and deep domain expertise.

Entrants Threaten

Entering the human capital technology and services market, particularly at the scale Alight Solutions operates, demands significant upfront capital. This includes substantial investments in robust cloud infrastructure, advanced software development, stringent data security measures, and the acquisition of highly specialized talent. For instance, companies like Workday, a major competitor, reported over $7.3 billion in revenue for fiscal year 2024, indicating the immense financial resources needed to compete effectively.

The HR, payroll, and benefits administration sector is a minefield of intricate regulations that are perpetually changing across different regions. New companies entering this space must commit substantial resources to legal and compliance teams, creating a significant hurdle.

For instance, in 2024, the landscape of data privacy regulations, such as GDPR and CCPA, continued to demand rigorous adherence, requiring continuous updates to systems and processes. This complexity acts as a powerful deterrent for potential new entrants who lack established compliance frameworks.

Alight Solutions, with its deep-rooted experience and robust infrastructure, has already navigated these regulatory complexities. This established expertise provides a formidable competitive moat, making it difficult for newcomers to match Alight's compliance capabilities and market trust.

Established players like Alight Solutions leverage significant brand loyalty, making it challenging for newcomers to gain traction. Many clients are deeply embedded with Alight's systems, creating substantial switching costs that deter them from moving to a new provider.

For instance, the complexity of integrating HR and benefits platforms often means clients face considerable disruption and expense if they attempt to switch. This deep integration, coupled with long-term contracts, acts as a powerful barrier, reinforcing Alight's market position against potential new entrants.

Access to Distribution Channels and Talent

New companies entering the HR technology and services space would struggle to establish robust sales and distribution channels capable of reaching Alight's large enterprise client base. Building these networks from scratch is a time-consuming and capital-intensive endeavor, often requiring years of established relationships and proven success.

Furthermore, the threat of new entrants is significantly mitigated by the intense competition for specialized talent. Alight Solutions, like its peers, relies on professionals with expertise in HR technology development, implementation, and ongoing service delivery. The market for such skilled individuals is highly competitive, with demand often outstripping supply, making it difficult for new players to attract and retain the necessary workforce.

Key talent acquisition challenges for new entrants include:

- High demand for specialized HR tech skills: Professionals with experience in cloud-based HR platforms, data analytics, and AI in HR are particularly sought after.

- Cost of talent acquisition: Competing for experienced professionals often involves significant salary and benefits packages, increasing operational costs for new entrants.

- Retention difficulties: Even if talent is acquired, retaining it against established players with strong employer branding and career progression opportunities presents a further hurdle.

Economies of Scale and Experience Curve

Alight Solutions benefits significantly from economies of scale in its technology development, service delivery, and extensive data processing capabilities. This operational scale allows for substantial cost efficiencies that are difficult for newcomers to replicate quickly.

New entrants would face considerable challenges in matching Alight's established operational experience and the cost advantages derived from its size. For instance, Alight's investment in advanced HR technology platforms, which are costly to develop and maintain, creates a significant barrier.

- Economies of Scale: Alight's large client base allows for bulk purchasing of technology and infrastructure, reducing per-unit costs.

- Experience Curve: Years of operation have refined Alight's processes, leading to greater efficiency and lower error rates in service delivery.

- Technology Investment: Significant capital is required to build and update the sophisticated platforms Alight utilizes, a hurdle for startups.

- Data Processing Power: Handling vast amounts of HR and payroll data efficiently requires substantial investment in IT infrastructure and expertise.

The threat of new entrants into Alight Solutions' market is generally low due to substantial capital requirements for technology and infrastructure, alongside significant regulatory hurdles. New players must also overcome entrenched client loyalty and high switching costs, making it difficult to gain market share.

The intense competition for specialized talent and the need to build extensive sales channels further deter new entrants. Alight's established economies of scale and operational experience create cost advantages that are hard for newcomers to match, solidifying its competitive position.

| Barrier to Entry | Impact on New Entrants | Alight's Advantage |

|---|---|---|

| Capital Requirements | High (Cloud infrastructure, software, security) | Established infrastructure, economies of scale |

| Regulatory Complexity | High (Data privacy, HR laws) | Proven compliance framework, legal expertise |

| Brand Loyalty & Switching Costs | High (System integration, long-term contracts) | Deep client integration, established trust |

| Talent Acquisition | Challenging (High demand for specialized skills) | Strong employer brand, competitive compensation |

| Sales & Distribution Channels | Difficult to build | Extensive existing client relationships |

Porter's Five Forces Analysis Data Sources

Our Alight Solutions Porter's Five Forces analysis leverages a comprehensive blend of data, including Alight's own financial reports, industry-specific market research from firms like Gartner and Forrester, and insights from competitor disclosures and analyst reports.