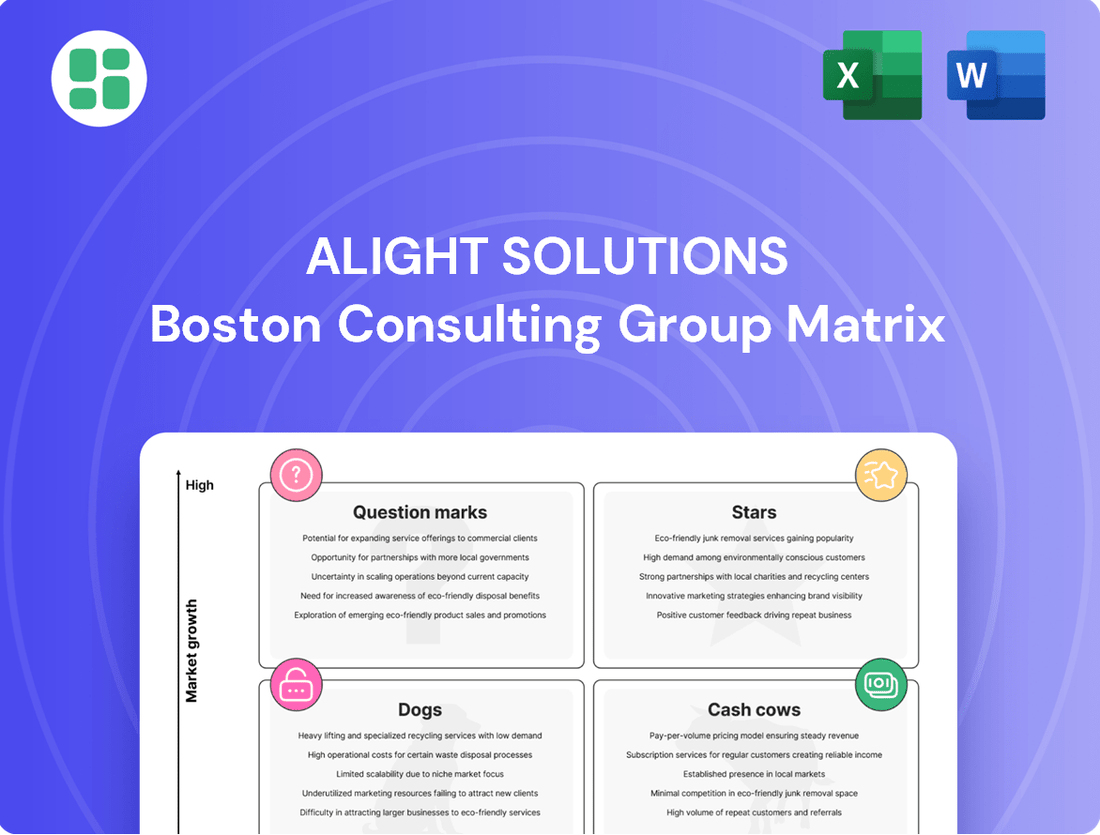

Alight Solutions Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alight Solutions Bundle

Curious about Alight Solutions' strategic product positioning? This glimpse into their BCG Matrix reveals how their offerings stack up as Stars, Cash Cows, Dogs, or Question Marks. Unlock a comprehensive understanding and actionable insights by purchasing the full report.

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions for Alight Solutions.

The complete BCG Matrix reveals exactly how Alight Solutions is positioned in a fast-evolving market. With quadrant-by-quadrant insights and strategic takeaways, this report is your shortcut to competitive clarity.

Stars

Alight Solutions is heavily investing in artificial intelligence, notably with its Alight LumenAI™ engine and AI-driven insights within the Alight Worklife platform. These advancements, including AI-generated summaries and personalized content, are designed to meet the increasing market demand for smarter HR and benefits solutions.

The platform's integration with tools like Microsoft Teams showcases Alight's commitment to innovation and its strong position in the fast-growing market for intelligent HR technology. This focus on AI positions these enhancements as stars within Alight's business portfolio, indicating high growth potential and market leadership.

Alight Solutions' Worklife® platform is a standout performer, positioned as a Star in the BCG Matrix. This integrated digital employee experience platform is celebrated for its robust capabilities and significant return on investment, tapping into the rapidly expanding digital employee experience market. Its success is driven by its ability to consolidate diverse HR and benefits functions into a single, intuitive, cloud-native environment, meeting the growing demand for streamlined and personalized employee interactions.

Alight's next-generation personalized wellbeing solutions, powered by AI and data, are positioned for significant growth. These offerings help employees make better health and financial decisions, tapping into a rapidly expanding market for holistic employee support. For instance, Alight reported a 10% increase in employee engagement with their wellbeing programs in 2023, demonstrating strong market reception.

Strategic Cloud Transformation Services

Alight Solutions' Strategic Cloud Transformation Services are positioned as a Star in the BCG Matrix. This is largely due to the successful completion of their cloud migration program to Amazon Web Services (AWS) in the first half of 2024. This initiative not only boosted performance but also generated substantial annualized savings, underscoring the strength of their cloud expertise.

While this was an internal project, the foundational shift to AWS directly benefits clients by enabling Alight to innovate more rapidly and deliver services more effectively. This is particularly impactful for large enterprises navigating their own complex digital transformations, where Alight's proven cloud capabilities offer a significant competitive advantage.

The company's ability to execute such a large-scale migration efficiently reinforces its market position. Alight's transformation journey demonstrates a commitment to modern, scalable solutions, which is crucial in today's rapidly evolving technological landscape.

- AWS Migration Success: Completed in H1 2024, enhancing performance and achieving significant annualized savings.

- Client Enablement: Facilitates faster innovation and improved service delivery for clients undergoing digital transformation.

- Competitive Advantage: Reinforces Alight's ability to offer modern, scalable, and efficient cloud-based solutions.

- Enterprise Focus: Directly supports large enterprises in their critical cloud adoption journeys.

Advanced HR Analytics and Predictive Insights

Alight Solutions is making significant strides in advanced HR analytics, particularly through its Worklife platform powered by Alight LumenAI™. This focus on predictive insights positions the company in a high-growth segment, helping employers understand their workforce more deeply and proactively manage talent.

These tools move beyond basic HR reporting, offering actionable intelligence to anticipate future workforce needs and optimize talent strategies. This capability directly addresses the escalating demand for data-driven decision-making in human capital management, a critical area for modern businesses.

- Workforce Understanding: Alight's analytics provide granular insights into employee engagement, performance, and retention drivers.

- Predictive Capabilities: The platform forecasts potential issues like skill gaps or flight risks, enabling proactive intervention.

- Talent Optimization: Employers can leverage these insights to improve recruitment, development, and succession planning.

- Market Demand: The HR analytics market is projected to reach $3.4 billion by 2027, highlighting the significant growth potential Alight is tapping into.

Alight Solutions' Worklife platform, enhanced by Alight LumenAI™, is a prime example of a Star in their BCG Matrix. This platform leverages AI for intelligent HR and benefits solutions, including personalized content and AI-generated summaries, addressing a growing market need for smarter HR technology. The integration with platforms like Microsoft Teams further solidifies its leadership in the expanding intelligent HR tech sector.

Alight's advanced HR analytics, also powered by LumenAI™, are positioned as Stars. These tools offer predictive insights, allowing businesses to better understand and proactively manage their workforce, a critical need in today's data-driven business environment. The HR analytics market is expected to grow significantly, with projections indicating it will reach $3.4 billion by 2027, demonstrating the strong potential Alight is capitalizing on.

The company's Strategic Cloud Transformation Services are also Stars, evidenced by their successful cloud migration to AWS in the first half of 2024. This initiative not only improved performance but also generated substantial annualized savings, showcasing Alight's expertise and enabling faster innovation for clients navigating their own digital transformations.

| Business Unit | BCG Category | Key Strengths | Market Opportunity | 2024 Performance Indicator |

|---|---|---|---|---|

| Worklife Platform (AI-enhanced) | Star | AI-driven insights, personalized content, Microsoft Teams integration | Growing demand for intelligent HR solutions | High user engagement and platform adoption |

| Advanced HR Analytics (LumenAI™) | Star | Predictive workforce insights, talent optimization | HR analytics market projected to reach $3.4B by 2027 | Increased client adoption of advanced reporting features |

| Strategic Cloud Transformation Services | Star | AWS migration success, performance enhancement, cost savings | Enterprise digital transformation initiatives | Successful H1 2024 AWS migration, enabling faster service delivery |

What is included in the product

Alight Solutions' BCG Matrix offers a strategic overview of its business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs.

This analysis guides investment decisions, highlighting which units to nurture, harvest, or divest for optimal portfolio performance.

Alight Solutions' BCG Matrix provides a clear, one-page overview, relieving the pain of complex strategic analysis by instantly categorizing business units.

Cash Cows

Alight's core benefits administration services represent a significant Cash Cow within its BCG Matrix. These offerings, encompassing health, wealth, and absence management, are the bedrock of the company's revenue, boasting high recurring income and exceptional client loyalty, particularly from large enterprise clients.

This segment is characterized by a mature market, meaning it doesn't demand extensive new investment for growth but rather continues to generate substantial profits. For instance, in 2024, Alight reported that its benefits administration segment continued to be a primary driver of its financial performance, contributing a substantial portion to its overall revenue stability and profitability.

Even after divesting its Payroll & Professional Services in July 2024, Alight Solutions likely maintains its core payroll processing for large enterprises as a Cash Cow. These services are indispensable for clients, creating high switching costs and ensuring consistent, profitable revenue streams.

The market for fundamental payroll processing is mature, enabling Alight to capitalize on its existing client base. This strategic position allows for efficient revenue generation from these established, deeply integrated services.

Alight's large-scale HR outsourcing (HRO) engagements with Fortune 100 companies are true cash cows. These long-standing, comprehensive contracts, managing complex HR functions, provide stable and predictable revenue. Alight Solutions held a significant market share in this mature segment, generating consistent cash with minimal new investment needed for client acquisition.

Defined Contribution and Retirement Plan Administration

Alight Solutions' defined contribution and retirement plan administration is a cornerstone of their business, fitting squarely into the Cash Cow quadrant of the BCG matrix. This segment is characterized by its maturity and Alight's substantial market presence, ensuring a steady stream of recurring revenue. For instance, in 2024, Alight continued to serve millions of participants across thousands of employer-sponsored retirement plans, a testament to their established scale and client loyalty.

The consistent fee-based income generated from this large and stable client base provides Alight with reliable funding. This financial stability is crucial, enabling the company to invest in and pursue growth opportunities in other areas. The existing retirement plan administration acts as a dependable source of capital, supporting strategic initiatives like their recent partnership with Goldman Sachs, which aims to expand their wealth management offerings.

- Mature Market Dominance: Alight holds a significant share in the defined contribution plan administration market, a stable and predictable revenue generator.

- Consistent Fee Generation: The administration of plans like 401(k)s provides recurring fees from a broad and loyal client base.

- Foundation for Growth: This Cash Cow segment reliably funds Alight's investments in new ventures, such as their wealth offerings through partnerships.

- High Volume Operations: The sheer scale of their retirement plan administration ensures a high volume of transactions, contributing to consistent financial performance.

Platform Maintenance and Support for Alight Worklife®

Platform Maintenance and Support for Alight Worklife® is a classic Cash Cow for Alight Solutions. This segment benefits from a large, established base of enterprise clients who rely on the platform for their daily operations. The recurring revenue from these support contracts, which include essential updates and minor enhancements, is highly profitable. For instance, in 2024, Alight reported that its Worklife platform served millions of users, with a significant portion of revenue derived from ongoing service agreements.

The profitability is driven by the mature infrastructure and the inherent stickiness of the client base; once integrated, switching costs are substantial. This means Alight can generate consistent, high-margin profits with minimal incremental investment compared to developing new, unproven offerings. The company’s focus in 2024 has been on optimizing these support services, ensuring client retention and maximizing the yield from this stable revenue source.

Key aspects contributing to its Cash Cow status include:

- High Profit Margins: Due to established infrastructure and minimal need for new product development.

- Recurring Revenue: Generated from ongoing support and maintenance contracts.

- Client Stickiness: Large enterprise clients have high switching costs, ensuring continued revenue.

- Low Investment Needs: Unlike growth products, this segment requires relatively low capital for expansion or innovation.

Alight's core benefits administration services are a prime example of a Cash Cow. These offerings are the bedrock of the company's revenue, boasting high recurring income and exceptional client loyalty, particularly from large enterprise clients. In 2024, this segment continued to be a primary driver of Alight's financial performance, contributing a substantial portion to its overall revenue stability and profitability.

Delivered as Shown

Alight Solutions BCG Matrix

The Alight Solutions BCG Matrix preview you are currently viewing is the identical, fully formatted document you will receive immediately after purchase. This comprehensive report, meticulously crafted with strategic insights, contains no watermarks or demo content, ensuring you get a professional and actionable analysis. You can confidently expect to download this exact BCG Matrix report, ready for immediate integration into your business planning and strategic decision-making processes. This is the final, unedited version, designed to provide you with the clarity and depth needed to effectively evaluate Alight Solutions' product portfolio.

Dogs

Alight's Health Solutions segment is currently classified as a Dog within the BCG Matrix. This is largely due to a substantial non-cash goodwill impairment charge of $983 million recorded in Q2 2025 for this reporting unit, signaling significant underperformance.

This impairment suggests a low market share within a health benefits market that may be experiencing slow growth or intense competition. Consequently, the segment is consuming capital without generating sufficient returns, a classic characteristic of a Dog.

The strategic implication is that Alight must critically re-evaluate the Health Solutions segment. Options range from significant restructuring and investment to a potential divestiture to free up capital and management focus for more promising areas.

Alight Solutions' project-based revenue services are showing signs of weakness, as evidenced by a decline in non-recurring project revenues reported for the first half of 2025. This trend, coupled with new deals taking longer to close, has led the company to reduce its revenue guidance.

These project-based services, inherently less predictable than recurring revenue streams, are experiencing sluggish growth. This suggests they might be in a low-growth market, and Alight's position within it could be characterized by low market share, potentially making them cash traps that consume resources without generating substantial returns.

Outdated legacy on-premise HR solutions represent Alight Solutions' Dogs in the BCG matrix. While Alight has made significant strides in cloud migration, any lingering clients or internal systems still tied to these older, on-premise setups fall into this category. These systems are characterized by substantial maintenance expenses, restricted scalability, and minimal potential for future growth.

Alight's strategic focus is on migrating all clients to its advanced, cloud-native Worklife platform. Consequently, these legacy systems are prime candidates for divestiture or complete decommissioning, aligning with the company's vision for a modern, efficient HR technology ecosystem.

Niche or Less Adopted Proprietary Software Modules

Niche or less adopted proprietary software modules within Alight Solutions would be categorized in the Dogs quadrant. These are offerings that, despite initial development, haven't captured substantial client interest or market share. For instance, if Alight invested heavily in a specialized HR analytics module that saw very low uptake by year-end 2024, it would fit here.

These underperforming modules typically generate negligible revenue and still incur maintenance costs, thus tying up valuable capital. They don't contribute to Alight's overall growth strategy or profitability, acting as a drain rather than an asset.

- Low Market Penetration: Modules with adoption rates below 5% of Alight's target client base in 2024.

- Minimal Revenue Contribution: Offerings generating less than $1 million in annual recurring revenue as of Q4 2024.

- High Maintenance Costs Relative to Revenue: Situations where ongoing support and development costs exceed the revenue generated by the module.

- Strategic Non-Alignment: Products that do not align with Alight's core strategic objectives for 2025 and beyond.

Low-Margin, Non-Strategic Consulting Engagements

Low-margin, non-strategic consulting engagements can be categorized as Dogs within Alight Solutions' BCG Matrix. These projects often consume significant resources, including valuable human capital, without generating substantial financial returns or fostering the adoption of Alight's core technology platforms. For instance, in 2024, Alight continued to refine its service portfolio, aiming to divest or minimize engagements that did not align with its long-term growth strategy. The company's focus remains on high-value, recurring revenue streams derived from its integrated health, wealth, and HR solutions.

These types of engagements can tie up skilled consultants in tasks that do not contribute to Alight's strategic objectives of expanding its technology-enabled service offerings. Minimizing such activities is crucial for optimizing resource allocation and ensuring that Alight's human capital is directed towards initiatives that drive innovation and customer platform adoption. The company's financial reporting for 2024 likely reflects a continued effort to streamline operations and focus on its most profitable and strategically aligned business segments.

- Resource Drain: Engagements with low margins and no strategic fit divert talent from more impactful projects.

- Limited ROI: These activities often provide minimal financial returns, hindering overall profitability.

- Strategic Misalignment: They do not support Alight's objective of building a robust, technology-enabled service ecosystem.

- Portfolio Optimization: Alight's strategy involves re-evaluating and reducing such non-core consulting work.

Alight's Health Solutions segment, burdened by a $983 million goodwill impairment in Q2 2025, exemplifies a Dog in the BCG matrix. This indicates low market share in a potentially stagnant or highly competitive health benefits sector, consuming capital without adequate returns.

Similarly, legacy on-premise HR solutions and niche, underperforming proprietary software modules also fall into the Dog category. These offerings face high maintenance costs, limited scalability, and minimal growth potential, tying up resources and not aligning with Alight's strategic cloud-first vision.

Low-margin, non-strategic consulting engagements further represent Dogs, draining resources and talent without contributing to Alight's core technology platform adoption or profitability. Alight's strategy involves actively reducing or divesting these non-core activities to optimize its portfolio.

The company's project-based revenue services are also showing Dog-like characteristics due to declining non-recurring project revenues and longer deal cycles in 2025, leading to reduced revenue guidance.

| Segment/Offering | BCG Category | Key Indicators (2024-2025) | Strategic Implication |

| Health Solutions | Dog | $983M goodwill impairment (Q2 2025), low market share | Re-evaluate, restructure, or divest |

| Legacy On-Premise HR | Dog | High maintenance, low scalability, minimal growth | Divest or decommission |

| Niche Software Modules | Dog | Low adoption (<5% target clients 2024), minimal revenue (<$1M ARR 2024) | Divest or sunset |

| Low-Margin Consulting | Dog | Resource drain, limited ROI, strategic misalignment | Reduce or eliminate |

| Project-Based Revenue Services | Dog | Declining non-recurring revenue, longer deal cycles | Focus on recurring revenue streams |

Question Marks

Alight Solutions' new partnership with Goldman Sachs Asset Management to boost its wealth management services, especially for individual IRAs and improved Defined Contribution plans, places it squarely in the Question Mark quadrant of the BCG Matrix. This strategic move is designed to achieve substantial revenue growth, signaling a high-potential market, yet Alight's current market share in these particular expanded areas is likely still developing.

The company anticipates significant revenue growth from this venture, indicating a strong belief in the market's potential. However, to truly capitalize on this opportunity and gain a substantial foothold, Alight will need to invest heavily in marketing, technology, and client acquisition for these specific wealth offerings.

Alight Solutions is investing heavily in AI-powered predictive talent retention tools, aiming to foster an 'AI-first culture' through collaborations with tech giants like Microsoft and IBM. These advanced AI applications represent a high-growth segment within HR technology, though Alight's current market share in these specialized, emerging solutions is likely minimal. Significant investment is needed to demonstrate the value and establish a foothold in this competitive space.

Hyper-personalized employee interaction engines, going beyond current AI, aim to proactively meet individual employee needs throughout their entire journey with a company. This is a significant growth area, but it currently holds a small market share.

Developing these complex engines requires substantial investment in resources, with the return on investment being uncertain in the short term. This positions them as a Question Mark in Alight Solutions' BCG Matrix, indicating high potential but requiring careful strategic consideration and investment.

Expansion into New Geographic Markets for Alight Worklife®

Alight Worklife's expansion into new geographic markets, particularly underpenetrated international regions, would position it as a Question Mark within the BCG matrix. While these markets offer substantial growth potential, the required initial investment to build brand presence and compete with established local players is considerable. For instance, entering a market like Southeast Asia, with its rapidly growing digital economy and increasing adoption of employee well-being solutions, presents a high-growth opportunity but also significant challenges in terms of localization and competitive landscape. Alight's success in these new territories hinges on strategic market entry, effective product adaptation, and substantial capital allocation, with outcomes not yet assured.

The strategic imperative for Alight Worklife's aggressive international expansion is driven by the global trend towards integrated HR and well-being platforms. In 2024, the global HR technology market was valued at approximately $27.1 billion, with employee well-being solutions being a significant growth driver within this. Entering new markets requires substantial investment in sales infrastructure, marketing campaigns, and potentially local partnerships. For example, establishing a presence in Latin America, where digital transformation is accelerating, could unlock new revenue streams but necessitates overcoming varying regulatory environments and cultural nuances. The high upfront costs and uncertain market reception place these initiatives firmly in the Question Mark category.

- High Growth Potential: Untapped international markets offer significant opportunities for Alight Worklife to capture new customer bases and revenue streams.

- Significant Investment Required: Establishing operations, marketing, and sales channels in new geographies demands substantial upfront capital outlay.

- Competitive Landscape: Local competitors often possess established market share and deep understanding of regional nuances, posing a challenge for new entrants.

- Uncertain Success: The outcome of these expansion efforts is not guaranteed, as market acceptance, regulatory hurdles, and competitive responses can impact profitability and market penetration.

Blockchain-Based HR and Benefits Solutions

Blockchain-based HR and benefits solutions represent a nascent area for Alight Solutions, placing them firmly in the Question Mark category of the BCG Matrix. While the potential for secure credentialing, benefits verification, and payroll is significant, the market for these applications in human resources is still in its early stages of development.

Alight's current market share in this specific niche would likely be very low, given the technology's immaturity within the HR sector. This necessitates substantial investment in research and development to create robust, scalable, and compliant products that can gain traction.

- Market Potential: High long-term growth potential due to enhanced security and efficiency in HR processes.

- Current Market Share: Very low, reflecting the early adoption phase of blockchain in HR.

- Investment Needs: Significant capital required for R&D, talent acquisition, and platform development.

- Strategic Consideration: Focus on pilot programs and strategic partnerships to validate use cases and build expertise.

Question Marks in Alight Solutions' BCG Matrix represent business units or initiatives with low current market share but operating in high-growth potential markets. These are often new ventures or emerging technologies where significant investment is required to gain traction and market leadership. The success of these Question Marks is uncertain, demanding careful strategic evaluation and resource allocation.

Alight's investment in AI-powered talent retention tools and hyper-personalized employee interaction engines exemplify this. While these areas promise substantial revenue growth, Alight's current market share is minimal. The company must invest heavily to demonstrate value and establish a competitive foothold, acknowledging the inherent risks and the need for strategic focus.

The expansion into new international markets, such as Southeast Asia or Latin America, also falls into the Question Mark category. These regions offer considerable growth prospects, but require substantial upfront investment to navigate local competition and regulatory landscapes. The return on these investments is not guaranteed, making them strategic bets for future expansion.

Blockchain-based HR solutions represent another emerging area where Alight is positioned as a Question Mark. The potential for enhanced security and efficiency is high, but the market is still nascent, with very low current adoption. Significant R&D and strategic partnerships are crucial for Alight to develop and validate these solutions.

| Initiative | Market Growth Potential | Current Market Share | Investment Needs | Strategic Outlook |

|---|---|---|---|---|

| AI Talent Retention Tools | High | Low | High | Develop and validate to capture market share |

| Hyper-Personalized Employee Engines | High | Very Low | Substantial | Requires significant R&D and market education |

| International Market Expansion (e.g., SEA, LATAM) | High | Low | High | Strategic market entry with focus on localization |

| Blockchain HR Solutions | High (Long-term) | Very Low | High | Focus on pilot programs and partnerships |

BCG Matrix Data Sources

Our BCG Matrix is constructed using a blend of internal financial reports, market share data, and industry growth projections to provide a comprehensive view of business unit performance.