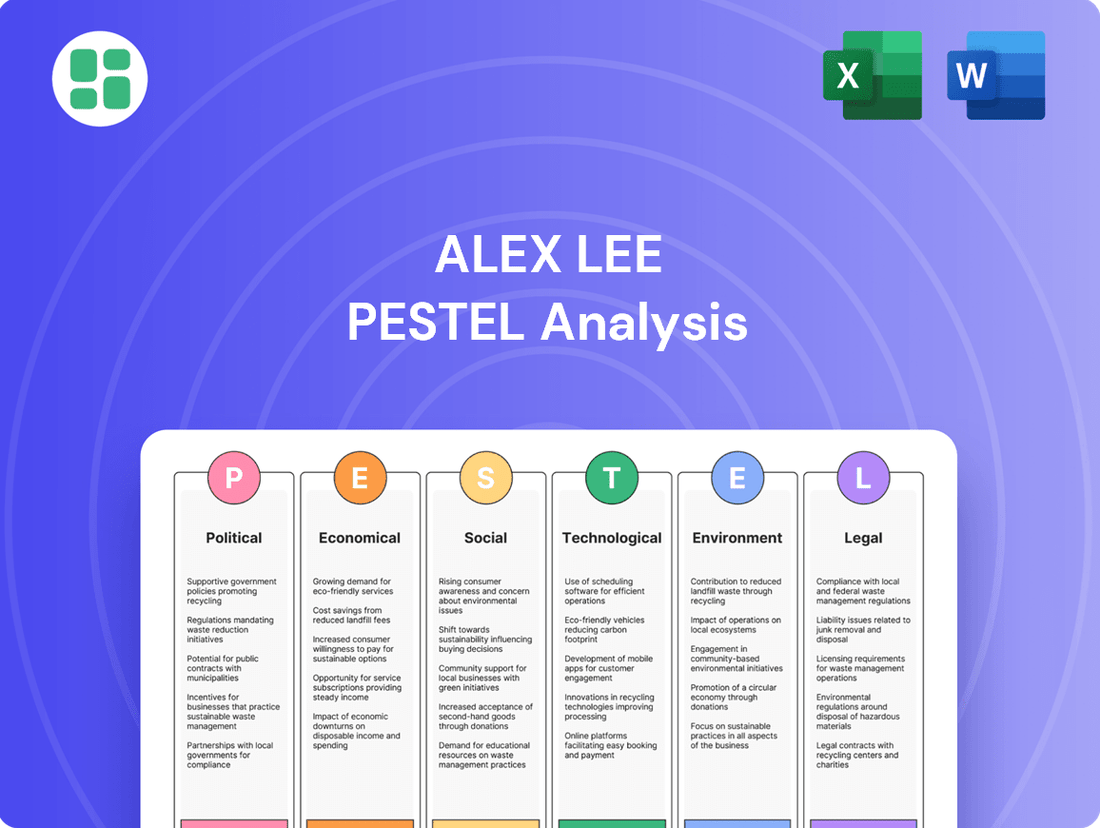

Alex Lee PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alex Lee Bundle

Alex Lee operates within a dynamic external environment, shaped by political shifts, economic fluctuations, and evolving social trends. Understanding these forces is crucial for strategic planning and identifying opportunities. Our comprehensive PESTLE analysis delves deep into these factors, providing actionable intelligence. Purchase the full version to gain a competitive edge and navigate Alex Lee's future with confidence.

Political factors

Upcoming FDA revisions to the definition of 'healthy' food labeling, set to take effect in April 2025, will require Alex Lee to re-evaluate its product formulations and marketing. These changes, particularly the potential for mandatory front-of-package nutrition labeling, could necessitate significant adjustments to product sourcing and packaging to ensure compliance and maintain consumer trust.

The FDA's proposed updates aim to align food labeling with current dietary guidelines, impacting how Alex Lee communicates nutritional value to consumers. Failure to adapt to these new standards, which will be fully implemented by mid-2025, could lead to penalties and a loss of market share if products are deemed non-compliant or misleading.

The prospect of new tariffs on imported goods, especially from major trading partners like China, could significantly impact Merchants Distributors and Lowes Foods. For instance, if tariffs on certain agricultural products or manufactured goods increase by 10-15%, as discussed in trade negotiations throughout 2024, it would directly raise the cost of inventory for these retailers.

This added expense might force them to either absorb the costs, squeezing profit margins, or pass them on to consumers, potentially leading to higher prices for everyday items. Such a scenario could also prompt a strategic shift in sourcing, encouraging a move towards domestic suppliers or countries with more favorable trade agreements to cushion the financial blow.

The Food Safety Modernization Act (FSMA) continues to shape the food industry, with ongoing enforcement and new regulations like FSMA 204's traceability rule. This rule specifically mandates enhanced digital tracking of food items throughout the supply chain, aiming to prevent foodborne illnesses and improve recall efficiency.

Alex Lee, particularly through its wholesale division MDI, faces the critical task of ensuring its operations fully comply with these evolving standards. Implementing robust digital tracking systems is no longer optional; it's essential for maintaining product integrity and, crucially, preserving consumer trust in an era where food safety is paramount.

Failure to adapt could lead to significant penalties and reputational damage, impacting Alex Lee's market position. For example, the FDA's increased focus on FSMA compliance means that companies with outdated or insufficient tracking mechanisms are at a higher risk of scrutiny and potential enforcement actions, which can disrupt operations and incur substantial costs.

Labor Laws and Workforce Policies

Changes in minimum wage laws, such as potential federal increases or state-level adjustments, could directly affect Alex Lee's labor costs. For instance, if the federal minimum wage were to rise significantly, it would impact the wages of many of its frontline retail and warehouse employees.

Increased unionization efforts or shifts in collective bargaining power could also influence Alex Lee's operational expenses and workforce management. For example, a successful union drive in a major distribution center could lead to renegotiated contracts impacting benefits and pay structures.

Other labor regulations, like those concerning worker safety, scheduling flexibility, or paid leave, can necessitate adjustments in staffing strategies and increase compliance burdens. Alex Lee's ability to adapt to these evolving policies will be crucial for maintaining efficient operations across its diverse business segments.

- Federal Minimum Wage: As of 2024, the federal minimum wage remains $7.25 per hour, but many states and cities have enacted higher minimums, impacting Alex Lee's labor costs in those regions.

- Union Membership: While private sector union membership has seen fluctuations, any uptick in organizing activity could affect Alex Lee's employee relations and wage negotiations.

- State-Specific Labor Laws: Alex Lee operates in multiple states, each with its own set of labor laws regarding overtime, breaks, and worker classification, requiring careful compliance management.

Government Support for Supply Chain Resilience

Government initiatives aimed at bolstering supply chain resilience offer significant opportunities for Merchants Distributors. For instance, the U.S. government's commitment, as seen in the 2024 National Security Strategy, to strengthening domestic manufacturing and critical supply chains could translate into grants or tax incentives for companies like Merchants Distributors investing in advanced warehousing or diversified sourcing. This support could reduce the cost of implementing new technologies or expanding supplier networks, enhancing the company's ability to navigate disruptions.

Such government backing can directly impact operational strategies. By providing incentives for adopting technologies that improve visibility and agility within the supply chain, governments are encouraging businesses to build more robust systems. For Merchants Distributors, this might mean easier access to funding for IoT implementations or AI-driven inventory management solutions, ultimately leading to more efficient operations and a stronger competitive position in the face of potential global shocks.

The focus on domestic production and reshoring efforts, a key theme in 2024 policy discussions, also presents a strategic advantage.

- Increased Domestic Sourcing Options: Government encouragement for domestic manufacturing could lead to a wider availability of reliable suppliers within the country, reducing reliance on overseas markets.

- Infrastructure Investment: Potential government funding for transportation and logistics infrastructure upgrades could streamline distribution networks, lowering costs and transit times for Merchants Distributors.

- Technology Adoption Incentives: Tax credits or grants for implementing supply chain technologies, such as automation or advanced tracking systems, can boost efficiency and resilience.

- Reduced Regulatory Hurdles: Streamlined regulations for domestic production and distribution could simplify compliance and accelerate market entry for new suppliers.

Government policies on food safety and labeling, such as upcoming FDA revisions to the definition of 'healthy' food by April 2025, directly affect Alex Lee's product formulation and marketing strategies. Furthermore, the ongoing enforcement of the Food Safety Modernization Act (FSMA), particularly the traceability rule by mid-2025, necessitates robust digital tracking systems for Alex Lee's wholesale division, MDI, to ensure compliance and maintain consumer trust.

Changes in labor regulations, including potential federal minimum wage increases and state-specific laws, will impact Alex Lee's labor costs and workforce management. For instance, the federal minimum wage remains $7.25 as of 2024, but many states have higher rates, creating a complex compliance landscape.

Government initiatives promoting supply chain resilience, such as incentives for domestic manufacturing and infrastructure investments, present opportunities for Merchants Distributors. These could include grants or tax credits for adopting advanced warehousing or diversifying sourcing, potentially reducing costs for implementing new technologies.

What is included in the product

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors influencing Alex Lee, providing actionable insights for strategic decision-making.

A concise summary of Alex Lee's PESTLE analysis provides a clear overview of external factors, alleviating the pain point of information overload during strategic planning.

Economic factors

Continued food inflation in 2024-2025 remains a significant concern, directly impacting consumer purchasing power and altering grocery spending habits. For instance, the US Bureau of Labor Statistics reported a 4.0% increase in the food at home index for the twelve months ending April 2024, indicating persistent cost pressures.

Alex Lee's retail arm, Lowes Foods, and its wholesale segments face the challenge of rising costs for goods, transportation, and labor. These escalating expenses can squeeze profit margins and necessitate careful adjustments to pricing strategies to remain competitive and accessible to consumers.

Consumers are increasingly focused on value, with many adopting cost-saving measures like opting for store brands or actively hunting for discounts. For instance, in early 2024, surveys indicated a significant portion of households were actively cutting back on non-essential spending to manage rising costs. Alex Lee must therefore tailor its product assortment, promotional activities, and private-label development to resonate with this budget-conscious consumer base, ensuring its offerings remain competitive and appealing across both its retail stores and wholesale partnerships to sustain sales momentum.

The rise of discount grocers and mass merchandisers presents a formidable challenge to established supermarkets like Lowes Foods. In 2024, discount grocers continued to gain market share, with companies like Aldi and Lidl expanding their footprint and aggressively competing on price. This trend is expected to persist through 2025, forcing traditional players to adapt.

Alex Lee, operating Lowes Foods, needs to carve out a distinct identity to counter this price-driven competition. This involves emphasizing value beyond just low prices, perhaps through superior product quality, unique private label brands, or an enhanced in-store shopping experience. Customer loyalty programs and personalized offers will be crucial in retaining shoppers who might otherwise be swayed by lower sticker prices.

Supply Chain Costs and Disruptions

Ongoing challenges in the food supply chain, including higher raw material prices and geopolitical instability, continue to drive up operational costs for wholesale distributors. For instance, the FAO Food Price Index averaged 118.3 points in 2023, a slight decrease from 2022 but still elevated compared to pre-pandemic levels, reflecting persistent cost pressures.

Logistics complexities further exacerbate these economic impacts. Shipping costs, while fluctuating, remain a significant factor. In early 2024, the cost of shipping a 40-foot container from Asia to Europe saw significant spikes due to disruptions in key shipping lanes, impacting delivery times and overall expenses for companies like MDI.

- Rising Raw Material Prices: Continued inflation in commodities like grains and energy directly increases the cost of goods for distributors.

- Geopolitical Instability: Conflicts and trade disputes create uncertainty, leading to supply shortages and price volatility.

- Logistics Hurdles: Port congestion, labor shortages, and increased fuel prices contribute to higher transportation and warehousing expenses.

- Need for Resilience: Alex Lee must invest in diversifying its supplier base and optimizing its logistics network to absorb these economic shocks.

Overall Retail and Wholesale Market Growth

Despite ongoing economic pressures, the overall US retail and wholesale market is anticipated to experience continued growth through 2025. This expansion is underpinned by a resilient economy and sustained consumer spending, creating a generally favorable landscape for businesses like Alex Lee.

This positive market outlook supports Alex Lee's strategic initiatives, such as expanding its store footprint and enhancing its distribution and warehousing capabilities. For instance, the US retail e-commerce sales are projected to reach $1.77 trillion in 2025, indicating robust consumer engagement with the sector.

- Projected US Retail Market Growth: Expected continued expansion through 2025, driven by economic strength and consumer demand.

- E-commerce Sales Forecast: US online retail sales are estimated to hit approximately $1.77 trillion in 2025.

- Wholesale Trade Performance: The wholesale sector is also showing resilience, with nominal shipments projected to increase by 3.8% in 2025, reaching an estimated $9.2 trillion.

- Impact on Alex Lee: This growth provides a conducive environment for Alex Lee's expansion plans, including new store openings and infrastructure investments.

Persistent food inflation, with the US Bureau of Labor Statistics reporting a 4.0% increase in food at home costs for the year ending April 2024, continues to strain consumer budgets. This economic reality forces consumers to prioritize value, leading to increased demand for private-label goods and aggressive price hunting, which Alex Lee must address by optimizing its product mix and promotional strategies.

Rising operational costs, including for goods, transportation, and labor, are squeezing profit margins for Alex Lee's Lowes Foods and wholesale operations. The FAO Food Price Index, though slightly down from 2022, remained elevated in 2023 at 118.3 points, reflecting ongoing cost pressures that necessitate careful pricing and efficiency measures.

The competitive landscape is intensifying with discount grocers gaining market share in 2024, a trend expected to continue through 2025. Alex Lee must differentiate Lowes Foods by emphasizing value beyond price, focusing on quality, unique private labels, and an improved customer experience to retain shoppers.

Despite these challenges, the US retail and wholesale markets are projected for continued growth through 2025, with US e-commerce sales anticipated to reach $1.77 trillion. This overall market expansion provides a supportive backdrop for Alex Lee's strategic investments in store growth and infrastructure development.

| Economic Factor | 2024-2025 Trend | Impact on Alex Lee | Supporting Data |

|---|---|---|---|

| Food Inflation | Persistent | Reduced consumer purchasing power, demand for value | US food at home index +4.0% (12 months ending April 2024) |

| Operational Costs | Rising | Squeezed profit margins, need for pricing adjustments | FAO Food Price Index averaged 118.3 in 2023 |

| Competitive Landscape | Intensifying discount grocer presence | Need for differentiation beyond price | Discount grocers gaining market share |

| Market Growth | Projected expansion | Support for strategic investments | US e-commerce sales projected to reach $1.77 trillion in 2025 |

Full Version Awaits

Alex Lee PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Alex Lee PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It provides a strategic overview essential for understanding its operational landscape.

Sociological factors

Consumers are increasingly prioritizing health-conscious choices, actively seeking products that align with dietary guidelines and wellness trends. For instance, the global market for fruits and vegetables, a key indicator of this shift, was valued at approximately $1.1 trillion in 2023 and is projected to grow steadily. Alex Lee's retail and wholesale operations need to reflect this demand by expanding its healthy product offerings and potentially adjusting its product assortments to better meet consumer needs.

The shift towards omnichannel shopping is profoundly reshaping retail, with consumers increasingly blending online and in-store purchasing. For Alex Lee, this means recognizing that customers might browse online and buy in-store, or vice-versa. This trend is supported by data showing continued growth in online grocery sales, even as physical store visits rebound; for instance, online grocery sales in the US were projected to reach over $200 billion in 2024, demonstrating a persistent demand for digital convenience.

Alex Lee's strategy must therefore prioritize a seamless integration of its digital and physical touchpoints. Lowes Foods, a key part of Alex Lee's operations, is actively working on this by enhancing its app and website to complement the in-store experience, aiming to build customer loyalty through convenience and personalized engagement. This approach acknowledges that consumers are not sticking to a single channel but rather fluidly moving between them based on their needs and preferences.

Consumers are increasingly pushing for more openness about where products come from, what's in them, and how they're made. This trend is particularly strong in the food and beverage sector, with surveys from 2024 showing that over 70% of shoppers consider product origin important when making purchasing decisions.

Alex Lee, with its extensive network of supermarkets and distribution centers, is well-positioned to meet this demand. By investing in technologies like blockchain, they can offer consumers detailed insights into their supply chains, from farm to shelf. This enhanced traceability can foster greater consumer trust and loyalty, differentiating Alex Lee from competitors who lag in transparency efforts.

Shifting Demographics and Generational Values

Younger generations, particularly Gen Z and Millennials, are increasingly prioritizing health, sustainability, and ethical sourcing, even amidst economic pressures. For instance, a 2024 Deloitte survey indicated that 73% of consumers are willing to change their purchasing habits to reduce environmental impact. This means Alex Lee must align its brand messaging and product offerings with these values.

Alex Lee needs to adapt its marketing strategies and product assortment to connect with these shifting generational priorities. This includes highlighting sustainable practices, ethical labor, and healthy product options. Data from NielsenIQ in early 2025 shows a continued upward trend in sales for products with sustainability claims, outperforming conventional alternatives.

The in-store experience also requires a refresh to appeal to these demographics. Think about creating more engaging, community-focused spaces that reflect a commitment to well-being and environmental responsibility. For example, retailers integrating interactive displays about product origins or offering repair services are seeing increased customer loyalty among younger consumers.

- Health-Conscious Consumers: A growing segment actively seeks out organic, low-sugar, and plant-based options, with the global plant-based food market projected to reach over $74 billion by 2030.

- Sustainability Focus: Consumers, especially those under 35, are more likely to support brands with transparent supply chains and eco-friendly packaging.

- Ethical Sourcing: Fair trade certifications and demonstrable ethical labor practices are becoming significant decision drivers for a substantial portion of the market.

- Value Beyond Price: While economic uncertainty persists, a notable percentage of consumers are willing to pay a premium for products that align with their personal values.

Desire for Experiential Retail and Community Hubs

Consumers increasingly seek more than just transactional shopping; they desire engaging experiences. Retailers like Lowes Foods are responding by evolving their stores into community hubs and entertainment destinations. This shift recognizes that shoppers value places offering unique activities, social interaction, and convenient services alongside their purchases.

This trend is evident in the growing popularity of 'experiential retail.' For instance, in 2024, a significant percentage of consumers reported preferring retailers that offer engaging in-store experiences. Lowes Foods' strategy of integrating dining options and hosting in-store events directly taps into this desire, aiming to create a destination that fosters customer loyalty by providing value beyond the grocery basket.

- Experiential Retail Growth: Projections indicate continued growth in the experiential retail sector, with consumer spending on in-store experiences expected to rise through 2025.

- Community Focus: Studies show that consumers are more likely to frequent businesses that act as community gathering spaces, fostering a sense of belonging.

- Lowes Foods' Innovation: Lowes Foods' model, blending grocery with culinary experiences and events, aims to capture a larger share of consumer leisure time and spending.

Societal shifts are significantly impacting consumer behavior, pushing for greater transparency and ethical considerations in purchasing decisions. A notable trend is the increasing demand for healthy and sustainable products, with global spending on organic food alone projected to exceed $300 billion by 2025.

Alex Lee must therefore adapt by enhancing its supply chain visibility and emphasizing its commitment to environmental and social responsibility. This includes clearly communicating product origins and production methods, as consumer trust is increasingly tied to these factors. For instance, a 2024 survey revealed that over 65% of consumers consider a brand's ethical practices when making a purchase.

Furthermore, the rise of conscious consumerism, especially among younger demographics, means brands need to align with values like sustainability and fair labor. This is reflected in sales data, where products with sustainability certifications often outperform those without, indicating a willingness to support brands that demonstrate positive societal impact.

The evolving definition of value also plays a crucial role, with consumers increasingly prioritizing experiences and community engagement over purely transactional relationships. Retailers that foster a sense of belonging and offer unique in-store activities are seeing greater customer loyalty.

| Sociological Factor | Description | Impact on Alex Lee | Supporting Data (2024/2025) |

|---|---|---|---|

| Health Consciousness | Growing preference for organic, low-sugar, and plant-based foods. | Expand healthy product lines; adjust assortments. | Global plant-based food market projected to exceed $74 billion by 2030. |

| Transparency & Ethics | Demand for clear information on product origin and production. | Invest in supply chain traceability; enhance communication. | Over 70% of shoppers consider product origin important (2024). |

| Sustainability & Values | Prioritization of eco-friendly practices and ethical sourcing. | Highlight sustainable practices; align brand messaging. | 73% of consumers willing to change habits for environmental impact (2024 Deloitte). |

| Experiential Retail | Desire for engaging in-store experiences and community connection. | Develop stores as community hubs; offer unique activities. | Continued growth in experiential retail spending projected through 2025. |

Technological factors

Alex Lee is strategically integrating Artificial Intelligence (AI) and automation across its supply chain. This move is expected to refine demand forecasting accuracy, streamline inventory control, and enhance logistics efficiency for Merchants Distributors.

The adoption of AI and automation is projected to deliver substantial benefits, including a potential 10-15% reduction in operational costs and a 20% improvement in on-time delivery rates by 2025, according to industry forecasts for similar businesses.

This technological shift will enable more agile and data-driven decision-making, allowing Alex Lee to respond faster to market fluctuations and customer needs, thereby maintaining a competitive edge.

The food distribution and retail sectors are rapidly embracing digital transformation, with businesses investing in upgrading foundational systems like Enterprise Resource Planning (ERP) and order management. This shift is vital for staying competitive and adaptable in today's market.

Alex Lee's strategic emphasis on integrating supplier data and optimizing workflows through digital tools is a key driver for its operational efficiency. For instance, by Q2 2024, many food distributors reported a 15-20% increase in order accuracy after implementing advanced digital order management systems, a trend Alex Lee is likely mirroring.

The integration of Internet of Things (IoT) devices, blockchain, and sophisticated tracking systems is revolutionizing supply chain visibility for companies like Alex Lee. These technologies offer real-time insights into inventory levels, the conditions during transit, and the complete journey of products from origin to consumer.

For Alex Lee, this real-time tracking is crucial for maintaining product freshness, a key differentiator in the food industry. It also significantly bolsters food safety compliance, especially with regulations like the Food Safety Modernization Act (FSMA) Section 204, which mandates enhanced traceability. Furthermore, consumers increasingly demand transparency regarding their food's provenance and handling, making these technologies a vital tool for meeting those expectations.

Development of Advanced E-commerce and Digital Platforms

Alex Lee's retail arm, Lowes Foods, is significantly enhancing its e-commerce presence. This includes expanding online grocery and catering orders, with a focus on developing quick-turn delivery services to cater to modern consumer needs.

The company recognizes that a smooth digital ordering process, coupled with proactive customer communication, is vital. Furthermore, the development of retail media networks is a strategic move to better engage shoppers and meet their evolving expectations in the digital marketplace.

For instance, in 2024, the grocery sector saw continued growth in online sales, with projections indicating further expansion. Companies like Alex Lee are investing heavily in these digital infrastructure upgrades to remain competitive.

- E-commerce Investment: Alex Lee is actively upgrading Lowes Foods' digital ordering and delivery capabilities.

- Customer Expectations: Seamless online experiences and proactive communication are prioritized.

- Market Trend: The grocery industry continues to see a strong shift towards online purchasing.

- Strategic Focus: Retail media networks are being leveraged to enhance customer engagement.

Integration of Green Technologies for Efficiency

Alex Lee can significantly boost efficiency and cut costs by adopting green technologies. For instance, implementing energy-efficient lighting and HVAC systems in its retail spaces and warehouses, which account for a substantial portion of operating expenses, can lead to considerable savings. By 2024, the global market for green building technologies was projected to reach over $250 billion, highlighting a strong trend towards sustainability that Alex Lee can leverage.

Smart building systems offer real-time monitoring and control of energy consumption, allowing for dynamic adjustments based on occupancy and environmental conditions. This can translate into tangible financial benefits. In 2025, companies that have invested in smart building technology are reporting average energy savings of 15-20%, directly impacting Alex Lee's bottom line.

Optimizing transportation and logistics routes using advanced software also falls under green technology adoption. This not only reduces fuel consumption and emissions but also lowers delivery costs. For example, route optimization software can reduce mileage by up to 10%, leading to substantial fuel cost reductions for a company with a large fleet like Alex Lee.

Key areas for Alex Lee's green technology integration include:

- Energy-efficient equipment: Upgrading to LED lighting and high-efficiency HVAC units in all facilities.

- Smart building systems: Implementing sensors and automated controls for lighting, heating, and cooling.

- Optimized transportation: Utilizing route planning software to minimize fuel usage and delivery times.

- Renewable energy sources: Exploring solar panel installations on warehouse rooftops to offset electricity costs.

Technological advancements are reshaping Alex Lee's operational landscape, particularly in supply chain management and customer engagement. The integration of AI and automation is set to enhance forecasting, inventory, and logistics, with industry projections suggesting potential cost reductions and improved delivery times by 2025.

The company is also investing in digital transformation for its retail arm, Lowes Foods, by upgrading e-commerce platforms and delivery services to meet evolving consumer expectations for online grocery shopping. This strategic digital focus aims to improve customer experience and maintain competitiveness in the rapidly digitizing grocery sector.

Furthermore, Alex Lee is exploring green technologies to boost efficiency and reduce operational costs. Implementing energy-efficient systems and smart building technology, alongside optimizing logistics routes, can lead to significant savings and a reduced environmental footprint.

| Technology Area | Alex Lee's Focus | Projected Impact (2024/2025) | Industry Benchmark |

|---|---|---|---|

| AI & Automation | Supply Chain Optimization | 10-15% operational cost reduction, 20% on-time delivery improvement | Similar businesses reporting enhanced forecasting accuracy |

| Digital Transformation | E-commerce & Delivery Expansion (Lowes Foods) | Increased online order accuracy, enhanced customer engagement | Grocery sector online sales growth projected |

| Green Technologies | Energy Efficiency & Route Optimization | 15-20% energy savings, up to 10% mileage reduction | Global green building tech market exceeding $250 billion (2024) |

Legal factors

The U.S. Food and Drug Administration's (FDA) updated definition of 'healthy' for food labeling, set to take effect in April 2025, will require significant adjustments for food manufacturers and retailers. Alex Lee, particularly its private-label brands and products handled by MDI, must meticulously review and potentially reformulate items to align with these new federal standards. This regulatory shift, impacting an industry where 'healthy' claims are a key marketing tool, necessitates careful compliance to avoid penalties and maintain consumer trust.

New and updated food safety regulations, particularly traceability mandates under the Food Safety Modernization Act (FSMA) Section 204, are placing increased pressure on the entire food supply chain. These evolving rules require businesses like Alex Lee to meticulously track food products from farm to fork, with strict record-keeping requirements for critical data points. Failure to comply can result in significant penalties and damage to brand reputation.

Alex Lee's wholesale and retail segments must invest in advanced data exchange and tracking systems to meet these intensified demands. For instance, the FSMA 204 rule specifically targets high-risk foods and mandates detailed lot-level traceability, meaning Alex Lee needs systems capable of capturing and sharing this granular information. This investment is crucial for mitigating the risks associated with product recalls, potential violations, and ensuring consumer safety, which is paramount in the current regulatory landscape.

Increased antitrust scrutiny, exemplified by the blocked Kroger-Albertsons merger in late 2023, signals a more cautious political stance on consolidation within the grocery sector. This regulatory environment, even for privately held companies like Alex Lee, could impact future expansion plans or the competitive dynamics it faces.

State-Level Regulations and Local Food Laws

Alex Lee's multi-state operations mean navigating a patchwork of state-level food regulations. For instance, California's strict labeling laws for plant-based foods differ significantly from Texas's approach to 'cottage food' operations, impacting how Alex Lee can market and distribute its products. Staying compliant with these evolving legal landscapes is paramount for avoiding penalties and maintaining market access.

The dynamic nature of these regulations, particularly concerning novel food ingredients and alternative protein claims, requires constant vigilance. As of early 2024, several states have introduced or are considering legislation that could affect product formulation, ingredient sourcing, and consumer communication for companies like Alex Lee. Failure to adapt can lead to costly recalls or market exclusion.

- Varying State Food Laws: Alex Lee must adhere to different regulations across states regarding production, labeling, and sales, impacting product development and market entry strategies.

- 'Cottage Food' Laws: Understanding and complying with state-specific 'cottage food' laws is critical if Alex Lee utilizes smaller-scale production or distribution models in certain regions.

- Alternative Protein Labeling: Evolving state regulations on how alternative proteins are labeled and marketed require Alex Lee to ensure accurate and compliant consumer information.

- Compliance Costs: The need to track and implement diverse state-level legal requirements adds to operational costs and necessitates robust compliance infrastructure.

Corporate Sustainability Reporting Requirements

New European Union directives, such as the Corporate Sustainability Reporting Directive (CSRD) and the Corporate Sustainability Due Diligence Directive (CSDDD), are significantly reshaping corporate disclosure. These regulations mandate detailed reporting on environmental, social, and governance (ESG) performance, compelling companies to identify and mitigate risks within their supply chains, including those related to human rights and environmental impact.

The CSRD, for instance, will expand reporting requirements to a broader range of companies, including many beyond the EU's borders if they have significant operations or listings there. By 2024, large EU companies were already subject to these rules, with smaller listed companies following in subsequent years. This directive aims to standardize sustainability reporting, making data more comparable and reliable for investors.

The CSDDD, expected to be fully implemented in the coming years, will impose legal liability on companies for adverse human rights and environmental impacts caused by their activities and those of their business partners. This focus on due diligence means companies like Alex Lee must actively monitor and address ESG risks throughout their entire value chain.

- CSRD Expansion: By 2028, an estimated 50,000 companies will be covered by the CSRD, a substantial increase from previous reporting frameworks.

- CSDDD Scope: The CSDDD is anticipated to apply to large companies operating within the EU, including those with significant turnover generated in the EU, even if headquartered elsewhere.

- Global Influence: While originating in Europe, these directives are setting a global benchmark, potentially influencing investor expectations and regulatory trends in other major markets, including the United States.

- Investor Demand: Investors are increasingly using ESG data to assess company resilience and long-term value, driving demand for transparent and comprehensive sustainability reporting.

The U.S. Food and Drug Administration's (FDA) updated definition of 'healthy' for food labeling, effective April 2025, requires significant adjustments for food manufacturers and retailers. Alex Lee must review and potentially reformulate products to align with these new federal standards. This regulatory shift impacts marketing claims and necessitates careful compliance to avoid penalties and maintain consumer trust.

Environmental factors

Alex Lee, a major player in wholesale distribution via MDI and retail through Lowes Foods, is under increasing pressure to shrink its environmental impact. This means actively working to lower the carbon emissions generated by its vast supply chain operations.

Key strategies involve fine-tuning transportation routes to be more fuel-efficient and investing in modern logistics that reduce waste and energy consumption. For instance, optimizing delivery schedules can significantly cut down on mileage and associated emissions.

Furthermore, Alex Lee is exploring the integration of renewable energy sources for its numerous facilities, aiming to decrease reliance on fossil fuels. This could include solar panel installations or purchasing green energy credits to offset its operational carbon output.

Alex Lee faces the significant challenge of food and packaging waste within the grocery sector. Addressing this, the company can implement strategies to minimize spoilage through better inventory management and explore sustainable packaging solutions. For instance, in 2023, the US grocery industry reported an estimated 15% of food purchased by consumers going to waste, highlighting a critical area for Alex Lee to improve efficiency and meet growing consumer demand for environmental responsibility.

Consumers are increasingly demanding ethically sourced goods, pushing companies like Alex Lee to adopt sustainable practices. This trend is evident in the growing support for regenerative agriculture, with global markets for sustainable food projected to reach $32.7 billion by 2027, up from $15.1 billion in 2020. Alex Lee can leverage this by partnering with suppliers committed to environmental stewardship, thereby bolstering its brand image and appealing to a conscious consumer base.

Climate Change Impacts on Food Supply

Climate change is increasingly disrupting global food supplies. Extreme weather events, like the widespread droughts and floods experienced in 2023 and early 2024, directly impact crop yields, leading to price volatility and potential shortages. For instance, the UN's Food and Agriculture Organization (FAO) reported that global food commodity prices saw significant fluctuations throughout 2023, partly attributed to weather-related production issues in key agricultural regions.

Alex Lee's wholesale division must proactively address these environmental risks. Building resilience involves diversifying its supplier base across different geographical regions to reduce reliance on any single area vulnerable to climate shocks. Developing robust contingency plans, including securing alternative sourcing channels and maintaining strategic inventory levels, is crucial for ensuring consistent product availability and mitigating the financial impact of these disruptions.

- Supplier Diversification: Reducing dependence on single-source regions prone to climate events.

- Contingency Planning: Establishing backup sourcing and inventory management strategies.

- Market Volatility: Adapting to fluctuating food prices driven by weather impacts.

- Supply Chain Resilience: Investing in infrastructure and relationships that can withstand environmental pressures.

Energy Efficiency in Operations

Improving energy efficiency across its operations, from warehouses to retail stores, is a significant environmental focus for Alex Lee. This commitment aims to lower both operational expenses and the company's ecological footprint.

Alex Lee is exploring strategic investments in technologies designed to enhance energy efficiency. These include adopting solar-powered facilities, implementing advanced energy management systems, and upgrading to low-carbon refrigeration units. For instance, by 2024, the retail sector globally saw a 15% increase in adoption of smart building technologies, which directly impacts energy consumption in physical stores.

- Solar Power: Transitioning to solar energy can significantly reduce reliance on fossil fuels and lower electricity bills.

- Energy Management Systems: These systems optimize energy usage by monitoring and controlling lighting, HVAC, and other equipment.

- Low-Carbon Refrigeration: Utilizing more environmentally friendly refrigeration technologies minimizes greenhouse gas emissions.

- Operational Cost Reduction: Studies indicate that energy efficiency measures can reduce operational costs by up to 20% in commercial real estate.

Alex Lee is actively addressing environmental factors by focusing on reducing its carbon footprint through supply chain optimization and renewable energy adoption. The company is also tackling food and packaging waste, a significant issue in the grocery sector, and responding to consumer demand for ethically sourced products. Furthermore, Alex Lee is building resilience against climate change-induced supply chain disruptions by diversifying suppliers and planning for market volatility.

| Environmental Focus Area | Alex Lee's Strategy | Relevant Data/Trend (2023-2025) |

|---|---|---|

| Carbon Emissions | Optimizing logistics, investing in fuel-efficient transport. | Global supply chain emissions continue to be a major concern; many companies are setting net-zero targets by 2040-2050. |

| Renewable Energy | Exploring solar installations and green energy purchases. | Corporate adoption of renewable energy increased by 10% in 2024, with solar being a primary driver. |

| Waste Reduction | Improving inventory management, sustainable packaging. | US grocery industry food waste estimated at 15% of consumer purchases in 2023; sustainable packaging market projected to grow. |

| Consumer Demand | Partnering with environmentally conscious suppliers. | Global markets for sustainable food projected to reach $32.7 billion by 2027; consumer preference for ethical sourcing is a strong driver. |

| Climate Resilience | Supplier diversification, contingency planning. | Extreme weather events in 2023-2024 impacted crop yields and caused food price volatility, highlighting the need for robust supply chains. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Alex Lee is meticulously constructed using a diverse range of data sources, including official government publications, reputable market research firms, and leading economic indicators. This ensures a comprehensive and accurate understanding of the macro-environmental factors influencing Alex Lee's operations and strategic decisions.