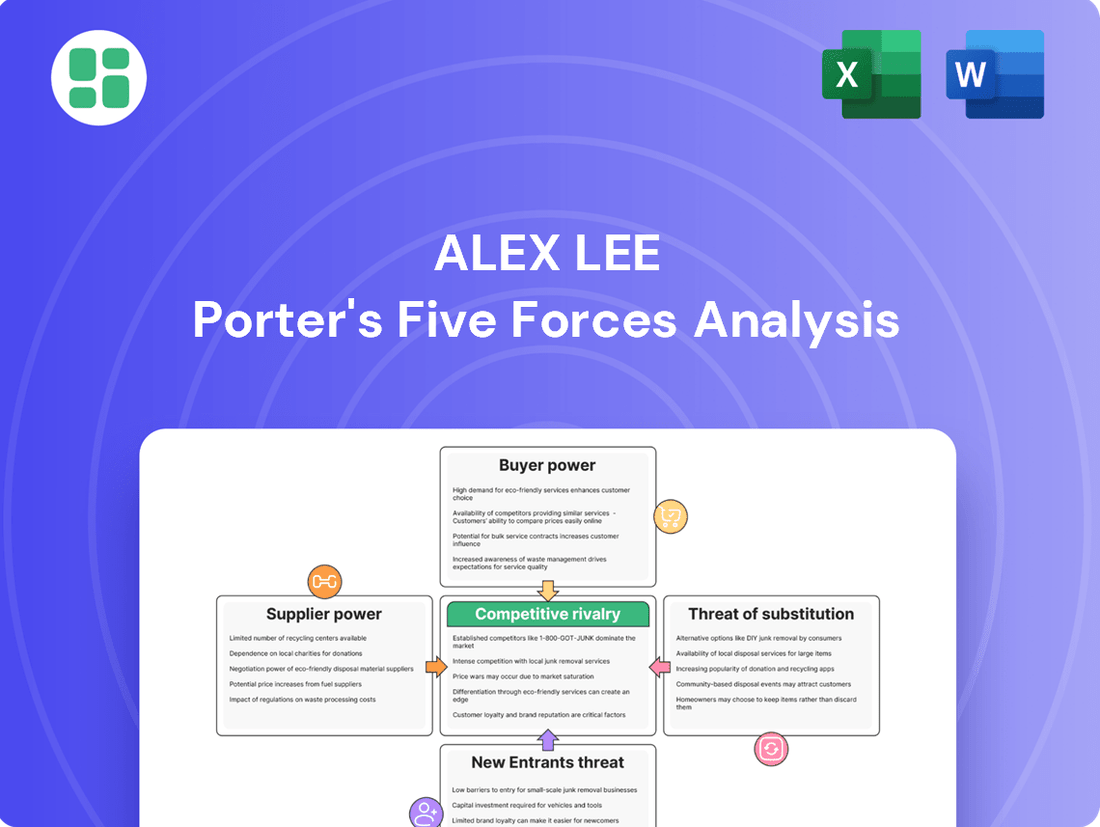

Alex Lee Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alex Lee Bundle

Alex Lee's competitive landscape is shaped by powerful forces, from the bargaining power of its suppliers to the intense rivalry among existing players. Understanding these dynamics is crucial for navigating the grocery industry effectively.

The complete report reveals the real forces shaping Alex Lee’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The grocery industry's reliance on a diverse supplier base, from major CPG giants to niche producers, means Alex Lee's bargaining power shifts with product type. For Alex Lee, operating both wholesale (MDI) and retail (Lowes Foods), supplier leverage is a key consideration.

In 2024, the grocery sector saw continued consolidation among large CPG manufacturers, potentially increasing their pricing power. For instance, reports indicate that major food producers maintained strong pricing strategies throughout the year, impacting input costs for retailers like Alex Lee.

When specific ingredients or proprietary products are sourced from a limited number of specialized suppliers, those suppliers gain significant leverage. This can translate to less favorable pricing and stricter contract terms for Alex Lee, directly affecting profit margins.

Switching suppliers for Alex Lee can incur substantial costs. These include the expenses associated with negotiating new agreements, reconfiguring supply chains and logistics, and the potential for disruptions in product availability or quality that could alienate their customer base. For example, if Alex Lee relies on a specialized supplier for a key ingredient, the cost and time to qualify and integrate a new supplier could be significant, potentially running into tens of thousands of dollars for testing and setup alone.

The bargaining power of suppliers for Alex Lee is significantly influenced by how crucial their products are to Alex Lee's overall business. If a supplier offers a unique or highly sought-after ingredient, perhaps a proprietary blend for private label products or a specialty item that differentiates Alex Lee's offerings, that supplier holds considerable sway. This is particularly true when Alex Lee's ability to satisfy its diverse customer base, from independent grocers to end consumers at Lowes Foods, hinges on a consistent supply of these specialized goods.

Threat of Forward Integration by Suppliers

Suppliers can increase their bargaining power by threatening to integrate forward into Alex Lee's business. This means they might start selling directly to consumers or retailers, cutting out Alex Lee's distribution or retail operations.

While large consumer packaged goods (CPG) suppliers rarely move into direct retail, smaller, specialized food producers are increasingly exploring direct-to-consumer (DTC) models. For instance, a niche organic food supplier might launch its own online store, bypassing traditional wholesale channels.

This threat is particularly relevant in sectors where supplier margins are squeezed, incentivizing them to capture more of the value chain. In 2024, the growth of e-commerce platforms has made direct sales more accessible for many suppliers.

- Forward Integration Threat: Suppliers may enter distribution or retail, bypassing Alex Lee.

- DTC Trend: Smaller food producers are increasingly using direct-to-consumer sales models.

- Margin Pressure: Suppliers facing low margins are more likely to consider forward integration.

- E-commerce Facilitation: Online platforms in 2024 have lowered the barrier for suppliers to sell directly.

Overall Supply Chain Dynamics and Inflationary Pressures

The broader food supply chain is currently grappling with significant challenges, including escalating costs, persistent labor shortages, and ongoing geopolitical disruptions. These factors collectively contribute to an elevated bargaining power for suppliers across the industry.

Alex Lee, much like its peers in distribution and retail, must actively manage these inflationary pressures. Suppliers are increasingly passing on their own heightened expenses related to raw materials, transportation logistics, and labor costs, directly impacting the cost structure for companies like Alex Lee.

- Rising Input Costs: In 2024, the Producer Price Index (PPI) for food manufacturing saw an increase of 4.5% year-over-year, indicating that suppliers are indeed facing and passing on higher input costs.

- Labor Shortages Impact: The U.S. Bureau of Labor Statistics reported that the food manufacturing sector continued to experience a labor deficit, with vacancy rates remaining above pre-pandemic levels throughout 2024, further empowering suppliers with fewer available workers.

- Transportation Inflation: Freight costs, a critical component for food distribution, saw an average increase of 7% in 2024 compared to 2023, directly attributable to fuel price volatility and driver shortages.

Suppliers wield significant power when they offer unique products or when switching costs for Alex Lee are high, impacting pricing and contract terms. In 2024, ongoing supply chain disruptions and labor shortages amplified this leverage, forcing retailers to absorb increased costs for raw materials and transportation.

The threat of suppliers engaging in forward integration, such as direct-to-consumer sales, also bolsters their bargaining position, particularly for niche producers. This trend was facilitated by the growing accessibility of e-commerce platforms throughout 2024.

Alex Lee must navigate these dynamics, especially as key suppliers, like major CPG manufacturers, continue to consolidate, potentially increasing their pricing power.

The bargaining power of suppliers for Alex Lee is influenced by several factors, including the uniqueness of their offerings and the costs associated with switching. In 2024, factors like rising input costs, labor shortages, and transportation inflation have collectively strengthened supplier leverage.

| Factor | Impact on Supplier Bargaining Power | 2024 Data Point |

|---|---|---|

| Product Uniqueness/Differentiation | High power for suppliers with proprietary or highly sought-after products. | Niche organic food suppliers increasingly exploring DTC models. |

| Switching Costs | High costs for Alex Lee (negotiation, logistics, disruption) increase supplier leverage. | Estimated tens of thousands of dollars for qualifying new suppliers. |

| Supplier Concentration | Consolidation among large CPG manufacturers can lead to increased pricing power. | Continued consolidation observed in the CPG sector throughout 2024. |

| Threat of Forward Integration | Suppliers may bypass Alex Lee by selling directly to consumers or retailers. | E-commerce platforms in 2024 lowered barriers for direct sales. |

| Industry Cost Pressures | Rising input, labor, and transportation costs empower suppliers to pass on expenses. | Producer Price Index for food manufacturing up 4.5% YoY in 2024; freight costs up 7%. |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Alex Lee's grocery and retail operations.

Quickly identify and address competitive threats with a visual, easy-to-understand breakdown of industry dynamics.

Customers Bargaining Power

Lowes Foods operates in a market where end consumers exhibit significant price sensitivity, a trend amplified by ongoing inflation in grocery costs. For instance, the U.S. Bureau of Labor Statistics reported a 4.7% increase in the food at home index in May 2024 compared to May 2023, directly impacting consumer purchasing power.

This heightened sensitivity compels shoppers to actively seek value. They are more inclined to compare prices across different retailers, opt for private label or generic brands, and diligently use coupons and loyalty program discounts. This behavior directly translates into downward pressure on Lowes Foods' pricing strategies and, consequently, its profit margins.

Independent grocery stores, MDI's customers, face intense competition, making them highly price-sensitive regarding wholesale costs. This sensitivity directly impacts MDI's ability to command higher margins.

These retailers have alternative sourcing options, including other distributors and direct manufacturer relationships, which strengthens their bargaining power. In 2024, the grocery wholesale market saw continued consolidation, potentially offering customers more choices and increasing pressure on distributors like MDI to offer competitive terms.

To counter this, MDI must leverage its broad product selection and dependable service as key differentiators. The ability to offer a wide range of products efficiently can reduce the need for independent grocers to manage multiple supplier relationships, thereby mitigating their perceived switching costs.

While MDI's customer base exceeds 600 retail food stores, a significant portion of its revenue may be tied to a smaller number of large independent grocery chains. This concentration means these key customers hold considerable sway, potentially leveraging their volume to negotiate more favorable pricing and terms. For instance, if the top 5 independent chains represent over 30% of MDI's total sales, their ability to dictate terms increases substantially.

Availability of Information and Online Shopping

The increasing availability of information, especially through online channels, significantly bolsters customer bargaining power in the grocery sector. Both independent grocers and end consumers can readily compare prices, product details, and reviews across various retailers. This transparency empowers consumers to make more informed purchasing decisions, driving competition among suppliers.

The proliferation of online grocery shopping and digital comparison platforms allows customers to effortlessly identify and switch to alternative providers. For instance, by mid-2024, online grocery sales in the US were projected to reach over $200 billion, demonstrating a substantial shift in consumer behavior and a heightened expectation for convenience and competitive pricing. This ease of access to alternatives directly translates into greater customer leverage.

- Enhanced Price Transparency: Consumers can easily compare prices from multiple grocers online, putting pressure on individual stores to remain competitive.

- Rise of Online Comparison Tools: Websites and apps dedicated to grocery price comparisons empower shoppers to find the best deals quickly.

- Omnichannel Expectations: Customers now expect seamless integration between online and in-store experiences, demanding flexibility and choice from retailers.

- Increased Switching Propensity: The low cost and ease of switching between online grocery platforms mean customers are less loyal to a single provider.

Growth of Private Labels and Discount Stores

The growing presence of private label brands and the expansion of discount grocery chains significantly bolster customer bargaining power. These alternatives offer comparable quality at lower price points, directly challenging established national brands and traditional retailers. For instance, by mid-2024, private label sales continued to capture market share, with some categories seeing growth rates exceeding national brands in many developed markets.

This dynamic forces companies like Alex Lee, through its Lowes Foods banner, to adapt. To counter this, Lowes Foods must strategically enhance its private label portfolio, focusing on value and quality to retain customer loyalty. This includes not only offering competitive pricing but also ensuring private label products meet or exceed customer expectations, thereby mitigating the direct price competition from discounters.

- Private Label Growth: Private label sales have consistently grown, often outpacing national brands, indicating increased customer acceptance and demand for value-oriented options.

- Discount Retailer Expansion: Chains like Aldi and Lidl have expanded their footprint, offering aggressive pricing that pressures traditional grocers to compete on cost.

- Customer Empowerment: Cheaper alternatives empower customers to switch brands and retailers more readily, increasing price sensitivity and demand for value.

- Strategic Response: Alex Lee's Lowes Foods must invest in and promote its private label offerings to remain competitive and capture customer spending.

The bargaining power of customers is a critical factor influencing profitability, especially in retail sectors like groceries. When customers have significant power, they can demand lower prices or higher quality, squeezing supplier margins. This power is amplified by factors like price sensitivity, availability of alternatives, and the cost for customers to switch suppliers.

Same Document Delivered

Alex Lee Porter's Five Forces Analysis

This preview showcases the complete Alex Lee Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the industry. The document you see here is precisely what you will receive immediately after purchase, ensuring full transparency and immediate usability for your strategic planning.

Rivalry Among Competitors

Alex Lee operates within intensely competitive landscapes in both its wholesale distribution arm, Merchants Distributors, Inc. (MDI), and its retail supermarket chain, Lowes Foods. The sheer volume of players means market share gains are hard-won.

In the retail sector, Lowes Foods contends with formidable national giants such as Walmart, Kroger, and Publix, alongside numerous regional grocery chains and aggressive discount retailers. This broad competitive set puts constant pressure on pricing and customer loyalty.

Similarly, MDI faces robust competition from other major wholesale distributors. For instance, in 2024, the US grocery wholesale market continues to be characterized by significant consolidation, but still features multiple large national and regional players vying for supplier contracts and retailer business.

For many basic grocery items, it's tough for brands to stand out. This means companies often compete mainly on price, how easy it is to shop, and the overall customer experience. For instance, in 2024, grocery retailers heavily relied on price matching and aggressive promotions to capture market share.

This low product differentiation naturally fuels intense rivalry. Companies are constantly running sales, offering loyalty points, and trying to make shopping more pleasant to keep customers coming back. This focus on non-product factors is crucial in a market where the core products are largely the same.

The U.S. grocery retail sector is largely mature, exhibiting only modest overall growth. This maturity intensifies competition as players fight harder for existing market share rather than focusing on expanding into entirely new territories.

While the online grocery segment is experiencing growth, the expansion of traditional brick-and-mortar stores is largely concentrated in either the value-oriented or specialty niche segments of the market.

For instance, in 2024, the overall U.S. grocery market growth was projected to be around 2% to 3%, a relatively stable but not explosive figure. This low growth environment means that any gains made by one retailer often come at the direct expense of another, fueling intense rivalry.

High Fixed Costs and Exit Barriers

The grocery industry, encompassing both wholesale distribution and retail supermarket operations, is characterized by substantial fixed costs. These include investments in warehouses, extensive logistics networks, and physical store locations, all of which represent significant capital outlays. For instance, a new supermarket build can easily cost millions of dollars, and maintaining a vast distribution network requires ongoing investment in technology and infrastructure.

These high fixed costs act as significant exit barriers, making it difficult and costly for companies to leave the market. Consequently, even when market conditions are unfavorable or profitability is low, businesses are compelled to stay operational and continue competing. This dynamic intensifies rivalry, as companies strive to maintain sales volume to cover their fixed overheads, often leading to price wars or aggressive promotional activities.

- Significant Capital Investments: Retailers and wholesalers must invest heavily in physical infrastructure like stores, warehouses, and distribution centers.

- High Operating Expenses: Beyond initial investment, ongoing costs for maintenance, utilities, and staffing these facilities are considerable.

- Intensified Competition: The need to cover fixed costs drives companies to compete aggressively, even in challenging economic periods.

- Reduced Flexibility: High fixed costs limit a company's ability to quickly adapt to changing market demands or exit unprofitable segments.

Mergers & Acquisitions and Digital Transformation

The grocery sector is experiencing significant consolidation, with larger companies actively acquiring smaller ones. This trend aims to achieve greater economies of scale and capture a larger share of the market. For instance, in 2024, Albertsons and Kroger's proposed merger, valued at approximately $24.6 billion, highlights this drive for consolidation, though regulatory scrutiny remains a key factor.

Simultaneously, there's a substantial push towards digital transformation across the industry. Companies are investing heavily in e-commerce capabilities, data analytics, and in-store technology to enhance customer experience and operational efficiency. This digital shift is not just about convenience; it's about survival and growth in a rapidly evolving retail landscape.

Alex Lee's strategic moves, such as expanding Lowes Foods' presence and investing in advanced technology, directly reflect these industry-wide dynamics. These actions demonstrate a proactive approach to navigating the competitive pressures arising from mergers and the imperative of digital innovation. The company's focus on both physical expansion and technological upgrades positions it to compete effectively.

- Industry Consolidation: Increased M&A activity to gain scale and market dominance.

- Digital Investment: Significant capital allocation towards e-commerce, AI, and data analytics.

- Competitive Response: Companies like Alex Lee are expanding their physical footprint and tech capabilities.

- Market Share Growth: Acquisitions and digital strategies are key drivers for increasing market share in 2024.

The competitive rivalry within the grocery sector, affecting both Alex Lee's wholesale and retail operations, is exceptionally fierce. Numerous players, from national giants to regional chains and discount retailers, constantly vie for customer attention and supplier contracts. This intense competition is exacerbated by a mature market with low overall growth, meaning market share gains are often achieved at the direct expense of rivals. For instance, the U.S. grocery market saw projected growth of only 2% to 3% in 2024, intensifying the fight for existing customers.

Product differentiation for many basic grocery items is low, forcing companies to compete primarily on price, convenience, and customer experience. This leads to frequent sales, loyalty programs, and a focus on operational efficiency to maintain sales volumes and cover substantial fixed costs associated with extensive infrastructure like stores and distribution networks. These high fixed costs also act as exit barriers, compelling companies to remain competitive even in challenging conditions, often resulting in price wars.

The industry is also shaped by ongoing consolidation, as seen in the proposed $24.6 billion merger of Albertsons and Kroger in 2024, aiming for greater economies of scale. Simultaneously, significant investments in digital transformation, including e-commerce and data analytics, are critical for survival and growth. Alex Lee's strategic expansions and technological upgrades are direct responses to these powerful forces, aiming to secure its position in this dynamic and highly competitive environment.

SSubstitutes Threaten

Consumers today have a vast array of options beyond traditional grocery stores like Lowes Foods for acquiring their food. These alternatives include convenient meal kit delivery services, direct-to-consumer brands shipping specialty items, vibrant farmers' markets offering fresh, local produce, quick-stop convenience stores, and the ever-popular restaurant sector.

The widening disparity between spending on dining out and grocery shopping, a trend observed throughout 2024, underscores the competitive pressure from restaurants. For instance, in Q1 2024, restaurant spending saw a notable increase, indicating consumers are increasingly viewing eating out as a viable substitute for preparing meals at home, directly impacting grocery retailers.

Independent grocers, key customers for wholesale distributors like Alex Lee, are increasingly exploring alternatives to traditional full-service models. This shift is driven by a desire for greater cost control and flexibility in their supply chains.

These alternatives include direct purchasing from food manufacturers, bypassing distributors altogether. For example, some smaller chains or individual stores might negotiate directly with bakeries or local produce farms. Another growing trend is the formation of buying cooperatives, where multiple independent grocers pool their purchasing power to secure better pricing and terms, much like a larger entity would. In 2024, the National Grocers Association reported a 15% increase in inquiries about cooperative purchasing models among its independent members.

Furthermore, cash-and-carry wholesale options provide another avenue for independent grocers to reduce their reliance on full-service distributors. These outlets allow stores to purchase goods on demand without the commitment of regular delivery schedules or minimum order quantities. This flexibility can be particularly attractive for managing seasonal demand or stocking niche products.

Shifting consumer preferences towards healthier, organic, local, or plant-based options presents a significant threat of substitutes for traditional grocery retailers like Alex Lee. Consumers increasingly seek out specialized stores or direct suppliers that cater to these specific demands more effectively, bypassing conventional supermarkets. For example, the plant-based food market in the US saw significant growth, with retail sales reaching an estimated $8 billion in 2023, indicating a clear consumer shift. Alex Lee must proactively adapt its product offerings and sourcing strategies to meet these evolving tastes and retain market share against these specialized alternatives.

Online-Only Grocery and Delivery Services

The rise of online-only grocery and delivery services presents a potent threat of substitutes for traditional brick-and-mortar grocers like Lowes Foods. These digital platforms, including giants like Amazon Fresh and services like Instacart, offer unparalleled convenience, allowing consumers to order groceries from their homes and have them delivered quickly. This shift in consumer preference, driven by the ease of online ordering and often competitive pricing, directly competes for market share.

By 2024, the online grocery market continued its robust expansion. For instance, Instacart reported significant growth in its platform usage, facilitating billions of dollars in grocery sales for its retail partners. This trend indicates a substantial portion of consumers are actively choosing these digital alternatives over traditional in-store shopping experiences, thereby impacting the sales volume and customer loyalty of physical grocery stores.

- Convenience Factor: Online platforms eliminate the need for travel and in-store browsing, appealing to time-pressed consumers.

- Competitive Pricing: Many online grocers and delivery services offer promotions and competitive pricing strategies to attract and retain customers.

- Market Share Erosion: The increasing adoption of these substitute services directly diverts sales and potentially reduces the customer base for traditional grocers.

- Technological Advancement: Continuous innovation in delivery logistics and user experience further strengthens the appeal of online grocery shopping.

Private Label and Discount Store Growth as Substitutes for Brands

The increasing prominence of private label brands within grocery chains poses a significant threat of substitution for national brands. These store-owned brands often offer comparable quality at a lower price point, directly appealing to budget-conscious consumers. For instance, by mid-2024, private label penetration in the US grocery market had reached an all-time high, with some categories seeing over 25% market share, according to industry reports.

Furthermore, the robust expansion of discount retailers, such as Aldi and Lidl, intensifies this substitution threat. These retailers focus on a curated selection of lower-priced goods, including their own private label offerings, directly competing with the product assortments found in more traditional grocery stores. The growth trajectory of these discount formats indicates a sustained shift in consumer spending habits towards value-oriented shopping, impacting sales for companies like Alex Lee.

- Private Label Market Share: Private label brands captured an estimated 20-25% of the U.S. grocery market in early 2024, a figure that has been steadily climbing.

- Discount Retailer Growth: Discount grocers saw sales growth exceeding 10% year-over-year through the first half of 2024, outpacing the overall grocery sector.

- Consumer Price Sensitivity: Surveys conducted in late 2023 and early 2024 indicated that over 70% of consumers were actively seeking ways to save money on groceries, prioritizing price in their purchasing decisions.

The threat of substitutes for grocery distributors like Alex Lee is multifaceted, encompassing alternative food sourcing channels and evolving consumer purchasing habits. From meal kits and direct-to-consumer brands to farmers' markets and restaurants, consumers have more options than ever for acquiring food, directly impacting traditional grocery sales. The increasing preference for dining out, highlighted by a notable rise in restaurant spending in Q1 2024, further illustrates this competitive pressure.

Independent grocers are actively seeking alternatives to traditional distribution models, exploring direct purchasing from manufacturers and forming buying cooperatives to enhance cost control and supply chain flexibility. The National Grocers Association reported a 15% increase in inquiries about cooperative purchasing in 2024, underscoring this trend. Furthermore, cash-and-carry wholesale options provide an agile alternative for inventory management.

The growing demand for specialized products like organic, local, or plant-based foods presents another significant substitution threat. Consumers are increasingly turning to niche retailers or direct suppliers that cater to these specific preferences more effectively than conventional supermarkets. The US plant-based food market, estimated at $8 billion in retail sales in 2023, exemplifies this shift.

Online grocery services and discount retailers also intensify the substitution threat. The online grocery market continued its robust expansion through 2024, with services like Instacart facilitating billions in sales. Simultaneously, discount grocers like Aldi and Lidl saw sales growth exceeding 10% year-over-year in the first half of 2024, driven by consumer price sensitivity, with over 70% of consumers actively seeking savings on groceries.

| Substitute Category | Key Drivers | 2024 Impact/Trend |

|---|---|---|

| Alternative Food Sourcing | Convenience, specialization, cost savings | Increased consumer adoption of meal kits, DTC brands, farmers' markets |

| Dining Out | Lifestyle changes, convenience | Notable increase in restaurant spending in Q1 2024 |

| Direct Sourcing & Cooperatives | Cost control, supply chain flexibility | 15% increase in inquiries about cooperatives among independent grocers (2024) |

| Online Grocery Services | Convenience, competitive pricing | Continued robust expansion; billions in sales facilitated by platforms like Instacart |

| Discount Retailers | Price sensitivity, value focus | Sales growth >10% YoY (H1 2024); >70% consumers seeking grocery savings |

Entrants Threaten

The grocery retail and wholesale distribution sectors demand significant upfront capital. Think about the costs for prime real estate, building or leasing large warehouses, investing in a robust logistics fleet, and stocking inventory. These aren't small figures; for instance, establishing a new supermarket chain in 2024 could easily run into tens of millions, if not hundreds of millions, of dollars before a single customer walks through the door.

Alex Lee’s established MDI distribution network and Lowes Foods retail presence grant it substantial economies of scale. This means they can buy more goods at lower prices and distribute them more efficiently than a newcomer could. For instance, in 2024, the grocery industry saw intense price competition, making these scale advantages even more critical for survival and profitability.

A new entrant would need a massive initial investment to even approach the purchasing power and logistical infrastructure that Alex Lee already possesses. Without this, they would face higher per-unit costs, making it difficult to compete on price with established players who benefit from years of network development and volume discounts.

Brand loyalty is a significant barrier for new entrants in the grocery sector. Lowe's Foods, for instance, has cultivated strong customer recognition and loyalty in its markets by offering a distinctive store experience and actively engaging with local communities. This deep-rooted connection makes it difficult for newcomers to attract and retain customers.

Similarly, MDI benefits from enduring relationships with independent grocers, a network built over many years. These established partnerships represent a formidable hurdle for any new player attempting to penetrate the market, as they already have a solidified customer base and distribution channels.

Regulatory Hurdles and Food Safety Standards

The grocery sector faces significant barriers to entry due to extensive regulations, particularly concerning food safety and intricate supply chain management. New companies must invest heavily in understanding and adhering to these rules, which can be a substantial financial and operational challenge.

Compliance with these regulations, such as those enforced by the Food and Drug Administration (FDA) and the Department of Agriculture (USDA), requires meticulous documentation, quality control, and often specialized infrastructure. For instance, in 2024, the cost of compliance for food businesses can range from thousands to millions of dollars depending on the scale and nature of operations.

- Stringent Food Safety: New entrants must meet rigorous standards like HACCP (Hazard Analysis and Critical Control Points) to prevent contamination.

- Supply Chain Complexity: Navigating regulations for sourcing, transportation, and storage of perishable goods adds significant cost and operational overhead.

- Licensing and Permits: Obtaining necessary federal, state, and local licenses can be a lengthy and expensive process, delaying market entry.

- Product Labeling Requirements: Accurate and compliant labeling, including nutritional information and allergen warnings, demands careful attention and can incur design and verification costs.

Access to Distribution Channels and Supplier Relationships

For a new player entering the retail food space, getting access to dependable supply chains and negotiating good deals with established food producers and distributors presents a significant hurdle. This is particularly true when competing against a company like MDI, which already has strong, long-standing relationships.

Similarly, a new wholesale business would face the daunting task of constructing an extensive network of suppliers and earning the confidence of independent grocery stores. This is made more difficult by MDI's established presence and market penetration, which likely includes exclusive or preferential agreements.

- Supply Chain Dependency: New entrants often rely on existing distributors, which may have limited capacity or prioritize established clients, leaving newcomers with less favorable terms or unreliable stock.

- Supplier Loyalty: Established players like MDI benefit from supplier loyalty built over years, making it harder for new entrants to secure the best products or pricing.

- Distribution Network Costs: Building a comparable distribution network from scratch involves substantial investment in logistics, warehousing, and transportation, which can be prohibitive for startups.

The threat of new entrants into the grocery sector is considerably low for Alex Lee due to substantial capital requirements, established economies of scale, and strong brand loyalty. New companies face immense costs for real estate, logistics, and inventory, with supermarket startups in 2024 potentially needing hundreds of millions. Alex Lee's existing infrastructure and purchasing power, amplified by 2024's price competition, create a significant cost disadvantage for any new competitor.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, drawing from publicly available company filings, reputable industry research reports, and macroeconomic indicators. This comprehensive approach ensures a thorough understanding of the competitive landscape.