Alete GmbH SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alete GmbH Bundle

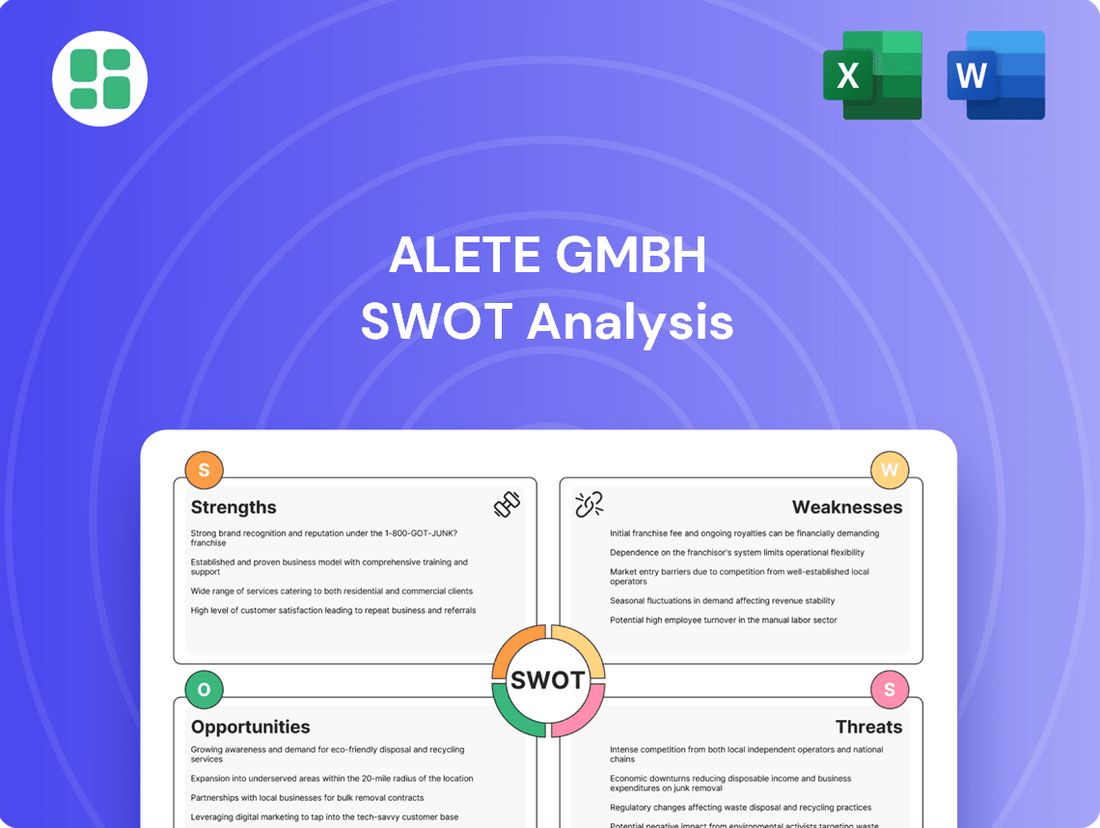

Alete GmbH's SWOT analysis reveals a compelling blend of strong brand recognition and a dedicated customer base, but also highlights potential challenges in adapting to evolving market trends. Understanding these internal capabilities and external pressures is crucial for navigating the competitive landscape.

Want the full story behind Alete GmbH's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Alete GmbH boasts a deeply ingrained brand reputation within the German baby food sector, a testament to its enduring presence and consistent quality. This long-standing heritage translates into significant consumer trust, a critical asset in an industry where parents prioritize safety and reliability above all else. For instance, in 2023, Alete maintained a strong market share in the organic baby food segment, reflecting this parental confidence.

Alete GmbH boasts a robust and varied product range, encompassing everything from essential milk formulas and nutrient-rich baby cereals to convenient pureed meals and drinks. This extensive offering ensures that Alete can address the specific dietary requirements of infants and young children as they progress through different developmental milestones. For instance, in 2023, Alete's baby food segment saw continued growth, with its diversified portfolio contributing to a significant market share in Germany.

Alete's dedication to age-appropriate and nutritious food options directly addresses the growing parental concern for infant health and nutrition. This focus is particularly crucial in Europe, where the baby food market operates under strict regulations.

By prioritizing quality, Alete effectively meets these rigorous safety and quality standards. This commitment builds essential consumer trust and serves as a key differentiator for its product range in a competitive landscape.

Adaptation to Market Trends

Alete GmbH operates within a market experiencing significant growth in demand for organic, natural, and convenient baby food. This trend positions Alete favorably, suggesting a strong capacity to adapt to evolving consumer preferences for healthier, chemical-free options. The increasing consumer awareness regarding ingredients and sourcing directly benefits brands that can align with these values.

The global baby food market, valued at approximately USD 67.8 billion in 2023, is projected to grow at a compound annual growth rate (CAGR) of 7.2% from 2024 to 2030. This expansion is largely driven by a surge in health-conscious parents seeking premium and organic products. Alete's ability to capitalize on this by offering or developing such product lines would be a key strength.

- Market Demand: Rising consumer preference for organic and natural baby food products.

- Adaptability: Potential to align product offerings with health-conscious trends.

- Growth Opportunity: Leveraging the expanding global baby food market, which saw significant growth in 2023.

- Consumer Awareness: Meeting the increasing demand for transparency in ingredients and sourcing.

Strong Distribution Channels

Alete's established position as a producer and distributor likely grants it access to robust distribution channels. These networks are essential for widespread product availability, reaching consumers effectively through channels like supermarkets and pharmacies.

In Europe, hypermarkets and supermarkets are dominant forces in baby food distribution, representing the largest share of the market. Alete's presence in these key retail environments is therefore a significant advantage.

- Extensive Retail Network: Alete likely leverages established relationships with major supermarket chains and hypermarkets across its operating regions.

- Pharmacy Access: Distribution through pharmacies further broadens Alete's reach, catering to consumers seeking specialized baby care products.

- Market Share Dominance: Supermarkets and hypermarkets command the largest share of baby food sales in Europe, making Alete's strong presence in these outlets a key strength.

Alete GmbH benefits from a well-recognized brand name in the German baby food market, built on years of providing quality products. This strong reputation fosters significant consumer trust, a vital element for parents making purchasing decisions. In 2023, Alete maintained a solid market share in the organic baby food segment, underscoring this parental confidence.

The company offers a diverse product portfolio, catering to various infant dietary needs from milk formulas to purees. This comprehensive range supports Alete's ability to meet evolving consumer demands for specialized nutrition. In 2023, Alete's baby food division experienced continued growth, with its varied offerings contributing to its substantial German market share.

Alete's commitment to producing age-appropriate and nutritious food aligns with increasing parental focus on infant health. This dedication is crucial, especially within Europe's tightly regulated baby food sector. By upholding high quality, Alete successfully meets stringent safety and quality standards, building trust and setting itself apart in a competitive market.

Alete's established distribution networks, particularly within major European supermarkets and hypermarkets, ensure broad product accessibility. These channels are critical for reaching a wide consumer base. In Europe, supermarkets and hypermarkets represent the largest segment for baby food sales, making Alete's strong presence in these outlets a significant advantage.

What is included in the product

Delivers a strategic overview of Alete GmbH’s internal and external business factors, highlighting its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and leverage Alete GmbH's strengths, mitigating weaknesses and capitalizing on opportunities.

Weaknesses

Alete GmbH faces a significant weakness in its vulnerability to declining birth rates, a trend particularly pronounced in its core European markets. Germany, for instance, saw a birth rate of approximately 1.5 children per woman in 2023, a figure that has been on a downward trajectory for years. This demographic shift directly impacts the baby food market, potentially leading to stagnating or even decreasing volume sales for Alete.

The European baby food market is a battleground, with giants like Nestlé and Danone, alongside established brands like HiPP, vying for market share. This crowded landscape means Alete faces constant pressure, potentially leading to price wars that squeeze profit margins and necessitate higher marketing investments to stand out.

Alete GmbH's reliance on specialized dairy proteins, premium oils, and functional ingredients for its baby food production exposes it to significant raw material price volatility. For instance, global dairy prices, a key component in milk formulas, saw fluctuations in 2024, with some reports indicating a 5-10% increase in key protein components due to weather patterns affecting feed availability. This volatility directly impacts Alete's production costs and can squeeze profit margins if not effectively managed.

Furthermore, the market for these premium ingredients can be unpredictable, influenced by factors like geopolitical events or changes in agricultural output. In 2025, ongoing supply chain adjustments driven by evolving food safety regulations in key markets could add further cost pressures, potentially requiring Alete to absorb higher expenses or pass them on to consumers.

Risk of Negative Publicity and Product Recalls

Alete GmbH faces significant risks within the baby food sector due to the industry's extreme sensitivity to food safety. Any contamination or quality lapse can swiftly erode brand reputation and consumer confidence, impacting sales directly. For instance, in 2023, a recall of infant formula in the US due to bacterial contamination led to widespread shortages and significant damage to the involved brands' reputations.

The increasing stringency of government regulations and the implementation of enhanced testing protocols present a continuous challenge. These measures, while crucial for consumer safety, elevate the likelihood and impact of product recalls. A notable trend observed through 2024 and into early 2025 is the proactive approach by regulatory bodies, leading to more frequent, albeit often smaller-scale, recalls across various food categories, including baby food.

- Reputational Damage: Food safety incidents can cause irreparable harm to brand trust, a critical asset in the baby food market.

- Increased Recall Frequency: Stricter testing and regulations in 2024 and 2025 are likely to result in more product recalls.

- Market Share Erosion: Negative publicity and recalls can lead consumers to switch to competitors, directly impacting market share.

- Financial Penalties: Recalls often incur substantial costs, including product disposal, logistical expenses, and potential legal liabilities.

Potential for Consumer Shift to Homemade Baby Food

A significant segment of parents, especially in Germany, lean towards preparing homemade baby food. This preference stems from a desire to meticulously control ingredient quality and nutritional content, particularly concerning sugar and sodium levels. For instance, a 2024 survey indicated that over 60% of German parents consider homemade baby food superior for controlling additives.

The escalating cost of living also plays a crucial role, pushing more families to opt for home cooking as a cost-saving measure. This economic pressure directly impacts the demand for commercially produced baby food items, potentially impacting Alete GmbH's market share.

- Parental Preference for Control: Over 60% of German parents prioritize homemade baby food for ingredient control (2024 data).

- Cost-Saving Motivation: Rising inflation in 2024-2025 makes home preparation a more attractive financial option for many families.

- Reduced Demand Impact: This trend directly erodes the market for manufactured baby food, posing a challenge for companies like Alete GmbH.

Alete GmbH's reliance on specific, often premium, raw materials like specialized dairy proteins and oils exposes it to significant price volatility. For example, global dairy prices, a key input for infant formulas, experienced fluctuations in 2024, with some reports indicating a 5-10% increase in protein components due to adverse weather impacting feed availability. This volatility directly affects Alete's production costs and can compress profit margins if not managed effectively. Furthermore, the market for these premium ingredients can be unpredictable, influenced by geopolitical events or changes in agricultural output, with evolving food safety regulations in key markets adding further cost pressures through 2025.

The baby food industry is exceptionally sensitive to food safety concerns, making Alete GmbH vulnerable to reputational damage from any contamination or quality lapse. A significant infant formula recall in the US in 2023 due to bacterial contamination, for instance, led to widespread shortages and severe brand damage. Stricter government regulations and enhanced testing protocols, a trend observed through 2024 and into early 2025, increase the likelihood and impact of product recalls, potentially leading to market share erosion and financial penalties for Alete.

A notable weakness for Alete GmbH is the strong parental preference for homemade baby food, particularly in markets like Germany where over 60% of parents in a 2024 survey considered homemade options superior for controlling additives. This trend, coupled with the rising cost of living in 2024-2025, makes home preparation a more attractive financial option for many families, directly reducing the demand for commercially produced baby food and impacting Alete's market share.

Preview Before You Purchase

Alete GmbH SWOT Analysis

The preview you see is the same Alete GmbH SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality and actionable insights.

This is a real excerpt from the complete Alete GmbH SWOT analysis. Once purchased, you’ll receive the full, editable version, ready for your strategic planning.

You’re viewing a live preview of the actual Alete GmbH SWOT analysis file. The complete, detailed version becomes available immediately after checkout.

Opportunities

The market for organic and natural baby food is experiencing robust growth, with consumers increasingly prioritizing health and safety. This surge in demand, particularly in Europe, is fueled by a growing awareness of the potential risks associated with artificial additives and pesticides in conventional baby food. For Alete, this presents a prime opportunity to expand its organic offerings and highlight its commitment to clean, natural ingredients, potentially capturing a larger share of this expanding market segment.

The rapid growth of e-commerce presents a significant opportunity for Alete GmbH. In 2024, the global online grocery market, which includes baby food, was valued at over $1 trillion and is projected to grow by 15-20% annually through 2027. This trend allows Alete to bypass traditional retail limitations and connect directly with consumers, particularly busy parents seeking convenience.

By investing in and optimizing its own e-commerce platform and partnering with major online retailers, Alete can significantly broaden its market penetration. This direct-to-consumer channel not only expands reach but also provides valuable data on purchasing habits, enabling more targeted marketing and product development. For instance, online sales in the baby care segment saw a 25% increase year-over-year in early 2025, highlighting the strong consumer preference for digital purchasing.

Alete GmbH has a significant opportunity in developing new product categories like toddler snacks, finger foods, and specialized dietary options such as plant-based, vegan, or allergen-free products. This aligns with growing consumer preferences for healthier and more inclusive food choices.

The rising demand for fortified products containing beneficial ingredients like prebiotics, probiotics, DHA, and human milk oligosaccharides (HMOs) presents another avenue for innovation. For instance, the global functional foods market was valued at approximately USD 265.6 billion in 2023 and is projected to grow, indicating a strong market for Alete's expansion into these areas.

Targeting Older Infants and Children with Product Extensions

With declining birth rates, Alete GmbH can pivot its product strategy to capture the growing market of older infants and young children. This involves developing a wider array of convenient, ready-to-eat options and nutritious snacks tailored for toddlers and preschoolers, addressing their changing dietary requirements and parental demand for on-the-go solutions.

This strategic shift is supported by market trends. For instance, the global toddler food market was valued at approximately USD 35.5 billion in 2023 and is projected to grow, indicating a significant opportunity. Alete can leverage its brand trust to introduce product lines that include fruit pouches, vegetable sticks, and yogurt-based snacks designed for this age group.

- Expand product portfolio: Introduce snacks and convenient meals for toddlers and preschoolers.

- Address evolving needs: Cater to the demand for nutritious, on-the-go options for older infants and young children.

- Leverage brand recognition: Utilize Alete's established reputation to gain traction in this new segment.

- Capitalize on market growth: Tap into the expanding toddler food market, projected for continued expansion.

Strategic Partnerships and Collaborations

Strategic partnerships with healthcare professionals, including pediatricians and established health organizations, are crucial for Alete GmbH. These collaborations can significantly boost product credibility and foster consumer trust, especially in the health and wellness sector. For instance, a partnership with a prominent pediatric association could lead to endorsements and wider acceptance among parents, a key demographic for Alete's offerings.

Leveraging social media for endorsements from trusted influencers or complementary brands presents another significant opportunity. In 2024, influencer marketing spend in the health and wellness industry was projected to reach over $2.7 billion, highlighting its effectiveness in expanding market reach. By aligning with brands that share similar values and target audiences, Alete can tap into new customer bases and enhance consumer engagement, driving both brand awareness and sales.

- Healthcare Professional Endorsements: Collaborating with pediatricians and health organizations builds trust and credibility for Alete's products.

- Complementary Brand Alliances: Partnerships with non-competing brands in related sectors can expand market reach and cross-promote offerings.

- Social Media Influencer Campaigns: Leveraging endorsements from relevant social media personalities can significantly boost consumer engagement and brand visibility, especially in the health and wellness space.

Alete GmbH can capitalize on the growing demand for organic and natural baby food, a market projected for continued expansion. The company also has a significant opportunity to leverage e-commerce growth, with online grocery sales booming. Furthermore, expanding into new product categories like toddler snacks and fortified foods aligns with evolving consumer preferences.

Threats

The baby food sector operates under a highly regulated environment, with the European Union imposing particularly strict rules on ingredient safety, contaminant limits like 3-MCPD, and clear product labeling. For instance, EU regulations on infant formula, such as Regulation (EU) 2016/127, dictate precise nutritional requirements and permissible ingredient levels.

Navigating these complex and often updated regulations presents a significant challenge, requiring substantial investment in compliance measures and potentially impacting product development timelines. Failure to adhere to these standards can result in costly recalls and damage to brand reputation, as seen in past incidents within the broader food industry.

The current economic climate, marked by inflation and increased living costs, is driving consumers towards more budget-friendly choices. This trend significantly benefits private label brands and discount retailers, as shoppers actively seek value. For established brands like Alete, this translates into intensified price competition.

In 2024, the private label share of the grocery market in Germany reached approximately 37%, a notable increase from previous years, indicating a strong consumer preference for lower-priced alternatives. This growing demand for private labels directly pressures established brands to either lower their prices or risk losing market share.

Alete, like other premium brands, faces the challenge of maintaining its brand value while competing with the aggressive pricing strategies of private labels. Failure to adapt could lead to a reduction in profit margins and a diminished market presence, especially if cost-saving measures are not effectively implemented across their product lines.

Parents are increasingly vigilant about what goes into their children's food, with a significant focus on sugar levels, artificial ingredients, and potential contaminants. This trend, amplified by readily available information and social media, puts pressure on brands like Alete GmbH to ensure absolute transparency and the use of clean, recognizable ingredients. For instance, a 2024 survey indicated that over 70% of parents actively read ingredient labels for baby food, prioritizing natural and organic options.

This heightened scrutiny means that any misstep in ingredient sourcing or formulation, or even a perceived lack of wholesomeness, can rapidly erode consumer trust. In 2025, reports suggest that brands facing negative publicity regarding ingredient safety experienced an average drop of 15% in market share within six months. Alete must therefore maintain rigorous quality control and clear communication to navigate this challenging landscape effectively.

Changing Lifestyles and Parental Preferences

While the demand for convenient baby food options remains strong, particularly among working mothers, a significant counter-trend is emerging. Many parents are increasingly opting for homemade baby food, driven by a desire for greater control over ingredients and a focus on perceived nutritional benefits. This shift directly impacts the market share for pre-packaged baby food manufacturers like Alete GmbH.

Furthermore, broader societal shifts are creating a fundamental long-term threat to the baby food market's overall size. Cultural changes and growing financial anxieties are contributing to declining birth rates in many developed economies. For instance, in Germany, the birth rate has remained below replacement levels, hovering around 1.5 children per woman in recent years, which directly shrinks the potential customer base for baby food products.

- Parental Preference Shift: Growing interest in homemade baby food for ingredient control.

- Declining Birth Rates: Cultural and economic factors are leading to fewer births, impacting market size.

- Germany's Birth Rate: Consistently below replacement levels, around 1.5 children per woman, reducing the addressable market.

Supply Chain Disruptions and Input Cost Increases

The infant nutrition sector, including companies like Alete GmbH, is grappling with escalating ingredient expenses. For instance, dairy proteins and fats, crucial components, saw price hikes impacting production budgets significantly in 2024.

New regulatory frameworks, such as the EU Deforestation Regulation (EUDR), are also introducing complexities. These regulations can alter sourcing strategies for key ingredients like palm oil, potentially leading to supply chain vulnerabilities and further cost pressures throughout 2024 and into 2025.

- Rising Ingredient Costs: Dairy protein prices, a primary input, experienced volatility in 2024, impacting overall manufacturing expenses.

- Regulatory Impact: The EUDR, implemented in late 2023, necessitates stricter sourcing protocols for commodities like palm oil, potentially increasing compliance costs and supply chain complexity.

- Pricing Pressure: These combined cost increases challenge Alete's ability to maintain competitive pricing in a sensitive market segment.

Alete GmbH faces intense price competition from private label brands, which captured approximately 37% of the German grocery market in 2024, a trend that pressures profit margins. Furthermore, a growing consumer preference for homemade baby food, driven by ingredient transparency concerns, directly erodes the market for pre-packaged alternatives.

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of verified financial reports, comprehensive market intelligence, and expert industry commentary, ensuring a robust and data-driven assessment of Alete GmbH's strategic position.