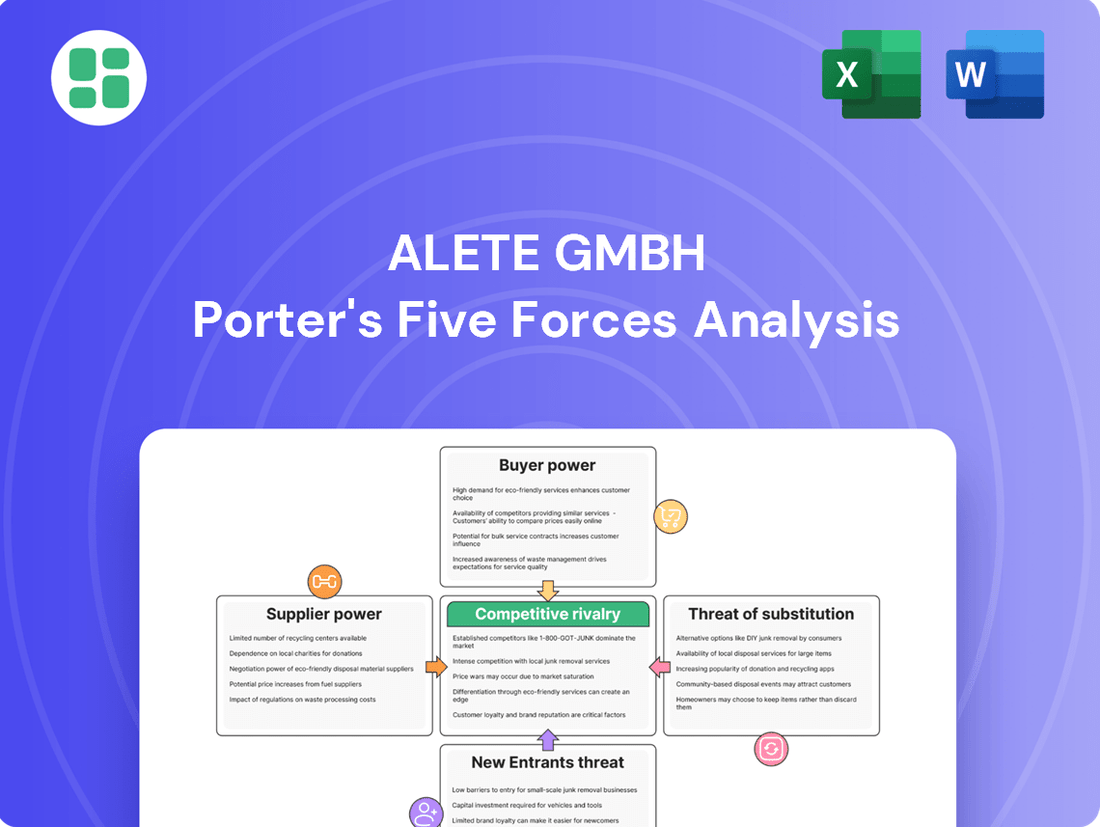

Alete GmbH Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alete GmbH Bundle

Alete GmbH navigates a competitive landscape shaped by powerful buyer bargaining, intense rivalry, and the ever-present threat of substitutes. Understanding these forces is crucial for any stakeholder.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Alete GmbH’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Alete GmbH's reliance on specialized, high-quality ingredients like organic milk, fruits, vegetables, and grains means they often deal with a select group of suppliers. These suppliers must meet rigorous safety and nutritional standards, particularly crucial for infant food. This specialization grants them a degree of leverage.

The purity and contaminant-free nature demanded for infant nutrition ingredients empower these specialized suppliers with moderate bargaining power. If these suppliers were to increase prices or face supply disruptions, Alete's production costs and overall profitability could be directly affected, highlighting the importance of strong supplier relationships.

Suppliers of essential testing services, certifications, and specialized equipment for baby food production wield considerable bargaining power. This strength stems directly from the stringent regulatory landscape governing infant nutrition. For instance, European Union regulations, such as those detailed in Regulation (EU) 2016/127, mandate exacting standards for infant formula and complementary foods, leaving Alete GmbH with little room for negotiation on compliance.

Alete's reliance on suppliers who can consistently meet these rigorous EU requirements, including microbiological testing and nutritional analysis, significantly curtails its ability to switch providers. The cost and time associated with validating new suppliers to ensure adherence to these complex rules, which can include detailed allergen testing and heavy metal analysis, further consolidate the power of existing, compliant partners. In 2024, the global baby food market reached an estimated value of over $75 billion, underscoring the critical importance of maintaining product integrity through these essential supplier inputs.

The bargaining power of logistics and packaging providers for Alete GmbH is influenced by the specialized requirements of baby food. While general logistics are often competitive, the need for sterile packaging and potentially cold chain management for sensitive infant products can elevate the leverage of these suppliers. For instance, in 2024, the global market for sterile packaging solutions saw significant demand, with companies investing in advanced technologies to meet stringent food safety regulations, a trend that likely continued into early 2025.

Suppliers offering specialized packaging that adheres to rigorous food safety and preservation standards for delicate baby food products can command greater negotiation power. This specialization limits the pool of viable partners, allowing these providers to potentially dictate terms. The increasing consumer focus on product integrity and shelf-life in the baby food sector further underscores the importance of these specialized capabilities, translating into higher costs and reduced bargaining flexibility for Alete.

Brand Reputation and Quality Assurance

Suppliers with established reputations for consistent quality and safety hold significant sway in the baby food sector, where product integrity is non-negotiable. Alete's brand image is intrinsically linked to the caliber of its ingredients, making the company hesitant to change suppliers based solely on price if it jeopardizes product safety or erodes consumer confidence.

This prioritization of quality over cost inherently bolsters the leverage of reputable suppliers. For instance, in 2024, the global baby food market was valued at approximately $75 billion, with safety and quality being primary purchasing drivers for consumers. Alete's commitment to sourcing premium organic fruits, a key component of its product line, means that suppliers of these specialized ingredients can command higher prices due to the stringent quality controls and certifications required.

- Brand Reputation: Alete's strong brand equity in the premium baby food segment relies heavily on ingredient quality, making it less susceptible to price-driven supplier changes.

- Quality Assurance: The baby food industry's strict safety regulations and consumer expectations for purity mean that suppliers meeting these high standards have increased bargaining power.

- Ingredient Specialization: Suppliers providing certified organic or uniquely sourced fruits and vegetables, crucial for Alete's product differentiation, can negotiate more favorable terms.

- Consumer Trust: Any perceived compromise in ingredient quality could lead to significant brand damage, reinforcing Alete's reliance on trusted, high-quality suppliers.

Limited Supplier Base for Niche Ingredients

For highly specialized ingredients like certain probiotics or human milk oligosaccharides (HMOs) used in infant nutrition, the number of available suppliers is often very limited. This scarcity significantly strengthens the bargaining power of these niche ingredient providers.

Alete GmbH, for instance, might find that sourcing unique fortified ingredients, crucial for advanced infant formulas, means dealing with a small pool of manufacturers. This exclusivity can drive up costs and create dependencies, as finding viable alternatives could involve substantial research and development investment and considerable time, potentially delaying product launches.

- Limited Supplier Base: In 2024, the market for specific functional ingredients like HMOs, essential for infant formula, is dominated by a few key global players.

- High Switching Costs: For Alete, changing suppliers for these specialized components could necessitate extensive reformulation and re-validation, impacting production timelines and R&D budgets.

- Supplier Exclusivity: The proprietary nature of some advanced ingredients means few, if any, alternative suppliers exist, granting significant leverage to the current providers.

The bargaining power of suppliers for Alete GmbH is generally moderate to high, particularly for specialized ingredients and services critical to infant nutrition. This is driven by stringent quality and safety regulations, limited supplier bases for niche components, and the high cost of switching providers, all of which empower suppliers to command better terms. For example, in 2024, the global baby food market, valued at over $75 billion, places immense emphasis on ingredient purity and safety, allowing compliant suppliers to leverage this demand.

| Factor | Impact on Alete GmbH | Example Data (2024) |

|---|---|---|

| Ingredient Specialization (Organic, Fortified) | Moderate to High Supplier Power | Global organic food market growth projected to exceed 10% annually. |

| Regulatory Compliance (EU Standards) | High Supplier Power | Strict EU regulations (e.g., Regulation (EU) 2016/127) mandate rigorous testing, limiting Alete's negotiation options. |

| Niche Ingredients (e.g., HMOs) | Very High Supplier Power | Market for specific functional ingredients often dominated by a few key global players, creating scarcity. |

| Brand Reputation & Consumer Trust | Moderate Supplier Power | Consumers prioritize safety and quality, making Alete hesitant to switch suppliers if it risks brand image. |

What is included in the product

This analysis meticulously examines the competitive forces shaping Alete GmbH's market, detailing threats from new entrants, the bargaining power of buyers and suppliers, the intensity of rivalry, and the impact of substitutes.

Instantly identify and mitigate competitive threats with a dynamic, visual representation of all five forces.

Customers Bargaining Power

Individual parents, Alete's end-users, wield substantial bargaining power. Their price sensitivity is heightened by the current economic climate, with inflation impacting household budgets significantly. For instance, the German consumer price index saw an average increase of 5.9% in 2023, a factor that directly influences purchasing decisions for baby food.

Furthermore, parents now have unprecedented access to information. They can readily compare ingredients, nutritional values, and prices online and through various retail platforms. This transparency empowers them to seek out specific product attributes like organic certification or non-GMO ingredients, readily available from competitors, thereby intensifying pressure on Alete.

Major supermarket and hypermarket chains, the primary avenues for Alete GmbH's baby food distribution, wield considerable influence. These retail giants, often commanding significant market share, can dictate terms like pricing, promotional support, and prime shelf placement, leveraging their vast customer reach and sales volumes to their advantage.

The expansion of online retail significantly amplifies customer bargaining power by offering unparalleled choice and ease of price comparison. For instance, in 2024, global e-commerce sales are projected to reach over $6.5 trillion, a figure that underscores the vastness of consumer options available.

Furthermore, the increasing prevalence of private-label baby food brands, often priced 20-30% lower than national brands, presents a compelling alternative for budget-conscious parents. This trend directly pressures established brands like Alete, as consumers are more willing to switch to more affordable options, especially when quality perceptions are similar.

Influence of Pediatricians and Health Professionals

Pediatricians and other healthcare professionals hold significant sway over parental decisions concerning infant nutrition. Their recommendations often dictate which specialized formulas parents choose, thereby granting them considerable indirect bargaining power over baby food manufacturers like Alete GmbH. For instance, in 2024, studies indicated that over 70% of parents consult their pediatrician before selecting an infant formula, especially for those with specific dietary needs.

Alete's strategy must therefore involve close alignment with current health guidelines and expert recommendations. This ensures product credibility and directly influences consumer adoption. Manufacturers that actively engage with the medical community and support research are better positioned to meet evolving parental expectations and secure market share.

- Healthcare professional recommendations are a primary driver of infant formula choice.

- In 2024, a substantial majority of parents sought pediatrician advice for formula selection.

- Manufacturers must align products with expert health guidelines to build trust and demand.

Low Switching Costs for Standard Products

For standard baby food items such as pureed fruits and cereals, customers face minimal barriers when switching between brands. Parents can readily opt for a different manufacturer if a more attractive price point, a perceived superior nutritional profile, or a flavor better suited to their infant's palate becomes available. This ease of transition directly fuels fierce competition, pushing companies to differentiate on factors beyond mere brand recognition.

The bargaining power of customers in the baby food market is significantly amplified by low switching costs for these standardized products. For instance, in 2024, the average price difference between leading organic baby food brands for a 4-ounce jar of fruit puree ranged between 5% and 10%. This narrow price gap encourages consumers to actively compare options, making price a key determinant in purchasing decisions.

- Low Switching Costs: Parents can easily switch between baby food brands without incurring significant financial or effort-related penalties.

- Price Sensitivity: A small price difference can be a major driver for consumers to change brands, especially for staple products like cereals and purees.

- Preference-Driven Choices: Infant's taste preferences and parental perceptions of healthiness also play a crucial role, allowing for brand fluidity.

Customers' bargaining power is a significant factor for Alete GmbH. Individual parents, as the end-users, are highly price-sensitive, especially given the economic climate. For example, German consumer prices rose by 5.9% on average in 2023, impacting household budgets and purchasing decisions for essential items like baby food.

The rise of e-commerce further amplifies this power. With global e-commerce sales projected to exceed $6.5 trillion in 2024, consumers have vast choices and can easily compare prices and ingredients online, putting pressure on brands to remain competitive.

The availability of lower-priced private-label brands, often 20-30% cheaper than national brands, presents a strong alternative for cost-conscious parents, encouraging brand switching when perceived quality is similar.

| Customer Segment | Bargaining Power Drivers | Impact on Alete GmbH |

|---|---|---|

| Individual Parents | Price Sensitivity (e.g., 5.9% inflation in Germany 2023) | Increased demand for value, potential for brand switching |

| Retailers (Supermarkets) | Market Share, Sales Volume | Ability to dictate pricing, shelf space, and promotional terms |

| Online Consumers | Access to Information, Price Comparison (e.g., $6.5T global e-commerce 2024) | Heightened price competition, need for online presence and competitive pricing |

| Private Label Brands | Lower Price Points (20-30% cheaper) | Direct competition, pressure on Alete's pricing strategy |

Preview Before You Purchase

Alete GmbH Porter's Five Forces Analysis

You are looking at the actual Alete GmbH Porter's Five Forces Analysis. Once you complete your purchase, you’ll get instant access to this exact, comprehensive document, providing a detailed breakdown of industry competition and profitability factors.

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders, ensuring you get a complete and professionally formatted analysis of Alete GmbH's competitive landscape.

The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy, offering actionable insights into the forces shaping Alete GmbH's market.

Rivalry Among Competitors

The European and German baby food market is a battleground for major players. Global titans like Nestlé and Danone, alongside regional powerhouses such as HiPP and Holle, fiercely compete. These established companies leverage significant financial backing, deep brand loyalty, and extensive distribution channels, creating substantial barriers for emerging competitors.

Competitive rivalry in the infant nutrition market is intense, fueled by relentless product innovation. Companies actively differentiate by offering organic certifications, a growing array of plant-based alternatives, and the incorporation of functional ingredients like probiotics and prebiotics to cater to specific health needs.

Manufacturers consistently introduce new product lines to align with shifting parental demands for healthier and more specialized infant nutrition. For instance, the global infant formula market was valued at approximately $58.9 billion in 2023 and is projected to reach over $89.2 billion by 2030, indicating significant investment in product development and market expansion.

Companies in this sector invest heavily in marketing and brand development to build trust with parents, as safety and quality are top priorities. For instance, in 2024, the global baby care market saw significant marketing spend, with brands utilizing influencer endorsements and targeted digital campaigns. This focus on brand loyalty intensifies competition, as new entrants must overcome established brand recognition.

Stagnating Birth Rates in Key Markets

Germany's declining birth rate, a significant demographic shift, directly impacts Alete GmbH by creating a smaller customer base for infant nutrition products. This stagnation in births, with Germany's birth rate hovering around 1.5 children per woman in recent years, intensifies rivalry as companies vie for a shrinking market share. Consequently, Alete must innovate and adapt to maintain sales volume.

The pressure from stagnating birth rates forces companies like Alete to shift their strategic focus. Instead of solely targeting newborns, there's an increased emphasis on older infants and toddlers, necessitating product diversification into areas like snacks and finger foods. This demographic challenge directly fuels competitive intensity as companies battle for the attention and spending of a more limited cohort of young families.

- Stagnating Birth Rate: Germany's birth rate has been consistently below replacement level, impacting the volume of new customers for infant products.

- Market Saturation: With fewer births, the market for traditional infant formula and baby food becomes more saturated, intensifying competition.

- Product Diversification: Companies are compelled to expand their product lines beyond basic infant nutrition to capture spending from families with older children or to attract new consumer segments.

- Increased Marketing Spend: To capture market share in a slower-growing market, companies may increase their marketing and promotional expenditures, further raising competitive pressures.

Pricing Pressure from Private Labels and Cost-Conscious Consumers

The increasing prevalence of private-label brands significantly intensifies competitive rivalry. These store-brand alternatives often offer comparable quality at a lower price point, directly challenging established brands like Alete. For instance, in 2024, private label market share in many grocery categories continued to grow, with some reports indicating it reached over 20% in key European markets.

Consumers, particularly in periods of economic uncertainty, exhibit heightened price sensitivity. This trend forces companies to carefully consider their pricing strategies. Alete must navigate this by balancing its premium brand image with the need to remain competitive against more budget-friendly options.

- Private Label Growth: Private label market share in key European grocery sectors is projected to exceed 22% by the end of 2024, a notable increase from previous years.

- Price Sensitivity Index: Consumer surveys in early 2024 indicated a 15% rise in price sensitivity across essential goods compared to the previous year.

- Margin Squeeze: The need to compete on price with private labels can put pressure on Alete's profit margins, potentially impacting reinvestment in product development or marketing.

- Brand Loyalty Erosion: In challenging economic climates, brand loyalty can diminish as consumers prioritize value, making it harder for premium brands to retain market share without price adjustments.

The competitive landscape for Alete GmbH is characterized by intense rivalry among global and regional players, all vying for a share of a market impacted by declining birth rates. This dynamic forces companies to innovate aggressively and manage pricing carefully.

Companies are investing heavily in product differentiation, focusing on organic, plant-based, and functional ingredients to meet evolving consumer demands. For example, the global infant nutrition market saw significant investment in new product launches throughout 2024, with a particular emphasis on specialized dietary needs and sustainable sourcing.

The rise of private-label brands, offering competitive pricing, further intensifies this rivalry. In 2024, private labels continued to gain traction in European grocery markets, with some segments reaching over 20% market share, putting pressure on established brands to justify premium pricing.

| Competitor Type | Key Strategies | Market Impact |

| Global Giants (e.g., Nestlé, Danone) | Extensive R&D, broad product portfolios, strong brand recognition, global distribution | Set market trends, high barriers to entry, significant marketing spend |

| Regional Powerhouses (e.g., HiPP, Holle) | Focus on organic/natural, strong local brand loyalty, specialized offerings | Capture niche markets, influence consumer preferences, drive innovation in specific segments |

| Private Labels | Price competitiveness, supermarket partnerships, value-driven marketing | Erode market share of premium brands, increase price sensitivity, pressure margins |

SSubstitutes Threaten

Breastfeeding stands as the most potent substitute for infant formula and prepared baby foods. Health organizations worldwide champion it as the optimal nutrition for infants, directly capping the market potential for manufactured baby food, especially for newborns. For instance, the World Health Organization (WHO) recommends exclusive breastfeeding for the first six months of life and continued breastfeeding alongside complementary foods up to two years or beyond.

The growing trend of parents preparing homemade baby food, particularly in Germany, presents a significant threat of substitutes for Alete GmbH. Many parents prioritize controlling ingredients, freshness, and nutritional value, leading them to opt for scratch cooking over pre-packaged options. This preference directly impacts the demand for manufactured baby food.

In 2024, consumer surveys indicated that over 60% of German parents with infants under two years old reported preparing some form of homemade baby food regularly. This shift is driven by concerns about additives and a desire for cost savings, as homemade options can be considerably cheaper than commercial brands, potentially reducing Alete's market share.

As infants mature, typically around 12 months, they begin a natural transition from specialized baby food to modified versions of regular family meals. This developmental stage inherently limits the duration of demand for dedicated infant nutrition products.

This gradual shift to adult foods represents a continuous form of substitution for Alete GmbH. For instance, in 2024, the global baby food market, while substantial, faces this inherent limitation as children age out of the primary consumer group.

Alternative Milk Sources (e.g., Cow's Milk for Older Infants)

For infants over six months, whole cow's milk can serve as a temporary, emergency substitute for specialized infant formula. While it doesn't offer the complete nutritional balance of formula, it can meet immediate needs, potentially reducing reliance on infant milk formulas in specific, short-term scenarios.

This creates a degree of threat, as parents might opt for readily available cow's milk if formula is scarce or unaffordable. For instance, in 2024, global infant formula sales reached an estimated $55 billion, indicating a significant market where even a small shift to alternatives could impact manufacturers.

- Nutritional Gap: Cow's milk lacks essential micronutrients like iron and vitamin D, crucial for infant development.

- Temporary Solution: It's not a long-term replacement and requires careful consideration of infant age and dietary needs.

- Market Impact: While a limited threat, it highlights the importance of formula accessibility and affordability.

Emergence of Niche and Specialized Diets

The rise of specialized diets, such as plant-based or allergen-free options, presents a significant threat of substitutes for conventional baby food manufacturers like Alete GmbH. Parents increasingly seek alternative feeding solutions outside traditional baby food ranges, driven by evolving nutritional awareness and specific infant needs. For instance, the global plant-based food market was valued at approximately $27 billion in 2023 and is projected to reach over $160 billion by 2030, indicating a strong consumer shift that can divert demand from established products.

While Alete GmbH and similar companies are adapting by introducing new product lines, the growing availability of diverse dietary alternatives from niche providers or through homemade preparations poses a direct substitution threat. These alternatives cater to specific requirements, offering a perceived advantage in terms of ingredient control or tailored nutrition. For example, the market for infant formula alternatives, including those catering to specific allergies, has seen substantial growth, with some reports suggesting double-digit annual growth rates in recent years.

The threat is amplified as more parents embrace DIY approaches, utilizing readily available ingredients to create custom baby food. This trend is supported by the proliferation of online resources and communities sharing recipes and advice for homemade infant nutrition. The accessibility and perceived health benefits of these alternatives can directly impact Alete's market share if they do not adequately address these evolving consumer preferences. In 2024, the demand for transparency in ingredients and a move away from processed foods continue to fuel the appeal of substitutes.

The key substitution threats include:

- Increased availability of plant-based and allergen-free baby food options from competitors.

- Growth in homemade baby food preparation driven by online resources and health trends.

- Parents opting for fresh, whole-food alternatives over processed baby food products.

The threat of substitutes for Alete GmbH is significant, primarily stemming from breastfeeding and the growing trend of homemade baby food. Health organizations strongly advocate for breastfeeding, directly limiting the market for infant formula, especially for newborns. In 2024, over 60% of German parents with infants under two years old reported preparing homemade baby food regularly, driven by cost savings and ingredient control.

As infants transition to family meals around 12 months, demand for specialized baby food naturally declines, representing an ongoing substitution. Furthermore, the rise of specialized diets like plant-based or allergen-free options, coupled with accessible online resources for DIY baby food, presents a growing challenge. These alternatives cater to evolving nutritional awareness and specific infant needs, potentially diverting demand from conventional products.

| Substitute Type | Key Drivers | 2024 Market Relevance |

|---|---|---|

| Breastfeeding | Health recommendations (WHO), natural nutrition | Primary nutrition for infants < 6 months; limits formula market |

| Homemade Baby Food | Ingredient control, cost savings, health trends | Over 60% of German parents with infants < 2 years prepare regularly |

| Transition to Family Meals | Infant development, reduced need for specialized food | Limits demand duration for dedicated baby food products |

| Specialized Diets (Plant-based, Allergen-free) | Nutritional awareness, specific infant needs | Growing market segment, increasing availability from niche providers |

Entrants Threaten

The threat of new entrants in the baby food market is significantly mitigated by the substantial capital investment required. Establishing state-of-the-art manufacturing facilities, acquiring specialized equipment, and funding rigorous research and development for safe and nutritious products demand hundreds of millions of euros. For instance, setting up a modern baby food production line can easily exceed €50 million.

Furthermore, established companies like Alete GmbH leverage significant economies of scale. This means they can produce and distribute their products at a lower per-unit cost than a new entrant would be able to achieve initially. Without a similarly massive upfront investment, new players would struggle to match the pricing power of incumbents, making market penetration exceedingly challenging.

The baby food market operates under exceptionally strict health, safety, and nutritional regulations, especially within the European Union and Germany. These stringent rules mean that any new company looking to enter must navigate a complex web of compliance, significantly raising the bar for market entry.

New entrants are confronted with substantial compliance costs, which include rigorous product testing, adherence to specific labeling standards, and often lengthy approval procedures. For instance, the EU's General Food Law (Regulation (EC) No 178/2002) and specific regulations for infant formula and baby food impose demanding requirements that can deter smaller or less capitalized competitors.

These high compliance costs and the time-consuming nature of regulatory approvals create a formidable barrier to entry. Companies must invest heavily in research and development, quality control, and legal expertise to meet these standards, making it difficult for new players to compete effectively against established brands that have already absorbed these costs.

In the baby food market, where parents place a premium on safety and health, strong brand loyalty is a significant barrier. Alete, for instance, has cultivated trust over many years, making it difficult for newcomers to quickly win over consumers without extensive marketing or a demonstrated history of quality.

Developed Distribution Networks

The threat of new entrants for Alete GmbH is significantly impacted by the established distribution networks. Access to major retail channels like hypermarkets, supermarkets, and pharmacies is crucial for reaching consumers, and these channels are already well-penetrated by existing brands.

Newcomers face substantial hurdles in securing prime shelf space and favorable distribution agreements. Incumbent players, like Alete, have cultivated long-standing relationships with these retailers, giving them a distinct advantage. This makes it difficult for new entrants to gain visibility and market share. In 2024, for instance, the grocery retail sector in Germany saw continued consolidation, with the top five retailers accounting for over 70% of sales, further solidifying the power of established distribution channels.

- High Barrier to Entry: Established relationships with major retailers create a significant barrier for new companies.

- Securing Shelf Space: New entrants struggle to compete for limited and valuable shelf space against well-established brands.

- Distribution Costs: Building a comparable distribution network from scratch would involve substantial investment and time.

Intense Competition from Existing Players

The threat of new entrants for Alete GmbH is significantly mitigated by the established dominance of a few large, well-resourced players in the market. These incumbents are continuously innovating and broadening their product offerings, creating a high barrier to entry. For instance, in 2024, the global sports nutrition market, where Alete operates, was valued at approximately $59.1 billion and is projected to grow, indicating significant investment capacity from existing firms.

Any new company attempting to enter this space would immediately confront fierce competition. Incumbents are likely to retaliate aggressively against new entrants, employing strategies such as price wars, extensive product diversification, and robust marketing initiatives to protect their market share. This intense rivalry means that a new entrant would need substantial capital and a highly differentiated value proposition to even begin to gain traction.

- Dominant Incumbents: The market features established players with significant financial and operational capabilities.

- Innovation and Expansion: Existing companies are constantly introducing new products and expanding their reach.

- Aggressive Defense Strategies: New entrants can expect strong pushback through pricing, product variety, and marketing.

- High Capital Requirements: Overcoming these barriers necessitates substantial financial resources and a unique market approach.

The threat of new entrants for Alete GmbH is considerably low due to high capital requirements, stringent regulatory hurdles, and established brand loyalty. New companies face immense costs for production facilities, R&D, and navigating complex safety regulations, with initial setup costs for a production line easily exceeding €50 million. Furthermore, securing prime shelf space in a market dominated by a few large players, who are actively innovating and have strong retailer relationships, presents a significant challenge.

| Barrier Type | Description | Estimated Cost/Impact |

|---|---|---|

| Capital Requirements | Establishing modern production facilities and R&D. | €50M+ for a single production line. |

| Regulatory Compliance | Meeting EU/German health, safety, and nutritional standards. | Significant investment in testing, legal expertise, and lengthy approval processes. |

| Distribution Networks | Gaining access to major retail channels. | Challenging due to retailer consolidation (top 5 retailers >70% of German grocery sales in 2024) and established incumbent relationships. |

| Brand Loyalty | Winning consumer trust against established brands. | Requires extensive marketing and a proven history of quality. |

| Incumbent Competition | Facing aggressive defense strategies from large players. | Potential for price wars and intense marketing battles. |

Porter's Five Forces Analysis Data Sources

Our Alete GmbH Porter's Five Forces analysis is built upon a foundation of robust data, drawing from industry-specific market research reports, financial statements from publicly traded competitors, and official company disclosures. This blend ensures a comprehensive understanding of competitive dynamics.