Aker Solutions PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aker Solutions Bundle

Navigate the complex external forces shaping Aker Solutions' future with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements are creating both challenges and opportunities for the company. Equip yourself with actionable intelligence to refine your own strategic planning and investment decisions. Download the full PESTLE analysis now and gain a critical competitive advantage.

Political factors

Global governments are accelerating the energy transition through policies and incentives, influencing companies like Aker Solutions that operate in both traditional and renewable energy sectors. For instance, the EU's Green Deal aims for climate neutrality by 2050, driving substantial investment in areas like offshore wind and carbon capture technologies, which are key growth areas for Aker Solutions.

National renewable energy targets, such as those in the UK and Norway, further stimulate demand for Aker Solutions' expertise in offshore wind farm development and CCUS projects. These policy shifts are crucial as Aker Solutions strategically navigates this evolving landscape, balancing its established oil and gas services with significant expansion into emerging energy markets.

Aker Solutions' global footprint, spanning over 15 countries, exposes it to the complexities of geopolitical stability and diverse regional regulations. Political stability in these operational areas is crucial, directly impacting project schedules, the safety of investments, and the overall efficiency of business operations. For instance, a sudden shift in a major market's political climate could delay a significant offshore wind project, impacting revenue streams.

Fluctuations in local content mandates and evolving trade policies present ongoing challenges. These changes can disrupt established supply chains and increase operational expenses, requiring Aker Solutions to maintain agile strategies. For example, a new regulation in Brazil requiring a higher percentage of locally sourced materials for subsea equipment could necessitate renegotiating supplier contracts and potentially increase lead times.

Aker Solutions' core business still heavily relies on oil and gas projects, making the regulatory landscape critical. Environmental permits, safety standards, and operational licenses are key, and these rules differ greatly by country. For instance, in 2024, Norway, a major market for Aker Solutions, continued its stringent environmental regulations for offshore operations, impacting project approval timelines.

Changes in these frameworks can directly affect Aker Solutions' bottom line. Stricter environmental rules, like increased carbon taxes or emissions caps, could raise operating costs or even make certain projects uneconomical. For example, a proposed carbon tax increase in the UK North Sea, discussed in late 2024, could add significant financial pressure on exploration and production activities.

International Climate Agreements and Commitments

International climate agreements, like the Paris Agreement, and national emissions reduction targets directly shape the market for Aker Solutions' low-carbon technologies. The company's strategic investments in carbon capture, utilization, and storage (CCUS) and offshore wind are well-positioned to capitalize on these global decarbonization trends. For instance, by 2023, over 100 countries had submitted enhanced Nationally Determined Contributions (NDCs) under the Paris Agreement, signaling a strong commitment to emission cuts.

These global commitments translate into tangible market opportunities for Aker Solutions. Governments are increasingly prioritizing and funding CCUS projects, which is a key area for the company. The International Energy Agency (IEA) reported in its 2023 CCUS special report that global investment in CCUS projects reached approximately $10 billion in 2022, a significant increase driven by policy support and industrial decarbonization efforts.

- Global Policy Alignment: International climate accords create a regulatory environment that favors Aker Solutions' low-carbon product portfolio.

- Increased CCUS Investment: Government incentives and private sector commitments are driving substantial growth in the CCUS market, directly benefiting Aker Solutions.

- Offshore Wind Expansion: Commitments to renewable energy targets are fueling the expansion of offshore wind, a core area of Aker Solutions' business.

Subsidies and Financial Incentives for Renewables

Government subsidies and financial incentives are crucial political drivers for the renewable energy sector, especially offshore wind. These programs, including tax credits and direct financial support, significantly lower project development costs and mitigate investment risks. For instance, the Inflation Reduction Act (IRA) in the United States, enacted in 2022, provides substantial tax credits for renewable energy projects, including offshore wind, extending through 2032. This policy directly supports companies like Aker Solutions as they scale up their offshore wind operations and technology development.

These financial mechanisms are designed to accelerate the adoption of clean energy technologies and build necessary infrastructure. By making projects more economically viable, they encourage investment in areas like offshore wind farm construction and associated supply chains. Aker Solutions, with its focus on offshore wind solutions, directly benefits from this supportive policy environment, which underpins its strategic expansion in the renewables market.

The availability and longevity of these incentives directly impact Aker Solutions' investment decisions and project pipeline. For example, the European Union's Green Deal and associated funding mechanisms, including the Just Transition Fund, aim to support regions in shifting towards a climate-neutral economy, which includes substantial investment in renewable energy infrastructure. This creates a more predictable and favorable landscape for Aker Solutions to pursue and secure new offshore wind contracts.

Key political factors influencing Aker Solutions' renewables business include:

- Government subsidies and tax credits: Such as the US Inflation Reduction Act, which offers significant incentives for renewable energy projects.

- Policy stability and long-term commitments: Predictable policy frameworks encourage sustained investment in offshore wind.

- Support for domestic manufacturing and supply chains: Policies that promote local content development can create opportunities for companies like Aker Solutions.

Government policies are a significant driver for Aker Solutions, particularly in the energy transition. International agreements like the Paris Agreement and national targets for emission reductions directly boost demand for the company's low-carbon solutions. For example, over 100 countries enhanced their Nationally Determined Contributions (NDCs) by 2023, signaling a strong global commitment to decarbonization.

Government subsidies and tax credits, such as the US Inflation Reduction Act, are crucial for accelerating renewable energy projects like offshore wind, Aker Solutions' key growth area. These incentives reduce project costs and risks, making investments more attractive and supporting the expansion of clean energy infrastructure. Policy stability in these areas is vital for Aker Solutions' long-term investment decisions.

Geopolitical stability and evolving regional regulations also impact Aker Solutions' global operations. Political shifts in key markets can affect project timelines and investment security. Furthermore, varying local content mandates and trade policies require Aker Solutions to maintain agile supply chain strategies to navigate these complexities effectively.

| Political Factor | Impact on Aker Solutions | Example/Data (2023-2025) |

| Energy Transition Policies | Drives demand for renewables and CCUS | EU Green Deal aims for climate neutrality by 2050; 100+ countries enhanced NDCs by 2023. |

| Subsidies & Tax Credits | Reduces renewable project costs, mitigates risk | US Inflation Reduction Act (IRA) provides significant tax credits for renewables through 2032. |

| Geopolitical Stability | Affects project timelines and investment security | Political instability in a key market could delay a major offshore wind project. |

| Regulatory Landscape | Impacts operational costs and project approvals | Norway's stringent environmental regulations for offshore operations continue in 2024. |

What is included in the product

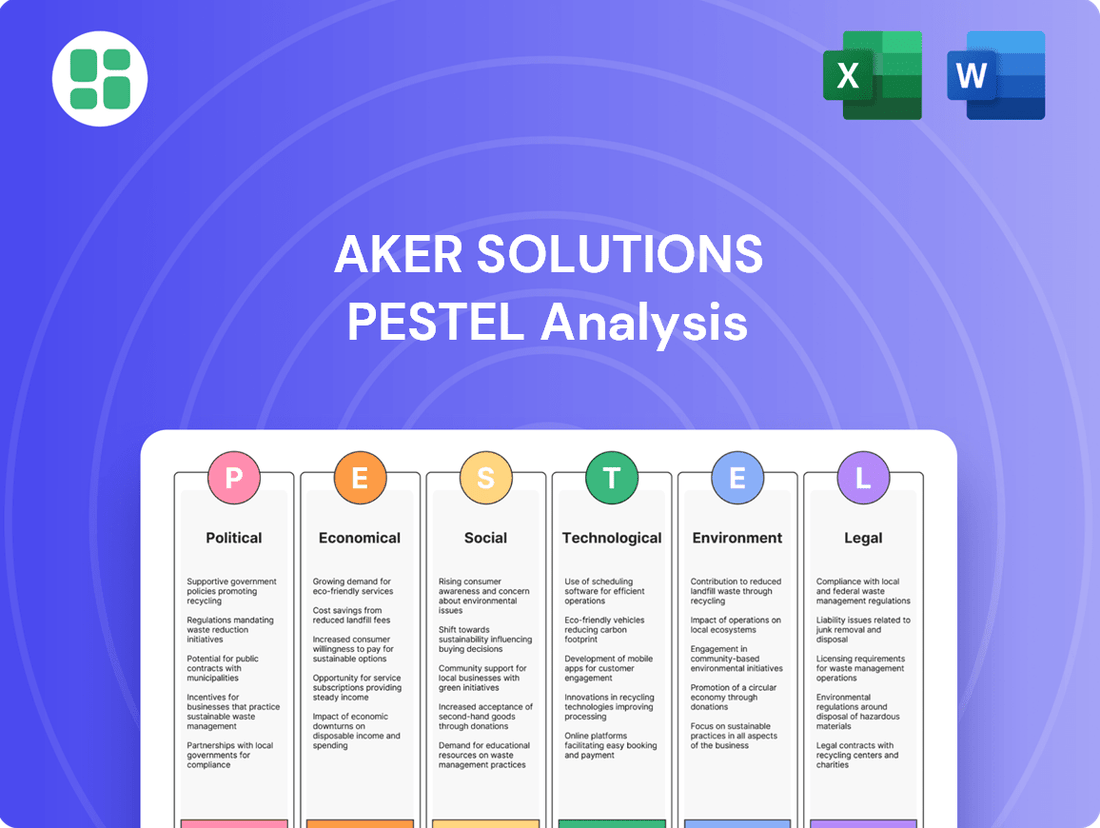

This PESTLE analysis examines the external macro-environmental factors impacting Aker Solutions, providing a comprehensive overview of the Political, Economic, Social, Technological, Environmental, and Legal forces shaping its operations and strategic landscape.

Aker Solutions' PESTLE analysis offers a structured framework to proactively identify and mitigate external threats, thereby relieving the pain point of unforeseen market disruptions and enabling more robust strategic planning.

Economic factors

Fluctuations in global oil and gas prices significantly impact Aker Solutions' core business, influencing the exploration and production spending of its clients. For instance, in early 2024, oil prices saw considerable swings, trading around $75-$85 per barrel, which directly affects the capital budgets allocated by energy companies for new projects and services.

While Aker Solutions is actively expanding its renewable energy portfolio, a substantial portion of its revenue remains tied to the stability of the hydrocarbon sector. This reliance means that volatile energy markets can create uncertainty. For example, a sharp drop in oil prices, such as those seen in late 2023 when Brent crude briefly dipped below $70 per barrel, can prompt clients to postpone or cancel investments in offshore projects, impacting Aker Solutions' order backlog and revenue streams.

The unpredictability of energy prices can lead to project delays or cancellations, directly affecting Aker Solutions' order intake and overall financial performance. In 2024, many oil and gas majors announced cautious investment strategies due to price volatility, leading to a more selective approach to awarding new contracts for subsea and offshore engineering services.

Economic trends reveal a substantial reallocation of capital towards renewable energy sources and decarbonization technologies. Global investment in clean energy reached an estimated $1.7 trillion in 2023, a significant increase from previous years, signaling a robust market shift.

Aker Solutions is strategically positioned to capitalize on this transition, securing substantial contracts in offshore wind projects, including the development of substations and foundations, and advancing carbon capture and storage (CCS) initiatives. These wins highlight the company's commitment and capability in emerging green sectors.

This evolving economic landscape presents Aker Solutions with considerable opportunities for expanding its revenue base through new green energy services. Concurrently, it necessitates careful management of its legacy oil and gas business, requiring adaptation and potential transformation to align with long-term sustainability goals and investor expectations.

Elevated inflation, with global consumer price index (CPI) increases averaging around 5.9% in 2023 and projected to remain above historical norms in 2024, significantly impacts Aker Solutions' operational costs. These economic pressures directly affect project profitability, especially for legacy renewables, where some projects saw negative returns in 2023 due to cost overruns.

Ongoing supply chain disruptions, a persistent issue since 2021, continue to delay equipment deliveries and increase logistics expenses. For instance, lead times for critical subsea components have extended by an average of 20% compared to pre-pandemic levels, impacting project timelines and budgets.

To counter these challenges, Aker Solutions has strategically shifted towards more selective contract models, prioritizing those that better allocate risk and protect margins. This includes a greater emphasis on fixed-price contracts with robust escalation clauses for materials and labor.

Currency Exchange Rate Fluctuations

Aker Solutions' global operations, spanning over 15 countries, mean that currency exchange rate fluctuations are a significant factor. These movements directly influence the company's revenue, costs, and ultimately, its financial health. For instance, a stronger Norwegian Krone (NOK) against currencies like the US Dollar or Euro could make Aker Solutions' services more expensive for international clients, potentially impacting contract values and reported earnings.

The volatility of exchange rates presents a constant challenge. Consider the impact of a sudden depreciation of the USD against the NOK in late 2024. This would mean that revenue earned in USD, when converted back to NOK, would be worth less, directly affecting the company's top-line figures. Conversely, a weaker NOK could boost reported earnings from foreign operations.

- Impact on Revenue: Fluctuations can alter the NOK value of contracts denominated in foreign currencies.

- Cost Management: Changes in exchange rates affect the cost of imported materials and components.

- Competitive Positioning: A strong NOK can make Aker Solutions' bids less competitive internationally.

- Financial Reporting: Exchange rate gains or losses are recognized in the income statement, impacting profitability.

Access to Capital and Project Financing

Securing funding for major energy projects, whether in traditional oil and gas or the growing renewables sector, is a significant economic consideration for Aker Solutions. The company's reliance on capital-intensive ventures means that favorable lending environments, robust investor confidence, and the availability of dedicated green financing for its sustainable energy projects are paramount. Aker Solutions' strong financial standing and healthy order backlog, as evidenced by their reported financial results, are key to attracting the necessary investment to undertake these large-scale endeavors.

For instance, in the first quarter of 2024, Aker Solutions reported an order intake of NOK 20.6 billion, contributing to a substantial total order backlog of NOK 72.1 billion as of March 31, 2024. This robust backlog provides a degree of financial stability and visibility, making the company a more attractive prospect for lenders and investors looking to finance energy infrastructure development.

- Favorable Lending Conditions: Access to credit at competitive rates directly impacts project profitability and Aker Solutions' ability to bid on and execute large contracts.

- Investor Confidence: A positive market sentiment and trust in Aker Solutions' long-term strategy are essential for equity and debt financing.

- Green Financing Availability: The increasing focus on sustainability drives demand for and availability of financing specifically earmarked for renewable energy projects, which Aker Solutions is actively pursuing.

- Order Backlog Strength: A strong order backlog, like Aker Solutions' NOK 72.1 billion as of Q1 2024, signals future revenue streams, enhancing its creditworthiness and appeal to investors.

Economic factors significantly shape Aker Solutions' operational landscape, from client spending to the company's own cost structures. Global energy price volatility directly influences the capital expenditure of its oil and gas clients, impacting project pipelines. Simultaneously, rising inflation and persistent supply chain issues in 2024 have increased operational costs and extended lead times for critical components, forcing strategic adjustments in contract negotiation and risk management.

Currency exchange rate fluctuations, particularly involving the Norwegian Krone, also present a dynamic challenge, affecting the reported value of international revenues and the cost of imported materials. The company's ability to secure financing for large-scale projects, both in traditional energy and burgeoning renewables, is heavily reliant on favorable lending conditions and sustained investor confidence, underscored by its substantial order backlog of NOK 72.1 billion as of Q1 2024.

What You See Is What You Get

Aker Solutions PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Aker Solutions delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company’s operations and strategic decisions.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain a detailed understanding of the external forces shaping Aker Solutions' industry landscape, enabling informed strategic planning.

The content and structure shown in the preview is the same document you’ll download after payment. This PESTLE analysis provides a robust framework for evaluating Aker Solutions' opportunities and threats in the global energy sector.

Sociological factors

Public opinion is increasingly favoring cleaner energy, which directly impacts how companies like Aker Solutions operate and attract investment. This societal shift creates pressure for businesses to prioritize sustainability.

Consumers and investors alike are demanding greater transparency and commitment to environmental responsibility. For Aker Solutions, this means actively showcasing its role in the energy transition, particularly in areas like carbon capture and storage (CCS) and offshore wind projects. For instance, by 2024, global investment in renewable energy sources is projected to surpass fossil fuel investments, a trend that underscores the market's evolving priorities.

The global shift towards cleaner energy sources, particularly in offshore wind and carbon capture, utilization, and storage (CCUS), necessitates a workforce proficient in both legacy and emerging technologies. Aker Solutions, like many in the energy sector, confronts a significant challenge in securing and keeping individuals with this dual expertise. This skills gap is a growing concern, as evidenced by reports in late 2024 highlighting a projected shortfall of over 1 million skilled workers in the renewable energy sector globally by 2030, impacting project timelines and the pace of innovation.

Aker Solutions prioritizes a robust Health, Safety, Security, and Environment (HSSE) culture, recognizing its direct link to operational success and brand integrity. This focus is essential as societal demands for safe and responsible practices, particularly in high-risk sectors like offshore energy, continue to escalate.

The company's dedication to preventing accidents and safeguarding its global workforce, which numbered around 11,800 individuals in over 15 countries as of recent reporting, underscores the importance of this cultural imperative.

Diversity, Equity, and Inclusion (DEI) Initiatives

Societal trends increasingly highlight the critical role of Diversity, Equity, and Inclusion (DEI) within corporate structures. Aker Solutions recognizes that its strength is amplified by a diverse workforce and actively champions equal opportunity and inclusion as fundamental to its ongoing success.

These focused DEI initiatives foster a more positive and collaborative work environment, which in turn drives enhanced innovation and attracts a wider spectrum of talent. For instance, Aker Solutions reported in its 2023 sustainability report that 34% of its global workforce were women, with a target to increase this to 40% by 2025, demonstrating a tangible commitment to gender diversity.

- Workforce Diversity: Aker Solutions aims to increase the representation of women in its global workforce to 40% by 2025, up from 34% in 2023.

- Inclusive Culture: The company actively promotes an inclusive culture to foster innovation and attract a broader talent pool.

- Talent Attraction: Strong DEI practices are linked to improved employer branding and access to a wider range of skilled professionals.

- Societal Expectations: Growing societal pressure mandates that companies demonstrate a genuine commitment to DEI principles.

Community Engagement and Social License to Operate

Aker Solutions prioritizes strong community ties, crucial for its social license to operate. This commitment translates into decisions that benefit society, complementing their environmental stewardship. For instance, in 2023, Aker Solutions reported investing NOK 250 million in community initiatives and local content development across its global operations. This proactive approach helps preempt project opposition and cultivates lasting collaborations.

Effective community engagement is a cornerstone of Aker Solutions' strategy, ensuring projects are welcomed and supported locally. This focus on shared value creation is vital for long-term operational success and reputation management. Their efforts in 2024 are expected to further solidify these relationships, building on the foundation of trust and mutual benefit.

- Community Investment: Aker Solutions allocated NOK 250 million in 2023 to community programs and local content development, demonstrating a tangible commitment to societal value.

- Social License: Maintaining positive relationships with local stakeholders is paramount for securing and retaining the social license to operate in diverse global locations.

- Risk Mitigation: Proactive and transparent community engagement helps mitigate potential project delays or opposition, fostering a more predictable operating environment.

- Partnership Building: Investing in local communities cultivates long-term, mutually beneficial partnerships that support sustainable business growth.

Societal expectations are driving a significant shift towards sustainability and clean energy, directly influencing Aker Solutions' strategic direction and investor appeal. This growing public demand for environmental responsibility necessitates companies to actively showcase their contributions to the energy transition, particularly in areas like carbon capture and offshore wind. Global investment trends in 2024 highlight this, with renewable energy investments projected to outpace fossil fuels, underscoring evolving market priorities.

Technological factors

Aker Solutions' core business in subsea and topside systems thrives on rapid technological evolution. Innovations here directly translate to better efficiency and safety in oil and gas extraction. For instance, advancements in subsea processing technology, like those being developed for projects targeting deeper waters, allow for more complex field developments that were previously uneconomical.

The company's focus on tie-back solutions, which connect new fields to existing infrastructure, is a testament to this. These solutions are becoming increasingly sophisticated, enabling the unlocking of resources in challenging offshore locations. This technological push is critical for maintaining competitive advantage and meeting the evolving demands of the energy sector, especially as exploration moves into more demanding environments.

Aker Solutions is at the forefront of the burgeoning Carbon Capture, Utilization, and Storage (CCUS) sector, fueled by significant technological leaps in capture, transportation, and long-term storage. The company's involvement in projects, such as capturing CO2 from cement facilities, highlights the critical role of these innovations in industrial decarbonization and meeting ambitious net-zero emission goals. The market for CCUS is projected to grow substantially, with global investments expected to reach hundreds of billions of dollars by 2030 as nations and industries prioritize climate action.

Offshore wind technology is rapidly evolving, with floating wind turbines emerging as a critical innovation. This allows for energy generation in deeper waters, previously inaccessible, significantly broadening the potential market for companies like Aker Solutions. By 2024, the global floating offshore wind pipeline reached over 130 GW, showcasing substantial growth.

Aker Solutions benefits from advancements in turbine efficiency, leading to higher energy yields from each installation. Furthermore, their expertise in construction and installation techniques for these complex structures is a key technological factor. The company's ability to adapt and implement these evolving construction methods is crucial for securing new projects in this expanding sector.

Digitalization, Robotics, and Artificial Intelligence (AI)

Aker Solutions is actively integrating digitalization, robotics, and artificial intelligence (AI) to boost efficiency, safety, and cost savings across its operations. This strategic focus is evident in their adoption of advanced technologies for project execution and asset management.

A prime example of this technological push is the deployment of autonomous drone systems for remote offshore inspections. These drones, coupled with AI-driven analytics, allow for more thorough and safer assessments of subsea infrastructure, reducing the need for human intervention in hazardous environments.

The benefits of these technologies extend to proactive maintenance and quicker identification of potential issues. For instance, AI algorithms can analyze sensor data from equipment to predict failures before they occur, enabling timely repairs and minimizing downtime. This proactive approach is crucial in the demanding offshore energy sector.

- Increased Operational Efficiency: Digitalization and AI streamline workflows, leading to faster project completion and reduced operational costs.

- Enhanced Safety: Robotics and autonomous systems minimize human exposure to hazardous offshore conditions.

- Predictive Maintenance: AI-powered analytics enable proactive identification of equipment issues, preventing costly failures and downtime.

- Cost Reduction: Automation and optimized processes contribute to significant cost savings across Aker Solutions' projects.

Hydrogen Production and Infrastructure Technologies

The evolution of hydrogen production and infrastructure technologies is a pivotal technological factor for Aker Solutions as the world shifts towards cleaner energy sources. This presents a substantial opportunity for the company to leverage its extensive experience in managing large-scale energy projects.

Aker Solutions is well-positioned to play a key role in developing the nascent hydrogen economy, offering innovative solutions for both green hydrogen (produced using renewable energy) and blue hydrogen (produced from natural gas with carbon capture). Their capabilities extend to the critical area of hydrogen transportation infrastructure.

By 2024, global investment in hydrogen technologies was projected to reach tens of billions of dollars, with significant growth anticipated through 2025 and beyond. For instance, the International Energy Agency (IEA) reported in its 2024 Hydrogen Market Report that over 30 countries have national hydrogen strategies, underscoring the global momentum.

- Green Hydrogen Production: Advancements in electrolyzer technology are making green hydrogen more cost-competitive.

- Blue Hydrogen Production: Carbon capture utilization and storage (CCUS) technologies are crucial for the viability of blue hydrogen.

- Transportation and Storage: Developing efficient and safe methods for transporting and storing hydrogen, such as pipelines and specialized carriers, is a key technological challenge.

- Aker Solutions' Role: The company's expertise in offshore engineering and project execution is directly applicable to building hydrogen production facilities and related infrastructure.

Technological advancements are reshaping Aker Solutions' core business, particularly in subsea and topside systems where innovations drive efficiency and safety in oil and gas extraction. The company's engagement with advanced subsea processing and tie-back solutions exemplifies how new technologies enable development in previously inaccessible offshore locations.

Aker Solutions is also a key player in the growing Carbon Capture, Utilization, and Storage (CCUS) market, leveraging technological leaps for industrial decarbonization. Their involvement in projects like capturing CO2 from cement facilities highlights the critical role of these innovations in meeting net-zero emission goals, with global CCUS investments projected to reach hundreds of billions by 2030.

The company is also capitalizing on the rapid evolution of offshore wind technology, especially floating turbines, which open up new deep-water energy generation possibilities. With the global floating offshore wind pipeline exceeding 130 GW by 2024, Aker Solutions' expertise in construction and installation is crucial for securing projects in this expanding sector.

Digitalization, robotics, and AI are being integrated to enhance operational efficiency and safety. For instance, autonomous drone systems with AI analytics improve subsea infrastructure inspections, while AI-driven predictive maintenance minimizes downtime.

| Technology Area | Impact on Aker Solutions | Key Data/Projections |

|---|---|---|

| Subsea Processing & Tie-backs | Enables development in deeper, more challenging waters. | Critical for unlocking complex field developments. |

| CCUS | Facilitates industrial decarbonization and net-zero goals. | Global CCUS investments projected to reach hundreds of billions by 2030. |

| Floating Offshore Wind | Expands energy generation to deeper waters. | Global pipeline exceeded 130 GW by 2024. |

| Digitalization & AI | Boosts operational efficiency, safety, and predictive maintenance. | AI-driven analytics for proactive equipment failure prediction. |

| Hydrogen Technologies | Positions Aker Solutions in the emerging clean energy economy. | Global investment in hydrogen technologies projected in tens of billions by 2024. |

Legal factors

Aker Solutions navigates a complex web of global environmental regulations and emissions standards, which are constantly being updated. Adhering to these rules, covering areas like carbon dioxide output, waste handling, and environmental impact studies, is absolutely essential for their operations.

For instance, the U.S. Environmental Protection Agency's proposed standards for new fossil fuel power plants, which could mandate carbon capture and storage (CCS) technology between 2032 and 2035, significantly shape the market for Aker Solutions' services. These evolving legal frameworks directly influence both the demand for their solutions and the operational demands placed upon them.

Aker Solutions, as a global entity, navigates a complex web of international trade laws, tariffs, and sanctions. For instance, in 2024, the ongoing geopolitical landscape continues to influence trade policies, with nations frequently updating their regulations and imposing new restrictions. Compliance is paramount, as violations can result in significant financial penalties and disrupt access to crucial international markets and supply chains.

The company's reliance on global supply chains means it is directly impacted by evolving trade agreements and potential protectionist measures. Changes in tariffs, such as those seen in various trade disputes in recent years, can directly affect the cost of materials and components. Furthermore, sanctions regimes, like those imposed on Russia, can significantly alter market access and project feasibility, as demonstrated by the impact on energy sector investments in affected regions.

Aker Solutions operates under stringent health and safety legislation across its global locations, impacting everything from workplace conditions to equipment standards. These regulations are particularly critical given the company's involvement in high-risk offshore and industrial sectors.

Compliance with these laws is not just about worker protection; it's essential for mitigating legal liabilities and safeguarding Aker Solutions' reputation. For instance, in 2023, the oil and gas sector, where Aker Solutions is a key player, saw continued focus on safety performance, with regulatory bodies like the Health and Safety Executive (HSE) in the UK issuing improvement notices for non-compliance, underscoring the financial and operational risks of oversight.

Contract Law and Project Liability

Aker Solutions operates within a legal landscape heavily influenced by contract law, particularly for its extensive engineering, procurement, and construction (EPC) projects. These long-term agreements, often spanning several years, contain intricate clauses that dictate liability, risk allocation, and the mechanisms for resolving disputes. The precise wording and enforceability of these contractual terms are paramount to managing project success and mitigating financial exposure.

Recent challenges encountered in legacy lump-sum renewables projects underscore the critical need for meticulous contract structuring and proactive commercial dialogue. These situations often arise from unforeseen cost escalations or technical complexities that strain the initial risk-sharing assumptions embedded in the contracts. Aker Solutions' approach to these issues directly impacts its profitability and reputation.

- Contractual Risk Allocation: Aker Solutions' EPC contracts are subject to rigorous scrutiny regarding how risks like material price volatility, currency fluctuations, and unforeseen site conditions are distributed between the company and its clients.

- Dispute Resolution Mechanisms: The effectiveness of arbitration, mediation, or litigation clauses within contracts is vital for resolving disagreements efficiently and minimizing project delays and associated costs.

- Liability Caps and Indemnities: Contractual provisions limiting Aker Solutions' liability and outlining indemnification procedures are crucial for protecting the company from excessive financial claims, especially in high-stakes energy projects.

- Regulatory Compliance: Adherence to evolving national and international contract laws, including those related to construction standards and environmental regulations, is a continuous legal imperative for Aker Solutions.

Corporate Governance and Reporting Requirements

Aker Solutions, as a publicly traded entity, is bound by stringent corporate governance and reporting mandates. These legal obligations encompass financial transparency, executive remuneration policies, and increasingly, sustainability disclosures. For instance, adherence to the EU's Corporate Sustainability Reporting Directive (CSRD) is crucial, influencing how the company structures its annual and sustainability reports to reflect its commitment to these legal frameworks.

The company's 2023 Annual Report and 2023 Sustainability Report, released in early 2024, showcase this compliance. These documents detail Aker Solutions' financial performance, governance structures, and its progress on environmental, social, and governance (ESG) targets, demonstrating a proactive approach to meeting evolving legal expectations.

- Financial Transparency: Aker Solutions must provide accurate and timely financial information to stakeholders, as mandated by stock exchange regulations and securities laws.

- Remuneration Policies: The company's executive compensation practices are subject to legal oversight, requiring clear disclosure and alignment with shareholder interests.

- Sustainability Reporting: Compliance with directives like the EU CSRD necessitates detailed reporting on the company's environmental impact, social responsibility, and governance practices.

- Corporate Governance Standards: Adherence to best practices in corporate governance ensures accountability, ethical conduct, and long-term value creation for shareholders.

Aker Solutions faces evolving environmental regulations, particularly concerning emissions and carbon capture, which directly influence demand for their services. For example, proposed U.S. EPA standards for new power plants could mandate CCS technology by 2032-2035, impacting the market landscape.

The company must also navigate complex international trade laws, tariffs, and sanctions, which are frequently updated. Geopolitical events in 2024 continue to shape trade policies, with sanctions like those affecting Russia significantly altering market access and project feasibility.

Stringent health and safety legislation is critical in Aker Solutions' high-risk operational sectors. Non-compliance, as seen with improvement notices issued by bodies like the UK's HSE in 2023, carries significant legal liabilities and reputational risks.

Contract law is central to Aker Solutions' extensive EPC projects, with meticulous contract structuring essential for managing risk allocation and dispute resolution. Recent challenges in renewables projects highlight the need for robust contractual frameworks to address cost escalations and technical complexities.

Environmental factors

Global awareness of climate change is intensifying, pushing industries toward decarbonization. Aker Solutions is positioned to benefit from this trend, with a focus on carbon capture and storage (CCS) and offshore wind projects. These areas are critical for meeting global climate targets, such as those outlined in the Paris Agreement, which aims to limit global warming to well below 2, preferably to 1.5 degrees Celsius, compared to pre-industrial levels.

The company's strategic alignment with these climate goals is evident in its project portfolio. For example, Aker Solutions is a key player in the Northern Lights project, a pioneering CCS initiative in Norway, which aims to capture and store CO2 from industrial sources. This focus not only addresses environmental concerns but also taps into a growing market for low-carbon solutions, with the global CCS market projected to reach significant growth by 2030.

The global energy landscape is undergoing a significant transformation, moving away from fossil fuels towards renewable sources. This shift is largely fueled by growing concerns about the finite nature of traditional resources and the environmental footprint of their extraction and use. For instance, the International Energy Agency (IEA) projected in its 2024 outlook that renewable energy sources would account for over 50% of global electricity generation by 2025, a substantial increase from previous years.

Aker Solutions is actively participating in this energy transition by offering specialized solutions for offshore wind, hydrogen production, and carbon capture technologies. These offerings directly support the evolving global energy mix, enabling cleaner energy generation and reducing the carbon intensity of industrial processes. The company's involvement in projects like the Hywind Tampen floating offshore wind farm in Norway, which began operations in late 2022, demonstrates its commitment to this evolving sector.

Managing the environmental risks inherent in ongoing oil and gas operations remains a crucial aspect of Aker Solutions' strategy. This includes implementing advanced technologies for leak detection, emissions reduction, and responsible decommissioning of offshore infrastructure. As of early 2024, the company continues to secure contracts for subsea production systems that incorporate technologies designed to minimize environmental impact, aligning with stricter regulatory frameworks and stakeholder expectations.

Aker Solutions' operations, particularly in marine and coastal settings for offshore wind and subsea projects, directly engage with biodiversity and ecosystem protection. Minimizing disruption to marine life and habitats is a critical planning and execution challenge. For instance, in 2023, Aker Solutions reported significant progress in its sustainability initiatives, aiming to reduce its environmental footprint across its project lifecycle, including marine environments.

Waste Management and Circular Economy Principles

There's a growing emphasis on how companies manage their waste and embrace circular economy ideas. This means moving away from a simple take-make-dispose model to one where resources are reused and recycled as much as possible. For Aker Solutions, this translates into actively seeking ways to reduce waste throughout its operations and project lifecycles, aiming to use resources more responsibly and lessen its overall environmental impact. This aligns with the energy sector's broader push towards sustainability.

Aker Solutions is committed to minimizing its environmental footprint. In 2023, the company reported a reduction in waste generated per employee, demonstrating progress in its waste management initiatives. Their strategy involves integrating circular economy principles by designing for disassembly and promoting the reuse of materials where feasible. This proactive approach is crucial as regulatory pressures and client expectations for sustainable practices continue to rise across the energy industry.

Key aspects of Aker Solutions' approach include:

- Focus on waste reduction: Implementing strategies to minimize waste generation at the source in manufacturing and project execution.

- Circular economy adoption: Exploring opportunities for material reuse, recycling, and repurposing of components and equipment.

- Responsible resource utilization: Prioritizing the efficient use of raw materials and energy in all business activities.

- Alignment with industry goals: Contributing to the energy sector's collective commitment to reducing environmental impact and promoting sustainable practices.

Risk of Environmental Incidents (e.g., Oil Spills)

Despite the global shift towards cleaner energy, Aker Solutions remains involved in oil and gas projects, exposing it to the persistent risk of environmental incidents like oil spills. The company's commitment to managing and mitigating these risks through stringent safety measures and well-prepared emergency response plans is paramount. Failure to do so can significantly damage its reputation and lead to severe regulatory penalties.

Aker Solutions' environmental performance is closely scrutinized. For instance, in 2023, the company reported a total recordable injury frequency rate of 1.9 per million working hours, demonstrating its focus on operational safety. While specific data on environmental incident costs for 2024 is not yet fully available, historical trends indicate that significant spills can incur billions in cleanup costs and fines, impacting profitability and investor confidence.

Key considerations for Aker Solutions regarding environmental incidents include:

- Robust spill prevention technologies: Investing in and deploying advanced containment and monitoring systems.

- Effective emergency preparedness: Maintaining and regularly testing comprehensive response plans to minimize impact.

- Regulatory compliance and reporting: Adhering to all environmental regulations and transparently reporting any incidents.

The increasing global focus on climate change and decarbonization presents significant opportunities for Aker Solutions, particularly in carbon capture and storage (CCS) and offshore wind. These sectors are vital for achieving climate goals, such as those set by the Paris Agreement. The company's involvement in projects like the Northern Lights CCS initiative underscores its strategic alignment with these critical environmental objectives and the growing market for low-carbon solutions.

Aker Solutions is actively contributing to the global energy transition by providing solutions for offshore wind, hydrogen, and CCS. This positions the company to benefit from the shift towards renewable energy sources, a trend supported by organizations like the IEA, which projected renewables to exceed 50% of global electricity generation by 2025. The company's participation in projects like the Hywind Tampen offshore wind farm highlights its commitment to this evolving energy landscape.

Managing environmental risks remains a core part of Aker Solutions' strategy, especially concerning its ongoing oil and gas operations. The company employs advanced technologies for leak detection and emissions reduction, and focuses on responsible decommissioning of offshore assets. This commitment is reflected in its project contracts, which increasingly incorporate technologies designed to minimize environmental impact, meeting stricter regulations and stakeholder expectations for sustainability.

Aker Solutions is actively embracing circular economy principles to reduce waste and improve resource efficiency. In 2023, the company reported a reduction in waste generated per employee. Their strategy includes designing for disassembly and promoting material reuse, which is crucial as environmental regulations and client demands for sustainable practices intensify across the energy sector.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Aker Solutions is informed by a comprehensive blend of official government publications, reputable industry analysis firms, and international economic data. This ensures a robust understanding of the political, economic, social, technological, legal, and environmental landscape impacting the company.