Aker Solutions Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aker Solutions Bundle

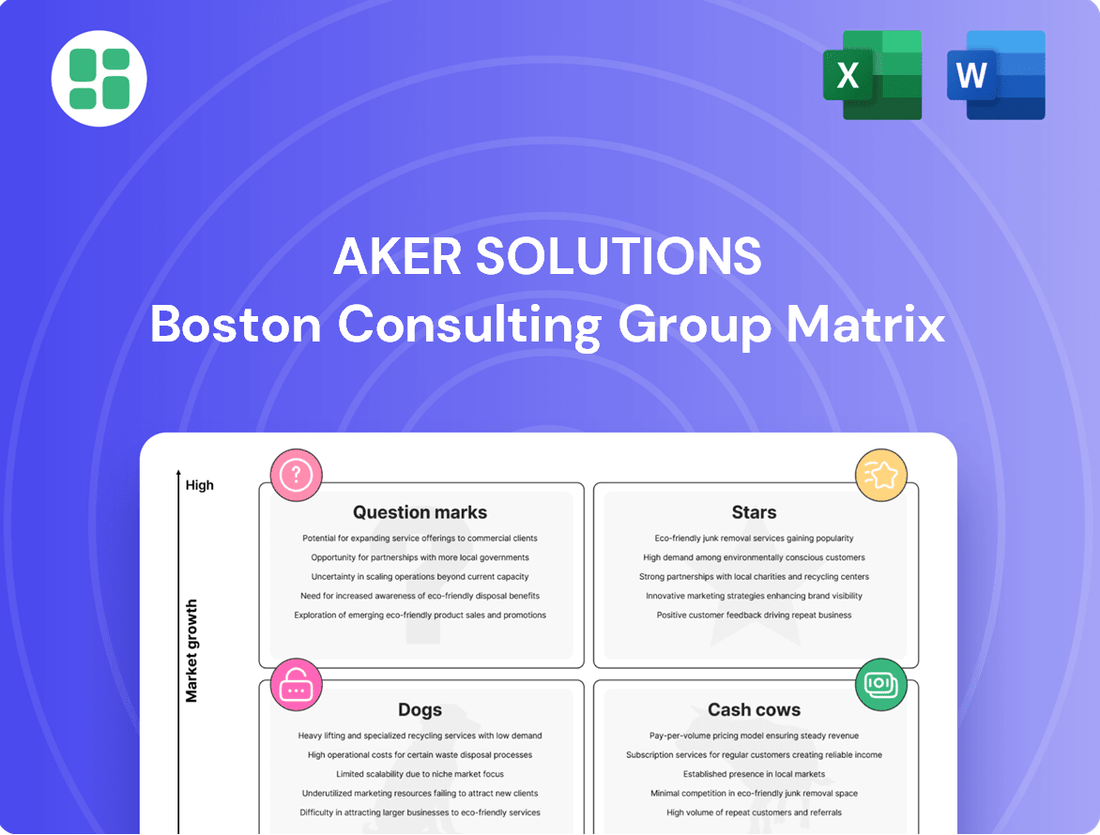

Curious about Aker Solutions' strategic product portfolio? This snapshot hints at their market positioning, but the full BCG Matrix unlocks the complete picture. Discover which products are their Stars, Cash Cows, Dogs, and Question Marks, and gain the clarity needed for informed investment decisions.

Don't settle for a glimpse; get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions for Aker Solutions.

Stars

Aker Solutions is a strong player in the growing carbon capture and storage (CCS) market. A key indicator of this is their securing of the Northern Lights Phase 2 project in 2025. This significant contract will greatly expand CO2 transport and storage capabilities, following the successful completion of Phase 1 in 2024.

The company's engagement in its fourth CO2 storage solution project underscores its leading role and deep expertise within this policy-driven, high-growth decarbonization sector.

Aker Solutions is a significant player in the offshore wind sector, particularly in Engineering, Procurement, Construction, and Installation (EPCI) for converter platforms and substructures. Their involvement in projects like the BalWin2 offshore wind farm highlights their capability in delivering complex, high-value infrastructure.

The market for these offshore wind components is experiencing robust growth. In 2023, Aker Solutions reported a substantial increase in their order intake for renewable energy solutions, with offshore wind EPCI contracts forming a key part of this expansion. This segment represents a strong growth area for the company, driven by the global push towards renewable energy sources.

Aker Solutions' 20% ownership in the OneSubsea joint venture is a significant contributor, consistently generating strong financial results and substantial dividends. The venture is projected to deliver over $250 million in dividends in 2025, underscoring its financial strength.

OneSubsea holds a leading position in advanced subsea technologies, operating within a specialized and growing market segment. This market leadership, coupled with its consistent cash generation, firmly establishes OneSubsea as a Star asset within Aker Solutions' portfolio.

Integrated Solutions for New Energy Projects

Aker Solutions' Renewables and Field Development segment, a powerhouse of integrated solutions for new energy projects, demonstrated exceptional performance. This segment, which includes offerings for offshore wind, hydropower, and carbon capture and storage (CCS), saw its revenue surge by approximately 69% in 2024. This substantial growth highlights Aker Solutions' strategic pivot towards the burgeoning energy transition market and its success in capturing market share within these rapidly expanding sectors.

The company's strategic focus on new energy solutions is clearly paying off, positioning this segment as a critical engine for future growth. Securing new orders in these dynamic markets is a testament to their competitive edge and forward-thinking approach.

- Revenue Growth: Approximately 69% increase in 2024 for the Renewables and Field Development segment.

- Key Offerings: Offshore wind, hydropower, and carbon capture and storage (CCS).

- Strategic Importance: Segment is a key growth driver due to successful market penetration and new order wins.

- Market Position: Demonstrates strong strategic shift and competitive advantage in high-growth energy transition areas.

Digitalization and Consultancy Services

Aker Solutions' consultancy arm, known as ENTR, experienced a remarkable surge in 2024, with revenues climbing by over 50%. This impressive growth is directly attributable to their strategic emphasis on digital transformation within the energy sector.

The consultancy services are heavily invested in cutting-edge digital technologies. These include:

- Industrial Internet of Things (IIoT)

- Artificial Intelligence (AI)

- Digital Twins

By integrating these advanced digital solutions, Aker Solutions aims to significantly boost efficiency and promote sustainability throughout the entire energy value chain. The substantial revenue increase underscores the company's competitive advantage in a dynamic and high-growth market segment.

Aker Solutions' Renewables and Field Development segment, encompassing offshore wind and CCS, is a clear Star. Its revenue grew by approximately 69% in 2024, driven by strong order intake in these high-growth energy transition markets. The company's leading position in CCS, evidenced by the Northern Lights Phase 2 project, and its significant role in offshore wind EPCI, solidify this segment's Star status.

| Business Unit/Segment | Market Attractiveness | Competitive Strength | BCG Classification |

| Renewables and Field Development (incl. Offshore Wind, CCS) | High (Energy Transition, Decarbonization) | Strong (Leading EPCI, CCS expertise, Northern Lights Phase 2) | Star |

| OneSubsea (20% owned JV) | High (Advanced Subsea Technologies) | Strong (Market Leader, Consistent Cash Generation) | Star |

| Consultancy (ENTR) | Medium-High (Digital Transformation in Energy) | Strong (50%+ revenue growth in 2024, AI/IIoT focus) | Star |

What is included in the product

The Aker Solutions BCG Matrix provides a strategic overview of its business units, categorizing them into Stars, Cash Cows, Question Marks, and Dogs.

It highlights which units to invest in, hold, or divest based on market growth and relative market share.

Aker Solutions' BCG Matrix provides a clear, actionable overview of its business units, relieving the pain of strategic uncertainty.

Cash Cows

The Life Cycle segment, encompassing brownfield EPC and modification services for existing oil and gas facilities, is a prime example of a Cash Cow for Aker Solutions. This segment consistently delivers robust revenues and boasts enhanced margins, largely due to long-term frame agreements and exceptional operational execution on established assets.

In 2024, Aker Solutions reported that its Lifecycle segment, which includes these critical brownfield services, continued to be a significant contributor to overall revenue. The company's dominant position in this mature market ensures a steady and predictable stream of cash flow, reinforcing its status as a Cash Cow within the BCG Matrix.

Aker Solutions' traditional subsea lifecycle services are a prime example of a Cash Cow. This segment leverages decades of deep subsea expertise, offering maintenance, upgrades, and operational support for existing subsea infrastructure. It serves a mature market, generating predictable cash flow with minimal need for new capital investment.

The company's strong, established client base and extensive experience contribute to a high market share in this critical area. For instance, in 2023, Aker Solutions reported significant revenue from its subsea segment, with a substantial portion attributed to ongoing service and maintenance contracts, demonstrating the consistent profitability of these lifecycle offerings.

EPC projects under the alliance model with Aker BP represent a significant Cash Cow for Aker Solutions. This collaborative approach, particularly in the mature Norwegian Continental Shelf market, has consistently delivered large-scale, stable revenue streams. In 2023, Aker Solutions secured orders worth NOK 12.7 billion from Aker BP, a testament to the strength and ongoing success of this partnership.

Standardized Subsea Production Systems and Equipment

Aker Solutions' standardized subsea production systems and equipment, including CO2-control-valve xmas trees (CO2 XT) for injector wells, are firmly positioned as Cash Cows within their portfolio.

This segment caters to a mature market where the demand for dependable, readily available solutions is consistently high. The widespread adoption of these proven components, coupled with efficient manufacturing processes, underpins their ability to generate steady revenue and robust profit margins for the company.

- Market Position: Mature and established with consistent demand for reliable, off-the-shelf subsea production solutions.

- Key Products: Standardized subsea production systems and equipment, exemplified by CO2 XT for injector wells.

- Financial Contribution: Drives consistent sales and healthy profit margins due to widespread adoption and efficient production.

- Strategic Advantage: Leverages proven technology and established market presence for predictable revenue streams.

Mature Engineering and Project Management for Oil & Gas

Aker Solutions' core engineering and project management services for conventional oil and gas developments are a prime example of a cash cow. This segment generates a stable and predictable revenue stream, underpinning the company's financial stability.

The company's deep-rooted expertise and proven track record in executing complex oil and gas projects allow it to command a significant market share, even within this mature sector. This strong market position translates into consistent profitability.

- Mature Market: The conventional oil and gas engineering and project management sector is well-established, offering steady demand.

- Strong Market Share: Aker Solutions leverages its long history and expertise to maintain a leading position.

- High Profitability: Despite slower growth, these services are highly profitable, contributing significantly to the company's bottom line.

- Financial Foundation: This segment provides a reliable financial base, supporting investments in other areas of the business.

Aker Solutions' lifecycle services, particularly for brownfield modifications and maintenance, are strong cash cows. These services benefit from long-term contracts and operational efficiency on established oil and gas assets, ensuring consistent revenue. In 2024, the company highlighted the continued strength of this segment, which provides predictable cash flow due to its dominant position in a mature market.

The company's subsea lifecycle services, offering maintenance and upgrades for existing infrastructure, also function as cash cows. With decades of expertise, Aker Solutions holds a significant market share, generating reliable income with minimal new capital expenditure. For example, in 2023, a substantial portion of their subsea revenue came from ongoing service and maintenance contracts.

EPC projects executed through alliances, such as with Aker BP, are another key cash cow. These collaborations, especially on the Norwegian Continental Shelf, deliver stable, large-scale revenue. Aker Solutions' orders from Aker BP in 2023, totaling NOK 12.7 billion, underscore the success of these partnerships.

| Segment | BCG Category | Key Characteristics | 2023 Financial Highlight (Example) |

|---|---|---|---|

| Lifecycle Services (Brownfield) | Cash Cow | Mature market, long-term contracts, operational efficiency | Significant revenue contributor |

| Subsea Lifecycle Services | Cash Cow | Established expertise, high market share, low capex | Consistent revenue from service/maintenance |

| EPC (Alliance Model) | Cash Cow | Stable, large-scale revenue, strong partnerships | NOK 12.7 billion in orders from Aker BP |

Delivered as Shown

Aker Solutions BCG Matrix

The Aker Solutions BCG Matrix you are previewing is the definitive report you will receive upon purchase, offering a clear and actionable strategic overview. This comprehensive analysis, meticulously crafted, will be delivered to you without any watermarks or placeholder content, ensuring immediate professional utility. You can be confident that the insights and visualizations presented here are precisely what you will gain access to, ready for integration into your strategic planning processes. This means no surprises, just the fully formatted, data-driven BCG Matrix report designed to empower your decision-making.

Dogs

Certain legacy lump-sum renewable energy projects have indeed been a drag on Aker Solutions' profitability, impacting margins negatively. These projects, primarily in the offshore wind sector, are anticipated to wrap up by 2025.

These underperforming ventures represent past commitments that are currently consuming cash rather than generating the expected returns. Their completion signifies a strategic move to exit less lucrative endeavors and refocus resources.

Generic, non-specialized fabrication services at Aker Solutions are considered Dogs in the BCG Matrix. These operations involve basic fabrication work that doesn't fully utilize the company's advanced technological expertise or sophisticated project management skills.

These services often compete in crowded markets where margins are thin, offering little strategic advantage or unique value compared to Aker Solutions' core, high-tech offerings. In 2023, Aker Solutions reported that its subsea segment, which includes specialized fabrication, saw significant growth, highlighting the contrast with less specialized areas.

Outdated conventional oil and gas technologies represent the 'Dogs' in Aker Solutions' BCG Matrix. These are older, less efficient methods and products for traditional oil and gas extraction that are being replaced by newer, greener, and more cost-effective alternatives. For instance, some legacy offshore platform designs might be significantly less energy-efficient than current modular or floating production systems.

While these older technologies are still in use in some existing operations, their market demand is shrinking. The global push towards decarbonization and the increasing availability of more advanced solutions mean that the profitability of these legacy systems is likely declining. For example, the operational costs associated with older drilling techniques can be substantially higher compared to advanced automated drilling rigs.

The shift away from these technologies is driven by both environmental regulations and economic incentives. Companies are increasingly investing in solutions that reduce emissions and improve operational efficiency. By 2024, the investment in renewables and lower-emission technologies within the energy sector has continued to grow, further marginalizing the market share and profitability of outdated oil and gas infrastructure.

Non-Strategic Minor Service Contracts

Non-strategic minor service contracts represent small-scale agreements that don't align with Aker Solutions' core strategy of delivering large, integrated solutions. These can divert crucial resources and management focus from more impactful, growth-oriented projects. For instance, in 2024, Aker Solutions continued its strategic shift towards larger, more complex projects, with smaller, ad-hoc service contracts representing a diminishing portion of their overall portfolio, contributing less than 5% to total revenue in many segments.

These minor contracts often yield suboptimal returns due to their limited scale and potential to tie up valuable personnel and equipment. They can create an inefficient allocation of capital, hindering Aker Solutions' ability to capitalize on its strengths in major offshore and subsea projects. The company's 2024 performance reports indicated a conscious effort to streamline its service offerings, phasing out or consolidating smaller, less profitable engagements to enhance operational efficiency.

- Resource Drain: Minor contracts can consume management time and operational resources that could be better allocated to larger, more strategic initiatives.

- Low Return on Investment: The revenue generated from these smaller agreements often does not justify the resources expended, leading to lower profitability.

- Strategic Misalignment: They deviate from Aker Solutions' primary focus on complex, integrated projects and long-term frame agreements, diluting strategic focus.

- Operational Inefficiency: Managing a multitude of small contracts can create administrative overhead and logistical complexities, reducing overall efficiency.

Geographical Markets with Limited Strategic Presence

Geographical markets with limited strategic presence represent Aker Solutions' potential 'Dogs' in a BCG Matrix analysis. These are typically regions where the company has a minimal footprint and the local energy sector is either stagnant or experiencing a downturn. For instance, operating in a mature oil and gas market with declining production, like parts of Western Europe or certain older fields in North America, might fall into this category if Aker Solutions' market share is insignificant and growth prospects are dim.

Continuing to invest resources in these underperforming regions can strain financial capacity and divert attention from more promising opportunities. This can lead to diluted profitability and hinder the company's ability to capitalize on emerging trends elsewhere. For example, if a specific region saw oil and gas exploration budgets slashed significantly in 2024 due to policy changes or resource depletion, Aker Solutions might find it challenging to gain traction.

- Low Market Share: Aker Solutions might hold less than 5% market share in these identified geographical areas.

- Stagnant or Declining Sector: The energy sector in these regions could be projected to shrink by 2-3% annually based on industry reports from 2024.

- Limited Growth Prospects: Future revenue growth from these markets may be projected at less than 1% per annum.

- Resource Drain: Continued operational costs in these 'Dog' markets could represent a disproportionate percentage of the company's overhead without yielding commensurate returns.

Generic fabrication services and outdated conventional oil and gas technologies are considered Dogs within Aker Solutions' BCG Matrix. These segments often operate in low-margin, competitive markets, failing to leverage the company's advanced capabilities. By 2024, Aker Solutions' strategic focus has been on high-tech, specialized offerings, further diminishing the relevance of these less differentiated areas.

Non-strategic minor service contracts and geographical markets with limited presence also fall into the Dog category. These ventures consume resources without significant strategic alignment or growth potential, contributing less than 5% to total revenue in many segments as of 2024. The company actively works to streamline these operations to enhance overall efficiency and profitability.

| Category | Description | Market Share | Growth Rate | Profitability |

| Generic Fabrication | Basic manufacturing, low differentiation | Low | Stagnant | Low |

| Outdated O&G Tech | Legacy extraction methods, less efficient | Declining | Negative | Low/Negative |

| Minor Service Contracts | Small-scale, non-core agreements | Low | Low | Low |

| Limited Geo Markets | Regions with minimal footprint, stagnant sectors | <5% | <1% (projected) | Low/Negative |

Question Marks

Aker Solutions' pilot projects in emerging energy technologies, like green hydrogen and advanced ammonia, are classic examples of "Question Marks" in the BCG Matrix. These ventures are in rapidly developing markets with substantial future promise, but currently hold a very small slice of the market. For instance, the global green hydrogen market, while projected to reach hundreds of billions by 2030, is still in its infancy, with Aker Solutions' current share being negligible.

These initiatives demand considerable initial capital expenditure and ongoing research and development, characteristic of Question Marks. The company is investing heavily in these areas to establish a foothold in what it anticipates will be key sectors of the future energy landscape. Success hinges on navigating technological hurdles and market adoption, which are significant risks but also offer the potential for high rewards if these technologies mature and gain widespread acceptance.

Aker Solutions is actively investing in early-phase studies for future large-scale energy opportunities, exploring new production methods and carbon reduction technologies. These initiatives, while promising, represent speculative investments with potential for high demand but no guaranteed market share or secured projects as of mid-2024.

Aker Solutions' innovative decommissioning technologies, while promising significant future returns in a growing market, are currently in the early stages of development and commercialization. These capital-intensive solutions are designed for complex offshore challenges, but their widespread adoption and established market share are still developing. For instance, advancements in remote-operated vehicle (ROV) technology for subsea infrastructure removal are showing promise, but the full economic viability for a broad range of applications is yet to be proven.

Expansion into New Geographic Energy Transition Markets

Aker Solutions' expansion into new geographic energy transition markets, particularly those with strong renewable energy or carbon capture potential, aligns with the characteristics of a question mark in the BCG matrix. These markets represent high-growth opportunities, but also carry significant risk due to Aker Solutions' limited existing operational footprint and the substantial upfront investment required to build local capabilities and establish market share.

For instance, consider the burgeoning offshore wind markets in Asia-Pacific. While Aker Solutions possesses advanced technology and expertise, entering countries like South Korea or Taiwan necessitates substantial capital expenditure for establishing supply chains, training local workforces, and navigating regulatory landscapes. This strategic move aims to capture future market leadership, much like a question mark business unit that requires careful nurturing and investment to potentially become a star.

Key considerations for these expansion efforts include:

- Market Assessment: Thoroughly evaluating the regulatory environment, competitive landscape, and demand for renewable energy and carbon capture solutions in target countries.

- Investment Strategy: Allocating significant capital for building local infrastructure, developing partnerships, and acquiring necessary talent to support operations.

- Risk Mitigation: Implementing strategies to manage political, economic, and operational risks associated with entering unfamiliar markets.

- Technology Transfer: Effectively transferring Aker Solutions' core competencies and technological advancements to these new regions to ensure competitive advantage.

Disruptive Digital Ventures Beyond Current Commercial Scope

Aker Solutions' "Question Marks" category encompasses highly innovative digital ventures, such as advanced AI for autonomous operations or blockchain applications aimed at optimizing the energy value chain. These initiatives are largely in the research and development or very early commercialization stages.

These ventures represent Aker Solutions' commitment to future market disruption, with the potential to redefine industry standards. However, their current contribution to revenue and market share is minimal, reflecting their nascent stage of development.

For instance, Aker Solutions has been exploring AI-driven solutions for subsea operations, which could significantly reduce downtime and operational costs. While specific financial figures for these early-stage digital projects are not publicly disclosed, the company's overall investment in digital transformation and R&D signals a strategic focus on these disruptive technologies.

- AI for Autonomous Operations: Focus on developing intelligent systems to manage and optimize offshore asset performance with minimal human intervention.

- Blockchain for Value Chain Optimization: Exploring distributed ledger technology to enhance transparency, security, and efficiency across the energy supply chain.

- Early Commercialization: Ventures are in pilot phases or have limited market penetration, indicating significant growth potential but also high risk.

- Future Market Disruption: These digital solutions are designed to create new market opportunities and competitive advantages for Aker Solutions in the long term.

Aker Solutions' investments in emerging technologies like green hydrogen and advanced digital solutions exemplify "Question Marks." These are high-potential but uncertain ventures, demanding significant investment with unclear future market share. For example, their AI development for autonomous offshore operations is a prime instance, requiring substantial R&D without guaranteed market adoption.

These "Question Marks" are characterized by their early stage and the need for strategic nurturing. The company is actively exploring new production methods and carbon reduction technologies, representing speculative bets on future energy demands. Success in these areas, such as their offshore wind expansion in Asia-Pacific, hinges on overcoming technological hurdles and market acceptance, mirroring the high-risk, high-reward profile of a question mark.

The company's focus on innovative decommissioning and digital ventures like blockchain for supply chain optimization also falls into this category. These initiatives, while aiming to disrupt the market, currently have minimal revenue contribution. For instance, Aker Solutions' digital ventures are in pilot phases, with potential for significant future growth but also considerable risk.

| Business Area | BCG Category | Market Growth | Market Share | Investment Focus |

|---|---|---|---|---|

| Green Hydrogen & Ammonia | Question Mark | High | Low | R&D, Pilot Projects |

| Decommissioning Technologies | Question Mark | Medium-High | Low-Medium | Early Commercialization |

| Asia-Pacific Offshore Wind | Question Mark | High | Low | Market Entry, Infrastructure |

| AI for Autonomous Operations | Question Mark | High | Low | R&D, Digitalization |

BCG Matrix Data Sources

Our Aker Solutions BCG Matrix is built on a foundation of robust financial disclosures, comprehensive market analytics, and in-depth industry research to provide strategic clarity.