Air Products & Chemicals PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Air Products & Chemicals Bundle

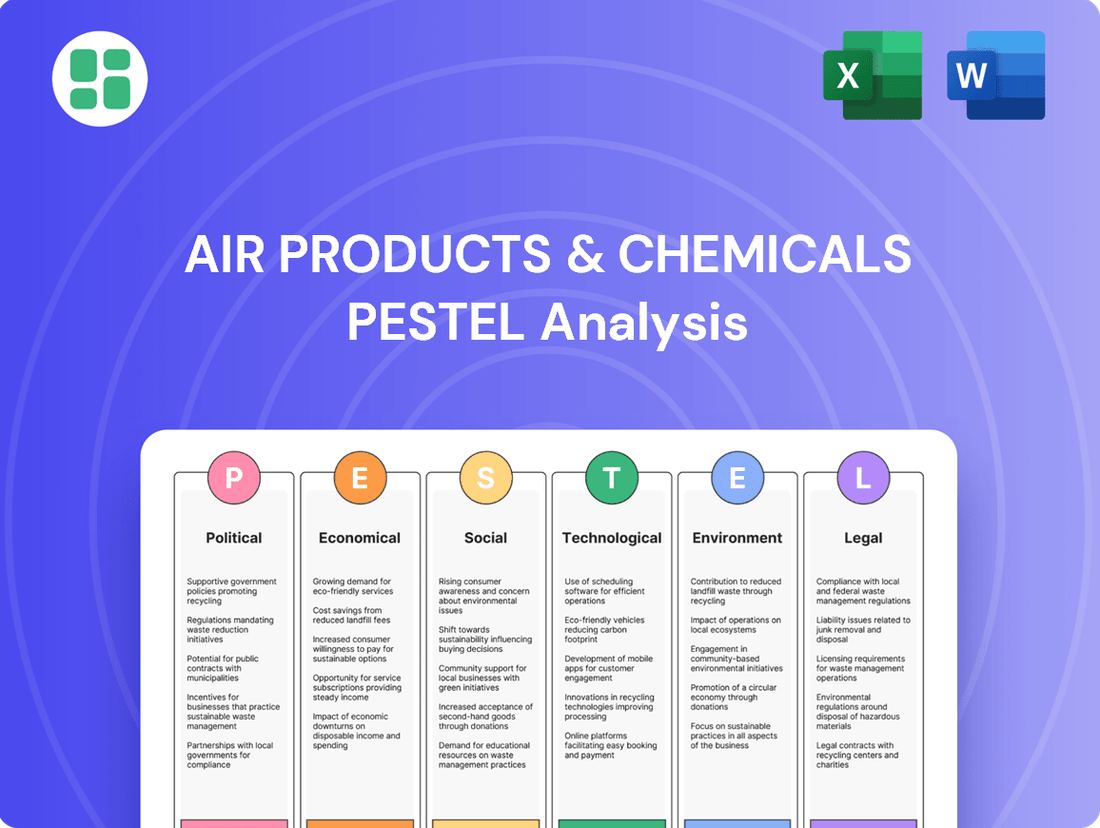

Navigate the complex external forces shaping Air Products & Chemicals with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements are creating both opportunities and challenges for the company. This expertly crafted analysis provides the critical intelligence you need to anticipate market trends and make informed strategic decisions. Download the full version now and gain a definitive edge.

Political factors

Government policies, including incentives and mandates for clean energy and hydrogen production, are a major driver for Air Products. For instance, the Inflation Reduction Act in the U.S. offers significant tax credits for clean hydrogen production, which directly supports Air Products' investments in projects like its planned hydrogen hub in Northeast Pennsylvania. These policies are crucial for accelerating the adoption of low-carbon technologies.

Global and national decarbonization goals, often codified in legislation, provide a strong tailwind for Air Products' strategic focus on the hydrogen economy. Many countries are setting ambitious targets for greenhouse gas emission reductions, and hydrogen is frequently identified as a key solution for hard-to-abate sectors. This creates a favorable environment for companies like Air Products that are investing heavily in hydrogen infrastructure and production.

The pace and nature of these government policies can significantly impact Air Products' project development and profitability. Favorable regulations and consistent support can speed up the deployment of clean energy infrastructure, boosting the company's project pipeline. Conversely, uncertainty or changes in policy could slow down investment and adoption rates, affecting future returns.

Global trade policies, including tariffs and ongoing trade disputes, directly impact Air Products' international supply chains and the cost of raw materials. These factors can also influence how competitive its products are in various global markets. For instance, a shift in tariffs on key components could increase operational expenses, potentially affecting pricing strategies.

While the core industrial gas business is largely localized, broader economic effects stemming from tariffs or significant trade events can ripple through to affect customer demand. If major trading partners impose new tariffs, it might slow down manufacturing activity in those regions, leading to reduced demand for industrial gases from Air Products' customers.

Air Products operates a significant global footprint, with operations and sales in numerous countries. This extensive international presence means the company must continuously monitor evolving international trade relations and agreements. Keeping a close watch on these dynamics is crucial for managing risks and identifying opportunities in diverse markets.

Geopolitical stability in regions like the Middle East, where Air Products is involved in major projects such as the NEOM green hydrogen facility in Saudi Arabia, directly influences operational continuity. Political unrest or shifts in government policy can disrupt project timelines and supply chains, impacting billions in capital investment.

Similarly, the political climate in North America, a key market for Air Products, affects regulatory environments and the ease of executing large-scale industrial gas projects. Unforeseen political changes can introduce risks to long-term infrastructure development and capital expenditure plans.

Industrial Policy and Sectoral Support

Government industrial policies significantly influence the demand for industrial gases, a core business for Air Products & Chemicals. Sectors like refining, petrochemicals, electronics, and general manufacturing, all key customers, are often subject to government support or regulation. For instance, initiatives like the CHIPS and Science Act of 2022, which aims to boost domestic semiconductor manufacturing, directly translate into higher demand for the high-purity gases and essential services Air Products provides. This act allocated over $52 billion for semiconductor research, development, and manufacturing, creating a more favorable environment for companies like Air Products that supply these critical materials.

The impact of these policies can be substantial. Increased investment in semiconductor fabrication plants, spurred by government incentives, means a greater need for gases such as nitrogen, oxygen, and specialty gases used in the chip-making process. Conversely, if government support for a particular industry wanes, or if new regulations hinder growth, it can lead to a contraction in demand for Air Products' offerings. For example, shifts in energy policy impacting the refining sector could alter the volume of hydrogen or oxygen required by those facilities.

- Government incentives for advanced manufacturing, like those for semiconductor production, directly increase demand for specialty gases and related services.

- The CHIPS Act's $52 billion investment in semiconductor manufacturing is a prime example of policy driving demand for Air Products' core products.

- Changes in industrial policy can create both opportunities for growth and risks of reduced volumes for industrial gas suppliers.

Regulatory Environment for Carbon Capture

The regulatory landscape for carbon capture, utilization, and storage (CCUS) is a critical determinant for Air Products' substantial investments in this area. Favorable government policies and streamlined permitting are paramount for the successful deployment and ongoing operation of their large-scale CO2 capture facilities.

For instance, the Inflation Reduction Act (IRA) in the United States, enacted in 2022, significantly enhanced tax credits for CCUS projects, with the 45Q credit being a key incentive. This has spurred considerable interest and development in the sector, directly impacting the financial viability of projects like Air Products' planned facilities.

- IRA 45Q Tax Credit: Provides up to $85 per metric ton of CO2 sequestered or utilized, a substantial boost for project economics.

- Permitting Streamlining Efforts: Regulatory bodies are working to create clearer and more efficient permitting pathways for CCUS infrastructure, reducing project development timelines.

- International Policy Alignment: Global initiatives and agreements, such as those stemming from COP meetings, influence national regulatory approaches to decarbonization and CCUS.

Government support for clean energy, particularly hydrogen, is a significant driver for Air Products. The U.S. Inflation Reduction Act (IRA), for example, offers substantial tax credits for clean hydrogen production, directly bolstering investments in projects like Air Products' planned hydrogen hub in Northeast Pennsylvania. These policies are instrumental in accelerating the adoption of low-carbon technologies, creating a favorable market for the company's offerings.

Decarbonization targets set by governments worldwide, often enshrined in legislation, provide a strong impetus for Air Products' strategic focus on the hydrogen economy. Many nations are establishing ambitious goals for reducing greenhouse gas emissions, with hydrogen frequently identified as a key solution for challenging sectors. This creates an advantageous environment for companies heavily invested in hydrogen infrastructure and production.

The political stability in regions where Air Products operates, such as the Middle East with its NEOM green hydrogen project, directly impacts operational continuity and capital investments. Political shifts or unrest can disrupt project timelines and supply chains, posing risks to substantial capital expenditures.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Air Products & Chemicals across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights and forward-looking perspectives to inform strategic decision-making and identify potential opportunities and threats.

A PESTLE analysis for Air Products & Chemicals provides a clear, actionable framework to navigate complex external forces, acting as a pain point reliever by highlighting opportunities and mitigating potential disruptions.

Economic factors

Global economic growth is a significant driver for Air Products, as it directly influences the demand for its industrial gases. When economies expand, industries like refining, chemicals, metals, and electronics typically ramp up production, leading to increased gas consumption. Conversely, economic slowdowns can dampen this demand.

Air Products' recent performance reflects this sensitivity. For example, Q2 and Q3 2025 results showed a dip in sales volumes, with weaker merchant demand being a notable factor. While on-site volumes provided some counterbalance, the overall trend underscores the impact of broader economic conditions on the company's top line.

The company's future growth projections are intrinsically linked to GDP forecasts. This means that Air Products' outlook is closely tied to the anticipated pace of industrial activity worldwide. A stronger global economy generally translates to higher volumes and better performance for Air Products.

Inflationary pressures and volatile energy prices, especially for electricity and natural gas, are major factors for Air Products. Energy is a significant input for producing atmospheric gases, directly affecting the company's operational expenses.

Despite pricing adjustments, higher costs, including those for maintenance and fixed overhead, have put pressure on Air Products' adjusted operating income. For instance, in the first quarter of 2024, the company reported adjusted earnings per share of $2.87, up from $2.55 in the prior year, but acknowledged the impact of cost inflation.

Air Products utilizes energy cost pass-through mechanisms within its contracts to offset some of these rising expenses. This strategy helps to transfer a portion of the increased energy costs to customers, thereby protecting the company's margins.

Fluctuations in interest rates directly impact Air Products' ability to finance its significant capital investments. For instance, higher rates increase the cost of borrowing for its ambitious clean hydrogen projects, potentially affecting project economics and the company's overall profitability.

Air Products is strategically deploying capital, with over half of its 2023-2025 expenditures earmarked for its established industrial gas operations. This focus, coupled with substantial investments in the burgeoning clean hydrogen sector, demonstrates a calculated approach to balancing existing strengths with future growth opportunities amidst evolving interest rate environments.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations present a significant economic factor for Air Products & Chemicals due to its extensive global operations across roughly 50 countries. These shifts can materially affect the reported revenues and profitability of its international business segments. For instance, the company experienced favorable currency impacts in certain regions during its third quarter of fiscal year 2025, contrasting with unfavorable currency movements that impacted its second quarter of fiscal year 2025, underscoring the dynamic nature of this risk.

The impact of these currency movements is not merely theoretical; it directly influences financial performance. For example, a stronger US dollar relative to other currencies can reduce the value of foreign earnings when translated back into dollars, while a weaker dollar can have the opposite effect. Air Products' ability to manage these exposures through hedging strategies or by adjusting pricing in local markets is crucial for maintaining stable financial results amidst global economic volatility.

- Global Exposure: Operating in approximately 50 countries exposes Air Products to a wide range of currency exchange rate risks.

- Reported Impact: Fluctuations directly influence reported revenues and profitability from international segments.

- Quarterly Variability: Q3 2025 saw favorable currency impacts in some regions, while Q2 2025 experienced unfavorable currency headwinds.

- Management Focus: Effective management of currency exposures is vital for financial stability and performance predictability.

Commodity Prices (e.g., Helium)

Fluctuations in specific commodity prices, particularly helium, directly impact Air Products' merchant business. For instance, a lower-than-expected helium contribution and subdued global demand were noted as reasons for reduced earnings and sales volumes in recent quarters of 2024.

Managing these commodity market dynamics is crucial for product lines like helium. The global helium market, valued at approximately $3.5 billion in 2023, is sensitive to supply disruptions and demand shifts, which can significantly influence Air Products' financial results.

- Helium Market Sensitivity: Air Products' merchant segment is significantly exposed to helium price volatility.

- 2024 Performance Impact: Lower helium volumes and demand in recent quarters of 2024 have demonstrably affected earnings.

- Strategic Importance: Effective management of helium market trends is vital for maintaining profitability in this product line.

- Global Market Value: The global helium market, estimated at $3.5 billion in 2023, underscores the financial significance of this commodity.

Economic growth directly influences Air Products' demand, with industrial expansion driving gas consumption. Conversely, economic slowdowns, like the Q2 and Q3 2025 dip in merchant demand, negatively impact sales volumes. The company's future hinges on global GDP forecasts, meaning a stronger economy generally boosts Air Products' performance.

Inflation and energy costs are significant operational concerns. Higher electricity and natural gas prices directly increase production expenses for atmospheric gases. Despite efforts like energy cost pass-throughs in contracts, inflation, including maintenance and overhead, pressured adjusted operating income, as seen in Q1 2024's results where earnings rose but cost impacts were acknowledged.

Interest rate fluctuations affect Air Products' capital investments, particularly for clean hydrogen projects. Higher borrowing costs can impact project economics. The company is strategically allocating capital, with over half of its 2023-2025 expenditures focused on industrial gas operations, balancing existing strengths with new ventures.

Currency exchange rates present a dynamic risk due to Air Products' global presence in about 50 countries. Fluctuations directly influence reported international revenues and profitability. For example, Q3 2025 saw favorable currency impacts in some regions, while Q2 2025 faced headwinds, highlighting the need for effective currency management.

Specific commodity prices, especially helium, significantly impact the merchant business. Lower helium volumes and subdued global demand in recent quarters of 2024 directly reduced earnings and sales. The global helium market, valued at approximately $3.5 billion in 2023, is sensitive to supply and demand shifts, making its management crucial for profitability.

| Economic Factor | Impact on Air Products | Recent Data/Observation (2024/2025) |

|---|---|---|

| Global Economic Growth | Drives demand for industrial gases. Slowdowns reduce consumption. | Q2/Q3 2025 saw weaker merchant demand, impacting sales volumes. |

| Inflation & Energy Prices | Increases operational expenses for gas production. | Q1 2024 adjusted EPS rose, but cost inflation pressures were noted. Energy is a key input cost. |

| Interest Rates | Affects cost of financing capital investments, especially clean hydrogen projects. | Strategic capital deployment for 2023-2025 balances industrial gas and clean hydrogen investments. |

| Currency Exchange Rates | Impacts reported international revenues and profitability. | Q3 2025 showed favorable currency impacts in some regions; Q2 2025 experienced unfavorable movements. |

| Commodity Prices (e.g., Helium) | Directly affects merchant business profitability. | Lower helium volumes and demand in recent 2024 quarters reduced earnings. Global helium market ~$3.5 billion (2023). |

What You See Is What You Get

Air Products & Chemicals PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Air Products & Chemicals delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions.

Sociological factors

Air Products is actively managing its workforce, planning to reduce its headcount by approximately 2,400 employees through 2025/2026. This strategic move follows a period of rapid hiring since 2018, which contributed to cost overruns and project delays, indicating a focus on optimizing operational efficiency.

Further workforce restructuring is anticipated by 2027/2028, underscoring a commitment to long-term cost savings and enhanced productivity. These adjustments reflect a broader trend in the industrial gas sector to streamline operations and improve financial performance in a competitive market.

Air Products faces a significant challenge in recruiting and retaining highly skilled professionals, especially those with expertise in emerging fields like advanced hydrogen technologies and carbon capture. The demand for these specialized skills is intense, impacting the company's ability to staff critical innovation and project execution roles. For instance, in 2024, the global shortage of engineers with specific experience in green hydrogen production was estimated to be around 15%, a figure that directly affects companies like Air Products.

The company's long-term growth hinges on its capacity to attract and cultivate a diverse workforce, which is increasingly seen as a competitive advantage. This diversity is particularly important as Air Products strategically shifts its focus towards clean energy solutions, requiring a broader range of perspectives and skill sets. By 2025, reports indicate that companies with strong diversity and inclusion initiatives are projected to see a 10-15% increase in employee retention rates compared to those with weaker programs.

Public perception of corporate responsibility and sustainability deeply impacts Air Products' reputation and how stakeholders view the company. A strong commitment to environmental, social, and governance (ESG) principles is increasingly vital for maintaining trust and attracting investment.

Air Products demonstrates its dedication through detailed sustainability reports, outlining ambitious goals for reducing emissions and managing resources. For instance, their 2023 sustainability report highlighted progress towards their net-zero targets and investments in renewable energy projects, which are crucial for appealing to a growing segment of socially conscious investors.

Diversity and Inclusion Initiatives

Air Products actively cultivates diversity and inclusion, aiming for a collaborative environment among its global workforce of over 23,000 individuals. This focus is not merely about social responsibility; it directly impacts business outcomes. For instance, being named one of America's Best Employers for Diversity in 2024 by Forbes highlights their dedication to creating an inclusive culture.

Such initiatives are crucial for attracting and retaining top talent, fostering innovation through varied perspectives, and ultimately boosting employee engagement and productivity. Companies that prioritize diversity often see improved decision-making and a stronger connection with a broader customer base. In 2023, Air Products reported that 34.5% of its U.S. salaried workforce identified as women, and 39.1% identified as underrepresented minorities, demonstrating tangible progress in their diversity metrics.

- Employee Engagement: A diverse and inclusive workplace typically leads to higher employee morale and commitment.

- Innovation: Varied backgrounds and experiences fuel creativity and problem-solving.

- Talent Acquisition & Retention: Strong D&I programs make companies more attractive to a wider pool of candidates.

- Market Relevance: Reflecting customer diversity enhances understanding and market penetration.

Safety Culture and Performance

In the industrial gas sector, safety isn't just a priority; it's foundational. Air Products & Chemicals, for instance, has explicitly stated its ambition to be the safest in the industry, aiming for zero accidents and incidents. This commitment underscores the inherent risks associated with handling and processing gases like hydrogen, oxygen, and nitrogen, which can be flammable, pressurized, or cryogenic.

This focus on safety directly impacts performance. A robust safety culture, deeply embedded within the organization, is crucial for several reasons:

- Employee Well-being: Protecting the health and safety of its workforce is paramount.

- Operational Integrity: Preventing accidents safeguards against costly disruptions, equipment damage, and production downtime.

- Regulatory Compliance: Adhering to stringent safety regulations is non-negotiable and avoids penalties.

For Air Products, this translates into significant investment in training, safety protocols, and continuous improvement. In 2023, the company reported a Total Recordable Incident Rate (TRIR) of 0.29, a figure that reflects their dedication to maintaining exceptionally high safety standards and minimizing workplace injuries.

Sociological factors significantly influence Air Products' operations and strategy, particularly concerning workforce management and public perception. The company is actively restructuring its workforce, planning to reduce headcount by approximately 2,400 employees through 2025/2026 to optimize efficiency after a period of rapid hiring. This is coupled with a long-term workforce adjustment anticipated by 2027/2028, aiming for cost savings and enhanced productivity.

Attracting and retaining skilled talent, especially in emerging fields like hydrogen technologies, remains a critical challenge, with a global shortage of engineers in green hydrogen production estimated at 15% in 2024. Air Products is also prioritizing diversity and inclusion, recognizing it as a competitive advantage. In 2023, 34.5% of its U.S. salaried workforce were women, and 39.1% were underrepresented minorities, reflecting progress in building a more diverse team.

Public perception of corporate responsibility and sustainability is paramount, driving Air Products' commitment to ESG principles and transparent reporting on emissions reduction and renewable energy investments. Their dedication to safety is also a core sociological aspect, with a 2023 Total Recordable Incident Rate (TRIR) of 0.29 underscoring their focus on employee well-being and operational integrity.

Technological factors

Air Products is heavily invested in pioneering hydrogen production and liquefaction technologies, positioning them as a leader in the burgeoning clean hydrogen sector. Their development of large-scale blue and green hydrogen facilities, coupled with advanced liquefaction capabilities, is crucial for capitalizing on the global shift towards cleaner energy sources.

This technological leadership provides a significant first-mover advantage. For instance, their involvement in the massive NEOM Green Hydrogen Complex underscores a substantial commitment to these cutting-edge advancements, aiming to produce millions of kilograms of clean hydrogen daily by 2030.

Air Products is making significant strides in carbon capture and sequestration (CCS) technologies. A prime example is their substantial CCS system at the Valero Refinery in Port Arthur, Texas, showcasing their commitment to practical deployment.

The company is also integrating CCS into its new blue hydrogen facilities, a key strategy for decarbonizing its own operations and providing vital solutions for customers in sectors that are difficult to decarbonize.

This focus on CCS is crucial for reducing the carbon intensity of Air Products' business and aligns with global efforts to achieve net-zero emissions, particularly in heavy industries.

Air Products is actively integrating AI and digital transformation tools to boost employee productivity and streamline operations. These advancements are designed to enhance daily tasks and unlock new efficiencies.

The company's investment in AI-driven energy management, for instance, is projected to significantly improve operational efficiency. This focus on digital tools is a key part of their strategy for future growth and competitiveness.

Research and Development (R&D) Investment

While Air Products saw a dip in R&D spending, with reported expenses around $340 million in fiscal year 2023 and projections indicating a similar trend for 2024 and 2025, sustained investment remains crucial. This focus is essential for developing innovative applications for industrial gases and advancing their clean energy solutions, like hydrogen production technologies.

Continued R&D fuels the company's ability to enhance process efficiencies and maintain its competitive edge in the industrial gases and emerging clean energy sectors. For instance, advancements in areas like carbon capture and green hydrogen production require significant research to scale and optimize.

- Innovation Driver: R&D is key to creating new product applications and improving existing processes.

- Market Responsiveness: Investments enable Air Products to adapt to evolving market demands, particularly in sustainability and clean energy.

- Technological Leadership: Ongoing research helps the company maintain its position at the forefront of industrial gas technology and clean energy solutions.

- Efficiency Gains: R&D efforts contribute to optimizing production and delivery processes, leading to cost savings and improved environmental performance.

Cryogenic and Gas Processing Equipment Innovation

Innovation in cryogenic and gas processing equipment is a cornerstone of Air Products' operations. Advancements in air separation units (ASUs) directly impact the efficiency and cost-effectiveness of producing essential industrial gases. For instance, in 2023, Air Products continued to invest in next-generation ASU technology, aiming for further energy savings and increased production capacity to meet growing global demand.

The company's focus extends to helium and hydrogen transport and storage solutions. Innovations here are critical for the burgeoning clean energy sector, particularly for hydrogen mobility and storage infrastructure. Air Products' commitment to developing advanced containment systems ensures safer and more efficient distribution of these vital gases, supporting the transition to lower-carbon energy sources.

These technological leaps translate into tangible benefits, such as improved reliability and reduced operational expenditures for customers. For 2024, Air Products anticipates that its ongoing R&D in these areas will yield enhanced performance metrics for its gas supply chain. This includes:

- Enhanced energy efficiency in ASU operations, targeting reductions of up to 5% in specific energy consumption for new designs.

- Development of lighter and more robust materials for hydrogen transport trailers, increasing payload capacity and reducing transportation costs.

- Advancements in cryogenic storage tank insulation, leading to lower boil-off rates for liquefied gases.

- Integration of digital monitoring and predictive maintenance for gas processing equipment, improving uptime and operational reliability.

Air Products' technological prowess is central to its market leadership, particularly in pioneering hydrogen production and carbon capture solutions.

The company's substantial investment in large-scale green and blue hydrogen facilities, like the NEOM project, highlights its commitment to clean energy advancements, aiming for significant production by 2030.

Furthermore, Air Products is actively integrating AI and digital transformation to boost operational efficiency, with AI-driven energy management projected to yield substantial improvements.

While R&D spending saw a dip to approximately $340 million in fiscal year 2023, continued investment is vital for innovation in industrial gases and clean energy technologies.

| Technology Area | Key Advancement | Impact/Target | Example/Year |

|---|---|---|---|

| Hydrogen Production | Large-scale green and blue hydrogen facilities | Capitalize on clean energy shift | NEOM Green Hydrogen Complex (progressing towards 2030 targets) |

| Carbon Capture | CCS systems for blue hydrogen and industrial clients | Decarbonize operations and serve hard-to-abate sectors | Valero Refinery CCS system (operational) |

| Process Efficiency | AI and digital transformation tools | Enhance productivity and streamline operations | AI-driven energy management (projected significant improvements) |

| Gas Processing | Next-generation Air Separation Units (ASUs) | Improve energy savings and production capacity | Ongoing investment in 2023 for next-gen technology |

Legal factors

Air Products navigates a complex web of environmental regulations worldwide, with a significant focus on greenhouse gas (GHG) emissions and water stewardship. The company has set ambitious targets, updating its carbon intensity goals for Scope 1, 2, and 3 GHG emissions against a 2023 baseline. This commitment underscores the increasing global pressure to decarbonize industrial processes.

Developing comprehensive water management plans for its high-priority facilities demonstrates Air Products' proactive approach to water scarcity and quality concerns. For instance, by 2030, the company aims to reduce its water intensity by 30% in water-stressed areas, a critical metric given the vital role water plays in many chemical processes.

Staying compliant with these dynamic environmental mandates is paramount for Air Products’ ongoing operations and the successful execution of new capital projects. Failure to adapt to evolving standards, such as stricter air quality controls or carbon pricing mechanisms, could lead to increased operational costs and potential project delays, impacting future growth.

The industrial gas sector operates under stringent safety regulations. Air Products maintains robust safety protocols and operational standards, critical for the secure manufacturing, transport, and delivery of its products.

Compliance with occupational safety laws, such as OSHA's Process Safety Management (PSM) standards, is fundamental. For instance, in 2023, Air Products reported zero major process safety incidents, underscoring their commitment to preventing operational disruptions and ensuring workforce safety.

Air Products operates under stringent anti-trust and competition laws globally, impacting its market strategies and potential for mergers and acquisitions. These regulations are designed to prevent monopolistic practices and ensure a level playing field for all market participants.

In 2024, the Federal Trade Commission (FTC) in the U.S. continued its robust enforcement of antitrust laws, scrutinizing large transactions. For instance, the FTC's ongoing review of major industry consolidations highlights the increased regulatory attention on market concentration, directly affecting companies like Air Products when considering expansion or strategic partnerships.

Adherence to these laws is not merely a compliance issue but a critical factor for maintaining market access and fostering sustainable growth. Failure to comply can result in significant fines and operational restrictions, as seen in past cases where companies faced penalties for anti-competitive behavior.

Labor and Employment Laws

Air Products & Chemicals, like any global employer, must navigate a complex web of labor and employment laws. When undertaking workforce restructuring, such as headcount reductions, strict adherence to country-specific regulations regarding layoffs, severance packages, and employee rights is paramount. Failure to comply can lead to significant legal challenges and damage to employee relations during critical periods of strategic change.

For instance, in the United States, the Worker Adjustment and Retraining Notification (WARN) Act requires employers with 100 or more employees to provide 60 days' advance notice of plant closings or mass layoffs. Similarly, European countries often have robust employee protection laws, including requirements for consultation with works councils and specific notice periods, which can vary significantly. In 2023, global companies faced increased scrutiny on fair labor practices and compensation equity, a trend expected to continue into 2024 and 2025, potentially impacting how restructuring is managed and communicated.

- Compliance with WARN Act: Ensuring proper notification procedures are followed for mass layoffs in the US.

- Severance Package Standards: Adhering to legal minimums and best practices for severance pay in various operating regions.

- Employee Consultation: Engaging with employee representatives or works councils as mandated by local laws before implementing significant workforce changes.

- Anti-Discrimination Laws: Ensuring all employment actions, including restructuring, are free from bias and comply with equal opportunity regulations.

Contractual Obligations and Project Exits

Air Products' contractual obligations, particularly concerning project exits, carry significant legal weight. The company's recent announcement of exiting several U.S.-based clean energy projects in early 2025 led to substantial charges, including asset write-downs and the termination of existing contractual commitments. This highlights the critical need for meticulous management of complex agreements such as 'take-or-pay' contracts and joint ventures.

Navigating the legal ramifications of project cancellations is a core operational challenge. These situations often involve intricate dispute resolution clauses, potential litigation, and the enforcement or renegotiation of long-term supply and offtake agreements. Understanding and adhering to these legal frameworks is paramount to minimizing financial and reputational damage.

- Contractual Complexity: Air Products manages a vast portfolio of agreements, including 'take-or-pay' contracts for hydrogen and other industrial gases, which obligate buyers to purchase a minimum quantity or pay a fee, creating significant legal exposure upon project termination.

- Joint Venture Liabilities: The company's involvement in numerous joint ventures means that project exits can trigger complex legal obligations and potential liabilities stemming from partnership agreements and shared ownership structures.

- Termination Costs: In 2024, Air Products disclosed approximately $300 million in charges related to project impairments and contract terminations, underscoring the financial and legal costs associated with unwinding these commitments.

- Regulatory Compliance: Project cancellations may also involve navigating environmental regulations and permit terminations, adding another layer of legal complexity to the exit process.

Air Products operates under a strict regulatory framework, particularly concerning product safety and handling. Compliance with regulations like the Globally Harmonized System of Classification and Labelling of Chemicals (GHS) is essential for ensuring safe transportation and use of its industrial gases. The company's commitment to safety is reflected in its operational record, with rigorous adherence to international and national safety standards.

Intellectual property laws are crucial for protecting Air Products' technological innovations and proprietary processes. The company actively manages its patent portfolio, which is vital for maintaining its competitive edge in the industrial gas market. Protecting these assets ensures continued investment in research and development, a cornerstone of its long-term strategy.

The company must also navigate international trade regulations and tariffs, which can impact the cost and availability of raw materials and finished products. Changes in trade policies, especially in key markets, can influence supply chain efficiency and pricing strategies. For instance, ongoing adjustments to global trade agreements in 2024 necessitate continuous monitoring and adaptation of its international business practices.

Environmental factors

Air Products has firmly committed to reaching net-zero carbon emissions across its operations by 2050, a significant move that mirrors worldwide efforts to combat climate change. This pledge is a key driver for substantial investments in burgeoning sectors like clean hydrogen and carbon capture technologies, alongside continuous efforts to enhance operational efficiency and shrink its overall carbon footprint.

Air Products & Chemicals has reinforced its commitment to sustainability by updating its 'Third by '30' carbon intensity reduction goals. The company has established a more ambitious 2023 baseline for Scope 1, 2, and 3 greenhouse gas emissions, while keeping the overall 2030 target intact.

This strategic revision signifies a deepened dedication to environmental stewardship, aiming for a 33% reduction in carbon intensity by 2030. This proactive stance is crucial in navigating the evolving regulatory landscape and meeting stakeholder expectations for climate action.

Air Products is aggressively pursuing renewable energy adoption, aiming to quadruple its renewable energy usage by 2030 from a 2023 baseline. This ambitious goal, surpassing commitments made at COP28, highlights a strategic shift towards decarbonizing its energy-intensive operations.

This commitment is crucial for the industrial gas sector, where energy consumption is significant. By leveraging renewable sources, Air Products aims to reduce its carbon footprint and enhance the sustainability of its product manufacturing processes.

Water Management Plans

Air Products is proactively addressing water scarcity by developing comprehensive water management plans for its high-priority facilities situated in water-stressed regions. These plans are slated for completion by 2026, with full implementation targeted for 2030. This strategic move underscores the company's commitment to responsible water stewardship, aiming to mitigate environmental risks and ensure sustainable water use across its global operations.

The company's focus on water management is particularly critical given the increasing global demand for water resources. By 2025, it's projected that over two-thirds of the world's population could face water shortages, according to the United Nations. Air Products' initiative aligns with these global concerns, demonstrating a forward-thinking approach to operational resilience and environmental responsibility.

Key aspects of Air Products' water management plans include:

- Water Risk Assessment: Identifying and evaluating water-related risks at each high-priority facility.

- Water Use Efficiency: Implementing strategies to reduce overall water consumption and improve recycling rates.

- Wastewater Management: Enhancing treatment processes to minimize the environmental impact of discharged water.

- Stakeholder Engagement: Collaborating with local communities and authorities on water resource management.

Clean Hydrogen and Ammonia Project Development

Environmental regulations and the global push for decarbonization are significant drivers for Air Products' strategic investments. The company is a major player in developing large-scale clean hydrogen and blue/green ammonia production facilities, aligning with worldwide efforts to reduce carbon emissions.

These projects are crucial for the energy transition. For instance, the NEOM Green Hydrogen Complex, a joint venture with ACWA Power and NEOM, aims to produce 650 tons per day of green hydrogen by 2026, a key component in achieving net-zero ambitions. Similarly, Air Products' Louisiana facility is set to produce 750 million standard cubic feet per day of blue hydrogen, with carbon capture technology in place.

- Global Decarbonization Efforts: Increasing pressure from governments and international bodies to reduce greenhouse gas emissions directly supports demand for Air Products' clean hydrogen and ammonia solutions.

- Renewable Energy Integration: The development of green hydrogen projects, like the one in Alberta, Canada, which is expected to produce 3 million metric tons of blue ammonia annually, relies heavily on the availability and cost-effectiveness of renewable energy sources.

- Carbon Capture and Storage (CCS) Mandates: For blue hydrogen projects, environmental mandates and incentives for CCS technology are critical for economic viability and regulatory compliance.

Air Products is actively responding to environmental pressures by targeting net-zero carbon emissions by 2050 and has updated its carbon intensity reduction goals, aiming for a 33% decrease by 2030 from a 2023 baseline. The company is also significantly increasing its renewable energy usage, planning to quadruple it by 2030, demonstrating a commitment to cleaner operations and a reduced carbon footprint.

Water scarcity is another key environmental consideration, with Air Products developing water management plans for high-priority facilities in water-stressed regions, targeting completion by 2026 and full implementation by 2030. This initiative addresses the growing global challenge of water availability, with projections indicating widespread shortages by 2025.

| Environmental Factor | Air Products' Action/Target | Relevant Data/Context |

| Climate Change & Emissions | Net-zero by 2050; 33% carbon intensity reduction by 2030 (from 2023 baseline). | Increasing global pressure for decarbonization. |

| Renewable Energy | Quadruple renewable energy usage by 2030 (from 2023 baseline). | Supports clean hydrogen and ammonia projects. |

| Water Scarcity | Water management plans for high-priority sites by 2026; full implementation by 2030. | UN projects over two-thirds of the world's population could face water shortages by 2025. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Air Products & Chemicals draws from a comprehensive blend of official government publications, reputable financial news outlets, and leading industry analysis firms. This ensures a robust understanding of political, economic, social, technological, legal, and environmental factors impacting the company.