Air Products & Chemicals Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Air Products & Chemicals Bundle

Curious about Air Products & Chemicals' product portfolio performance? Our BCG Matrix preview highlights key areas, but to truly unlock strategic advantage, you need the full picture. Understand which products are driving growth and which require careful consideration.

Dive deeper into Air Products & Chemicals' strategic positioning with the complete BCG Matrix. Gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks—and receive data-backed recommendations for optimal resource allocation. Purchase the full version for a comprehensive breakdown and actionable insights you can implement immediately.

Stars

Air Products is aggressively investing billions in large-scale green hydrogen production, exemplified by its NEOM project in Saudi Arabia and the Louisiana Clean Energy Complex. These massive undertakings are designed to establish Air Products as a leader in the burgeoning clean energy sector.

The NEOM facility is slated for production by 2026, with the Louisiana complex following in 2028, positioning the company to secure substantial market share in this high-growth industry.

Green ammonia, stemming from Air Products' significant green hydrogen ventures like the NEOM project, is positioned as a key offering for global industrial decarbonization efforts.

This strategic move capitalizes on the company's established hydrogen capabilities to meet the rapidly expanding need for environmentally friendly chemicals and fuels.

With industries worldwide prioritizing carbon reduction, green ammonia emerges as a product with substantial growth prospects and the potential for Air Products to secure a leading market position.

Air Products is a major player in industrial decarbonization, particularly through its hydrogen offerings. The company has secured a significant 15-year contract to supply green hydrogen to TotalEnergies' refineries in Northern Europe. This deal highlights the growing demand for clean hydrogen as a feedstock in heavy industries, driven by regulatory pressures and corporate sustainability targets.

This segment of Air Products' business is poised for growth as industries seek to reduce their carbon footprint. Their capacity to deliver large-scale, dependable clean hydrogen solutions positions them as a leader in this crucial environmental shift. The company's strategic investments and contract wins underscore the increasing importance of hydrogen in achieving industrial decarbonization goals.

Gases for the Electronics Industry

The electronics industry, particularly semiconductor manufacturing, relies heavily on ultra-high purity industrial gases like nitrogen and oxygen. These gases are critical for various production steps, ensuring the integrity and performance of electronic components. Air Products is a significant player in this sector, capitalizing on the rapid growth driven by ongoing technological innovation and the escalating global demand for semiconductors.

Air Products' strong position in the electronics market is further solidified by its specialized gas portfolio and deep application knowledge. This expertise allows them to meet the stringent purity requirements of advanced manufacturing processes. The company's commitment to innovation and its ability to adapt to evolving industry needs contribute to its competitive edge in this dynamic and expanding market.

- Market Growth: The global semiconductor market was projected to reach over $600 billion in 2024, highlighting the substantial demand for essential industrial gases.

- Air Products' Role: Air Products supplies critical gases like nitrogen, helium, and specialty chemicals vital for chip fabrication, etching, and cleaning processes.

- Competitive Advantage: The company's advanced purification technologies and global supply chain ensure the consistent delivery of high-purity gases required by leading electronics manufacturers.

- Future Outlook: Continued investments in advanced packaging and next-generation chip technologies are expected to further fuel the demand for Air Products' specialized gas solutions.

Biogas and Hydrogen Recovery Technologies

Air Products is strategically positioning itself in the high-growth biogas and hydrogen recovery sector, a key area within environmental technologies. The company's $70 million investment in expanding its gas separation and purification membrane technologies underscores this commitment. This expansion is directly fueled by the escalating demand for efficient biogas upgrading and effective hydrogen recovery solutions across various industries.

These advanced membrane systems offer Air Products a distinct competitive advantage in this niche market. As global industries increasingly prioritize resource efficiency and strive to reduce their environmental footprint, the demand for these technologies is set to surge.

- Investment: $70 million allocated for expanding gas separation and purification membrane technologies.

- Market Driver: Increasing demand in biogas upgrading and hydrogen recovery.

- Competitive Edge: Advanced membrane systems provide a distinct advantage.

- Growth Outlook: Significant market expansion anticipated due to focus on resource efficiency and emission reduction.

Air Products' ambitious green hydrogen projects, such as the NEOM facility in Saudi Arabia and the Louisiana Clean Energy Complex, represent significant investments that position the company as a potential leader in the rapidly expanding clean energy market.

These large-scale ventures, with NEOM expected online by 2026 and Louisiana by 2028, are designed to meet the growing global demand for decarbonized fuels and chemicals, particularly green ammonia.

The company's strategic focus on hydrogen and its derivatives, including green ammonia, leverages its existing expertise to capture market share in industries prioritizing carbon reduction.

By securing long-term contracts, like the one with TotalEnergies for green hydrogen, Air Products is demonstrating its capability to supply essential clean energy solutions to heavy industries, driven by regulatory and sustainability mandates.

Air Products is a key supplier of essential ultra-high purity gases to the booming electronics sector, particularly for semiconductor manufacturing, a market projected to exceed $600 billion in 2024.

The company's advanced purification technologies and robust global supply chain provide a competitive edge in delivering the critical gases needed for chip fabrication, etching, and cleaning.

Air Products' strategic investment of $70 million in expanding its gas separation and purification membrane technologies highlights its commitment to the growing biogas and hydrogen recovery markets, driven by resource efficiency and emission reduction goals.

| Category | Product/Service | Market Position | Growth Drivers | Key Investments/Facts (2024 Focus) |

| Stars | Green Hydrogen & Ammonia | Emerging Leader | Industrial Decarbonization, Regulatory Push, Corporate Sustainability | NEOM Project (2026 Online), Louisiana Complex (2028 Online), 15-year TotalEnergies contract |

| Stars | High-Purity Gases for Electronics | Strong Player | Semiconductor Demand, Technological Innovation | Global semiconductor market >$600 billion (2024 projection), Critical for chip fabrication |

| Stars | Biogas & Hydrogen Recovery Technologies | Niche Leader | Resource Efficiency, Emission Reduction | $70 million investment in membrane technologies expansion |

What is included in the product

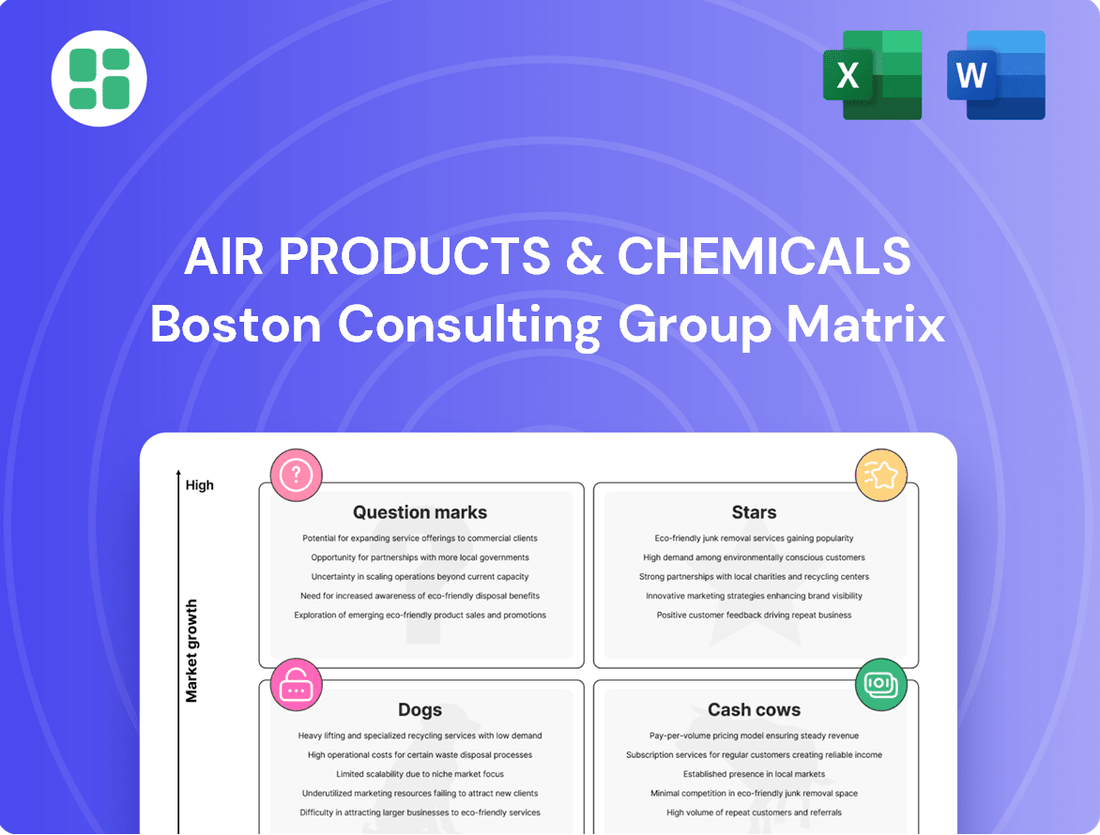

The Air Products & Chemicals BCG Matrix provides a framework for analyzing their business units based on market growth and share.

It offers strategic guidance on investing in Stars, harvesting Cash Cows, developing Question Marks, and divesting Dogs.

The Air Products & Chemicals BCG Matrix provides a clear, one-page overview of business unit performance, relieving the pain of strategic uncertainty.

Cash Cows

Air Products' on-site industrial gas supply via pipelines is a prime example of a Cash Cow. This segment, which involves building and running gas production facilities directly at customer locations, is secured by long-term, take-or-pay contracts. These agreements ensure highly stable and predictable revenue, making it a reliable generator of consistent cash flow with limited need for further sales and marketing expenditures once operational.

Merchant Industrial Gas Supply (Bulk Liquids) is a cornerstone of Air Products & Chemicals, fitting squarely into the Cash Cows quadrant of the BCG Matrix. The company's expertise lies in delivering essential gases like oxygen, nitrogen, and argon in bulk liquid form via tankers and tube trailers. This service caters to a wide spectrum of industries, from manufacturing to healthcare, underscoring its broad market penetration.

This segment benefits from a robust and extensive distribution network, coupled with a deeply entrenched customer base. These factors contribute to consistent, high-margin cash flow, primarily generated from mature industrial markets where demand is stable. For instance, in fiscal year 2023, Air Products reported that its Industrial Gases segment, which heavily features this offering, generated approximately $12.1 billion in revenue, highlighting its significant contribution to the company's overall financial health.

The established infrastructure and strong, long-standing customer relationships within Merchant Industrial Gas Supply significantly reduce the need for substantial marketing or promotional expenditures. This operational efficiency further solidifies its position as a reliable generator of profits. The company's commitment to this segment is evident in its ongoing investments in capacity and efficiency, ensuring its continued dominance in providing these critical industrial inputs.

Atmospheric gases like oxygen, nitrogen, and argon are critical components in established heavy industries, including steelmaking, metal fabrication, and chemical manufacturing. Air Products has a substantial market presence as a reliable, top-tier supplier in these segments, contributing to consistent and predictable revenue streams.

The ongoing demand from these foundational industries guarantees a steady flow of cash for Air Products. For instance, in 2024, the industrial gases market, a key segment for atmospheric gases, was projected to reach over $200 billion globally, underscoring the maturity and stability of this sector.

Industrial Gases for Food & Beverage Sector

Industrial gases like carbon dioxide for chilling and nitrogen for packaging are vital for extending shelf life and ensuring quality in the food and beverage sector. Air Products has a robust, long-standing position in this market.

This segment represents a stable, non-cyclical business for Air Products, characterized by consistent demand. The company's strong market share translates into predictable revenue streams and profitability.

- Market Stability: The food and beverage industry's need for industrial gases is largely unaffected by economic downturns.

- Revenue Generation: Consistent demand for gases like CO2 and nitrogen provides a reliable source of income for Air Products.

- Air Products' Position: The company is a key supplier, leveraging its established infrastructure and customer relationships.

- Growth Potential: While mature, the sector offers steady growth driven by increasing demand for processed and packaged foods.

Medical Gases and Equipment

The medical gases and equipment segment for Air Products & Chemicals functions as a robust Cash Cow within its portfolio. This business unit is characterized by its consistent demand, driven by the essential nature of medical-grade oxygen, nitrogen, and other specialty gases for healthcare operations.

The resilience of this sector is a key factor. Even during economic downturns, hospitals and healthcare facilities require these life-sustaining products, ensuring a stable revenue stream. Air Products' established presence and strong relationships within the healthcare industry further solidify its market leadership and profitability in this area.

- Stable Demand: Medical gases are critical for patient care, ensuring consistent demand regardless of economic conditions.

- Resilient Revenue: This segment provides a reliable and predictable source of income and profit for Air Products.

- Strong Market Position: Long-term partnerships with healthcare providers enhance Air Products' competitive advantage.

The company's established infrastructure and strong, long-standing customer relationships within Merchant Industrial Gas Supply significantly reduce the need for substantial marketing or promotional expenditures. This operational efficiency further solidifies its position as a reliable generator of profits.

The industrial gases market, a key segment for atmospheric gases, was projected to reach over $200 billion globally in 2024, underscoring the maturity and stability of this sector. Air Products has a substantial market presence as a reliable, top-tier supplier in these segments, contributing to consistent and predictable revenue streams.

The food and beverage industry's need for industrial gases is largely unaffected by economic downturns, providing consistent demand for gases like CO2 and nitrogen. This represents a stable, non-cyclical business for Air Products, characterized by consistent demand and strong market share translating into predictable revenue streams and profitability.

Medical gases are critical for patient care, ensuring consistent demand regardless of economic conditions. This segment provides a reliable and predictable source of income and profit for Air Products, with long-term partnerships with healthcare providers enhancing its competitive advantage.

| Business Segment | BCG Category | Key Characteristics | 2023 Revenue Contribution (Approx.) | Market Outlook |

|---|---|---|---|---|

| On-site Industrial Gas Supply | Cash Cow | Long-term, take-or-pay contracts; stable revenue; low sales/marketing costs. | Significant portion of Industrial Gases Segment | Mature, stable demand from large industrial customers. |

| Merchant Industrial Gas Supply (Bulk Liquids) | Cash Cow | Extensive distribution network; entrenched customer base; high margins. | ~ $12.1 billion (Industrial Gases Segment) | Broad market penetration across manufacturing, healthcare, etc. |

| Atmospheric Gases (Steel, Chemicals) | Cash Cow | Critical for heavy industries; steady demand; top-tier supplier position. | Integral to Industrial Gases Segment | Global industrial gases market projected > $200 billion in 2024. |

| Industrial Gases (Food & Beverage) | Cash Cow | Non-cyclical; consistent demand for CO2, nitrogen; strong market share. | Part of Industrial Gases Segment | Steady growth driven by processed and packaged foods. |

| Medical Gases & Equipment | Cash Cow | Essential for healthcare; resilient revenue; long-term partnerships. | Integral to Industrial Gases Segment | Consistent demand driven by healthcare needs. |

Preview = Final Product

Air Products & Chemicals BCG Matrix

The Air Products & Chemicals BCG Matrix you are previewing is the identical, fully formatted report you will receive upon purchase. This comprehensive analysis, meticulously crafted by industry experts, offers a clear strategic overview of Air Products' product portfolio, categorizing each into Stars, Cash Cows, Question Marks, and Dogs based on market share and growth rate. You can trust that the insights and visual representations presented here are exactly what you will download, ready for immediate integration into your business planning and decision-making processes without any alterations or watermarks.

Dogs

Air Products & Chemicals divested its LNG process technology and equipment business in September 2024, selling it to Honeywell for $1.81 billion. This move strategically positions the LNG segment within the BCG Matrix as a potential 'Dog'.

The divestiture indicates that this business, while generating revenue, was not a high-growth area for Air Products and was considered non-core to its primary focus on industrial gases and clean hydrogen. The substantial sale price allowed for capital reallocation to more promising ventures.

The Massena Green Liquid Hydrogen Project, a venture initiated by Air Products & Chemicals, was unfortunately cancelled in February 2025. This project, initially seen as a promising growth area, ultimately became a significant drain on resources.

The cancellation stemmed from critical regulatory shifts affecting clean hydrogen tax credits and a slower-than-anticipated expansion of the hydrogen mobility market in the Massena, New York region. These factors significantly undermined the project's initial high-growth potential.

This venture consumed substantial capital and operational resources without generating the expected market traction or financial returns, effectively classifying it as a cash trap within the company's portfolio.

Air Products & Chemicals' decision to terminate its agreement for the World Energy Sustainable Aviation Fuel (SAF) expansion project in California, citing challenging commercial aspects, firmly places this initiative in the Dog category of the BCG matrix. This means the project consumed significant capital and operational resources without yielding the expected returns or aligning with strategic growth objectives.

The termination signifies a venture that failed to meet profitability thresholds, a hallmark of a Dog. Such projects drain company resources and are unlikely to contribute positively to future earnings or market share, necessitating their divestment or closure to reallocate capital to more promising ventures.

Cancelled Carbon Monoxide Project in Texas

Air Products & Chemicals' carbon monoxide project in Texas, initially slated for cancellation in February 2025, exemplifies a 'Dog' in the BCG Matrix. The project's termination was attributed to unfavorable project economics, signaling a significant drain on resources without a promising return on investment.

This situation highlights the challenges of capital allocation in large-scale industrial projects. Despite the potential to meet market demands, the project's financial viability was insufficient to justify continued investment.

- Project Status: Cancelled in February 2025.

- Reason for Cancellation: Unfavorable project economics.

- BCG Classification: Dog, due to low market share and low growth prospects, representing a cash drain.

- Financial Impact: Resources were not generating adequate returns, leading to a decision to cease operations.

Older, Less Strategic Small-Scale Production Assets

Older, less strategic small-scale production assets, such as aging air separation units (ASUs) in established regions or smaller, commoditized packaged gas operations, often represent the Dogs in Air Products & Chemicals' portfolio. These facilities may struggle with lower profit margins, increased upkeep expenses, or operate in highly competitive, fragmented markets where Air Products doesn't hold a strong competitive advantage.

The company's ongoing strategy to upgrade its infrastructure, exemplified by plans to construct new ASUs that will replace older, less efficient ones, highlights the declining strategic importance of these particular assets. For instance, Air Products has been investing in modernizing its production capabilities to enhance efficiency and reduce operational costs.

- Declining Margins: Assets in mature markets often yield lower profit margins compared to newer, more efficient facilities.

- Higher Maintenance Costs: Older equipment typically requires more frequent and costly repairs, impacting profitability.

- Competitive Pressure: Small-scale, commoditized operations face intense competition, limiting pricing power and market share.

- Strategic Divestment/Replacement: Air Products actively manages its asset base by replacing or divesting units that no longer align with its long-term strategic goals and profitability targets.

These elements, characterized by low market share and limited growth potential, are categorized as Dogs in Air Products & Chemicals' portfolio. They consume resources without contributing significantly to overall growth or profitability.

The divestiture of the LNG business in September 2024 for $1.81 billion and the cancellation of the Massena Green Liquid Hydrogen Project in February 2025 are prime examples. These moves indicate a strategic effort to shed underperforming or non-core assets.

Similarly, the termination of the World Energy SAF expansion project and the planned cancellation of the Texas carbon monoxide project highlight ventures that failed to meet economic viability or strategic objectives.

These Dogs represent cash drains, necessitating careful management through divestment or closure to reallocate capital towards more promising growth areas within the company.

| Asset/Project | BCG Classification | Reason | Status |

|---|---|---|---|

| LNG Process Technology and Equipment | Dog | Divested, non-core | Divested September 2024 |

| Massena Green Liquid Hydrogen Project | Dog | Regulatory shifts, slow market expansion | Cancelled February 2025 |

| World Energy SAF Expansion Project | Dog | Challenging commercial aspects | Terminated |

| Texas Carbon Monoxide Project | Dog | Unfavorable project economics | Planned cancellation February 2025 |

Question Marks

Air Products is investing in building a network of hydrogen refueling stations, including multi-modal sites planned for Canadian corridors to serve both heavy-duty and light-duty vehicles. This strategic move positions them to capture future growth in the hydrogen mobility sector.

While the long-term potential for hydrogen mobility is substantial, driven by global decarbonization goals, the market for refueling infrastructure is still in its early stages. This means significant upfront capital is needed with uncertain near-term widespread adoption.

The commissioning of new regional CO2 production facilities, such as the Midlands CO2 Facility in Sasolburg, South Africa, expected in April 2025, signifies a strategic move to enhance supply reliability and capture specific market demands. This initiative aims to diversify Air Products' CO2 sourcing, particularly to address peak demand periods and fill identified market gaps within the region.

These new facilities are designed to cater to localized or seasonal CO2 needs, presenting growth prospects in niche markets where supply can be inconsistent. While these projects are crucial for regional supply chain resilience, their impact on Air Products' overall global market share and long-term financial performance is still under assessment as they enter operational phases.

Industrial gases are indispensable for cutting-edge manufacturing, particularly in additive manufacturing, or 3D printing. This burgeoning field presents significant growth opportunities, driven by continuous technological innovation. For Air Products, these specialized applications represent an area where market share is actively being cultivated.

The demand for high-purity gases like argon and nitrogen in 3D printing is projected to grow substantially, with the global additive manufacturing market expected to reach over $50 billion by 2030. Air Products' involvement in this sector is strategic, focusing on developing the necessary infrastructure and gas supply solutions to support this rapid expansion.

Hydrogen for Marine Decarbonization

New regulations like FuelEU Maritime are pushing for emissions reductions in shipping, creating a significant growth avenue for hydrogen suppliers. By 2030, these mandates will necessitate increased use of green hydrogen-derived fuels, a market Air Products is well-positioned to enter due to its established hydrogen production capabilities.

While the marine sector's shift to hydrogen is still nascent, leading to currently low market share for suppliers, the long-term potential is substantial. For instance, the International Maritime Organization (IMO) aims for net-zero GHG emissions from international shipping by or around 2050, underscoring the strategic importance of developing hydrogen as a marine fuel.

- Regulatory Tailwinds: FuelEU Maritime mandates are driving demand for low-carbon fuels.

- Market Entry Potential: Air Products' hydrogen production expertise offers a competitive advantage.

- Early Stage Adoption: The marine sector's transition to hydrogen is in its infancy, indicating future growth.

- Long-Term Vision: The IMO's net-zero goal by 2050 highlights the strategic imperative for hydrogen solutions.

Carbon Capture and Sequestration (CCS) Related Gas Supply

Air Products is actively involved in large-scale projects like the Louisiana Clean Energy Complex, which incorporates substantial carbon capture and sequestration (CCS) elements. This involvement positions them as a key gas supplier for these critical environmental initiatives.

While the broader CCS market is experiencing robust growth due to global decarbonization mandates, the precise market share for industrial gas providers within this developing technology is still being defined. Air Products' strategic investments in this sector are geared towards future market leadership.

- Louisiana Clean Energy Complex: A flagship project demonstrating Air Products' commitment to CCS infrastructure.

- Decarbonization Driver: CCS technology is a significant growth area fueled by environmental policy and corporate sustainability goals.

- Emerging Market: The specific market share for industrial gas suppliers in CCS is still developing, offering significant future potential.

- Strategic Investment: Air Products' focus on CCS reflects a forward-looking strategy to capture future market opportunities.

The hydrogen refueling infrastructure for mobility, while promising, represents a nascent market with significant capital requirements and uncertain near-term adoption rates. This positions it as a potential Question Mark within the BCG matrix, requiring careful investment and strategic development to capture future growth.

Similarly, the CO2 production facilities, while addressing regional supply gaps, have an impact on overall market share still under assessment as they become operational. Their focus on niche markets suggests they could also be categorized as Question Marks, dependent on localized demand and supply consistency.

The marine sector's adoption of hydrogen, driven by regulations like FuelEU Maritime, presents a long-term growth opportunity but currently has low market share for suppliers. This early-stage adoption makes it a prime candidate for the Question Mark quadrant, demanding strategic investment to build presence.

The Carbon Capture and Sequestration (CCS) market, while growing due to decarbonization mandates, sees the specific market share for industrial gas providers still being defined. Air Products' investments here are geared towards future leadership, characteristic of a Question Mark seeking to become a Star.

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.