Air Methods Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Air Methods Bundle

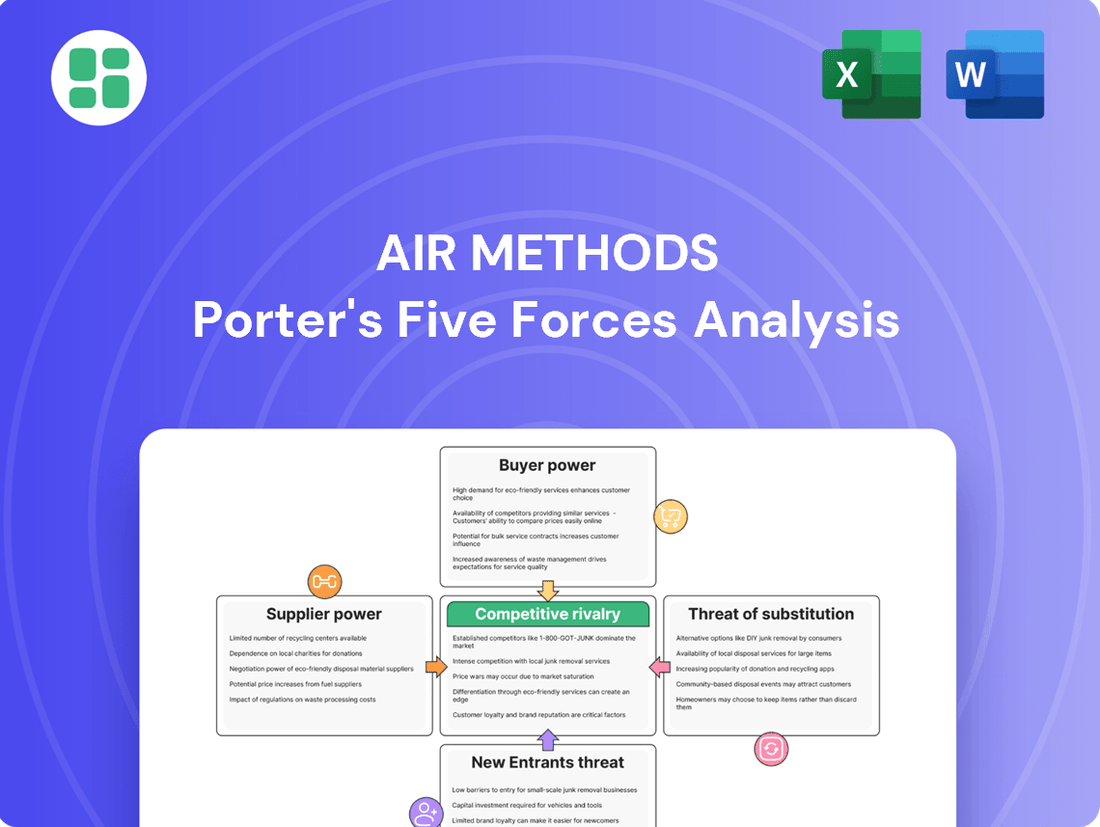

Air Methods navigates a complex landscape shaped by intense rivalry, significant buyer power, and the constant threat of new entrants. Understanding these forces is crucial for any stakeholder looking to grasp the company's strategic positioning.

The complete report reveals the real forces shaping Air Methods’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of specialized aircraft manufacturers, such as Airbus, is substantial for companies like Air Methods. These suppliers produce complex, high-cost assets, like helicopters and fixed-wing aircraft, which are critical for air medical services. The limited number of manufacturers and the highly technical nature of aerospace production contribute to this strong supplier position.

Air Methods' recent fleet expansion, including the addition of new aircraft from manufacturers like Airbus, underscores the reliance on these specialized suppliers. The long lead times and significant capital investment associated with acquiring new aircraft, such as the H140 model expected in 2028, further solidify the power of these manufacturers in the market.

The bargaining power of suppliers in the air medical sector, particularly for highly skilled personnel like pilots, flight nurses, and paramedics, is significant. These professionals possess specialized training and experience that are critical for safe and effective patient transport, making them a scarce resource.

Companies like Air Methods must offer competitive compensation and benefits packages to attract and retain this talent, directly impacting labor costs. For instance, the average annual salary for a flight nurse in the US was around $85,000 in 2024, with experienced professionals commanding higher figures. This demand for expertise gives these individuals considerable leverage.

Suppliers of advanced medical equipment, like ventilators and defibrillators, hold considerable sway over Air Methods. These high-tech devices are essential for Air Methods to operate as airborne intensive care units, directly impacting patient care and operational capabilities. For instance, the adoption of new technologies such as the ZOLL AutoPulse NXT automated CPR device highlights a dependence on specific, innovative medical technology manufacturers.

Fuel and Maintenance Service Providers

Fuel and maintenance service providers hold considerable bargaining power over Air Methods. Fuel is a substantial operating cost, and in 2024, aviation fuel prices saw volatility, impacting margins for air medical services. For instance, average jet fuel prices at major US airports fluctuated significantly throughout the year, with some periods seeing increases of over 15% compared to the previous year, directly affecting Air Methods' cost structure.

The specialized nature of aircraft and medical equipment maintenance further concentrates supplier power. These services require certified technicians and specific parts, often limiting the pool of available vendors. This reliance on a few key suppliers for critical safety and operational needs allows them to influence pricing and terms, as Air Methods cannot easily switch providers without compromising compliance and operational readiness.

- High Reliance on Specialized Maintenance: Air Methods' fleet requires highly technical and certified maintenance, limiting the number of qualified service providers.

- Criticality of Fuel Supply: Consistent and affordable fuel is essential for Air Methods’ operations, giving fuel suppliers leverage.

- Impact of Fuel Price Volatility: Fluctuations in global oil markets directly translate to increased operating costs for Air Methods, enhancing supplier influence.

- Limited Alternatives for Essential Services: The specialized nature of aircraft parts and repair means few viable alternatives exist, strengthening supplier negotiation power.

Regulatory and Compliance Service Providers

Regulatory and compliance service providers wield significant influence over Air Methods. Adherence to aviation and medical regulations, such as FAA certifications and state EMS licenses, is paramount and non-negotiable for air medical operations. These specialized service providers ensure Air Methods meets critical legal and safety standards, making their offerings indispensable.

The power of these suppliers is amplified by the dynamic nature of regulations. For instance, shifts in airspace availability or operational requirements mandated by bodies like the FAA can directly increase the leverage of companies offering compliance solutions and training. In 2024, the FAA continued to update its regulations concerning drone integration and advanced air mobility, areas that directly impact the operational landscape for companies like Air Methods.

- Compliance Necessity: Aviation and medical regulations are strict, requiring specialized services for adherence.

- Supplier Leverage: Changes in regulations, such as airspace access, increase supplier bargaining power.

- Training and Certification: Providers of essential training and certification programs hold considerable sway.

The bargaining power of suppliers for Air Methods is considerable, stemming from specialized aircraft manufacturers, essential maintenance providers, and skilled personnel. Critical components and specialized services often have limited suppliers, granting them significant leverage in pricing and terms. For instance, the acquisition of new helicopters involves substantial capital and long lead times, giving manufacturers like Airbus considerable influence.

Skilled medical and aviation professionals are another key area where supplier power is high. The demand for experienced pilots, flight nurses, and paramedics, who possess unique certifications and extensive training, often outstrips supply. In 2024, the average salary for a flight nurse in the US hovered around $85,000, with specialized skills commanding even higher compensation, reflecting this leverage.

Fuel and maintenance services also represent areas of strong supplier influence. Aviation fuel costs are a major operating expense, and price volatility in 2024, with some periods seeing jet fuel prices increase by over 15% year-over-year at major US airports, directly impacts Air Methods' profitability. Similarly, the specialized nature of aircraft maintenance, requiring certified technicians and proprietary parts, limits vendor options.

| Supplier Category | Key Factors Influencing Power | Examples of Impact on Air Methods |

|---|---|---|

| Aircraft Manufacturers | High R&D costs, limited competition, long production cycles | Negotiating power on aircraft prices and delivery schedules; e.g., H140 delivery in 2028 |

| Skilled Personnel | Specialized training, certifications, high demand, limited supply | Increased labor costs due to competitive salaries and benefits; e.g., Flight Nurse salaries ~$85,000 (2024 avg.) |

| Fuel Providers | Global commodity prices, geopolitical factors, limited distribution networks | Operating cost fluctuations; e.g., 2024 jet fuel price volatility impacting margins |

| Maintenance & Parts | Proprietary technology, specialized certifications, limited repair facilities | Higher maintenance costs, potential operational delays if parts are scarce |

| Regulatory Services | Mandatory compliance, specialized knowledge, evolving regulations | Increased costs for compliance and training; adaptation to new FAA regulations (e.g., drone integration) |

What is included in the product

This analysis dissects the competitive forces impacting Air Methods, including the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the air medical services industry.

Visualize competitive intensity across all five forces with a dynamic, interactive dashboard, eliminating the guesswork in strategic planning.

Customers Bargaining Power

Hospitals and large healthcare systems are significant customers for Air Methods, frequently contracting for critical emergency medical services and patient transfers between facilities. Their substantial business volume grants them considerable leverage. For instance, in 2023, the U.S. hospital sector generated over $1.3 trillion in revenue, indicating the scale of these potential clients.

These healthcare giants possess strong bargaining power due to their ability to negotiate favorable contract terms, often influencing pricing and service levels. Furthermore, they can explore partnerships with alternative air or ground transport providers, creating competitive pressure. As healthcare systems increasingly integrate transportation services into their overall care management strategies, their influence over providers like Air Methods is likely to grow.

Insurance companies and government payers, particularly Medicare and Medicaid, wield considerable bargaining power over air medical services like Air Methods. These entities represent a substantial portion of revenue, and their reimbursement rates directly impact the financial health of the industry. For instance, Medicare, which covers close to 40% of air medical transports, often reimburses at rates significantly lower than the actual cost of providing the service, underscoring their potent influence.

This disparity in reimbursement highlights the significant leverage these payers possess. Air Methods, recognizing this dynamic, has been a proponent of legislative efforts aimed at updating and modernizing these reimbursement structures. Such initiatives underscore the direct link between payer power and the profitability and operational sustainability of air medical providers.

Individual patients, while the end-users of Air Methods' services, possess limited direct bargaining power. The critical and often urgent nature of air medical transport means patients have little leverage to negotiate prices at the point of service.

However, rising healthcare costs and increased patient responsibility for out-of-pocket expenses, exacerbated by factors like surprise billing, can indirectly amplify patient influence. This growing financial burden on individuals can foster public dissatisfaction and potentially lead to regulatory changes affecting service pricing and reimbursement models, impacting Air Methods.

Rural Communities and Underserved Regions

For patients in rural or hard-to-reach areas, air medical services are frequently the sole option for critical care transportation. This reliance grants these communities a degree of collective bargaining power, as their limited access to alternative healthcare makes the ongoing provision of air ambulance services essential. For instance, in 2024, a significant portion of air medical transports, estimated to be over 30%, served rural populations where ground transport times would be prohibitive.

Policies designed to ensure continued access to these vital services in rural regions highlight this influence. The critical nature of these services means that providers like Air Methods cannot easily withdraw from these markets without significant public and regulatory backlash. This dependence can translate into leverage for communities negotiating service levels or pricing, particularly when government subsidies or contracts are involved.

- Essential Service: Air medical transport is often the only critical care option for rural and underserved populations.

- Limited Alternatives: The lack of other viable transport methods increases the bargaining power of these communities.

- Policy Influence: Government policies aimed at maintaining rural healthcare access indirectly bolster the negotiating position of these regions.

- Provider Dependence: Air medical providers rely on serving these areas to maintain operational reach and fulfill their mission, making them sensitive to community needs.

Growing Demand for Specialized Transfers

The increasing prevalence of chronic diseases and an aging demographic are significantly boosting the need for specialized patient transport. This trend, coupled with the rise in medical tourism, directly translates to a stronger bargaining position for customers requiring these critical, often advanced, medical transfer services. Providers are compelled to tailor their services to these specialized demands.

For instance, the U.S. population aged 65 and over is projected to reach 88 million by 2050, nearly doubling from 2015. This demographic shift alone fuels demand for healthcare services, including specialized transportation. Air Methods, a key player in this sector, reported that approximately 70% of its patient transports in 2023 involved critical care patients, highlighting the specialized nature of the demand.

- Increased Demand Drivers: Chronic diseases and an aging population are key factors.

- Medical Tourism Impact: Growth in international patients seeking care also elevates demand.

- Customer Leverage: Higher demand for specialized inter-hospital transfers empowers customers.

- Provider Adaptation: Companies must adjust services to meet evolving, specialized needs.

Hospitals and large healthcare systems, representing significant clients for Air Methods, possess substantial bargaining power due to their volume and ability to negotiate terms. In 2023, the U.S. hospital sector's revenue exceeded $1.3 trillion, illustrating the financial clout of these entities. These large organizations can also leverage alternative transport providers, intensifying competition and influencing pricing and service standards.

Major payers like Medicare and Medicaid exert considerable influence, with Medicare alone covering nearly 40% of air medical transports. Their reimbursement rates, often below service costs, underscore their potent leverage. This dynamic necessitates Air Methods' engagement in legislative efforts to modernize reimbursement structures, directly impacting its financial viability.

While individual patients have limited direct bargaining power during emergencies, rising healthcare costs and increased out-of-pocket expenses can indirectly amplify their influence. Growing patient financial burdens can lead to dissatisfaction and potential regulatory shifts affecting pricing and reimbursement.

Rural communities, often lacking alternatives, rely heavily on air medical services, granting them collective bargaining power. In 2024, over 30% of air medical transports served rural populations where ground transport is impractical. Policies ensuring rural access highlight this leverage, as providers depend on these areas for operational reach and mission fulfillment.

The increasing demand for specialized patient transport, driven by chronic diseases and an aging population, strengthens customer bargaining power. The U.S. elderly population is projected to reach 88 million by 2050, fueling demand for advanced medical transfer services. Air Methods noted that around 70% of its 2023 transports involved critical care patients, emphasizing this specialized need.

Same Document Delivered

Air Methods Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. This comprehensive Air Methods Porter's Five Forces analysis details the competitive landscape, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the air medical services industry. You'll gain actionable insights into the strategic positioning of Air Methods and its key competitive advantages.

Rivalry Among Competitors

The air medical transport sector is characterized by a moderate level of concentration, featuring formidable national competitors such as Global Medical Response (GMR) and PHI. These large entities operate alongside a considerable number of smaller, regional providers, creating a dynamic competitive environment. Air Methods itself navigates this complex arena, facing significant rivalry in each of the 47 states where it provides services.

Operating a large fleet of specialized aircraft, like those used in air medical services, and maintaining an extensive network of bases comes with significant fixed costs. For instance, companies in this sector must invest heavily in aircraft maintenance, hangar space, and highly trained personnel, regardless of how many flights they operate. This creates immense pressure to keep their assets busy and maximize transport volume to cover these overheads and turn a profit.

This high cost structure often fuels aggressive pricing and intense competition for contracts. Companies are driven to secure every possible flight to spread their fixed costs over a larger operational base. In 2024, the air medical industry, a key sector facing these dynamics, continued to see intense bidding for critical care transport contracts, with providers striving to optimize their fleet utilization to remain competitive.

Competitive rivalry in the air medical services sector, including for companies like Air Methods, heavily hinges on the perceived quality of care delivered during transport. This often translates into a focus on rapid response times and a strong emphasis on safety records, as these are critical factors for patients and referring healthcare facilities. In 2024, Air Methods continued to highlight its commitment to best-in-class clinical quality and the extensive training of its medical crews, aiming to set itself apart in a crowded market.

Differentiation strategies commonly involve investing in cutting-edge medical equipment and ensuring that personnel are highly experienced and credentialed. Building robust relationships with hospitals and local emergency medical services is also paramount, as these partnerships can drive patient referrals and solidify a company's reputation. Ultimately, clinical excellence emerges as a primary battleground where companies vie for market share and patient trust.

Geographic Market Overlap and Expansion Strategies

Air Methods faces intense competition as rivals frequently operate in the same geographic areas, directly competing for crucial contracts with hospitals and emergency medical services. This overlap intensifies the battle for market share and operational dominance.

To gain an advantage, companies like Air Methods and its competitors are actively pursuing expansion. This includes establishing new bases in previously unserved or underserved regions, a strategy known as opening 'greenfield bases'.

Furthermore, expanding in-network agreements with commercial insurers is a key growth driver. This allows companies to broaden their revenue streams and solidify their presence by offering services to a larger patient population.

- Geographic Overlap: Competitors frequently target the same regions, leading to direct competition for contracts.

- Greenfield Expansion: Companies are opening new bases to capture market share in underserved areas.

- Insurer Networks: Expanding in-network with commercial insurers is a critical strategy for growth and revenue.

Impact of Regulatory and Reimbursement Changes

Changes in regulatory frameworks, especially concerning insurance reimbursement and surprise billing, have a profound effect on competitive rivalry within the air medical services industry. For example, the No Surprises Act, enacted in 2022, has created hurdles for air ambulance providers like Air Methods in securing payment for their services, impacting their revenue streams and necessitating strategic shifts to maintain a competitive edge.

These reimbursement changes directly influence how providers compete for market share and financial stability. Providers must adapt their operational and financial strategies to navigate these new payment landscapes, which can lead to increased price competition or a focus on securing favorable contracts with payers.

- Regulatory Impact: The No Surprises Act has altered payment dynamics, potentially reducing out-of-network revenue for air ambulance providers.

- Reimbursement Challenges: Uncertainty in reimbursement rates and payment collection processes creates a more challenging competitive environment.

- Business Model Adjustments: Providers are compelled to innovate their business models, potentially by focusing on in-network contracts or exploring new revenue streams, to remain competitive.

- Financial Health: The ability to adapt to these regulatory and reimbursement shifts directly correlates with a provider's financial health and their capacity to invest in service quality and expansion.

Competitive rivalry in the air medical sector is intense due to a moderate industry concentration with major players like Global Medical Response (GMR) and PHI alongside numerous regional providers. Air Methods faces this competition across all 47 states it serves, driven by high fixed costs associated with maintaining specialized fleets and extensive base networks, pushing companies to maximize flight volume to cover expenses and achieve profitability.

This pressure translates into aggressive pricing and fierce competition for contracts, as providers aim to spread fixed costs over greater operational capacity. In 2024, this dynamic was evident in the continuous bidding for critical care transport contracts, with companies prioritizing fleet utilization for competitiveness.

The battle for market share is also fought on the grounds of clinical quality, with rapid response times and safety records being paramount differentiators. Air Methods, in 2024, emphasized its superior clinical quality and crew training to stand out. Strategies like expanding into new, underserved regions (greenfield bases) and securing in-network agreements with commercial insurers are crucial for growth and revenue diversification.

| Competitor | 2024 Market Presence (Approximate States Served) | Key Strategy Example |

|---|---|---|

| Air Methods | 47 | Focus on clinical excellence and training |

| Global Medical Response (GMR) | Extensive national presence | Fleet optimization and contract acquisition |

| PHI Air Medical | Significant national presence | Geographic expansion and service diversification |

SSubstitutes Threaten

Ground ambulance services are the primary substitute for air medical transport. For shorter distances or less severe medical emergencies, ground ambulances are often a more practical and cost-effective choice, especially when weather grounds air operations. In 2023, the US saw an estimated 45 million ground ambulance transports, highlighting their widespread use.

Advancements in telemedicine and remote patient monitoring present a growing threat of substitutes for Air Methods. These technologies allow for initial diagnostics and consultations without the immediate need for physical transport, impacting the demand for certain patient transfers. For instance, a significant portion of initial patient triage can now be handled virtually, potentially reducing the volume of less critical emergency medical service calls that would have historically required transport.

While telemedicine doesn't replace the critical care transport Air Methods specializes in, it can reduce the overall demand for some patient transfers by enabling remote initial care or triage. This means fewer patients might require an ambulance in less severe situations, a trend that gained momentum in 2024 with increased adoption of virtual health services. Studies in 2024 indicated that up to 30% of routine medical appointments were being conducted remotely, a figure that could indirectly influence the need for air medical services by managing patient conditions before they escalate to a critical transport level.

For non-emergency situations, patients might consider using private vehicles. However, this is not a practical substitute for Air Methods' critical care services. In 2024, the average response time for emergency medical services in the US was approximately 8 minutes, a crucial factor where private vehicles cannot compete.

Emerging Technologies (e.g., eVTOL for limited missions)

Emerging technologies like electric Vertical Take-Off and Landing (eVTOL) aircraft present a future threat of substitution for Air Methods, particularly in urban medical transport. These eVTOLs are being developed with the potential for quieter, faster, and more eco-friendly operations compared to traditional helicopters. While still in early development stages, with significant regulatory hurdles and infrastructure needs, they could eventually serve as alternatives for specific, high-density urban missions.

The eVTOL market is seeing substantial investment, indicating a serious long-term potential. For instance, by early 2024, numerous companies have secured billions in funding for eVTOL development and certification. While widespread commercial use for critical care transport is likely still several years away, the technological advancements and market interest signal a developing substitute that Air Methods will need to monitor and potentially integrate into its long-term strategy.

- eVTOLs offer potential advantages: quieter operation, faster transit times in congested urban areas, and reduced emissions.

- Market development is ongoing: Significant capital is being invested globally in eVTOL research, development, and certification processes.

- Current limitations exist: eVTOLs face challenges including battery technology, range, payload capacity, and the need for new vertiport infrastructure.

- Long-term strategic consideration: While not an immediate threat, eVTOLs represent a future substitute for specific mission profiles, especially in urban environments.

Hospital-Based or Integrated Transport Systems

Large hospital networks and integrated healthcare systems represent a significant threat of substitutes for Air Methods. These entities may develop and operate their own in-house medical transport services, encompassing both ground and air ambulances. This vertical integration allows them to manage patient logistics and critical care transfers internally, thereby decreasing their dependence on external providers like Air Methods. For instance, a major hospital system might invest in its own fleet of helicopters and trained personnel, directly competing with Air Methods' service offerings.

This trend towards self-sufficiency in medical transport can be seen as a strategic move by healthcare providers to gain greater control over patient care pathways and operational efficiency. By owning and managing their transport assets, hospitals can potentially reduce costs, ensure service quality, and streamline the critical process of moving patients between facilities or to specialized care units. In 2024, the increasing consolidation within the healthcare industry further fuels this trend, as larger systems have the capital and operational scale to support such integrated transport solutions.

The existence of these hospital-owned transport systems directly impacts Air Methods by siphoning off potential business and creating a competitive alternative. This can put pressure on Air Methods' pricing and market share, particularly in regions where dominant healthcare systems have the capacity to establish their own robust transport divisions. The ability of these integrated systems to offer a seamless, end-to-end patient care experience, including transport, poses a considerable challenge.

- Integrated Healthcare Systems: Many large hospital networks are developing their own medical transport capabilities.

- Reduced Reliance: This self-sufficiency directly reduces the need for third-party air medical services.

- Cost and Control: Hospitals aim for better cost management and control over patient care logistics.

- Market Impact: This trend can dilute Air Methods' market share and put pressure on pricing.

Ground ambulance services remain a primary substitute, especially for shorter distances and less severe emergencies, with an estimated 45 million ground ambulance transports in the US in 2023.

Telemedicine advancements, while not replacing critical care transport, can reduce overall demand by enabling remote triage and initial care, a trend amplified in 2024 with increased virtual health adoption.

Emerging eVTOL aircraft represent a future threat, particularly for urban transport, with significant investment in their development by early 2024, signaling potential competition for specific mission profiles.

Large hospital networks increasingly operate their own in-house medical transport, a trend accelerated by healthcare consolidation in 2024, reducing reliance on external providers like Air Methods.

| Substitute Type | Description | 2023/2024 Data Point | Impact on Air Methods |

|---|---|---|---|

| Ground Ambulances | Primary substitute for shorter distances/less severe cases. | 45 million US transports (2023) | Limits demand for less critical missions. |

| Telemedicine | Enables remote triage and initial care. | Up to 30% of routine appointments remote (2024 estimate) | Reduces potential need for some transports. |

| eVTOL Aircraft | Future potential for urban transport. | Billions invested in development (early 2024) | Long-term competitive threat for specific routes. |

| In-house Hospital Transport | Vertical integration by healthcare systems. | Trend accelerated by 2024 healthcare consolidation | Siphons off potential business, creates direct competition. |

Entrants Threaten

The threat of new entrants in the air medical services sector, specifically for Air Methods, is significantly mitigated by the extraordinarily high capital investment needed. Acquiring and maintaining a fleet of specialized medical helicopters and fixed-wing aircraft represents a massive financial hurdle. For instance, a single advanced medical helicopter can easily cost upwards of $10 million, and that's just the beginning.

Beyond the aircraft themselves, establishing the necessary operational infrastructure is equally capital-intensive. This includes building and equipping numerous bases, maintaining hangars, and ensuring rigorous, ongoing maintenance facilities. The sheer scale of this upfront financial commitment acts as a powerful deterrent, effectively blocking many potential new players from entering the market.

Stringent regulatory requirements represent a significant barrier for new entrants in the air medical transport sector. Aviation authorities like the Federal Aviation Administration (FAA) mandate rigorous operational safety standards, while healthcare bodies impose specific medical transport protocols. These necessitate extensive licensing, certifications, and approvals, making the initial investment in compliance substantial and time-consuming.

The air medical industry demands a highly specialized workforce, including pilots with extensive flight hours and certifications, and critical care medical staff with advanced training. For instance, a pilot for an air ambulance service often requires thousands of flight hours and specific instrument ratings, a benchmark that takes years to achieve. This scarcity of qualified personnel presents a substantial barrier to entry.

New companies entering the air medical field would struggle to attract and retain these essential professionals. The cost and time investment in training and recruitment are significant, making it difficult for newcomers to build a competent and experienced team capable of meeting stringent safety and operational standards. This need for specialized talent directly impacts the threat of new entrants.

Established Relationships with Hospitals and Healthcare Systems

Established relationships with hospitals and healthcare systems present a significant barrier to new entrants in the air medical services industry. Companies like Air Methods have cultivated deep, long-standing partnerships and contracts with critical care facilities, trauma centers, and regional EMS networks. These relationships are built on a foundation of trust, demonstrated reliability, and the seamless integration of complex logistical systems, making it exceedingly difficult for newcomers to replicate.

New entrants would face substantial hurdles in replicating the established trust and proven track record that incumbent operators like Air Methods have with their hospital partners. These partnerships are not merely transactional; they involve intricate operational dependencies and a history of dependable service delivery, often solidified through multi-year agreements. For instance, in 2023, Air Methods reported serving over 3,000 hospitals across the United States, underscoring the depth of their network.

- Incumbent Advantage: Air Methods and similar providers have decades of experience building and maintaining relationships with healthcare providers.

- Trust and Reliability: These relationships are based on consistent, high-quality service, which is difficult for new entrants to immediately establish.

- Logistical Integration: Existing contracts often involve integrated systems for dispatch, patient handoff, and billing, creating significant switching costs for hospitals.

- Market Penetration: In 2023, Air Methods' extensive network meant they were often the preferred or exclusive provider for many healthcare systems, limiting market access for new competitors.

Operational Complexities and Safety Standards

Operating air medical services presents significant operational complexities and stringent safety standards that act as a substantial barrier to entry. Navigating adverse weather, managing intricate flight paths, and ensuring patient safety during critical transports require specialized expertise and robust systems. For instance, in 2024, the FAA continues to emphasize rigorous pilot training and aircraft maintenance protocols, demanding substantial investment from any new player.

New entrants must develop comprehensive safety management systems and accumulate considerable operational expertise, a process that is both time-consuming and capital-intensive. This makes it challenging for them to quickly scale operations and compete effectively. The cost of acquiring and maintaining a fleet of specialized aircraft, coupled with the need for highly trained medical and flight personnel, further elevates the barrier.

Consider the following key challenges for new entrants:

- High Capital Investment: Acquiring and maintaining specialized aircraft, such as helicopters equipped for medical transport, requires millions of dollars. For example, a new Leonardo AW119, a common air ambulance, can cost upwards of $5 million.

- Regulatory Hurdles: Obtaining certifications from aviation authorities like the FAA and health regulatory bodies is a lengthy and complex process, often taking years.

- Operational Expertise: Developing the necessary logistical capabilities, including base operations, maintenance, and flight planning, demands significant experience and skilled personnel.

- Safety Culture: Establishing and maintaining a strong safety culture, paramount in air medical services, requires ongoing training, stringent protocols, and a commitment to continuous improvement.

The threat of new entrants for Air Methods is considerably low due to the immense capital required for aircraft acquisition, operational infrastructure, and regulatory compliance. In 2024, the cost of a new, advanced air ambulance helicopter can easily exceed $10 million, a substantial barrier. Furthermore, the need for specialized, highly trained personnel, including pilots with thousands of flight hours and critical care medical teams, makes market entry exceptionally challenging.

Existing relationships with over 3,000 hospitals, as reported by Air Methods in 2023, create a significant moat. New entrants would struggle to replicate the trust, proven reliability, and integrated logistical systems that incumbent providers have established over decades. This deep integration and established reputation make it difficult for newcomers to secure vital contracts and gain market access.

| Barrier to Entry | Description | Impact on New Entrants | Example Data (2023-2024) |

|---|---|---|---|

| Capital Investment | Acquisition and maintenance of specialized aircraft and infrastructure. | Extremely High | New air ambulance helicopter cost: ~$10M+ |

| Regulatory Compliance | FAA certifications, healthcare regulations, and licensing. | High | Years-long process for full operational approval. |

| Specialized Workforce | Pilots with extensive flight hours, certified medical staff. | High | Pilot requirements: Thousands of flight hours, specific ratings. |

| Established Relationships | Long-standing contracts and trust with hospitals and healthcare systems. | Very High | Air Methods served over 3,000 hospitals in 2023. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Air Methods leverages data from industry-specific market research reports, financial filings of key competitors, and regulatory databases to assess the competitive landscape.