Air Methods Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Air Methods Bundle

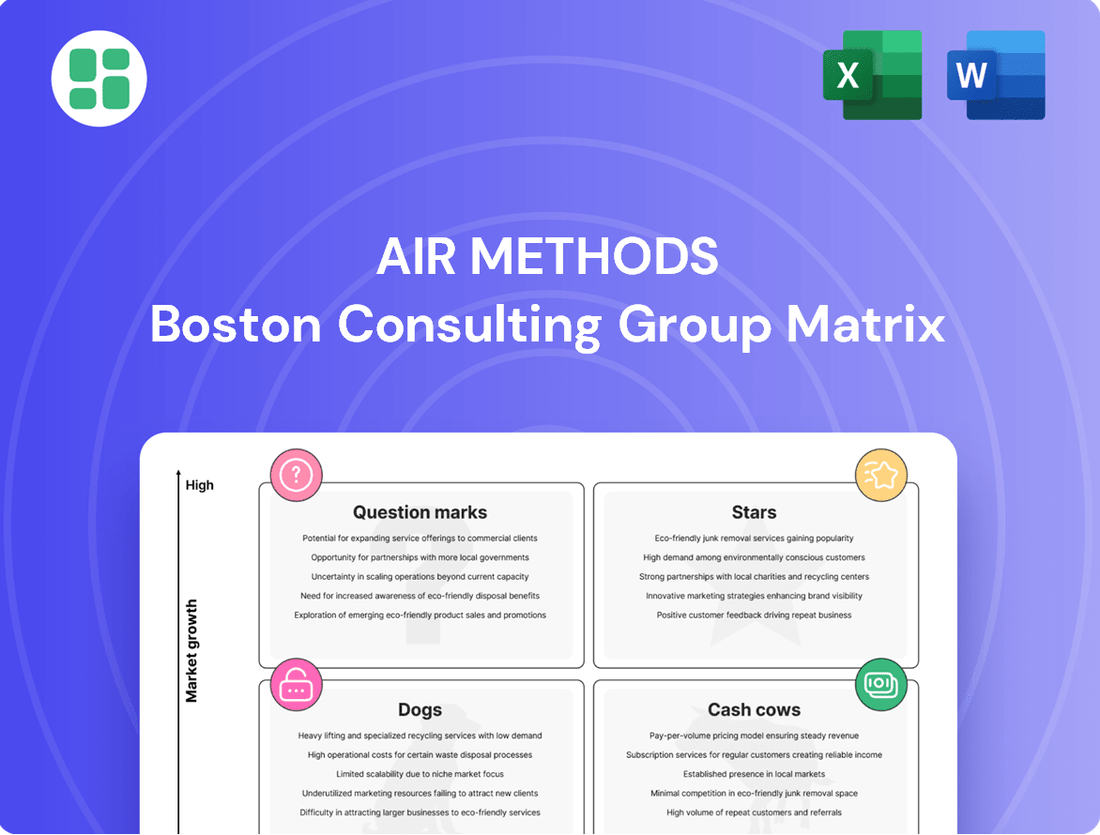

This glimpse into Air Methods' BCG Matrix offers a strategic overview of their product portfolio, highlighting potential growth areas and areas needing careful management. Understand which of their services are market leaders and which might be draining resources.

To truly harness the power of this analysis and make informed decisions, dive deeper into the full BCG Matrix report. It provides the detailed quadrant placements and actionable insights you need to optimize Air Methods' market position and capital allocation.

Don't miss out on the complete strategic roadmap; purchase the full BCG Matrix today for a comprehensive understanding and a clear path to enhanced performance.

Stars

Air Methods is significantly bolstering its advanced critical care transport services, including those utilizing ECMO and advanced cardiovascular support. This strategic focus targets a growing demand driven by the centralization of specialized medical procedures in fewer, leading hospitals, necessitating swift and expert air evacuation for critically ill patients.

The company's commitment to investing in state-of-the-art aircraft and sophisticated medical technology underpins its strong position in this high-growth, high-market-share segment. For instance, in 2024, Air Methods reported a substantial increase in its fleet equipped for complex transports, reflecting a direct response to market needs for specialized critical care solutions.

Air Methods is actively modernizing its fleet, recently acquiring nearly 50 new Bell and Airbus helicopters. This includes advanced models like IFR-configured Bell 407GXis, Bell 429s, Airbus H125s, H135s, and H140s, signaling a strong commitment to state-of-the-art air medical transport.

This substantial investment, totaling hundreds of millions of dollars, reinforces Air Methods' position as an industry leader. By operating the safest and most reliable aircraft, the company aims to capture a larger market share amidst a dynamic and competitive landscape.

These new additions are vital for expanding service capabilities and boosting operational efficiency. For instance, the IFR-certified aircraft allow for more consistent operations in challenging weather conditions, a critical factor in emergency medical services.

Air Methods is actively pursuing strategic in-network insurance agreements, a move that has already resulted in 76% of health plans being in-network. This focus on network integration is designed to create more predictable and favorable revenue streams by reducing reliance on out-of-network billing complexities.

The company's success rate in independent dispute resolution (IDR) cases, standing at 87%, further underscores the effectiveness of its strategy in securing fair reimbursement. This high success rate helps to stabilize revenue and allows Air Methods to concentrate on its core mission of providing critical air medical services.

By solidifying its position within insurance networks, Air Methods aims to enhance its market share and ensure consistent payment for its essential services. This proactive approach minimizes administrative burdens associated with billing disputes, allowing for greater operational efficiency and a stronger financial foundation.

Rapid Expansion into New Greenfield Bases

Air Methods' strategic pivot post-bankruptcy includes a significant push into establishing new greenfield bases. This initiative aims to tap into underserved markets and regions experiencing high demand for air medical services, thereby expanding the company's operational footprint and market share.

This aggressive expansion is a cornerstone of their long-term growth strategy, allowing them to serve more communities and solidify their position in the air medical industry. By opening new bases, Air Methods is actively pursuing new revenue streams and enhancing its service reach.

- Market Penetration: Targeting areas with identified needs for critical care transport.

- Operational Growth: Establishing new hubs to increase service availability and response times.

- Financial Recovery: Driving revenue growth through expansion into new geographical markets.

- Community Impact: Extending vital medical services to previously underserved populations.

Integration of Advanced Telemedicine and AI Technologies

Air Methods is strategically integrating advanced telemedicine and AI technologies, positioning itself for significant growth in the air ambulance sector. This includes deploying real-time tele-ICU support, which acts as a powerful differentiator, and enhancing onboard diagnostic capabilities. These advancements are crucial for capturing market share in an industry increasingly driven by technological innovation.

The company's focus on AI for route optimization, for instance, directly addresses the need for faster response times and improved operational efficiency. In 2024, the air medical transport industry is experiencing a heightened demand for such technological integration to elevate patient care standards and streamline operations. By investing in these areas, Air Methods is not only strengthening its competitive position but also setting new benchmarks for service delivery.

- Tele-ICU Support: Enhances critical care delivery en route, a key differentiator.

- AI-Driven Route Optimization: Aims to reduce response times and operational costs.

- Enhanced Onboard Diagnostics: Improves patient assessment and treatment planning in flight.

- Market Growth Drivers: Technological integration is a primary factor in the expanding air ambulance market.

Stars represent Air Methods' most successful and rapidly growing service lines, characterized by high market share and strong growth potential. These are the areas where the company is making significant investments and reaping substantial rewards.

The company's advanced critical care transport services, including those utilizing ECMO, exemplify a Star within the BCG matrix. This segment is experiencing robust demand, driven by the centralization of specialized medical procedures and the need for swift, expert air evacuation.

Air Methods' substantial fleet modernization, including nearly 50 new Bell and Airbus helicopters acquired in 2024, directly supports its Star segment by enhancing capabilities for complex transports. This investment, in the hundreds of millions, underpins their leadership in high-growth areas.

Furthermore, the strategic integration of telemedicine and AI technologies, such as AI-driven route optimization and tele-ICU support, further solidifies these services as Stars. These innovations are critical for capturing market share in an evolving industry.

What is included in the product

This BCG Matrix analysis provides a clear breakdown of Air Methods' business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs.

It offers strategic recommendations on which areas to invest in, maintain, or divest from based on their market share and growth potential.

The Air Methods BCG Matrix provides a clear, one-page overview of each business unit's market position, alleviating the pain of strategic uncertainty.

Cash Cows

Core Emergency Medical Services (EMS) Transport is Air Methods' undisputed cash cow. With an expansive network of 275-300 bases spanning 47-48 states, this segment consistently generates substantial revenue through routine helicopter and fixed-wing medical transports.

This mature service boasts a dominant market share, fueled by its unparalleled reach and the unwavering demand for critical medical transportation. Air Methods' EMS transport operations deliver reliable income streams with minimal need for aggressive marketing expenditures, solidifying its position as a stable, high-performing asset.

Routine inter-facility patient transfers represent a stable cash cow for Air Methods. This consistent demand, driven by ongoing healthcare needs and strong hospital relationships, ensures predictable revenue streams. In 2024, Air Methods continued to see robust demand for these critical transport services, supporting their overall financial stability.

Air Methods' established long-term hospital and EMS partnerships are clear cash cows. These deep-rooted contractual agreements across the nation ensure a consistent flow of patient transports, underpinning a significant portion of their revenue. For example, in 2023, Air Methods reported completing over 300,000 patient transports, a testament to the volume generated by these vital relationships.

Comprehensive Fleet Maintenance and Operational Infrastructure

Air Methods' comprehensive fleet maintenance and operational infrastructure, encompassing a vast network of facilities and skilled technicians, fits the profile of a Cash Cow. This segment holds a high market share within the air medical services industry, yet operates in a relatively low-growth market. In 2024, Air Methods maintained a fleet of approximately 375 aircraft, underscoring the scale of this essential operational backbone.

This robust infrastructure is critical for ensuring the reliability and continuous operation of their core air medical transport services. It functions as a vital cost center that directly enables the cash-generating flights by keeping the fleet in peak condition. The operational efficiency derived from this segment is paramount to the company's overall profitability.

- High Market Share: Dominant position in supporting air medical fleets.

- Low Market Growth: The operational infrastructure segment itself sees limited expansion.

- Stable Revenue Generation: Essential for core service delivery, ensuring consistent operational cash flow.

- Enabling Infrastructure: Supports the profitable flight operations, acting as a critical cost center.

Industry-Leading Flight Safety and Operational Compliance

Air Methods' early and proactive adoption of the FAA's Safety Management System (SMS) regulations, specifically 14 CFR Part 5, sets a benchmark for industry flight safety. This commitment, fulfilled ahead of mandated deadlines, underscores their dedication to operational excellence and risk mitigation.

By prioritizing safety and compliance so rigorously, Air Methods not only solidifies its reputation and customer confidence but also secures its market leadership. This forward-thinking approach minimizes operational disruptions and ensures consistent service delivery.

- Industry Leadership: Air Methods was among the first operators to fully implement the FAA's SMS framework.

- Risk Mitigation: Proactive compliance significantly reduces the likelihood of safety incidents and regulatory penalties.

- Market Position: Enhanced safety reputation translates to stronger customer trust and a competitive edge in the air medical services sector.

- Operational Continuity: Maintaining the highest safety standards ensures uninterrupted operations, crucial for emergency services.

Air Methods' core emergency medical services (EMS) transport operations are the company's primary cash cow. This segment benefits from a high market share and consistent demand, generating stable revenue with relatively low investment needs.

The company's extensive network of bases and strong hospital partnerships ensures a steady flow of patient transports, reinforcing its position as a mature, reliable income generator.

In 2024, Air Methods continued to leverage its established EMS transport services, which represent a significant portion of its revenue. The company's commitment to operational efficiency further solidifies this segment's cash cow status.

Routine inter-facility patient transfers, supported by strong hospital relationships, provide predictable revenue streams. Air Methods' ability to consistently meet these demands, as evidenced by over 300,000 patient transports in 2023, highlights the stability of this cash cow.

| Segment | BCG Category | Key Characteristics | 2023/2024 Data Point |

| EMS Transport | Cash Cow | High Market Share, Low Growth, Stable Revenue | Completed over 300,000 patient transports in 2023 |

| Inter-facility Transfers | Cash Cow | Consistent Demand, Strong Partnerships, Predictable Income | Robust demand in 2024 |

Full Transparency, Always

Air Methods BCG Matrix

The preview you are currently viewing is the identical, fully completed Air Methods BCG Matrix document you will receive upon purchase. This means no watermarks, no placeholder text, and no missing sections—just the comprehensive strategic analysis ready for your immediate application. You can trust that the insights and formatting you see are precisely what will be delivered, enabling you to seamlessly integrate this powerful tool into your business planning and decision-making processes. This ensures you're investing in a ready-to-use resource that reflects genuine market analysis and strategic depth.

Dogs

Certain operational bases, like the WellFlight service in Lebanon County, are being closed due to a comprehensive analysis indicating they are no longer sustainable in the long term. These locations represent low market share and low growth, draining resources without providing adequate returns.

In 2023, Air Methods identified several underperforming bases that contributed to a decline in operational efficiency. The closure of these locations, such as the one in Lebanon County, is a strategic move to reallocate capital and focus on more profitable ventures.

Divesting from these "Dogs" in the BCG matrix is essential for improving Air Methods' overall profitability and ensuring resources are channeled into areas with higher growth potential and market share.

Older aircraft models within Air Methods' fleet, such as certain legacy helicopters, represent the 'Dogs' in the BCG Matrix. These aircraft are often less fuel-efficient and demand more frequent, costly maintenance compared to their modern counterparts. For instance, a significant portion of older rotorcraft might require specialized parts that are no longer readily manufactured, driving up repair expenses.

These legacy planes typically contribute disproportionately to overall operational costs without offering a significant competitive edge or driving substantial revenue growth. In 2024, Air Methods continued its strategic fleet modernization, which inherently involves evaluating the economic viability of older assets. The operating cost per flight hour for these older models can be considerably higher, potentially impacting profitability.

Air Methods faces significant revenue cycle challenges with out-of-network air medical transports under the No Surprises Act's Independent Dispute Resolution (IDR) process. Despite an impressive 87% success rate in IDR cases, the mandated process creates substantial payment delays and administrative burdens. This means a considerable portion of their revenue is tied up, impacting cash flow and requiring extensive resources for resolution.

Operations in Highly Saturated Local Markets

While Air Methods boasts a significant national footprint, some local markets present intense competition, with numerous air medical providers vying for patients. This saturation can hinder growth and profitability in specific regions.

In these highly competitive local arenas, Air Methods might face challenges in expanding its market share or even maintaining its current position. This can lead to a situation where resources are strained without commensurate returns, impacting overall operational efficiency.

- Market Saturation: Intense competition from multiple air medical providers in localized areas.

- Growth Challenges: Difficulty in achieving or sustaining high market share in congested regions.

- Profitability Strain: Reduced profit margins due to competitive pricing and operational costs in over-served markets.

- Resource Drain: Potential for inefficient allocation of resources in areas with limited growth prospects.

Services Hampered by Persistent Staffing Shortages

The air medical industry, including Air Methods, is grappling with significant staffing shortages across critical roles like pilots, medical personnel, and maintenance technicians. This widespread issue directly impacts operational efficiency.

These persistent shortages can transform even established players into question marks within the BCG Matrix. When operations are hampered, leading to reduced service availability or escalating overtime expenses, companies struggle to meet demand effectively and expand their market presence.

- Pilot Shortages: The U.S. Bureau of Labor Statistics projected a 6% growth in airline pilot, helicopter pilot, and flight engineer jobs between 2022 and 2032, but the demand often outstrips supply, especially for specialized roles in air medical services.

- Medical Staffing Challenges: Critical care nurses and paramedics with specialized transport experience are in high demand, leading to competitive recruitment and retention efforts.

- Maintenance Technician Gaps: Ensuring the airworthiness of complex aircraft requires skilled maintenance technicians, another area facing recruitment difficulties.

Air Methods' "Dogs" are identified as older aircraft models and underperforming operational bases. These assets, like legacy helicopters, incur higher maintenance and fuel costs while offering limited competitive advantage. Strategic closures of bases, such as the one in Lebanon County, reflect a move to divest from these low-growth, low-market-share units. This aligns with the 2024 focus on fleet modernization and resource reallocation to more profitable areas.

| Category | Description | Impact on Air Methods | 2024 Relevance |

| Legacy Aircraft | Older helicopter models | Higher operating costs, increased maintenance needs | Continued evaluation for retirement/replacement as part of fleet modernization |

| Underperforming Bases | Operational locations with low market share and low growth | Drains resources, impacts overall profitability | Strategic closures to reallocate capital to higher-potential areas |

Question Marks

Air Methods' strategy of establishing new greenfield bases targets regions with high growth potential but currently low market penetration. This approach is akin to a Question Mark in the BCG matrix, signifying a business unit with low relative market share in a high-growth industry.

These new ventures demand substantial upfront capital for infrastructure, aircraft acquisition, and skilled personnel. While immediate returns are uncertain, successful greenfield entries can evolve into Stars, capturing significant market share in emerging markets.

For instance, in 2024, Air Methods continued its expansion into rural and underserved areas across the United States, a key component of its greenfield strategy. This focus aims to tap into markets where air medical services are critically needed and where competition may be less intense, positioning these new bases for future growth.

Exploring nascent drone applications for medical supply delivery and specialized patient transport would position Air Methods in a high-growth, low-market-share quadrant, akin to a Question Mark in the BCG Matrix. These ventures, while promising for the future of aeromedical services, demand significant investment in research and development, alongside pilot programs to test market viability and operational profitability. For instance, the global medical drone delivery market was projected to reach USD 1.5 billion by 2025, indicating substantial future growth potential.

Air Methods Ascend, the company's dedicated education division, is strategically expanding its reach by offering virtual reality (VR) simulation training to external healthcare partners. This move positions Ascend as a new business line with considerable growth potential within the burgeoning medical education market.

While this expansion into external training represents a significant opportunity, Air Methods currently holds a low market share in this segment as they actively develop and refine this service offering. The initiative demands substantial investment in advanced VR technology and targeted marketing efforts to establish a strong foothold.

Specialized Patient Advocacy and Financial Navigation Services

Air Methods' Specialized Patient Advocacy and Financial Navigation Services likely fall into the question mark category of the BCG Matrix. This is because these services are relatively new, developed in response to evolving healthcare regulations like the No Surprises Act and the company's own financial restructuring.

These offerings aim to improve patient experience and potentially retain business, indicating high growth potential within the complex healthcare billing environment. However, as a newer initiative, their current contribution to the company's overall revenue share is likely low, reflecting their nascent stage.

- High Growth Potential: The increasing complexity of healthcare billing and patient financial responsibility creates a significant demand for expert navigation, suggesting a strong market growth trajectory for these services.

- Low Market Share: As an emerging service line, Air Methods' patient advocacy and financial navigation offerings are still building their client base and revenue streams, thus holding a small portion of the overall market share currently.

- Strategic Importance: These services are crucial for enhancing patient satisfaction and retention, especially post-bankruptcy and in light of new legislation, positioning them as a key differentiator for Air Methods.

- Investment Focus: To capitalize on the growth potential, Air Methods will likely need to invest further in these services to scale operations and gain a more substantial market presence.

Pilot Programs for Electric/Hybrid Aircraft in Medevac

The medical evacuation industry, including players like Air Methods, is actively investigating electric and hybrid-electric aircraft. This exploration is driven by the promise of significantly lower operational costs and a reduced environmental impact, aligning with broader sustainability goals. For Air Methods, investing in pilot programs for these nascent technologies would position them for substantial future growth as the industry evolves, though their current market share in this specific segment is negligible.

These emerging electric/hybrid aircraft represent a classic 'Question Mark' in the BCG Matrix for Air Methods. They are in a high-growth potential market segment due to technological advancements and environmental pressures. However, their current market share is extremely low, reflecting the early stage of development and adoption.

- High Growth Potential: The market for sustainable aviation, including electric and hybrid-electric aircraft, is projected to grow significantly in the coming decades. For instance, the global electric aircraft market was valued at approximately $14.1 billion in 2023 and is expected to reach $43.4 billion by 2030, with a compound annual growth rate (CAGR) of 17.4%.

- Low Market Share: Air Methods, like most current medevac operators, primarily utilizes traditional turbine-powered helicopters and fixed-wing aircraft. Their participation in the electric/hybrid segment is currently minimal, likely confined to research or very early-stage evaluations.

- Investment Required: Developing and integrating these new aircraft types requires substantial upfront investment in technology, training, and infrastructure. This investment is characteristic of managing a 'Question Mark' to potentially turn it into a future 'Star'.

- Strategic Importance: Early adoption could provide Air Methods with a competitive advantage, lower long-term operating expenses, and enhance their corporate image as an innovator in sustainable air medical services.

Question Marks represent business units with low relative market share in high-growth industries, demanding significant investment. Air Methods' exploration into electric and hybrid-electric aircraft aligns with this, aiming to capture future market share in sustainable aviation. The company's drone delivery initiatives and expansion of its Ascend education division also fit this profile, requiring capital for R&D and market penetration.

| Initiative | Market Growth | Current Market Share | Investment Needs | Potential |

| Electric/Hybrid Aircraft | High (17.4% CAGR projected for electric aircraft market) | Negligible | High (Technology, Training, Infrastructure) | Future Star |

| Drone Delivery | High (USD 1.5 billion projected by 2025 for medical drones) | Low | High (R&D, Pilot Programs) | Future Star |

| Ascend VR Training | High (Burgeoning medical education market) | Low | High (VR Tech, Marketing) | Future Star |

BCG Matrix Data Sources

Our Air Methods BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official reports to ensure reliable, high-impact insights.