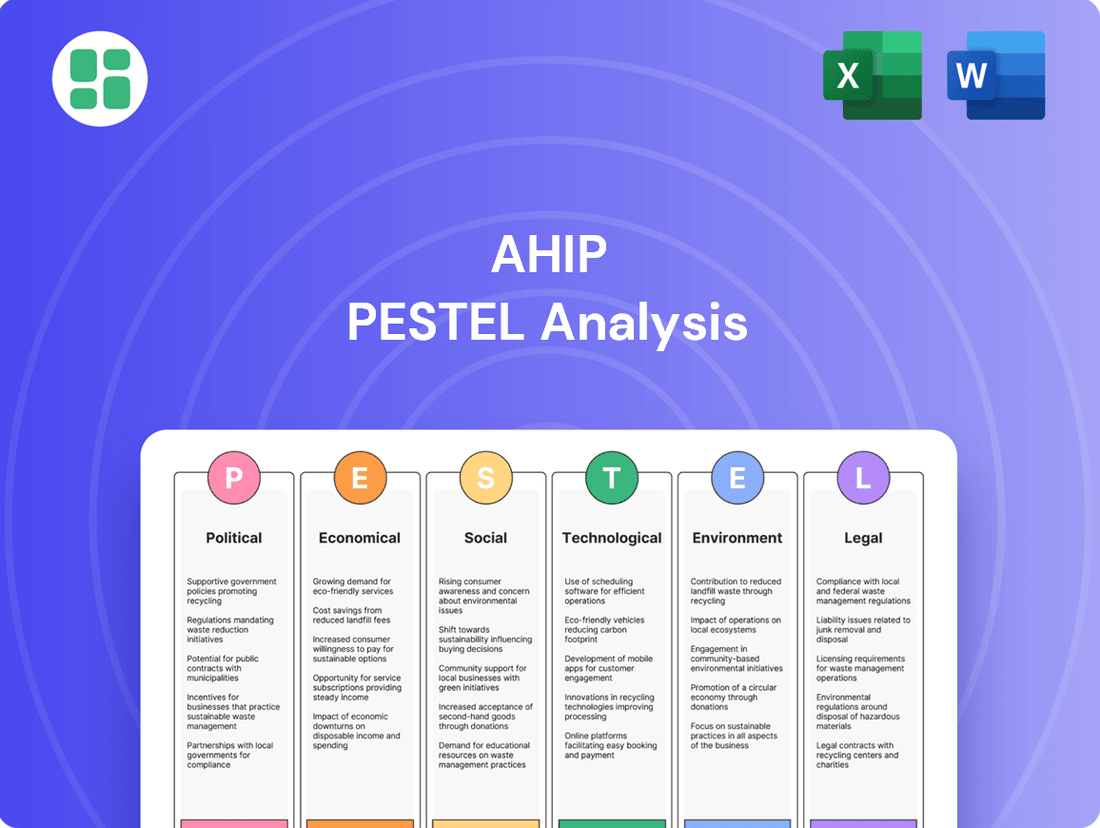

AHIP PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AHIP Bundle

Uncover the critical Political, Economic, Social, Technological, Legal, and Environmental factors shaping AHIP's strategic landscape. This comprehensive PESTLE analysis provides actionable intelligence to anticipate challenges and capitalize on opportunities. Download the full version now to gain a decisive advantage.

Political factors

Government tourism policies and visa regulations are critical drivers for the hospitality industry. For instance, changes to visa processing times or the introduction of new entry requirements, like potential bond mandates for certain visa types, can directly affect the influx of international tourists. In 2023, the US welcomed over 67 million international visitors, a significant rebound from pandemic lows, highlighting the sensitivity of tourism volumes to such policies.

Legislative shifts, like potential federal minimum wage hikes to $15 per hour, directly increase operating expenses for hotels by raising payroll costs. New overtime regulations, such as those proposed to expand eligibility, could further inflate labor budgets for hotels that rely on salaried staff working extended hours.

Recall rights laws, which some states have implemented or are considering, can restrict a hotel's ability to hire new staff quickly after layoffs, impacting operational agility and potentially increasing labor costs if experienced but more expensive former employees must be rehired.

Real estate and zoning regulations are critical for the hotel industry. Local and state governments' laws dictate where new hotels can be built and how existing ones can be repurposed. For instance, in 2024, many cities are grappling with balancing housing needs against commercial development, which can lead to stricter zoning for hotels in desirable areas.

Changes in land use policies directly impact investment. If a municipality tightens zoning to prevent new hotel construction in a prime tourist district, it can significantly reduce the supply pipeline. Similarly, restrictions on foreign ownership of land, which have been a point of discussion in several countries throughout 2024, could deter international investment in hotel development.

Trade Policies and Geopolitical Stability

Broader trade policies, tariffs, and ongoing geopolitical tensions create significant uncertainty, directly affecting consumer and business confidence in travel. For instance, the International Air Transport Association (IATA) noted in early 2024 that while air cargo demand showed resilience, the broader economic outlook remained subject to geopolitical risks.

This uncertainty has contributed to a noticeable decline in international leisure travel. A stronger U.S. dollar in 2023 and early 2024 also made travel to the U.S. more expensive for many international visitors, further dampening inbound tourism.

- Trade Policy Uncertainty: Ongoing trade disputes and potential new tariffs can disrupt supply chains and increase costs for businesses, impacting travel budgets.

- Geopolitical Tensions: Conflicts and political instability in various regions can deter international travel due to safety concerns and travel advisories.

- Currency Fluctuations: A strong dollar, as seen in 2023-2024, can make inbound international travel less attractive, impacting sectors like hospitality and tourism.

- Consumer Confidence: Economic and political uncertainty often leads consumers to postpone discretionary spending, including leisure travel.

Government Stimulus and Support for Hospitality

Government stimulus packages continue to be a critical factor for the hospitality industry. For instance, the U.S. government's Restaurant Revitalization Fund, while having closed applications, provided significant relief. Looking ahead, potential new initiatives in 2024 and 2025 could further bolster recovery and growth, especially for small and medium-sized enterprises within the sector.

Strategic investments in transportation infrastructure are also pivotal. In the U.S., the Infrastructure Investment and Jobs Act, enacted in late 2021, is set to disburse billions through 2025, improving airports, roads, and public transit. These enhancements directly benefit travel and tourism by making destinations more accessible and appealing to a wider range of visitors.

- Government Support: The U.S. government allocated $28.6 billion to the Restaurant Revitalization Fund, with over 100,000 businesses receiving grants. Future stimulus measures in 2024-2025 could target specific hospitality segments facing ongoing challenges.

- Infrastructure Investment: The Infrastructure Investment and Jobs Act earmarks approximately $1.2 trillion for infrastructure upgrades, with a substantial portion dedicated to transportation projects that will enhance travel connectivity through 2025.

Government policies profoundly shape the hospitality landscape, influencing everything from labor costs to market access. Regulatory changes, such as potential federal minimum wage increases to $15 per hour, directly impact operational expenses through higher payroll. Furthermore, evolving labor laws, like expanded overtime eligibility, can further strain hotel budgets, particularly for those relying on salaried staff working extended hours.

Government support and infrastructure spending are vital for industry recovery and growth. The U.S. Infrastructure Investment and Jobs Act, with significant allocations through 2025, is enhancing transportation networks, making destinations more accessible. This improved connectivity is crucial for boosting inbound tourism and overall travel demand, supporting the sector's economic vitality.

| Policy Area | Impact on Hospitality | 2024/2025 Data/Trends |

|---|---|---|

| Labor Regulations | Increased payroll costs, potential hiring restrictions | Minimum wage discussions continue; overtime rule changes under review. |

| Tourism Policies | Affects international visitor numbers | US welcomed over 67 million international visitors in 2023; visa policy reviews ongoing. |

| Infrastructure Investment | Improved accessibility, enhanced travel experience | Infrastructure Investment and Jobs Act disbursing funds through 2025 for transportation upgrades. |

What is included in the product

This AHIP PESTLE analysis examines the impact of external macro-environmental factors across Political, Economic, Social, Technological, Environmental, and Legal dimensions to identify strategic opportunities and threats.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors into actionable insights.

Economic factors

Elevated interest rates significantly increase the cost of borrowing for real estate, directly impacting AHIP's ability to acquire and develop new properties. For instance, a 100 basis point increase in interest rates can add millions to the financing costs of a large hotel acquisition.

While the prospect of interest rate cuts by central banks in late 2024 or early 2025 could boost investor sentiment, the current high cost of capital remains a substantial barrier to undertaking new hotel development projects.

Persistent inflation continues to squeeze hotel profitability. For instance, the average cost of hotel utilities saw an increase of 8% in 2024 compared to the previous year, directly impacting operating expenses. This rise in costs for essentials like electricity and water, alongside escalating prices for supplies and food and beverage, puts significant pressure on profit margins.

Labor costs remain a critical challenge for the hospitality industry. In 2024, the average labor cost per occupied room in major U.S. metropolitan areas rose by approximately 6.5%. This upward trend, driven by wage increases and the ongoing demand for skilled staff, directly affects the bottom line, especially for hotels operating with tighter budgets.

Consumer confidence remains a key indicator for the hospitality industry, directly influencing discretionary spending on leisure travel. Despite a generally resilient consumer, recent data suggests a potential softening in spending patterns, particularly for higher-ticket travel items like airfares and hotel stays, as economic uncertainties persist.

For instance, in early 2024, while domestic leisure travel showed strength, reports indicated a dip in consumer willingness to book flights and hotels further out, a sign of caution. This cautiousness can directly impact occupancy rates and revenue per available room (RevPAR) for hotels and airlines.

GDP Growth and Economic Outlook

The overall Gross Domestic Product (GDP) growth rate is a key indicator that directly influences both business and leisure travel demand. As economies expand, disposable income and corporate budgets tend to increase, fueling more travel. For instance, the International Monetary Fund (IMF) projected global GDP growth to be around 3.2% in 2024, with a slight moderation expected into 2025.

A projected deceleration in GDP growth, as anticipated by many economic forecasts for 2025, could significantly impact the lodging sector. Lower economic expansion often translates to reduced corporate spending on travel and a more cautious approach from consumers regarding discretionary spending like vacations. This slowdown could lead to a noticeable deceleration in Revenue Per Available Room (RevPAR) growth for hotels.

- Global GDP Growth Forecast: Many institutions, including the IMF and World Bank, are projecting a global GDP growth rate in the range of 2.8% to 3.1% for 2025, a dip from the estimated 3.2% in 2024.

- Impact on Travel Demand: Historically, a 1% change in GDP growth can correlate with a similar percentage change in travel spending, highlighting the sensitivity of the sector to economic performance.

- RevPAR Projections: Industry analysts are anticipating that the moderating GDP growth could cap RevPAR growth in the mid-single digits for 2025, down from potentially higher rates seen in prior recovery periods.

REIT Market Performance and Investor Sentiment

The broader REIT market's performance significantly influences hospitality REITs like AHIP. As of early 2025, the Real Estate Investment Trusts (REIT) sector has shown resilience, with many segments experiencing steady growth. Investor sentiment towards hospitality real estate, while cautiously optimistic, is particularly strong for properties in high-demand urban centers and popular resort destinations, directly benefiting AHIP's portfolio.

Investor confidence, though subject to economic fluctuations, generally leans bullish for well-positioned hospitality assets. This positive outlook is crucial for AHIP's valuation and its capacity to secure necessary capital for growth and development. For instance, the U.S. lodging industry occupancy rates are projected to approach pre-pandemic levels by late 2024 and continue strengthening into 2025, a key indicator of market health.

- REIT Sector Performance: Continued steady growth observed in early 2025, with specific segments showing robust returns.

- Hospitality REIT Sentiment: Cautiously optimistic, with a strong bullish trend for urban and resort markets.

- AHIP's Valuation Impact: Positive market sentiment and performance directly enhance AHIP's market value and capital-raising ability.

- Industry Data Point: U.S. lodging occupancy rates expected to near pre-pandemic levels by late 2024, supporting market confidence.

Economic headwinds, including persistent inflation and elevated interest rates, continue to pressure hospitality businesses like AHIP. While forecasts suggest potential interest rate cuts in late 2024 and early 2025, the current cost of capital remains a significant hurdle for new developments. These factors directly impact profitability and the feasibility of expansion strategies.

| Economic Factor | 2024 Data/Forecast | 2025 Forecast | Impact on AHIP |

|---|---|---|---|

| Global GDP Growth | ~3.2% | ~2.8% - 3.1% | Potential moderation in travel demand |

| Inflation (Utilities) | +8% (YoY) | Expected to moderate but remain elevated | Increased operating costs, squeezed margins |

| Labor Costs | +6.5% (per occupied room) | Continued upward pressure | Higher operational expenses |

| Interest Rates | Elevated | Potential cuts, but still a concern | Increased cost of borrowing, impact on development |

Full Version Awaits

AHIP PESTLE Analysis

The preview you see here is the exact AHIP PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use for your strategic planning.

This is a real screenshot of the product you’re buying—delivered exactly as shown, covering political, economic, social, technological, legal, and environmental factors impacting AHIP, no surprises.

The content and structure shown in the preview is the same comprehensive AHIP PESTLE Analysis document you’ll download after payment, providing valuable insights.

Sociological factors

Travel preferences are shifting, with a growing demand for personalized and authentic experiences, impacting hotel segment choices. For instance, a significant portion of travelers now prioritize unique local immersion over standardized offerings, influencing how hotels design their guest experiences and amenities. This evolution directly affects occupancy rates and revenue streams across various hotel categories.

The 'bleisure' trend, combining business and leisure travel, is a key demographic shift, with an estimated 50% of business trips in 2024 expected to include leisure days, according to industry reports. This creates a demand for hotels that cater to both professional needs, like co-working spaces and reliable Wi-Fi, and leisure desires, such as on-site dining and recreational facilities, reshaping property development and marketing strategies.

Demographic changes, including an aging population and the increasing spending power of millennials and Gen Z, also play a crucial role. Older travelers may seek comfort and accessibility, while younger generations often prioritize sustainability, technology integration, and experiential stays. This dual demand requires hotels to offer diverse amenities and service models to capture a broader market share.

Lingering health concerns, a direct echo of recent pandemic experiences, significantly shape how travelers approach their stays. This translates into a heightened demand for contactless check-ins and rigorous cleaning standards, influencing hotel operational priorities and investment in guest well-being technologies. For instance, by late 2024, industry reports indicated that over 70% of travelers prioritized hotels with visible and robust hygiene protocols.

The shift towards remote and hybrid work models is significantly reshaping how people travel and where they choose to stay. This trend is particularly relevant for companies like AHIP, which operate in the lodging sector. For instance, a 2024 survey indicated that over 60% of U.S. workers are now in roles that can be performed remotely at least part-time, a substantial increase from pre-pandemic levels.

This widespread adoption of flexible work arrangements is fueling a rise in 'workcations' and extended stays, as individuals combine business with leisure and seek accommodations that support both. A report from early 2025 highlighted that bookings for extended-stay hotels, specifically those offering amenities like reliable Wi-Fi and workspace options, saw a 15% year-over-year increase, suggesting a growing demand for these integrated living and working solutions.

Consequently, AHIP can capitalize on these evolving sociological factors by adapting its property offerings to cater to this new segment of travelers. This might involve enhancing in-room workspace amenities, offering longer-term booking discounts, or even developing specialized packages that appeal to digital nomads and those seeking a change of scenery while maintaining productivity.

Sustainability Consciousness of Travelers

A significant shift is occurring in travel preferences, with a growing number of consumers, especially younger demographics like millennials and Gen Z, actively seeking out eco-friendly and sustainable travel options. This trend directly impacts the hospitality industry, influencing booking decisions and brand perception.

Hotels demonstrating a commitment to green initiatives, such as waste reduction, energy efficiency, and responsible sourcing, are increasingly favored by this conscious traveler segment. This focus on sustainability not only attracts new customers but also fosters stronger brand loyalty among those who align with these values.

For instance, a 2024 report indicated that 70% of travelers surveyed stated they would be more likely to book accommodations that clearly displayed their commitment to sustainability. Furthermore, studies from 2025 suggest that hotels with robust environmental, social, and governance (ESG) programs experienced a 5% higher occupancy rate compared to those without.

- Growing Demand: Millennials and Gen Z are driving the demand for sustainable travel, with a significant portion willing to pay more for eco-conscious options.

- Brand Differentiation: Hotels embracing green practices can differentiate themselves in a competitive market and attract a values-driven customer base.

- Loyalty Factor: Demonstrating genuine commitment to sustainability fosters deeper customer relationships and encourages repeat business.

- Market Opportunity: The increasing traveler consciousness presents a substantial market opportunity for hotels that integrate and effectively communicate their sustainability efforts.

Social Awareness and Local Community Impact

Growing public awareness about how tourism affects local populations is increasingly shaping hotel operations. This heightened social consciousness can translate into direct pressure for more ethical and sustainable tourism models, potentially influencing local government policies and how consumers view a hotel's commitment to its community.

For instance, in 2024, a significant portion of travelers, estimated at over 60% according to industry surveys, indicated a preference for accommodations that demonstrably benefit local communities. This trend is pushing hotels to adopt practices that support local economies and minimize negative social externalities.

- Increased Demand for Ethical Travel: Consumers are actively seeking out hotels that prioritize local employment and fair wages.

- Regulatory Influence: Public pressure can lead to new local ordinances regarding land use, cultural preservation, and community benefit sharing.

- Reputational Impact: Hotels that fail to address social concerns risk negative publicity and reduced bookings.

- Community Partnerships: Successful hotels often forge strong ties with local businesses and cultural organizations.

Sociological factors significantly influence travel and accommodation choices, with a noticeable shift towards personalized and authentic experiences. Younger demographics, particularly millennials and Gen Z, are increasingly prioritizing sustainability and ethical practices, impacting brand perception and booking decisions. For example, a 2025 report indicated that 70% of travelers would book accommodations demonstrating a commitment to sustainability, with hotels showcasing robust ESG programs seeing a 5% higher occupancy rate.

The rise of remote and hybrid work has fueled 'workcations' and extended stays, creating demand for accommodations that blend living and working spaces. By early 2025, extended-stay hotel bookings saw a 15% year-over-year increase, highlighting the need for hotels to adapt by enhancing workspace amenities and offering longer-term packages.

Consumer awareness regarding the social impact of tourism is growing, with over 60% of travelers in 2024 preferring accommodations that benefit local communities. This trend encourages hotels to adopt ethical practices, support local economies, and forge community partnerships to enhance their reputation and customer appeal.

| Sociological Factor | Impact on Hospitality | Supporting Data (2024-2025) |

|---|---|---|

| Demand for authentic experiences | Shift in hotel design and amenities | Significant portion of travelers prioritize local immersion. |

| 'Bleisure' trend | Need for integrated work and leisure facilities | 50% of business trips expected to include leisure days in 2024. |

| Sustainability focus | Increased bookings for eco-friendly hotels | 70% of travelers prefer hotels with visible sustainability commitment (2024); ESG-focused hotels saw 5% higher occupancy (2025). |

| Ethical tourism awareness | Preference for community-benefiting accommodations | Over 60% of travelers prefer hotels that demonstrably benefit local communities (2024). |

Technological factors

Artificial intelligence and automation are significantly reshaping hotel operations and guest services. AI-powered smart check-ins and chatbots are streamlining customer interactions, while predictive maintenance and dynamic pricing models are boosting operational efficiency and revenue management. For instance, by 2024, it's projected that AI in customer service will handle over 95% of customer interactions in many sectors, a trend clearly visible in hospitality.

These advancements not only improve the speed and accuracy of services but also allow for a more personalized guest experience. Hotels are leveraging AI to analyze guest preferences and tailor offerings, from room amenities to dining recommendations. This personalized approach is becoming a key differentiator, with studies in 2024 showing that personalized experiences can increase customer loyalty by up to 20%.

The integration of Internet of Things (IoT) devices and smart room technology is transforming the hospitality industry, allowing guests to personalize their environments, from lighting to temperature, for enhanced comfort and immersive experiences. This technological advancement directly boosts guest satisfaction and streamlines hotel operations, a key driver for increased bookings and positive reviews.

However, this increased connectivity also presents significant cybersecurity challenges. The proliferation of IoT devices within hotel rooms expands the potential attack surface, making robust security measures paramount to protect guest data and maintain operational integrity, especially as the global IoT market is projected to reach $1.56 trillion by 2025, with a significant portion in consumer and enterprise applications.

The increasing digitalization of hotel operations, from booking systems to in-room technology, exposes the industry to significant cybersecurity risks. Hotels handle vast amounts of sensitive customer data, including payment information and personal details, making them attractive targets for cybercriminals. In 2024, the hospitality sector continued to see a rise in ransomware attacks, with some reports indicating a 20-30% year-over-year increase in incidents targeting hotel chains.

Robust cybersecurity measures are no longer optional but a critical necessity for hotels to protect guest information and ensure business continuity. This includes implementing strong firewalls, regular software updates, employee training on phishing awareness, and data encryption. Failure to do so can lead to severe financial losses, reputational damage, and legal penalties, especially with evolving data protection regulations like GDPR and CCPA.

Online Travel Agencies (OTAs) and Digital Distribution

Online Travel Agencies (OTAs) continue to be a dominant force in travel distribution, influencing hotel booking channels and revenue. For instance, in 2024, OTAs like Booking.com and Expedia are projected to maintain significant market share, though hotels are increasingly focusing on direct bookings to reduce commission costs. This dynamic necessitates that hotels adapt their digital distribution strategies to effectively manage occupancy rates and optimize pricing in a competitive landscape.

Hotels are actively refining their approaches to digital distribution to counter OTA reliance and enhance direct booking revenue. Many are investing in improved website user experience and loyalty programs. By 2025, it's anticipated that hotels will further leverage data analytics to personalize offers and target specific customer segments. This strategic shift aims to improve profitability and customer relationships.

The evolving strategies of OTAs present both challenges and opportunities for the hospitality industry. Hotels must remain agile in their digital presence and marketing efforts. Key considerations for adapting include:

- Diversifying Distribution Channels: Reducing over-reliance on a single OTA by exploring alternative online travel marketplaces and direct booking platforms.

- Enhancing Direct Booking Incentives: Offering exclusive perks, loyalty points, or best-rate guarantees to encourage guests to book directly on the hotel's website.

- Leveraging Technology for Personalization: Utilizing customer data to tailor marketing messages and offers through digital channels, increasing conversion rates.

- Optimizing Mobile Experience: Ensuring seamless booking processes and engaging content on mobile devices, as mobile bookings continue to rise.

Data Analytics for Personalization and Revenue Management

Hotels are increasingly using big data analytics and artificial intelligence to tailor guest experiences and implement dynamic pricing. This approach allows for hyper-personalization, anticipating individual guest needs and preferences, which is crucial for standing out in a crowded market.

By analyzing vast datasets, hotels can predict demand and adjust room rates in real-time, a strategy known as dynamic pricing. For instance, during peak seasons or major events in 2024 and projected into 2025, hotels that effectively leverage these technologies can see significant revenue uplift compared to static pricing models.

The benefits are tangible:

- Enhanced Guest Loyalty: Personalized offers and services driven by data analytics foster stronger guest relationships.

- Optimized Revenue: Dynamic pricing, informed by AI, can boost occupancy rates and average daily rates (ADR). For example, early 2024 data indicated that hotels employing advanced revenue management systems saw ADR increases of up to 15% during high-demand periods.

- Operational Efficiency: Predictive analytics can help manage staffing and inventory more effectively, reducing waste and improving service delivery.

Technological advancements are fundamentally altering hotel operations and guest interactions, with AI and automation streamlining services and personalizing experiences. The integration of IoT devices further enhances guest comfort and operational efficiency, though it also introduces significant cybersecurity risks. The industry is also adapting to digital distribution shifts, with a growing emphasis on direct bookings and data-driven personalization strategies, supported by technologies like big data analytics and AI for dynamic pricing.

Legal factors

The hospitality industry faces a complex web of evolving data privacy and cybersecurity regulations. Laws like the General Data Protection Regulation (GDPR) and various state-specific mandates, such as California's CCPA/CPRA, impose stringent requirements on how guest data is collected, stored, and used, demanding enhanced transparency and consent mechanisms.

Compliance is not merely a legal obligation but a critical safeguard against escalating cybersecurity threats targeting the hospitality sector. In 2024, the industry continues to be a prime target, with data breaches impacting millions of customers annually, leading to significant financial penalties and reputational damage.

The hospitality sector constantly navigates evolving labor and employment laws. Minimum wage hikes, such as the increase to $15.50 per hour for federal contractors in early 2024, directly affect operational costs. Overtime regulations and mandates for employee benefits, like paid sick leave which is now law in over 20 states, add further complexity to workforce management.

Specific state legislation, like California's SB 56, which grants extended recall rights to employees laid off during the pandemic, significantly impacts hiring and staffing strategies. These laws require careful planning to ensure compliance and manage labor relations effectively, especially as the industry recovers and adapts to new workforce dynamics.

Laws governing real estate transactions and property rights directly influence AHIP's ability to acquire and develop properties. For instance, in 2024, the U.S. saw continued scrutiny on foreign investment in real estate, with specific regulations potentially impacting AHIP's international acquisition strategies.

Zoning and land use policies are critical legal considerations. Changes in these regulations, such as increased environmental protections or density requirements in urban areas, can significantly alter the feasibility and cost of development projects for AHIP.

Health, Safety, and Accessibility Regulations

Hotels are subject to stringent health, safety, and accessibility regulations designed to protect guests and staff. These include adherence to building codes, fire safety standards, and food hygiene practices. For instance, in 2024, the U.S. Department of Justice continued to enforce the Americans with Disabilities Act (ADA), with ongoing litigation and settlements related to hotel accessibility, impacting renovation budgets and operational procedures.

Compliance often involves significant capital investment. In 2025, many hotels are expected to allocate substantial portions of their budgets towards upgrades, such as installing visual fire alarms, improving restroom accessibility, and ensuring clear pathways throughout the property. Failure to comply can result in hefty fines and reputational damage, underscoring the critical nature of these legal mandates.

- Building Codes: Hotels must meet updated building codes, which can vary by municipality and often require structural, electrical, and plumbing modifications.

- Fire Safety: Regulations mandate specific fire suppression systems, emergency exit signage, and regular inspections, with compliance checks becoming more rigorous.

- Accessibility Standards: The ADA and similar international laws require hotels to provide accessible rooms, common areas, and amenities, impacting room design and service delivery.

- Food Safety: For hotels with restaurants or room service, strict adherence to food handling and preparation regulations is paramount to prevent health code violations.

Consumer Protection and Pricing Transparency Laws

Legislation like the Junk Fee Prevention Act, proposed in 2023 and actively debated through 2024, mandates that all mandatory service charges be included in advertised prices. This means businesses, including those in the health insurance industry, must overhaul their pricing structures to reflect the total cost upfront. For example, a health insurance plan's advertised monthly premium must now encompass all administrative fees and surcharges, preventing unexpected charges at the point of service.

This shift necessitates a thorough review of existing pricing models. Companies need to ensure that all components of their service costs are consolidated into the final advertised price. Failure to comply can result in significant penalties, impacting profitability and brand reputation. The Consumer Financial Protection Bureau (CFPB) has been actively scrutinizing hidden fees across various sectors, with a particular focus on financial services and healthcare in 2024.

- Pricing Transparency Mandates: Laws require the upfront disclosure of all fees associated with a service.

- Impact on Business Models: Companies must adapt pricing strategies to include all charges in advertised rates.

- Regulatory Scrutiny: Agencies like the CFPB are increasing enforcement actions against non-compliant businesses.

- Consumer Trust: Clearer pricing builds consumer confidence and can be a competitive advantage.

Legal frameworks surrounding insurance operations are critical, encompassing everything from policyholder protections to regulatory compliance. In 2024, the U.S. saw continued emphasis on consumer protection, with state insurance departments actively enforcing regulations against unfair or deceptive practices. For instance, the National Association of Insurance Commissioners (NAIC) has been instrumental in developing model laws that states adopt, influencing areas like market conduct and solvency.

Antitrust laws and regulations are also pertinent, ensuring fair competition within the health insurance market. AHIP must operate within these legal boundaries, avoiding monopolistic practices or price-fixing. The Federal Trade Commission (FTC) and the Department of Justice (DOJ) actively monitor mergers and acquisitions in the healthcare sector, including insurance, to prevent anti-competitive outcomes.

Contract law governs the agreements AHIP has with providers, employers, and members. Ensuring clarity and enforceability in these contracts is vital. In 2025, expect continued focus on contract disputes and the interpretation of terms, particularly concerning network adequacy and reimbursement rates.

Government regulations, such as the Affordable Care Act (ACA), continue to shape the health insurance landscape. Provisions like guaranteed issue and essential health benefits remain central to AHIP's operational model, requiring ongoing adaptation to federal and state-level policy changes and enforcement actions throughout 2024 and into 2025.

Environmental factors

The escalating frequency and intensity of climate change-driven extreme weather events present significant physical risks to hotel properties. Consider the 2023 hurricane season, which saw record-breaking activity, impacting coastal resorts and leading to substantial repair costs and business interruptions for affected establishments.

These disruptions translate directly into increased operational costs, including higher insurance premiums and the necessity for investing in resilient infrastructure, such as reinforced structures and advanced flood defenses, to mitigate future damage and ensure business continuity.

Growing regulatory pressure and evolving industry standards are compelling hotels to embrace sustainable practices, particularly in green building design and energy efficiency. For instance, in 2024, the global green building market was valued at over $3.5 trillion, with a projected compound annual growth rate of 8.5% through 2030, indicating a strong trend towards eco-conscious construction and retrofitting in the hospitality sector.

Certifications like Leadership in Energy and Environmental Design (LEED) are increasingly vital for validating a hotel's commitment to sustainability, influencing consumer choice and investor confidence. As of early 2025, over 100,000 LEED projects were registered and certified worldwide, demonstrating the growing importance of these benchmarks in the hospitality industry's environmental strategy.

Hotels are facing growing demands to minimize their environmental impact, focusing on efficient water use and incorporating renewable energy sources. Smart energy management systems are becoming crucial for this transition. For instance, in 2024, many hotel chains reported significant reductions in water consumption through low-flow fixtures and water recycling programs, with some achieving up to a 15% decrease in water usage per occupied room.

The increasing accessibility of energy technologies like solar, wind, and geothermal power presents substantial opportunities for hotels. By 2025, it's projected that over 30% of new hotel constructions will integrate on-site renewable energy generation, reducing reliance on traditional grids and lowering operational costs. This shift is driven by both environmental consciousness and the financial benefits of reduced energy bills, which can amount to savings of 10-20% annually for properties making the switch.

Waste Management and Recycling Initiatives

The hospitality industry is increasingly prioritizing waste reduction, with many establishments adopting zero-waste programs, expanding composting efforts, and actively phasing out single-use plastics. This shift is driven by both environmental consciousness and growing consumer demand for sustainable practices. For instance, many hotels in 2024 are reporting significant reductions in landfill waste, with some aiming for over 75% diversion rates from landfills through comprehensive recycling and composting programs.

The integration of technology, particularly artificial intelligence (AI), is playing a crucial role in optimizing these waste management strategies. AI-powered systems are being deployed to meticulously monitor and analyze food waste patterns in kitchens and dining areas. This data allows businesses to make informed decisions about inventory management, portion control, and menu planning, ultimately minimizing surplus food and associated waste. Early adopters of such AI solutions in 2024 have seen a 15-20% reduction in food waste within their operations.

- Zero-Waste Programs: Many hotels and restaurants are implementing comprehensive strategies to minimize waste generation across all operations.

- Composting Expansion: Increased adoption of on-site or third-party composting services for organic waste from kitchens and guest rooms.

- Plastic Reduction: A concerted effort to eliminate single-use plastics, such as straws, cutlery, and miniature toiletries, replacing them with reusable or biodegradable alternatives.

- AI for Food Waste Optimization: Utilizing AI to track, analyze, and reduce food waste through better inventory management and demand forecasting.

Eco-Conscious Travel and Regenerative Tourism

The growing wave of eco-conscious travelers is fundamentally reshaping the hospitality industry. Hotels are increasingly recognizing that sustainability isn't just a marketing angle; it's a core operational necessity. This shift is driven by consumer demand and a growing awareness of the environmental impact of travel. For instance, a 2024 survey indicated that over 70% of travelers consider sustainability when booking accommodations.

Emerging from this trend is regenerative hospitality, a more ambitious approach that seeks to leave a positive mark on both the environment and local communities. This model moves beyond simply minimizing harm to actively contributing to restoration and well-being. It's becoming an aspirational standard, with many properties now focusing on initiatives like carbon offsetting, waste reduction, and supporting local economies.

Key aspects of this environmental shift include:

- Prioritizing Sustainable Operations: Hotels are investing in renewable energy sources, water conservation technologies, and reducing single-use plastics.

- Community Engagement: Regenerative tourism emphasizes fair wages, local sourcing of food and materials, and cultural preservation.

- Measurable Impact: A growing number of hotels are seeking certifications and transparently reporting on their environmental performance, with many aiming for net-zero emissions by 2030.

The hotel industry faces increasing pressure to adopt sustainable practices, driven by both regulatory changes and growing consumer demand for eco-friendly options. This includes a focus on reducing carbon footprints and implementing circular economy principles.

Hotels are investing in energy efficiency and renewable energy sources to mitigate operational costs and environmental impact. For instance, by 2025, it's projected that over 30% of new hotel constructions will integrate on-site renewable energy generation, potentially saving 10-20% annually on energy bills.

Waste reduction is a key environmental focus, with many establishments implementing zero-waste programs and phasing out single-use plastics. AI is also being utilized to optimize food waste management, with early adopters seeing 15-20% reductions in food waste in 2024.

Consumer preference is shifting, with over 70% of travelers in a 2024 survey considering sustainability when booking accommodations, pushing hotels towards regenerative hospitality models that aim to leave a positive environmental and community impact.

PESTLE Analysis Data Sources

Our AHIP PESTLE Analysis is built on a robust foundation of data from official government health agencies, leading economic institutions, and reputable industry publications. We meticulously gather information on policy changes, market trends, and societal shifts to ensure comprehensive and accurate insights.