AHIP Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AHIP Bundle

AHIP's competitive landscape is shaped by powerful forces, from intense rivalry among existing players to the significant bargaining power of buyers. Understanding these dynamics is crucial for navigating the healthcare industry.

This brief overview only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore AHIP’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

AHIP's reliance on major hotel brands like Marriott, Hilton, and IHG significantly amplifies supplier power. These brands wield considerable influence due to their established guest loyalty programs, proprietary reservation systems, and stringent operational standards, which present high switching costs for AHIP's select-service hotels.

These licensing agreements are foundational to AHIP's business model, directly impacting revenue streams and market standing. For instance, in 2023, AHIP operated a substantial portfolio of franchised and managed hotels, with a significant portion bearing these major brand flags, underscoring their critical role in the company's performance.

The concentration of major hotel brands significantly limits AHIP's alternatives, granting substantial leverage to its existing brand partners. For instance, in 2024, the top five hotel franchisors globally controlled over 60% of all franchised hotel rooms, a figure that underscores the limited options for independent hotel owners like AHIP when seeking brand affiliations.

Even within AHIP's focus on select-service hotels, these properties are bound by strong brand standards. These standards often dictate operational procedures, marketing strategies, and even renovation cycles, thereby reducing AHIP's flexibility in negotiating favorable terms and fees with the brand providers.

Key operational suppliers for hospitality businesses, like property management firms or specialized tech providers, can hold significant bargaining power. For instance, a hotel reliant on a single, advanced property management system provider might find that vendor has considerable leverage, especially if switching costs are high.

The hospitality sector's move towards unified procurement platforms and AI solutions in 2024 is a trend that could concentrate power among a few dominant technology or service providers. This consolidation means these suppliers could dictate terms more effectively, impacting the industry's cost structure.

Supplier Power 4

The bargaining power of suppliers for AHIP is significant, particularly due to rising construction and renovation costs. These expenses, coupled with increasing labor and utility rates, directly impact AHIP's ability to maintain and upgrade its hotel properties. Suppliers in these sectors can leverage these escalating costs to demand higher prices from AHIP.

Hotels, including those within AHIP's portfolio, are consistently facing upward cost pressures. Suppliers of essential materials, skilled labor, and energy are in a strong position to pass these increased expenses onto their hotel clients. This dynamic means AHIP must contend with potentially higher operating expenditures as suppliers exert their influence.

- Rising Construction and Renovation Costs: These are critical for property upkeep and modernization, giving suppliers leverage.

- Increasing Labor Expenses: Higher wages for construction and maintenance staff translate to increased costs for AHIP.

- Elevated Utility Rates: Energy costs are a substantial operating expense, and suppliers can dictate terms.

- Supplier Cost Pass-Through: Suppliers of materials, labor, and energy can readily transfer their own cost increases to AHIP.

Supplier Power 5

The bargaining power of suppliers is a significant factor for American Hotel Income Properties (AHIP). Hotel brands often mandate specific property improvements and capital expenditures. These requirements, while intended to enhance asset value, can be non-negotiable, effectively granting suppliers like contractors and designers considerable leverage in pricing and terms.

This supplier power directly impacts AHIP's operational costs and its flexibility in managing investments. For instance, in 2024, the construction industry experienced rising material costs and labor shortages, particularly in key hospitality markets where AHIP operates. This environment amplifies the ability of suppliers to dictate terms for necessary renovations or upgrades, potentially increasing AHIP's capital expenditure budgets beyond initial projections.

- Brand Mandates: Hotel brands frequently impose specific renovation standards and capital expenditure requirements on franchisees and owners like AHIP.

- Supplier Leverage: The necessity of complying with these brand standards empowers suppliers (e.g., construction firms, FF&E providers) to negotiate higher prices and less flexible contract terms.

- Cost Impact: In 2024, increased costs for materials like lumber and steel, coupled with a tight labor market, have further strengthened the bargaining position of suppliers in the hospitality sector.

- Reduced Flexibility: AHIP's ability to control its own capital allocation and operational spending is constrained when faced with non-negotiable supplier demands driven by brand requirements.

AHIP faces considerable supplier power, particularly from hotel brand franchisors and providers of essential goods and services. This is exacerbated by rising costs in construction, labor, and utilities, which suppliers can pass on. For example, in 2024, the construction sector saw material costs increase by an average of 5-10% year-over-year, and labor shortages further bolstered supplier leverage for renovations and maintenance.

| Supplier Category | Impact on AHIP | 2024 Trend Example |

|---|---|---|

| Hotel Brand Franchisors | Mandated upgrades, strict standards limit flexibility | Brand standards often require specific FF&E (Furniture, Fixtures & Equipment) updates, increasing capital expenditure needs. |

| Construction & Renovation Suppliers | Higher material and labor costs increase project expenses | Increased demand and supply chain issues in 2024 led to higher bids for renovation projects. |

| Labor Providers (Skilled Trades) | Shortages drive up wages and service costs | Skilled trade labor shortages in hospitality markets in 2024 meant higher hourly rates for essential maintenance. |

| Utility Providers | Elevated energy rates directly impact operating expenses | In many regions, utility costs saw a 3-7% increase in 2024, affecting AHIP's bottom line. |

What is included in the product

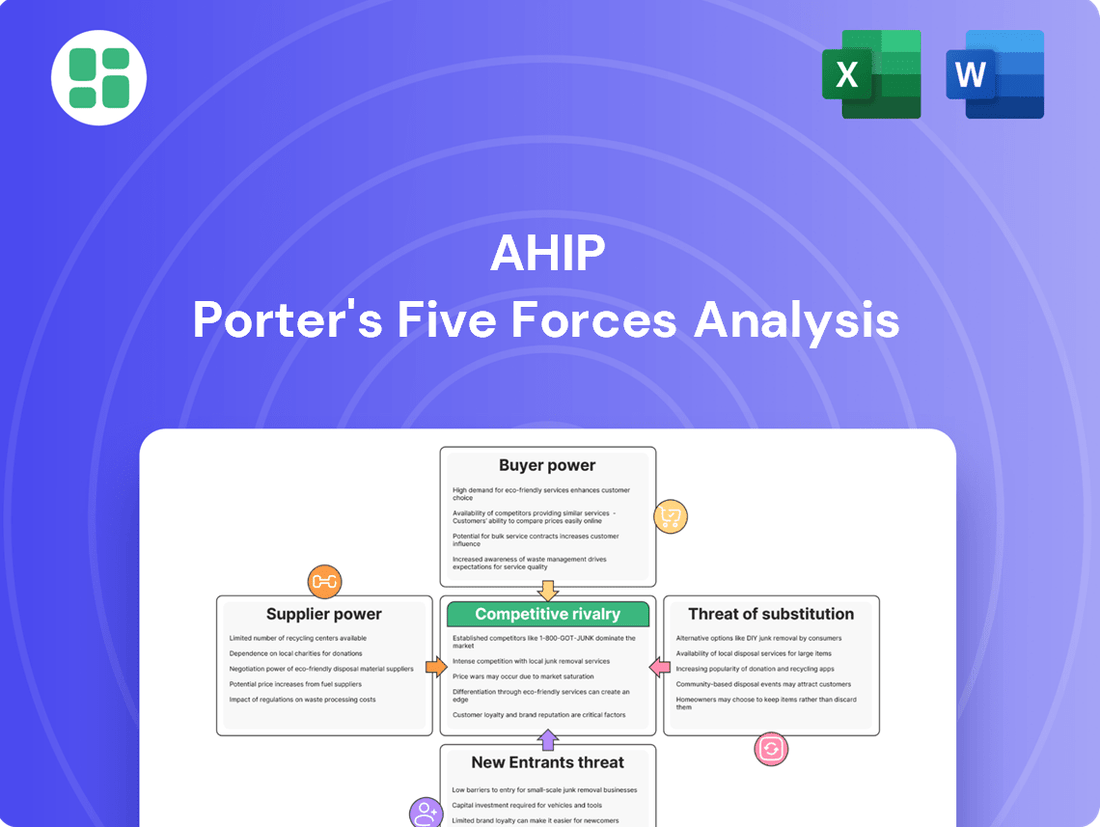

AHIP's Porter's Five Forces analysis dissects the competitive intensity within its industry, examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the rivalry among existing competitors.

Instantly identify and prioritize competitive threats with a clear, actionable breakdown of Porter's Five Forces.

Customers Bargaining Power

The bargaining power of hotel guests is generally considered moderate. This is due to a combination of factors, including their sensitivity to price, the ease with which they can access information about different options, and the sheer number of lodging choices available to them.

Online Travel Agencies (OTAs) and review websites significantly enhance this power. These platforms allow guests to easily compare prices across various hotels and read detailed reviews about service quality, making it simpler for them to find the best value and make informed decisions.

For instance, in 2024, the average hotel guest considered price to be a primary factor in their booking decision, with many actively using comparison tools. Research from early 2024 indicated that over 70% of travelers used at least one OTA to book their accommodations, highlighting the influence of these platforms on consumer choice and hotel pricing strategies.

While individual leisure travelers often have limited direct bargaining power, large corporate clients and group bookings represent a significant segment that can negotiate more favorable rates and terms. This is particularly true as the hospitality industry anticipates a strong return of business and group travel in 2025, potentially amplifying the leverage of these larger customers.

The sheer number of hotel options available to travelers significantly boosts customer bargaining power. In 2024, the select-service and extended-stay segments, where AHIP operates, continue to see substantial brand proliferation, offering consumers a vast selection of properties. This abundance of choice means customers can easily compare prices and amenities, forcing hotels to remain competitive.

Customer Power 4

While major hotel brands, under which AHIP's properties operate, offer loyalty programs that can temper price sensitivity for some guests, the ease with which customers can switch between brands or opt for alternative accommodations presents a significant challenge. This brand affiliation, though a retention tool, doesn't negate the constant threat of competitive offerings.

In 2024, the hotel industry saw continued emphasis on loyalty programs. For instance, Marriott Bonvoy, a leading program, boasts over 190 million members, highlighting the broad reach of such initiatives. However, the rise of the sharing economy, with platforms like Airbnb continuing to gain traction, means that for every loyal hotel guest, there's a traveler easily comparing rates and amenities across vastly different lodging types. This dynamic underscores the persistent pressure customers can exert.

- Customer Loyalty Programs: While beneficial, their effectiveness is challenged by the ease of switching to competitors or alternative accommodations.

- Brand Affiliation: AHIP's hotels benefit from brand recognition, aiding customer retention, but this advantage is not absolute.

- Competitive Landscape: The availability of numerous hotel brands and alternative lodging options empowers customers with significant choices and bargaining power.

- Price Sensitivity: Despite loyalty programs, guests remain sensitive to pricing, especially when comparing similar offerings or considering non-traditional lodging.

Customer Power 5

The bargaining power of customers in the hospitality industry is significantly influenced by travelers' evolving preferences, pushing them to seek unique experiences and sustainable practices over basic accommodation. This trend means guests are more discerning, demanding specific property features and services that align with their values, thereby increasing their sway over hotel offerings.

Hotels that proactively integrate technology for personalized guest experiences or develop distinctive, eco-friendly amenities can better capture and hold onto this increasingly powerful customer base. For instance, by mid-2024, a significant percentage of travelers indicated a willingness to pay a premium for sustainable hotel options, directly reflecting this heightened customer demand.

- Shifting Guest Demands: Travelers are prioritizing unique experiences and sustainability, moving beyond just a place to stay.

- Value Beyond Price: Customers increasingly seek hotels that offer specific features and practices aligning with their personal values.

- Adaptation is Key: Hotels that integrate technology and offer unique, sustainable options are better positioned to attract and retain guests.

- Market Data: Reports from early 2024 showed a notable increase in consumer interest and spending on eco-conscious travel options.

The bargaining power of hotel customers is substantial, driven by easy price comparison and a vast array of choices. In 2024, over 70% of travelers used Online Travel Agencies (OTAs), amplifying their ability to find the best deals, which puts pressure on hotels to remain competitive on price.

| Factor | Impact on Customer Bargaining Power | 2024 Data/Trend |

|---|---|---|

| Information Accessibility | High | 70%+ travelers use OTAs for booking. |

| Availability of Substitutes | High | Proliferation of select-service and extended-stay brands. |

| Price Sensitivity | High | Price remains a primary booking factor for many guests. |

| Switching Costs | Low | Easy to switch between brands or choose alternative lodging. |

Preview Before You Purchase

AHIP Porter's Five Forces Analysis

This preview showcases the complete AHIP Porter's Five Forces Analysis, providing a deep dive into the competitive landscape of the health insurance industry. You're looking at the actual document, which meticulously details the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry among existing firms. The document you see here is exactly what you’ll be able to download after payment, offering actionable insights for strategic decision-making.

Rivalry Among Competitors

American Hotel Properties Inc. (AHIP) navigates a fiercely competitive landscape within the hotel real estate sector. Rivalry is intense, with other hotel Real Estate Investment Trusts (REITs), private equity firms, and significant institutional investors actively vying for prime select-service hotel properties across the United States. This competition extends to attracting investor capital, as these entities all seek to deploy funds into promising hospitality assets.

Competitive rivalry within the hotel sector is escalating, particularly for prime properties. The U.S. hotel investment market is anticipated to see a significant uptick in deal volume throughout 2024, driving up competition for desirable existing assets.

Investor demand is robust, with a notable preference for value-add and opportunistic strategies. This trend directly impacts companies like AHIP, as it intensifies the pursuit of select-service properties, a key area of focus for the company.

The hotel industry is characterized by intense competition, with fluctuating occupancy rates and average daily rates (ADR) impacting revenue per available room (RevPAR). While RevPAR is expected to grow, the growth rate is moderating, signaling a need for hotels to aggressively compete for market share.

Competitive Rivalry 4

Competitive rivalry is particularly fierce in the select-service and extended-stay hotel sectors where AHIP focuses its investments. This intense competition among numerous hotel brands directly impacts the industry by driving innovation and influencing pricing strategies.

The sheer number of hotel flags available means guests have a wide array of choices, forcing brands to constantly differentiate themselves through service, amenities, and loyalty programs. For AHIP, this translates into a dynamic environment where the performance of its owned properties is closely tied to the strength and appeal of the brands they operate under. For instance, in 2024, the U.S. hotel industry saw a significant number of new openings, particularly in the select-service segment, further intensifying this rivalry.

- Brand Proliferation: The select-service and extended-stay markets are characterized by a high density of hotel brands, leading to increased competition for market share.

- Impact on Agreements: This competitive pressure can influence the terms and conditions of management agreements AHIP enters into, potentially affecting revenue streams and operational flexibility.

- Property Performance: The success of AHIP's investments is directly linked to the ability of its hotel brands to attract and retain guests amidst a crowded marketplace.

- Market Dynamics: In 2024, the extended-stay sector, a key focus for AHIP, demonstrated strong occupancy rates, but this also attracted significant new development, heightening competitive pressures.

Competitive Rivalry 5

The hotel industry, particularly for established players like AHIP (American Hotel Properties Inc.), faces intense competitive rivalry. High fixed costs are a significant driver; think about the immense capital needed for property acquisition, ongoing maintenance, and essential renovations. For instance, major hotel chains often budget hundreds of millions annually for property improvements and technology integration to stay competitive.

These substantial fixed costs create a strong incentive for hotels to maximize occupancy and revenue. When a hotel isn't full, those fixed costs still need to be covered, putting pressure on pricing and operational efficiency. This means companies are constantly vying for market share and customer loyalty to ensure their properties are generating enough income to offset these significant expenses.

- High Fixed Costs: Property ownership, operations, and necessary renovations represent substantial fixed expenses for hotel companies.

- Capital Expenditure Demands: Continuous investment in property upgrades and technology is crucial for maintaining competitiveness and guest satisfaction.

- Revenue Maximization Pressure: To cover high fixed costs, hotels are driven to achieve high occupancy rates and optimize revenue per available room (RevPAR).

- Strategic Reinvestment: Companies that strategically reinvest in their assets and services are better positioned to withstand and thrive amidst intense rivalry.

Competitive rivalry significantly impacts American Hotel Properties Inc. (AHIP) due to the presence of numerous hotel brands and investors targeting similar select-service and extended-stay properties. This intense competition drives innovation and influences pricing strategies, as seen in the U.S. hotel industry's anticipated increase in deal volume for 2024, which will further intensify the pursuit of desirable assets.

The proliferation of hotel brands, especially in the select-service and extended-stay segments where AHIP operates, means guests have abundant choices. This forces brands to constantly differentiate through service and amenities, directly affecting AHIP's property performance. For example, 2024 saw substantial new hotel openings, particularly in select-service, amplifying this rivalry.

High fixed costs associated with property acquisition, maintenance, and renovations compel hotels to aggressively compete for market share and customer loyalty. This pressure to maximize occupancy and revenue is crucial for covering these substantial expenses, making strategic reinvestment in assets and services vital for AHIP to thrive.

| Metric | 2023 (Est.) | 2024 (Proj.) | Impact on AHIP |

| U.S. Hotel Deal Volume | $45 Billion | $50-55 Billion | Increased competition for acquisitions |

| Select-Service RevPAR Growth | 4.5% | 3.0-4.0% | Moderating growth necessitates stronger competitive positioning |

| New Hotel Openings (Select-Service) | ~1,000 | ~1,100 | Heightened supply intensifies market rivalry |

SSubstitutes Threaten

The threat of substitutes for the health insurance industry, particularly for organizations like AHIP (America's Health Insurance Plans), is significant and primarily stems from alternative healthcare delivery and financing models. These substitutes challenge the traditional employer-sponsored or individual market insurance plans that AHIP members represent.

One of the most potent substitutes comes from direct-to-consumer healthcare solutions and innovative care delivery models. For instance, the rise of telehealth services, direct primary care practices, and employer-sponsored self-funded health plans bypass traditional insurance intermediaries. In 2024, the telehealth market continued its robust growth, with estimates suggesting it could reach hundreds of billions of dollars globally, offering convenience and potentially lower costs for certain services, thereby reducing reliance on conventional insurance plans.

The rise of platforms like Airbnb presents a significant threat of substitutes for traditional hotels. For instance, in 2023, Airbnb reported a 14% increase in nights booked compared to 2022, impacting hotel occupancy rates in popular tourist destinations.

While some hotels have adapted by listing their own rooms on these platforms, the fundamental availability of alternative lodging options, often at different price points and with unique amenities, continues to challenge the established hotel industry's market share.

The threat of substitutes for the hotel industry remains significant, particularly as consumer preferences evolve. Millennials and Gen Z, for instance, increasingly seek authentic and personalized experiences, often finding these in alternative accommodations like Airbnb or boutique guesthouses. This shift means hotels must actively differentiate themselves by offering unique services and memorable stays to counter this trend. For example, in 2024, the short-term rental market continued its robust growth, with Airbnb reporting a 14% increase in bookings year-over-year, highlighting the ongoing competitive pressure from substitutes.

4

The increasing prevalence of virtual meetings and telecommuting, while not entirely new, poses an ongoing threat to the demand for business travel. This shift directly impacts the need for hotel accommodations, particularly in urban centers that historically relied heavily on corporate bookings. For instance, a 2024 report indicated that while business travel has seen some recovery, it still lags behind pre-pandemic levels, with a significant portion of companies maintaining hybrid work models.

This substitution effect means that fewer in-person conferences, client meetings, and team offsites are occurring, directly reducing the customer base for hotels. The convenience and cost-effectiveness of digital collaboration tools further solidify this trend, making virtual interactions a viable alternative for many business needs.

Consider these impacts:

- Reduced Business Travel Spend: Companies are reallocating budgets previously dedicated to travel to technology and virtual collaboration tools.

- Shifting Demand Patterns: Demand for hotels in business districts may see a structural decline, while leisure travel might continue to grow.

- Technological Advancements: Improvements in video conferencing, virtual reality, and collaboration software will continue to enhance the substitute offering.

- Cost Savings for Businesses: Virtual alternatives offer significant cost savings compared to traditional business travel, making them an attractive substitute.

5

The threat of substitutes for the health insurance industry, particularly for organizations like AHIP, is significant and multifaceted. Beyond direct competitors offering similar insurance plans, consumers have increasingly diverse travel and accommodation options that can divert spending and attention from traditional hotel stays. These alternatives, while not directly health insurance, represent a broader competitive landscape for discretionary spending that could otherwise be allocated to health-related services or benefits.

Less direct substitutes include options like staying with friends or family, which reduces the need for paid accommodations. Furthermore, alternative travel accommodations such as RVs or cruise ships cater to different traveler segments but collectively expand the choices available to consumers. This diversification of travel options provides consumers with more choices, potentially diverting demand and spending away from traditional hotel sectors, which in turn can influence overall consumer spending patterns that might otherwise support health insurance needs.

For instance, the rise in the sharing economy and alternative lodging platforms has fundamentally altered the accommodation market. In 2024, the global travel accommodation market, excluding traditional hotels, is projected to continue its growth trajectory, indicating a sustained shift in consumer preferences. This broader competitive landscape for consumer spending means that resources that might have been directed towards health insurance or related services could be allocated to these alternative experiences.

- Diversified Travel Options: Consumers increasingly opt for non-traditional accommodations like RVs and cruise ships, impacting discretionary spending.

- Sharing Economy Growth: Platforms offering alternative lodging continue to expand, providing more choices outside conventional hotels.

- Consumer Spending Shifts: Increased spending on leisure and alternative experiences can indirectly affect the pool of funds available for health insurance premiums or services.

- Broadened Competitive Landscape: These substitutes, while not direct competitors, represent alternative uses of consumer capital that could otherwise be directed towards healthcare.

The threat of substitutes for the health insurance industry, represented by organizations like AHIP, is significant as consumers explore alternative healthcare financing and delivery methods. These substitutes challenge traditional insurance models by offering direct access to care or different payment structures.

Innovative healthcare models such as direct primary care and employer-sponsored self-funded plans represent key substitutes. These models often bypass traditional insurance intermediaries, providing more direct patient-provider relationships and potentially more predictable costs. In 2024, the telehealth market continued its significant expansion, with projections indicating a substantial global market value, offering convenient and cost-effective alternatives for many healthcare needs.

The increasing adoption of direct-to-consumer health services and wellness programs also acts as a substitute. These offerings empower individuals to manage their health proactively, potentially reducing the need for comprehensive insurance coverage for certain services. For instance, the digital health market saw continued investment and growth throughout 2024, with a focus on preventative care and personalized wellness solutions.

| Substitute Category | Description | 2024 Market Trend/Impact |

|---|---|---|

| Telehealth Services | Remote medical consultations and monitoring | Continued robust growth, projected to reach hundreds of billions globally, increasing convenience and reducing reliance on traditional visits. |

| Direct Primary Care (DPC) | Membership-based primary care without insurance billing | Growing adoption by employers and individuals seeking predictable costs and direct access to physicians. |

| Employer Self-Funded Plans | Employers directly fund employee healthcare costs | Remains a significant portion of the market, offering flexibility and cost control, bypassing traditional insurance carriers. |

| Digital Health & Wellness Platforms | Apps and services for fitness, nutrition, and mental health | Increased consumer engagement in preventative care, potentially reducing demand for certain insurance-covered services. |

Entrants Threaten

The hotel real estate market, especially the select-service segment, continues to show strong investment appeal, with potential for robust returns. This attractiveness naturally invites new players looking to capitalize on these opportunities. For instance, in 2024, the lodging sector saw significant investment activity, with transaction volumes expected to rise as investor confidence in hospitality real estate steadily increases.

The threat of new entrants in the hotel industry, particularly for a company like AHIP (American Hotel Properties Inc.), is generally moderate. Significant capital is required to acquire or develop hotel properties, which acts as a substantial barrier. For instance, the average cost to build a new hotel can range from $15 million to $30 million or more, depending on the brand and location, making it a considerable hurdle for potential new players.

The threat of new entrants into the branded select-service hotel segment, where AHIP primarily operates, is somewhat mitigated by the significant capital required and the necessity of securing established brand affiliations. New players need substantial investment to acquire or develop properties and gain access to recognizable hotel brands like Marriott, Hilton, or IHG, which AHIP leverages. Without these relationships, breaking into the market and attracting guests is considerably more challenging.

4

The threat of new entrants in the hotel industry, particularly concerning AHIP (American Hotel & Lodging Properties), is significantly mitigated by substantial regulatory barriers. Navigating complex and often lengthy processes for zoning, permitting, and construction, which vary greatly by municipality, can be a major deterrent. For instance, in 2024, the average time to obtain a building permit in major US cities often exceeded several months, adding considerable cost and uncertainty for new developers.

These regulatory hurdles translate into higher upfront capital requirements and extended timelines, making it challenging for smaller or less capitalized players to enter the market. The sheer administrative burden and the potential for project delays due to unforeseen regulatory challenges can effectively discourage many aspiring hotel operators.

- Regulatory Complexity: Zoning laws, environmental impact assessments, and local building codes create a formidable barrier to entry.

- Permitting Delays: Obtaining necessary permits can take anywhere from 6 months to over a year in some jurisdictions, increasing development costs.

- Capital Intensity: The combination of land acquisition, construction, and compliance with regulations demands significant financial resources, limiting the pool of potential new entrants.

- Location-Specific Challenges: Each market has unique regulatory landscapes, requiring specialized knowledge and increasing the risk for those unfamiliar with local requirements.

5

The threat of new entrants for AHIP (Anthem Health Insurance Plans) is generally considered moderate to low. Established players like AHIP benefit significantly from substantial economies of scale, allowing them to spread fixed costs over a larger volume of business and achieve lower per-unit costs. For instance, in 2023, AHIP, operating as Elevance Health, reported total revenue of $171.1 billion, a figure that dwarfs what a new entrant could realistically achieve in its initial years.

Furthermore, AHIP possesses a diversified portfolio of health insurance products and services, coupled with extensive operational efficiencies honed over years of experience. This broad asset base and established infrastructure create significant barriers to entry. New companies struggle to replicate the same level of brand recognition, customer loyalty, and sophisticated administrative systems that AHIP has cultivated.

The ability to leverage existing relationships with healthcare providers, employers, and government entities also presents a formidable challenge for newcomers. Building these crucial networks from scratch is time-consuming and resource-intensive.

- Economies of Scale: AHIP's large operational size allows for cost advantages not easily matched by new entrants.

- Diversified Portfolio: A wide range of offerings makes AHIP more resilient and attractive to a broader customer base.

- Operational Efficiencies: Years of experience have led to streamlined processes and cost savings.

- Established Relationships: Existing networks with providers and employers create a competitive moat.

The threat of new entrants for AHIP (American Hotel Properties Inc.) is generally moderate. While the hotel sector is attractive, significant capital is needed for property acquisition and development, acting as a primary barrier. For instance, in 2024, the average cost to build a select-service hotel property, AHIP's focus, can easily exceed $20 million, requiring substantial financial backing.

Porter's Five Forces Analysis Data Sources

Our AHIP Porter's Five Forces analysis leverages data from AHIP's annual reports, industry association publications, and government regulatory filings to provide a comprehensive view of the competitive landscape.