AGT Food and Ingredients, Inc. Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AGT Food and Ingredients, Inc. Bundle

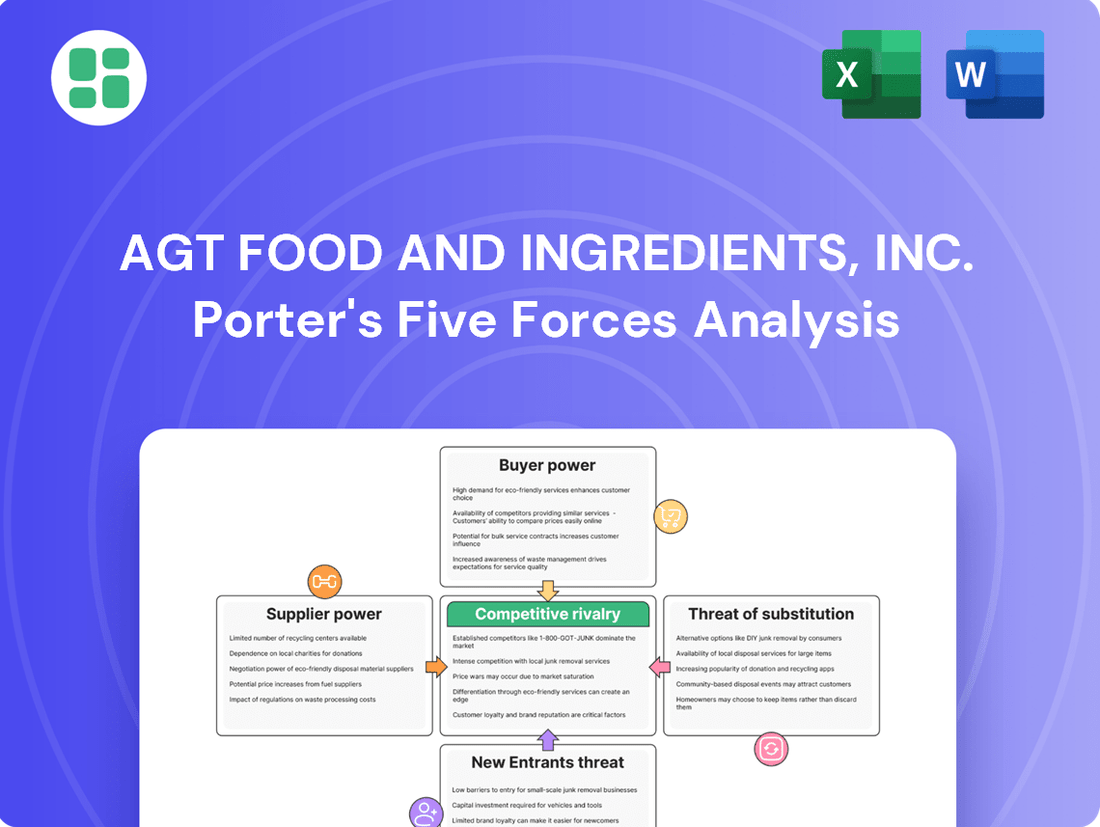

AGT Food and Ingredients, Inc. navigates a landscape shaped by moderate buyer power and intense rivalry, with the threat of substitutes posing a significant challenge to its market dominance.

The full Porter's Five Forces Analysis reveals the strength and intensity of each market force affecting AGT Food and Ingredients, Inc., complete with visuals and summaries for fast, clear interpretation.

Unlock key insights into AGT Food and Ingredients, Inc.’s industry forces—from supplier power to the threat of new entrants—and use this knowledge to inform strategy or investment decisions.

Suppliers Bargaining Power

AGT Food and Ingredients Inc. sources its raw agricultural products, such as pulses and durum wheat, from a vast network of farmers across the globe. While individual farmers typically hold little sway, significant bargaining power can emerge from regional concentrations of specialized growers. For instance, in key pulse and grain-producing regions like Saskatchewan, a collective of farmers specializing in specific crop varieties or quality grades can exert considerable influence on supply and pricing dynamics.

The bargaining power of suppliers for AGT Food and Ingredients, Inc. is generally low due to the commoditized nature of most raw agricultural products. Inputs like standard pulses and grains are widely available from numerous sources, limiting any single supplier's ability to dictate terms. This means AGT can often source its primary materials without significant reliance on any one entity.

While AGT primarily deals with commodities, certain specialized inputs, such as specific pulse varieties or durum wheat with precise protein content requirements, can present a slightly different dynamic. For these niche products, switching suppliers might involve minor costs associated with recalibrating quality control processes or establishing new supplier relationships. However, for a company of AGT's scale, these switching costs are typically manageable and do not grant suppliers significant leverage.

The threat of individual farmers integrating forward into processing, packaging, and global distribution for AGT Food and Ingredients, Inc. is exceptionally low. This is primarily due to the substantial capital outlay and specialized knowledge needed for these complex operations. For instance, establishing a state-of-the-art processing facility can easily run into tens or hundreds of millions of dollars, a barrier most individual farmers cannot overcome.

While larger agricultural cooperatives or aggregators might present a theoretical challenge, AGT's established global infrastructure and extensive market presence significantly mitigate this risk. AGT's 2023 revenue of CAD $2.1 billion demonstrates its scale, making it difficult for smaller entities to compete effectively in terms of reach and efficiency.

Importance of Supplier to Buyer

AGT Food and Ingredients, Inc. operates as a significant global purchaser of pulses and grains. By offering substantial volume contracts and ensuring dependable market access for numerous farmers, AGT establishes itself as a crucial client for its suppliers.

This position inherently curtails the individual bargaining power of many farmers, fostering a more consistent and predictable supply chain for AGT. For instance, in 2023, AGT's procurement volume across its key product categories represented a substantial portion of the available market supply for many of its agricultural suppliers.

- AGT's large-scale purchasing agreements provide significant revenue streams for its suppliers.

- The company's stable demand reduces price volatility for farmers who supply them.

- This reliance limits the ability of individual suppliers to negotiate higher prices or more favorable terms.

- AGT's global reach means suppliers often compete to secure contracts with the company.

Supply Chain Disruptions and Input Costs

Global supply chain disruptions and geopolitical uncertainties, particularly evident throughout 2023 and into early 2024, significantly amplify the bargaining power of suppliers for AGT Food and Ingredients, Inc. These external pressures directly translate into fluctuating agricultural commodity prices, creating a challenging environment for input cost management.

Farmers are increasingly experiencing elevated costs for critical inputs such as fuel, fertilizers, and labor. For instance, global fertilizer prices, while seeing some moderation from 2022 peaks, remained elevated in early 2024 compared to pre-pandemic levels, impacting agricultural production costs. This cost pressure empowers farmers to seek higher prices for their produce, thereby increasing their bargaining leverage with companies like AGT.

- Rising Farmer Input Costs: Fuel costs, a significant component of agricultural operations, saw volatility in 2023 and early 2024, impacting transportation and machinery expenses.

- Fertilizer Price Sensitivity: While not at their 2022 highs, fertilizer prices in early 2024 continued to reflect supply chain constraints and energy costs, directly affecting crop yields and farmer profitability.

- Geopolitical Impact on Commodities: Ongoing geopolitical tensions have continued to influence global food commodity markets, creating price volatility and strengthening the negotiating position of agricultural producers.

The bargaining power of suppliers for AGT Food and Ingredients, Inc. is generally low due to the commoditized nature of most raw agricultural products, which are widely available from numerous sources. While specialized inputs might present a slightly different dynamic, AGT's scale and global infrastructure significantly mitigate supplier leverage.

AGT's substantial purchasing volume and dependable market access make it a crucial client for many farmers, limiting individual suppliers' ability to negotiate higher prices or more favorable terms.

However, global supply chain disruptions and rising farmer input costs, such as fuel and fertilizers, have amplified supplier bargaining power in 2023 and early 2024. For example, fertilizer prices, while moderating from 2022 peaks, remained elevated in early 2024, increasing production costs for farmers.

AGT's 2023 revenue of CAD $2.1 billion underscores its market presence, yet the company must navigate increased farmer costs and price volatility to maintain its supply chain stability.

What is included in the product

This analysis tailors Porter's Five Forces to AGT Food and Ingredients, Inc., identifying competitive intensity, buyer and supplier power, threat of new entrants, and the impact of substitutes on its market position.

AGT Food and Ingredients' Porter's Five Forces analysis provides a clear, one-sheet summary of all competitive pressures—perfect for quick strategic decision-making.

This analysis helps AGT Food and Ingredients alleviate the pain point of uncertainty by offering a simplified, visual representation of market dynamics, ready to be incorporated into crucial business presentations.

Customers Bargaining Power

AGT Food and Ingredients, Inc. serves a diverse global clientele, including major retailers, food manufacturers, and distributors. This broad customer base, while a strength, also presents a challenge in managing the bargaining power of large volume purchasers.

Customers who buy in significant quantities, particularly for AGT's commodity products, possess considerable leverage. They can negotiate for better pricing, stricter quality standards, and more favorable delivery schedules, directly impacting AGT's margins and operational flexibility.

For AGT Food and Ingredients, the bargaining power of customers is significantly influenced by product differentiation and switching costs. In the realm of bulk pulse and durum wheat, where AGT operates as a supplier of commodities, differentiation is inherently low. This means customers have considerable power because it's relatively easy and inexpensive for them to switch to another supplier offering similar products. This lack of unique features means AGT has less leverage in price negotiations for these core offerings.

However, the landscape shifts for AGT's value-added ingredients and specialized plant-based protein products. Here, product differentiation plays a crucial role in reducing customer power. When AGT offers unique formulations or ingredients that are difficult to replicate, customers face higher switching costs. These costs can arise from the need to reformulate their own products, re-test, and potentially re-certify, giving AGT more room to command pricing power and reducing the immediate threat of customer defection.

Customer price sensitivity is a significant factor for AGT Food and Ingredients, Inc. Large buyers like major grocery chains and food production companies are always on the lookout for ways to reduce their costs, and this directly impacts AGT’s pricing power. For instance, in 2023, the average inflation rate for food products in Canada hovered around 6%, meaning retailers are under pressure to keep their own prices competitive, which they often pass back to their suppliers.

The growing popularity of private label brands, especially in the plant-based food sector, further amplifies this price sensitivity. Consumers often opt for these store-branded alternatives due to their lower cost. This trend puts additional pressure on AGT, as it needs to offer competitive pricing to secure shelf space and maintain sales volumes against these more affordable options, potentially impacting its profit margins.

Threat of Backward Integration

Large food manufacturers, a key customer segment for AGT Food and Ingredients, possess the theoretical capability to integrate backward into the primary processing of pulses and grains. This would involve them setting up their own facilities to handle raw materials, bypassing suppliers like AGT.

However, the practical implementation of such a strategy is significantly hindered by substantial barriers. The capital investment required for specialized processing equipment and infrastructure is immense, and developing the necessary operational expertise and supply chain networks takes considerable time and effort.

Given AGT's extensive global processing infrastructure and established market presence, the threat of backward integration by customers is generally considered low. For instance, AGT's 2024 reported revenue of CAD 1.9 billion underscores its significant scale and the difficulty for individual customers to replicate such an operation cost-effectively.

- Capital Intensity: Backward integration demands substantial upfront investment in processing plants and technology.

- Specialized Expertise: Operating pulse and grain processing requires specific knowledge and skilled labor.

- Infrastructure Requirements: Establishing a reliable supply chain and logistics network is complex and costly.

- AGT's Scale Advantage: AGT's global processing capabilities and market share present a formidable competitive barrier.

Market Information and Transparency

Customers in the food ingredient sector, including AGT Food and Ingredients, Inc., benefit from increased market information and transparency. This readily available data on commodity prices and alternative suppliers significantly strengthens their ability to negotiate favorable terms. For instance, in 2024, global agricultural commodity prices experienced notable volatility, making it easier for buyers to compare offerings and exert pressure on suppliers like AGT to maintain competitive pricing.

This heightened transparency directly impacts AGT's strategy, requiring the company to consistently offer competitive pricing and superior service to retain its broad base of international customers. AGT's ability to manage its supply chain efficiently and offer value-added services becomes crucial in a market where customers can easily cross-reference options. The company's 2024 financial reports highlight the ongoing efforts to optimize operational costs to remain agile in this environment.

- Increased Customer Leverage: Greater access to market data empowers buyers to negotiate better prices and terms.

- Competitive Pricing Pressure: Transparency forces AGT to remain price-competitive to secure and retain business.

- Focus on Service and Value: Beyond price, AGT must differentiate through service and added value to maintain client loyalty.

- Impact of 2024 Market Conditions: Volatile commodity prices in 2024 amplified the bargaining power of informed customers.

The bargaining power of customers for AGT Food and Ingredients is influenced by factors like product differentiation and customer price sensitivity. For commodity products like pulses and durum wheat, where differentiation is low, customers have significant leverage to switch suppliers, impacting AGT's pricing power. This is particularly evident in 2024, with volatile agricultural commodity prices making it easier for buyers to compare and negotiate.

However, AGT's value-added ingredients and specialized plant-based proteins offer greater differentiation, increasing switching costs for customers and thus reducing their bargaining power. The rise of private label brands, driven by consumer price sensitivity, further pressures AGT to offer competitive pricing, especially against more affordable alternatives.

While large food manufacturers could theoretically integrate backward, the immense capital investment, specialized expertise, and complex infrastructure required make this a low threat for AGT, especially given its global scale, evidenced by its 2024 revenue of CAD 1.9 billion.

Increased market information and transparency empower AGT's customers, strengthening their negotiating position. This means AGT must focus on competitive pricing, efficient supply chains, and value-added services to retain its global customer base, as highlighted by its 2024 financial reports detailing cost optimization efforts.

| Factor | Impact on AGT | 2024 Context |

|---|---|---|

| Product Differentiation (Commodities) | High customer power, low AGT pricing power | Low differentiation in pulses/wheat |

| Product Differentiation (Value-Added) | Low customer power, high AGT pricing power | Unique ingredients reduce switching costs |

| Customer Price Sensitivity | Pressure on AGT pricing | Inflation (e.g., ~6% food inflation in Canada 2023) and private labels |

| Threat of Backward Integration | Low | High capital/expertise barriers; AGT's scale (CAD 1.9B revenue 2024) |

| Market Information Transparency | Increased customer leverage | Volatile commodity prices in 2024 enhance buyer negotiation |

Same Document Delivered

AGT Food and Ingredients, Inc. Porter's Five Forces Analysis

This preview provides an in-depth Porter's Five Forces analysis of AGT Food and Ingredients, Inc., detailing the competitive landscape and strategic positioning within the global food and ingredients sector. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy, offering a comprehensive examination of buyer power, supplier power, threat of new entrants, threat of substitutes, and industry rivalry.

Rivalry Among Competitors

AGT Food and Ingredients, Inc. operates in highly competitive sectors, with the pulse processing and plant-based protein markets featuring a significant number of global and regional participants. This includes major agricultural conglomerates and niche ingredient producers, all vying for market share.

The company encounters direct competition within pulse processing, facing rivals who also source and refine pulses. Furthermore, AGT competes more broadly with a wide array of plant-based food companies that offer alternative protein sources, impacting its diverse product offerings.

While the broader pulses market demonstrates a steady, moderate growth trajectory, the plant-based protein and ingredients sector, a key area for AGT Food and Ingredients, Inc., is currently experiencing robust expansion. This dynamic growth environment is a magnet for new entrants and existing competitors alike, as businesses aim to capture a larger share of this burgeoning market.

AGT Food and Ingredients, Inc. operates in a competitive landscape where differentiation is key, moving beyond basic commodities to offer value-added ingredients and consumer products. This strategic pivot is essential for carving out market share.

AGT's emphasis on plant-based proteins and novel ingredient development provides a degree of differentiation. However, the company must maintain a strong commitment to research and development to consistently outpace rivals in innovation, a crucial factor for sustained competitive advantage.

High Fixed Costs and Exit Barriers

AGT Food and Ingredients, Inc. operates in an industry characterized by substantial upfront capital requirements. Building and maintaining advanced processing facilities, acquiring specialized machinery, and establishing robust global supply chains demand significant financial commitment, resulting in elevated fixed costs for all players.

These high fixed costs, coupled with assets that are often industry-specific and difficult to redeploy, erect considerable exit barriers. This means that companies like AGT Food and Ingredients are incentivized to stay operational and continue competing, even when market conditions are challenging, to spread their fixed costs over a larger production volume.

- High Capital Investment: The agri-food processing sector necessitates extensive investment in plant, property, and equipment.

- Specialized Assets: Many assets used in food processing have limited alternative uses, increasing exit barriers.

- Competitive Intensity: High fixed costs and exit barriers contribute to sustained competitive rivalry as firms strive to achieve economies of scale.

- Financial Resilience: Companies with strong balance sheets are better positioned to weather industry downturns and outlast less capitalized competitors.

Global Market Reach and Trade Dynamics

AGT Food and Ingredients, Inc. navigates intense competitive rivalry due to its extensive global footprint, exporting to over 120 countries. This broad reach exposes AGT to a wide array of competitors across diverse geographical markets, each with unique competitive strategies and cost structures.

International trade dynamics significantly influence this rivalry. Fluctuations in tariffs, quotas, and trade agreements can rapidly alter the cost competitiveness of AGT and its rivals. For instance, recent trade tensions in 2024 have led to unpredictable shifts in market access and pricing for agricultural commodities, directly impacting AGT's global operations and competitive positioning.

- Global Export Network: AGT's presence in over 120 countries means it competes with local producers and international players in each market.

- Trade Policy Impact: Tariffs and trade disputes, such as those observed in 2024 affecting key agricultural trade routes, can create significant competitive advantages or disadvantages for AGT and its competitors.

- Price Volatility: Global commodity price swings, often influenced by geopolitical events and trade policies, intensify price-based competition among market participants.

- Regulatory Differences: Varying food safety standards and import regulations across countries add another layer of complexity to the competitive landscape for AGT.

AGT Food and Ingredients, Inc. faces intense competition from numerous global and regional players in both pulse processing and the rapidly expanding plant-based ingredients market. The company's strategy of moving into value-added products and novel ingredients is crucial for differentiation in this crowded space.

High capital investment and specialized assets create significant barriers to entry and exit, compelling existing firms to maintain operations and compete aggressively to spread fixed costs. This dynamic intensifies rivalry, particularly as the plant-based sector experiences rapid growth, attracting new entrants.

AGT's extensive export network, reaching over 120 countries, exposes it to diverse competitive pressures and varying trade policies. For instance, global trade disruptions in 2024 have highlighted how tariffs and regulatory differences can quickly shift competitive advantages among market participants.

| Competitor Type | Examples | Impact on AGT |

|---|---|---|

| Major Agricultural Conglomerates | Cargill, ADM | Price competition, broad product portfolios |

| Specialized Pulse Processors | Ingredion, Roquette | Innovation in pulse derivatives, ingredient functionality |

| Plant-Based Protein Companies | Beyond Meat, Impossible Foods | Competition for consumer preference, R&D investment |

| Regional Ingredient Suppliers | Local processors in key markets | Cost advantages, tailored local solutions |

SSubstitutes Threaten

AGT Food and Ingredients, Inc.'s plant-based protein products contend with a broad array of substitutes. These include established animal proteins like beef, chicken, and dairy, which maintain strong consumer loyalty due to familiarity and taste profiles. The market also features a growing number of alternative plant-based proteins derived from sources such as soy, pea, rice, and potato, each offering different nutritional and functional attributes.

Consumer preferences are a key driver in the threat of substitutes. Factors like perceived health benefits, ethical concerns surrounding animal agriculture, and evolving taste preferences significantly influence purchasing decisions. For instance, a 2024 report indicated that the global plant-based food market is projected to reach over $74 billion by 2030, highlighting the dynamic nature of consumer demand and the competitive landscape.

The price-performance trade-off for substitute products is a significant consideration for AGT Food and Ingredients. While the demand for plant-based alternatives is growing, many consumers remain price-sensitive. If plant-based options are perceived as more expensive than traditional animal-based products or even other plant-based choices, adoption can be hindered. For instance, in 2024, the average price difference between conventional beef and some plant-based burgers in major North American markets often exceeded 30%, impacting purchasing decisions for budget-conscious shoppers.

The food industry's rapid innovation, especially in plant-based options, continuously presents new and better substitutes for AGT Food and Ingredients. For instance, advancements in fermentation-derived proteins and cultivated meat offer competitive functionality and taste profiles. By mid-2024, the global plant-based food market was projected to reach over $74 billion, highlighting the significant and growing threat from these alternatives.

Consumer Propensity to Substitute

The increasing consumer interest in flexitarian diets, aiming to reduce meat consumption, directly heightens the likelihood of substitution for traditional protein sources. This trend presents both an opportunity and a challenge for AGT Food and Ingredients, Inc. In 2024, the global plant-based food market was valued at approximately $44.4 billion, demonstrating significant consumer adoption.

AGT's pulse-based ingredients are well-positioned to capitalize on this shift, offering alternatives to animal proteins. However, they face intense competition from a broad spectrum of other plant-based ingredients and finished goods, including soy, pea protein isolates, and various meat analogues. The variety of readily available substitutes means consumers have many choices, potentially impacting AGT's market share if its offerings are not perceived as superior or cost-effective.

- Flexitarianism Growth: Consumers are actively seeking to reduce meat, boosting demand for plant-based alternatives.

- Competitive Landscape: AGT's pulse ingredients compete with a wide array of other plant-based options.

- Market Value: The global plant-based food market reached around $44.4 billion in 2024.

- Consumer Choice: A diverse market of substitutes gives consumers significant power to switch.

Durum Wheat Alternatives

For AGT Food and Ingredients' durum wheat business, the threat of substitutes is a significant consideration. Other wheat varieties, like common wheat, can be used in flour production, offering a direct alternative for some applications. Additionally, grains such as corn and rice present themselves as substitutes in various food products, especially in regions where these are staple crops.

The appeal of these substitutes is heavily influenced by the specific end-use. For instance, while common wheat might suffice for some baking needs, its suitability for high-quality pasta production, a key market for durum wheat, is limited. Gluten-free options are also gaining traction, particularly in health-conscious markets, further diversifying the competitive landscape for durum wheat.

In 2024, the global gluten-free products market was valued at approximately USD 29.4 billion, showcasing a growing demand for alternatives to traditional grains. Similarly, the demand for corn as a food ingredient continues to be robust, with global corn production projected to reach over 1.2 billion metric tons in the 2024/2025 crop year.

- Direct Wheat Substitutes: Common wheat varieties can replace durum wheat in certain flour applications, impacting demand for durum in general baking.

- Alternative Grains: Grains like corn and rice serve as substitutes in a broader range of food products, particularly in staple-based diets.

- Gluten-Free Market Growth: The expanding gluten-free sector offers a significant alternative for consumers seeking wheat-free options, impacting traditional wheat demand.

- End-Use Specificity: The viability of substitutes varies greatly depending on whether the end-use is pasta production or other food manufacturing segments.

The threat of substitutes for AGT Food and Ingredients' products is substantial, driven by a wide range of alternatives from both traditional and emerging categories. For their plant-based protein division, established animal proteins like beef and chicken remain strong competitors due to consumer familiarity and established taste preferences. Furthermore, the plant-based market itself is crowded with alternatives derived from soy, pea, rice, and potato, each offering distinct nutritional profiles and functionalities.

Consumer preferences are increasingly shaped by health consciousness, ethical considerations, and evolving tastes, directly impacting the demand for substitutes. The global plant-based food market, valued at approximately $44.4 billion in 2024, demonstrates this dynamic shift. Price also plays a critical role, with many consumers remaining sensitive to the cost difference between plant-based and traditional protein sources, a gap that often exceeded 30% for beef alternatives in North American markets in 2024.

Innovation in food technology continuously introduces new and improved substitutes, such as fermentation-derived proteins and cultivated meat, which offer competitive taste and texture. The growing flexitarian movement further amplifies the threat, as consumers actively reduce meat consumption. AGT's pulse-based ingredients, while well-positioned, face intense competition from a diverse array of plant-based ingredients and finished goods, making product differentiation and cost-effectiveness crucial for maintaining market share.

| Category | Key Substitutes | Consumer Driver | 2024 Market Data Point |

| Plant-Based Protein | Animal Proteins (Beef, Chicken, Dairy) | Familiarity, Taste | Global Plant-Based Food Market: ~$44.4 billion |

| Plant-Based Protein | Other Plant Proteins (Soy, Pea, Rice) | Health, Ethics, Taste | Price Premium vs. Beef: Often >30% |

| Durum Wheat | Common Wheat, Corn, Rice | Cost, Availability, End-Use Suitability | Gluten-Free Market: ~$29.4 billion |

| Durum Wheat | Gluten-Free Grains | Health Consciousness | Global Corn Production (2024/25): >1.2 billion metric tons |

Entrants Threaten

The pulse and plant-based ingredient sector demands significant upfront capital. Building state-of-the-art processing facilities, acquiring specialized equipment, and establishing robust supply chains represent substantial financial hurdles. For instance, a modern pulse processing plant can easily cost tens of millions of dollars to construct and equip.

Established companies like AGT Food and Ingredients leverage their existing infrastructure and production volumes to achieve considerable economies of scale. This allows them to produce goods at a lower per-unit cost, creating a significant price advantage that new entrants struggle to match. In 2023, AGT reported total assets of CAD 1.3 billion, reflecting the scale of their operations.

New companies looking to enter the pulse and durum wheat processing market would find it difficult to secure reliable sources of raw materials. AGT Food and Ingredients has built strong, long-term relationships with farmers, ensuring a consistent supply of high-quality ingredients. For instance, in 2024, AGT continued to expand its grower network, which is crucial for maintaining its competitive edge.

Building efficient and resilient supply chains from scratch is a significant hurdle. It requires substantial investment in logistics, storage, and quality control systems. New entrants would need to replicate AGT's global origination capabilities, which have been developed over many years and involve deep understanding of regional agricultural practices and market dynamics.

AGT Food and Ingredients, Inc. benefits from deeply entrenched relationships with retailers, food manufacturers, and distributors worldwide. These established networks are a significant barrier, as new entrants would find it exceedingly difficult and costly to replicate the reach and efficiency of AGT's existing supply chain. For instance, in 2024, AGT's extensive distribution footprint allowed it to serve over 100 countries, a scale that is challenging for newcomers to match quickly.

Furthermore, brand loyalty and consumer trust, cultivated over years of consistent product quality and reliable supply, present another formidable hurdle. Customers, both in the bulk commodity sector and for value-added ingredients, are often hesitant to switch from trusted suppliers. This loyalty, evidenced by AGT's consistent market share in key product categories like pulses and specialty ingredients in 2024, means that new entrants must offer a compelling value proposition beyond mere price to gain traction.

Regulatory Hurdles and Food Safety Standards

The food industry, including segments AGT Food and Ingredients operates within, faces substantial regulatory barriers. Stringent food safety, quality control, and labeling regulations across various jurisdictions demand significant capital investment and specialized knowledge for compliance. For instance, in 2024, the U.S. Food and Drug Administration (FDA) continued to emphasize enhanced traceability requirements under the Food Safety Modernization Act (FSMA), impacting all food producers.

- Regulatory Complexity: Navigating diverse and evolving food safety laws, such as those enforced by Health Canada and the European Food Safety Authority (EFSA), presents a significant hurdle for new entrants.

- Compliance Costs: Meeting these standards requires substantial upfront investment in facilities, testing, and personnel, making it difficult for smaller or less capitalized companies to compete.

- Expertise Requirement: New businesses need to acquire or hire expertise in regulatory affairs, quality assurance, and international trade compliance to successfully enter and operate in the market.

Technological Expertise and Intellectual Property

AGT Food and Ingredients, Inc. possesses a substantial competitive advantage due to its deep technological expertise and proprietary processes in pulse processing and the creation of value-added ingredients, particularly plant-based proteins. Developing comparable capabilities requires significant investment in research and development, as well as the acquisition of specialized knowledge. For instance, AGT's advanced milling and extraction techniques allow them to produce high-quality protein isolates and concentrates, a feat that is not easily replicated.

- Proprietary Processes: AGT's unique methods for pulse fractionation and protein isolation are protected intellectual property, creating a high barrier for new entrants aiming to match product quality and functionality.

- Technical Know-How: The company's accumulated expertise in optimizing ingredient performance for various food applications is a critical asset that new competitors would struggle to quickly build.

- Investment in R&D: Significant capital expenditure is necessary for new market participants to develop or license the advanced technologies required to compete with AGT's current product offerings.

The threat of new entrants for AGT Food and Ingredients is considerably low due to immense capital requirements for processing facilities and specialized equipment, with new plants costing tens of millions. AGT's established economies of scale, reflected in its CAD 1.3 billion in total assets as of 2023, allow for lower per-unit costs that are difficult for newcomers to match.

Securing reliable raw material supply chains and building strong farmer relationships, as AGT did by expanding its grower network in 2024, presents a significant barrier. Furthermore, AGT's global distribution network, serving over 100 countries in 2024, and established customer loyalty make market penetration extremely challenging for new players.

Stringent regulatory compliance, including food safety standards like those emphasized by the FDA in 2024, adds substantial costs and requires specialized expertise, further deterring potential entrants. AGT's proprietary technologies in pulse processing and value-added ingredients, developed through significant R&D investment, also create a technological moat that is hard to overcome.

| Barrier to Entry | Description | AGT's Advantage |

|---|---|---|

| Capital Requirements | High cost of building processing plants and acquiring equipment. | Existing infrastructure and operational scale. |

| Economies of Scale | Lower per-unit production costs for established players. | Significant asset base (CAD 1.3 billion total assets in 2023). |

| Supply Chain & Farmer Relations | Difficulty in securing consistent, high-quality raw materials. | Extensive grower network expansion in 2024. |

| Distribution Network | Reaching global markets and established customer relationships. | Serving over 100 countries in 2024. |

| Regulatory Compliance | Navigating complex food safety and quality standards. | Established compliance expertise and systems. |

| Proprietary Technology & R&D | Developing advanced processing and ingredient creation capabilities. | Proprietary fractionation and isolation techniques. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for AGT Food and Ingredients, Inc. is built upon a foundation of public financial statements, investor relations materials, and industry-specific market research reports. We also incorporate insights from trade publications and competitor disclosures to provide a comprehensive view of the competitive landscape.