AGT Food and Ingredients, Inc. Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AGT Food and Ingredients, Inc. Bundle

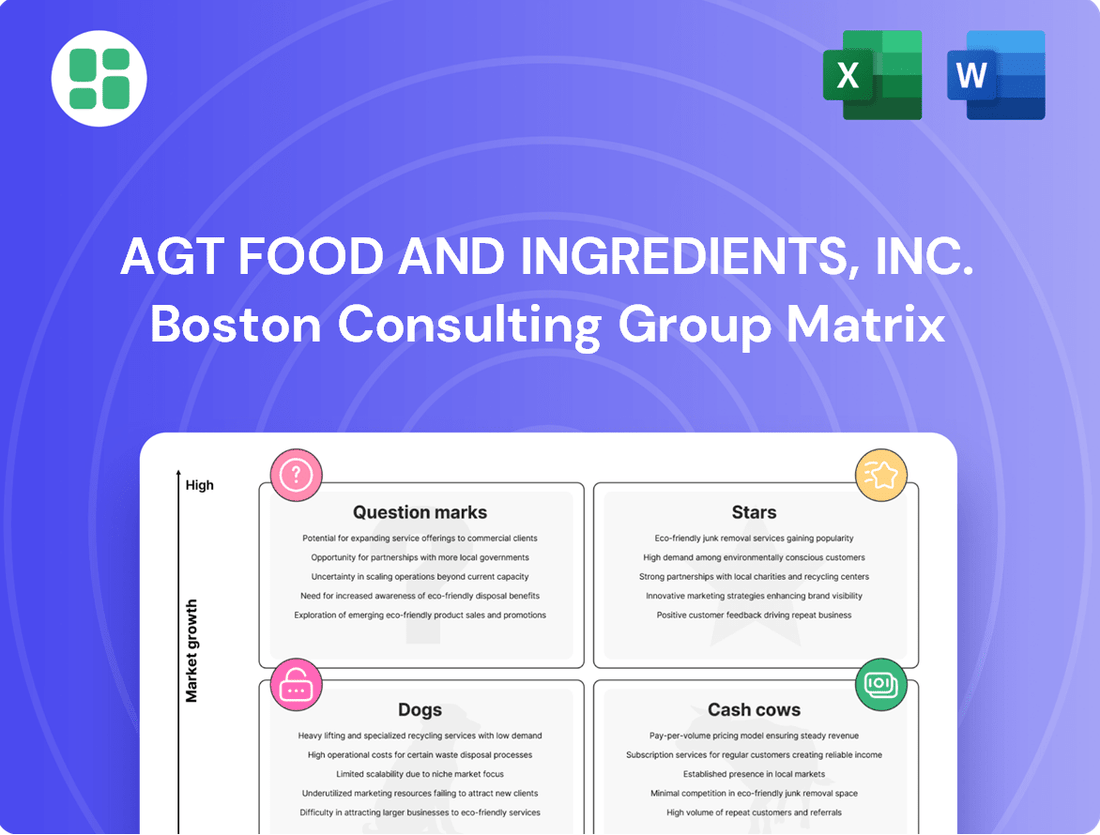

AGT Food and Ingredients, Inc.'s BCG Matrix offers a crucial snapshot of its product portfolio's market share and growth potential. Understanding which segments are Stars, Cash Cows, Dogs, or Question Marks is vital for strategic resource allocation.

This initial glimpse highlights the importance of a comprehensive analysis to pinpoint opportunities and challenges within AGT's diverse offerings.

Unlock the full strategic potential by purchasing the complete BCG Matrix report, providing detailed quadrant placements and actionable insights to drive informed investment decisions and optimize your product strategy.

Stars

Plant-Based Protein Ingredients, a segment of AGT Food and Ingredients, Inc., stands as a strong contender in a booming market. This sector is anticipated to expand at a robust compound annual growth rate (CAGR) of 12.4% to 14.1% starting in 2025, reflecting a clear upward trend in consumer preference for sustainable and healthy food options.

AGT Food and Ingredients is a key player, manufacturing a diverse range of pulse-derived ingredients like proteins, fibers, starches, and flours. These products serve both the food ingredient and industrial sectors, directly addressing the growing global demand for plant-based alternatives. The company's strategic collaboration with FrieslandCampina to introduce the Plantaris range of pea and faba isolates underscores its commitment to innovation and its solid footing in this high-growth area.

AGT Food and Ingredients, Inc.'s investment in its Minot, North Dakota extrusion center for gluten-free, pulse-based pasta, branded as VeggiPasta, signals a strong push for market dominance in a rapidly expanding health-focused segment. The facility is designed for significant global output, with a projected capacity reaching 40 million pounds annually, underscoring the company's commitment to this high-growth area.

AGT Food and Ingredients, Inc.'s Minot extrusion center expansion is strategically positioned to capitalize on the surging demand for extruded crispy snacks and ingredients crucial for meat alternatives. This move directly addresses the rapidly expanding global plant-based food market, driven by a growing consumer preference for protein-rich and sustainable food choices.

The company's focus on developing innovative products that satisfy consumer desires for taste, texture, and affordability in the meat alternative sector highlights a significant competitive advantage. This strategic direction is expected to solidify AGT's market leadership in this dynamic and fast-growing segment of the food industry.

Advanced Pulse Derivatives and Isolates

AGT Food and Ingredients, Inc. is pushing the boundaries with its advanced pulse derivatives and isolates. These aren't just simple pulse flours; they are highly specialized ingredients designed for demanding applications, particularly in the booming plant-based food sector.

AGT's strategic focus on these high-value ingredients positions them strongly within the global pea protein market. This market is experiencing significant expansion, with projections indicating a compound annual growth rate exceeding 22% starting from 2023. This growth underscores the increasing demand for sophisticated pulse-based components.

These advanced ingredients are crucial for meeting specific consumer and industry needs. They are engineered to provide:

- Enhanced Protein Fortification: Offering concentrated protein content for nutritional boosts.

- Gluten-Free Formulations: Catering to the growing demand for allergen-friendly products.

- Clean-Label Solutions: Meeting consumer preference for simple, recognizable ingredients.

Global Value-Added Processing of Plant-Based Foods

AGT Food and Ingredients, Inc. is actively pursuing a strategy centered on value-added processing within the plant-based food sector. This move signifies a departure from its historical role as a bulk commodity trader, aiming instead to deliver finished food ingredients and consumer goods.

This strategic shift is directly influenced by the growing consumer demand for healthier and more sustainable food choices. By focusing on value-added processing, AGT is positioning itself to achieve higher profit margins and secure a stronger market presence in the premium segments of the plant-based food industry.

AGT's global operational network and its broad range of products are key enablers of its leadership in transforming raw agricultural materials into sophisticated food solutions.

- Global Value-Added Processing of Plant-Based Foods: AGT Food and Ingredients, Inc. has made significant strides in value-added processing, enhancing its portfolio beyond raw commodities.

- Strategic Pivot to Finished Products: The company is increasingly focused on producing finished food ingredients and consumer products, aligning with market trends for healthier and sustainable options.

- Market Position and Margin Enhancement: This strategic direction allows AGT to capture higher margins and expand its market share in premium plant-based food segments.

- Operational Strengths: AGT leverages its extensive global operational footprint and diversified product offerings to drive innovation in plant-based food solutions.

AGT Food and Ingredients, Inc.'s plant-based protein segment, particularly its advanced pulse derivatives and isolates, can be viewed as a Star in the BCG Matrix. This segment is experiencing substantial growth, with the global pea protein market alone projected to grow at over 22% annually from 2023. AGT's strategic focus on value-added processing, including gluten-free pasta and ingredients for meat alternatives, positions it to capitalize on this high-growth, high-market-share area.

What is included in the product

AGT Food and Ingredients' BCG Matrix likely categorizes its diverse product lines, guiding strategic decisions on investment, divestment, and resource allocation.

The AGT Food and Ingredients BCG Matrix offers a clear, one-page overview of business units, simplifying strategic decisions and alleviating the pain of complex portfolio analysis.

Cash Cows

AGT Food and Ingredients is a major player in the global pulses market, particularly with its bulk lentil and pea processing operations. This segment is considered a cash cow for the company due to its dominant market position and the steady, albeit mature, growth of the pulses sector. In 2024, the global pulses market continued its upward trajectory, driven by increasing consumer awareness of health benefits and a growing preference for plant-based diets.

AGT's extensive processing infrastructure and established global supply chain for lentils and peas ensure reliable cash generation. This segment requires minimal new investment to maintain its market share, allowing AGT to leverage its existing strengths for consistent profitability. The company's significant processing capacity, estimated to be among the largest globally for these commodities, underpins its ability to generate substantial and predictable revenue streams.

Bulk chickpea and bean processing represents a significant Cash Cow for AGT Food and Ingredients, Inc. Similar to lentils and peas, these are core pulse crops for AGT, and the company possesses substantial processing capacity. In 2024, AGT continued to leverage its strong market position in these staple food categories.

The demand for chickpeas and beans remains robust, acting as a dietary staple across key regions like the Indian subcontinent and the Middle East. This consistent demand ensures stable revenue generation for AGT's processing operations.

AGT's large-scale, efficient processing capabilities, combined with its high market share in these fundamental pulse crops, contribute to the reliable and predictable cash flows characteristic of a Cash Cow.

AGT Food and Ingredients, Inc.'s durum wheat semolina and traditional pasta, including brands like Arbella, are classic cash cows. While the market for traditional wheat products may not be expanding as rapidly as newer categories, it remains a substantial and reliable revenue stream for AGT.

These established products benefit from AGT's existing production capabilities and strong brand loyalty, generating consistent profits. In 2024, the global pasta market, a key segment for these products, was valued at approximately $50 billion, demonstrating the enduring demand for these staples.

Established Retail Packaged Foods (CLIC, Arbella)

AGT Food and Ingredients, Inc.'s established retail packaged foods, including brands like CLIC and Arbella, function as Cash Cows within its BCG Matrix. These brands cater to mature markets, particularly in regions with high pulse consumption, ensuring consistent revenue streams.

Their established presence translates to strong consumer loyalty and broad retail distribution, minimizing the need for aggressive marketing spend. This stability allows them to generate significant, reliable cash flow for the company.

- Brand Strength: CLIC and Arbella benefit from established brand recognition in key markets, fostering repeat purchases.

- Market Maturity: Operating in mature segments, these products offer predictable sales volumes and lower growth expectations.

- Cash Flow Generation: High market share and reduced marketing costs enable these brands to be significant net cash generators.

- Strategic Role: They provide the financial stability to support investments in other areas of AGT's portfolio, such as Stars or Question Marks.

Global Trading and Distribution of Core Pulses

AGT Food and Ingredients' global trading and distribution of core pulses, operating in over 120 countries, represents a significant cash cow. Their established network across North America, Europe, Africa, and Asia underpins a substantial market share in the global pulse trade, ensuring consistent revenue generation.

This extensive reach allows AGT to effectively manage supply chains and logistics, capitalizing on steady international demand for pulses. The company's ability to consistently deliver these essential commodities worldwide solidifies its position as a reliable cash generator.

- Global Reach: Operations in over 120 countries.

- Market Dominance: High market share in the global pulse trade.

- Revenue Stream: Consistent and substantial cash generation from trading and distribution.

- Logistical Strength: Well-established supply chains and facilities across continents.

AGT Food and Ingredients' bulk lentil and pea processing operations are a prime example of a cash cow. These segments benefit from AGT's dominant global market position and the steady, mature growth of the pulses sector. In 2024, the global pulses market continued its growth, driven by health consciousness and plant-based diets, with AGT's extensive infrastructure ensuring reliable cash generation with minimal new investment.

Bulk chickpea and bean processing also represents a significant cash cow for AGT. The company's substantial processing capacity and strong market share in these staple food categories, supported by consistent demand across key regions, ensure stable and predictable revenue streams. This allows AGT to leverage its efficient operations for consistent profitability.

AGT's durum wheat semolina and traditional pasta, including brands like Arbella, are classic cash cows. Despite operating in a mature market, these products provide a substantial and reliable revenue stream, benefiting from existing production capabilities and strong brand loyalty. The global pasta market, valued at approximately $50 billion in 2024, underscores the enduring demand for these staples.

Established retail packaged foods, such as CLIC and Arbella, function as cash cows due to their presence in mature markets with high pulse consumption. Their established brand recognition and broad retail distribution minimize marketing costs, enabling significant and reliable cash flow generation. These brands provide crucial financial stability for AGT's strategic investments.

| Segment | BCG Category | Key Drivers | 2024 Market Context | AGT's Position |

|---|---|---|---|---|

| Bulk Lentil & Pea Processing | Cash Cow | Dominant market position, steady sector growth | Increasing health awareness, plant-based diets | Extensive infrastructure, minimal investment |

| Bulk Chickpea & Bean Processing | Cash Cow | Substantial processing capacity, staple food demand | Robust demand in Indian subcontinent, Middle East | High market share, efficient operations |

| Durum Wheat Semolina & Pasta (e.g., Arbella) | Cash Cow | Brand loyalty, existing production | Global pasta market ~ $50 billion | Strong brand recognition, established distribution |

| Retail Packaged Foods (e.g., CLIC, Arbella) | Cash Cow | Mature markets, high pulse consumption | Stable consumer loyalty, broad retail access | Significant net cash generators, financial stability |

Full Transparency, Always

AGT Food and Ingredients, Inc. BCG Matrix

The BCG Matrix preview you are currently viewing is the identical, fully completed document you will receive upon purchase. This means you're seeing the exact strategic analysis of AGT Food and Ingredients, Inc.'s product portfolio, ready for immediate application without any watermarks or placeholder content.

Rest assured, the AGT Food and Ingredients, Inc. BCG Matrix you're examining is the final, professionally formatted report that will be delivered to you after your purchase. This preview accurately represents the comprehensive analysis you can expect, ensuring no surprises and full readiness for your strategic planning needs.

Dogs

AGT Food and Ingredients, Inc.'s undifferentiated bulk commodity trading, particularly in highly competitive pulse segments, likely falls into the Dogs quadrant of the BCG Matrix. These operations, characterized by thin margins and intense competition, may struggle to generate substantial profits or significant growth. For example, in 2024, global pulse markets experienced price volatility due to abundant supply from major producers, putting pressure on trading margins.

AGT Food and Ingredients, Inc. may operate processing facilities that are less strategic or have become outdated, especially as the company pivots towards value-added products and plant-based alternatives. These older sites could represent a drag on profitability due to higher operating expenses and lower efficiency compared to modern facilities.

For instance, if a significant portion of AGT's revenue, say 15%, comes from legacy processing lines that are not easily adaptable to new product development, these facilities would likely be classified as Dogs in a BCG matrix analysis. The company's 2024 financial reports might detail specific segments or facilities experiencing declining margins, signaling potential candidates for rationalization.

AGT Food and Ingredients, Inc. may have several small-scale product lines that haven't gained much traction. These might be regional specialties or very niche offerings that haven't found a broad customer base. For example, a specific pulse-based snack targeted at a very narrow demographic could fall into this category.

These products likely have low market share within their respective segments, which are often stagnant or intensely competitive. This lack of scale means they struggle to achieve cost efficiencies, leading to poor returns on investment for AGT. Think of a unique lentil flour blend sold only in a few select stores; its sales volume might not justify the production costs.

Non-Core Business Units Divested for Capital Reallocation

AGT Food and Ingredients, Inc. divested its shortline rail and bulk handling infrastructure, MobilGrain, in late 2024/early 2025. This move signals a strategic shift away from capital-intensive, less central operations.

The divestment of MobilGrain allows AGT to reallocate capital towards more promising growth sectors. These include their expanding packaged foods division and the burgeoning plant-based protein market.

- Divestment Rationale: Exiting a segment deemed less critical for future strategic objectives and capital allocation.

- Capital Reallocation: Freeing up financial resources from potentially lower-performing assets.

- Strategic Focus: Reinvesting freed capital into high-growth areas such as packaged foods and plant-based proteins.

- Financial Impact: Aiming to improve overall return on investment by concentrating on core, higher-margin businesses.

Segments Heavily Reliant on Fluctuating Commodity Prices

AGT Food and Ingredients, Inc. might have segments heavily reliant on fluctuating commodity prices that could be considered Dogs in a BCG Matrix analysis. These are typically areas where AGT's business is primarily exposed to the raw price of commodities like pulses, grains, or oilseeds without significant further processing or strong risk management strategies.

Such segments would likely show weak market share and low growth potential, often struggling to generate consistent profits. For instance, if a significant portion of AGT's revenue comes from simply trading raw agricultural commodities, and they haven't implemented robust hedging or value-added services, this business line could be vulnerable to price downturns.

For example, if AGT's 2024 financial reports indicate that their basic commodity trading division experienced a significant margin squeeze due to a sharp decline in global pulse prices, and this segment contributed only a small, stagnant percentage to overall company growth, it would strongly suggest a Dog.

- Low Profitability: Segments exposed to volatile commodity prices without value-added processing may struggle to maintain healthy profit margins, potentially breaking even or incurring losses during price downturns.

- Stagnant Growth: These areas often exhibit low market growth rates as they are primarily driven by the commodity cycle rather than innovation or increasing demand for specialized products.

- Limited Control: Without effective hedging or diversification into higher-margin processed goods, AGT has minimal control over the profitability of these segments when commodity prices fluctuate unfavorably.

AGT Food and Ingredients, Inc.'s undifferentiated bulk commodity trading, particularly in highly competitive pulse segments, likely falls into the Dogs quadrant of the BCG Matrix. These operations, characterized by thin margins and intense competition, may struggle to generate substantial profits or significant growth. For example, in 2024, global pulse markets experienced price volatility due to abundant supply from major producers, putting pressure on trading margins.

AGT Food and Ingredients, Inc. may have several small-scale product lines that haven't gained much traction, such as a specific pulse-based snack targeted at a very narrow demographic. These products likely have low market share within their respective segments, which are often stagnant or intensely competitive, struggling to achieve cost efficiencies and leading to poor returns on investment for AGT.

The divestment of MobilGrain in late 2024/early 2025 signals a strategic shift away from capital-intensive, less central operations, allowing AGT to reallocate capital towards more promising growth sectors like their expanding packaged foods division and the burgeoning plant-based protein market.

Segments heavily reliant on fluctuating commodity prices without significant further processing or strong risk management strategies, such as basic commodity trading, could be considered Dogs. These areas often exhibit low market growth rates and limited control over profitability when commodity prices fluctuate unfavorably.

| Segment/Operation | BCG Quadrant Classification | Rationale | 2024 Market Context/Data |

|---|---|---|---|

| Bulk Commodity Trading (Pulses) | Dogs | Low margins, intense competition, price volatility impacting profitability. | Global pulse markets faced price volatility due to abundant supply, pressuring trading margins in 2024. |

| Legacy Processing Facilities | Dogs | Potentially outdated, higher operating expenses, lower efficiency compared to modern facilities. | If 15% of revenue comes from legacy lines not adaptable to new products, these facilities are potential Dogs. |

| Niche/Small-Scale Product Lines | Dogs | Low market share, stagnant or competitive segments, struggle for cost efficiencies. | A unique lentil flour blend sold in few stores may not justify production costs due to low sales volume. |

| MobilGrain (Divested) | Dogs (Pre-Divestment) | Capital-intensive, less central to strategic objectives. | Divested late 2024/early 2025 to reallocate capital to growth sectors. |

Question Marks

AGT Food and Ingredients, Inc. is actively exploring biomass-derived products for fuel and feed, a sector poised for significant growth due to increasing global demand for sustainable alternatives. This aligns with broader trends toward renewable resources, suggesting strong future market potential for AGT's initiatives in this area.

Currently, these biomass programs are in their developmental stages, meaning they represent potential future revenue streams rather than established market leaders. This positioning places them in the 'question mark' category of the BCG matrix, requiring substantial investment to mature and capture market share.

AGT Food and Ingredients' investment in new oat processing capabilities at its Aberdeen facility directly addresses the surging consumer preference for gluten-free and environmentally conscious food choices. This strategic move positions AGT to capitalize on the burgeoning oat market, which is experiencing significant growth fueled by products such as oat milk and oat flour.

While the oat-based ingredients sector presents a high-growth opportunity, AGT is likely in the developmental stages of establishing its market presence and scaling its production capacity within this specific niche. Consequently, this segment can be categorized as a Question Mark within the BCG Matrix, signifying its considerable future potential alongside the inherent uncertainties of market penetration and competitive positioning.

AGT Food and Ingredients, Inc.'s expansion into niche plant-based food categories positions these new products as potential Stars or Question Marks within the BCG Matrix. These specialized ingredients or end-products are designed to capitalize on emerging consumer trends in high-growth areas.

While these ventures target rapidly expanding markets, their current scale for AGT necessitates significant investment in marketing and distribution to capture substantial market share. For instance, the global plant-based food market was valued at approximately $27 billion in 2023 and is projected to reach over $160 billion by 2030, indicating a strong growth trajectory for these niche segments.

Strategic Partnerships for Novel Ingredient Development

AGT Food and Ingredients, Inc.'s strategic partnerships for novel ingredient development, like the collaboration with FrieslandCampina for the Plantaris line, are classic examples of potential 'Question Marks' within the BCG Matrix. These ventures focus on new protein isolates designed for enhanced taste and functionality, tapping into growing consumer demand for plant-based alternatives.

The success of these novel ingredients hinges on market acceptance and the ability to scale production efficiently. As of early 2024, the plant-based protein market continues to see robust growth, with global revenues projected to reach significant figures, yet the specific adoption rates for highly specialized isolates like those from Plantaris are still being established. This means substantial ongoing investment is required to nurture these products from their current nascent stage towards becoming market leaders.

- Market Potential: The global plant-based protein market is expanding, with forecasts indicating continued strong growth through 2030, suggesting a fertile ground for novel ingredients.

- Investment Needs: Significant capital is necessary for research, development, scaling production, and market penetration to overcome the initial uncertainties of adoption.

- Competitive Landscape: While innovative, these new isolates face competition from established protein sources and other emerging plant-based alternatives.

- Risk Factor: The primary risk lies in whether these novel ingredients can achieve widespread commercial success and justify the substantial investments made.

Penetration into Underexplored Geographic Markets

Penetration into underexplored geographic markets would position AGT Food and Ingredients, Inc. as a potential star in the BCG matrix. These markets, often characterized by burgeoning middle classes and increasing demand for food products, represent significant untapped potential.

Consider AGT's expansion into Southeast Asia, a region with a rapidly growing population and rising disposable incomes. For instance, Vietnam's agricultural import market was valued at approximately $30 billion in 2023, presenting a substantial opportunity for a company with AGT's product portfolio.

- High Growth Potential: Emerging markets in Africa and parts of South America offer substantial demographic tailwinds and increasing food consumption.

- Market Development Investment: AGT would need to invest in establishing distribution networks, understanding local consumer preferences, and potentially localizing production.

- Competitive Landscape: While underexplored, these markets may have established local players or other international competitors entering, requiring a strategic approach.

- Regulatory Environment: Navigating diverse regulatory frameworks and food safety standards will be crucial for successful market entry.

AGT Food and Ingredients' ventures into biomass-derived products for fuel and feed are currently in their early stages, requiring significant investment to reach their full market potential. These initiatives represent potential future revenue streams, placing them firmly in the Question Mark category of the BCG matrix due to their nascent market position and the need for substantial capital to grow.

The company's expansion into niche plant-based food categories, while targeting high-growth markets like the global plant-based food sector projected to exceed $160 billion by 2030, also falls into the Question Mark quadrant. This is due to the current scale of AGT's operations in these areas, necessitating considerable investment in marketing and distribution to achieve significant market penetration.

AGT's strategic collaborations for novel ingredient development, such as the Plantaris line, are classic examples of Question Marks. The success of these specialized protein isolates depends on market acceptance and efficient scaling, with ongoing investment crucial to transition them from their current early stage to market leadership.

New geographic market penetration, like expansion into Southeast Asia, also presents Question Mark characteristics for AGT. While regions like Vietnam's agricultural import market, valued at approximately $30 billion in 2023, offer substantial opportunity, significant investment in distribution and localization is required for successful market capture.

BCG Matrix Data Sources

Our BCG Matrix for AGT Food and Ingredients, Inc. is built on a foundation of comprehensive financial disclosures, including annual reports and investor presentations, alongside robust market research and industry growth forecasts.