Agnico Eagle Mines Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Agnico Eagle Mines Bundle

Agnico Eagle Mines operates in a sector characterized by significant capital requirements and established players, influencing the threat of new entrants and the bargaining power of buyers. Understanding these dynamics is crucial for any stakeholder.

The complete report reveals the real forces shaping Agnico Eagle Mines’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Agnico Eagle Mines, like its peers in the senior gold mining sector, depends on highly specialized and often proprietary equipment and technology. These critical assets are frequently sourced from a select group of global manufacturers, creating a concentrated supplier base.

This concentration of suppliers grants them considerable bargaining power, particularly for essential machinery needed for complex operations like deep underground mining or extensive open-pit projects. For example, the cost of specialized drilling rigs or advanced processing equipment can run into millions of dollars.

The substantial capital investment required for these specialized assets results in high switching costs for Agnico Eagle. This financial barrier makes it difficult and expensive to change suppliers, further solidifying the leverage held by existing equipment providers.

The gold mining sector, including operations like Agnico Eagle Mines, relies heavily on a specialized workforce. Think geologists, mining engineers, and skilled equipment operators. These aren't jobs you can easily fill with just anyone, especially when mines are in remote or challenging locations.

When this specialized talent is scarce, particularly in the specific regions where Agnico Eagle operates, the bargaining power of employees and unions naturally increases. This can translate into pressure for higher wages and benefits, directly impacting the company's operational costs. In 2023, the average annual wage for mining engineers in Canada, a key operating region for Agnico Eagle, was around CAD 115,000, reflecting the demand for these skills.

Agnico Eagle's commitment to safety and ongoing talent development is a strategic move to counteract this supplier power. By investing in their workforce and ensuring a safe working environment, they aim to attract and retain the skilled labor necessary for efficient and cost-effective operations, thereby mitigating the risk of significant wage inflation.

Mining is a thirsty business when it comes to energy. Agnico Eagle Mines, like many in the sector, relies heavily on electricity and fuel, costs that can swing wildly based on global market dynamics. In 2024, for instance, the price of Brent crude oil, a key indicator for fuel costs, experienced significant volatility, impacting operational budgets across the industry.

Beyond fuel, mining operations depend on crucial consumables, such as the chemicals needed for ore processing. Cyanide, for example, is vital for gold extraction, and its availability and pricing are often tied to a limited number of specialized suppliers. Any disruption or price hike from these suppliers directly affects Agnico Eagle's bottom line.

Agnico Eagle is actively working to buffer itself against these energy and consumable price shocks. By investing in renewable energy sources, such as solar and wind power for its operations, the company aims to gain more control over its energy expenses and reduce its exposure to volatile fossil fuel markets.

Logistics and Infrastructure Providers

Agnico Eagle Mines' reliance on logistics and infrastructure providers is significant, given its widespread operations in Canada, Australia, Finland, and Mexico. These providers are crucial for transporting everything from raw materials and heavy equipment to the finished gold product. In 2024, the global logistics market experienced continued volatility, with shipping costs fluctuating based on fuel prices and geopolitical events, directly impacting Agnico Eagle's operational expenses.

The bargaining power of these suppliers can be substantial, particularly in the remote mining locations where Agnico Eagle operates. Limited availability of specialized transportation and infrastructure services in these areas often creates a near-monopolistic situation for the providers. This necessity means Agnico Eagle has fewer alternatives, strengthening the suppliers' position to negotiate terms and pricing. For instance, in certain Canadian Arctic regions where Agnico Eagle has operations, the cost of air freight for essential supplies can be exceptionally high due to the lack of extensive road or rail networks.

- Limited Competition: In remote mining sites, the number of logistics providers capable of servicing these areas is often very small, sometimes even a single entity.

- High Switching Costs: Establishing new logistics partnerships in remote locations can be time-consuming and expensive, making it difficult for Agnico Eagle to switch suppliers.

- Essential Services: The critical nature of timely delivery of supplies and equipment for continuous mining operations gives logistics providers significant leverage.

- Specialized Equipment: Many logistics providers possess specialized equipment necessary for mining operations, such as heavy-lift aircraft or specialized vehicles, which are not readily available from multiple sources.

Environmental and Consulting Services

Agnico Eagle Mines relies on environmental and consulting services for regulatory compliance and ESG reporting. The growing complexity of environmental laws and the push for strong ESG performance can increase the leverage of these specialized consultants. These firms provide essential expertise and certifications that are vital for Agnico Eagle to maintain its social license to operate, impacting project approvals and ongoing operations.

In 2024, the demand for specialized environmental consulting services, particularly those focused on ESG and climate risk assessment, continued to rise across the mining sector. Companies like Agnico Eagle face increasing scrutiny from investors and regulators regarding their environmental footprint and social impact. This heightened focus means that consultants with proven track records in areas like biodiversity management, water stewardship, and community engagement hold significant sway.

- Increasing Regulatory Complexity: Environmental regulations globally are becoming more stringent, requiring specialized knowledge to navigate.

- ESG Reporting Demands: Investors and stakeholders demand comprehensive ESG data, making expert reporting services crucial.

- Social License to Operate: Consultants specializing in social impact assessments and community relations are key to maintaining public acceptance.

- Specialized Expertise: Firms offering niche services like advanced environmental monitoring or carbon accounting can command higher fees and influence.

The bargaining power of suppliers for Agnico Eagle Mines is moderate, influenced by the specialized nature of inputs and the geographic concentration of some operations. While some critical components and services are sourced from a limited number of providers, Agnico Eagle's scale and strategic sourcing efforts help to mitigate excessive supplier leverage.

For essential mining equipment and advanced processing technologies, a concentrated supplier base can exert significant influence. For example, the cost of specialized underground mining machinery can represent a substantial portion of capital expenditure, and switching providers involves high costs and operational disruptions, as seen with the millions of dollars required for advanced processing equipment.

Similarly, the availability of specialized labor, such as experienced geologists and mining engineers, particularly in remote locations, can empower employees and their representatives. In 2023, the average annual wage for mining engineers in Canada was approximately CAD 115,000, indicating the demand for skilled professionals.

Energy and chemical consumables also present a degree of supplier power. Fluctuations in fuel prices, like the volatility observed in Brent crude oil in 2024, directly impact operational budgets. The reliance on specific chemicals for ore processing, such as cyanide, from a limited number of suppliers, further concentrates this power.

| Input Category | Supplier Power Factors | Impact on Agnico Eagle |

|---|---|---|

| Specialized Equipment | Limited suppliers, high switching costs | Potential for higher capital costs, operational dependency |

| Skilled Labor | Scarcity in remote locations, specialized skills | Wage pressure, retention challenges |

| Energy & Consumables | Market volatility, limited specialized chemical suppliers | Operational cost fluctuations, supply chain risks |

| Logistics & Infrastructure | Geographic isolation, limited providers | Increased transportation costs, reliance on specific partners |

| Environmental Consulting | Regulatory complexity, ESG demands | Increased demand for specialized services, higher consulting fees |

What is included in the product

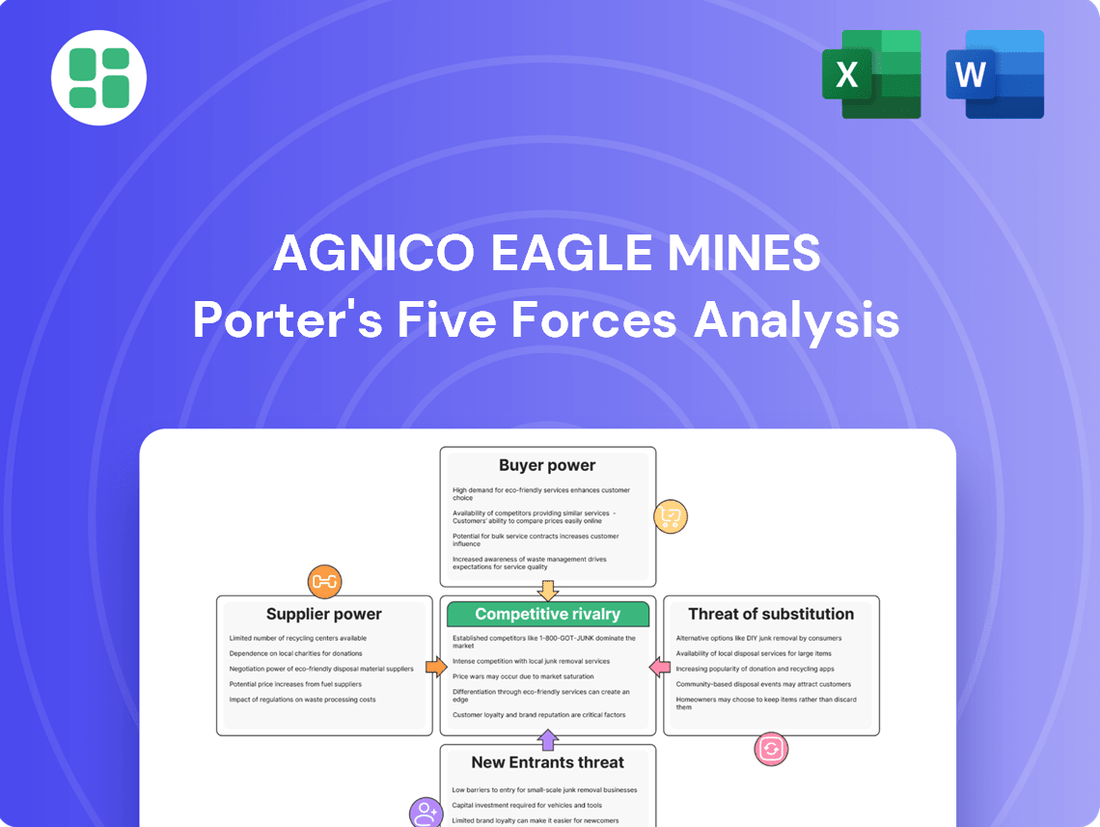

This analysis unpacks the competitive forces impacting Agnico Eagle Mines, detailing industry rivalry, buyer and supplier power, threats of new entrants and substitutes, and their collective influence on the company's profitability and strategic positioning.

A dynamic dashboard that visualizes Agnico Eagle Mines' Porter's Five Forces, allowing for rapid assessment of competitive pressures and strategic adjustments.

Effortlessly identify and mitigate competitive threats by clearly mapping the intensity of each force impacting Agnico Eagle Mines' profitability.

Customers Bargaining Power

Gold's status as a globally traded commodity means Agnico Eagle Mines' product is essentially the same as that offered by competitors. This lack of differentiation means individual customers have little leverage; they can easily switch suppliers based on price. In 2024, the average gold price fluctuated significantly, impacting purchasing decisions for many buyers.

Agnico Eagle Mines serves a broad range of customers, including gold refiners, central banks, industrial fabricators, and institutional investors. This wide distribution of sales means no single buyer holds a substantial portion of Agnico Eagle's revenue.

The lack of a dominant customer significantly dilutes buyer power. Because no individual entity accounts for a large enough percentage of Agnico Eagle's sales, their ability to dictate terms or prices is limited, which is beneficial for the company's profitability.

The bargaining power of customers in the gold market, including for Agnico Eagle Mines, is minimal. Global gold prices are dictated by broad market forces like supply and demand, geopolitical stability, and investor confidence, not by individual customer negotiations. For instance, gold prices reached record highs in early 2024, demonstrating the market's sensitivity to these macro factors rather than buyer leverage.

High Demand for Gold

The bargaining power of customers for Agnico Eagle Mines is significantly mitigated by the high and sustained demand for gold. This robust demand stems from its role as a safe-haven asset, its widespread use in jewelry, and its industrial applications. Key buyers, including central banks and Exchange Traded Funds (ETFs), actively seek gold, creating a competitive environment for supply.

Central bank purchases, a crucial driver of gold demand, are expected to remain strong. For instance, central banks added a substantial amount of gold in 2023, continuing a trend that analysts project will see continued robust buying through 2025. This consistent institutional buying reduces the ability of any single customer to negotiate lower prices.

- Sustained Demand: Gold's appeal as a safe haven, in jewelry, and industry ensures a constant market for Agnico Eagle's output.

- Central Bank & ETF Activity: Significant purchases by these entities create a competitive buyer landscape.

- Projected 2025 Demand: Forecasts indicate continued strong central bank acquisitions, further solidifying market demand.

- Reduced Customer Leverage: The competition among buyers for a limited supply limits their power to dictate terms.

No Forward Sales Policy

Agnico Eagle Mines' commitment to a no forward sales policy significantly limits customer bargaining power. By not pre-selling gold, the company ensures it benefits from all market price fluctuations, removing a key avenue for customers to negotiate future prices.

This strategy directly contrasts with companies that might use forward contracts to secure sales, which could give large buyers leverage. For Agnico Eagle, this means no long-term price commitments are made, leaving customers with little ability to dictate terms for future purchases.

Consider the implications: if gold prices surge, Agnico Eagle captures that upside entirely. Conversely, if prices fall, the company bears the full impact without the buffer of prior price agreements. This direct market exposure is a strategic choice that minimizes customer influence on pricing.

- No Forward Sales Policy: Agnico Eagle does not engage in forward gold sales, meaning they don't lock in prices for future deliveries with customers.

- Full Market Exposure: This policy ensures Agnico Eagle has complete exposure to prevailing market gold prices, for better or worse.

- Reduced Customer Leverage: By avoiding pre-agreed prices, the company removes a significant mechanism through which customers could exert bargaining power on future sales.

- Strategic Pricing Control: Agnico Eagle retains full control over its pricing strategy, adapting to real-time market conditions rather than being bound by past agreements.

The bargaining power of customers for Agnico Eagle Mines is generally low. Gold's status as a globally traded commodity with limited differentiation means individual buyers have little leverage to negotiate prices, especially given the market's sensitivity to broad economic factors. For instance, gold prices saw significant volatility in 2024, driven by macroeconomic trends rather than customer demand specifics.

| Customer Segment | Significance to Agnico Eagle | Bargaining Power Influence |

|---|---|---|

| Refiners | Process raw gold into marketable forms | Low; dependent on market price |

| Central Banks | Major institutional buyers, often for reserves | Low; driven by global monetary policy and confidence |

| Industrial Fabricators | Use gold in electronics, dentistry, etc. | Low; demand is price-sensitive but volume is dispersed |

| Institutional Investors (ETFs) | Hold gold as an investment asset | Low; influenced by broader market sentiment and ETF creation/redemption |

Same Document Delivered

Agnico Eagle Mines Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. The comprehensive analysis delves into the Agnico Eagle Mines Porter's Five Forces, detailing the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the gold mining industry. Understand the competitive landscape and strategic positioning of Agnico Eagle Mines with this ready-to-use report.

Rivalry Among Competitors

The global gold mining sector is quite concentrated, meaning a few major companies hold a large chunk of the market. Agnico Eagle Mines is a prime example, ranking as the third-largest gold producer worldwide in 2024. This puts it in direct competition with giants like Newmont and Barrick Gold.

This concentration naturally fuels intense rivalry. These leading producers are constantly vying for prime mining assets, skilled labor, and the attention of investors. Their competition for market share and resources is a significant factor influencing the industry's dynamics.

Gold mining demands substantial upfront investment in exploration, mine development, and ongoing operations, creating high fixed costs. Companies must produce at high volumes to amortize these significant expenditures and achieve economies of scale. This necessity drives intense competition as firms push for maximum output to cover costs and ensure profitability.

For Agnico Eagle Mines, this dynamic means that maintaining high production levels is crucial. In 2023, Agnico Eagle produced approximately 3.1 million ounces of gold. Companies that can effectively manage their production costs and achieve higher volumes often gain a competitive edge, as seen in Agnico Eagle's continued focus on operational efficiency and reserve management.

The mining industry is grappling with a significant challenge: the declining quality of ore grades and the overall scarcity of new, high-grade reserves. This scarcity naturally fuels intense competition among major players, including Agnico Eagle Mines, as they vie to secure and develop promising deposits that will underpin future production.

Agnico Eagle's proactive approach, evidenced by its robust exploration budget and strategic acquisitions like the C$300 million deal for O3 Mining in 2023, underscores the critical nature of this competitive dynamic. These moves are essential for maintaining a pipeline of high-quality assets in an increasingly challenging resource landscape.

Cost Control and Operational Efficiency

Competitive rivalry is intense in the gold mining industry, with companies like Agnico Eagle Mines constantly striving to outdo each other on cost control and operational efficiency. Maintaining low all-in sustaining costs (AISC) is paramount, especially when gold prices are volatile and operational expenses are on the rise. Agnico Eagle, for instance, has been a leader in keeping its AISC competitive, demonstrating a strong focus on improving margins.

In 2023, Agnico Eagle reported an AISC of $1,127 per ounce, a figure that reflects their commitment to efficient operations. This focus allows them to remain competitive even when market conditions are challenging. The drive for efficiency often involves adopting new technologies and optimizing existing processes to reduce waste and maximize output.

- Agnico Eagle's 2023 AISC: $1,127 per ounce.

- Focus on Efficiency: Continuous efforts to reduce operating expenses and improve productivity.

- Technological Adoption: Investing in advancements to enhance extraction and processing.

- Competitive Advantage: Lower costs allow for greater profitability and market resilience.

Geographical and Political Stability

Agnico Eagle Mines faces competition not just from other mining companies, but also from the need to secure operations in politically stable and favorable mining jurisdictions. This is a critical factor in the industry, as unstable regions can lead to operational disruptions and increased costs.

Agnico Eagle's strategic focus on regions like Canada, Australia, Finland, and Mexico provides a significant competitive advantage. These locations are generally known for their political stability and supportive mining regulations, which helps mitigate geopolitical risks and ensures operational continuity. This stability is a key differentiator in the highly competitive mining sector.

- Geographical Advantage: Agnico Eagle's presence in Canada, a leading mining nation, offers access to established infrastructure and a skilled workforce. In 2023, Canada's mining sector contributed an estimated $125 billion to the national GDP.

- Political Stability: Australia and Finland are also recognized for their stable political environments and clear legal frameworks for mining, reducing the likelihood of unexpected policy changes that could impact operations.

- Risk Mitigation: By concentrating operations in these secure jurisdictions, Agnico Eagle effectively minimizes exposure to the volatility often associated with mining in less stable countries, thereby safeguarding its investments and production.

The gold mining industry is characterized by intense rivalry among major players like Agnico Eagle Mines, Newmont, and Barrick Gold, who are the top three global producers as of 2024. This competition is driven by the need to secure high-quality ore bodies, attract skilled labor, and gain investor attention in a concentrated market. Companies must achieve economies of scale due to high upfront investment and fixed costs, pushing for maximum output to ensure profitability.

Agnico Eagle's strategy involves maintaining cost leadership, as demonstrated by its 2023 all-in sustaining cost (AISC) of $1,127 per ounce, which is competitive within the industry. This focus on efficiency, often achieved through technological adoption and operational optimization, is crucial for navigating volatile gold prices and rising operational expenses. The company's proactive approach to acquiring new assets, such as the 2023 O3 Mining deal, highlights the ongoing battle for future production reserves.

| Metric | Agnico Eagle Mines (2023) | Industry Context |

|---|---|---|

| Gold Production Rank (2024) | 3rd Largest | Top 3 producers dominate market share. |

| All-in Sustaining Cost (AISC) | $1,127 per ounce | Key differentiator for cost control and profitability. |

| Acquisition Activity | O3 Mining ($300M, 2023) | Strategic moves to secure future reserves. |

SSubstitutes Threaten

For investors looking at Agnico Eagle Mines, the threat of substitutes is significant. Gold, the company's primary product, is often seen as a safe haven. However, it competes with other assets like U.S. Treasury bonds, which have seen yields rise in 2024, making them more attractive to income-seeking investors. Real estate also remains a popular alternative, and the performance of these substitutes directly impacts the demand for gold and, consequently, Agnico Eagle's market position.

The rise of digital currencies, often framed as digital gold, introduces a potential, though still developing, alternative for investors looking for decentralized and inflation-hedging assets. While not a direct replacement for physical gold in all its uses, the expanding adoption and market value of cryptocurrencies could influence investment flows away from traditional gold holdings over time.

As of early 2024, the total market capitalization of cryptocurrencies fluctuated significantly, but remained in the trillions of dollars, demonstrating a substantial pool of investor capital. For instance, Bitcoin, a leading cryptocurrency, saw its market cap reach over $1 trillion at certain points in 2024, indicating its growing significance as an alternative asset class.

The threat of substitutes for industrial and technological materials used by Agnico Eagle Mines is relatively low, but not entirely absent. Gold's unique properties, such as its excellent conductivity and resistance to corrosion, make it valuable in electronics and certain specialized industrial applications. However, ongoing advancements in material science continually explore alternatives. For instance, research into advanced ceramics, specialized alloys, and conductive polymers aims to replicate gold's performance characteristics at a potentially lower cost. While these substitutes are unlikely to replace gold entirely in high-end applications, they could erode demand in less critical sectors over the long term.

Changing Consumer Preferences in Jewelry

The threat of substitutes in the jewelry market, particularly for traditional gold, is a significant consideration. Consumer preferences can evolve, leading to a shift towards alternative materials like platinum or palladium, or even entirely different luxury goods. For instance, the growing acceptance and affordability of lab-grown diamonds present a direct substitute for mined diamonds, which are often incorporated into gold jewelry.

A sustained trend away from classic gold pieces, driven by changing fashion or economic factors, could directly impact demand for gold producers like Agnico Eagle Mines. This is particularly relevant as gold jewelry accounts for a substantial portion of global gold consumption. In 2023, the World Gold Council reported that jewelry accounted for 40% of total gold demand, underscoring its importance.

- Shifting Tastes: Consumers may opt for alternative precious metals or fashion jewelry made from less expensive materials.

- Lab-Grown Alternatives: The increasing popularity and accessibility of lab-grown diamonds pose a substitute threat to natural diamonds, often set in gold.

- Non-Jewelry Luxury Goods: Spending on luxury experiences, technology, or other high-end items can divert consumer budgets away from jewelry purchases.

- Cultural Significance: While gold holds cultural importance, evolving societal values or economic pressures could diminish its appeal for some consumer segments.

Other Commodities and Resource Investments

Investors have a broad universe of commodity and resource investments beyond gold, such as base metals, energy, and even agricultural products. For instance, in 2024, the price of crude oil experienced significant volatility, with Brent crude averaging around $80 per barrel for much of the year, while copper prices also saw an upward trend, driven by demand for electrification. This diversification of investment options means capital can easily flow away from gold mining companies like Agnico Eagle if other sectors present more compelling opportunities.

The relative performance and outlook of these alternative investments directly impact the attractiveness of gold. If, for example, the energy sector offers substantial gains due to geopolitical events or supply constraints, investors might reallocate funds from gold, which is often seen as a safe-haven asset, to those higher-return sectors.

- Diversified Commodity Exposure: Investors can choose from a wide range of commodities including oil, natural gas, copper, nickel, and agricultural goods.

- Performance-Driven Capital Flows: In 2024, energy prices like Brent crude averaged approximately $80 per barrel, and copper experienced a notable price increase, influencing investment decisions.

- Impact on Gold Investment: Strong performance in other commodity markets can divert investment capital away from gold mining companies like Agnico Eagle.

- Risk-Return Trade-offs: Investors constantly evaluate the risk-return profiles of various commodities, shifting allocations based on perceived opportunities and market conditions.

The threat of substitutes for gold, Agnico Eagle's primary product, is considerable. Beyond traditional safe havens like U.S. Treasury bonds, which offered attractive yields in 2024, digital currencies present a growing alternative. Bitcoin's market capitalization exceeding $1 trillion at times in 2024 highlights the substantial capital that could be diverted from gold investments.

In the jewelry sector, fashion trends and the increasing appeal of lab-grown diamonds, often set in gold, pose a direct challenge. Gold jewelry accounted for 40% of global gold demand in 2023, making shifts in consumer preference a significant factor. Other luxury goods and experiences also compete for discretionary spending.

Investors also have a wide array of commodity alternatives. For instance, Brent crude averaged around $80 per barrel in 2024, and copper prices rose, drawing capital away from gold if these sectors offer more compelling returns. This broad investment universe means capital can easily flow to competing assets.

| Substitute Asset | 2024 Highlight | Impact on Gold Demand |

|---|---|---|

| U.S. Treasury Bonds | Rising yields made them more attractive | Increased appeal for income-seeking investors |

| Cryptocurrencies (e.g., Bitcoin) | Market cap reached over $1 trillion | Potential diversion of investment capital |

| Other Commodities (e.g., Crude Oil, Copper) | Brent crude ~$80/barrel; Copper prices up | Capital reallocation based on sector performance |

| Lab-Grown Diamonds | Increasing popularity and accessibility | Threat to gold jewelry demand |

Entrants Threaten

The gold mining sector presents a formidable barrier to entry due to its exceptionally high capital requirements. Establishing a new gold mine demands billions of dollars for exploration, land acquisition, extensive infrastructure, and sophisticated extraction equipment. Agnico Eagle Mines, for instance, consistently allocates substantial capital to its projects, with significant expenditures planned for ongoing development, underscoring the immense financial commitment needed to even begin operations.

New companies entering the gold mining sector confront a formidable wall of extensive regulatory hurdles and lengthy permitting processes. These include rigorous environmental impact assessments, detailed social effect studies, and a complex web of approvals that can stretch for many years. For instance, in 2024, the average time to obtain mining permits in many jurisdictions still exceeded three to five years, a significant barrier to entry.

Agnico Eagle Mines' commitment to high standards, such as the Responsible Gold Mining Principles and Towards Sustainable Mining, further elevates the compliance benchmark. This dedication to sustainability and responsible operations, while beneficial for established players, creates a substantial challenge for potential new entrants aiming to match these operational and ethical standards from the outset.

The threat of new entrants for Agnico Eagle Mines, specifically concerning access to quality reserves and expertise, is significantly mitigated. Finding commercially viable, high-grade gold deposits is becoming a tougher task globally, with projections indicating a decline in gold production from 2025 due to dwindling reserves. This scarcity naturally erects a substantial barrier.

Established companies like Agnico Eagle have already secured extensive geological expertise and vast land packages, often with a history of successful discoveries. This existing infrastructure and proven capability make it exceptionally difficult for new players to replicate their access to and development of competitive reserves, effectively limiting the threat.

Operational Scale and Efficiency

Senior gold miners like Agnico Eagle benefit immensely from their established operational scale and efficiency. Decades of experience have allowed them to cultivate economies of scale, optimize production processes, and build robust supply chains. For instance, Agnico Eagle's diversified portfolio across multiple countries, as of Q1 2024, with operations in Canada, Mexico, and Finland, enables them to strategically manage costs and production levels, leveraging regional advantages.

New entrants face a significant hurdle in replicating these cost structures and operational efficiencies. Achieving comparable economies of scale and supply chain integration would require substantial upfront investment and considerable time, making it difficult to compete on cost with established players. This barrier is particularly high in the capital-intensive mining sector.

- Economies of Scale: Established miners can spread fixed costs over larger production volumes, lowering per-unit costs.

- Operational Efficiencies: Decades of experience lead to optimized mining techniques, processing, and waste management.

- Supply Chain Mastery: Long-standing relationships with suppliers and logistics providers ensure reliable and cost-effective inputs.

- Capital Intensity: The significant capital required for exploration, development, and infrastructure makes it challenging for new entrants to match the scale of established companies like Agnico Eagle.

Geopolitical Risk and Social License to Operate

The mining sector, especially for gold, is heavily influenced by geopolitical stability and the need for a social license to operate. New companies entering this space face a significant hurdle in replicating the established relationships and trust Agnico Eagle has cultivated with local communities and governments. This process is both time-consuming and resource-intensive, making it a substantial barrier to entry.

Agnico Eagle's strategic focus on operating in politically stable jurisdictions and fostering robust community engagement acts as a deterrent to potential new entrants. For instance, in 2024, the company continued to emphasize its commitment to sustainable development and community partnerships across its global operations, a factor that new entrants would find challenging to match quickly.

- Geopolitical Stability: Agnico Eagle's operational footprint in countries like Canada and Finland, known for their stable political and regulatory environments, reduces the risk of sudden policy changes or disruptions that could impact new entrants.

- Social License to Operate: Building and maintaining a positive relationship with local communities and indigenous groups is crucial. This involves significant investment in community development programs and transparent communication, a process that can take years to establish.

- Replication Difficulty: The deep-rooted trust and established operational protocols that Agnico Eagle possesses are not easily replicated by newcomers, creating a formidable barrier to entry.

- Regulatory Hurdles: Navigating complex and often localized regulatory frameworks for exploration, permitting, and environmental compliance presents a significant challenge for any new mining operation.

The threat of new entrants for Agnico Eagle Mines is considerably low due to the immense capital requirements and the scarcity of readily accessible, high-grade gold reserves. The sheer cost of exploration, land acquisition, and infrastructure development, often running into billions of dollars, creates a substantial barrier. Furthermore, finding new, commercially viable gold deposits is increasingly challenging, with global production expected to decline from 2025 onwards due to dwindling reserves.

Navigating the complex and lengthy regulatory and permitting processes, which can take three to five years on average in many jurisdictions as of 2024, further deters new players. Agnico Eagle’s commitment to high operational and ethical standards, such as the Responsible Gold Mining Principles, also raises the compliance bar significantly.

Established players like Agnico Eagle benefit from significant economies of scale, operational efficiencies honed over decades, and mastery of supply chains. Their presence in politically stable regions and established social licenses to operate with local communities are difficult and time-consuming for newcomers to replicate, effectively limiting the threat of new entrants.

| Barrier to Entry | Description | Impact on New Entrants |

| Capital Requirements | Billions of dollars needed for exploration, land, infrastructure, and equipment. | Extremely High |

| Reserve Scarcity | Difficulty in finding new, commercially viable high-grade gold deposits. | High |

| Regulatory Hurdles | Lengthy permitting processes (3-5+ years) and environmental/social assessments. | High |

| Operational Scale & Efficiency | Established players have cost advantages due to economies of scale and optimized processes. | High |

| Geopolitical & Social License | Need for stable jurisdictions and established community relationships. | High |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Agnico Eagle Mines is built upon a foundation of comprehensive data, including their annual reports, investor presentations, and SEC filings, alongside industry-specific market research and reports from reputable mining consultancies.