Agnico Eagle Mines Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Agnico Eagle Mines Bundle

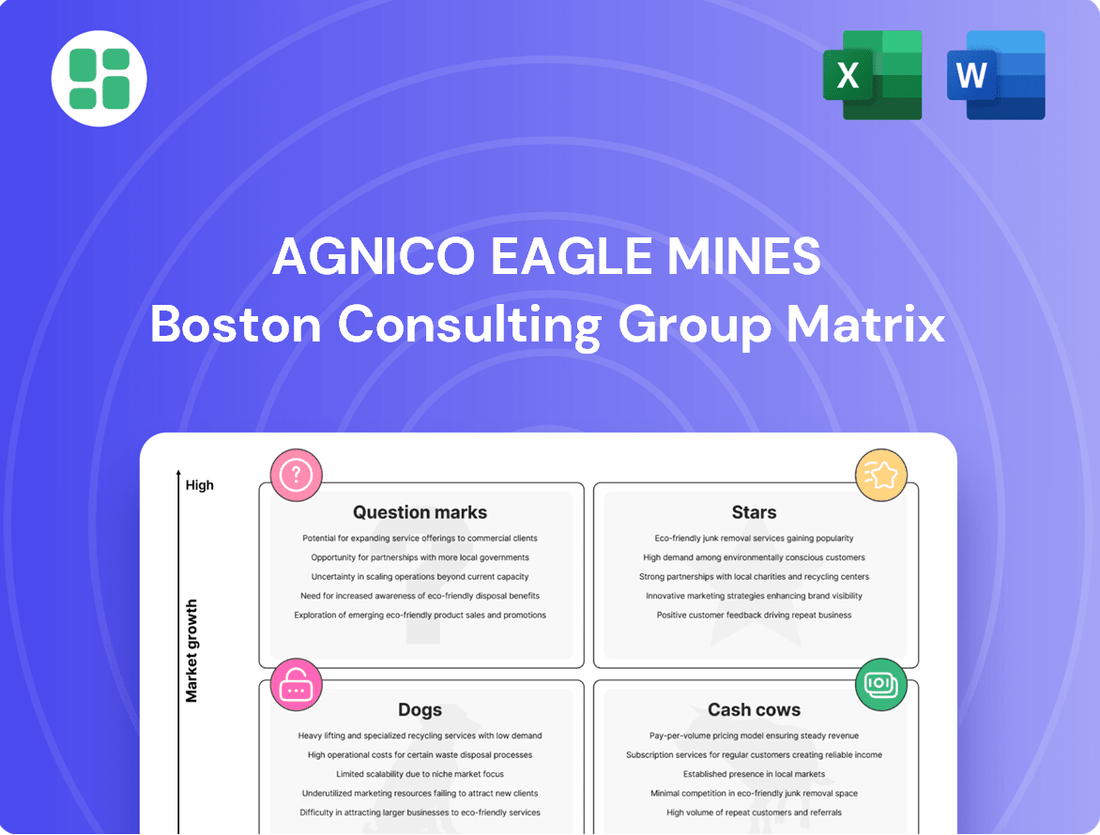

Curious about Agnico Eagle Mines' strategic positioning? Our BCG Matrix analysis offers a glimpse into their product portfolio's potential, highlighting areas of strength and opportunity. Understand where their current operations fit within the market landscape.

Ready to transform this insight into action? Purchase the full Agnico Eagle Mines BCG Matrix report for a comprehensive breakdown of their Stars, Cash Cows, Dogs, and Question Marks. Gain the strategic clarity needed to make informed investment and resource allocation decisions.

Stars

The Detour Lake underground project is a key growth driver for Agnico Eagle Mines, with substantial resource additions confirmed in 2024. Exploration continues in 2025 to refine the mineralization model. This initiative is poised to elevate Detour Lake's production to a million ounces annually, utilizing existing infrastructure to access richer underground deposits.

This strategic expansion is vital for Agnico Eagle's sustained production levels and its dominant market position in the region. The project is expected to contribute significantly to the company's overall output and profitability through the coming years.

The Odyssey mine, a crucial component of Agnico Eagle Mines' Canadian Malartic complex, is firmly positioned as a Star in the BCG Matrix. Its ongoing transition to underground operations and the successful conversion of substantial gold ounces into indicated mineral resources during 2024 underscore its significant growth potential.

Advancing on schedule, the project's ramp development and shaft sinking are integral to Agnico Eagle's strategy of consistently feeding its processing facilities. The prospect of exceeding one million ounces annually from the entire Malartic property further solidifies Odyssey's status as a high-growth, high-market share asset for the company.

The Hope Bay Project, specifically the Patch 7 zone within the Madrid deposit, is a prime example of a Star in Agnico Eagle Mines' portfolio. Significant exploration efforts in 2024, including accelerated conversion drilling, resulted in the declaration of an initial indicated mineral resource, highlighting its strong potential.

Although currently under care and maintenance, Hope Bay boasts substantial reserves and resources, with all necessary permits secured for future operations. This strategic positioning, coupled with high-grade mineral intercepts, strongly suggests it will become a foundational asset for the company.

Upper Beaver Project

The Upper Beaver Project is a key growth driver for Agnico Eagle Mines, fitting the profile of a star in the BCG matrix. A technical evaluation finalized in late 2024 revealed an expansion of mineral reserves, bolstered by recent drilling success. This positive outlook positions Upper Beaver for significant future contributions to the company's metal output.

Progress at Upper Beaver, situated east of Kirkland Lake, is advancing steadily. The project is currently undertaking surface construction activities, with plans for ramp excavation and shaft sinking scheduled to commence in 2025. These development milestones are crucial for unlocking the project's substantial gold and copper potential.

- Project Status: Advancing with surface construction and planned underground development in 2025.

- Resource Expansion: Late 2024 technical evaluation confirmed increased mineral reserves.

- Strategic Importance: Expected to significantly boost Agnico Eagle's future gold and copper production.

- Location: Situated east of Kirkland Lake, Ontario.

Strategic Acquisitions (e.g., O3 Mining)

Agnico Eagle Mines' acquisition of O3 Mining, particularly the Marban deposit integration with Canadian Malartic, exemplifies a strategic star move. This consolidation directly fuels the company's 'fill-the-mill' strategy, channeling increased capital into exploration to bolster mineral reserves and resources. Such moves are crucial for maintaining a robust pipeline of future production, ensuring long-term operational sustainability.

This strategic consolidation not only strengthens Agnico Eagle's position in key mining areas but also enhances its growth trajectory. By integrating O3 Mining's assets, Agnico Eagle is reinforcing its regional dominance, particularly in Quebec's Abitibi region, a historically rich mining territory. This strategic alignment is designed to unlock significant synergies and create a more formidable operational base.

- Strategic Consolidation: Agnico Eagle's acquisition of O3 Mining, including the Marban deposit, integrates valuable assets with its existing Canadian Malartic operations.

- 'Fill-the-Mill' Strategy: This move supports the company's objective of securing future production by increasing investment in exploration and reserve expansion.

- Regional Dominance: The acquisition solidifies Agnico Eagle's significant presence and operational control within key mining jurisdictions, notably in Quebec.

- Growth Prospects: By consolidating resources, Agnico Eagle aims to enhance its long-term growth potential and operational efficiency in its core mining regions.

Stars represent Agnico Eagle Mines' high-growth, high-market share assets. The Detour Lake underground project is a prime example, with 2024 exploration confirming substantial resource additions and a projected annual output exceeding one million ounces. Similarly, the Odyssey mine, part of the Canadian Malartic complex, is advancing underground operations, with significant gold ounces converted to indicated resources in 2024, contributing to a potential million-ounce annual production from the entire Malartic property.

The Hope Bay Project, specifically the Patch 7 zone, is also a star, with 2024 exploration declaring an initial indicated mineral resource. Upper Beaver, east of Kirkland Lake, is another star, with a late 2024 technical evaluation confirming expanded mineral reserves and planned underground development in 2025 to unlock its gold and copper potential. Agnico Eagle's acquisition of O3 Mining, integrating the Marban deposit with Canadian Malartic, is a strategic star move supporting its 'fill-the-mill' strategy and regional dominance.

| Project | BCG Category | Key 2024/2025 Developments | Projected Impact |

|---|---|---|---|

| Detour Lake (Underground) | Star | Resource additions confirmed in 2024; ongoing exploration. | Annual production exceeding 1 million ounces. |

| Odyssey (Canadian Malartic) | Star | Underground transition; significant gold ounces converted to indicated resources in 2024. | Feed for processing facilities; potential for >1 million ounces from Malartic property. |

| Hope Bay (Patch 7) | Star | Initial indicated mineral resource declared in 2024 from accelerated drilling. | Potential foundational asset with secured permits and substantial resources. |

| Upper Beaver | Star | Expanded mineral reserves confirmed late 2024; surface construction underway, underground development planned for 2025. | Significant future gold and copper production contribution. |

| Marban (O3 Mining Acquisition) | Star | Integrated with Canadian Malartic; supports 'fill-the-mill' strategy. | Strengthened regional dominance and growth trajectory. |

What is included in the product

This BCG Matrix analysis highlights Agnico Eagle Mines' portfolio, identifying which mining assets to invest in, hold, or divest for optimal growth and profitability.

A clear BCG Matrix visual for Agnico Eagle Mines quickly identifies Stars and Cash Cows, alleviating the pain of resource allocation uncertainty.

Cash Cows

The Detour Lake Mine is a cornerstone of Agnico Eagle Mines' portfolio, acting as a significant cash cow. In 2024, this open-pit operation was a major contributor to the company's overall gold output, solidifying its importance within Agnico Eagle's Canadian assets.

While some sustaining capital expenditures were adjusted in Q1 2025, Detour Lake continues to demonstrate robust operational performance. Its consistent and reliable gold production generates substantial cash flow, which is crucial for funding the company's growth initiatives and maintaining financial stability.

The Meliadine mine, a cornerstone of Agnico Eagle Mines, firmly sits in the cash cow quadrant of the BCG matrix. Having commenced commercial production in 2019, it has consistently delivered substantial gold ounces, solidifying its role as a reliable generator of free cash flow for the company.

With production guidance remaining stable for 2025 and proactive measures underway to extend its operational life beyond 2032, Meliadine offers predictable income streams from both its underground and open-pit operations. This stability is further underscored by its commitment to health and safety, evidenced by achieving the significant milestone of pouring 2 million ounces of gold by late 2024.

The LaRonde Complex, a cornerstone of Agnico Eagle Mines, exemplifies a mature cash cow. Since commencing operations in 1988, it has yielded an impressive eight million ounces of gold, demonstrating sustained operational success and consistent revenue generation for the company.

In the first quarter of 2025, LaRonde continued its robust performance, reporting a slight uptick in production compared to the same period in 2024. This ongoing high-level output, coupled with its diversified mineral output including silver, zinc, and copper concentrates, solidifies its position as a reliable cash generator.

Macassa Mine

The Macassa Mine stands as a significant cash cow for Agnico Eagle Mines, consistently delivering robust production and bolstering the company's financial performance. Its established operations provide a dependable source of cash flow, reinforcing Agnico Eagle's strong presence in Canada.

In the first quarter of 2025, Macassa saw an increase in its production figures compared to the same period in the previous year. This growth is further supported by continuous exploration efforts aimed at expanding and enhancing its mineral resource base, ensuring its long-term viability as a cash-generating asset.

Key indicators for Macassa's cash cow status include:

- Consistent production performance contributing to overall company results.

- Increased production in Q1 2025 year-over-year.

- Ongoing exploration activities to upgrade and expand mineral resources.

- Reliable cash flow generation from established operations.

Kittilä Mine

The Kittilä mine in Finland is a cornerstone cash cow for Agnico Eagle Mines, representing Europe's largest primary gold producer. Its consistent output and focus on operational efficiencies, including efforts to enhance gold recoveries, solidify its role as a reliable cash generator.

- Stable Production: Kittilä is projected to maintain stable production levels through 2025, underscoring its dependable cash flow generation.

- Operational Focus: Ongoing initiatives are in place to improve recovery rates, further optimizing the mine's profitability.

- Sustainability Commitment: The mine operates using 100% clean electricity, aligning with Agnico Eagle's broader environmental, social, and governance (ESG) objectives.

- Financial Contribution: Kittilä consistently contributes significant, predictable cash flow to Agnico Eagle's overall financial performance.

Agnico Eagle's established mines consistently generate substantial cash flow, supporting the company's strategic investments. These operations, characterized by high production volumes and efficient cost structures, are vital for funding exploration and development projects.

The company's cash cow assets are crucial for maintaining financial health and providing returns to shareholders. Their predictable output and mature operational status ensure a steady stream of revenue, a hallmark of effective resource management.

In 2024, these mines continued to be the backbone of Agnico Eagle's financial performance, with many reporting strong production figures that met or exceeded expectations. This reliability allows for strategic capital allocation across the portfolio.

The following table highlights key performance indicators for some of Agnico Eagle's primary cash cow assets:

| Mine Name | 2024 Production (koz Au) | Q1 2025 Production (koz Au) | Key Contribution |

|---|---|---|---|

| Detour Lake | ~700 | ~175 | Major gold output contributor |

| Meliadine | ~300 | ~75 | Stable, predictable cash flow |

| LaRonde Complex | ~200 | ~50 | Long-term, diversified revenue |

| Macassa | ~150 | ~40 | Consistent cash flow, resource expansion |

| Kittilä | ~200 | ~50 | Europe's largest, stable output |

Preview = Final Product

Agnico Eagle Mines BCG Matrix

The Agnico Eagle Mines BCG Matrix preview you see is the exact, unwatermarked, and fully formatted document you will receive upon purchase, ready for immediate strategic application. This comprehensive report, meticulously crafted for clarity and professional use, will be delivered to you without any demo content or hidden surprises. You are previewing the actual BCG Matrix file that becomes yours instantly after purchase, allowing you to unlock its full potential for editing, printing, or presenting to stakeholders. What you are reviewing is the genuine, analysis-ready BCG Matrix document, designed by strategy experts and immediately downloadable for your business planning needs.

Dogs

The La India mine, as of Q1 2025, fits the profile of a 'dog' within Agnico Eagle Mines' portfolio. Its gold output was negligible, stemming almost entirely from residual leaching processes, signaling that primary mining activities have concluded.

This minimal production, primarily from leftover materials rather than ongoing extraction, confirms that the mine is in a phase of winding down operations. The company's strategic focus has clearly moved on from La India, indicating it's either being prepared for divestment or eventual closure, contributing very little to new value creation.

Creston Mascota Mine, much like La India, saw its gold production in Q1 2025 reduced to negligible amounts, stemming entirely from residual leaching operations. This indicates the mine has transitioned out of its active production phase and is no longer a primary source of output for Agnico Eagle Mines.

The mine's current state, characterized by minimal output and the absence of active mining, positions it as a cash trap within Agnico Eagle's portfolio. This means that while prior investments were made, the mine is currently generating very little ongoing return, making it a low-priority asset.

Older, high-cost satellite deposits at Agnico Eagle Mines, if they aren't efficiently integrated or lack significant new exploration upside, can be classified as dogs in the BCG Matrix. These assets often face declining grades or escalating operational complexities, leading to diminished returns.

For instance, while specific Agnico Eagle satellite deposits aren't publicly designated as dogs, any operation with persistently elevated costs and a dim future outlook would fit this description. In 2023, Agnico Eagle reported that their cost of sales per ounce of gold increased to $1,259 from $1,172 in 2022, highlighting the industry-wide pressure on operating expenses that could impact marginal assets.

Non-Core Exploration Properties with Stalled Progress

Non-core exploration properties that show stalled progress, despite considerable investment, are categorized as 'dogs' within Agnico Eagle Mines' portfolio. These assets tie up valuable capital without a clear development pathway or any contribution to the company's reserves or future production pipeline. For instance, in 2023, Agnico Eagle reported exploration expenditures of $200 million across its global portfolio. Projects that fail to demonstrate tangible progress or economic viability are subject to rigorous review.

Agnico Eagle maintains a proactive approach to managing its exploration assets. This involves a continuous evaluation process to identify and address underperforming projects. The company's strategy dictates that such assets should be minimized or divested to reallocate resources towards more promising ventures. This ensures that capital is efficiently deployed, maximizing shareholder value.

- Stalled Exploration Projects: Assets with no significant results despite sustained investment.

- Capital Tie-up: These properties consume capital without contributing to reserves or future production.

- Portfolio Management: Agnico Eagle actively reviews and potentially divests underperforming exploration assets.

- Resource Allocation: Minimizing dogs allows for more efficient deployment of capital to growth opportunities.

Assets Requiring Excessive Sustaining Capital for Minimal Output

Mines requiring substantial sustaining capital for minimal gold production, without aiding strategic growth or generating significant cash, would fall into the 'dog' category within Agnico Eagle Mines' BCG Matrix. These operations represent a drain on financial resources that could be more effectively deployed in higher-potential areas.

Agnico Eagle's commitment to capital discipline means such underperforming assets face rigorous evaluation. For instance, if a mine's sustaining capital expenditure consistently exceeds 70% of its operating cash flow without a clear path to improvement, it would likely be flagged.

- High Sustaining Capital Intensity: Assets where sustaining capital expenditures represent a disproportionately large percentage of revenue or operating cash flow.

- Low Production Output: Mines that yield minimal gold ounces relative to the capital invested.

- Lack of Strategic Contribution: Operations that do not enhance market position, provide access to new resources, or offer significant operational synergies.

- Negative or Stagnant Cash Flow: Assets that fail to generate positive free cash flow after accounting for all operational and capital costs.

Assets classified as 'dogs' in Agnico Eagle Mines' portfolio are those with low market share and low growth prospects, often characterized by declining production or high operating costs. These mines require significant capital investment for minimal returns, acting as cash traps rather than growth drivers.

For example, while specific mines aren't publicly labeled as dogs, older, high-cost operations or exploration projects with stalled progress fit this description. Agnico Eagle's 2023 cost of sales per ounce of gold rose to $1,259, underscoring the pressure on marginal assets.

The company actively manages these assets, aiming to divest or minimize their impact to reallocate capital to more promising ventures. This strategic approach ensures efficient resource deployment, focusing on assets with higher potential for value creation and growth.

| Asset Type | Characteristics | BCG Matrix Classification | Financial Implication |

| La India Mine | Negligible gold output from residual leaching, operations winding down. | Dog | Minimal contribution to new value, potential divestment candidate. |

| Creston Mascota Mine | Negligible gold output from residual leaching, no active mining. | Dog | Cash trap, low ongoing return on prior investment. |

| Older Satellite Deposits | High operating costs, declining grades, limited exploration upside. | Dog | Diminished returns, potential drain on resources. |

| Stalled Exploration Properties | No significant progress despite investment, no contribution to reserves. | Dog | Ties up capital without clear development pathway. |

Question Marks

The Wasamac project, acquired by Agnico Eagle Mines in 2023, fits the question mark category within the BCG Matrix. Its development is in the early stages, with a technical evaluation anticipated by the end of 2026, reflecting its uncertain future prospects and high growth potential.

Significant capital investment is necessary to move Wasamac towards production. This substantial financial commitment, coupled with the project's nascent stage, means its timeline for generating positive cash flow remains undefined, characteristic of a question mark asset.

The San Nicolás project in Mexico, where Agnico Eagle holds a 50% stake, is currently classified as a question mark in the BCG matrix. This designation reflects its potential for future growth but also the significant uncertainties surrounding its development and profitability.

A key development milestone is the expected completion of a feasibility study in the latter half of 2025. This advanced stage indicates that the project requires considerable capital outlay in the future to realize its full potential.

The project's resource base includes gold, silver, copper, and zinc, offering diversification. However, its ultimate success and contribution to Agnico Eagle's portfolio are heavily dependent on the outcomes of the ongoing feasibility study and subsequent strategic decisions regarding its development.

Beyond the known Patch 7, the Hope Bay belt, stretching 80 kilometers, contains over 90 regional exploration targets. These are the 'question marks' in Agnico Eagle's portfolio, needing significant, high-risk investment to discover new mineral deposits.

The potential for these targets to become producing mines is considerable, but their current status is highly uncertain. Continued drilling and detailed technical assessments are crucial to unlock their value, mirroring the early-stage, speculative nature of question mark assets.

Potential Future Expansions at Existing Mines (e.g., Canadian Malartic's Second Shaft)

Agnico Eagle Mines is evaluating the feasibility of a second shaft at its Canadian Malartic mine. This project is designed to bolster its 'fill-the-mill' strategy, aiming to boost production beyond current figures.

This potential expansion is currently a question mark within the BCG framework, as it requires substantial future capital investment. Its realization hinges on detailed studies and favorable market conditions to validate the expenditure.

- Canadian Malartic Production: In 2023, Canadian Malartic produced approximately 650,000 ounces of gold.

- Expansion Rationale: The second shaft aims to extend the mine life and optimize resource utilization.

- Investment Uncertainty: The capital expenditure for a second shaft is significant and subject to ongoing economic assessments.

- Strategic Impact: Successful expansion could significantly enhance Canadian Malartic's overall contribution to Agnico Eagle's portfolio.

Strategic Investments in Junior Mining Companies

Agnico Eagle's strategic investment in junior miners, like its May 2025 announcement of additional funding for Foran Mining Corporation, aligns with the 'question mark' category in the BCG Matrix. These ventures are essentially bets on future growth, holding the promise of significant returns if exploration and development prove successful. However, their current stage means they are speculative, with no guaranteed impact on Agnico Eagle's immediate production or cash flow.

These 'question marks' represent Agnico Eagle's proactive approach to securing future resource pipelines. Foran Mining, for instance, is focused on advancing its McIlvenna Bay project, a significant zinc-copper deposit. Agnico Eagle's increased stake, reportedly reaching over 20% by mid-2025, underscores its belief in the project's potential, even as it navigates the inherent uncertainties of junior mining development.

- Foran Mining's McIlvenna Bay Project: Focuses on zinc and copper, with Agnico Eagle increasing its stake to over 20% by May 2025.

- Speculative Growth Potential: Investments in junior miners offer exposure to new discoveries but carry higher risk due to early-stage development.

- Uncertain Immediate Impact: These 'question marks' do not yet contribute to Agnico Eagle's current production levels or established cash flow generation.

- Strategic Pipeline Building: Represents Agnico Eagle's commitment to exploring and potentially developing future growth assets.

The question mark category within Agnico Eagle Mines' BCG Matrix encompasses projects with high growth potential but also significant uncertainty regarding their future success and profitability. These are typically early-stage ventures requiring substantial investment to move forward.

The Wasamac project, acquired in 2023, is a prime example, with a technical evaluation expected by the end of 2026. Similarly, the San Nicolás project in Mexico, in which Agnico Eagle holds a 50% stake, is awaiting a feasibility study completion in late 2025. These projects represent future possibilities that demand considerable capital and strategic decision-making.

Agnico Eagle's exploration efforts, such as the numerous targets along the Hope Bay belt, also fall into this category, requiring high-risk investment to uncover new mineral deposits. Furthermore, strategic investments in junior miners, like the increased funding for Foran Mining Corporation announced in May 2025, are also considered question marks, offering speculative growth potential.

| Project/Initiative | Category | Status/Key Milestone | Potential Impact | Investment Stage |

|---|---|---|---|---|

| Wasamac | Question Mark | Technical evaluation by end of 2026 | Future production | Early stage, high capital required |

| San Nicolás (50% stake) | Question Mark | Feasibility study completion in H2 2025 | Future production (gold, silver, copper, zinc) | Requires significant future capital |

| Hope Bay Belt Exploration | Question Mark | Over 90 regional exploration targets | Discovery of new mineral deposits | High-risk, speculative investment |

| Canadian Malartic - Second Shaft | Question Mark | Feasibility evaluation | Boost production, extend mine life | Substantial future capital required |

| Foran Mining Investment | Question Mark | Agnico Eagle stake >20% by May 2025 | Exposure to new discoveries (zinc, copper) | Speculative, early-stage development |

BCG Matrix Data Sources

Our Agnico Eagle Mines BCG Matrix is built on verified market intelligence, combining financial data from annual reports, industry research on market share, and expert commentary on growth prospects.