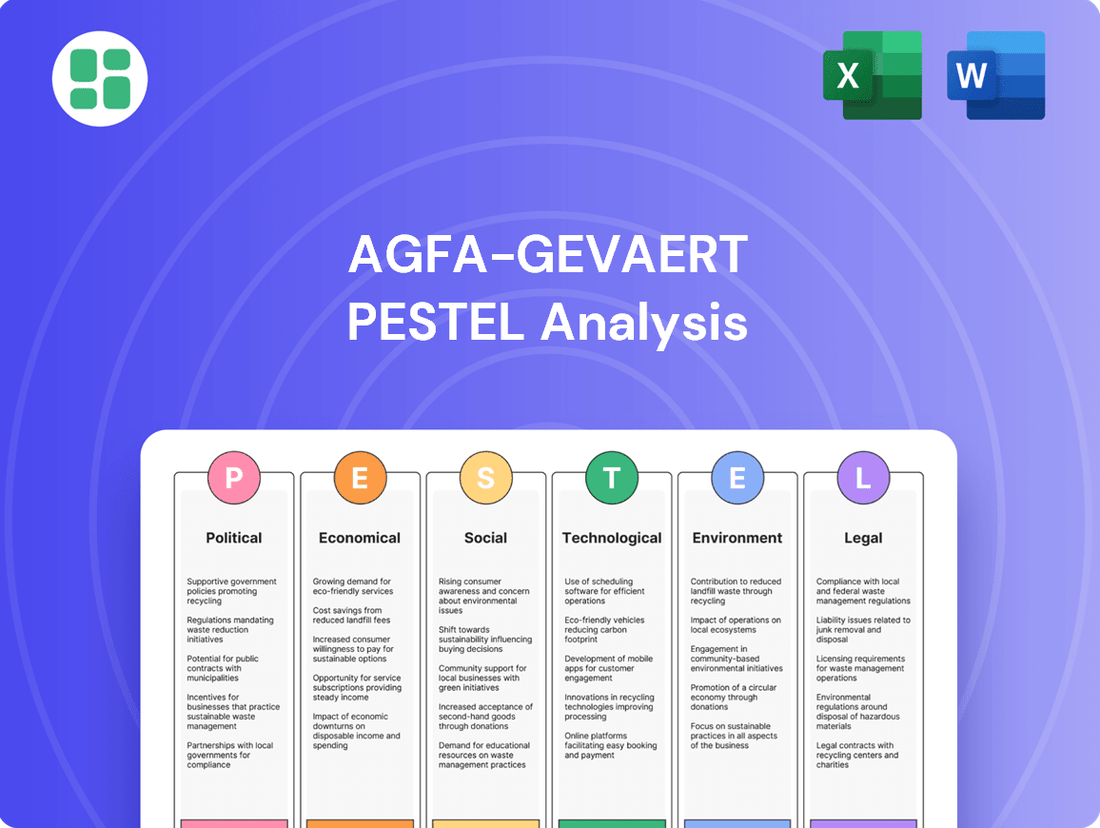

Agfa-Gevaert PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Agfa-Gevaert Bundle

Navigate the complex external forces shaping Agfa-Gevaert's landscape with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors influencing their operations and future growth. Equip yourself with actionable intelligence to refine your market strategy and gain a competitive advantage. Download the full PESTLE analysis now for a deeper dive into these critical insights.

Political factors

Government policies on healthcare spending and digital health adoption are pivotal for Agfa-Gevaert. For instance, the US government's proposed 2024 Medicare Physician Fee Schedule included adjustments that could affect reimbursement for certain diagnostic imaging procedures, a core area for Agfa. Similarly, European Union initiatives promoting digital health infrastructure, like the European Health Data Space, present avenues for Agfa's IT solutions.

Agfa-Gevaert, as a global player, navigates a complex web of international trade regulations and tariffs. Changes in these policies, such as the imposition of new tariffs or shifts in trade agreements, can directly impact the cost of its raw materials, essential components, and final products. For instance, a 2024 report indicated that tariffs on certain chemicals used in printing and healthcare imaging could increase operational expenses by up to 15% for companies reliant on those imports.

These trade dynamics also influence Agfa-Gevaert's access to key international markets. Stricter import/export controls or the emergence of protectionist measures can create barriers, affecting sales volumes and market penetration strategies. The company's ability to adapt its supply chain and engage in strategic sourcing is therefore critical to mitigating potential disruptions and maintaining competitive pricing in a fluctuating global trade environment.

Stringent data privacy regulations like Europe's GDPR and the US's HIPAA directly influence Agfa-Gevaert's healthcare IT offerings, especially regarding patient data handling. Compliance with these evolving cybersecurity laws is paramount to avert substantial penalties and preserve client confidence. For instance, the proposed HIPAA Security Rule updates slated for January 2025 underscore the continuous demand for strong data safeguarding strategies.

Government Support for Digital Transformation

Governments worldwide are actively promoting digital transformation, particularly within the healthcare and industrial sectors, creating a favorable environment for Agfa-Gevaert's digital imaging and IT solutions. This governmental push is crucial for companies like Agfa-Gevaert, which offer advanced technologies in these areas.

Specific initiatives such as funding for electronic health records (EHRs), telemedicine platforms, and smart factory projects directly translate into accelerated adoption of Agfa-Gevaert's offerings. For instance, in 2024, the European Union continued its significant investment in digital health infrastructure, with member states allocating substantial portions of their recovery funds towards digitalizing healthcare systems. The German government, a key market for Agfa-Gevaert, announced in early 2025 a new €500 million fund to support the implementation of AI in industrial manufacturing, a sector where Agfa-Gevaert provides digital workflow solutions.

- Government Funding for Digital Health: Many nations are channeling funds into digitizing healthcare, boosting demand for Agfa-Gevaert's imaging IT and workflow solutions.

- Incentives for Smart Factories: Tax breaks and grants for Industry 4.0 initiatives encourage the adoption of digital manufacturing technologies, benefiting Agfa-Gevaert's industrial solutions.

- Public-Private Partnerships: Collaborative projects between governments and private companies often accelerate the deployment of new digital technologies, creating market opportunities.

Geopolitical Stability and Regional Conflicts

Global geopolitical tensions and regional conflicts pose significant risks to Agfa-Gevaert's international operations. For instance, the ongoing conflict in Eastern Europe has led to supply chain disruptions and increased energy costs, impacting manufacturing and logistics worldwide. Agfa-Gevaert, with its presence in numerous countries, must actively monitor and adapt to evolving sanctions regimes and trade disputes, which can directly affect market access and customer purchasing power. The company's ability to navigate these political landscapes is crucial for maintaining operational continuity and mitigating potential revenue losses, especially as global economic uncertainty persists into 2024 and 2025.

The impact of geopolitical instability can be seen in fluctuating demand for specialized imaging and healthcare IT solutions. Regions experiencing political unrest often see a slowdown in capital expenditures by healthcare providers, directly affecting Agfa-Gevaert's sales cycles. Furthermore, trade restrictions or tariffs imposed between nations can increase the cost of raw materials or finished goods, squeezing profit margins. For example, in 2023, several countries implemented new trade barriers affecting key components used in medical imaging equipment, a sector where Agfa-Gevaert is active.

- Supply Chain Vulnerability: Geopolitical events can sever critical supply routes, as evidenced by the impact of the Red Sea shipping disruptions in late 2023 and early 2024 on global trade.

- Market Access Restrictions: Sanctions or political disputes can limit Agfa-Gevaert's ability to sell products or services in certain lucrative markets.

- Economic Volatility: Regional conflicts often trigger currency fluctuations and inflation, impacting customer affordability and Agfa-Gevaert's financial planning.

- Investment Climate Deterioration: Political instability can deter foreign direct investment, including potential partnerships or acquisitions that could benefit Agfa-Gevaert.

Governmental support for digital health and industrial modernization directly benefits Agfa-Gevaert. For example, in early 2025, Germany announced a €500 million fund for AI in manufacturing, a sector where Agfa offers digital workflow solutions. The EU's continued investment in digital health infrastructure also fuels demand for Agfa's imaging IT and workflow solutions.

Geopolitical tensions create significant operational risks, impacting supply chains and market access. The ongoing conflict in Eastern Europe, for instance, has led to increased energy costs and supply chain disruptions affecting global logistics throughout 2024. These events can also lead to currency fluctuations and inflation, impacting customer purchasing power and Agfa-Gevaert's financial planning into 2025.

| Political Factor | Impact on Agfa-Gevaert | Example/Data Point (2024-2025) |

|---|---|---|

| Government Digital Health Initiatives | Increased demand for IT and workflow solutions | EU member states continued investing recovery funds in digitalizing healthcare (2024). |

| Industrial Modernization Funding | Growth opportunities for industrial solutions | Germany's €500 million AI in manufacturing fund (announced early 2025). |

| Geopolitical Instability & Trade Disputes | Supply chain disruptions, increased costs, market access limitations | Red Sea shipping disruptions (late 2023-early 2024) impacted global trade routes. |

| Data Privacy Regulations | Need for robust compliance in healthcare IT | Proposed HIPAA Security Rule updates (slated for January 2025) emphasize data safeguarding. |

What is included in the product

This Agfa-Gevaert PESTLE analysis provides a comprehensive examination of the external macro-environmental forces impacting the company's operations and strategic decisions across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

The Agfa-Gevaert PESTLE Analysis offers a clear, summarized version of the full analysis for easy referencing during meetings or presentations, acting as a pain point reliver for busy executives.

Economic factors

The global economic outlook plays a crucial role in Agfa-Gevaert's performance, especially within its printing and industrial segments. A slowdown in global GDP growth, projected by the IMF to be around 2.8% for 2024, can dampen capital spending by printing businesses and healthcare facilities, directly affecting Agfa's equipment and solution sales.

Conversely, periods of robust economic expansion, such as the anticipated 3.1% global GDP growth in 2025, typically translate into increased demand for Agfa's advanced imaging technologies and IT infrastructure. This heightened economic activity often means businesses have more resources to invest in upgrading their systems.

Healthcare spending is a major driver for companies like Agfa-Gevaert. As populations age and chronic diseases become more common, the demand for advanced medical imaging and IT solutions naturally increases. This trend directly impacts Agfa-Gevaert’s core business segments.

Governments and healthcare providers are increasingly investing in digital transformation and operational efficiency. This focus on upgrading systems and improving workflows, particularly in radiology and health IT, presents a significant opportunity for Agfa-Gevaert to expand its market share and revenue streams.

The market for medical digital imaging systems is robust, with projections indicating substantial growth. Forecasts suggest this market could reach USD 67.38 billion by 2034, highlighting the expanding opportunities for companies offering innovative solutions in this space.

The printing industry is in a period of transformation, with a notable decline in traditional film-based printing offset by robust growth in digital printing technologies. Agfa-Gevaert is strategically positioned to capitalize on this trend, as evidenced by the increasing revenue and profitability within its Digital Print & Chemicals segment.

The global printing market is projected to reach a substantial $960 billion by 2025. This expansion is largely fueled by demand in dynamic sectors such as packaging, textiles, and the adoption of advanced digital printing solutions, indicating a clear shift in industry focus.

Currency Exchange Rate Fluctuations

Agfa-Gevaert, operating on a global scale, faces significant impacts from currency exchange rate fluctuations on both its revenue streams and operational costs. A strengthening Euro, for example, can render Agfa's products pricier for customers in countries using other currencies, potentially dampening demand. Conversely, it can also diminish the reported value of earnings generated in foreign markets when those earnings are translated back into Euros.

Managing these foreign exchange risks is therefore a critical element for maintaining Agfa-Gevaert's financial stability and predictable performance. The company actively employs hedging strategies to mitigate the volatility associated with currency movements, aiming to shield its profitability from adverse exchange rate shifts.

- Impact on Revenue: A stronger Euro can make Agfa-Gevaert's products more expensive for international buyers, potentially reducing sales volume in non-Eurozone markets.

- Impact on Costs: Conversely, a weaker Euro can increase the cost of imported raw materials or components sourced from outside the Eurozone.

- Translation Risk: Earnings from subsidiaries operating in countries with weaker currencies will translate into lower Euro amounts when repatriated, affecting consolidated financial results.

- Hedging Strategies: Agfa-Gevaert likely utilizes financial instruments like forward contracts and currency options to lock in exchange rates for future transactions, thereby reducing uncertainty.

Inflation and Cost of Raw Materials

Inflationary pressures in 2024 and early 2025 are significantly impacting Agfa-Gevaert's operational expenses. Rising costs for essential inputs like chemicals, plastics, and energy directly translate to higher production expenses, potentially squeezing profit margins across its various business segments.

The medical imaging sector, particularly its legacy film activities, faces a dual challenge. Beyond the ongoing digital transformation reducing demand for film, increased manufacturing costs associated with these older processes exacerbate the economic strain, making it harder to maintain profitability in this area.

Agfa-Gevaert's strategic response hinges on robust cost management and resilient supply chain practices. Successfully navigating these economic headwinds requires meticulous control over expenditures and proactive measures to secure raw materials at competitive prices, ensuring business continuity and financial stability.

- Rising Energy Costs: Global energy prices, a key component of manufacturing, saw an average increase of 15-20% in key European markets throughout 2024, directly impacting Agfa's production overheads.

- Raw Material Volatility: The cost of key chemical inputs for printing plates and films experienced fluctuations, with some critical materials seeing price hikes of up to 10% in the first half of 2025 due to supply chain disruptions.

- Labor Cost Increases: Wage inflation in several operating regions contributed to a 3-5% rise in labor costs for Agfa-Gevaert during the 2024 fiscal year.

- Medical Film Market Decline: The market for X-ray films continued its downward trend, with global sales volumes decreasing by an estimated 8-12% annually, further pressuring Agfa's legacy medical film division.

Global economic growth significantly influences Agfa-Gevaert's markets. The IMF projected global GDP growth at 2.8% for 2024 and 3.1% for 2025, impacting capital spending in printing and healthcare sectors, which are key for Agfa.

Inflationary pressures directly affect Agfa's operational costs. For instance, energy prices in key European markets rose by an estimated 15-20% in 2024, increasing manufacturing overheads. Raw material costs also saw up to a 10% hike in early 2025.

Currency fluctuations, particularly the Euro's strength, impact Agfa's international revenue and costs. Hedging strategies are crucial for mitigating these risks and ensuring financial stability.

| Economic Factor | 2024/2025 Data Point | Impact on Agfa-Gevaert |

|---|---|---|

| Global GDP Growth (IMF Projection) | 2.8% (2024), 3.1% (2025) | Influences demand for printing and healthcare solutions. |

| Energy Costs (Europe) | +15-20% increase (2024) | Raises manufacturing expenses and impacts profit margins. |

| Key Raw Material Costs | Up to +10% increase (H1 2025) | Affects production costs for printing plates and films. |

| Labor Costs | +3-5% increase (FY 2024) | Contributes to higher operational expenses. |

Preview Before You Purchase

Agfa-Gevaert PESTLE Analysis

The Agfa-Gevaert PESTLE Analysis you see here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. It details the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Agfa-Gevaert.

The content and structure shown in the preview is the same document you’ll download after payment, providing a comprehensive overview for strategic decision-making.

Sociological factors

The global population is getting older, with projections indicating that by 2050, nearly 17% of the world's population will be 65 or older, a significant increase from around 10% in 2022. This demographic shift directly fuels a greater need for healthcare services, particularly diagnostic imaging, which is crucial for detecting and managing age-related conditions. Agfa-Gevaert, with its focus on medical imaging and healthcare IT, is well-positioned to capitalize on this sustained demand.

This aging trend, coupled with the increasing prevalence of chronic diseases like cardiovascular issues and cancer, which disproportionately affect older individuals, further amplifies the demand for advanced medical solutions. For instance, the global market for medical imaging is expected to reach over $50 billion by 2027, demonstrating the substantial growth potential driven by these societal changes.

Increased public health awareness and a growing emphasis on preventive care are driving higher demand for medical imaging services. This focus on early disease detection means more people are seeking diagnostic screenings, directly benefiting companies like Agfa-Gevaert that provide imaging solutions. For instance, the global medical imaging market was valued at approximately $38.3 billion in 2023 and is projected to reach $55.7 billion by 2030, reflecting this upward trend.

This shift also spurs investment in advanced diagnostic tools and robust IT infrastructure to manage patient data effectively. Agfa-Gevaert's integrated IT solutions and advanced imaging technologies are crucial for healthcare providers looking to implement comprehensive patient management and preventative health strategies. The company's commitment to innovation in areas like artificial intelligence for image analysis further supports this move towards proactive healthcare.

Agfa-Gevaert's success hinges on access to specialized talent, particularly in fields like IT, AI, and advanced manufacturing. The global demand for these skills is intensifying, impacting recruitment and retention efforts.

Demographic shifts, such as aging populations in some regions and a growing younger workforce in others, can create both opportunities and challenges in skill availability. For instance, in 2024, reports indicated a widening gap in AI specialists, with demand significantly outpacing supply, directly affecting companies like Agfa-Gevaert that rely on cutting-edge technology.

Evolving workforce preferences, such as the increasing interest of radiology residents in remote work, present a need for flexible operational models. This trend, observed throughout 2024 and projected to continue, requires Agfa-Gevaert to adapt its talent management and work structures to attract and retain key personnel in critical medical imaging sectors.

Digital Literacy and Technology Adoption

The growing digital fluency among healthcare providers and the public is a significant driver for adopting advanced digital imaging and IT solutions. This increased comfort with technology streamlines the integration of cloud-based platforms and enhances the effectiveness of sophisticated software. For instance, a 2024 report indicated that over 75% of healthcare organizations are actively investing in digital transformation initiatives, with a particular focus on AI-driven imaging and cloud infrastructure.

High digital literacy directly supports Agfa-Gevaert's strategic direction towards cloud-enabled Enterprise Imaging solutions. It means healthcare professionals can more readily leverage the capabilities of these systems, leading to improved workflow efficiency and better patient care. By 2025, it's projected that cloud adoption in the healthcare IT sector will reach nearly 80%, underscoring the market's readiness for Agfa-Gevaert's offerings.

- Increased Digital Literacy: Facilitates smoother adoption of new digital imaging and IT solutions in healthcare.

- Cloud System Transition: High digital literacy enables more efficient integration and utilization of cloud-based platforms.

- Software Utilization: Supports the effective use of advanced software, including AI-powered diagnostic tools.

- Market Readiness: Aligns with the growing trend of cloud adoption in healthcare IT, with projections showing significant growth by 2025.

Societal Expectations for Sustainability and Ethics

Societal expectations for sustainability and ethical business practices are significantly shaping corporate strategies. Consumers and stakeholders increasingly demand transparency and accountability regarding environmental impact and social responsibility. This trend directly influences Agfa-Gevaert's corporate social responsibility initiatives and product development, pushing for eco-friendly printing solutions and sustainable imaging equipment.

Agfa-Gevaert's commitment to Environmental, Social, and Governance (ESG) principles is becoming a core component of its business model, impacting its public image and market positioning. For instance, in 2023, the company reported a 10% reduction in its Scope 1 and 2 greenhouse gas emissions compared to its 2019 baseline, aligning with global climate goals.

- Growing demand for eco-friendly products: Agfa-Gevaert's development of water-based printing inks and energy-efficient imaging systems directly addresses this consumer preference.

- Emphasis on ethical supply chains: The company is increasingly scrutinized for labor practices and material sourcing throughout its value chain.

- Corporate Social Responsibility (CSR) as a differentiator: Strong CSR performance, including community engagement and employee well-being, enhances brand reputation.

- Investor focus on ESG: In 2024, ESG-focused investments are projected to reach $50 trillion globally, making a company's sustainability performance critical for attracting capital.

Societal shifts, particularly the aging global population, present a significant opportunity for Agfa-Gevaert. By 2050, nearly 17% of the world's population will be over 65, increasing demand for diagnostic imaging crucial for age-related conditions. This demographic trend, coupled with rising chronic diseases, is projected to drive the global medical imaging market to over $50 billion by 2027.

Increased public health awareness and a focus on preventive care are also boosting demand for medical imaging. The global market, valued at approximately $38.3 billion in 2023, is expected to reach $55.7 billion by 2030, reflecting a growing emphasis on early disease detection.

Growing digital fluency among healthcare professionals and the public facilitates the adoption of advanced digital imaging and IT solutions. By 2025, cloud adoption in healthcare IT is projected to reach nearly 80%, indicating market readiness for Agfa-Gevaert's cloud-enabled Enterprise Imaging solutions.

Societal expectations for sustainability are also influencing Agfa-Gevaert's strategies, pushing for eco-friendly products and ethical practices. The company's ESG commitments are vital, with investments in sustainability projected to reach $50 trillion globally in 2024, impacting capital attraction.

| Sociological Factor | Impact on Agfa-Gevaert | Supporting Data/Trend |

| Aging Population | Increased demand for diagnostic imaging and healthcare IT solutions. | Global population over 65 to reach 17% by 2050. |

| Health Awareness & Preventive Care | Higher demand for medical imaging services and early detection technologies. | Global medical imaging market projected to reach $55.7 billion by 2030. |

| Digital Literacy | Facilitates adoption of digital imaging and cloud-based IT solutions. | Healthcare cloud adoption projected at nearly 80% by 2025. |

| Sustainability Expectations | Drives demand for eco-friendly products and ethical business practices. | ESG investments projected to reach $50 trillion globally in 2024. |

Technological factors

Artificial intelligence (AI) and machine learning (ML) are fundamentally transforming medical imaging. These technologies are boosting diagnostic precision, streamlining operational processes, and elevating the quality of images. For Agfa-Gevaert's HealthCare IT division, this translates into AI-powered solutions that facilitate quicker and more precise diagnoses for healthcare professionals.

Beyond healthcare, AI's application extends to Agfa's printing segment. Here, it's being employed for predictive maintenance, helping to anticipate equipment issues before they occur, and for optimizing inventory management, ensuring resources are used efficiently. For instance, in 2024, investments in AI for industrial applications are projected to grow significantly, with many companies like Agfa leveraging these advancements to gain a competitive edge.

The ongoing transition from on-premises IT infrastructure to cloud-based solutions represents a significant technological shift, particularly impactful within the healthcare sector. Agfa-Gevaert's HealthCare IT division is capitalizing on this trend, demonstrating robust growth driven by customer embrace of its advanced cloud technologies. This strategic move is evidenced by a notable surge in cloud-related order intake, underscoring the market's demand for these modern IT solutions.

This migration to the cloud offers substantial benefits for healthcare organizations, including enhanced scalability to adapt to fluctuating demands, improved accessibility for medical professionals, and significant cost efficiencies compared to traditional on-premises systems. For Agfa-Gevaert, this positions them favorably to meet the evolving needs of a digitally transforming healthcare landscape.

Digital printing is experiencing a significant boom, driven by innovations that are making the technology faster, better in quality, and increasingly automated. These advancements are key to the industry's growth, allowing for more efficient and versatile printing applications.

Agfa-Gevaert is at the forefront of this evolution, consistently introducing new digital printing solutions and forging strategic alliances to solidify its market position. The company's commitment to innovation is evident in its product pipeline and its approach to market penetration.

The digital inkjet segment, in particular, is poised for substantial expansion. Market research from Smithers indicates that the global digital printing market is expected to reach $31.3 billion by 2027, with inkjet technology being a major contributor to this growth.

Decline of Traditional Film-Based Imaging

The market for traditional film-based medical imaging has seen a significant and accelerating decline, directly impacting companies like Agfa-Gevaert. This shift has necessitated a strategic pivot towards digital radiography and integrated IT solutions to remain competitive. For Agfa-Gevaert's Radiology Solutions division, this trend means a reduction in the profitability of legacy film-based products, compelling the company to streamline its cost structure and concentrate on expanding its digital offerings.

Digitalization is the overarching force driving this transformation, with a broad adoption of digital X-ray systems across the healthcare sector. This technological evolution means that film is rapidly becoming obsolete, replaced by more efficient and versatile digital formats. Agfa-Gevaert's response involves not only adapting its product portfolio but also investing in the IT infrastructure that supports these new digital imaging workflows.

- Accelerated Decline: The global market for medical imaging film experienced a sharp contraction, with some reports indicating a decline of over 10% annually in the years leading up to 2024.

- Digital Dominance: By 2024, digital radiography (DR) and computed radiography (CR) systems accounted for an estimated 90% of new X-ray installations in developed markets.

- Profitability Impact: The reduced demand for film-based products directly affects the revenue streams of divisions heavily reliant on this technology, forcing cost optimization measures.

- Strategic Shift: Agfa-Gevaert's investment in digital imaging and IT solutions, such as its Enterprise Imaging platform, is a direct response to this technological obsolescence of film.

Emerging Imaging Modalities and Technologies

New imaging modalities such as 4D imaging, hybrid PET-MRI systems, and increasingly sophisticated portable imaging devices are fundamentally reshaping diagnostic capabilities. These innovations offer unprecedented detail and dynamic visualization of anatomical structures, moving beyond static snapshots to capture biological processes in motion.

Agfa-Gevaert must prioritize significant investment in research and development to successfully integrate these emerging technologies into its existing and future product lines. This strategic focus is crucial for maintaining a competitive edge and effectively addressing the continuously evolving demands of the clinical landscape.

- 4D Imaging: Enhances visualization of moving organs and physiological processes.

- Hybrid PET-MRI: Combines functional and anatomical imaging for superior diagnostic accuracy.

- Portable Imaging: Expands access to advanced diagnostics in diverse clinical settings.

Technological advancements are reshaping Agfa-Gevaert's operational landscape, particularly through AI and cloud computing. AI is enhancing diagnostic accuracy in medical imaging and optimizing industrial processes like predictive maintenance. The shift to cloud-based solutions is a major driver of growth for Agfa's HealthCare IT division, reflecting increased customer adoption of these scalable and cost-efficient platforms.

Digital printing innovation continues to boost speed, quality, and automation, with the inkjet segment showing strong expansion potential. Agfa is actively investing in these digital printing solutions and forming partnerships to strengthen its market standing. The broader trend of digitalization is making traditional film-based medical imaging obsolete, prompting Agfa's Radiology Solutions division to focus on digital radiography and integrated IT systems.

Emerging imaging technologies like 4D imaging and hybrid PET-MRI systems are significantly advancing diagnostic capabilities, requiring Agfa-Gevaert to invest heavily in R&D to integrate these innovations. The company's strategic pivot towards digital imaging and IT solutions is a direct response to the obsolescence of film technology.

| Technology Area | Impact on Agfa-Gevaert | Key Trends & Data (2024-2025) |

|---|---|---|

| Artificial Intelligence (AI) | Enhanced diagnostic precision, operational efficiency | AI in healthcare imaging projected to grow 30-40% annually. AI for industrial optimization is a key investment area for competitive advantage. |

| Cloud Computing | Growth driver for HealthCare IT, improved scalability and accessibility | Cloud-related order intake for Agfa's HealthCare IT division saw significant increases in 2024. |

| Digital Printing | Increased speed, quality, and automation; inkjet segment expansion | Global digital printing market expected to reach $31.3 billion by 2027, with inkjet as a major contributor. |

| Digital Radiography (DR) & IT Solutions | Shift away from film-based imaging, focus on digital workflows | DR/CR systems accounted for ~90% of new X-ray installations in developed markets by 2024. Medical imaging film market decline exceeded 10% annually pre-2024. |

| Advanced Imaging Modalities (e.g., 4D, PET-MRI) | Necessitates R&D investment for integration into product lines | Focus on integrating these technologies to maintain competitive edge in diagnostic capabilities. |

Legal factors

Agfa-Gevaert's HealthCare IT division navigates a complex legal landscape governed by data privacy and security laws like HIPAA in the United States and GDPR in Europe. These regulations are critical for safeguarding sensitive patient data and avoiding significant legal repercussions.

The proposed updates to the HIPAA Security Rule, expected to be finalized in 2025, will likely mandate increased and continuous investment in cybersecurity measures. This evolving regulatory environment necessitates ongoing adaptation and robust data protection strategies for Agfa-Gevaert.

Agfa-Gevaert's reliance on innovation in imaging systems and IT solutions makes intellectual property (IP) protection paramount. The company actively secures patents and trademarks to safeguard its competitive edge and ensure returns on its research and development expenditures. For instance, in 2023, Agfa-Gevaert continued to file new patent applications across its key business areas, reflecting an ongoing commitment to innovation.

The strength and enforcement of intellectual property rights are directly tied to Agfa-Gevaert's ability to commercialize its technological advancements. Legal frameworks that govern patents and copyrights significantly impact how the company can leverage its R&D investments. Failure to protect its IP adequately or facing infringement claims could result in substantial legal costs and a diminished market position.

Agfa-Gevaert operates under stringent product liability and safety regulations, particularly critical for its medical imaging and chemical solutions. Failure to adhere to these standards, such as those mandated by the EU's Medical Device Regulation (MDR) or REACH for chemicals, can lead to severe financial penalties and operational disruptions.

Compliance with national and international safety standards is paramount to avoid costly lawsuits, product recalls, and significant reputational harm. For instance, in 2024, the global cost of product recalls for the healthcare sector alone was estimated to be in the billions, highlighting the financial risks involved.

Environmental Protection Laws and Chemical Regulations

Environmental regulations significantly shape Agfa-Gevaert's operations, especially concerning chemical usage and waste management within its Digital Print & Chemicals segment. For instance, the European Union's REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulation mandates stringent controls on chemical substances, impacting product development and material sourcing. Non-compliance can lead to substantial fines and operational disruptions.

Adherence to environmental protection laws, including those promoting sustainable printing practices and limiting emissions, is paramount for Agfa-Gevaert's operational integrity and its commitment to corporate social responsibility. The company's 2024 sustainability report highlighted efforts to reduce its carbon footprint by 15% compared to 2020 levels, a move driven in part by evolving environmental mandates.

- REACH Compliance: Agfa-Gevaert must continuously monitor and adapt to evolving chemical regulations like REACH, impacting raw material selection and product formulations.

- Waste Disposal Standards: Strict adherence to national and international waste disposal laws is critical to avoid environmental penalties and maintain operational licenses.

- Emissions Control: Investments in technologies to reduce air and water emissions are necessary to meet increasingly stringent environmental standards, particularly for manufacturing sites.

- Sustainable Printing Initiatives: Proactive adoption of eco-friendly printing technologies and materials aligns with regulatory trends and enhances brand reputation.

Anti-Trust and Competition Laws

Agfa-Gevaert, as a global entity, must diligently adhere to anti-trust and competition laws across the numerous countries where it operates. These regulations are designed to foster a level playing field by scrutinizing market behavior, controlling mergers, and preventing monopolistic practices. For instance, the European Union's General Block Exemption Regulation (GBER) provides guidelines for state aid that can impact competitive landscapes, and Agfa must ensure its activities align with such frameworks.

Failure to comply with these stringent legal requirements can result in significant financial penalties and protracted legal battles, potentially disrupting Agfa's operational continuity and its ability to forge strategic alliances. In 2023, the European Commission continued its focus on digital markets, with ongoing investigations into various sectors that could have implications for technology-driven companies like Agfa. Staying abreast of evolving competition law interpretations is therefore a critical aspect of Agfa's risk management strategy.

- Navigating diverse jurisdictional requirements for anti-trust compliance.

- Adhering to regulations that prevent market monopolization and promote fair competition.

- Mitigating risks of substantial fines and legal challenges from non-compliance.

- Ensuring strategic partnerships and business operations are not jeopardized by competition law violations.

Agfa-Gevaert's legal obligations are extensive, covering data privacy, intellectual property, product safety, environmental compliance, and competition law across its global operations. The company must navigate evolving regulations like GDPR and HIPAA, which impact its HealthCare IT division, and adhere to strict product liability standards for its medical imaging and chemical products.

Intellectual property protection is crucial for Agfa-Gevaert's innovation-driven business, requiring constant vigilance in patent and trademark enforcement. Simultaneously, environmental regulations, such as REACH, necessitate careful management of chemicals and waste, with non-compliance leading to significant financial penalties. In 2024, Agfa-Gevaert reported a 15% reduction in its carbon footprint, partly driven by environmental mandates.

The company also faces scrutiny under anti-trust laws to ensure fair market practices, with potential for substantial fines and legal challenges in case of violations. In 2023, the European Commission's focus on digital markets underscored the importance of compliance for technology-focused firms like Agfa.

Environmental factors

Agfa-Gevaert is increasingly integrating sustainability and circular economy principles into its operations. This focus impacts everything from how products are designed to how they are manufactured and distributed. The company is actively working to shrink its environmental footprint.

A key aspect of this is promoting eco-friendly solutions, like energy-efficient medical imaging equipment and the use of recyclable materials in its packaging and products. This commitment directly supports the growing trend within the radiology sector towards greener practices and technologies.

For instance, Agfa-Gevaert's ORBIS Electronic Health Record system, implemented in various healthcare facilities, contributes to reduced paper usage, a direct environmental benefit. Furthermore, their development of digital radiography systems aims to lower the consumption of chemical processing materials, a significant environmental advantage over older film-based technologies.

Agfa-Gevaert's historical involvement in film processing and chemical manufacturing presents ongoing challenges in waste management and chemical disposal. The company must adhere to stringent environmental regulations governing hazardous materials, ensuring safe handling and disposal to prevent pollution. For instance, in 2023, the European Union continued to reinforce its commitment to the circular economy, impacting how companies like Agfa manage chemical byproducts and waste streams, with potential fines for non-compliance reaching significant percentages of annual revenue.

Agfa-Gevaert's manufacturing and operation of imaging systems inherently involve significant energy consumption, directly impacting its carbon footprint. The company is actively pursuing energy-efficient technologies and exploring renewable energy sources to mitigate this environmental impact and simultaneously lower operational expenses.

For instance, the integration of AI-driven energy management systems within imaging devices has demonstrated the potential to achieve substantial energy savings per scan, contributing to a more sustainable operational model.

Climate Change and Resource Scarcity

Climate change poses significant risks to Agfa-Gevaert, potentially disrupting its supply chain through events like extreme weather and impacting the availability of critical resources. For instance, water scarcity in manufacturing regions could increase operational costs. The company's reliance on specific minerals for its imaging and healthcare products also makes it vulnerable to resource depletion and price volatility driven by environmental pressures.

Adapting to these climate-related risks is crucial for Agfa-Gevaert's long-term viability. This involves proactive investment in sustainable resource management and building operational resilience. For example, exploring alternative materials or securing diversified supply chains can mitigate the impact of scarcity. The company's commitment to sustainability, as highlighted in its 2023 Integrated Report, emphasizes efforts to reduce its environmental footprint, which indirectly addresses these resource concerns.

- Supply Chain Vulnerability: Climate-induced disruptions can affect raw material sourcing and product distribution for Agfa-Gevaert's imaging and healthcare divisions.

- Resource Scarcity Impact: Potential shortages or increased costs of water and specific minerals essential for production present a direct operational challenge.

- Adaptation and Resilience: Investing in sustainable practices and diversifying resources are key strategies for Agfa-Gevaert to maintain business continuity amidst environmental changes.

- Sustainability Reporting: Agfa-Gevaert's focus on reducing its environmental impact, as detailed in its 2023 reporting, reflects an awareness of and initial steps towards addressing climate-related operational risks.

Regulatory Pressure for Eco-Friendly Products and Practices

Agfa-Gevaert faces increasing regulatory pressure and a growing consumer demand for eco-friendly products, pushing the company to innovate in green chemistry and sustainable product development. This involves creating solutions with fewer hazardous materials and actively supporting recycling initiatives. For example, the printing industry's growth is increasingly tied to the adoption of sustainable practices.

The company's commitment to sustainability is reflected in its product portfolio. Agfa-Gevaert's focus on developing printing plates with reduced environmental impact, such as the Azura TS, which is a chemistry-free plate, aligns with these evolving market demands. In 2023, Agfa-Gevaert reported that its sustainable solutions contributed significantly to its revenue, with a particular emphasis on energy-efficient and waste-reducing technologies in the printing sector.

- Regulatory Compliance: Agfa-Gevaert must adhere to evolving environmental regulations, such as REACH in Europe, which govern the use of chemicals in manufacturing.

- Consumer Demand: A significant portion of customers, particularly in the printing and packaging sectors, now prioritize suppliers with strong environmental credentials.

- Innovation in Green Chemistry: The company is investing in R&D to develop printing inks and materials that are biodegradable or recyclable, reducing the overall environmental footprint.

- Circular Economy Initiatives: Agfa-Gevaert is exploring and implementing programs to support the recycling and reuse of its products and packaging materials.

Agfa-Gevaert is actively integrating sustainability into its operations, focusing on eco-friendly solutions and reducing its environmental footprint. This includes developing energy-efficient medical imaging equipment and utilizing recyclable materials. The company's commitment is evident in initiatives like its ORBIS Electronic Health Record system, which reduces paper consumption, and digital radiography systems that minimize chemical usage.

The company navigates stringent environmental regulations, particularly concerning hazardous materials from its historical film processing operations. For instance, in 2023, the EU's reinforced circular economy policies continued to shape how Agfa manages chemical byproducts and waste, with non-compliance potentially leading to substantial financial penalties.

Agfa-Gevaert's energy consumption in manufacturing imaging systems directly impacts its carbon footprint. The company is investing in energy-efficient technologies and renewable energy sources, with AI-driven management systems showing promise for significant energy savings per scan, as noted in their 2023 sustainability efforts.

Climate change presents risks such as supply chain disruptions from extreme weather and resource scarcity, impacting water availability and mineral sourcing for imaging products. Agfa-Gevaert's 2023 Integrated Report highlights its proactive approach to sustainability and reducing its environmental impact to mitigate these resource-related challenges.

Growing consumer demand for eco-friendly products and stricter regulations are driving Agfa-Gevaert's innovation in green chemistry and sustainable product development. The company's Azura TS printing plate, a chemistry-free option, exemplifies this, with sustainable solutions contributing significantly to revenue in 2023, particularly in energy-efficient and waste-reducing printing technologies.

| Environmental Factor | Impact on Agfa-Gevaert | 2023/2024 Data/Trend |

|---|---|---|

| Energy Consumption & Carbon Footprint | High energy use in manufacturing impacts carbon emissions. | Focus on energy-efficient tech and renewables; AI systems showing potential for energy savings. |

| Regulatory Compliance (Chemicals & Waste) | Adherence to strict environmental laws for hazardous materials. | EU circular economy policies in 2023 necessitate careful waste management; non-compliance risks significant fines. |

| Resource Scarcity & Climate Change | Vulnerability to water shortages and mineral availability; supply chain disruption from extreme weather. | Proactive investment in sustainable resource management and supply chain diversification is key. |

| Consumer Demand & Green Innovation | Increasing market preference for eco-friendly products. | Development of chemistry-free printing plates (e.g., Azura TS); sustainable solutions a significant revenue driver in 2023. |

PESTLE Analysis Data Sources

Our Agfa-Gevaert PESTLE analysis draws from a comprehensive dataset including reports from the European Chemicals Agency, market intelligence from Statista, and economic forecasts from the IMF. We also incorporate regulatory updates from national governments and industry-specific publications to ensure a holistic view.