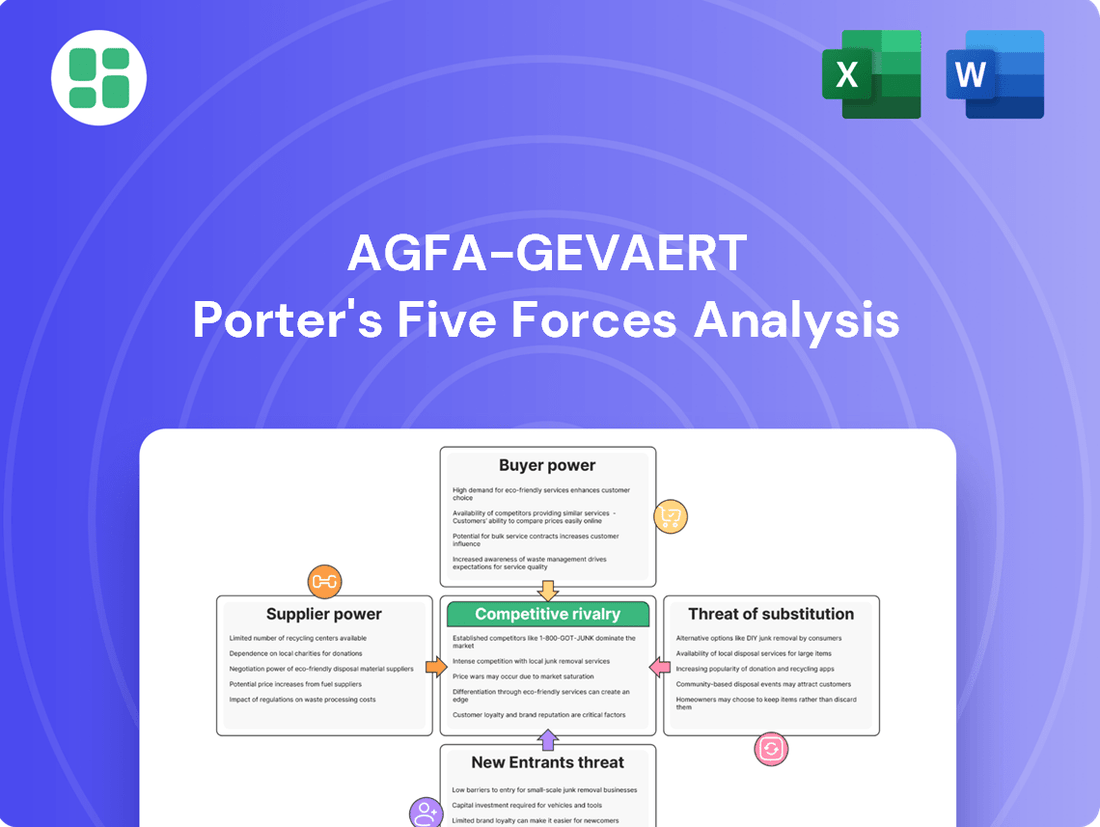

Agfa-Gevaert Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Agfa-Gevaert Bundle

Agfa-Gevaert navigates a complex landscape shaped by intense rivalry and the persistent threat of substitutes. Understanding the bargaining power of both buyers and suppliers is crucial for any strategic assessment of their market position.

The complete report reveals the real forces shaping Agfa-Gevaert’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Agfa-Gevaert's broad product range, from traditional film chemicals to advanced digital printing components and green hydrogen membranes, means the bargaining power of its suppliers isn't uniform. For common items like basic chemicals or standard IT equipment, Agfa likely faces many suppliers, which keeps their power in check. This is a common scenario where competition among suppliers limits their ability to dictate terms.

However, the situation changes for specialized inputs. When Agfa requires proprietary digital inks or advanced materials crucial for its ZIRFON membranes, it may encounter a smaller pool of highly specialized suppliers. If these suppliers have unique capabilities and the cost or complexity of switching to another provider is substantial, their bargaining power increases significantly. For instance, a single supplier of a critical rare earth element for a high-performance sensor could wield considerable influence.

The bargaining power of suppliers for Agfa-Gevaert is significantly influenced by the criticality of their inputs. For instance, the price of silver, a key component in traditional medical film, directly affects the profitability of Agfa's Radiology Solutions segment. Fluctuations in silver prices can therefore grant suppliers leverage.

In emerging sectors like digital printing and green hydrogen, the situation is similar. The performance and innovation of Agfa's products in these areas depend heavily on the quality and reliable supply of specialized chemicals and components. This reliance gives suppliers of these niche materials a degree of bargaining power, as Agfa needs to ensure consistent access to maintain its competitive edge.

Switching costs for Agfa-Gevaert are notably high, especially when dealing with integrated systems or specialized components. These situations often necessitate extensive qualification, rigorous testing, and significant adjustments to existing processes, which directly translates to increased supplier leverage.

For example, a shift in ink suppliers for Agfa's digital printing solutions or a change in membrane manufacturers for their hydrogen production systems would likely incur substantial research and development expenses. Furthermore, recalibrating production lines and managing potential operational disruptions adds another layer of cost and complexity, solidifying the bargaining power of these suppliers.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into Agfa-Gevaert's business is generally low. While a supplier of specialized components or software might consider developing their own imaging or printing solutions, the significant capital investment and intricate market dynamics of sectors like healthcare IT and industrial printing present substantial barriers. For instance, the healthcare IT market demands extensive regulatory compliance and established distribution networks, making it difficult for new entrants, even those with component expertise, to compete effectively against established players like Agfa-Gevaert.

However, for certain niche suppliers, the temptation to capture more of the value chain could exist. Consider a supplier of advanced printhead technology for industrial inkjet printers. If they possess proprietary knowledge and see a clear path to market, they might explore developing integrated printing systems. Yet, Agfa-Gevaert's established brand, customer relationships, and ongoing innovation in areas like inkjet inks and workflow software provide a strong defense against such moves.

- Low Capital Intensity for Raw Material Suppliers: Suppliers of basic raw materials typically lack the capital and expertise to vertically integrate into complex imaging or printing solutions.

- Market Complexity as a Deterrent: Agfa-Gevaert operates in highly specialized markets, such as diagnostic imaging software and industrial printing solutions, which require significant R&D, regulatory approvals, and established sales channels.

- Focus on Core Competencies: Most suppliers are content to focus on their core manufacturing or software development capabilities rather than undertaking the substantial risks associated with entering Agfa-Gevaert's end markets.

- Agfa-Gevaert's Competitive Strengths: Agfa-Gevaert's strong intellectual property, established customer base, and continuous product development create a formidable competitive moat, discouraging supplier forward integration.

Supplier's Unique or Differentiated Inputs

Suppliers providing unique or highly differentiated inputs, like patented chemical formulas for inks or specialized materials for advanced membranes, wield significant bargaining power. Agfa-Gevaert's dependence on these specialized inputs for its innovation-driven growth areas means maintaining robust supplier relationships and potentially securing long-term agreements is crucial to manage this influence.

For instance, in the digital printing sector, Agfa relies on proprietary ink formulations. The development and manufacturing of these inks involve complex chemical processes and specific raw materials that may only be available from a limited number of suppliers. This exclusivity grants these suppliers considerable leverage.

- Specialized Inputs: Suppliers of patented chemical formulations for inks or advanced materials for high-performance membranes possess greater bargaining power.

- Innovation Dependence: Agfa-Gevaert's reliance on these specialized inputs for its innovative growth engines necessitates strong supplier relationships.

- Mitigation Strategies: Long-term contracts and strategic partnerships are key to mitigating the bargaining power of such suppliers.

The bargaining power of suppliers for Agfa-Gevaert varies significantly based on the nature of the input. For common chemicals or standard components, Agfa faces numerous suppliers, limiting individual supplier leverage. However, for specialized inputs like proprietary digital inks or unique materials for their ZIRFON membranes, a smaller supplier base and high switching costs can substantially increase supplier power. For example, the price of silver, a critical component in medical film, directly impacts Agfa's Radiology Solutions segment, giving silver suppliers considerable influence.

| Input Type | Supplier Landscape | Agfa's Dependence | Supplier Bargaining Power |

|---|---|---|---|

| Common Chemicals/Standard Components | Fragmented, many suppliers | Low to moderate | Low |

| Proprietary Digital Inks | Concentrated, few specialized suppliers | High | High |

| Advanced Membrane Materials (e.g., for ZIRFON) | Highly specialized, limited options | High | High |

| Silver (for medical film) | Commodity market, price volatility | High (for specific segment) | Moderate to High (due to price fluctuations) |

What is included in the product

Analyzes the competitive intensity within Agfa-Gevaert's markets, examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry.

Instantly identify and address competitive threats with a clear, actionable Agfa-Gevaert Porter's Five Forces analysis, streamlining strategic planning.

Gain a competitive edge by easily visualizing and responding to the intensity of each force, transforming complex market dynamics into manageable insights.

Customers Bargaining Power

Agfa-Gevaert's customer base includes major players in healthcare, such as hospitals and large health systems, and industrial clients in the printing sector. These significant customers often purchase in large volumes, which inherently gives them some leverage.

However, Agfa's success in securing substantial, multi-year contracts, especially for its cloud-based Enterprise Imaging solutions, indicates that its value proposition is strong enough to offset some of this customer power. This suggests a more balanced relationship where Agfa's innovative offerings are a key differentiator.

For Agfa-Gevaert's customers, especially within the HealthCare IT sector, the costs associated with switching to a competitor are quite high. This is largely because their imaging and IT systems are deeply embedded into daily operations, making a change disruptive. Consider the complexity of migrating vast amounts of patient data, a process that requires significant time and resources, further increasing the barrier.

These substantial switching costs, including the need for extensive staff retraining on new platforms, effectively create a form of customer lock-in for Agfa-Gevaert. This lock-in naturally diminishes the immediate bargaining power that customers possess once they have invested in and integrated Agfa-Gevaert's solutions into their established workflows.

In mature markets, such as traditional photographic film where demand has been declining, customers are indeed very sensitive to price. This heightened price sensitivity, coupled with the availability of numerous alternatives, significantly boosts their bargaining power. For Agfa-Gevaert, this translates into a constant pressure to optimize costs in these segments.

However, the situation differs for Agfa's more advanced offerings. In areas like digital printing solutions or specialized healthcare IT systems, customers often place a higher value on performance, reliability, and the comprehensiveness of the service provided. For these customers, the lowest price is not the primary deciding factor, which consequently moderates their bargaining power.

Availability of Substitute Products for Customers

The increasing availability of substitute products significantly boosts customer bargaining power for Agfa-Gevaert. The rapid shift from traditional analog products to digital and cloud-based solutions across healthcare and digital printing sectors means customers have a wider array of choices than ever before.

This trend compels Agfa-Gevaert to continuously innovate and differentiate its product and service portfolio to maintain its competitive edge and secure customer loyalty. For instance, the company has strategically focused on its growth engines to adapt to evolving market demands.

- Digital Transformation: The healthcare imaging market, a key sector for Agfa-Gevaert, has seen a substantial move towards digital workflows and electronic health records, reducing reliance on traditional film-based solutions.

- Cloud Adoption: The rise of cloud-based storage and management systems for medical images provides alternatives to on-premise solutions, offering greater flexibility and potentially lower costs for healthcare providers.

- Print Industry Shifts: In the digital printing segment, advancements in inkjet and other digital technologies offer viable alternatives to offset printing, increasing customer options and putting pressure on traditional players.

Threat of Backward Integration by Customers

The threat of backward integration by Agfa-Gevaert's customers is generally low, meaning customers are unlikely to start making Agfa's products themselves.

For instance, hospitals, a key customer segment for Agfa's imaging solutions, would find it extremely difficult and costly to develop their own complex medical imaging software or to manufacture specialized printing plates. The sheer technical expertise and capital investment required create a significant barrier.

Even large printing conglomerates, while possessing some manufacturing capabilities, would face substantial hurdles in replicating Agfa's proprietary research and development, as well as its advanced manufacturing processes. This high barrier effectively deters most customers from attempting to produce these solutions internally.

- Low Threat of Backward Integration: Customers' ability to produce Agfa's specialized imaging and printing products themselves is limited.

- High R&D and Manufacturing Barriers: The complexity and cost of developing and manufacturing Agfa's offerings are significant deterrents.

- Limited Customer Capability: Hospitals and even large printing groups typically lack the specialized resources to undertake backward integration for these products.

Agfa-Gevaert's customers, particularly large healthcare systems and printing companies, possess moderate bargaining power due to their significant purchasing volumes. However, this power is tempered by high switching costs associated with integrating Agfa's specialized imaging and IT solutions, often involving extensive data migration and staff retraining. While customers in mature markets like traditional film are price-sensitive, those in advanced segments like digital printing and healthcare IT prioritize performance and service, thereby reducing their leverage.

| Customer Segment | Key Products/Services | Customer Bargaining Power Factors | Agfa's Counterbalancing Factors |

|---|---|---|---|

| Healthcare (Hospitals, Health Systems) | Enterprise Imaging Solutions, Medical Imaging Software | High volume purchases, potential for standardization | High switching costs (data migration, retraining), strong value proposition of integrated solutions |

| Printing Industry (Large Printing Companies) | Digital Printing Solutions, Printing Plates | Significant order sizes, price sensitivity in some segments | Proprietary technology, innovation in digital printing, brand reputation |

| Mature Markets (e.g., Traditional Film) | Declining demand products | High price sensitivity, availability of alternatives | Focus on cost optimization, niche market strategies |

Preview the Actual Deliverable

Agfa-Gevaert Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It thoroughly details Agfa-Gevaert's competitive landscape through Porter's Five Forces, analyzing the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitute products, and the intensity of rivalry within the industry. This comprehensive assessment provides actionable insights into the strategic positioning and future outlook of Agfa-Gevaert.

Rivalry Among Competitors

Agfa-Gevaert navigates a landscape of varied industry growth rates, directly impacting competitive rivalry. The traditional film sector, a legacy business, is experiencing accelerated decline. This contraction naturally intensifies the battle for the shrinking market share among existing players.

In contrast, Agfa-Gevaert's strategic focus on growth areas like digital printing, healthcare IT, and nascent markets such as green hydrogen presents a different competitive dynamic. These sectors, characterized by robust expansion, attract significant investment and innovation. This influx of capital and new ideas fuels intense competition as numerous companies vie to capture emerging opportunities and establish market leadership.

Agfa-Gevaert navigates a competitive arena populated by both broad-reaching multinational corporations and highly specialized firms. In the healthcare sector, giants like Siemens Healthineers and GE Global Research present formidable competition, offering extensive portfolios that often overlap with Agfa's offerings. Simultaneously, the printing technology segment sees rivalry from numerous agile, niche players focused on specific printing applications.

Agfa-Gevaert focuses on product differentiation through advanced technology, like its cloud-based Enterprise Imaging platform and rapid digital printing solutions. These innovations are designed to make it harder for customers to switch to competitors, thereby lessening intense price competition.

Strategic alliances, such as the collaboration with EFI, further bolster Agfa-Gevaert's market position. By integrating complementary technologies and services, the company aims to lock in customers and increase the perceived value of its offerings, making switching more costly.

Exit Barriers

Agfa-Gevaert encounters substantial exit barriers in its legacy divisions, particularly in areas like conventional printing plates and medical imaging film. The company has significant, sunk costs tied to its extensive manufacturing facilities and specialized research and development capabilities. For instance, the substantial investment in its Mortsel, Belgium, production site, which has undergone modernization for digital printing solutions, represents a considerable commitment that would be difficult to divest without significant losses.

These high exit barriers mean Agfa-Gevaert is compelled to continue operating in mature or declining markets, even when profitability is challenged. The costs associated with shutting down production lines, managing workforce reductions, and disposing of specialized assets can be prohibitive. This situation can inadvertently prolong competitive intensity within these segments, as Agfa-Gevaert, like its peers, must strive to maintain market share and operational efficiency to offset the burden of fixed costs.

The company's strategic pivot towards digital printing and healthcare IT solutions aims to mitigate these exit barriers by reallocating capital and expertise. However, the legacy infrastructure and established customer relationships in traditional segments create a sticky situation. For example, while Agfa-Gevaert has been actively expanding its digital inkjet printing business, the financial implications of scaling down or exiting its legacy printing plate production remain a key consideration.

- High Capital Investment: Significant investments in manufacturing plants and R&D for traditional products create substantial sunk costs.

- Specialized Workforce & Assets: Specialized employee skills and unique machinery are difficult to redeploy or sell, increasing exit costs.

- Restructuring Expenses: Costs associated with plant closures, layoffs, and asset write-offs act as a deterrent to exiting established business lines.

- Market Presence: Maintaining a presence in legacy markets, even if declining, can be preferable to incurring the full cost of exit.

Strategic Commitments and Acquisitions

Agfa-Gevaert's strategic focus on its 'growth engines' and significant investments, such as those in green hydrogen production, signal a proactive approach to capturing market share. This aggressive positioning intensifies rivalry as competitors also leverage innovation, partnerships, and acquisitions.

The competitive landscape is shaped by strategic commitments, with companies actively pursuing market leadership through targeted investments and mergers. For instance, in the broader industrial sector where Agfa-Gevaert operates, major players are consolidating to enhance technological capabilities and market reach.

- Increased R&D Spending: Many companies in related sectors are boosting R&D, with global R&D spending in advanced materials and industrial technologies projected to grow by an estimated 7-9% annually leading up to 2025.

- Mergers & Acquisitions Activity: The industrial sector witnessed a significant volume of M&A in 2023, with over $150 billion in deals announced, often aimed at acquiring innovative technologies or expanding geographic presence.

- Strategic Alliances: Companies are forming alliances to share risks and costs associated with developing new technologies, particularly in areas like sustainable manufacturing and digital transformation.

- Focus on Sustainability: Investments in green technologies, like Agfa-Gevaert's green hydrogen initiative, are becoming a key differentiator, forcing rivals to also prioritize sustainable solutions to remain competitive.

Agfa-Gevaert faces intense competition from both large, diversified corporations and specialized niche players across its various business segments. The company's strategy of product differentiation through advanced technology and strategic alliances aims to mitigate direct price wars and customer churn.

High exit barriers in legacy businesses, such as conventional printing plates, compel Agfa-Gevaert to remain in mature or declining markets, prolonging competitive pressures. Proactive investment in growth areas like digital printing and healthcare IT fuels rivalry as competitors also pursue innovation and market leadership.

The competitive landscape is dynamic, with companies increasing R&D spending and engaging in mergers and acquisitions to gain technological advantages and market reach. For instance, global R&D spending in industrial technologies is projected to grow significantly, and M&A activity in the industrial sector exceeded $150 billion in 2023.

| Competitive Factor | Agfa-Gevaert's Position | Industry Trend |

|---|---|---|

| Rivalry Intensity | High in legacy, moderate in growth areas | Increasing R&D spending, M&A activity |

| Differentiation Strategy | Technology, alliances | Focus on sustainability, digital transformation |

| Exit Barriers | Significant in traditional segments | Companies hesitant to exit established markets due to sunk costs |

SSubstitutes Threaten

The most significant threat to Agfa-Gevaert's traditional business comes from digital technologies that are rapidly replacing analog solutions. This shift presents a compelling price-performance trade-off for customers.

In the healthcare sector, for instance, digital radiography and cloud-based imaging IT solutions offer demonstrably better performance, including quicker access to images, enhanced collaboration capabilities, and the potential for artificial intelligence integration. While initial investment might be a factor, these digital alternatives often present a lower long-term cost compared to traditional film-based systems, making them highly attractive substitutes.

Agfa-Gevaert itself has acknowledged this trend and is actively working to transition its product portfolio to align with the growing demand for digital imaging solutions. This strategic pivot is crucial for maintaining competitiveness in a market where technological obsolescence is a constant concern.

Customer propensity to substitute is notably high for Agfa-Gevaert, particularly within the healthcare industry. The increasing demand for integrated digital solutions that enhance efficiency and data management means customers are readily exploring and adopting alternatives that offer superior performance and capabilities. This trend is evident in the significant shift away from traditional film-based imaging, a core area for Agfa historically.

The decline in Agfa's legacy film business serves as a direct indicator of this high propensity to substitute. Customers have demonstrated a clear willingness to embrace digital alternatives, driven by the advantages they offer in terms of workflow, storage, and diagnostic accuracy. For example, the global digital radiography market alone was valued at over USD 20 billion in 2023 and is projected for continued growth, underscoring the market's embrace of digital technologies over older film-based systems.

The threat of substitutes for Agfa-Gevaert is significant, as close alternatives are readily available in its key markets. In the medical imaging sector, for instance, alternative digital imaging systems and integrated IT platforms from various manufacturers offer comparable functionalities, potentially drawing customers away from Agfa's solutions.

Similarly, in the printing industry, the rise of diverse digital printing technologies and flexible service models presents a substantial substitute threat to traditional offset, flexo, and gravure printing methods. Many printing applications can now be effectively handled by these digital alternatives, impacting Agfa's established market share.

Evolution of Technology and Innovation

The threat of substitutes for Agfa-Gevaert is significantly amplified by the rapid evolution of technology and innovation. Emerging digital solutions and advanced printing technologies are constantly creating new ways for customers to achieve similar outcomes, often at lower costs or with greater efficiency.

Key technological shifts impacting Agfa-Gevaert include:

- Artificial Intelligence (AI) and Machine Learning: AI is enabling more sophisticated image processing, automation in workflows, and personalized content creation, offering alternatives to traditional Agfa-Gevaert solutions in areas like graphic arts and healthcare imaging.

- Cloud Computing: Cloud-based platforms provide scalable, accessible, and often subscription-based alternatives for data management, workflow automation, and software-as-a-service (SaaS) offerings, potentially reducing the need for on-premise hardware or proprietary software.

- Digital Printing Advancements: Innovations in digital printing, such as inkjet and 3D printing, are increasingly capable of high-quality, short-run production, directly competing with Agfa-Gevaert's established solutions in segments like commercial printing and industrial applications. For example, the global digital printing market was valued at approximately $27.4 billion in 2023 and is projected to grow substantially, indicating a strong substitute landscape.

Agfa-Gevaert must maintain a robust R&D pipeline and strategic investments to counter this threat. Its focus on developing new products and enhancing cloud-based solutions demonstrates an awareness of this dynamic. For instance, Agfa-Gevaert's continued investment in areas like inkjet technology and digital workflow solutions aims to ensure its offerings remain competitive against these evolving substitutes.

Regulatory or Environmental Shifts Favoring Substitutes

Regulatory or environmental shifts can significantly bolster the threat of substitutes for Agfa-Gevaert's products. For example, if governments implement stricter regulations on chemical usage in traditional printing or film development, this would naturally make greener, digital alternatives more attractive. This could accelerate the move away from Agfa's legacy offerings.

Consider the growing global emphasis on sustainability. By 2024, many regions saw increased pressure on industries to reduce their carbon footprint and waste. This trend directly favors digital printing technologies and other non-chemical-based imaging solutions, which are often perceived as more environmentally friendly.

The potential for such regulatory changes creates a dynamic where substitutes become not just an option, but a preferred choice due to compliance and corporate responsibility. This indirectly intensifies the substitution threat for companies like Agfa-Gevaert, especially in sectors highly sensitive to environmental impact.

- Increased environmental regulations: Stricter rules on chemical disposal and emissions in traditional printing could favor digital alternatives.

- Government incentives for green tech: Subsidies or tax breaks for adopting sustainable technologies can make substitutes more economically viable.

- Consumer demand for eco-friendly products: Growing public awareness of environmental issues pushes businesses towards cleaner processes, indirectly supporting substitutes.

- Advancements in digital imaging: Continuous innovation in digital technology makes it a more compelling and efficient substitute for traditional methods.

The threat of substitutes for Agfa-Gevaert is substantial, driven by rapid technological advancements across its core markets. Digital imaging and printing technologies offer compelling alternatives that often provide superior performance, cost-effectiveness, and environmental benefits.

For instance, in healthcare, digital radiography systems are largely replacing traditional film-based solutions, a shift underscored by the global digital radiography market exceeding $20 billion in 2023. Similarly, the printing industry sees digital printing technologies, valued at approximately $27.4 billion in 2023, increasingly competing with established methods.

Agfa-Gevaert's own strategic pivot towards digital solutions, including investments in inkjet and cloud-based platforms, reflects a proactive response to this intensifying substitution pressure. The company must continuously innovate to maintain relevance against these evolving alternatives.

| Industry Segment | Traditional Agfa-Gevaert Solutions | Key Substitutes | Market Data (2023/2024 Estimates) |

|---|---|---|---|

| Healthcare Imaging | X-ray Film, Analog Systems | Digital Radiography (DR), Computed Radiography (CR), PACS | Digital Radiography Market: >$20 Billion |

| Printing | Offset Printing Plates, Film | Digital Printing (Inkjet, Toner), 3D Printing | Digital Printing Market: ~$27.4 Billion |

Entrants Threaten

Entering Agfa-Gevaert's key sectors like healthcare IT and industrial digital printing necessitates considerable financial outlay. This includes funding for research and development, establishing advanced manufacturing capabilities, and building out robust sales and customer support infrastructure.

For instance, the development and production of specialized materials, such as Agfa's ZIRFON membranes crucial for green hydrogen technology, demand significant upfront capital investment. This substantial financial barrier effectively deters potential new competitors from easily entering these markets.

Agfa-Gevaert benefits significantly from economies of scale in its manufacturing processes and its extensive global distribution network. New companies entering the market would find it incredibly difficult to match these cost efficiencies without achieving a substantial sales volume, immediately placing them at a considerable cost disadvantage compared to Agfa.

The company's decades of accumulated experience in imaging technology also create a powerful intangible barrier. This deep well of knowledge and specialized expertise is not easily replicated by newcomers, offering Agfa a competitive edge that goes beyond mere operational scale.

Agfa-Gevaert benefits from a strong brand reputation and unique product offerings, especially in medical imaging and industrial inkjet. This differentiation fosters customer loyalty, making it challenging for new players to gain traction. For instance, in 2023, Agfa HealthCare continued to innovate in digital radiography and enterprise imaging solutions, areas where established trust is paramount.

Access to Distribution Channels

For Agfa-Gevaert, the threat of new entrants is significantly moderated by the difficulty of accessing established distribution channels in its core markets, healthcare and printing. Building a comparable global sales and service network is a substantial undertaking, requiring considerable investment and time.

New players face a steep climb to replicate Agfa-Gevaert's established reach. For instance, in the medical imaging sector, securing contracts with hospitals and clinics often relies on existing relationships and proven reliability, which are hard-won assets. In 2023, Agfa-Gevaert reported a strong presence in key geographical regions, underscoring the breadth of its distribution capabilities.

Consider these points regarding distribution channel access:

- High Capital Investment: New entrants need substantial capital to build out the necessary infrastructure for global distribution and service, a barrier Agfa-Gevaert has already overcome.

- Established Relationships: Agfa-Gevaert benefits from long-standing relationships with distributors and end-users, creating loyalty and preferential access.

- Regulatory Hurdles: Navigating the complex regulatory landscape for healthcare products and printing solutions in various countries adds another layer of difficulty for newcomers.

- Brand Reputation: Agfa-Gevaert's reputation for quality and reliability, built over decades, influences purchasing decisions and makes it harder for unproven entrants to gain traction.

Regulatory Barriers and Intellectual Property

The healthcare industry presents significant hurdles for newcomers due to rigorous regulatory frameworks and demanding certification processes. For instance, navigating regulations like the EU Medical Device Regulation (MDR) involves substantial investment and time, acting as a strong deterrent. Agfa-Gevaert's robust intellectual property, encompassing patents for specialized inks, advanced imaging software, and proprietary membranes, further solidifies its market position by making product replication exceedingly difficult and expensive for potential entrants.

Navigating the complex regulatory landscape, such as the EU MDR, can cost new entrants millions of euros and take years to achieve compliance, effectively raising the barrier to entry. Agfa-Gevaert's intellectual property portfolio, which includes hundreds of active patents across its key business segments, provides a significant competitive moat. This IP protection directly limits the ability of new companies to enter the market with comparable technologies, thereby reducing the threat of new entrants.

- High Compliance Costs: New entrants face substantial expenses in meeting stringent healthcare regulations like the EU MDR, potentially running into millions of Euros for product certification and quality management systems.

- Intellectual Property Protection: Agfa-Gevaert holds a significant number of patents, particularly in areas like inkjet technology and medical imaging software, which create a strong barrier against imitation.

- R&D Investment: The need for substantial R&D to develop innovative products that can compete with Agfa-Gevaert's patented technologies requires significant upfront capital, deterring many potential new players.

- Market Access Challenges: Obtaining necessary approvals and establishing distribution channels within the highly regulated healthcare sector is a time-consuming and costly endeavor for any new company.

The threat of new entrants for Agfa-Gevaert is generally low due to significant barriers. High capital requirements for R&D, manufacturing, and distribution, coupled with established economies of scale and deep technical expertise, make entry challenging. Furthermore, Agfa's strong brand reputation, extensive distribution networks, and robust intellectual property portfolio, especially in regulated sectors like healthcare, create substantial hurdles for newcomers. Navigating complex regulatory environments, such as the EU MDR, adds considerable cost and time, further deterring potential competitors.

| Barrier Type | Description | Impact on New Entrants | Agfa-Gevaert's Advantage | Example Data (Illustrative) |

|---|---|---|---|---|

| Capital Requirements | High upfront investment for R&D, manufacturing, and global distribution networks. | Deters new entrants lacking substantial funding. | Existing infrastructure and scale provide cost efficiencies. | Developing a new medical imaging system can cost hundreds of millions of Euros. |

| Economies of Scale | Lower per-unit costs achieved through high production volumes. | New entrants struggle to match Agfa's cost competitiveness. | Agfa's established production capacity leads to significant cost advantages. | Agfa's inkjet printing solutions benefit from large-scale component sourcing. |

| Brand Reputation & Loyalty | Established trust and customer preference built over decades. | Difficult for new brands to gain market share and customer acceptance. | Agfa's long-standing presence in healthcare and printing fosters loyalty. | In 2023, Agfa HealthCare's established relationships were key to securing new hospital contracts. |

| Intellectual Property & Patents | Proprietary technologies and patents protecting unique products. | Limits imitation and requires costly R&D for competitors. | Agfa holds numerous patents in imaging, software, and materials. | Agfa's patents on ZIRFON membranes for hydrogen technology create a strong competitive moat. |

| Regulatory Hurdles | Strict compliance requirements in sectors like healthcare. | Adds significant time, cost, and complexity for market entry. | Agfa has established processes and expertise to navigate regulations. | EU MDR compliance for medical devices can cost millions and take years. |

Porter's Five Forces Analysis Data Sources

Our Agfa-Gevaert Porter's Five Forces analysis is built upon a foundation of comprehensive data, including company annual reports, industry-specific market research from firms like IBISWorld, and publicly available financial filings.