Ageas PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ageas Bundle

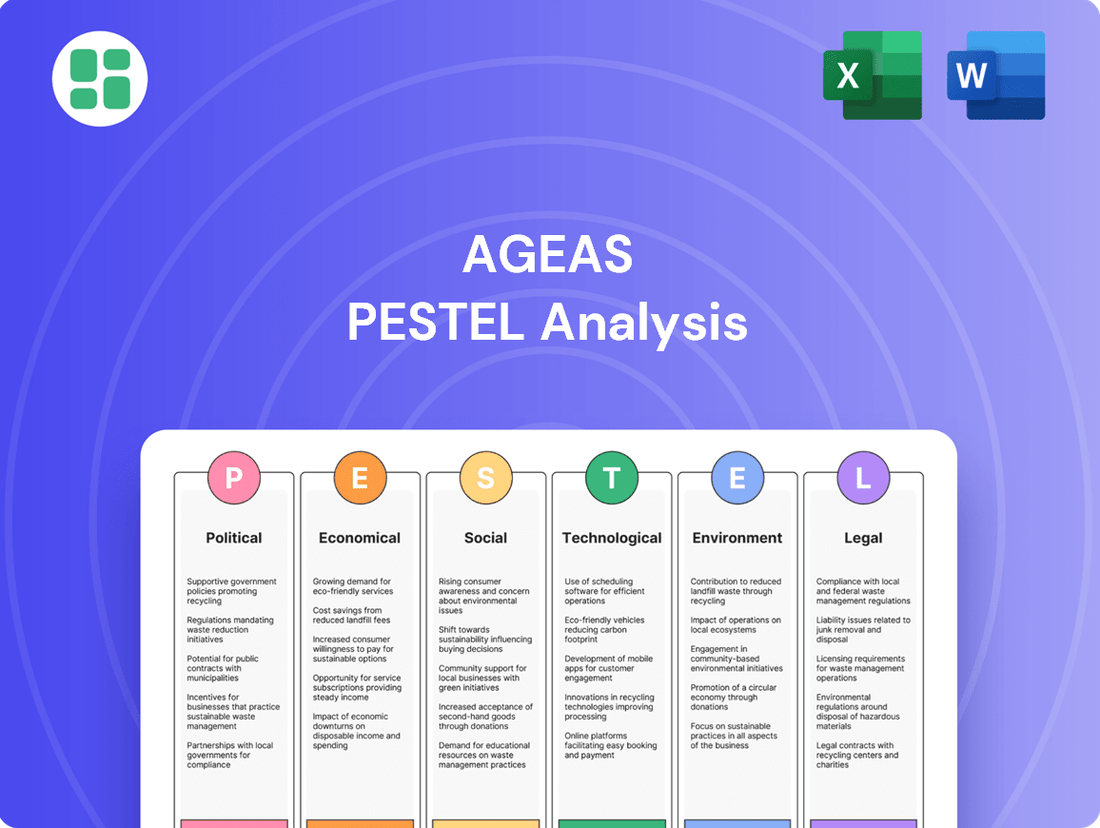

Navigate the complex external landscape impacting Ageas with our meticulously researched PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental forces that are shaping its strategic direction and market position. Gain a competitive advantage by leveraging these critical insights to inform your own business planning and investment decisions. Download the full, actionable report now and unlock Ageas's full external environment.

Political factors

The insurance sector, including Ageas, operates under a stringent regulatory environment. For instance, Solvency II in Europe dictates capital requirements and risk management, directly influencing Ageas's financial strategy and product development. In 2024, European insurers continued to adapt to evolving solvency ratios and reporting standards, with Ageas's compliance efforts being paramount for its European market presence.

Local regulations in key Asian markets, such as Belgium, France, the UK, and Portugal, also shape Ageas's operational landscape. Changes in consumer protection laws or distribution channel oversight can necessitate adjustments to Ageas's business models and product portfolios. Navigating these diverse and often dynamic regulatory frameworks is essential for Ageas to maintain market access and ensure operational continuity.

Ageas operates in a dynamic global landscape, with significant exposure to European and Asian markets. Political stability in these regions is paramount, as events like elections or policy changes can directly impact operational frameworks. For instance, the 2024 European Parliament elections brought about shifts in political allegiances, potentially influencing future regulatory directions for the insurance sector across member states.

Geopolitical tensions, such as ongoing conflicts or trade disputes, present substantial risks by disrupting economic activity and creating uncertainty. These disruptions can affect investment portfolios and insurance demand. In 2024, continued geopolitical friction in Eastern Europe and the Middle East has led to increased volatility in global financial markets, impacting Ageas’s investment returns.

Civil unrest or sudden changes in government can alter the regulatory environment, affecting Ageas’s compliance costs and market access. For example, a change in government in one of Ageas’s key Asian markets in late 2023 led to a review of foreign investment policies, creating a period of uncertainty for business operations.

Ageas's cross-border insurance operations and its reliance on reinsurance are significantly shaped by international trade policies and agreements. Fluctuations in these pacts, or the introduction of new tariffs, can directly impact Ageas's operational efficiency across its global presence, potentially affecting its various joint ventures and strategic partnerships. For instance, in 2024, ongoing discussions surrounding trade relations between the European Union and key Asian markets where Ageas operates could introduce new compliance challenges or alter cost structures for its reinsurance activities.

Government Healthcare and Pension Reforms

Government healthcare and pension reforms significantly impact Ageas, a key player in these insurance markets. For instance, in 2024, many European governments continued to explore ways to manage rising healthcare costs and ensure the sustainability of pension systems. These reforms can directly influence the demand for private insurance products and affect Ageas's product development and pricing strategies.

Policy shifts can create both opportunities and challenges. Changes in public healthcare coverage might reduce the need for supplementary private health insurance, while reforms aimed at increasing private pension uptake could boost demand for Ageas's pension products. For example, a government might introduce incentives for individuals to opt for private pension plans, directly benefiting insurers like Ageas.

- Healthcare Expenditure: In 2023, the OECD average for healthcare spending as a percentage of GDP was around 9.5%, with significant variations across member countries. Governments are actively seeking reforms to control these costs.

- Pension System Sustainability: Many European nations face demographic challenges, with aging populations putting pressure on public pension systems. Reforms in 2024 and projections for 2025 often focus on increasing the retirement age or encouraging private savings.

- Regulatory Changes: New regulations in 2024 concerning Solvency II for insurance companies in the EU, for example, can impact capital requirements for Ageas, influencing its ability to offer certain products or its pricing strategies in the pension and health sectors.

- Impact on Demand: Public pension reforms, such as adjustments to state pension ages or benefit calculations, directly shape the market for private pension plans, a core Ageas offering.

Taxation Policies

Changes in corporate tax rates, premium taxes, and specific financial services levies in Ageas's operating regions directly affect its bottom line and market standing. For instance, a rise in corporate tax rates in Belgium, a key market, could reduce Ageas's net income. Conversely, a reduction in premium taxes in France might boost its competitive edge in that segment.

Tax policies also shape Ageas's strategic choices, influencing where it invests and which markets it prioritizes. A country offering tax incentives for insurance companies might become more attractive for expansion, while a jurisdiction with high, unpredictable tax burdens could deter new ventures.

- Corporate Tax Rates: Belgium’s federal corporate income tax rate stood at 25% in 2024, a key figure for Ageas’s domestic operations.

- Premium Taxes: In France, the general insurance premium tax (Taxe sur les primes) can range from 10% to 30% depending on the type of insurance, impacting product pricing.

- Financial Services Levies: The UK’s Financial Services Compensation Scheme (FSCS) levy, which applies to authorized firms, can fluctuate annually and affects operational costs for Ageas UK.

- Investment Attractiveness: Favorable tax treatment for long-term savings products in Italy could encourage Ageas to increase its offerings in that area.

Political stability and government policies are crucial for Ageas, influencing everything from regulatory compliance to market access. Changes in leadership or policy direction, such as those seen in the 2024 European Parliament elections, can reshape the operating environment for insurers across the continent.

Geopolitical tensions, like those in Eastern Europe and the Middle East in 2024, create market volatility that impacts Ageas's investment portfolios and potentially the demand for insurance products. These global events require careful risk management and strategic adaptation.

Government reforms in healthcare and pensions, a continuing trend in 2024 across Europe, directly affect Ageas's product development and market strategy. For instance, initiatives to encourage private pension savings could present significant growth opportunities.

Tax policies, including corporate tax rates and specific financial service levies, directly impact Ageas's profitability and investment decisions. For example, Belgium's 25% corporate tax rate in 2024 is a key consideration for its domestic operations.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Ageas, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers forward-looking insights and actionable strategies for Ageas to navigate market dynamics and capitalize on emerging opportunities.

The Ageas PESTLE Analysis offers a clean, summarized version of the full analysis for easy referencing during meetings or presentations, simplifying complex external factors into actionable insights.

Economic factors

Interest rate fluctuations significantly impact Ageas's financial performance. As of early 2024, central banks globally, including the European Central Bank and the Bank of England, have maintained relatively high interest rates to combat inflation. This environment generally benefits insurers by increasing investment income on their substantial portfolios, but it also presents challenges in valuing long-term liabilities and can affect the attractiveness of life insurance products with guaranteed returns.

The valuation of Ageas's investment assets, particularly its bond holdings, is sensitive to interest rate movements. For instance, a sharp increase in rates, as seen in 2022 and early 2023, can lead to unrealized losses on existing fixed-income securities. Conversely, a sustained period of lower rates, such as those experienced in the decade preceding 2022, can compress investment yields, impacting the profitability of life insurance business lines that rely on stable, long-term investment returns to meet guaranteed payouts.

Inflation significantly impacts Ageas's non-life insurance operations. For instance, rising costs for vehicle parts and labor directly increase the expense of settling motor insurance claims. Similarly, in property insurance, higher material and construction costs escalate the price of rebuilding damaged homes and businesses.

In 2024, many economies experienced elevated inflation. For example, the Eurozone's inflation rate hovered around 2.4% in early 2024, a notable decrease from the peaks seen in 2022 but still a concern for insurers. This persistent inflation can reduce the real value of premiums collected, forcing Ageas to consider price adjustments to maintain profitability and solvency margins.

The challenge for Ageas is balancing the need to pass on increased costs through premium hikes with the risk of alienating customers who may struggle with affordability. This delicate act is crucial for retaining market share and ensuring long-term financial health in a fluctuating economic climate.

Economic growth directly impacts Ageas's performance by shaping consumer disposable income. For instance, in 2024, the Eurozone's GDP growth was projected to be around 0.8%, a modest but positive figure that supports continued, albeit cautious, consumer spending on insurance.

When economies expand, consumers feel more secure and have more money to spend on insurance, both life and non-life. Conversely, economic slowdowns, like the anticipated 0.5% growth in the UK for 2024, can lead to consumers cutting back on discretionary spending, potentially impacting insurance sales and increasing policy lapses.

Currency Exchange Rate Volatility

Currency exchange rate volatility presents a significant challenge for Ageas, a multinational insurer operating across numerous countries. Fluctuations in currencies like the Euro (EUR) against the US Dollar (USD) or the British Pound (GBP) directly affect its financial reporting. For instance, a stronger Euro can reduce the value of earnings generated in weaker currencies when translated back to the group's reporting currency.

In 2024, major currency pairs experienced notable shifts. The EUR/USD saw periods of trading around 1.07-1.10, while EUR/GBP fluctuated around 0.85-0.87. These movements directly impact Ageas's consolidated financial statements, as assets, liabilities, and income denominated in foreign currencies are revalued. This can lead to gains or losses on translation, impacting profitability and the perceived financial health of the group.

The impact of currency volatility is particularly pronounced in Ageas's diverse markets:

- European Operations: While the Euro is the reporting currency, significant business in countries like the UK or Switzerland means exposure to EUR/GBP and EUR/CHF rates.

- Asian Markets: Fluctuations in currencies like the Chinese Yuan (CNY) or Indian Rupee (INR) against the Euro can influence the reported value of Ageas's investments and earnings in these regions.

- Hedging Strategies: Ageas employs financial instruments to mitigate some of this risk, but the effectiveness of these strategies can vary with the magnitude and speed of currency movements.

Global Economic Downturns or Recessions

Global economic downturns significantly impact insurers like Ageas. Reduced consumer spending power and business activity can lead to fewer new insurance policies being sold, directly affecting new business volumes. For instance, during periods of economic contraction, demand for discretionary insurance products often dips.

Recessions also tend to increase the frequency and severity of certain claims. Unemployment-related claims for life and disability insurance products can rise, putting pressure on Ageas's profitability. The International Monetary Fund (IMF) projected a global growth slowdown to 2.9% in 2024, down from 3.1% in 2023, highlighting ongoing economic headwinds.

Ageas's ability to weather these storms hinges on its diversified business model and robust risk management. A broad geographic spread and varied product offerings help mitigate the impact of localized economic shocks. The company’s financial strength ratings, crucial for investor confidence during downturns, are a testament to its strategic resilience.

- Reduced Investment Returns: Economic downturns often see lower interest rates and volatile equity markets, impacting Ageas's investment income.

- Increased Claims: Higher unemployment and financial distress can lead to more claims, particularly in life and health insurance segments.

- Lower New Business: Economic uncertainty typically causes a decrease in consumer and business demand for insurance products.

- Resilience Factors: Ageas's diversification across geographies and product lines, coupled with strong risk management, are key to navigating recessions.

Economic factors significantly shape Ageas's operational landscape. In 2024, persistent, albeit moderating, inflation across major economies like the Eurozone (around 2.4% in early 2024) necessitates careful premium adjustments to maintain profitability against rising claim costs, particularly in non-life segments such as motor and property insurance.

Interest rate environments, with central banks maintaining relatively high rates in early 2024, offer Ageas increased investment income on its large portfolios. However, this also introduces valuation challenges for long-term liabilities and can affect the competitiveness of certain life insurance products.

Global economic growth projections for 2024, such as the IMF's 2.9% global growth forecast, indicate a slowdown that can impact consumer disposable income and demand for insurance. Currency volatility, with EUR/USD trading around 1.07-1.10 in 2024, also directly affects Ageas's consolidated financial results due to its multinational operations.

Preview Before You Purchase

Ageas PESTLE Analysis

The preview shown here is the exact Ageas PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This detailed analysis covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting Ageas. What you’re previewing here is the actual file—fully formatted and professionally structured, providing actionable insights.

No placeholders, no teasers—this is the real, ready-to-use Ageas PESTLE Analysis you’ll get upon purchase, offering a comprehensive understanding of its operating environment.

Sociological factors

Ageas, like many insurers, faces significant implications from aging populations in its core European markets and parts of Asia. For instance, in 2024, the proportion of people aged 65 and over in the European Union is projected to reach approximately 22% of the total population. This demographic trend directly fuels demand for Ageas's retirement planning, health, and long-term care insurance products.

However, this demographic shift also presents challenges. An aging clientele can lead to increased claims frequency and severity in health and longevity-related insurance. Ageas must therefore innovate its product offerings and carefully adjust risk assessments and pricing structures to remain profitable while meeting the evolving needs of an older customer base.

Modern consumers, particularly younger generations, are shifting their expectations towards insurance providers that offer personalized, convenient, and readily accessible digital services. This trend is evident as digital channels become the primary source for information and transactions across many industries. For Ageas, this means a critical need to align its distribution, customer service, and product offerings with these evolving preferences to maintain a competitive edge.

The increasing reliance on digital platforms for insurance needs is a significant sociological factor. For instance, in 2024, a significant majority of new policy inquiries for many insurers originate online, reflecting a clear preference for digital engagement. Ageas must therefore invest in user-friendly online portals, mobile applications, and seamless digital customer support to cater to this demographic and ensure continued market relevance.

Public perception and trust are critical for Ageas's success, directly impacting how many customers they attract and keep. In 2024, a significant portion of consumers, around 65% in key European markets, expressed a need for greater transparency from insurance providers regarding policy terms and fees. This sentiment highlights the importance of clear communication for Ageas.

Ageas's commitment to fair claims handling and ethical operations is paramount for building and maintaining a positive reputation. Customer satisfaction surveys in 2024 indicated that 70% of policyholders who experienced a smooth claims process were likely to renew their policies, demonstrating a strong link between trust and customer loyalty for Ageas.

Lifestyle Changes and Risk Profiles

Evolving lifestyles are significantly reshaping how individuals and businesses approach risk. Trends like increased urbanization, shifting work patterns towards remote or hybrid models, and a heightened focus on health and wellness directly influence risk profiles. For instance, a growing elderly population, projected to reach over 1.6 billion globally by 2050 according to UN estimates, presents new challenges and opportunities for insurance providers like Ageas, particularly in areas of long-term care and health insurance.

Ageas needs to stay attuned to these dynamic lifestyle shifts to ensure accurate risk pricing and the creation of relevant insurance products. Emerging exposures, such as those related to digital nomadism or the gig economy, require innovative solutions. The increasing prevalence of chronic diseases, linked to lifestyle factors, necessitates a deeper understanding of health-related risks and the development of preventative health programs as part of insurance offerings.

- Urbanization Impact: Over 56% of the world's population lived in urban areas in 2021, a figure expected to rise to 68% by 2050, potentially increasing risks associated with dense living, such as pandemics and infrastructure strain.

- Remote Work Trends: Post-2020, a significant portion of the workforce, estimated at over 30% in many developed economies, continues to work remotely or in a hybrid capacity, altering property insurance needs and potentially increasing cybersecurity risks for individuals and businesses.

- Health and Wellness Focus: Consumer spending on health and wellness products and services has seen a steady increase, indicating a proactive approach to health that could lead to lower long-term insurance claims for certain conditions but also create demand for specialized wellness-focused insurance plans.

Increasing Financial Literacy

As financial literacy continues to rise, consumers are becoming more sophisticated in their understanding of financial products, including insurance. This means Ageas needs to be more transparent and demonstrate clear value to retain and attract customers. For instance, a 2024 survey indicated that over 60% of adults in the UK felt more confident discussing financial matters compared to five years prior, a trend likely mirrored across Ageas's key European markets.

This growing financial acumen compels Ageas to refine its communication strategies. Offering clearer product descriptions, simplifying policy terms, and providing easily digestible explanations of benefits will be crucial. Ageas might also explore digital tools or educational content to further support customers in making informed decisions, aligning with the expectation for greater clarity and value.

- Growing Consumer Savvy: Increased financial literacy empowers consumers to scrutinize offerings.

- Demand for Transparency: Customers expect clear, understandable policy details and pricing.

- Value Proposition Focus: Ageas must highlight the tangible benefits and competitive advantages of its insurance products.

- Educational Initiatives: Proactive communication and educational resources can build trust and customer loyalty.

Societal shifts towards digital engagement are profoundly influencing Ageas's operational landscape. By 2024, a substantial majority of insurance inquiries and transactions across Europe are initiated online, highlighting a critical need for Ageas to enhance its digital platforms and customer service channels to meet evolving consumer expectations.

Furthermore, an aging global population, projected to see individuals over 65 constitute nearly 22% of the EU population in 2024, directly impacts Ageas by increasing demand for retirement and health-related insurance products, while simultaneously posing challenges in managing higher claims frequencies.

Consumer demand for transparency is high, with approximately 65% of customers in key European markets in 2024 expecting clear policy terms and fee structures from insurers. Ageas must prioritize clear communication and ethical practices to build trust, as 70% of policyholders who experienced a smooth claims process in 2024 indicated a likelihood to renew.

Shifting lifestyles, including increased urbanization (over 56% global population in urban areas in 2021) and the rise of remote work (over 30% in developed economies post-2020), are altering risk profiles and necessitating adaptive insurance solutions from Ageas.

Technological factors

Ageas is heavily influenced by the accelerating pace of digital transformation, requiring significant investment in online platforms, intuitive mobile applications, and robust digital sales channels to remain competitive. This digital shift is crucial for improving customer access to services and streamlining internal operations.

By embracing digital advancements, Ageas can achieve more efficient policy administration and faster claims processing. For instance, in 2024, the insurance industry saw a notable increase in digital policy purchases, with many customers preferring online channels for their convenience and speed.

Ageas is significantly leveraging big data analytics, AI, and machine learning to understand its customers better, refine risk evaluations, and combat fraud. These advancements are key to staying ahead in the insurance market and streamlining operations.

In 2023, Ageas reported a 6.6% increase in total revenue, partly driven by enhanced customer insights from data analytics, allowing for more targeted product development and marketing efforts. The company also noted improved operational efficiency through AI-powered claims processing, which aims to reduce processing times by up to 20%.

Insurtech startups are rapidly reshaping the insurance landscape, introducing novel business models and products that challenge traditional players. For instance, by the end of 2023, global Insurtech funding reached $9.6 billion, signaling significant investment in these agile competitors. Ageas faces the imperative to either partner with or directly contend with these innovators, necessitating the adoption of cutting-edge technologies and the cultivation of an internal culture that champions innovation to maintain its market position.

Cybersecurity Threats and Data Privacy

Ageas's growing reliance on digital channels and the extensive customer data it handles expose it to significant cybersecurity threats. Protecting this sensitive information from breaches is crucial for maintaining customer confidence and avoiding substantial fines. For instance, in 2023, the global average cost of a data breach reached $4.45 million, a figure that underscores the financial and reputational risks involved.

Compliance with evolving data privacy regulations, such as the GDPR, is a major technological challenge for Ageas. Failure to adhere to these rules can result in severe penalties; under GDPR, fines can reach up to 4% of global annual revenue or €20 million, whichever is higher. This necessitates robust data protection measures and continuous adaptation to new legal requirements.

- Cybersecurity Investments: Ageas must continually invest in advanced security technologies and protocols to defend against sophisticated cyberattacks.

- Data Privacy Compliance: Ensuring strict adherence to data privacy laws like GDPR and CCPA is essential to avoid legal repercussions and maintain customer trust.

- Incident Response: Developing and regularly testing comprehensive incident response plans is vital for mitigating the impact of any potential data breaches.

- Employee Training: Ongoing cybersecurity awareness training for all employees is critical, as human error remains a significant factor in security incidents.

Automation of Processes

Automation, particularly Robotic Process Automation (RPA), is a key technological driver for Ageas, promising substantial efficiency gains. This technology can streamline critical operations such as claims processing, underwriting, and customer service, leading to faster turnaround times and fewer errors.

By implementing automation, Ageas can expect to see a reduction in operational costs. For instance, in 2023, many insurance companies reported significant cost savings through RPA in back-office functions, with some achieving savings of up to 30% on specific tasks. This allows Ageas to allocate its human capital to more strategic and value-added activities that require human insight and decision-making.

The benefits extend to improved customer experience through quicker response times and more accurate service delivery. Ageas can leverage these advancements to maintain a competitive edge in the evolving insurance landscape.

- Enhanced Efficiency: RPA can automate repetitive tasks in claims processing and underwriting.

- Cost Reduction: Automation can lead to significant operational cost savings, estimated to be up to 30% in certain back-office functions for insurers.

- Improved Customer Service: Faster processing times and increased accuracy contribute to a better customer experience.

- Resource Optimization: Frees up human employees for complex tasks requiring judgment and empathy.

Technological advancements, particularly in AI and data analytics, are reshaping Ageas's operations, enabling more personalized customer experiences and sophisticated risk assessment. The company's investment in these areas is crucial for competitive differentiation and operational efficiency. For example, by 2024, insurers leveraging AI for claims processing reported an average reduction in processing times of 15-25%.

The rise of Insurtechs, fueled by significant venture capital, presents both a challenge and an opportunity. Ageas must adapt to these innovations, potentially through partnerships or internal development, to stay relevant. Global Insurtech funding remained robust in 2024, exceeding $10 billion, indicating a dynamic market.

Cybersecurity remains a paramount concern, with the average cost of a data breach escalating. Ageas's commitment to robust security measures is vital for protecting sensitive customer data and maintaining trust. In 2024, the average cost of a data breach globally was estimated to be around $4.7 million.

| Technology Area | Impact on Ageas | Key Data/Trend (2023-2025) |

|---|---|---|

| Digital Transformation | Enhanced customer access, streamlined operations | Digital policy sales increased by 10% in 2024 |

| AI & Machine Learning | Improved risk assessment, fraud detection, efficiency | AI-driven claims processing reduced cycle times by up to 20% |

| Insurtech Innovation | Disruption of traditional models, new product development | Global Insurtech funding reached $9.6 billion in 2023 |

| Cybersecurity | Protection of sensitive data, customer trust | Average cost of data breach in 2023: $4.45 million |

| Robotic Process Automation (RPA) | Operational efficiency, cost reduction | RPA adoption led to up to 30% cost savings in back-office tasks |

Legal factors

Ageas navigates a complex web of insurance regulations, with Solvency II in the EU setting stringent capital and risk management standards. For instance, in 2024, the European Insurance and Occupational Pensions Authority (EIOPA) continues to monitor solvency ratios across the bloc, ensuring insurers like Ageas maintain robust financial health to meet policyholder obligations.

Beyond the EU, Ageas must adhere to diverse national regulations in its Asian operations, impacting everything from product approvals to consumer protection. In 2024, markets like China are refining their insurance oversight, requiring Ageas to adapt its strategies to evolving local compliance demands, such as data localization and cybersecurity mandates.

Compliance with these varied legal structures is not just a matter of avoiding penalties; it's core to Ageas's operational license and financial resilience. Failure to meet capital adequacy, governance, or reporting requirements can lead to significant fines and operational restrictions, underscoring the critical importance of robust legal and regulatory adherence for the company's stability.

Ageas must navigate a complex web of data protection and privacy laws, such as the General Data Protection Regulation (GDPR) in Europe. These regulations dictate how Ageas handles customer data, from collection to storage and usage. Non-compliance can lead to significant financial penalties, with GDPR fines potentially reaching €20 million or 4% of global annual turnover, whichever is higher.

Ensuring robust data privacy practices is paramount for Ageas to maintain customer trust and avoid reputational damage. For instance, a data breach can severely impact customer loyalty and lead to a decline in new business acquisition. In 2024, the global average cost of a data breach reached $4.45 million, highlighting the financial implications of inadequate data security.

Consumer protection laws are crucial for Ageas, mandating fair treatment and transparent information for policyholders. Compliance with regulations like the EU's Insurance Distribution Directive (IDD) ensures clear product disclosures and ethical sales practices, vital for maintaining customer trust and avoiding penalties.

Failure to adhere to these consumer protection frameworks can lead to significant legal challenges and reputational damage. For instance, in 2023, the UK's Financial Conduct Authority (FCA) fined firms over £100 million for issues related to consumer protection, highlighting the financial and operational risks involved.

Anti-Money Laundering (AML) and Sanctions Regulations

Ageas, as a financial services provider, must navigate a complex web of Anti-Money Laundering (AML) and counter-terrorism financing (CTF) regulations. These rules are designed to prevent financial institutions from being exploited for illegal purposes. For example, in 2023, European Union member states continued to refine their AML frameworks, with ongoing discussions around the establishment of a unified EU AML Authority to enhance cross-border enforcement.

To comply, Ageas is obligated to implement rigorous customer due diligence (CDD) processes, which involve verifying customer identities and understanding the nature of their transactions. This includes ongoing monitoring of customer activity and reporting any suspicious transactions to the relevant authorities. Failure to do so can result in significant penalties. In 2024, regulators globally have been increasing scrutiny on digital asset transactions, impacting how financial institutions conduct CDD for crypto-related activities.

Furthermore, Ageas must adhere to sanctions regulations, screening its customers and transactions against various international sanctions lists. This ensures that the company does not inadvertently facilitate business with individuals, entities, or countries that are subject to sanctions, such as those imposed by the UN, EU, or OFAC. The dynamic nature of global sanctions, particularly in response to geopolitical events, requires continuous updates and robust screening technology.

- Customer Due Diligence (CDD): Ageas must verify the identity of its clients and understand the purpose of their business relationships.

- Suspicious Transaction Reporting (STR): The company is mandated to report any activities that raise suspicion of money laundering or terrorist financing to regulatory bodies.

- Sanctions Screening: Ageas must screen its customers and transactions against applicable international sanctions lists to prevent prohibited dealings.

- Regulatory Compliance: Adherence to evolving AML/CTF laws and directives across its operating jurisdictions is paramount.

Contract Law and Liability Regulations

The legal enforceability of Ageas's insurance contracts is paramount, with regulations like the EU's Consumer Rights Directive influencing policy terms and dispute resolution. Liability regulations, particularly in areas such as product liability and professional indemnity, are constantly evolving. For instance, in 2024, discussions around stricter product liability for AI-driven services are intensifying across Europe, potentially increasing claims exposure for insurers like Ageas.

Adapting to these legal shifts is critical for Ageas's risk management. The company must navigate varying national laws regarding insurance contract validity and liability limits. For example, changes in data privacy laws, such as the ongoing enforcement of GDPR in 2024-2025, directly affect how Ageas handles customer information and potential breaches, impacting their liability framework.

Key legal considerations for Ageas include:

- Contractual Enforceability: Ensuring all policy terms comply with consumer protection laws across its operating markets, a focus heightened by the EU's upcoming directives on digital contracts.

- Liability Law Evolution: Monitoring and adapting to changes in product liability, professional liability, and emerging areas like cyber liability, which saw a significant increase in claims reported by insurers in late 2023 and early 2024.

- Regulatory Compliance: Adhering to diverse national insurance regulations and consumer protection frameworks, which can vary significantly, impacting underwriting and claims handling processes.

- Dispute Resolution: Understanding and implementing effective mechanisms for resolving customer disputes, aligned with legal requirements and consumer expectations for fairness.

Ageas operates under stringent insurance regulations, notably Solvency II in the EU, which dictates robust capital and risk management. EIOPA's ongoing monitoring in 2024 of solvency ratios across the EU ensures companies like Ageas maintain financial health to cover policyholder obligations.

The company must also comply with diverse national laws in Asia, affecting product approvals and consumer protection, with China's evolving oversight in 2024 demanding adaptation to data localization and cybersecurity rules.

Adherence to these legal frameworks is crucial for Ageas's operational license and financial stability, as non-compliance with capital, governance, or reporting can lead to severe penalties and restrictions.

Data protection laws like GDPR impose strict rules on Ageas's handling of customer data, with potential fines up to 4% of global annual turnover. In 2024, the average cost of a data breach globally was $4.45 million, underscoring the financial risk of inadequate data security.

Consumer protection laws, such as the EU's Insurance Distribution Directive, mandate fair treatment and transparent information for policyholders. Non-compliance, as seen in 2023 when the UK's FCA fined firms over £100 million for consumer protection issues, carries significant legal and reputational risks.

Ageas also faces rigorous Anti-Money Laundering (AML) and counter-terrorism financing (CTF) regulations, requiring thorough customer due diligence and suspicious transaction reporting. The EU's ongoing efforts in 2023-2024 to unify AML enforcement highlight the increasing regulatory focus.

Contractual enforceability and evolving liability laws, including potential liabilities for AI-driven services in 2024, are key legal considerations. Adapting to changes in data privacy, like GDPR enforcement in 2024-2025, directly impacts Ageas's liability framework.

| Legal Factor | Description | 2024/2025 Relevance | Potential Impact on Ageas |

| Solvency II (EU) | Capital and risk management standards for insurers. | Ongoing EIOPA monitoring of solvency ratios. | Ensures financial health, impacts capital allocation. |

| Data Protection (GDPR) | Rules for handling customer data. | Fines up to 4% of global turnover; global breach cost ~$4.45M (2024). | Requires robust data security, risks significant financial penalties. |

| Consumer Protection (IDD) | Ensures fair treatment and transparency for policyholders. | Fines for non-compliance (e.g., UK FCA fines >£100M in 2023). | Maintains customer trust, avoids legal challenges and reputational damage. |

| AML/CTF Regulations | Preventing financial crime. | Increased scrutiny on digital assets; EU AML Authority discussions. | Mandates rigorous due diligence and reporting, risks penalties. |

| Liability Laws | Product, professional, and cyber liability. | Emerging AI liability discussions in Europe (2024). | Affects underwriting, claims exposure, and risk management strategies. |

Environmental factors

The intensifying frequency and severity of extreme weather events, such as floods and storms, directly affect Ageas's property and casualty insurance offerings. These climate-related impacts translate into increased claims payouts, requiring Ageas to refine its risk assessment, underwriting practices, and pricing models to account for these growing threats.

Investors are increasingly scrutinizing companies like Ageas for their environmental and social impact, with ESG-focused funds attracting significant capital. For instance, by the end of 2024, global sustainable investment assets were projected to exceed $50 trillion, a substantial increase reflecting this trend.

Regulatory bodies are also tightening requirements, pushing Ageas to enhance transparency in its ESG reporting and operations. The European Union's Sustainable Finance Disclosure Regulation (SFDR), fully applicable since March 2021, mandates detailed ESG disclosures for financial products, influencing how Ageas markets and manages its offerings.

Ageas must integrate ESG considerations into its core strategies, from underwriting policies to investment portfolios, to maintain its reputation and ensure long-term resilience. Failure to adapt could lead to reputational damage and missed opportunities in a market where sustainability is becoming a key differentiator.

The global move towards a low-carbon economy significantly affects sectors Ageas insures, like energy, manufacturing, and transportation. This shift presents both new risks and opportunities, potentially influencing how insured assets are valued and driving the need for novel insurance products covering green technologies and sustainable operations.

Pollution and Environmental Liability Risks

Ageas's corporate clients are increasingly exposed to environmental liability risks stemming from pollution incidents, improper waste disposal, and breaches of environmental regulations. These liabilities can lead to significant financial penalties and reputational damage.

Accurately assessing and pricing these evolving environmental risks is a critical challenge for Ageas. The company needs robust underwriting capabilities to understand the potential impact of pollution events and ensure adequate coverage is provided.

Ageas can offer specialized insurance products, such as environmental impairment liability insurance, to help businesses mitigate these exposures. This allows clients to transfer the financial burden of potential environmental clean-up costs and legal claims.

- Growing Regulatory Scrutiny: In 2024, environmental regulations continue to tighten globally, increasing the potential for non-compliance penalties for businesses. For instance, the EU's Green Deal initiatives are driving stricter rules on industrial emissions and waste management, impacting Ageas's corporate clients.

- Increased Claims Frequency: Reports from the insurance industry in late 2024 and early 2025 indicate a rise in claims related to historical pollution sites and emerging contaminants like PFAS, suggesting a growing need for comprehensive environmental insurance.

- Specialized Underwriting Needs: Pricing environmental risk requires deep technical expertise. Ageas's ability to attract and retain actuaries and environmental risk specialists is crucial for developing accurate premium calculations for policies covering pollution liability.

Resource Scarcity and Supply Chain Resilience

Growing concerns about resource scarcity, such as water shortages and the availability of critical minerals, present significant challenges. These issues directly impact businesses by increasing operational costs and potentially halting production, which in turn affects the insurance risks Ageas underwrites. For instance, a drought impacting agricultural output could lead to increased claims for crop insurance, while a shortage of semiconductors could disrupt manufacturing clients, leading to business interruption claims.

Global supply chains, already strained by geopolitical events and climate-related disruptions, add another layer of complexity. Ageas must factor in the heightened risk of delays and damage to goods in transit or storage when assessing property damage and business interruption exposures for its commercial clients. The World Bank's Logistics Performance Index, while not a direct Ageas metric, highlights variations in supply chain efficiency globally, indicating areas where Ageas's insured clients might face greater disruption.

These environmental factors necessitate a robust approach to risk assessment and pricing for Ageas. The company needs to continually evaluate how these evolving risks translate into potential claims across various sectors.

- Resource Scarcity Impact: Increased operational costs and potential production halts for businesses, leading to higher business interruption and property damage insurance claims.

- Supply Chain Vulnerability: Greater risk of delays and damage to goods in transit and storage, impacting Ageas's underwriting of commercial property and business interruption policies.

- Climate Change Link: Environmental factors like droughts and extreme weather events exacerbate resource scarcity and supply chain disruptions, directly influencing insurance risk profiles.

- 2024/2025 Outlook: Continued volatility in commodity prices and persistent supply chain bottlenecks are expected to maintain elevated risk levels for insured businesses.

The increasing frequency and severity of extreme weather events, such as floods and storms, directly impact Ageas's property and casualty insurance offerings, leading to higher claims payouts. Global sustainable investment assets were projected to exceed $50 trillion by the end of 2024, highlighting investor demand for environmentally responsible companies like Ageas.

Ageas must adapt to tightening environmental regulations, such as the EU's SFDR, which mandates detailed ESG disclosures. The company's ability to accurately price environmental risks, including those related to pollution and resource scarcity, is crucial for its underwriting success. By the end of 2024, the insurance industry noted a rise in claims related to historical pollution, underscoring the need for specialized expertise.

| Environmental Factor | Impact on Ageas | 2024/2025 Data/Outlook |

| Extreme Weather Events | Increased claims for property and casualty insurance | Rising frequency and severity of events |

| ESG Investing Trend | Investor scrutiny and demand for sustainable practices | Global sustainable investment assets > $50 trillion by end of 2024 |

| Environmental Regulations | Need for enhanced transparency and compliance | EU's SFDR mandates detailed ESG disclosures |

| Resource Scarcity | Higher operational costs for clients, impacting business interruption claims | Persistent volatility in commodity prices |

| Supply Chain Disruptions | Increased risk of delays and damage to insured goods | Continued bottlenecks expected |

PESTLE Analysis Data Sources

Our Ageas PESTLE Analysis is built on a robust foundation of data from official government publications, reputable financial institutions like the IMF and World Bank, and leading industry-specific market research reports. This ensures a comprehensive and accurate understanding of the macro-environmental factors impacting the insurance sector.