Ageas Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ageas Bundle

Curious about Ageas's strategic product portfolio? This glimpse into their BCG Matrix highlights key areas of growth and potential challenges. Understand where Ageas's offerings shine as Stars and where they generate consistent revenue as Cash Cows.

To truly unlock Ageas's competitive advantage, dive into the full BCG Matrix. Gain a comprehensive understanding of their product positioning across all four quadrants, empowering you with actionable insights for informed investment and resource allocation decisions.

Don't miss out on the complete strategic roadmap. Purchase the full Ageas BCG Matrix report to receive detailed quadrant analysis, data-driven recommendations, and a clear path to optimizing their market presence and future growth.

Stars

Ageas's reinsurance business, Ageas Re, is a significant growth driver, evidenced by a 21% increase in gross written premium (GWP) in 2024. This segment's expansion is further highlighted by a remarkable 250% surge in external third-party business GWP, reaching EUR 140 million.

Recognized as a cornerstone of Ageas's Elevate27 strategy, Ageas Re benefits from a strong market position in an expanding and increasingly specialized insurance sector. The business's strategic move into new areas such as Agriculture and Credit & Bond, while consistently maintaining underwriting margins, underscores its robust performance and future potential.

Ageas UK's Personal Lines Insurance stands out, earning the title of Personal Lines Insurer of the Year for the second year running. This achievement is backed by impressive profitable growth and the acquisition of nearly 300,000 new customers in 2024 alone. This segment shows robust demand and Ageas's strong market penetration.

The recent strategic partnership with Saga Services Limited, commencing in Q4 2025, further cements Ageas's dominance in the over-50s market. This collaboration will see Ageas distribute motor and home insurance to Saga's extensive customer base, reinforcing its high market share in a stable, ongoing demand sector.

Ageas Portugal's Life and Health products are shining stars within the BCG Matrix. In 2024, Life inflows surged by an impressive 45%, driven by successful new savings product campaigns. This robust growth highlights strong market reception and effective strategy execution.

Portugal also stands as Ageas's undisputed Centre of Excellence for Health insurance. The company commands approximately 30% of the Portuguese health market, securing a solid No. 2 position. This significant market share in a crucial and growing European sector underscores the star status of these offerings.

Asia (Malaysia and India) Growth

Ageas's Asian operations demonstrated robust commercial momentum in 2024, with inflows increasing by 7% at constant exchange rates. This growth was significantly fueled by the exceptional performance in Malaysia and India. These two markets are key components of Asia's rapidly expanding insurance sector, where Ageas continues to solidify its position and broaden its reach.

The sustained sales growth in both Malaysia and India highlights their considerable growth potential and Ageas's competitive strength within these dynamic markets.

- Malaysia and India: Key Growth Drivers

- 2024 Inflows: Up 7% at constant exchange rates

- Asian Insurance Landscape: Rapidly expanding

- Ageas's Position: Solid performance and expanding presence

Digital Transformation & AI Integration

Ageas is strategically channeling significant resources into digital transformation and AI integration, a cornerstone of its Elevate27 strategy, which spans 2025-2027. This initiative is designed to propel profitable expansion, optimize operational efficiency, and elevate customer interactions.

The company's commitment is evident in its investment in AI-powered solutions, such as SPARK in India, which streamlines underwriting processes. Furthermore, Ageas is actively pursuing an 'open insurance' model and developing embedded insurance offerings, showcasing its forward-thinking approach to leveraging technology for market leadership.

- Data & AI Investment: Ageas's Elevate27 strategy (2025-2027) prioritizes data and AI for growth, efficiency, and customer experience.

- AI in Underwriting: Implementation of AI solutions like SPARK in India demonstrates practical application for automated underwriting.

- Open & Embedded Insurance: Focus on these areas signals Ageas's push into new distribution models and technology-driven ecosystems.

- Market Position: Ageas aims to capture significant market share by leading in the adoption of digital and AI technologies.

Ageas's Portuguese Life and Health insurance offerings are clearly identified as Stars in the BCG Matrix. Life inflows saw a substantial 45% jump in 2024, fueled by successful new savings products, indicating strong market appeal and effective strategy execution.

Portugal also serves as Ageas's Health insurance center of excellence, holding a commanding 30% market share and a solid second position. This significant penetration in a vital and growing European sector solidifies these segments' star status.

| Business Segment | Region | 2024 Performance Highlight | BCG Matrix Category |

|---|---|---|---|

| Life Insurance | Portugal | 45% inflow growth | Star |

| Health Insurance | Portugal | 30% market share (No. 2) | Star |

| Personal Lines | UK | Personal Lines Insurer of the Year (2nd year) | Star |

| Reinsurance | Global | 21% GWP increase, 250% external GWP surge | Star |

What is included in the product

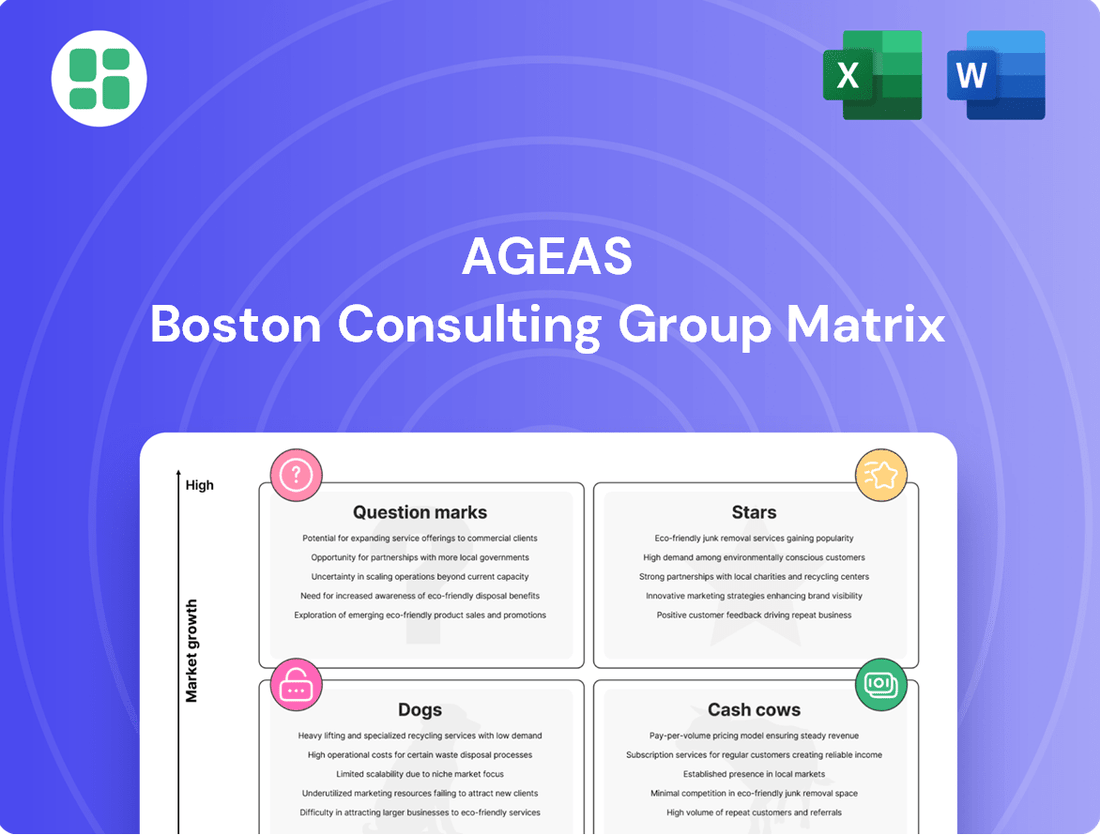

The Ageas BCG Matrix analyzes its business units as Stars, Cash Cows, Question Marks, and Dogs to guide investment and divestment strategies.

The Ageas BCG Matrix provides a clear, one-page overview of business unit performance, alleviating the pain of complex data analysis.

Cash Cows

Ageas's core Belgian Life insurance business demonstrated a return to growth in 2024, with Group Life & Invest products spearheading a 9% rise in the Group's overall life inflows. This segment represents a mature market where Ageas holds a substantial and well-established market share.

The Belgian market's stability, coupled with Ageas's strong competitive positioning, ensures consistent cash flow generation. This reliable profitability and capital generation capability firmly classify Belgian Life insurance as a Cash Cow within the Ageas BCG Matrix.

The traditional non-life insurance business in Europe, excluding France, has been a powerhouse for Ageas. In 2024, this segment experienced a substantial 18% surge in inflows, significantly boosting the Group's overall non-life inflow growth to 14%.

Ageas's operational strength is evident in its robust non-life combined ratio, which stood at a healthy 93.3%. This figure underscores the segment's strong technical performance and consistent profitability in these well-established European markets.

These mature markets allow Ageas to leverage its competitive advantages and operational efficiencies, consistently yielding high profit margins and substantial cash flow from its traditional non-life insurance offerings.

The UK motor insurance business, a core component of Ageas's personal lines, demonstrated robust expansion in 2024, achieving a 21% growth rate. This surge was fueled by both an increase in the customer base and higher premiums, underscoring its strength in a mature market.

This segment is a substantial contributor to Ageas's overall non-life insurance profitability. Its consistent financial performance and established market position solidify its role as a dependable cash generator for the company.

Given its mature status, the UK motor insurance business requires relatively low promotional investment. This allows it to reliably generate cash flow, making it a classic cash cow within Ageas's portfolio.

China Life Insurance Joint Venture

Ageas's joint venture in China, a key Cash Cow, demonstrated robust sales momentum throughout 2024. This partnership significantly boosted Asia's total inflows and operational capital generation.

While accounting adjustments for low-interest rates presented some challenges, the core technical performance of the Chinese operation remained strong.

This venture capitalizes on Ageas's established expertise within China's vast market. It continues to be a substantial source of cash flow, even as its growth moderates from prior double-digit expansion rates.

- 2024 China JV Inflows: Significant contribution to Ageas's Asian segment.

- Operational Capital: Strong generation supporting group capital.

- Underlying Performance: Technical results remain solid despite accounting headwinds.

- Market Leverage: Utilizes Ageas's expertise in a large, dynamic market.

Ageas's Overall Strong Capital Position

Ageas demonstrates a remarkably strong capital position, underscored by its Pillar II Solvency II ratio reaching 218% by the close of 2024. This figure significantly surpasses its internal targets, signaling robust financial health and a substantial buffer against unforeseen market events.

Furthermore, the company generated an impressive EUR 1.5 billion in operational free capital in 2024. This consistent and substantial free cash flow, derived from its well-established business segments, solidifies Ageas's status as a cash cow.

- Robust Capitalization: Ageas's Pillar II Solvency II ratio stood at 218% at the end of 2024, exceeding its objectives.

- Strong Capital Generation: The company produced EUR 1.5 billion in operational free capital during 2024.

- Financial Flexibility: This strong balance sheet and capital generation capacity enable Ageas to pursue new investment opportunities and enhance shareholder returns.

- Cash Cow Status: The consistent, significant free cash flow from its mature operations provides the financial stability necessary for Ageas to fund its strategic growth initiatives.

Ageas's Belgian Life insurance and European non-life segments, alongside its UK motor insurance business, are prime examples of Cash Cows. These operations benefit from mature markets, strong market share, and operational efficiencies, leading to consistent profitability and substantial cash flow generation. The China joint venture also contributes significantly, leveraging Ageas's expertise in a large market.

| Business Segment | 2024 Performance Highlight | BCG Matrix Classification |

|---|---|---|

| Belgian Life Insurance | 9% rise in Group Life & Invest inflows; stable market share. | Cash Cow |

| European Non-Life (excl. France) | 18% surge in inflows; 93.3% combined ratio. | Cash Cow |

| UK Motor Insurance | 21% growth; strong customer base and premium increases. | Cash Cow |

| China Joint Venture | Robust sales momentum; strong operational capital generation. | Cash Cow |

Preview = Final Product

Ageas BCG Matrix

The Ageas BCG Matrix preview you're examining is the identical, fully formatted document you'll receive immediately after purchase. This means no watermarks or demo content, just a comprehensive, analysis-ready report designed for strategic decision-making.

Dogs

Underperforming niche segments within Ageas, while not specifically itemized in current public disclosures, would represent areas with limited growth potential and a small existing market share. These could include older, legacy insurance products or highly specialized offerings that no longer align with current market demands or Ageas's growth strategy. For instance, if a particular type of annuity product, introduced years ago, now sees minimal new business and has a declining customer base, it would fit this description.

Legacy IT systems at Ageas, those not yet modernized, can be categorized as 'dogs' in the BCG matrix due to their operational inefficiencies. These systems often come with substantial maintenance expenses and limit the company's ability to adapt quickly to market changes, yielding a low return on investment compared to modern digital platforms.

For instance, in 2024, many insurers still grapple with the high costs associated with maintaining aging core systems, which can consume a significant portion of IT budgets. Ageas's strategic emphasis on digital transformation, including investments in cloud-based solutions and data analytics, clearly signals a deliberate effort to phase out or significantly reduce reliance on such legacy infrastructure.

Markets where Ageas holds a minor share and faces sluggish growth, alongside fierce competition, could be classified as 'dogs' within its portfolio. These are often areas where Ageas has found it difficult to establish a strong foothold or offer a unique proposition, resulting in low market penetration and profitability.

For instance, if Ageas's presence in certain Eastern European insurance markets remains minimal and these markets exhibit flat or declining growth rates, as indicated by a general trend of low insurance penetration in some of these regions, they might be considered dogs. The company's strategic focus on core European markets, where it demonstrates robust performance, further highlights the potential underperformance of these less significant geographical areas.

Certain Outdated Product Offerings

Certain Ageas product lines may be classified as 'dogs' if they fail to resonate with current customer demands or prevailing market trends. These products typically exhibit sluggish new business generation and struggle with policy renewals, indicating a low market share and minimal growth potential.

Such offerings often demand significant resources for meager returns, representing an inefficient use of capital. Ageas's strategic emphasis on launching innovative products and enhancing customer engagement is designed to proactively address and mitigate the risk of accumulating such underperforming assets within its portfolio.

- Low Growth Prospects: Products that do not align with evolving customer needs or market trends, and thus generate minimal new business or face declining policy renewals, might be considered 'dogs'.

- Low Market Share: These offerings would have low growth prospects and likely a low market share, requiring disproportionate effort for limited returns.

- Strategic Response: Ageas's new product launches and focus on customer experience aim to avoid this category by ensuring product relevance and market competitiveness.

Commercial Lines Business (Divested)

Ageas UK's strategic move to divest its commercial lines business, completed with the sale to AXA in 2022, clearly positions this segment as a 'Dog' within its portfolio. This decision was further solidified by the January 1, 2025, loss portfolio transfer reinsurance agreement with Swiss Re, effectively transferring the economic risks associated with this divested business.

This exit from commercial lines underscores Ageas's focus on personal lines, aiming to shed a low-growth, low-return segment where it identified a lack of significant competitive advantage. For instance, in 2023, the UK general insurance market saw continued price competition, particularly in commercial lines, impacting profitability for many insurers.

- Divestment Rationale Ageas UK sold its commercial lines business to AXA in 2022, signaling a strategic shift away from this market.

- Risk Transfer A loss portfolio transfer reinsurance agreement with Swiss Re, effective January 1, 2025, removes remaining economic risks from Ageas.

- Market Performance Commercial lines often present lower growth and return profiles compared to personal lines, especially in competitive markets like the UK.

- Strategic Focus The divestment allows Ageas to concentrate resources and capital on its core personal lines business, where it aims for stronger competitive positioning.

Products or business segments that exhibit low market share and minimal growth potential are classified as 'Dogs' in the BCG matrix for Ageas. These areas typically require significant investment for very limited returns, representing an inefficient allocation of resources. Ageas's strategic initiatives, such as introducing new, customer-centric products and enhancing digital platforms, are designed to move away from such underperforming assets.

Ageas UK's divestment of its commercial lines business to AXA in 2022, with a loss portfolio transfer to Swiss Re effective January 1, 2025, exemplifies a 'Dog' segment. This move highlights a strategic decision to exit a low-growth, competitive market where Ageas lacked a strong competitive advantage, allowing for a reallocation of capital to more promising personal lines business.

Question Marks

Ageas is strategically investing in emerging digital platform partnerships for embedded insurance, a key component of its growth strategy. In 2024, the company launched micro credit life coverage with seven new partners in India, tapping into the burgeoning open insurance market.

This push into embedded insurance represents a high-growth opportunity, though Ageas's current market share within this nascent distribution channel is still taking shape. Significant capital deployment is necessary to scale these collaborations and transform them into substantial revenue generators.

Ageas Re's strategic expansion into Credit & Surety and Agriculture reinsurance lines in 2024 marks a significant move into high-growth segments. The company is actively building its capabilities in these specialized areas, with initial renewals anticipated in Credit & Surety during 2025.

These new ventures represent Ageas's ambition to capture market share in promising reinsurance sectors. While the long-term profitability and leadership potential are still developing, the focus is on establishing a strong foundation for future growth.

Ageas is strategically expanding into new health ecosystem ventures, exemplified by MediSa in Türkiye and OneClinics in Portugal. MediSa integrates digital healthcare with insurance, while OneClinics is a physiotherapy network acquisition. These initiatives target the high-growth healthcare services market, though Ageas's current market share in these specific segments is still developing.

These ventures are currently cash-intensive, requiring investment for growth and market penetration. However, they hold significant potential for substantial future returns if they successfully capture market share and establish strong positions within their respective health service niches. For instance, the global digital health market was valued at approximately USD 211 billion in 2023 and is projected to grow substantially in the coming years, indicating the attractive growth trajectory of these ventures.

Advanced AI and Data Solutions for Underwriting and Customer Service

Ageas's commitment to advanced AI and data solutions, like the SPARK platform for automated underwriting in India and improving digital customer journeys, places it in the question mark category of the BCG matrix. These initiatives are crucial for staying competitive in a rapidly evolving, tech-centric insurance market, aiming for future efficiency and superior customer experiences.

While the strategic importance of these investments is clear, their direct financial returns and impact on market share are still being established, reflecting the early stages of adoption and the need for continued capital allocation to unlock full potential. For instance, in 2024, Ageas continued to explore AI-driven underwriting, with some markets reporting efficiency gains, though comprehensive financial impact data across all regions is still under evaluation.

- Investment in AI: Ageas is actively investing in AI for underwriting and customer service, with specific projects like SPARK in India demonstrating this focus.

- Efficiency Gains: Early indicators suggest these AI solutions are contributing to operational efficiencies, though quantifiable financial returns are still developing.

- Customer Experience: Enhancing digital customer journeys through data analytics is a key objective, aiming to improve engagement and retention in a competitive landscape.

- Future Potential: The long-term success hinges on realizing the full potential of these technologies, which requires sustained investment and adaptation to market dynamics.

Strategic Acquisitions for Market Consolidation (e.g., AICL/Saga)

Ageas's acquisition of AICL and its 20-year exclusive partnership with Saga Services Limited in the UK, inked in December 2024, is a clear play for market consolidation within the over-50s personal lines insurance segment. This strategic maneuver is designed to significantly expand Ageas's footprint in a demographic known for its stability and increasing insurance needs.

The UK market for over-50s insurance is substantial, with projections indicating continued growth. For instance, the over-50s market segment in the UK is estimated to be worth billions of pounds annually, and Ageas's move aims to capture a larger share of this lucrative market. The integration process is critical for realizing the full potential of this acquisition, including achieving projected synergies and market share gains.

- Strategic Focus: Targeting the growing and valuable over-50s demographic in the UK.

- Partnership Duration: A 20-year exclusive agreement with Saga Services Limited.

- Growth Objective: To increase Ageas's scale and market share in personal lines insurance.

- Investment Significance: Represents a major commitment to consolidating Ageas's position in a high-potential segment.

Ageas's investments in AI and data solutions, like the SPARK platform in India for automated underwriting, position it within the question mark category. These initiatives are vital for enhancing efficiency and customer experience in the evolving insurance landscape.

While these AI efforts are strategically important, their direct financial returns and market share impact are still being assessed. Ageas continued to explore AI-driven underwriting in 2024, with some markets reporting efficiency gains, though comprehensive financial impact data is still under evaluation.

These ventures require ongoing capital to scale and realize their full potential, aiming to improve operational efficiencies and customer journeys. The long-term success depends on sustained investment and adaptation to market changes.

Ageas's strategic expansion into new health ecosystem ventures, such as MediSa in Türkiye and OneClinics in Portugal, also falls into the question mark category. These initiatives target the high-growth healthcare services market, with the global digital health market valued at approximately USD 211 billion in 2023.

| Initiative | Strategic Focus | Current Stage | Investment Need | Potential |

| AI & Data Solutions (e.g., SPARK) | Underwriting efficiency, customer journey enhancement | Early adoption, efficiency gains reported in some markets | Sustained capital for scaling and adaptation | Improved operational efficiency, enhanced customer experience |

| Health Ecosystem Ventures (MediSa, OneClinics) | Growth in healthcare services, digital health integration | Developing market share, cash-intensive | Significant capital for growth and market penetration | Substantial future returns if market share is captured |

BCG Matrix Data Sources

Our BCG Matrix leverages a blend of financial disclosures, market research reports, and internal performance metrics to provide a comprehensive view of business unit positioning.