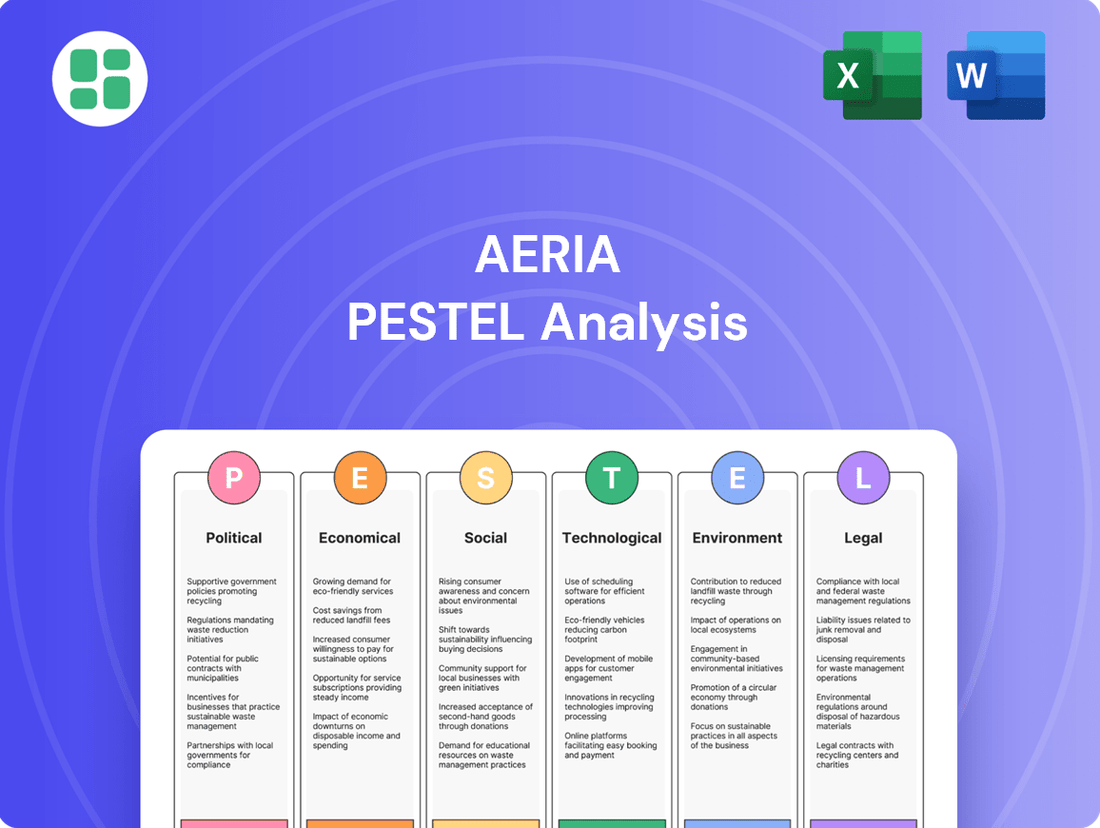

Aeria PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aeria Bundle

Uncover the critical Political, Economic, Social, Technological, Environmental, and Legal forces shaping Aeria's trajectory. Our meticulously researched PESTLE analysis provides the strategic foresight you need to anticipate market shifts and capitalize on emerging opportunities. Don't be left behind; download the full version for actionable intelligence that drives informed decision-making and secures your competitive advantage.

Political factors

Governments worldwide are stepping up their oversight of the online gaming sector, with a growing focus on areas like game content, how games make money (think loot boxes), and safeguarding players. For Aeria Corporation, staying ahead of these changing laws in every market it operates in is crucial for compliance and avoiding fines.

This means Aeria must be diligent in following rules like age verification and promoting responsible gaming practices. For instance, in 2024, several European countries, including Germany and Spain, continued to refine their regulations concerning in-game purchases and advertising aimed at minors, reflecting a broader trend of increased scrutiny.

Aeria's cross-border operations and online game publishing are significantly shaped by international trade agreements and tariffs. For instance, the European Union's Digital Single Market strategy aims to reduce barriers to digital trade, potentially benefiting Aeria's expansion within member states. Conversely, increased tariffs on imported gaming hardware or software components could directly impact Aeria's cost of goods sold and overall profitability, especially if key development or operational resources are sourced from countries with new trade restrictions.

The increasing enforcement of data privacy laws, such as the GDPR and CCPA, significantly impacts Aeria's operations by dictating how user data is handled. For instance, the GDPR’s fines can reach up to 4% of annual global turnover or €20 million, whichever is higher, highlighting the financial risks of non-compliance. This necessitates ongoing investment in robust data security and privacy measures to maintain user trust and avoid substantial penalties.

Intellectual Property Protection

Governmental effectiveness in safeguarding intellectual property is paramount for Aeria, a company built on its unique game content and underlying technology. Regions with lax enforcement pose a significant risk, potentially leading to widespread piracy and the unauthorized exploitation of Aeria's valuable intellectual assets, which directly impacts revenue streams. For instance, the global video game market experienced an estimated $30 billion in losses due to piracy in 2023, a figure that underscores the importance of robust IP protection measures.

Aeria, like many tech-forward companies, can leverage lobbying and participate in industry associations to advocate for and influence the development of stronger intellectual property laws and enforcement mechanisms worldwide. Such collective action is vital for creating a more secure operating environment and ensuring fair competition.

- Global IP Enforcement Challenges: Reports from organizations like the U.S. Chamber of Commerce's Global Innovation Policy Center consistently highlight varying levels of IP protection across different countries, impacting companies with digital assets.

- Impact on Digital Goods: The intangible nature of digital game content makes it particularly susceptible to online piracy, necessitating continuous adaptation of legal and technological safeguards.

- Industry Advocacy: Trade groups such as the Entertainment Software Association (ESA) actively engage with policymakers to address issues like online infringement and the protection of digital intellectual property.

Political Stability in Key Markets

Political stability in Aeria's key markets is a critical factor for its operations. For instance, ongoing geopolitical tensions in Eastern Europe, a region where Aeria has a notable user presence, could impact consumer discretionary spending on entertainment services. In 2024, several emerging markets Aeria operates in experienced shifts in government, leading to potential policy adjustments that might affect data privacy regulations or taxation on digital services.

Sudden policy changes can create significant headwinds. A hypothetical scenario could involve a major market implementing new regulations on user data collection, directly impacting Aeria's advertising revenue models. Furthermore, the security of Aeria's development centers, particularly those located in regions with a history of political instability, necessitates continuous risk assessment to ensure business continuity and the safety of its workforce.

Consider the following impacts:

- Disruption of Services: Political unrest can lead to internet disruptions or censorship, affecting Aeria's ability to deliver its services.

- Investment Risk: Instability increases the risk for Aeria's investments in local infrastructure or talent acquisition.

- Consumer Confidence: Political uncertainty often erodes consumer confidence, leading to reduced spending on non-essential goods and services like digital entertainment.

- Regulatory Uncertainty: Frequent changes in government can result in unpredictable regulatory landscapes, impacting compliance costs and operational strategies.

Governments globally are intensifying their scrutiny of the online gaming industry, focusing on content, monetization models like loot boxes, and player protection. Aeria must navigate these evolving regulations across its markets to ensure compliance and avoid penalties, with 2024 seeing continued refinement of rules on in-game purchases and advertising to minors in countries like Germany and Spain.

International trade agreements and tariffs significantly influence Aeria's operations, with initiatives like the EU's Digital Single Market potentially easing expansion, while increased tariffs on hardware could raise costs.

Data privacy laws, including GDPR and CCPA, impose strict data handling requirements on Aeria, with GDPR fines potentially reaching 4% of global annual turnover, underscoring the need for robust security investments.

Intellectual property protection is vital for Aeria, as weak enforcement in some regions can lead to piracy, costing the global video game market an estimated $30 billion in 2023.

Political stability is crucial; geopolitical tensions and shifts in government in emerging markets during 2024 can affect consumer spending and lead to policy changes impacting digital services.

What is included in the product

The Aeria PESTLE analysis systematically examines external macro-environmental influences across Political, Economic, Social, Technological, Environmental, and Legal dimensions, providing a comprehensive understanding of the operating landscape.

Aeria's PESTLE Analysis provides a clear, summarized version of the full analysis for easy referencing during meetings or presentations, alleviating the pain of sifting through extensive data.

Economic factors

The overall health of the global economy plays a crucial role in consumer spending, especially on non-essential items like online entertainment. A strong global economic outlook, with projected growth around 2.7% for 2024 and a similar forecast for 2025 by the IMF, generally translates to higher disposable incomes, benefiting companies like Aeria that rely on discretionary spending for gaming subscriptions and in-game purchases.

Conversely, economic slowdowns or recessions can lead to reduced consumer confidence and tighter household budgets. This could mean less money available for entertainment, potentially impacting Aeria's revenue streams as consumers prioritize essential goods and services over leisure activities.

Currency exchange rate fluctuations pose a significant challenge for Aeria's global operations. For instance, if the Euro strengthens against the US Dollar, Aeria's revenue generated in US dollars would translate into fewer Euros, impacting its reported earnings. Conversely, a weaker Euro could make imported components for its gaming hardware more expensive, increasing operational costs.

As of early 2024, the Euro had shown some volatility against major currencies. For example, the EUR/USD pair traded in a range, with significant swings impacting businesses with cross-border transactions. Aeria likely employs hedging strategies, such as forward contracts, to lock in exchange rates for anticipated transactions, thereby mitigating some of this risk.

Rising inflation presents a significant challenge for Aeria, potentially increasing operational expenses. For instance, the cost of essential services like cloud computing, critical for game hosting and development, saw notable increases throughout 2024. Similarly, the price of hardware components used in server maintenance and upgrades also experienced upward pressure, directly impacting Aeria's cost of goods sold.

Higher interest rates, a trend observed globally in 2024 and projected to continue into early 2025, can hinder Aeria's growth ambitions. Increased borrowing costs make financing new game development projects, which are often capital-intensive, more expensive. This also affects the feasibility of investing in advanced IT infrastructure or pursuing strategic acquisitions, potentially slowing down expansion and market share growth.

Consumer Spending Habits

Consumer spending habits are undergoing significant transformations, directly impacting companies like Aeria. A notable trend is the increasing embrace of subscription-based services, shifting away from traditional one-time purchases. This can be seen across various sectors, including entertainment and software, where recurring revenue models are becoming the norm.

For Aeria, this means their revenue streams are increasingly tied to customer retention and the perceived ongoing value of their offerings. The gaming industry, in particular, has seen a surge in free-to-play models complemented by in-app purchases. This strategy allows for a broader user base acquisition while monetizing through optional upgrades or cosmetic items.

Economic conditions play a crucial role in shaping these spending patterns. For instance, during periods of economic uncertainty or inflation, consumers may become more budget-conscious, potentially favoring lower-cost entry points like free-to-play games or opting for more affordable subscription tiers. Conversely, in stronger economic times, consumers might be more willing to invest in premium subscriptions or larger in-app purchases.

- Subscription Growth: The global subscription e-commerce market was projected to reach $2.6 trillion by 2025, underscoring the shift towards recurring revenue models.

- In-App Purchase Dominance: In 2023, mobile game revenue from in-app purchases alone was estimated to be over $90 billion globally.

- Consumer Confidence Impact: Fluctuations in consumer confidence indices, such as those reported by the Conference Board, often correlate with changes in discretionary spending on entertainment and digital goods.

- Value Perception: Consumers are increasingly prioritizing value for money, leading to a demand for flexible pricing and tiered offerings that cater to different budget levels.

Competition and Market Saturation

The online gaming and mobile content landscapes are incredibly crowded, often leading to aggressive price competition and escalating marketing costs for companies like Aeria. This intense rivalry means Aeria must constantly strive to offer unique and engaging experiences to capture and keep its audience. The sheer volume of available content puts pressure on pricing strategies and can ultimately squeeze profit margins.

For instance, the global mobile gaming market was projected to generate over $90 billion in revenue in 2024, highlighting the immense scale but also the fierce competition for a share of that pie. Companies are spending significantly on user acquisition, with average customer acquisition costs (CAC) in some segments of the mobile gaming market rising by as much as 20% year-over-year leading into 2025.

- High Market Density: The online gaming sector features a vast number of developers and publishers vying for player attention.

- Price Sensitivity: Consumers often have numerous free-to-play or low-cost alternatives, impacting Aeria's ability to command premium pricing.

- Marketing Expenditure: Significant investment in advertising and promotions is necessary to stand out, directly affecting operational costs.

- Innovation Imperative: Continuous development of new features, games, and content is crucial for user retention and attracting new players in a rapidly evolving market.

Global economic growth forecasts, with the IMF projecting around 2.7% for 2024 and a similar outlook for 2025, directly influence consumer discretionary spending on services like online gaming. Fluctuations in currency exchange rates, such as the EUR/USD, impact Aeria's international revenue and costs, necessitating hedging strategies. Rising inflation in 2024 increased operational expenses for cloud computing and hardware, while higher interest rates projected into early 2025 make financing and investment more costly.

| Economic Factor | Impact on Aeria | 2024/2025 Data/Projection |

|---|---|---|

| Global GDP Growth | Influences consumer spending on non-essentials. | IMF forecast ~2.7% for 2024 and 2025. |

| Currency Exchange Rates | Affects international revenue and operational costs. | EUR/USD volatility observed; hedging strategies employed. |

| Inflation | Increases operational expenses. | Notable increases in cloud computing and hardware costs in 2024. |

| Interest Rates | Raises borrowing costs, impacting investment and financing. | Globally observed trend continuing into early 2025. |

Full Version Awaits

Aeria PESTLE Analysis

The preview you see here is the exact Aeria PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use for your strategic planning.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, providing a comprehensive overview of Aeria's operating environment.

The content and structure shown in the preview is the same document you’ll download after payment, offering a detailed breakdown of Political, Economic, Social, Technological, Legal, and Environmental factors impacting Aeria.

Sociological factors

The gaming landscape is rapidly evolving, with a significant shift away from its historically younger, male-dominated image. By 2024, reports indicate that women now represent nearly half of all gamers, a substantial increase that necessitates a broader approach to game development and marketing.

This demographic diversification extends to age as well. The average age of gamers is climbing, with older adults increasingly engaging with gaming for entertainment and cognitive benefits. Aeria must recognize this trend, potentially by developing titles or adapting existing ones to cater to these mature audiences, opening up previously untapped revenue streams.

The rise of casual gaming, accessible on mobile devices and through simpler interfaces, further broadens the player base. Aeria's strategy should incorporate accessible gameplay mechanics and diverse monetization models to capture these growing segments, as casual gamers often prioritize convenience and social interaction.

Cultural acceptance of gaming is a key sociological factor for Aeria. In 2024, the global games market was projected to reach over $200 billion, indicating a broad societal embrace of gaming as a form of entertainment and social interaction. However, this acceptance isn't uniform; some regions still view gaming with skepticism, particularly concerning its impact on younger demographics.

Aeria needs to navigate these differing perceptions. For instance, while South Korea has a deeply ingrained esports culture with professional leagues and widespread acceptance, other markets might see more parental concern about screen time or the potential for addiction. Understanding and respecting these local nuances is crucial for effective content localization and marketing campaigns.

Social media platforms like Twitch and YouTube are now primary channels for game discovery, with millions of viewers tuning into gameplay streams. In 2024, over 80% of gamers reported discovering new titles through social media or influencer recommendations. Aeria's success hinges on leveraging these channels for organic promotion and direct player interaction.

Dedicated online communities, such as Discord servers and Reddit forums, are vital for fostering player loyalty and gathering feedback. Games with active communities often see significantly longer player retention rates, sometimes by as much as 30% compared to those without. Effective community management by Aeria can transform casual players into dedicated advocates.

Work-Life Balance and Leisure Time

Societal shifts prioritizing work-life balance are creating more opportunities for leisure, directly benefiting the gaming industry. In 2024, reports indicate a growing demand for flexible work arrangements, with over 60% of employees seeking better integration of personal and professional lives. This trend means more potential playtime for consumers, but Aeria must contend with a wider array of entertainment choices vying for that limited leisure time.

The challenge for Aeria lies in creating engaging content that caters to diverse lifestyles and time constraints. For instance, the rise of short-form video content and quick-access mobile games in 2024 highlights a consumer preference for experiences that can be enjoyed in shorter bursts. Aeria's strategy should involve developing games with both deep, immersive experiences and shorter, more accessible gameplay loops to capture a broader audience.

- Increased Leisure Time: Global surveys in 2024 show a consistent rise in reported leisure hours, particularly among younger demographics.

- Competition for Attention: Streaming services, social media, and other digital entertainment platforms are fierce competitors for consumer leisure time.

- Adaptable Game Design: Aeria must innovate with game mechanics that accommodate both extended play sessions and brief, on-the-go engagement.

- Lifestyle Integration: Successful games will seamlessly fit into users' daily routines, offering value without demanding excessive time commitments.

Digital Literacy and Connectivity

The rise in global digital literacy and access to high-speed internet, coupled with smartphone ubiquity, is a significant driver for Aeria's business. As of early 2024, over 5.3 billion people were internet users, representing about 66% of the world's population, with mobile phones being the primary internet access device for many. This expanding digital footprint directly translates into a larger potential audience for online and mobile gaming platforms, bolstering Aeria's market penetration and creating new avenues for growth.

This trend is further evidenced by the projected growth in mobile gaming revenue, which is expected to reach over $110 billion globally in 2024. With an increasing number of individuals worldwide gaining reliable internet access and affordable smartphones, the addressable market for Aeria's offerings expands dramatically. This enhanced connectivity fuels user acquisition and engagement, directly supporting the company's expansion strategies.

- Growing Internet Penetration: Global internet users are projected to surpass 5.4 billion by the end of 2024, a substantial increase from previous years.

- Mobile Dominance: Mobile devices account for the majority of internet traffic, highlighting the importance of mobile-first strategies for companies like Aeria.

- Digital Literacy Advancement: Educational initiatives and increasing access to technology are steadily improving digital literacy rates worldwide, making more consumers comfortable with online services.

- E-commerce and Digital Services Growth: The overall expansion of digital services, including online gaming, is directly correlated with improvements in connectivity and user digital skills.

Societal attitudes towards gaming are becoming increasingly positive, with a notable shift towards inclusivity. By 2024, women constitute nearly half of all gamers, and the average age of players is also rising, indicating a broader demographic appeal than previously assumed. This evolving perception is crucial for Aeria, as it signals a larger and more diverse potential customer base eager for engaging content.

The widespread adoption of social media and streaming platforms has fundamentally changed how games are discovered and consumed. In 2024, over 80% of gamers reported finding new titles through influencers and social channels, making these platforms vital for Aeria's marketing and community building efforts. Actively engaging with these communities can foster loyalty and drive organic growth.

A growing emphasis on work-life balance means consumers have more leisure time, but also face increased competition for their attention from various entertainment sources. Aeria must design games that can be enjoyed in both short bursts and longer sessions to cater to these varied lifestyles. Successfully integrating games into daily routines will be key to capturing and retaining player engagement.

The expansion of global internet access, particularly via mobile devices, is opening up significant new markets for Aeria. With over 5.3 billion internet users by early 2024, and mobile phones serving as the primary access point for many, the addressable market for online and mobile gaming is growing exponentially. This trend is projected to drive mobile gaming revenue past $110 billion globally in 2024.

| Sociological Factor | 2024 Data Point | Implication for Aeria |

|---|---|---|

| Gamer Demographics | Women represent nearly 50% of gamers; average age is increasing. | Broaden game design and marketing to appeal to diverse age and gender groups. |

| Discovery Channels | 80%+ gamers discover titles via social media/influencers. | Prioritize social media marketing and influencer partnerships for promotion. |

| Leisure Time Competition | Increased leisure hours but fierce competition from other entertainment. | Develop games with flexible play sessions and strong community engagement. |

| Digital Access & Literacy | 5.3 billion+ internet users; mobile is primary access. | Focus on mobile-first strategies and accessible online platforms for market expansion. |

Technological factors

The gaming industry is witnessing a technological revolution, driven by rapid advancements in game engines like Unreal Engine 5 and Unity, which offer enhanced graphics and physics. In 2024, the global gaming market was valued at over $200 billion, underscoring the immense financial stakes tied to technological adoption.

Aeria must prioritize research and development to integrate cutting-edge AI for more sophisticated non-player characters (NPCs) and explore the growing potential of VR and AR to create truly immersive player experiences. Companies that fail to innovate risk falling behind in this dynamic sector, as evidenced by the increasing market share of studios leveraging advanced technologies.

Aeria's reliance on cloud infrastructure for game hosting, data storage, and scalable operations is paramount for its online gaming success. The global cloud computing market, projected to reach $1.3 trillion by 2025, highlights the essential nature of these services.

Leveraging cloud and edge computing enables Aeria to deliver low-latency experiences to its worldwide player base, a crucial factor in player retention. This technological adoption also directly influences operational costs and the company's ability to scale its IT solutions efficiently.

The relentless advancement in smartphone hardware, operating systems, and network speeds, particularly the widespread adoption of 5G, directly shapes the sophistication of mobile games and applications Aeria can create. For instance, by mid-2024, 5G network availability is projected to cover over 60% of the global population, enabling richer, more interactive mobile experiences.

Aeria's success hinges on optimizing its content for a vast array of mobile devices and effectively utilizing emerging features to attract and keep its mobile audience engaged. This strategic adaptation is crucial for staying competitive in a market where mobile gaming revenue is expected to reach $135 billion in 2024.

Furthermore, these technological shifts significantly influence how Aeria can monetize its mobile offerings, as users increasingly expect seamless, high-quality, and data-intensive content, driving demand for innovative in-app purchases and subscription models.

Cybersecurity Technologies

As an online game developer and IT solutions provider, Aeria operates in an environment where cybersecurity is a critical concern. Threats like data breaches, distributed denial-of-service (DDoS) attacks, and in-game cheating are persistent challenges that require significant investment in advanced security measures. Protecting sensitive user data and ensuring uninterrupted service availability are paramount to maintaining customer trust and Aeria's brand reputation.

The landscape of cyber threats is constantly evolving, necessitating continuous adaptation and upgrades to cybersecurity technologies. For instance, the global cost of cybercrime was projected to reach $10.5 trillion annually by 2025, highlighting the immense financial stakes involved. Aeria must stay ahead of these threats by implementing state-of-the-art solutions.

- Advanced Threat Detection: Implementing AI-powered systems to identify and neutralize novel cyber threats in real-time.

- Data Encryption: Employing robust encryption protocols for all user data, both in transit and at rest, to prevent unauthorized access.

- DDoS Mitigation: Utilizing specialized services and infrastructure to absorb and filter malicious traffic during DDoS attacks, ensuring service continuity.

- Secure Development Practices: Integrating security into the software development lifecycle to minimize vulnerabilities in Aeria's games and IT solutions.

Artificial Intelligence and Machine Learning

Artificial intelligence (AI) and machine learning (ML) are poised to significantly transform the gaming industry, offering Aeria opportunities to enhance its offerings. These technologies can revolutionize game development through procedural content generation, creating vast and dynamic game worlds, and by powering more sophisticated non-player characters (NPCs) that offer richer player interactions. For instance, the global AI in gaming market was valued at approximately $2.1 billion in 2023 and is projected to reach over $12 billion by 2030, showcasing substantial growth potential.

Aeria can strategically leverage AI and ML to elevate the player experience through advanced personalization, tailoring game content and recommendations to individual player preferences. Beyond gameplay, these technologies are crucial for bolstering security and operational efficiency, particularly in areas like fraud detection within online gaming environments and optimizing IT infrastructure. Companies are increasingly investing in AI for these purposes; a 2024 survey indicated that over 70% of gaming companies are exploring or implementing AI solutions.

By embracing early adoption of AI and ML, Aeria can secure a substantial competitive edge. This proactive approach allows for the development of innovative new services and the refinement of existing ones, leading to improved user engagement and operational cost savings. The ongoing advancements in AI, such as generative AI models, are expected to further accelerate these capabilities, enabling Aeria to create more immersive and personalized gaming experiences.

- AI in gaming market projected to grow from $2.1 billion in 2023 to over $12 billion by 2030.

- Over 70% of gaming companies are exploring or implementing AI solutions as of 2024.

- AI enhances procedural content generation, NPC intelligence, and player personalization.

- Machine learning is vital for fraud detection and IT solution optimization in online gaming.

The rapid evolution of cloud computing, with the global market projected to exceed $1.3 trillion by 2025, makes scalable and efficient IT infrastructure a cornerstone for Aeria's operations. Leveraging cloud and edge computing is crucial for delivering the low-latency experiences demanded by a global player base, directly impacting player retention and operational costs.

Advancements in mobile technology, including 5G adoption which is expected to cover over 60% of the global population by mid-2024, enable Aeria to develop more sophisticated mobile games. This directly influences revenue streams, with mobile gaming revenue projected at $135 billion in 2024, necessitating optimization for diverse devices and emerging features.

Artificial intelligence and machine learning are transforming gaming, with the AI in gaming market expected to surge from $2.1 billion in 2023 to over $12 billion by 2030. Aeria can gain a competitive edge by integrating AI for procedural content generation, enhanced NPCs, player personalization, and optimizing IT infrastructure, as over 70% of gaming companies were exploring AI in 2024.

Cybersecurity remains a critical technological factor, with the global cost of cybercrime projected to reach $10.5 trillion annually by 2025. Aeria must invest in advanced threat detection, data encryption, DDoS mitigation, and secure development practices to protect user data and ensure service continuity.

| Technology Area | 2024/2025 Projection/Status | Impact on Aeria |

|---|---|---|

| Cloud Computing Market | Projected to exceed $1.3 trillion by 2025 | Enables scalable operations and low-latency experiences |

| 5G Network Availability | Over 60% global population coverage by mid-2024 | Facilitates richer, more interactive mobile gaming |

| AI in Gaming Market | $2.1 billion (2023) to over $12 billion (2030) | Enhances game development, personalization, and security |

| Global Cybercrime Cost | Projected to reach $10.5 trillion annually by 2025 | Requires robust cybersecurity investments for data protection |

Legal factors

Aeria must navigate a complex web of consumer protection laws, particularly concerning online transactions, refund policies, and advertising standards across all its publishing territories. Failure to comply, for instance with the EU's General Data Protection Regulation (GDPR) which impacts how user data is handled, can result in substantial penalties. For example, in 2023, the UK's Competition and Markets Authority (CMA) took action against several gaming companies for misleading pricing and unfair contract terms, highlighting the scrutiny on the industry.

Maintaining absolute transparency in terms of service and detailing all in-game purchase mechanics is critical to building and retaining consumer trust. This includes clear explanations of loot box probabilities and any potential for hidden fees. The Digital Services Act in the EU, fully applicable from February 2024, imposes stricter obligations on online platforms, including game publishers, regarding content moderation and user rights, which Aeria must actively address.

Aeria Corporation navigates a complex web of labor laws, encompassing minimum wage requirements, workplace safety standards, and regulations governing employee intellectual property. For instance, in 2024, the US Department of Labor reported an average hourly wage increase across technology sectors, necessitating Aeria's careful compensation strategy.

Compliance with unionization rights and collective bargaining agreements is also critical, especially as Aeria expands its global talent pool. Failure to adhere to these regulations, such as those outlined in the National Labor Relations Act, can lead to costly litigation and operational disruptions, impacting workforce stability.

The legal landscape for content licensing and copyright is paramount for Aeria, given its reliance on both owned and third-party intellectual property. Navigating these regulations ensures Aeria can legally utilize external content while safeguarding its own creative assets. This is crucial for maintaining a stable revenue flow and preventing costly legal disputes.

In 2024, the global digital content market saw significant growth, underscoring the importance of robust IP protection. For instance, the music industry alone generated over $26 billion in revenue in 2023, a substantial portion of which is driven by licensing agreements. Aeria must ensure its licensing practices are compliant to tap into and benefit from such markets, while also protecting its own innovations from unauthorized use.

Online Gambling and Loot Box Legislation

The legal landscape surrounding online gambling and in-game monetization, particularly 'loot boxes', is a critical factor for Aeria. Several countries have begun classifying these mechanics as gambling, leading to stricter regulations. For instance, Belgium and the Netherlands have already taken action against certain loot box implementations, impacting game availability in those markets.

Aeria must remain vigilant regarding these evolving legal frameworks. Non-compliance can result in significant fines and restrictions on market access, directly affecting revenue streams and player acquisition. Adapting game design and monetization strategies proactively is essential to navigate these challenges successfully.

- Loot Box Classification: Jurisdictions like Belgium have classified certain loot boxes as gambling, leading to potential bans or heavy regulation.

- Regulatory Scrutiny: Governments globally are increasing their focus on consumer protection in digital gaming, particularly concerning monetization practices.

- Market Access Impact: Failure to comply with loot box regulations can lead to Aeria being unable to offer its games in specific, lucrative markets.

- Compliance Costs: Adapting game mechanics and monetization models to meet diverse legal requirements can incur substantial development and legal expenses.

Anti-Trust and Competition Law

As Aeria Inc. expands, particularly through potential mergers and acquisitions or significant market plays, strict adherence to anti-trust and competition laws becomes paramount. These regulations are designed to prevent monopolistic practices and foster a level playing field within the competitive gaming and broader IT industries. Failure to comply can result in substantial fines and hinder strategic growth initiatives, including market expansion and the formation of crucial partnerships.

Regulatory bodies worldwide, such as the U.S. Federal Trade Commission (FTC) and the European Commission, actively scrutinize mergers and acquisitions to ensure they do not stifle competition. For instance, in 2023, the FTC challenged several tech mergers, highlighting an ongoing trend of increased regulatory oversight. Aeria must navigate these complex legal landscapes, ensuring its business strategies align with competition mandates to avoid penalties and maintain market access.

- Regulatory Scrutiny: Increased global enforcement of anti-trust laws impacts M&A activity in the tech and gaming sectors.

- Market Dominance Concerns: Regulators are vigilant against companies achieving dominant market positions that could harm consumers or smaller competitors.

- Strategic Partnership Impact: Competition laws can influence the terms and feasibility of joint ventures and strategic alliances Aeria might consider.

Aeria must navigate evolving data privacy regulations, such as the California Consumer Privacy Act (CCPA) and its successor, the California Privacy Rights Act (CPRA), which grant consumers more control over their personal information. These laws, effective in 2023 and with further provisions in 2025, impose strict requirements on data collection, usage, and deletion, impacting Aeria's user engagement strategies and marketing efforts.

Compliance with international data transfer frameworks, like the EU-U.S. Data Privacy Framework, is crucial for Aeria's global operations. This framework, established in 2023, provides a mechanism for transferring personal data from the EU to certified U.S. companies, but requires careful adherence to its principles to avoid disruptions.

The legal framework for intellectual property, particularly copyright and trademark law, remains a cornerstone for Aeria's business model. Protecting its own game assets and ensuring proper licensing for third-party content are vital. For instance, the U.S. Copyright Office reported a significant increase in digital content registrations in 2023, reflecting the growing importance of IP in the digital age.

Aeria must also stay abreast of changes in tax laws, including digital services taxes and international tax treaties, which can affect its revenue recognition and profit margins across different operating regions. For example, the OECD's Pillar Two rules, aiming for a global minimum corporate tax rate, began impacting multinational enterprises in 2024, requiring adjustments to financial planning.

| Legal Factor | Description | Impact on Aeria | Relevant 2023/2024 Data/Trend |

| Data Privacy | Regulations like CCPA/CPRA and GDPR | Requires robust data handling policies, impacts marketing and user data management. | CCPA enforcement actions increased in 2023; CPRA provisions expand consumer rights from 2025. |

| Intellectual Property | Copyright and trademark laws | Essential for protecting game assets and licensing content; requires diligent IP management. | Digital content registrations saw a notable rise in 2023, highlighting IP's value. |

| Taxation | Digital services taxes, international tax treaties | Affects revenue recognition and profitability; necessitates careful financial strategy. | OECD's Pillar Two implementation in 2024 impacts global corporate tax rates. |

Environmental factors

The burgeoning demand for online gaming and sophisticated IT solutions places a substantial energy burden on data centers. Aeria, like many in the tech sector, is feeling the heat to curb its environmental impact. This means a serious push towards more energy-efficient hardware and a greater reliance on renewable energy sources to power these operations.

In 2024, data centers globally are estimated to consume around 1.5% of the world's electricity, a figure projected to rise. For Aeria, this translates directly into increased operational expenses if energy efficiency isn't prioritized. Furthermore, aligning with sustainability goals is becoming a critical component of corporate social responsibility, influencing investor sentiment and brand reputation.

Aeria, even as a software-focused entity, operates within the broader IT ecosystem, which inevitably generates electronic waste, or e-waste. The responsible management of this waste is crucial, particularly as the company's IT infrastructure scales and potentially expands into hardware-related investments. For instance, in 2023, global e-waste generation reached an estimated 62 million metric tons, a figure projected to climb significantly in the coming years.

Navigating the complex landscape of e-waste regulations is paramount for Aeria. Companies must ensure compliance with increasingly stringent disposal and recycling mandates, which vary by region. Failure to do so can result in substantial fines and reputational damage. Promoting responsible disposal practices, such as partnering with certified e-waste recyclers, not only mitigates environmental impact but also aligns with growing corporate social responsibility expectations.

Extreme weather events, amplified by climate change, pose a significant threat to Aeria's physical infrastructure, including data centers and network cables. For instance, the U.S. experienced 28 separate billion-dollar weather and climate disasters in 2023, totaling over $92.9 billion in damages, highlighting the increasing vulnerability of critical infrastructure.

To counter this, Aeria must prioritize resilient infrastructure planning and robust disaster recovery protocols. This ensures uninterrupted service continuity even when faced with disruptions. Companies are increasingly investing in hardening their facilities; for example, Google Cloud announced in 2024 a significant expansion of its renewable energy procurement to power its data centers, aiming for 24/7 carbon-free operations by 2030, demonstrating a commitment to environmental resilience.

Furthermore, Aeria's strategic location selection for new facilities must now incorporate thorough climate risk assessments. This proactive approach helps mitigate future operational disruptions and associated financial losses, aligning with industry trends where companies are factoring climate resilience into their long-term capital expenditure planning.

Supply Chain Sustainability

Aeria's commitment to environmental responsibility extends to its supply chain. For hardware components and IT services procured externally, Aeria must scrutinize the environmental practices of its suppliers, from raw material extraction to final product assembly. This diligence is crucial for mitigating reputational damage and ensuring ethical sourcing.

A sustainable supply chain directly impacts Aeria's overall environmental footprint. By prioritizing suppliers with robust environmental management systems, Aeria can reduce its indirect emissions and waste generation. For instance, the growing pressure on tech companies to disclose their Scope 3 emissions, which include supply chain impacts, highlights the financial and strategic importance of this area. A report by CDP in late 2024 indicated that over 70% of companies surveyed were engaging with suppliers on climate change, a trend expected to accelerate.

- Supplier Audits: Implementing regular environmental audits for key suppliers to assess their adherence to sustainability standards.

- Material Sourcing: Prioritizing suppliers who utilize recycled materials or employ eco-friendly manufacturing processes.

- Circular Economy Principles: Encouraging suppliers to adopt circular economy models, reducing waste and promoting resource efficiency.

- Transparency: Demanding greater transparency from suppliers regarding their environmental performance data and certifications.

Corporate Environmental Responsibility (CER)

Aeria's Corporate Environmental Responsibility (CER) is increasingly scrutinized, directly impacting its brand and investor relations. Growing investor demand for ESG integration, with sustainable funds projected to reach $50 trillion globally by 2025, means Aeria's environmental performance is a key differentiator. Demonstrating robust sustainability initiatives can solidify its reputation and attract capital.

Aeria's commitment to reducing its carbon footprint, for instance, by investing in renewable energy sources for its operations, can significantly enhance its appeal to environmentally conscious consumers and investors. Companies with strong environmental records often see improved financial performance and lower operational risks. For example, in 2024, companies in the top quartile for ESG performance saw a 13% higher return on equity compared to those in the bottom quartile.

Key environmental considerations for Aeria include:

- Carbon Emission Reduction: Setting ambitious targets for reducing greenhouse gas emissions across its value chain.

- Waste Management and Circularity: Implementing strategies to minimize waste and promote circular economy principles in product design and operations.

- Water Stewardship: Ensuring responsible water usage and management, particularly in water-stressed regions where Aeria may operate.

- Biodiversity and Ecosystem Protection: Mitigating the impact of operations on natural habitats and contributing to conservation efforts.

Aeria's environmental strategy must address the significant energy demands of its operations, particularly data centers, which are projected to consume an increasing share of global electricity. Aligning with sustainability goals is no longer optional; it's crucial for investor appeal and brand reputation, especially as global e-waste generation continues to climb, necessitating responsible disposal practices.

Climate change impacts, such as extreme weather events, pose a direct threat to Aeria's infrastructure, underscoring the need for resilient planning and disaster recovery. Furthermore, scrutinizing the environmental practices of suppliers is vital for mitigating indirect emissions and ensuring ethical sourcing, a trend amplified by increasing demands for Scope 3 emissions disclosure.

| Environmental Factor | 2024/2025 Data/Trend | Implication for Aeria |

|---|---|---|

| Data Center Energy Consumption | Estimated 1.5% of global electricity in 2024, projected to rise. | Increased operational costs if efficiency is not prioritized; need for renewable energy integration. |

| E-waste Generation | Global e-waste reached 62 million metric tons in 2023, expected to increase. | Compliance with disposal regulations is critical; reputational risk if not managed. |

| Extreme Weather Events | U.S. experienced 28 billion-dollar weather disasters in 2023 ($92.9B damages). | Need for resilient infrastructure and robust disaster recovery plans to ensure service continuity. |

| Supply Chain Sustainability | Over 70% of companies surveyed by CDP in late 2024 engaged suppliers on climate change. | Pressure to disclose Scope 3 emissions; importance of vetting supplier environmental practices. |

| ESG Investment Growth | Sustainable funds projected to reach $50 trillion globally by 2025. | Strong environmental performance is a key differentiator for attracting capital and enhancing brand reputation. |

PESTLE Analysis Data Sources

Our PESTLE analysis for Aeria is meticulously constructed using a blend of official government publications, reputable industry research firms, and leading economic and technological forecasting agencies. This ensures a comprehensive and accurate understanding of the external factors influencing Aeria's operating environment.