Aeria Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aeria Bundle

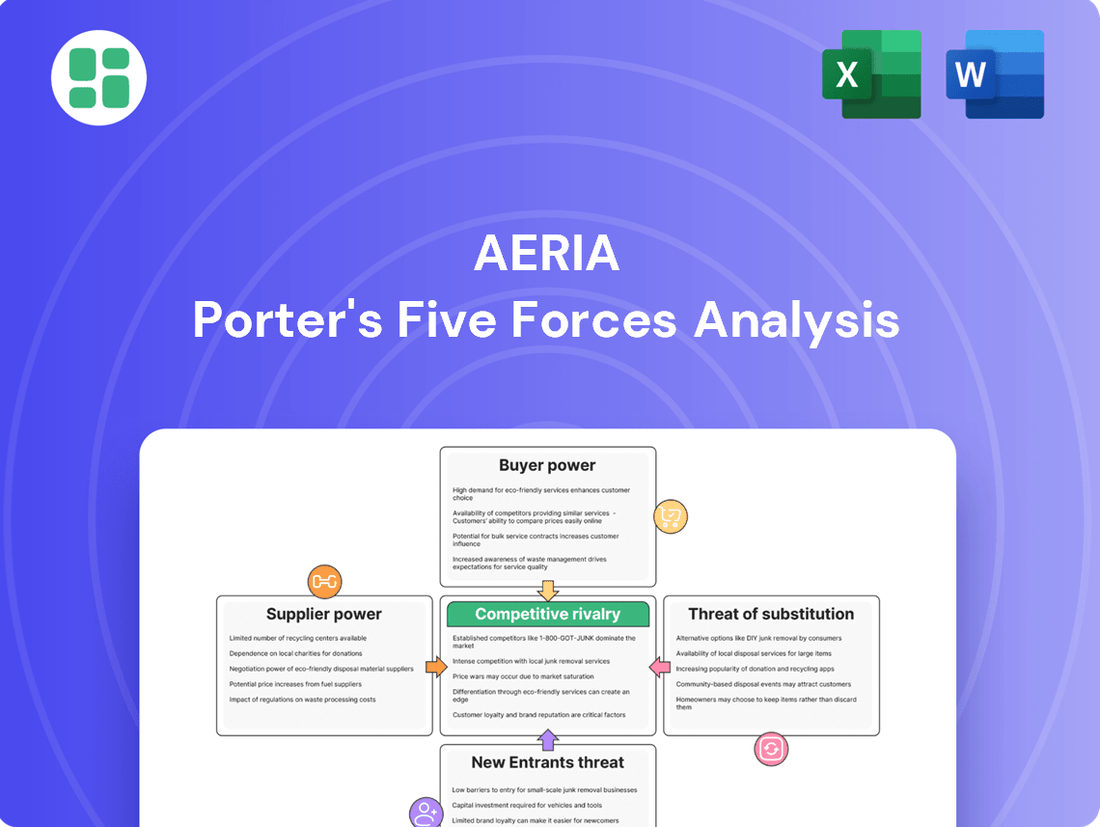

Aeria's competitive landscape is shaped by the interplay of five key forces, revealing the intensity of rivalry and the potential for profitability. Understanding these dynamics is crucial for navigating the market effectively.

The complete report reveals the real forces shaping Aeria’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Aeria Corporation's reliance on specialized game developers and intellectual property (IP) significantly influences supplier bargaining power. Developers with unique, in-demand skills or established IPs can command higher licensing fees or development contracts, impacting Aeria's costs and content pipeline.

In 2024, the gaming industry continued to see high demand for experienced developers, particularly those with expertise in trending genres like live-service games or immersive RPGs. Companies often face bidding wars for top talent, which directly translates to increased labor costs for studios like Aeria.

Furthermore, the owners of popular gaming IPs hold substantial leverage. Licensing fees for well-known franchises can be considerable, reflecting the guaranteed player engagement and revenue potential these IPs bring. Aeria's ability to secure and retain access to such valuable content is a critical factor in its competitive standing.

Suppliers of critical technology and infrastructure, such as game engine developers like Unity and Unreal Engine, cloud service providers like AWS and Azure, and payment gateway services, wield significant influence. These providers are essential for Aeria's operations, and their pricing or service terms can directly impact Aeria's profitability and competitiveness.

The costs associated with switching major technology platforms or payment systems are often substantial for a company like Aeria. For instance, migrating a complex game's backend infrastructure or its entire payment processing system can involve considerable time, resources, and potential disruption, thereby increasing Aeria's reliance on its current providers and strengthening their bargaining position.

The rapid pace of technological evolution, particularly in fields like artificial intelligence and cloud computing, means Aeria must depend on these external suppliers to maintain its competitive edge. Industry analyses from 2024 indicate continued heavy investment in these areas by major tech firms, underscoring Aeria's need to stay current through these partnerships, which further solidifies supplier power.

The availability of skilled talent in game development, IT solutions, and digital marketing significantly influences Aeria's operational costs. Programmers, artists, and game designers are in high demand, granting these professionals considerable bargaining power.

In 2024, the average salary for a senior game developer in major tech hubs could range from $120,000 to $180,000 annually. This high demand means Aeria must offer competitive compensation and benefits to attract and retain top-tier talent, directly impacting project budgets and timelines.

Marketing and User Acquisition Platforms

Marketing and user acquisition platforms, like the Apple App Store and Google Play Store, hold considerable sway over businesses. These channels are crucial for reaching potential customers, and their policies and fees directly impact profitability. In 2024, the mobile gaming sector experienced intense competition for user attention, with a notable increase in advertising spend and creative assets.

The bargaining power of these platforms is amplified by their control over vast user bases and their ability to set advertising terms. For instance, app store commissions can range from 15% to 30%, significantly impacting revenue for developers. Mobile ad networks also play a vital role, with their reach and targeting capabilities influencing acquisition costs. The escalating competition in 2024 meant that advertisers often faced higher costs per install (CPI) due to the sheer volume of demand.

- Platform Control: Major app stores and social media giants act as gatekeepers to user acquisition.

- Pricing Power: These platforms dictate advertising costs and commission structures, directly affecting business margins.

- Market Dynamics (2024): Increased advertiser competition led to higher acquisition costs and a demand for more sophisticated ad creatives.

- User Base Access: Their extensive reach makes them indispensable, limiting alternatives for many businesses.

Cost of Raw Materials and Hardware

Aeria Porter's reliance on IT hardware and potential software licenses means that fluctuations in these costs directly affect its operational expenses. For instance, the global semiconductor shortage experienced in 2021-2022 significantly increased the price of server components, a trend that could resurface if supply chains are disrupted again.

The increasing demand for data center infrastructure, fueled by the widespread adoption of cloud computing and the burgeoning field of artificial intelligence, is a key factor. This surge in demand, projected to continue through 2024 and beyond, can lead to higher prices for essential hardware like high-performance servers and networking equipment, impacting Aeria's capital expenditure and operational costs.

- Hardware Costs: Aeria's IT infrastructure relies on servers and networking equipment, whose prices are subject to global supply and demand dynamics.

- Software Licensing: Potential reliance on specialized software licenses can introduce variable costs based on vendor pricing strategies.

- Data Center Investment Surge: Increased investment in data centers globally, driven by cloud and AI, is pushing up the cost of critical hardware components.

- Supply Chain Vulnerabilities: Past disruptions, like the semiconductor shortage, highlight the potential for price volatility in hardware procurement.

Suppliers of specialized talent, intellectual property, and critical technology hold significant leverage over Aeria Corporation. This power stems from their unique offerings, the high cost of switching providers, and the intense demand within the gaming industry. In 2024, the competition for skilled game developers, particularly those with expertise in live-service or RPG genres, drove up salaries, with senior roles commanding $120,000-$180,000 annually in tech hubs.

Owners of popular gaming IPs can dictate substantial licensing fees, as demonstrated by the guaranteed revenue these franchises generate, while essential tech providers like Unity, Unreal Engine, AWS, and Azure influence Aeria's operational costs through their pricing and service terms. The substantial investment required to switch these platforms further solidifies supplier power.

Marketing and user acquisition channels, such as app stores and ad networks, also exert considerable influence. App store commissions typically range from 15% to 30%, directly impacting revenue, and the heightened competition for users in 2024 led to increased advertising costs per install (CPI).

| Supplier Category | Key Factors Influencing Bargaining Power | Impact on Aeria (2024 Context) |

|---|---|---|

| Specialized Game Developers | Unique skills, in-demand genres, talent scarcity | Increased labor costs due to bidding wars for talent; potential delays in content pipeline. |

| IP Owners | Brand recognition, player engagement potential | High licensing fees for popular franchises, impacting content acquisition costs. |

| Technology Providers (Engines, Cloud) | Essential infrastructure, high switching costs | Direct impact on operational expenses and profitability; reliance due to migration complexity. |

| Marketing/User Acquisition Platforms | User base access, platform policies, advertising terms | Significant revenue share through commissions (15-30%); rising ad costs (CPI) due to market competition. |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Aeria's position in the gaming industry.

Instantly identify and address competitive threats with a comprehensive, visual breakdown of all five forces.

Customers Bargaining Power

For Aeria's gaming customers, the ease with which they can switch between different online and mobile games significantly weakens the company's bargaining power. With numerous free-to-play titles readily available, players can effortlessly transition to a competitor if they are unhappy with Aeria's offerings, be it the gameplay, monetization strategies, or customer support.

This low barrier to exit means Aeria must constantly innovate and deliver compelling content to retain its player base. In 2024, the mobile gaming market alone generated over $90 billion globally, highlighting the intense competition and the need for Aeria to stand out to prevent player churn.

Gamers, especially in the mobile and free-to-play online spaces, often exhibit significant price sensitivity. This is particularly true for in-app purchases and subscription services. While mobile gaming saw revenue growth from in-app purchases in 2024, the prevalence of free-to-play models, which rely on optional transactions or advertising, remains a dominant trend.

Customers seeking entertainment have a vast selection of options beyond Aeria's offerings. This includes a wide range of video games across different platforms, popular streaming services like Netflix and Disney+, engaging social media applications, and even traditional forms of entertainment. This broad competitive landscape significantly enhances customer bargaining power.

The mobile gaming market itself, while a significant segment, is quite mature and highly fragmented. Numerous publishers are vying for player attention, leading to a crowded marketplace. In 2024, the global mobile gaming market was valued at over $90 billion, with a substantial portion of this revenue coming from in-app purchases, a segment where customer choice is paramount.

Fragmented Gaming Customer Base

Aeria's gaming customer base is incredibly diverse, made up of millions of individual players worldwide. This vast number means no single player holds significant sway in negotiations. However, the collective voice of these players, amplified through reviews, community forums, and social media, can powerfully shape public opinion and affect how many new players are drawn to Aeria's games. For instance, a strong positive community buzz can lead to a significant uptick in user acquisition, while widespread negative feedback can deter potential players.

The sheer scale of Aeria's player base, numbering in the tens of millions across its various titles, underscores this fragmentation. While individual players have minimal bargaining leverage, their aggregated influence is substantial. Consider that in 2024, the global gaming market was valued at over $200 billion, with player engagement being a key driver of revenue. This highlights how crucial positive community sentiment is for Aeria's sustained success and market position.

- Fragmented Player Base: Millions of individual gamers worldwide.

- Collective Influence: User reviews, community feedback, and social media trends impact perception.

- Market Impact: Positive sentiment can boost new player acquisition; negative sentiment can deter them.

- 2024 Market Value: Global gaming market exceeded $200 billion, emphasizing player engagement's importance.

Demand for Quality and Engagement

Gamers today have incredibly high expectations. They want games that look amazing, run smoothly, and keep them hooked with fresh content and great support. For instance, in 2024, the mobile gaming market saw a strong emphasis on live service games and leveraging established intellectual property, with companies like Tencent and NetEase focusing on long-term player engagement strategies to maximize lifetime value.

This demand for quality and constant engagement directly impacts the bargaining power of customers. If a game doesn't deliver on these fronts, players can quickly move on to competitors. This is especially true in the mobile space, where a vast array of options are readily available. In 2024, player retention metrics, such as daily active users (DAU) and monthly active users (MAU), remained critical performance indicators, directly influencing a game's revenue potential and the developer's ability to command premium pricing or in-app purchases.

- High Expectations: Players demand cutting-edge graphics, seamless performance, and continuous updates.

- Engagement is Key: Ongoing content, community interaction, and responsive support are crucial for retention.

- Impact on Revenue: Failure to meet these standards leads to quick churn and lost revenue opportunities.

- Market Trends: The 2024 focus on live service games and established IPs highlights the importance of sustained player satisfaction.

The bargaining power of customers is significantly amplified by the sheer abundance of choices available in the gaming market. With millions of games across various platforms, players can easily switch if they find a better experience elsewhere. This is particularly true for mobile gaming, a sector valued at over $90 billion globally in 2024, where free-to-play titles offer low barriers to entry and exit.

Price sensitivity is another key factor; players often expect free-to-play models or are hesitant to spend on in-app purchases if competitors offer similar value for less. The market's fragmentation, with numerous publishers vying for attention, further empowers consumers. In 2024, the global gaming market's overall value exceeding $200 billion underscores the intense competition and the critical need for companies like Aeria to offer compelling value to retain their player base.

| Factor | Description | Impact on Aeria | 2024 Data Point |

|---|---|---|---|

| Availability of Substitutes | Numerous competing games and entertainment options exist. | Weakens Aeria's pricing power and customer loyalty. | Mobile gaming market valued at over $90 billion. |

| Price Sensitivity | Players are often sensitive to in-app purchase costs and subscription fees. | Forces Aeria to offer competitive pricing and value. | Dominance of free-to-play models in mobile gaming. |

| Customer Information | Players can easily research and compare games and pricing. | Increases transparency and pressure on Aeria to be competitive. | Growth in player review sites and gaming communities. |

Preview Before You Purchase

Aeria Porter's Five Forces Analysis

You're previewing the final version of our Aeria Porter's Five Forces Analysis. This comprehensive document, detailing the competitive landscape for Aeria, is precisely the same file that will be available to you instantly after completing your purchase. You can trust that what you see is exactly what you'll receive, ready for immediate application in your strategic planning.

Rivalry Among Competitors

The gaming landscape is incredibly crowded, with a vast number of companies competing for player engagement. This includes giants like Tencent, which reported over $20 billion in gaming revenue in 2023, alongside countless smaller independent developers.

The sheer volume of competitors, especially in the booming mobile gaming sector which accounted for an estimated 50% of the global gaming market revenue in 2023, means companies must constantly innovate to stand out. This intense rivalry drives down prices and necessitates significant marketing spend to capture market share.

The mobile gaming market in 2024 is characterized by intense competition for acquiring new users, a trend exacerbated by plateauing download numbers. Companies are heavily investing in aggressive marketing and user acquisition campaigns, leading to significantly higher advertising costs. This heightened competition directly impacts pricing strategies and monetization models, creating a challenging landscape for all players.

This fierce competition means that even well-established games are finding it increasingly difficult to maintain player engagement and attract a consistent stream of new players. The cost to acquire a single user, often referred to as Customer Acquisition Cost (CAC), has seen a substantial increase across the industry. For instance, some reports indicated that in 2023, the average CAC for mobile games could range from $2 to $5, a figure that is expected to continue its upward trajectory in 2024 due to these market dynamics.

The gaming and IT industries are characterized by relentless technological evolution, with breakthroughs in AI, cloud gaming, and AR/VR constantly reshaping the landscape. This rapid pace means companies like Aeria must stay ahead of the curve.

Competitors are perpetually launching new games, innovative features, and novel business models, forcing Aeria to continuously refresh its portfolio. This necessitates substantial investment in research and development, directly fueling the intensity of competitive rivalry.

For instance, the global gaming market was projected to reach over $200 billion in 2023, underscoring the high stakes and the need for constant innovation to capture market share.

Focus on Live Services and Established IP

The gaming industry in 2024 continued to emphasize the importance of live services, with developers focusing on maximizing revenue from existing, successful titles. This trend means that established intellectual property (IP) and strong brand recognition are crucial for sustained growth and market presence.

New game releases face significant challenges in capturing player attention and market share when competing against these evergreen, well-supported titles. Companies like Aeria must therefore commit substantial resources to live operations, including content updates, community engagement, and monetization strategies, to maintain player interest and revenue streams.

Leveraging existing or licensed popular IPs can be a powerful strategy to cut through the noise and attract a ready audience. For instance, the continued success of games built on established franchises highlights the value of brand loyalty in a crowded marketplace.

- Live Service Dominance: 2024 data shows a continued trend of developers prioritizing the ongoing support and monetization of live-service games over entirely new IP launches.

- IP as a Competitive Edge: Games leveraging established and popular intellectual property (IP) demonstrated higher player retention and revenue generation compared to those relying solely on new concepts.

- Challenges for New Entrants: The market saturation with successful live titles makes it increasingly difficult for new, unproven games to gain traction and build a substantial player base.

- Strategic Imperative: Investment in robust live operations and the strategic use of existing or licensed IPs are essential for companies like Aeria to remain competitive and achieve market success.

Price and Feature-Based Competition

Competitive rivalry in the gaming sector, particularly for entities like Aeria Porter, frequently centers on price and features. Many titles adopt free-to-play models, monetizing through in-app purchases, which intensifies competition on both initial accessibility and ongoing value. Differentiation becomes critical, often achieved through unique gameplay mechanics, robust community engagement, and high-quality, exclusive content.

The IT solutions arm of such a company also experiences intense rivalry. Success here hinges on delivering superior service quality, maintaining cost-effectiveness, and possessing specialized technical expertise. Companies must continuously innovate and adapt their offerings to meet evolving client needs and industry standards.

- Gaming Monetization: In 2023, the global games market generated an estimated $184 billion, with mobile gaming accounting for the largest share, highlighting the prevalence of in-app purchase models.

- IT Services Market: The global IT services market reached approximately $1.3 trillion in 2023, with growth driven by cloud computing, cybersecurity, and digital transformation initiatives.

- Feature Differentiation: Games with unique intellectual property or innovative gameplay mechanics often command higher player retention rates and revenue.

- Service Value: IT service providers differentiate by offering specialized skills in areas like AI integration and data analytics, which saw significant demand in 2024.

Competitive rivalry in the gaming sector is fierce, driven by a vast number of players and a constant stream of new releases. Companies like Tencent, with over $20 billion in gaming revenue in 2023, set a high bar.

The mobile gaming market, representing about 50% of global gaming revenue in 2023, sees intense competition for user acquisition, pushing up marketing costs. This necessitates constant innovation and strong live service operations to retain players against established titles.

Differentiation through unique gameplay, community engagement, and leveraging popular IPs is crucial. For instance, games built on established franchises often see better player retention, a key factor in the $184 billion global games market of 2023.

The IT services market, valued at around $1.3 trillion in 2023, also experiences intense competition, with success depending on service quality, cost-effectiveness, and specialized skills in areas like AI and data analytics.

| Metric | 2023 Value | Trend | Impact on Rivalry |

| Global Gaming Revenue | $184 Billion | Growth | Intensifies competition for market share |

| Mobile Gaming Share | ~50% | Dominant | Focus on mobile user acquisition |

| Tencent Gaming Revenue | >$20 Billion | Strong | Sets benchmark for large players |

| Global IT Services Market | ~$1.3 Trillion | Growth | Drives competition on specialized skills |

SSubstitutes Threaten

The most significant threat to Aeria's gaming business stems from the vast array of alternative entertainment options vying for consumer attention and spending. These include popular video streaming services like Netflix and YouTube, which saw global revenue reach approximately $245 billion in 2023, social media platforms, music streaming services, traditional media such as television and movies, reading, and even outdoor recreational activities.

These diverse entertainment forms directly compete for consumers' limited leisure time and disposable income. For instance, the global social media market size was valued at over $600 billion in 2023, illustrating the immense draw of these platforms. This intense competition means Aeria must continuously innovate and offer compelling experiences to retain its user base.

Gamers have a wide array of alternative platforms to Aeria's core PC and smartphone offerings. Consoles like PlayStation, Xbox, and Nintendo Switch, alongside dedicated handhelds, provide robust gaming experiences that can easily substitute for PC or mobile play.

While mobile gaming dominated the market, capturing a substantial portion of revenue, PC and console gaming remain significant revenue generators. In 2023, the global gaming market was valued at an estimated $184 billion, with mobile gaming accounting for roughly 50% of that, underscoring the continued importance of PC and console segments as viable alternatives.

The increasing prevalence of cross-platform play further erodes platform loyalty. This trend allows players on different devices to compete and engage together, making the specific platform less of a barrier and increasing the threat of substitution for Aeria's games.

For Aeria's IT solutions, a significant threat comes from businesses building their own IT infrastructure internally or choosing readily available software packages instead of bespoke services. This bypasses the need for external IT providers like Aeria, especially for companies with simpler or more standardized IT requirements.

Furthermore, general-purpose productivity suites and cloud-based platforms can often fulfill the needs met by specialized IT solutions, acting as accessible substitutes. For instance, many businesses can leverage Microsoft 365 or Google Workspace for collaboration and data management, reducing reliance on custom-built systems. The growing trend of Equipment-as-a-Service (EaaS) in the IT sector also offers an alternative procurement model, allowing companies to access necessary technology and support on a subscription basis, thereby substituting traditional IT project investments.

Emerging Technologies as Substitutes

New technological advancements, such as highly immersive virtual reality (VR) and augmented reality (AR) experiences, or the metaverse, could serve as substitutes for traditional online and mobile gaming experiences. While still niche, these technologies are attracting significant investment and could evolve into more mainstream entertainment forms, offering different ways for users to interact with digital content.

The gaming industry saw substantial growth in 2023, with global gaming revenue projected to reach over $184 billion. However, the emergence of VR and AR platforms, with significant investments pouring in, poses a potential threat. For instance, Meta Platforms invested approximately $10 billion in its Reality Labs division in 2023, signaling a strong commitment to developing the metaverse and VR/AR experiences that could divert consumer attention and spending from existing gaming formats.

- VR/AR Investment: Meta's $10 billion investment in Reality Labs in 2023 highlights the significant capital flowing into alternative digital experiences.

- Market Evolution: As VR and AR technology matures and becomes more accessible, it could offer compelling alternatives to current online and mobile gaming.

- Consumer Engagement: The potential for more interactive and immersive digital entertainment in the metaverse could shift user engagement away from traditional gaming platforms.

User-Generated Content (UGC) Platforms

User-generated content (UGC) platforms present a significant threat of substitutes for companies like Aeria. Platforms such as Roblox and Minecraft offer immersive, creative, and interactive experiences that directly compete for user attention, particularly with younger audiences. In 2023, Roblox reported over 250 million daily active users, highlighting the immense scale of engagement these platforms command. This user-driven content creation model provides a diverse and constantly evolving entertainment landscape that can divert users from traditionally developed and published games.

While Aeria focuses on its proprietary game development and publishing, UGC platforms empower their user bases to become creators themselves. This democratizes game creation and offers a vast array of experiences that a single company might not be able to produce. For instance, Minecraft's marketplace sees millions of user-created items and worlds being sold, demonstrating a powerful alternative entertainment ecosystem. This ability for users to create, share, and even monetize their own digital experiences poses a substantial competitive challenge.

The threat is amplified by the accessibility and community aspects of UGC platforms. They foster strong social connections and a sense of ownership among users, making them sticky. Consider that in 2023, the creator economy, which UGC platforms heavily leverage, was valued at over $100 billion globally. This economic incentive further fuels the creation of content that directly substitutes for professionally developed games, offering a continuous stream of novel entertainment without the direct development costs typically borne by publishers like Aeria.

- UGC Platforms as Substitutes: Roblox and Minecraft offer interactive, creative experiences competing for user engagement, especially among younger demographics.

- User Empowerment: UGC platforms allow users to create and share their own games and experiences, contrasting with Aeria's model of developing and publishing its own content.

- Market Scale: Roblox, for example, had over 250 million daily active users in 2023, demonstrating the significant reach of UGC platforms.

- Creator Economy Impact: The global creator economy, valued at over $100 billion in 2023, fuels UGC platforms with content and incentivizes user creation as a viable alternative to traditional gaming.

The threat of substitutes for Aeria is significant, encompassing a wide range of entertainment and IT solutions. These alternatives compete directly for consumer time and money, forcing Aeria to continuously innovate. The increasing accessibility of user-generated content platforms and emerging technologies like VR/AR further amplifies this threat.

For Aeria's gaming division, substitutes include not only other video games on different platforms but also broader entertainment options. The IT solutions arm faces competition from in-house development and readily available software packages. Emerging technologies like VR and AR, alongside platforms fostering user-generated content, represent evolving substitutes that could reshape market dynamics.

| Substitute Category | Examples | 2023 Market Data/Relevance | Impact on Aeria |

|---|---|---|---|

| Broader Entertainment | Streaming Services (Netflix, YouTube), Social Media, Music | Global streaming revenue ~$245 billion; Social media market ~$600 billion | Diverts consumer leisure time and disposable income from gaming. |

| Alternative Gaming Platforms | Consoles (PlayStation, Xbox, Switch), Handhelds | Global gaming market ~$184 billion (mobile ~50%) | Offers different gaming experiences, potentially reducing platform loyalty. |

| IT Solutions Alternatives | In-house IT, Off-the-shelf software, Cloud platforms (Microsoft 365) | Growth in cloud computing services | Reduces demand for Aeria's specialized IT services. |

| Emerging Technologies | VR/AR, Metaverse | Meta's Reality Labs investment ~$10 billion (2023) | Potential to shift entertainment consumption to new immersive formats. |

| User-Generated Content (UGC) | Roblox, Minecraft | Roblox daily active users >250 million (2023); Creator economy ~$100 billion (2023) | Provides diverse, constantly updated content that competes directly with Aeria's games. |

Entrants Threaten

The online and mobile gaming sector demands considerable upfront capital. Developing a polished, competitive game, alongside robust marketing campaigns and essential server infrastructure, can easily run into millions of dollars. For instance, major AAA game development budgets frequently exceed $100 million, a figure that makes it challenging for newcomers to enter the market without significant backing.

Established companies like Aeria benefit from significant brand recognition, making it harder for newcomers to capture attention. In 2024, the average cost to acquire a new customer in the gaming industry continued its upward trend, with some estimates placing it well over $50 per user, especially for competitive genres.

New entrants must overcome this hurdle by investing heavily in marketing and often employing unique strategies to build a player community. Achieving meaningful market penetration in a saturated market requires not just financial investment but also innovative approaches to stand out and attract a loyal user base.

The demand for specialized skills in areas like AI-driven game development and advanced cybersecurity is exceptionally high. For instance, in 2024, the global cybersecurity workforce gap was estimated at 3.5 million professionals, making it difficult for new entrants to secure the necessary talent.

Attracting top-tier game developers and IT architects often requires offering competitive salaries and innovative work environments, a challenge for startups lacking established brand recognition and financial resources. The average salary for a senior game programmer in the US, for example, can exceed $120,000 annually.

Furthermore, the rapid evolution of technology necessitates continuous upskilling and investment in training programs. Companies like Unity and Unreal Engine frequently update their platforms, requiring developers to constantly adapt, which adds to the operational cost and complexity for newcomers.

Regulatory and Legal Hurdles

While the online gaming sector might not have the same barriers as heavy manufacturing, new players still encounter significant regulatory and legal challenges. Navigating data privacy laws like GDPR, which saw significant enforcement actions in 2024, and varying consumer protection standards across global markets adds complexity and cost. For instance, a 2024 report indicated that compliance costs for data protection alone can range from thousands to millions of dollars for businesses operating internationally.

Furthermore, the landscape of intellectual property rights and licensing is intricate. Protecting unique game mechanics, characters, and code requires robust legal frameworks, and securing necessary licenses for music, software, or even specific game features can involve substantial upfront investment and ongoing fees. In 2024, several high-profile legal battles over intellectual property in the gaming industry underscored the importance and expense of these legal protections.

- Data Privacy Compliance: Adherence to regulations like GDPR and CCPA, with significant fines levied for breaches in 2024.

- Consumer Protection Laws: Meeting diverse international standards for fair play, advertising, and age verification.

- Intellectual Property (IP) Protection: Safeguarding game assets, code, and design through patents, copyrights, and trademarks.

- Licensing Agreements: Securing rights for third-party content, software, and technologies, often incurring substantial costs.

Network Effects and Platform Dominance

Many successful online games thrive on network effects, meaning the more players join, the more valuable the game becomes for everyone. This creates a significant hurdle for newcomers, as players are naturally drawn to established games with large, active communities. For instance, in 2024, the top mobile gaming platforms continued to see player concentration in a few dominant titles, making it difficult for new games to gain traction.

This challenge is amplified by the control major app stores and distribution platforms wield. These gatekeepers can significantly influence a new game's visibility and accessibility, further solidifying the advantage of existing, popular titles.

- Network effects: Value increases with user base, benefiting incumbents.

- Player concentration: Dominant games in 2024 held large player bases, deterring new entrants.

- Platform gatekeeping: App stores and distribution channels favor established titles.

The threat of new entrants in the online gaming sector is moderate, primarily due to high capital requirements and established brand loyalty. Developing a competitive game can cost tens of millions, with AAA titles often exceeding $100 million in 2024. Customer acquisition costs also present a barrier, with some estimates placing them over $50 per user in competitive genres that year.

New players must also contend with the need for specialized talent, as the demand for skilled game developers and cybersecurity professionals remained high in 2024, with a global cybersecurity workforce gap estimated at 3.5 million. Furthermore, navigating complex intellectual property laws and licensing agreements adds significant cost and legal overhead for any aspiring entrant.

Network effects, where a game's value increases with its user base, also favor incumbents. In 2024, major gaming platforms saw continued player concentration in dominant titles, making it difficult for new games to gain traction. Platform gatekeepers, like app stores, further exacerbate this by often favoring established and popular games.

| Barrier to Entry | Description | 2024 Relevance/Data |

|---|---|---|

| Capital Requirements | Significant upfront investment for game development, marketing, and infrastructure. | AAA game budgets often exceed $100 million. |

| Brand Recognition & Loyalty | Established companies enjoy customer trust and preference. | Customer acquisition costs can surpass $50 per user. |

| Talent Acquisition | High demand for specialized skills in game development and IT. | Global cybersecurity workforce gap estimated at 3.5 million professionals. |

| Intellectual Property & Licensing | Complex legal frameworks and costs for protecting and acquiring rights. | High-profile IP legal battles underscore the expense. |

| Network Effects | Value increases with user base, benefiting established games. | Dominant titles continue to hold large player bases. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, including industry-specific market research reports, company annual filings, and government economic indicators. This comprehensive approach ensures a thorough understanding of the competitive landscape.