AEON Financial Service PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AEON Financial Service Bundle

Unlock the critical external factors shaping AEON Financial Service's trajectory with our comprehensive PESTLE analysis. Understand how political stability, economic shifts, technological advancements, social trends, environmental regulations, and legal frameworks are creating both opportunities and challenges. Equip yourself with actionable intelligence to navigate the complex landscape and make informed strategic decisions. Download the full PESTLE analysis now to gain a decisive advantage.

Political factors

The political landscape across AEON Financial Service's key Asian markets, including Japan, Malaysia, and Indonesia, directly shapes the regulatory environment for financial services. For instance, in 2024, several Southeast Asian nations are reviewing or implementing stricter capital adequacy requirements for banks, which could increase compliance costs for AEON.

Shifts in government policies regarding digital banking, data privacy, and consumer protection are also critical. Indonesia's push for financial inclusion through digital platforms, as seen in recent policy discussions throughout 2024, presents both opportunities and compliance challenges for AEON's digital offerings.

Political stability is a bedrock for investor confidence and economic predictability. Countries experiencing political transitions or uncertainty, such as potential shifts in economic policy in certain emerging markets in 2025, can dampen consumer spending and demand for AEON's credit and insurance products.

Central bank decisions significantly shape AEON's operating environment. For instance, the US Federal Reserve's interest rate hikes throughout 2022 and into early 2023 increased borrowing costs, impacting AEON's cost of funds and potentially slowing consumer demand for loans. Similarly, the European Central Bank's monetary tightening measures in 2023 affected liquidity across the Eurozone.

Government fiscal policies also play a critical role. In 2024, many nations are considering or implementing targeted stimulus measures to boost economic activity, which could increase disposable income and, consequently, demand for AEON's wealth management and investment services. Conversely, potential tax increases or austerity measures could dampen consumer spending and business investment, posing challenges.

The broader geopolitical landscape in Asia, particularly concerning international trade relations and regional diplomatic ties, presents a dual-edged sword for AEON Financial Service. For instance, the ongoing trade tensions between major Asian economies, such as the US-China trade dynamic, can introduce volatility. In 2024, the World Bank projected global trade growth to remain subdued, reflecting these geopolitical uncertainties, which directly impacts AEON's cross-border investment strategies and potential market access.

Regional conflicts or significant diplomatic shifts can further disrupt established supply chains and dampen consumer confidence across the continent. Such instability can lead to unpredictable currency fluctuations, impacting AEON's profitability on international transactions. Conversely, the establishment of new, favorable trade agreements, like the Regional Comprehensive Economic Partnership (RCEP) which came into full effect in 2023, offers potential avenues for AEON to expand its market reach and capitalize on projected economic growth within participating nations.

Consumer Protection and Data Privacy Legislation

Governments are actively strengthening consumer protection and data privacy, with many Asian nations adopting GDPR-like frameworks. AEON Financial Service must remain agile, updating its operations to meet these escalating legal demands for transparency and data security. Failure to comply risks substantial financial penalties and can severely damage its public image.

The increasing focus on data privacy means AEON Financial Service needs robust systems. For instance, the Personal Data Protection Act 2019 in Thailand, similar to global trends, mandates strict consent and data handling protocols. Non-compliance can result in penalties reaching up to THB 5 million.

- GDPR-inspired regulations are expanding globally, impacting financial services.

- AEON Financial Service must invest in data security and privacy compliance.

- Fines for data breaches can be substantial, affecting profitability.

- Reputational damage from privacy violations can deter customers.

Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) Regulations

The increasing global focus on combating financial crime means institutions like AEON Financial Service must consistently upgrade their anti-money laundering (AML) and counter-terrorism financing (CTF) systems. This isn't just about avoiding fines; it's about maintaining trust and the ability to operate. For instance, the Financial Action Task Force (FATF) continues to update its recommendations, influencing national regulations worldwide.

Governments are stepping up their scrutiny, demanding more rigorous Know Your Customer (KYC) checks and detailed reporting of any unusual financial activity. Failure to comply can lead to severe penalties, potentially jeopardizing a financial service provider's license. In 2024, regulatory bodies globally reported a significant increase in AML enforcement actions, with fines reaching billions of dollars across the financial sector.

- Regulatory Scrutiny: Increased government oversight on financial transactions.

- Compliance Investment: Ongoing need for advanced technology and personnel for AML/CTF.

- Operational Risk: Non-compliance can result in substantial fines and license suspension.

- Global Standards: Adherence to evolving international frameworks like FATF recommendations is crucial.

Government stability and policy consistency are paramount for financial services. In 2024, several Asian markets are navigating political transitions, potentially impacting economic policies and investor confidence. For example, upcoming elections in key Southeast Asian nations could lead to shifts in regulatory approaches to digital finance and consumer protection.

Regulatory frameworks are tightening, particularly concerning data privacy and anti-money laundering (AML). Many countries are adopting stricter compliance measures, mirroring global trends like GDPR. AEON Financial Service must continuously adapt its operations to meet these evolving legal demands, with non-compliance risking significant fines and reputational damage.

Fiscal policies, including government spending and taxation, directly influence consumer disposable income and business investment. In 2024, targeted stimulus packages in some regions aim to boost economic activity, potentially increasing demand for AEON's wealth management services. Conversely, austerity measures could dampen spending.

Geopolitical factors, such as trade tensions and regional agreements, shape market access and investment strategies. The ongoing US-China trade dynamics, for instance, continue to introduce volatility. However, trade pacts like RCEP, effective since 2023, offer opportunities for AEON to expand its reach within participating economies.

What is included in the product

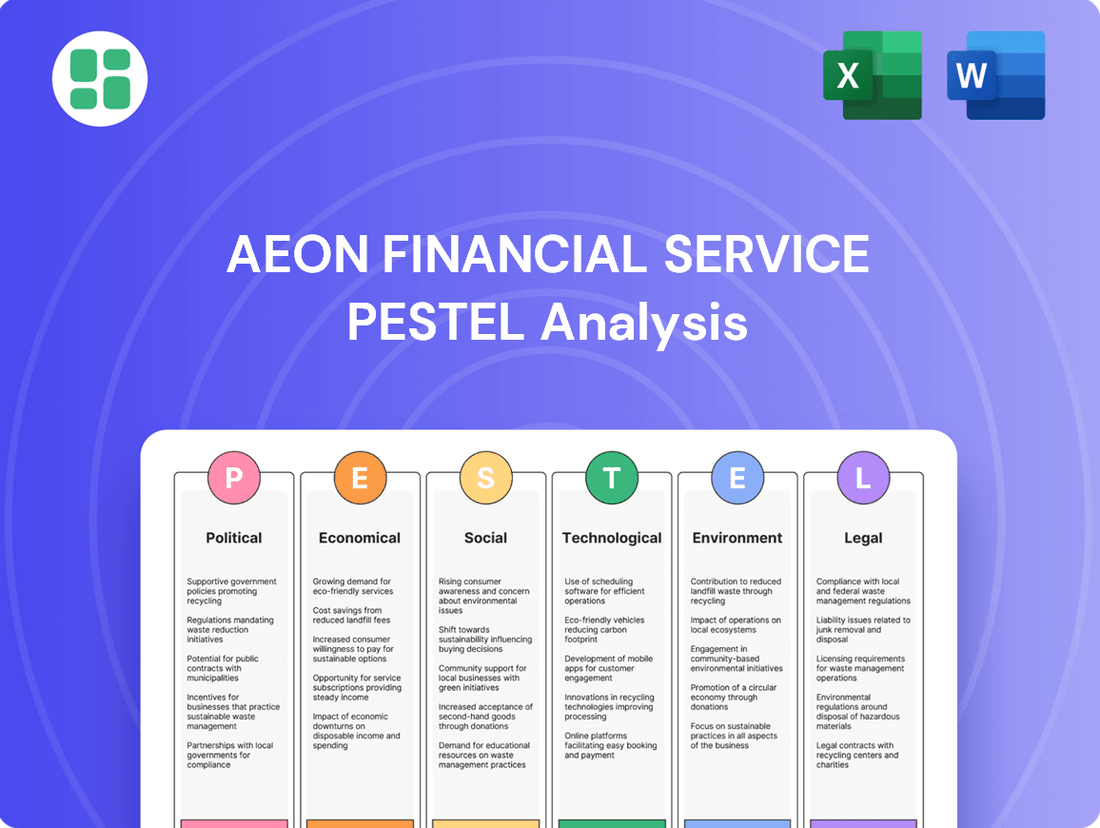

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting AEON Financial Service, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights and forward-looking perspectives to guide strategic decision-making and identify potential opportunities and threats.

The AEON Financial Service PESTLE analysis provides a clear, summarized version of external factors for easy referencing during strategic discussions, alleviating the pain point of information overload.

This analysis is visually segmented by PESTEL categories, allowing for quick interpretation at a glance and simplifying complex market dynamics for AEON Financial Services.

Economic factors

Changes in benchmark interest rates, such as the Federal Funds Rate, directly impact AEON Financial Service's profitability. For instance, if the Federal Reserve raises rates in 2024 or 2025, AEON's borrowing costs for funds will likely increase, potentially squeezing net interest margins on its loan portfolios. Conversely, a rate cut could stimulate loan demand but also reduce the yield on its deposit base.

Higher interest rates can also dampen consumer appetite for AEON's credit products. In a rising rate environment, the cost of borrowing for individuals and businesses increases, which might lead to reduced demand for mortgages, auto loans, and credit cards. This reduced demand can directly affect AEON's revenue streams from interest income and fees.

Managing interest rate risk is therefore a critical strategic imperative for AEON. The company must actively hedge against adverse rate movements to protect its financial health and ensure stable earnings. For example, in late 2023 and early 2024, many financial institutions adjusted their asset-liability management strategies in anticipation of potential rate shifts by central banks like the Federal Reserve.

Inflationary pressures are a significant concern for AEON Financial Service, as they directly impact consumer purchasing power. For instance, in the US, the Consumer Price Index (CPI) saw a notable increase, reaching 3.3% year-over-year in May 2024, which means consumers have less disposable income for non-essential financial products like premium credit cards or new personal loans.

This erosion of purchasing power can lead to a slowdown in demand for AEON's discretionary financial services. Furthermore, persistent high inflation, such as the 5.1% average annual inflation recorded in the Eurozone for 2023, can strain household budgets, potentially increasing the risk of loan defaults as individuals struggle to meet their financial obligations.

Consequently, AEON Financial Service must closely monitor inflation trends and economic indicators to proactively adjust its product development, marketing strategies, and crucially, its risk assessment models to mitigate potential losses and maintain portfolio health.

AEON Financial Service's performance is closely tied to the economic growth cycles in its primary markets, notably Japan and Southeast Asia. Robust economic expansion fuels consumer confidence, directly boosting demand for credit cards, personal loans, and insurance products, which are core to AEON's business model.

For instance, Japan's GDP growth, projected to be around 0.5% in 2024 and 0.6% in 2025 according to IMF estimates, indicates a period of modest expansion. Meanwhile, many Southeast Asian economies are experiencing more vigorous growth, with countries like the Philippines and Vietnam showing projected GDP growth rates exceeding 5% for 2024-2025, creating a more favorable environment for increased financial service uptake.

Conversely, any significant economic slowdown or recession in these regions would present considerable challenges. Lower consumer spending power and increased unemployment could translate into reduced transaction volumes, a decline in new loan origination, and a rise in non-performing loans, necessitating higher provisions for credit losses for AEON.

Disposable Income and Household Debt Levels

Disposable income is a key driver for financial services like AEON. In 2024, the average disposable income for households in many developed economies is projected to see modest growth, but this varies significantly by region and demographic. For instance, in the United States, disposable income per capita saw an increase in early 2024, reflecting a resilient labor market.

Household debt levels present a dual-edged sword for AEON. While higher debt can sometimes indicate consumer confidence and a willingness to leverage for purchases, it also signals potential risk. For example, in the UK, household debt as a percentage of disposable income remained a concern in late 2023 and early 2024, with rising interest rates potentially straining repayment capacity.

AEON Financial Service must closely monitor these trends to tailor its offerings and risk management.

- Disposable Income Growth: Projections for 2024 indicate a slight uptick in real disposable income in many advanced economies, though inflation remains a factor.

- Household Debt-to-Income Ratio: This metric, a key indicator of financial strain, needs careful tracking as interest rate environments shift. For example, in Canada, the household debt service ratio was at a notable level entering 2024.

- Consumer Spending Capacity: Higher disposable income directly correlates with increased potential for new loans, investments, and other financial products offered by AEON.

- Credit Risk Assessment: Elevated household debt necessitates robust credit scoring and potentially more conservative lending policies to mitigate default risks.

Currency Exchange Rate Volatility

Currency exchange rate volatility presents a significant consideration for AEON Financial Service, given its broad operational footprint across multiple Asian nations. Fluctuations in exchange rates directly affect the value of revenues and profits earned in foreign currencies when these are translated back into Japanese Yen. For instance, a weakening of the Philippine Peso against the Yen could reduce the Yen-equivalent earnings from AEON's operations in the Philippines.

This inherent volatility also impacts the economics of AEON's cross-border transactions and strategic investments. For example, if AEON plans to invest in new digital infrastructure in Vietnam, a strengthening Vietnamese Dong could make that investment more expensive in Yen terms. Conversely, a depreciating Dong might lower the cost, but could also signal broader economic instability in the region.

Recent data highlights this challenge. As of early 2024, the Japanese Yen experienced periods of significant depreciation against major Asian currencies, including the Indonesian Rupiah and the Thai Baht. This trend, if sustained, would generally boost the Yen-denominated value of AEON's earnings from these markets. However, the unpredictable nature of these movements requires robust hedging strategies to mitigate potential downside risks on AEON's consolidated financial statements.

- Impact on Consolidated Earnings: Depreciation of foreign currencies like the Malaysian Ringgit against the Japanese Yen can decrease the Yen value of AEON's reported profits from Malaysia.

- Cross-Border Investment Costs: A strengthening South Korean Won could increase the Yen cost of AEON's capital expenditures or acquisitions in South Korea.

- Transaction Costs: Increased volatility in the Singapore Dollar can lead to higher hedging costs for AEON's intercompany transactions and remittances.

- Competitive Landscape: Exchange rate shifts can alter the relative pricing of financial services offered by AEON and its competitors in different markets, potentially affecting market share.

Economic growth is a primary driver for AEON Financial Service. Strong GDP expansion in key markets like Japan and Southeast Asia fuels consumer confidence, increasing demand for credit cards, loans, and insurance. For example, while Japan's GDP growth was modest around 0.5% in 2024, countries like the Philippines and Vietnam saw growth exceeding 5% in the same period, creating a more favorable environment for AEON.

Disposable income directly influences consumer spending capacity for financial products. While 2024 projections show modest growth in real disposable income in many advanced economies, persistent inflation can erode this. AEON must monitor household debt-to-income ratios, such as the notable levels in Canada entering 2024, to assess credit risk and tailor lending policies accordingly.

Currency fluctuations significantly impact AEON's consolidated earnings. A depreciating currency in markets like Malaysia against the Japanese Yen can reduce reported profits. Conversely, a strengthening South Korean Won could increase the Yen cost of AEON's investments there, highlighting the need for robust hedging strategies to manage these economic factors.

| Economic Factor | 2024/2025 Projection/Data Point | Impact on AEON Financial Service |

|---|---|---|

| GDP Growth (Japan) | ~0.5% (2024) | Modest expansion, potentially lower demand for aggressive credit products. |

| GDP Growth (Philippines) | >5% (2024-2025) | Strong growth, indicating higher consumer confidence and demand for financial services. |

| US Disposable Income | Increase in early 2024 | Boosts consumer spending capacity for AEON's offerings. |

| Canadian Household Debt Service Ratio | Notable levels entering 2024 | Increased credit risk, requiring careful monitoring and potentially conservative lending. |

| Japanese Yen vs. Asian Currencies | Periods of depreciation against IDR, THB (early 2024) | Increases Yen-denominated earnings from these markets, but requires hedging for volatility. |

Preview the Actual Deliverable

AEON Financial Service PESTLE Analysis

The preview shown here is the exact AEON Financial Service PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain immediate access to a comprehensive PESTLE analysis covering Political, Economic, Social, Technological, Legal, and Environmental factors impacting AEON Financial Service.

The content and structure shown in the preview is the same AEON Financial Service PESTLE Analysis document you’ll download after payment, providing actionable insights for strategic planning.

Sociological factors

Consumer lifestyles are rapidly evolving, with urbanization and digitalization reshaping how people interact with financial services. This shift means a greater demand for convenient, personalized, and digitally accessible banking solutions. For instance, a significant portion of the global population now lives in urban areas, increasing the need for seamless digital transactions and remote account management.

Younger demographics, in particular, are driving this trend, showing a strong preference for mobile banking apps and online platforms over traditional branch visits. Reports from 2024 indicate that over 70% of Gen Z and Millennials prefer digital channels for their banking needs, highlighting the imperative for AEON Financial Service to innovate its product offerings and service delivery models to resonate with these key consumer segments.

AEON Financial Service operates within markets exhibiting significant demographic variations. Japan's aging population, with approximately 29.1% of its citizens aged 65 and over as of 2023, creates a strong demand for wealth management, annuities, and healthcare-related financial products. This trend is projected to continue, offering AEON opportunities in catering to the specific needs of older consumers.

Conversely, Southeast Asian nations, such as Vietnam and Indonesia, boast much younger demographics, with a substantial portion of the population under 30. This youthful segment is increasingly seeking access to credit, digital payment solutions, and consumer financing. AEON's strategy must adapt to capture this growing, digitally-native consumer base, potentially through mobile-first offerings and tailored loan products.

Financial literacy varies significantly across Asian markets, impacting how readily consumers adopt and understand sophisticated financial products. For instance, in 2024, while Singapore boasts high financial literacy rates, many Southeast Asian nations are still developing foundational knowledge, creating a gap in product uptake.

AEON Financial Service can leverage this by championing financial inclusion. By offering user-friendly, simplified financial products and providing accessible educational materials, particularly in emerging markets where financial literacy is lower, AEON can attract a broader customer base. This strategy is crucial for building trust and cultivating enduring customer loyalty, as seen in initiatives in countries like Vietnam aiming to boost financial education for small businesses.

Cultural Attitudes Towards Debt and Savings

Cultural attitudes towards debt and savings differ significantly across Asia, impacting AEON Financial Service's market approach. For instance, while countries like Singapore and Hong Kong often exhibit high savings rates, with household savings rates reaching approximately 25% and 20% respectively in recent years, other markets may show a greater propensity for credit utilization.

Understanding these nuances is crucial for AEON. A preference for saving over debt in some regions might necessitate marketing strategies emphasizing wealth accumulation and secure investment options, whereas in areas with higher credit adoption, promoting responsible borrowing for consumption or investment could be more effective.

AEON must tailor its product offerings and risk management strategies to these varying cultural expectations. For example, a campaign highlighting the benefits of leveraging credit for education or property in a credit-friendly market contrasts with a savings-focused campaign promoting long-term financial security in a more conservative market.

- Savings as a Cultural Pillar: In many East Asian cultures, saving is deeply ingrained, often viewed as a virtue and a primary means of financial security.

- Credit Acceptance Spectrum: While some Asian economies are rapidly embracing credit for lifestyle upgrades and business expansion, others maintain a more cautious approach to borrowing.

- Wealth Management Focus: Cultural attitudes influence the demand for various financial products, from simple savings accounts to complex investment portfolios and debt consolidation services.

- Risk Perception and Debt: Societal views on the social stigma or acceptability of debt can directly affect the uptake of loans and credit facilities offered by financial institutions like AEON.

Digital Adoption and Mobile Penetration Rates

The increasing digital adoption and mobile penetration across Asia are fundamentally reshaping consumer behavior in financial services. By mid-2024, internet penetration in Southeast Asia was estimated to be around 75%, with smartphone ownership driving this connectivity. This digital shift means consumers expect readily available, user-friendly financial tools at their fingertips.

AEON Financial Service needs to capitalize on this by enhancing its digital offerings. This includes developing intuitive mobile banking applications and expanding digital payment solutions to cater to the growing demand for convenience. For instance, by the end of 2023, mobile payments in the region had seen significant growth, with transaction volumes projected to continue their upward trajectory throughout 2024 and into 2025.

- Smartphone Penetration: Over 85% of internet users in major Southeast Asian markets access the web via smartphones, a figure expected to grow.

- Digital Payment Growth: The digital payments market in Asia is projected to reach over $2 trillion by 2025, indicating a massive opportunity for financial service providers.

- Consumer Expectations: A significant majority of consumers now prefer digital channels for managing their finances, demanding seamless online and mobile experiences.

- Investment in Digital Infrastructure: AEON Financial Service's strategic investments in robust mobile apps and online customer service are crucial for meeting these evolving consumer demands.

Societal attitudes towards savings and debt vary significantly across Asian markets, influencing consumer engagement with financial products. While some cultures prioritize saving for security, others readily adopt credit for lifestyle and business growth. AEON Financial Service must tailor its strategies to these distinct cultural norms, emphasizing wealth accumulation in conservative markets and responsible credit utilization where appropriate.

Financial literacy levels also present a key sociological factor, impacting product adoption and customer trust. AEON can foster broader market penetration by championing financial inclusion through simplified products and accessible educational resources, particularly in regions with lower literacy rates.

Demographic shifts, such as aging populations in Japan and youthful demographics in Southeast Asia, create specific demands for financial services. AEON needs to adapt its offerings to cater to the wealth management needs of older citizens while also developing mobile-first solutions for the digitally-native younger generation.

| Sociological Factor | Description | Implication for AEON Financial Service |

|---|---|---|

| Savings Culture | Deeply ingrained saving habits in many East Asian societies. | Focus on wealth accumulation and secure investment products. |

| Credit Acceptance | Varying societal views on debt, from cautious to embracing credit for growth. | Tailored marketing for responsible borrowing or savings-focused campaigns. |

| Financial Literacy | Disparities in understanding financial products across markets. | Opportunity for financial inclusion through education and simplified offerings. |

| Demographics | Aging populations in some regions, youthful populations in others. | Develop wealth management for seniors and digital-first solutions for youth. |

Technological factors

The financial services sector is undergoing a significant upheaval driven by FinTech innovation. Companies are increasingly offering digital solutions for payments, lending, and investment, challenging traditional models. For instance, the global FinTech market was valued at approximately $2.4 trillion in 2023 and is projected to reach $3.5 trillion by 2024, indicating substantial growth and disruption.

AEON Financial Service needs to actively engage with this digital transformation. Investing in technologies like AI for personalized customer service, blockchain for secure transactions, and cloud computing for scalable operations is crucial. This will not only streamline internal processes, potentially reducing operational costs by up to 20-30% as seen in some digital transformations, but also allow AEON to compete effectively with nimble FinTech startups and digital-first banks that are capturing market share.

The escalating volume of online financial transactions and the extensive collection of customer data amplify cybersecurity threats and the risk of data breaches for AEON Financial Service. In 2024, the global cost of data breaches was estimated to reach $9.5 million on average, highlighting the substantial financial and reputational damage such incidents can inflict.

To counter these risks, AEON Financial Service must prioritize continuous investment in advanced cybersecurity solutions and sophisticated data encryption. For instance, adopting zero-trust architecture and employing multi-factor authentication are critical steps in safeguarding sensitive customer information and preserving client trust in an increasingly digital landscape.

Furthermore, AEON Financial Service must remain vigilant in adhering to evolving data protection regulations, such as GDPR and CCPA. Non-compliance can result in significant penalties; for example, GDPR fines can reach up to 4% of global annual revenue or €20 million, whichever is higher, underscoring the imperative for robust compliance frameworks.

Artificial Intelligence and Machine Learning are fundamentally reshaping the financial services landscape. These technologies are powering advancements in areas like credit scoring, allowing for more nuanced risk assessments, and driving personalized product recommendations that better meet individual customer needs. AEON Financial Service can capitalize on AI and ML to refine its risk management strategies and boost marketing effectiveness.

The integration of AI and ML offers AEON Financial Service significant opportunities to enhance operational efficiency and customer engagement. For instance, AI-driven fraud detection systems can process vast datasets in real-time, identifying suspicious activities with greater accuracy, a crucial capability in today's digital environment. Furthermore, AI-powered chatbots are increasingly handling customer inquiries, freeing up human agents for more complex issues and improving overall service delivery.

By embracing AI and ML, AEON Financial Service can expect to see tangible benefits in profitability and customer satisfaction. The ability to offer highly tailored financial products and services, coupled with more robust fraud prevention, positions the company for competitive advantage. The global AI in financial services market was valued at approximately $10.6 billion in 2023 and is projected to grow significantly, with some forecasts suggesting it could reach over $40 billion by 2030, underscoring the immense potential for companies like AEON.

Blockchain and Distributed Ledger Technology (DLT)

Blockchain and Distributed Ledger Technology (DLT) present significant opportunities for AEON Financial Service to innovate. These technologies are poised to revolutionize areas like cross-border payments and trade finance, streamlining processes and enhancing security. For instance, by mid-2025, the global blockchain in finance market is projected to reach over $20 billion, highlighting its growing impact.

AEON Financial Service should actively investigate how blockchain and DLT can improve transaction efficiency and transparency. Implementing these solutions could lead to substantial cost reductions and a stronger security posture. Early adoption in digital identity verification, for example, could offer a more robust and secure way to manage customer data.

- Enhanced Security: DLT's cryptographic nature can significantly reduce fraud and cyber threats in financial transactions.

- Cost Reduction: Automating processes through smart contracts can lower operational expenses, particularly in areas like reconciliation and compliance.

- Increased Transparency: Shared, immutable ledgers provide a clear audit trail, improving trust and regulatory oversight.

- Faster Transactions: Cross-border payments, often bogged down by intermediaries, can be processed much more rapidly using DLT.

Cloud Computing and Infrastructure Modernization

Adopting cloud computing is a significant technological driver for AEON Financial Service. This allows for a more agile and scalable IT infrastructure, which can directly translate to reduced operational expenses. For instance, many financial institutions are seeing significant cost savings; a 2024 report indicated that organizations leveraging cloud infrastructure experienced an average of 15-20% reduction in IT operational costs compared to on-premises solutions.

Modernizing core banking systems and migrating to cloud-based platforms are crucial for enhancing AEON's operational agility. This shift improves data analytics capabilities, enabling faster insights and better decision-making. Furthermore, it facilitates the seamless integration of emerging digital tools, such as AI-powered customer service or advanced fraud detection systems, which are becoming increasingly vital in the competitive financial landscape.

The move to cloud infrastructure supports AEON Financial Service in accelerating the deployment of new financial products and services. This speed-to-market is critical for staying ahead of competitors and meeting evolving customer demands. By leveraging cloud-native architectures, AEON can streamline development cycles, leading to quicker innovation and a more responsive service offering.

Key benefits realized by financial services firms adopting cloud include:

- Enhanced Scalability: Ability to adjust IT resources up or down based on demand, crucial for handling peak transaction periods.

- Cost Optimization: Shifting from capital expenditure on hardware to operational expenditure on cloud services, often leading to lower total cost of ownership.

- Improved Agility and Innovation: Faster deployment of new applications and services, fostering a culture of continuous improvement.

- Advanced Data Analytics: Access to powerful cloud-based analytics tools for deeper customer insights and risk management.

Technological advancements are rapidly transforming the financial services landscape, necessitating continuous adaptation for AEON Financial Service. The rise of FinTech, particularly in digital payments and lending, is reshaping customer expectations and creating new competitive pressures. By mid-2025, the global FinTech market is projected to exceed $3.5 trillion, underscoring the scale of this digital shift.

AEON must strategically invest in technologies like AI for enhanced customer service and data analytics, and blockchain for secure, efficient transactions. For example, AI-powered fraud detection systems can reduce losses, and the global AI in financial services market is expected to grow substantially, potentially reaching over $40 billion by 2030.

The increasing reliance on digital platforms also elevates cybersecurity risks, with average data breach costs reaching approximately $9.5 million in 2024. Implementing robust cybersecurity measures and adhering to data protection regulations like GDPR, which can impose fines up to 4% of global annual revenue, is paramount for maintaining trust and operational integrity.

| Technology Area | Key Impact | AEON Opportunity/Risk | Market Projection (2024/2025) |

|---|---|---|---|

| FinTech Innovation | Digital payments, lending, investment disruption | Compete with startups, capture market share | Global FinTech market projected >$3.5T by 2024 |

| AI & Machine Learning | Personalized services, credit scoring, fraud detection | Improve efficiency, risk management, customer engagement | AI in financial services market projected >$40B by 2030 |

| Cybersecurity | Data breaches, fraud, regulatory compliance | Mitigate financial & reputational damage, maintain trust | Average data breach cost ~$9.5M in 2024 |

| Blockchain & DLT | Cross-border payments, trade finance, digital identity | Enhance transaction efficiency, security, transparency | Global blockchain in finance market projected >$20B by mid-2025 |

| Cloud Computing | Scalability, cost optimization, agility | Reduce IT operational costs (15-20% savings), faster innovation | Cloud adoption driving significant IT cost reductions |

Legal factors

AEON Financial Service navigates a stringent regulatory landscape, adhering to banking and financial services laws across its operating regions. Key among these are capital adequacy requirements, such as those outlined in the Basel III framework, which dictate minimum capital levels to absorb unexpected losses. For instance, as of early 2024, major international banks are still adapting to the finalization of Basel III reforms, impacting capital planning and risk management.

Compliance with licensing and prudential standards is paramount, directly influencing AEON's operational capacity and market access. Failure to meet these requirements, which can include stringent data privacy laws like GDPR or evolving anti-money laundering (AML) directives, can result in significant penalties and reputational damage. The financial services sector saw increased regulatory scrutiny in 2023, with a focus on operational resilience and consumer protection, trends expected to continue into 2024.

Consumer credit and lending laws are a critical legal factor for AEON Financial Service. These regulations, which dictate everything from interest rate caps to loan terms and responsible lending, differ significantly across jurisdictions. For instance, in the United States, the Truth in Lending Act (TILA) mandates clear disclosure of credit terms, while the Fair Credit Reporting Act (FCRA) governs how consumer credit information is collected and used. Failure to comply can lead to substantial fines; in 2023, the Consumer Financial Protection Bureau (CFPB) collected over $3.7 billion in debt relief for consumers, highlighting the financial consequences of non-compliance.

AEON Financial Service must maintain rigorous adherence to these varied legal frameworks to prevent costly penalties, avoid protracted legal disputes, and safeguard its hard-earned reputation. The company's credit card and loan portfolios are directly impacted by these laws, influencing both profitability and overall risk. For example, a change in usury laws in a key market could reduce the potential revenue from interest charges, thereby altering the risk-return profile of those specific assets.

AEON Financial Service's insurance products are shaped by a complex web of regulations governing everything from initial design and policyholder safeguards to solvency standards and how claims are managed. These rules, like the Solvency II directive in Europe, which mandates robust capital requirements for insurers, are designed to shield consumers and maintain the stability of insurance companies. For instance, in 2023, the global insurance industry saw regulatory scrutiny intensify, particularly around data privacy and cybersecurity, impacting how AEON must handle sensitive customer information.

Staying compliant means AEON must constantly track and adjust to evolving insurance legislation. This includes adapting to new consumer protection measures, such as enhanced disclosure requirements for complex financial products, and ensuring adherence to capital adequacy ratios. Failure to do so can lead to significant penalties and reputational damage. The ongoing focus on digital transformation within the financial sector also brings new regulatory considerations, particularly concerning the use of AI in underwriting and claims processing, a trend that gained significant traction in 2024.

Anti-Trust and Competition Laws

AEON Financial Service, as a significant entity in the financial services industry, is bound by stringent anti-trust and competition laws across its operational geographies. These regulations are designed to foster a level playing field, preventing any single entity from dominating the market and stifling innovation. For instance, in 2024, the European Commission continued its robust enforcement of competition rules, issuing fines totaling over €1.5 billion across various sectors, underscoring the seriousness with which these matters are treated.

AEON's strategic decisions, particularly concerning mergers, acquisitions, and market expansion initiatives, require meticulous evaluation against these legal frameworks. Failing to adhere to these regulations can lead to substantial penalties, reputational damage, and even the unwinding of business transactions. In 2025, regulators globally are expected to maintain or even increase their scrutiny of large financial institutions to ensure fair market practices.

- Mergers and Acquisitions: AEON must ensure that any proposed consolidation does not create a dominant market position, as seen in past regulatory reviews where deals were blocked or modified due to competition concerns.

- Pricing and Collusion: The company must avoid any practices that could be construed as price-fixing or anti-competitive collusion with other market participants.

- Market Dominance: Strategies aimed at leveraging market share must be carefully managed to prevent abuse of dominance, which could lead to investigations and sanctions.

Cross-Border Regulatory Harmonization

Operating across multiple Asian countries, AEON Financial Service must contend with a patchwork of differing legal frameworks. While initiatives like ASEAN financial integration aim to streamline operations, substantial regulatory disparities persist, complicating cross-border business. For instance, varying data privacy laws across nations like Singapore, Malaysia, and Indonesia create unique compliance hurdles for financial services firms.

AEON Financial Service must navigate the intricate web of cross-border data flow regulations, differing reporting mandates, and compliance requirements. These legal complexities can significantly influence the company's strategic approach to regional expansion and market penetration. The ongoing evolution of financial regulations in key markets, such as the implementation of new digital banking frameworks in Thailand, necessitates continuous adaptation.

- Diverse Legal Systems: AEON Financial Service operates under distinct legal structures in each Asian country, demanding tailored compliance strategies.

- Harmonization Efforts: While ASEAN integration promotes some regulatory alignment, significant differences in areas like capital requirements and consumer protection remain.

- Data Flow Complexities: Cross-border data transfer regulations, such as those concerning personal financial information, present ongoing compliance challenges.

- Reporting Variances: AEON must manage diverse regulatory reporting standards for financial activities, impacting operational efficiency and data management.

AEON Financial Service is subject to evolving legal frameworks governing financial conduct, including consumer protection and data privacy. For instance, the European Union's General Data Protection Regulation (GDPR) continues to influence how customer data is handled, with ongoing enforcement actions in 2023 and 2024 highlighting the penalties for non-compliance. Similarly, evolving anti-money laundering (AML) regulations require continuous adaptation in transaction monitoring and reporting.

Capital adequacy and prudential requirements, such as those derived from Basel III, remain critical legal considerations impacting AEON's financial strategies and risk management. These regulations, which dictate minimum capital levels, are subject to ongoing refinement, with international bodies like the Basel Committee on Banking Supervision releasing updated guidance. For example, the finalization of Basel III reforms in early 2024 continues to shape capital planning for global financial institutions.

The company must also navigate a complex landscape of consumer credit and lending laws, which vary significantly by jurisdiction. These laws dictate terms, interest rates, and disclosure requirements, with regulatory bodies actively enforcing compliance. In 2023, consumer protection agencies collected billions in consumer relief, underscoring the financial repercussions of failing to adhere to responsible lending practices.

Environmental factors

The global shift towards Environmental, Social, and Governance (ESG) principles is intensifying, with investors increasingly scrutinizing companies' sustainability practices. By mid-2024, sustainable investment funds saw significant inflows, with assets under management in ESG-focused funds projected to exceed $33.9 trillion globally by 2026, according to Morningstar data.

AEON Financial Service is experiencing heightened pressure from stakeholders, including regulators and a growing base of environmentally conscious customers, to embed ESG criteria into its core operations, from lending policies to investment portfolios. This demand is driven by a desire to mitigate climate-related risks and capitalize on emerging green finance opportunities.

Developing and promoting green financial products, such as sustainable bonds or eco-friendly loans, and showcasing robust ESG performance can significantly bolster AEON's brand image. This enhanced reputation is crucial for attracting substantial sustainable capital, which is becoming a key differentiator in the competitive financial services landscape.

Climate change poses tangible risks to AEON Financial Service, with physical impacts like extreme weather potentially devaluing loan collateral, such as properties in vulnerable coastal or flood-prone regions. For instance, the increasing frequency of severe storms in 2024 has already led to higher insurance claims in affected areas, indirectly impacting property values and the security of loans tied to them.

Simultaneously, the global shift towards a low-carbon economy unlocks significant growth avenues for AEON. The company can capitalize on financing opportunities in renewable energy projects, which saw substantial investment growth globally in 2024, with renewable capacity additions reaching record levels. This aligns with growing investor demand for Environmental, Social, and Governance (ESG) compliant investments and potential regulatory tailwinds supporting green finance initiatives.

Governments and financial regulators are increasingly mandating environmental reporting and disclosure requirements for financial institutions. For instance, the Task Force on Climate-related Financial Disclosures (TCFD) recommendations, adopted by many jurisdictions, are becoming de facto standards, pushing firms to report on governance, strategy, risk management, and metrics and targets related to climate change.

AEON Financial Service may need to report on its carbon footprint, financed emissions, and climate-related financial risks. In 2024, the European Union's Corporate Sustainability Reporting Directive (CSRD) expanded disclosure obligations, requiring companies to report on a wide range of sustainability issues, including environmental impacts and risks, with AEON likely falling under its purview if operating within the EU.

Compliance with these evolving standards is crucial for transparency and to avoid potential penalties or reputational damage. Failure to meet these requirements, such as those outlined by the SEC's proposed climate disclosure rules in the US, could lead to fines and a loss of investor confidence, impacting AEON's market standing.

Resource Scarcity and Operational Footprint

Growing concerns over resource scarcity, especially regarding energy and water, directly influence AEON Financial Service's operational expenses and its commitment to sustainability. For instance, fluctuations in global energy prices, as seen with Brent crude oil averaging $82.50 per barrel in early 2024, can significantly impact the cost of powering AEON's extensive network of offices and data centers.

AEON must actively manage its environmental footprint. This involves optimizing energy consumption across its physical locations, which is crucial given the increasing reliance on digital infrastructure. In 2023, the financial services sector globally saw a notable increase in data center energy usage, underscoring the need for efficient management.

Promoting sustainable practices throughout its retail network is also paramount. Initiatives focused on energy efficiency, such as LED lighting upgrades and smart building management systems, alongside robust waste reduction programs, are key to minimizing AEON's environmental impact and aligning with evolving stakeholder expectations.

- Energy Costs: Global energy price volatility directly affects AEON's operational budget.

- Data Center Efficiency: The increasing energy demand of digital operations necessitates focus on efficiency.

- Retail Network Sustainability: Implementing energy-saving and waste-reduction measures across branches is vital.

- Resource Management: Proactive management of water and energy resources supports long-term operational resilience.

Reputational Risk from Environmental Controversies

Public awareness and scrutiny of corporate environmental responsibility are on a significant upswing. This heightened attention means financial institutions like AEON Financial Service are increasingly exposed to reputational damage if perceived as supporting environmentally detrimental activities or neglecting their own ecological footprint.

AEON Financial Service faces tangible reputational risks. For instance, a 2024 report by the Financial Times highlighted that investors are divesting from companies with poor Environmental, Social, and Governance (ESG) scores, impacting market valuations. If AEON is linked to projects that draw environmental criticism, it could alienate a growing segment of environmentally conscious clients and investors.

To mitigate these risks, AEON must demonstrate a robust commitment to environmental stewardship. This includes not only its own operational sustainability but also the environmental impact of its financing decisions. Transparency in reporting these efforts is paramount for building and maintaining brand reputation and fostering customer trust in the evolving financial landscape.

- Increasing ESG Scrutiny: By 2025, it's projected that over 50% of global assets under management will be influenced by ESG factors, according to various industry analyses.

- Financing Controversies: A hypothetical scenario could involve AEON financing a large-scale infrastructure project that faces significant public opposition due to its environmental impact, leading to negative media coverage.

- Brand Impact: Studies from 2024 indicate that companies with strong sustainability credentials can command a premium in customer loyalty and talent acquisition.

- Transparency as a Shield: AEON's proactive communication about its green financing initiatives and carbon reduction targets can serve as a critical defense against reputational damage.

The financial services sector, including AEON, is increasingly influenced by environmental factors, with a significant push towards sustainable finance. By mid-2024, sustainable investment funds continued to see strong inflows, with global ESG assets projected to surpass $33.9 trillion by 2026, highlighting a clear market trend. This shift necessitates AEON's integration of ESG criteria into its operations and product offerings to mitigate climate risks and capture green finance opportunities.

Climate change presents both risks and opportunities for AEON. Physical risks, such as extreme weather events impacting property values, can devalue loan collateral. Conversely, the global transition to a low-carbon economy offers substantial financing avenues in renewable energy, a sector that saw record capacity additions globally in 2024.

Regulatory bodies are imposing stricter environmental reporting requirements, with frameworks like the TCFD and the EU's CSRD becoming standard. AEON must prepare to report on its carbon footprint and climate-related financial risks to ensure compliance and maintain investor confidence, avoiding potential penalties and reputational damage.

Operational costs for AEON are also directly impacted by environmental factors, particularly energy price volatility, with Brent crude averaging $82.50 per barrel in early 2024. Managing the energy consumption of data centers and promoting sustainability across its retail network are crucial for cost efficiency and environmental responsibility.

| Environmental Factor | Impact on AEON Financial Service | Key Data/Trend (2024/2025) |

|---|---|---|

| ESG Investment Growth | Increased demand for sustainable products; reputational enhancement | Global ESG assets projected to exceed $33.9 trillion by 2026. |

| Climate Change (Physical Risks) | Devaluation of loan collateral (e.g., property in flood zones) | Increased frequency of severe storms in 2024 leading to higher insurance claims. |

| Low-Carbon Transition | Opportunities in renewable energy financing | Record renewable capacity additions globally in 2024. |

| Environmental Regulations | Mandatory reporting on carbon footprint and climate risks | EU's CSRD expanded disclosure obligations in 2024. |

| Energy Price Volatility | Increased operational expenses | Brent crude averaged $82.50 per barrel in early 2024. |

PESTLE Analysis Data Sources

Our AEON Financial Service PESTLE Analysis is meticulously constructed using a blend of official government publications, reputable financial news outlets, and comprehensive market research reports. We ensure every insight into political, economic, social, technological, legal, and environmental factors is grounded in credible, current data.