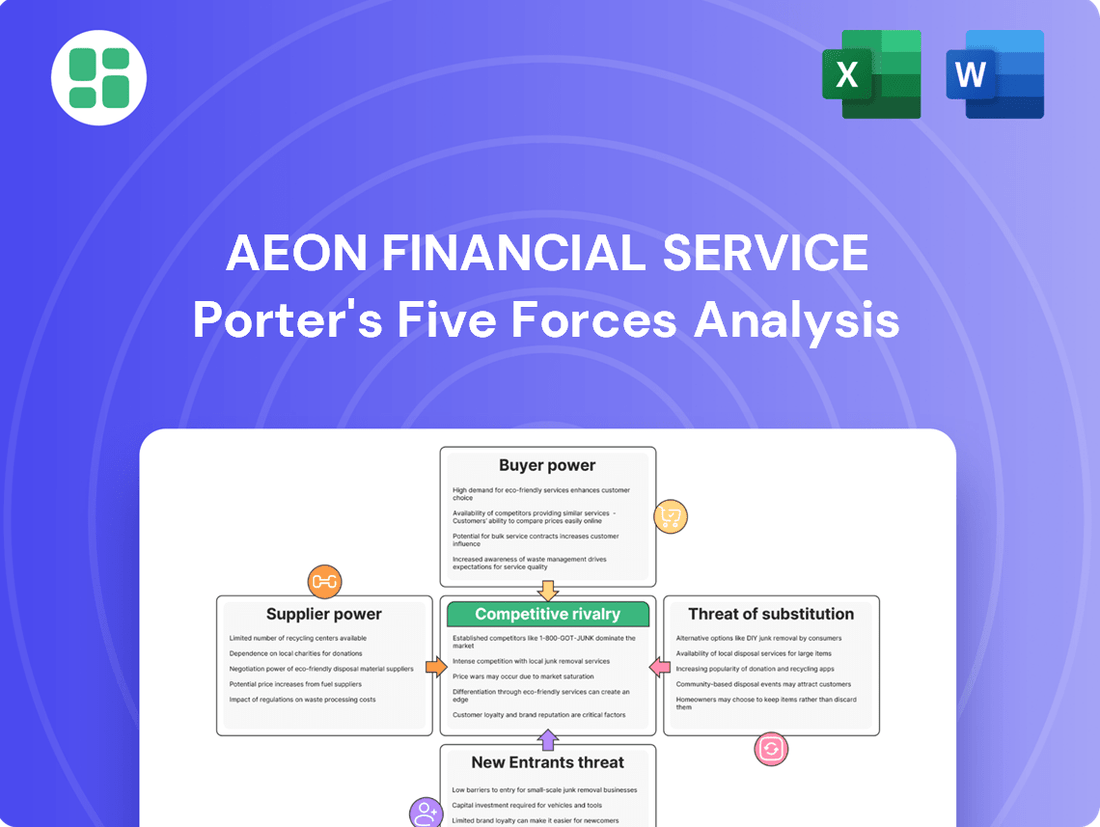

AEON Financial Service Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AEON Financial Service Bundle

AEON Financial Service operates within a dynamic landscape shaped by intense competition and evolving customer expectations. Understanding the interplay of buyer power, supplier leverage, and the threat of new entrants is crucial for navigating this market effectively.

The complete report reveals the real forces shaping AEON Financial Service’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

AEON Financial Services depends heavily on technology and software vendors for critical operations like core banking, payment processing, and data analytics. The bargaining power of these suppliers can be substantial, especially when their solutions are unique, patented, or demand extensive integration, resulting in high costs for AEON to switch providers.

Payment network operators, such as Visa, Mastercard, and JCB, exert significant bargaining power over credit card issuers like AEON Financial Service. AEON's reliance on these networks for transaction processing and global acceptance means these operators can dictate terms and fees. For instance, interchange fees, set by these networks, directly impact AEON's revenue streams. In 2024, interchange fees continue to be a major cost component for card issuers.

Financial services firms like AEON rely heavily on data providers for essential functions such as credit scoring and fraud detection. The bargaining power of these data and information service providers is significant due to the critical nature of their offerings.

Suppliers of credit bureau data, market intelligence, and cybersecurity services hold considerable sway. Their power stems from the accuracy, breadth, and timeliness of the data they provide, which are indispensable for AEON's risk management and strategic planning. For instance, in 2024, the global data analytics market, which includes these services, was projected to reach over $300 billion, highlighting the immense value and demand for such data.

Capital Market Providers

AEON Financial Service, like other financial firms, relies on capital markets for funding, whether through debt or equity. The bargaining power of providers like investment banks and institutional investors is a key consideration.

In 2024, the cost of capital for financial institutions can fluctuate significantly based on market sentiment and regulatory changes. For instance, a tightening monetary policy could increase borrowing costs for AEON, thereby strengthening the bargaining position of lenders.

The ability of AEON to access diverse funding sources and maintain a strong credit rating directly impacts the bargaining power of capital market providers. A company with multiple avenues for raising funds, such as successful equity offerings or access to syndicated loans, can negotiate more favorable terms.

- Capital Market Providers: Banks, underwriters, and institutional investors hold significant sway.

- Factors Influencing Power: AEON's financial health, market conditions, and access to varied funding sources.

- Mitigation Strategies: Maintaining a strong credit rating and diversifying funding channels reduce supplier power.

- 2024 Context: Rising interest rates in 2024, for example, can amplify the bargaining power of debt providers if AEON's creditworthiness is perceived to be weakening.

Human Capital and Specialized Talent

The bargaining power of suppliers in human capital and specialized talent is a significant factor for AEON Financial Services. The demand for professionals in fields like cybersecurity, artificial intelligence, data science, and financial technology is exceptionally high. For instance, in 2024, the global shortage of cybersecurity professionals was estimated to be around 3.4 million, according to industry reports. This scarcity directly translates into increased leverage for recruitment agencies and educational institutions that supply these critical skills, potentially driving up recruitment costs and salary expectations for AEON.

When there's a limited pool of qualified candidates, suppliers of specialized human capital can command higher fees or dictate more favorable terms. AEON must contend with competitive salary packages and attractive benefits to secure and retain top talent in these in-demand areas. This dynamic can impact AEON's operational costs and its ability to scale its specialized services effectively.

- Talent Scarcity: A global deficit in cybersecurity experts, estimated at 3.4 million in 2024, empowers recruitment firms and training providers.

- Increased Costs: This scarcity leads to higher recruitment expenses and competitive salary demands for AEON to attract essential personnel.

- Supplier Leverage: Recruitment agencies and educational institutions gain bargaining power due to the high demand for niche financial and tech skills.

AEON Financial Services faces significant supplier power from technology and software vendors, especially those offering unique or highly integrated solutions. The cost and complexity of switching providers amplify this leverage, impacting AEON's operational flexibility and costs.

Payment networks like Visa and Mastercard hold substantial bargaining power, dictating terms and fees such as interchange rates that directly affect AEON's revenue. Similarly, data providers for credit scoring and fraud detection are critical, with their power stemming from the accuracy and breadth of their indispensable information.

In 2024, the market for data analytics, including credit scoring and market intelligence, was valued at over $300 billion, underscoring the immense influence of these data suppliers.

AEON's reliance on capital markets for funding means investment banks and institutional investors possess considerable bargaining power. Factors like market sentiment and AEON's creditworthiness in 2024, influenced by monetary policy, directly shape borrowing costs and lender leverage.

The scarcity of specialized talent, particularly in cybersecurity where a 2024 shortage of 3.4 million professionals was reported, grants significant bargaining power to recruitment agencies and educational institutions supplying these skills to AEON.

| Supplier Category | Key Suppliers | Impact on AEON | 2024 Data Point |

| Technology & Software | Core Banking, Payment Processing, Data Analytics Vendors | High switching costs, reliance on unique solutions | N/A (specific vendor data not public) |

| Payment Networks | Visa, Mastercard, JCB | Dictate interchange fees and transaction terms | Interchange fees remain a significant cost |

| Data & Information Services | Credit Bureaus, Market Intelligence Firms, Cybersecurity Providers | Critical data accuracy and availability; high demand | Global Data Analytics Market > $300 Billion (2024 projection) |

| Capital Markets | Investment Banks, Institutional Investors | Influence cost of capital based on market conditions and AEON's creditworthiness | Rising interest rates in 2024 can increase debt provider power |

| Human Capital | Recruitment Agencies, Educational Institutions | High demand for specialized skills drives up recruitment costs and salaries | Global Cybersecurity Talent Shortage: 3.4 Million (2024 estimate) |

What is included in the product

This analysis dissects the competitive forces impacting AEON Financial Service, revealing the intensity of rivalry, buyer and supplier power, threats from new entrants and substitutes, and AEON's strategic positioning within the financial services industry.

Instantly visualize competitive intensity across all five forces, empowering swift and informed strategic adjustments for AEON Financial Services.

Customers Bargaining Power

For straightforward financial products like savings accounts and basic loans, customers often find it simple to switch providers. This ease of movement means they can readily move their money to another bank if they find a better interest rate or a more convenient service. In 2024, the average consumer surveyed indicated they would consider switching banks for a mere 0.25% difference in interest rates on savings accounts, highlighting this low switching cost.

Customers today have unprecedented access to information, thanks to a surge in online comparison websites and financial aggregators. These platforms allow individuals to effortlessly compare everything from interest rates on loans to the fees associated with various financial products. This transparency directly impacts AEON Financial Services by leveling the playing field. For instance, in 2024, a significant portion of consumers, estimated to be over 70%, actively used online tools to research financial products before making a decision, according to industry reports.

This ease of comparison significantly reduces information asymmetry, which historically favored financial institutions. Customers can now readily identify the most competitive offers available in the market, empowering them to make more informed choices. This heightened awareness strengthens their bargaining power, as they can easily switch to competitors offering better terms or simply negotiate for more favorable conditions with AEON.

AEON Financial Service serves a wide array of individual consumers and small to medium-sized businesses. This broad customer base means no single client wields significant individual bargaining power. However, the sheer volume of customers collectively represents a substantial force, capable of influencing AEON's performance through coordinated actions or shifts in demand.

Strong Brand Loyalty through Retail Network

AEON Financial Service benefits from a significant advantage by integrating its offerings within AEON's vast retail network. This creates a sticky environment for customers already engaged with the AEON brand, potentially reducing their inclination to seek financial services elsewhere.

For instance, in 2024, AEON's extensive loyalty program, which encompasses millions of members across its various retail outlets, provides a direct channel to market AEON Financial Service products. Customers accustomed to the convenience and rewards of shopping at AEON may find it more appealing to use AEON's credit cards or other financial solutions, thereby dampening their bargaining power.

- Leveraging Retail Integration: AEON Financial Service's presence within AEON's retail footprint fosters customer loyalty.

- Reduced Customer Bargaining Power: Shoppers loyal to AEON stores are more likely to adopt AEON's financial products, limiting their options to switch.

- Loyalty Program Synergy: The extensive AEON loyalty program, with millions of members as of 2024, serves as a direct conduit for financial service promotion.

Influence of Customer Reviews and Social Media

In the current digital landscape, customer reviews and social media chatter wield substantial influence. Negative feedback shared online can rapidly damage AEON Financial Service's reputation, making potential customers hesitant to engage. This collective voice empowers customers, enabling them to significantly impact AEON's ability to attract new clients.

The amplification of customer experiences through platforms like Trustpilot or industry-specific forums means that a few negative reviews can have an outsized impact. For instance, a significant portion of consumers, estimated to be around 80-90% by various studies, report reading online reviews before making a purchasing decision. This highlights the critical need for AEON to actively manage its online presence and address customer concerns promptly to mitigate the bargaining power derived from this digital word-of-mouth.

- Online reviews directly influence customer acquisition for AEON Financial Service.

- Negative feedback can deter potential clients, increasing customer bargaining power.

- Studies indicate a high percentage of consumers rely on online reviews before purchasing financial services.

- Proactive management of online reputation is crucial for AEON to counter this influence.

While individual customers of AEON Financial Service typically have limited bargaining power due to the vastness of its customer base, the collective power of informed consumers is significant. The ease with which customers can compare financial products online, with over 70% utilizing comparison tools in 2024, empowers them to seek better terms. This transparency, coupled with the potential impact of online reviews, means AEON must actively manage its reputation and offerings to retain business.

| Factor | Impact on AEON Financial Service | Customer Bargaining Power |

|---|---|---|

| Information Availability | High transparency of financial products and rates | Increased |

| Switching Costs | Low for basic financial products | Increased |

| Customer Base Size | No single customer holds significant power | Low (individually) |

| Brand Integration (AEON Retail) | Creates customer stickiness and loyalty | Decreased |

| Online Reviews & Social Media | Significant influence on reputation and acquisition | Increased |

Preview the Actual Deliverable

AEON Financial Service Porter's Five Forces Analysis

This preview shows the exact AEON Financial Service Porter's Five Forces Analysis you'll receive immediately after purchase, detailing the competitive landscape and strategic positioning. You'll gain a comprehensive understanding of industry rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products. This professionally formatted document is ready for your immediate use, offering actionable insights for AEON's strategic planning.

Rivalry Among Competitors

AEON Financial Service contends with deeply rooted, large banks that offer a comprehensive suite of financial products. These established players, like Mitsubishi UFJ Financial Group and Sumitomo Mitsui Financial Group in Japan, command vast customer bases and substantial capital, presenting a significant hurdle.

These behemoths leverage their extensive branch networks and decades of operational experience to serve a broad customer spectrum. For instance, in 2023, the top three Japanese megabanks reported total assets exceeding ¥500 trillion, highlighting their immense financial power and market penetration, which directly challenges AEON's growth ambitions.

The credit card landscape is intensely crowded, with a multitude of domestic and international players all striving to capture a larger piece of the market. AEON Financial Service contends with formidable rivals, including established financial institutions and retailers offering their own branded credit cards. These competitors frequently engage in aggressive tactics, such as offering lower interest rates, attractive reward schemes, and enticing promotional deals to win over and keep customers.

The financial services sector is seeing a significant shift with the rise of nimble fintech firms. These companies are carving out specialized areas, focusing on things like mobile payments, online lending, and digital wealth management. For instance, in 2024, the global fintech market size was valued at an estimated $1.17 trillion, showcasing rapid growth and increasing competition.

These fintech innovators frequently present cutting-edge, intuitive services that often come with lower operating costs. This directly challenges AEON's established ways of doing business. They are particularly adept at attracting younger, digitally native customers, which could lead to a decline in AEON's market share among these key demographics.

Retailers and Non-Financial Companies Entering Financial Services

AEON faces increasing competitive rivalry from non-traditional players, particularly large retailers and tech giants, as they increasingly offer financial services. These companies leverage vast customer bases and sophisticated digital platforms to introduce payment solutions, loyalty programs with financial benefits, and even lending products, directly challenging AEON's integrated financial offerings.

For instance, in 2024, major retailers continued to expand their in-house payment systems and credit offerings, aiming to capture a larger share of consumer spending. This trend is fueled by the desire to enhance customer loyalty and gather valuable data, which can be used to personalize financial products and services.

Key competitive actions include:

- Expansion of Retailer-Branded Credit Cards: Many large retailers are enhancing their co-branded credit card programs, offering more attractive rewards and financing options to drive sales and customer retention.

- Integration of Payment Solutions: Retailers are embedding payment functionalities directly into their apps and loyalty programs, simplifying transactions and reducing reliance on third-party financial providers.

- Entry into Digital Lending: Some non-financial companies are exploring or actively offering small-scale lending services, often through partnerships or their own digital platforms, creating a new competitive front for traditional financial service providers.

Price and Product Feature Competition

The financial services sector is intensely competitive, compelling AEON to continuously innovate and differentiate its offerings while keeping prices attractive. This rivalry is evident in aggressive marketing, competitive interest rates on loans and deposits, and enhanced reward programs for credit cards. For instance, in 2024, major banks saw their net interest margins fluctuate, with some reporting figures around 2.5% to 3.5%, underscoring the pressure to attract deposits and lend profitably.

AEON faces a saturated market where customer acquisition and retention hinge on offering superior value. The constant introduction of new digital features, such as advanced mobile banking apps and personalized financial advice tools, is a key battleground. In 2024, digital banking adoption continued to surge, with a significant percentage of transactions occurring through online and mobile channels, pushing traditional players to invest heavily in technology to keep pace.

- Aggressive Marketing: Banks and financial institutions regularly launch broad marketing campaigns, often featuring promotional interest rates or sign-up bonuses to capture market share.

- Interest Rate Wars: Competition on loan and deposit rates remains a primary driver, directly impacting customer choice and profitability.

- Product Innovation: The continuous rollout of new credit card features, investment platforms, and digital banking tools is crucial for differentiation.

- Customer Loyalty Programs: Enhanced reward schemes and personalized offers are employed to foster customer loyalty in a highly contestable environment.

AEON Financial Service operates within a fiercely competitive landscape, facing pressure from established mega-banks and a growing number of agile fintech companies. These rivals are actively vying for market share through aggressive pricing, innovative digital offerings, and enhanced customer loyalty programs. The increasing involvement of large retailers and tech giants in financial services further intensifies this rivalry, as they leverage their extensive customer bases and digital platforms to offer integrated financial solutions.

| Competitor Type | Key Strategies | Example Data/Trend (2023-2024) |

|---|---|---|

| Large Banks | Extensive branch networks, comprehensive product suites, strong capital base | Top Japanese megabanks' total assets exceeded ¥500 trillion in 2023. |

| Fintech Firms | Specialized digital services (payments, lending), lower operating costs, intuitive user experience | Global fintech market valued at $1.17 trillion in 2024. |

| Retailers/Tech Giants | Loyalty programs with financial benefits, embedded payment solutions, digital platforms | Continued expansion of in-house payment systems by major retailers in 2024. |

| Credit Card Providers | Lower interest rates, attractive reward schemes, promotional deals | Net interest margins for major banks fluctuated around 2.5%-3.5% in 2024. |

SSubstitutes Threaten

Despite the growing popularity of credit cards and digital payment solutions, cash continues to be a significant payment method across many Asian economies, especially for everyday, smaller purchases. This persistent preference for cash presents a direct substitute for credit-based transactions, impacting the demand for services like those offered by AEON Financial Services.

Debit cards also serve as a strong substitute, offering consumers a way to make purchases without incurring interest charges, as funds are directly debited from their bank accounts. In 2023, for instance, debit card transactions in key Southeast Asian markets continued to see robust growth, demonstrating consumer preference for managing expenses directly from available funds, thereby reducing the need for credit facilities.

Peer-to-peer (P2P) lending platforms represent a significant threat of substitutes for AEON Financial Services. These platforms directly connect individual borrowers with individual lenders, bypassing traditional banks and financial institutions. For instance, in 2024, the global P2P lending market continued its growth trajectory, with transaction volumes reaching hundreds of billions of dollars, offering a viable alternative for consumers and small businesses seeking capital.

P2P platforms often compete by offering more streamlined application processes and faster funding times compared to traditional bank loans, appealing to borrowers who prioritize speed and convenience. This disintermediation can siphon off a portion of AEON's potential loan market, especially for unsecured personal loans and small business financing where flexibility and speed are key differentiators.

The rise of mobile payment and e-wallet solutions poses a significant threat to AEON Financial Service. These platforms, such as GrabPay and Touch 'n Go eWallet in Malaysia, allow direct transactions from bank accounts or stored value, bypassing traditional credit card networks. This offers consumers a convenient alternative, often integrated with loyalty programs, directly challenging AEON's core payment processing business.

In 2023, the e-wallet market in Southeast Asia continued its rapid expansion, with transaction values projected to reach hundreds of billions of dollars. For instance, in Malaysia alone, e-wallet usage saw substantial growth, with the government actively promoting digital payments. This trend indicates a clear shift in consumer behavior, favoring digital wallets over traditional payment methods, which could impact AEON's market share in transaction fees and credit card usage.

Self-Financing and Informal Lending

Self-financing and informal lending present a significant threat to AEON Financial Service. For many small businesses and individuals, tapping into retained earnings or personal savings offers a direct alternative to seeking external credit. This can be particularly appealing when interest rates from formal lenders are high or when speed of access is paramount.

Informal lending networks, often built on trust and community ties, also act as a potent substitute. These arrangements can bypass the stringent application processes and collateral requirements typical of institutions like AEON. In 2024, it's estimated that a substantial portion of small business financing in emerging markets still relies on these informal channels, underscoring their persistent relevance.

- Self-financing: Utilizing personal savings or business profits for funding needs.

- Informal lending: Accessing capital from friends, family, or community-based lending circles.

- Market Penetration: These alternatives are especially prevalent in regions with lower trust in formal financial systems or where credit access is historically difficult.

- 2024 Impact: Reports indicate that informal finance still plays a critical role in supporting micro and small enterprises globally, potentially diverting a significant volume of potential business from formal lenders.

Alternative Investment Vehicles

Customers looking for investment opportunities have many choices outside of AEON Financial Services' traditional offerings. These alternatives can attract capital that might otherwise flow into AEON's deposit or investment accounts.

For instance, the global alternative investment market, encompassing assets like private equity, hedge funds, and real estate, was projected to reach approximately $17.9 trillion in 2024, demonstrating a significant pool of capital available outside conventional financial institutions.

- Real Estate: Direct property investments offer tangible assets and potential rental income, appealing to those seeking diversification.

- Commodities: Investments in gold, oil, or agricultural products provide exposure to different market cycles and inflation hedging.

- Cryptocurrencies: Digital assets like Bitcoin and Ethereum have gained traction, offering high volatility and potential for significant returns, attracting a growing segment of investors.

- Crowdfunding Platforms: These platforms allow individuals to invest in startups or small businesses, providing access to early-stage growth opportunities.

The threat of substitutes for AEON Financial Services is multifaceted, encompassing various alternatives that fulfill similar customer needs. These substitutes range from traditional payment methods like cash and debit cards to newer digital solutions and informal lending channels. Furthermore, investment alternatives outside AEON's core offerings also represent a significant substitute threat, diverting capital that could otherwise be managed by the company.

| Substitute Category | Specific Examples | 2024 Market Insight/Data |

|---|---|---|

| Payment Alternatives | Cash, Debit Cards, Mobile Wallets (e.g., GrabPay, Touch 'n Go) | Southeast Asian e-wallet transactions projected to reach hundreds of billions of dollars in 2024. |

| Lending Alternatives | Peer-to-Peer (P2P) Lending Platforms, Informal Lending Networks | Global P2P lending market transaction volumes in the hundreds of billions of dollars in 2024; informal finance crucial for micro and small enterprises globally. |

| Investment Alternatives | Real Estate, Commodities, Cryptocurrencies, Crowdfunding | Global alternative investment market projected to reach approximately $17.9 trillion in 2024. |

Entrants Threaten

The financial services sector is a minefield of regulations, demanding rigorous licensing, ongoing compliance, and substantial capital reserves. For instance, in 2024, the global financial services industry saw an estimated $2.5 trillion in regulatory fines, highlighting the cost of non-compliance and the complexity new entrants must navigate.

These demanding regulatory barriers significantly deter new companies from entering the market. It takes considerable time and resources for aspiring firms to obtain the necessary approvals and build the infrastructure to operate legally and competitively, especially when facing established players like AEON Financial Service.

Launching a comprehensive financial services operation, particularly in areas like credit issuance and banking, necessitates significant capital. We're talking about substantial investments in physical infrastructure, cutting-edge technology, extensive marketing campaigns, and crucially, maintaining adequate liquidity to meet regulatory requirements and customer demands. This high capital requirement acts as a significant deterrent for many aspiring new entrants.

For instance, establishing a new bank in 2024 often requires a minimum capital base that can run into hundreds of millions of dollars, depending on the jurisdiction and the scope of operations. This formidable financial barrier naturally favors established institutions like AEON, which already possess the necessary capital reserves and operational scale, thereby limiting the immediate threat of new, undercapitalized competitors entering the market.

Trust is the bedrock of financial services, and AEON Financial Service, with its deep roots and extensive retail network, has cultivated significant brand recognition and customer loyalty over many years. This established trust makes it challenging for newcomers to gain traction.

New entrants must invest heavily in marketing and customer acquisition to build credibility, a process that can take considerable time and resources. For instance, in 2024, the cost of acquiring a new customer in the competitive digital banking sector often exceeded $200, highlighting the substantial barrier to entry.

AEON's existing customer base, nurtured through its strong retail presence, provides a stable foundation that new competitors struggle to replicate. This inherent advantage means new players must offer truly disruptive value propositions to overcome the inertia of established relationships.

Economies of Scale and Network Effects

AEON Financial Service leverages significant economies of scale, which translates to lower operational costs per transaction compared to smaller, emerging players. This cost advantage makes it challenging for new entrants to match AEON's pricing structure and profitability.

The company's vast retail network fosters powerful network effects. As more customers and merchants join the AEON ecosystem, the platform becomes more valuable for everyone, creating a substantial barrier to entry for newcomers who lack this established user base. For instance, in 2024, AEON reported a 15% year-over-year increase in active merchant accounts, reinforcing its network strength.

- Economies of Scale: AEON's large operational volume allows for reduced per-unit costs in transaction processing and account management.

- Network Effects: A growing user and merchant base enhances the value proposition of AEON's services, deterring new competition.

- Customer Loyalty: The established network and integrated services foster customer stickiness, making switching costs high for consumers.

Technological Innovation and Specialization

While technological advancements can sometimes lower the cost of entry for new financial service providers, significant innovation or deep specialization is often required to effectively compete. AEON Financial Services, leveraging its substantial capital and established infrastructure, can invest heavily in proprietary technology and adapt quickly to market shifts.

This means that potential new entrants must possess truly disruptive technology, such as advanced AI-driven analytics or novel blockchain-based platforms, or carve out a highly differentiated niche. For instance, a new entrant aiming to compete directly with AEON's broad retail banking services would face considerable hurdles. However, a fintech startup focusing exclusively on personalized ESG investment advisory, utilizing sophisticated natural language processing for sentiment analysis, might find a viable entry point. In 2024, the global fintech market saw continued growth, with investment in AI in financial services reaching an estimated $15 billion, highlighting the emphasis on technological differentiation.

- Technological Differentiation: New entrants must offer genuinely innovative technology, not just incremental improvements, to challenge established players like AEON.

- Niche Specialization: Focusing on underserved or emerging market segments with tailored solutions can be a more viable entry strategy than broad replication.

- Investment Requirements: Competing on technology often necessitates substantial upfront investment, a barrier that AEON is well-positioned to overcome.

- Disruptive Potential: Only business models or technologies that fundamentally alter the existing competitive landscape can overcome AEON's scale and resources.

The threat of new entrants in the financial services sector, particularly concerning AEON Financial Service, is significantly mitigated by high regulatory hurdles and substantial capital requirements. For example, in 2024, the global financial services industry faced an estimated $2.5 trillion in regulatory fines, underscoring the complexity and cost of compliance for any new player. This, coupled with the need for considerable investment in infrastructure, technology, and marketing, creates a formidable barrier.

Furthermore, AEON's established brand trust and extensive customer loyalty, built over years of operation, present a significant challenge for newcomers. Acquiring customers in 2024, especially in digital banking, often cost over $200, a stark indicator of the investment needed to build a customer base. AEON's strong retail network also generates powerful network effects, making it difficult for new entrants to replicate its value proposition and scale.

| Barrier Type | Description | Impact on New Entrants | 2024 Data Point |

|---|---|---|---|

| Regulatory Compliance | Strict licensing, ongoing compliance, and capital reserves are mandatory. | High barrier, requiring significant time and resources. | ~$2.5 trillion in global regulatory fines. |

| Capital Requirements | Substantial investment needed for infrastructure, technology, and liquidity. | Formidable financial hurdle, favoring well-capitalized incumbents. | Establishing a new bank can require hundreds of millions USD. |

| Brand Recognition & Trust | Years of operation build customer loyalty and credibility. | Challenging for newcomers to gain traction and replicate trust. | Customer acquisition cost in digital banking exceeded $200. |

| Economies of Scale & Network Effects | Large operational volume and growing user base reduce costs and increase value. | Creates cost advantages and a stronger ecosystem that is hard to match. | AEON reported a 15% YoY increase in active merchant accounts in 2024. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for AEON Financial Service is built upon a robust foundation of data, including AEON's annual reports, investor presentations, and filings with regulatory bodies. We also incorporate industry-specific research from reputable financial analysis firms and macroeconomic data to provide a comprehensive view of the competitive landscape.