Aegean Airlines PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aegean Airlines Bundle

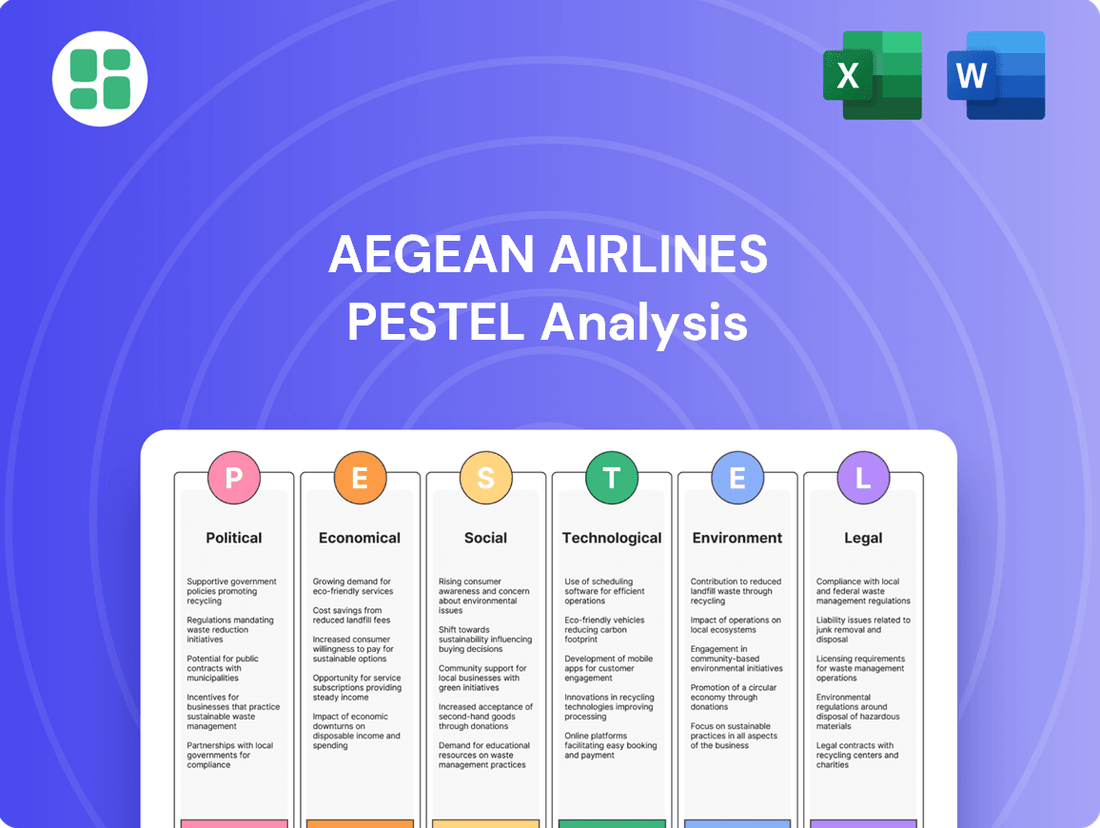

Explore the intricate web of political, economic, social, technological, legal, and environmental factors impacting Aegean Airlines. Understand how evolving regulations, fluctuating fuel prices, and shifting passenger preferences are shaping its operational landscape. Download the full PESTLE analysis to uncover critical insights and gain a competitive advantage.

Political factors

Aegean Airlines navigates a complex web of government aviation policies, primarily shaped by Greek national regulations and the broader European Union framework. These rules govern critical operational areas like market access, how flight slots are distributed at busy airports, and the stringent safety and operational standards airlines must meet. For instance, EU open skies policies have historically fostered competition, but national governments retain influence over aspects like airport infrastructure and passenger rights.

Shifts in governmental focus, particularly concerning tourism promotion or broader economic development strategies, can significantly alter the operating landscape for Aegean. For example, if the Greek government prioritizes increasing tourism arrivals, it might implement policies that favor airlines like Aegean through infrastructure investments or targeted subsidies, potentially impacting route planning and fleet expansion. Conversely, a focus on environmental regulations could lead to increased operational costs or requirements for newer, more fuel-efficient aircraft.

In 2024, the aviation sector continues to feel the impact of post-pandemic recovery efforts, with governments often balancing economic stimulus with fiscal responsibility. This can translate into evolving approaches to air transport taxation or support mechanisms. Aegean's strategic planning must remain agile to adapt to these dynamic policy shifts, ensuring compliance while capitalizing on opportunities presented by favorable government initiatives.

Geopolitical instability in the Eastern Mediterranean poses a significant risk to Aegean Airlines. Tensions in this region, a core part of Aegean's operational network, can directly impact flight operations and passenger confidence. For example, during the latter half of 2024, specific geopolitical events led to temporary flight suspensions to certain routes, demonstrably affecting international passenger numbers.

As a prominent Star Alliance member, Aegean Airlines navigates a landscape shaped by EU aviation directives, particularly the open skies agreements. These agreements are pivotal, fostering seamless cross-border operations and intensifying competition within the European Union. For Aegean, this translates to expanded network opportunities without the historical constraints of bilateral air service agreements.

The liberalization brought about by open skies agreements allows Aegean to more freely establish routes and codeshare partnerships across the EU. This is crucial for its competitive positioning, especially as the airline sector continues to consolidate and globalize. For instance, the EU's commitment to a single aviation market aims to reduce barriers, and Aegean benefits from this by accessing a larger passenger base.

Adherence to the evolving EU regulatory framework is non-negotiable for Aegean's sustained operational success and market competitiveness. This includes adapting to new environmental standards, passenger rights regulations, and safety protocols mandated by the EU. Failure to comply could result in penalties or restrictions, impacting its ability to leverage the benefits of open skies.

Bilateral Air Service Agreements

Aegean Airlines' strategic growth into non-EU regions like the Middle East and Africa is significantly shaped by bilateral air service agreements. These pacts between Greece and destination countries dictate crucial operational aspects such as permissible flight paths, how often flights can operate, and the number of passengers or cargo allowed. For instance, as of early 2024, Greece has active air service agreements with over 70 countries globally, providing a framework for international connectivity.

The airline's strategic investment in longer-range aircraft, like the Airbus A321neo LR, directly supports its ambition to tap into these non-EU markets more efficiently. However, the success of these routes hinges on securing and maintaining favorable bilateral agreements that permit the necessary flight frequencies and capacity. These agreements are dynamic, with ongoing negotiations influencing market access and competitive positioning for carriers like Aegean.

- Bilateral Agreements: Essential for non-EU market access, defining routes and capacity.

- Geographic Focus: Middle East and Africa are key expansion areas for Aegean.

- Fleet Investment: Extended-range aircraft are deployed to capitalize on these agreements.

- Regulatory Framework: Favorable pacts are critical for operational viability and growth in these regions.

Government Support and Subsidies for Tourism/Aviation

The Greek government's strategic emphasis on boosting tourism directly bolsters Aegean Airlines, a key player in linking Greece's domestic destinations with global markets. In 2023, tourism receipts in Greece reached an estimated €20.5 billion, underscoring the sector's economic significance and the airline's crucial role. Government initiatives like infrastructure upgrades and international marketing campaigns provide a favorable operating environment.

Furthermore, potential government aid, such as subsidies or economic stimulus packages tailored for the aviation sector, could significantly enhance Aegean Airlines' financial resilience and capacity for expansion. For instance, the European Union's Recovery and Resilience Facility, with significant allocations for Greece, could indirectly support aviation through broader economic recovery measures.

- Tourism Growth: Greece's tourism sector saw a robust recovery, with international arrivals in 2023 nearing pre-pandemic levels, providing a strong demand base for Aegean.

- Infrastructure Investment: Government plans for upgrading airports and related transportation networks enhance connectivity and passenger experience, benefiting airlines like Aegean.

- Government Support Measures: While specific direct subsidies for airlines are not always prevalent, broader economic support or favorable regulatory frameworks can indirectly assist Aegean's operations.

Political factors significantly influence Aegean Airlines' operations through EU aviation policies and national Greek regulations. These frameworks dictate market access, slot allocation, and safety standards, with open skies agreements fostering competition across the EU. Aegean's strategic planning must remain agile to adapt to evolving policy shifts, such as those impacting air transport taxation or support mechanisms, especially in the context of ongoing post-pandemic recovery efforts throughout 2024.

What is included in the product

This PESTLE analysis delves into the external macro-environmental factors impacting Aegean Airlines, examining Political, Economic, Social, Technological, Environmental, and Legal influences to uncover strategic opportunities and threats.

A concise PESTLE analysis for Aegean Airlines, presented in a visually segmented format, offers a quick overview of external factors impacting the airline, thereby alleviating the pain point of information overload during strategic planning.

Economic factors

Aegean Airlines' success is intrinsically linked to the health of Greek tourism. The airline's core business involves connecting Greece to the world, making international visitor numbers crucial for its passenger traffic and revenue streams. This reliance means that trends in global travel directly impact Aegean's bottom line.

The outlook for Greek tourism in 2024 and 2025 is particularly strong, with projections indicating significant growth. For instance, international air arrivals are anticipated to see a robust increase, and scheduled airline seats are also set to expand, directly translating to more passengers for Aegean. This surge in travel demand is a primary driver for the airline's operational performance.

Furthermore, the broader Greek economy plays a supportive role. With an estimated economic growth rate of around 2.2% to 2.3% projected for both 2024 and 2025, this economic expansion underpins increased consumer spending power. This generally translates into higher overall travel demand, benefiting airlines like Aegean.

Fuel prices are a major expense for airlines like Aegean, directly impacting their bottom line. Global oil price swings create significant uncertainty. For instance, Brent crude oil prices averaged around $83 per barrel in early 2024, a notable increase from previous years, and forecasts suggest continued volatility through 2025 due to geopolitical tensions and supply dynamics.

Aegean Airlines, like its peers, faces the challenge of managing this volatility. Strategies such as fuel hedging are essential to mitigate the risk of sudden price hikes and maintain predictable operating costs, thereby safeguarding profitability amidst an inflationary environment.

Aegean Airlines faces significant exposure to Euro-USD exchange rate volatility, as the company incurs substantial costs, particularly for fuel and aircraft leases, in U.S. dollars. Conversely, a large portion of its revenue is generated in Euros.

This mismatch means that a weakening Euro against the U.S. dollar can directly impact Aegean's profitability. For instance, in 2024, a notable slide in the Euro's value against the dollar led to temporary valuation losses on its forward lease obligations, which in turn contributed to a decrease in the airline's net income for the period.

Consumer Disposable Income and Travel Spending

Consumer confidence and disposable income in Aegean Airlines' key source markets, such as Germany, the UK, and France, are crucial drivers of travel spending and, consequently, air ticket demand. Despite lingering macroeconomic concerns and geopolitical tensions in 2024 and early 2025, a notable trend has been the continued prioritization of experiential spending by consumers. This has translated into robust demand for air travel, with many households allocating a significant portion of their discretionary income towards holidays and leisure trips.

The broader European economic outlook, while exhibiting some signs of moderation in growth projections for 2025, generally remains supportive of continued travel. For instance, the Eurozone's GDP growth is forecast to be around 1.0% to 1.5% in 2025, providing a stable, albeit not booming, environment for discretionary spending on travel. This sustained, albeit potentially slower, economic activity underpins the expectation of ongoing travel demand for airlines like Aegean.

- Consumer Confidence: While fluctuating, consumer confidence indices in major European economies have shown resilience, particularly concerning travel intentions for 2025.

- Disposable Income Growth: Real disposable income in key markets is projected to see modest but positive growth in 2025, supporting increased spending on leisure activities.

- Experiential Spending Trend: Surveys indicate that a significant percentage of European consumers (often exceeding 60%) plan to maintain or increase their spending on travel and experiences in the coming year.

- Impact on Demand: This consistent demand for travel directly benefits airlines by filling seats and supporting fare levels, even amidst broader economic uncertainties.

Inflation and Operating Costs

Inflationary pressures directly impact Aegean Airlines' operating costs, affecting everything from employee wages and aircraft maintenance to essential airport charges. While Greece's inflation rate has shown signs of cooling, ongoing service inflation could still put upward pressure on the airline's expenses throughout 2024 and into 2025.

Effectively managing these escalating costs is paramount for Aegean to sustain competitive ticket prices and ensure healthy profit margins in a dynamic market. For instance, the Harmonised Index of Consumer Prices (HICP) in Greece, a key inflation indicator, stood at 2.4% in April 2024, a decrease from previous months, but specific service components may still exhibit stickiness.

- Labor Costs: Wage increases to retain staff in a competitive environment.

- Maintenance Expenses: Rising costs for parts and specialized labor.

- Fuel Surcharges: Fluctuations in global oil prices impacting operational expenses.

- Airport Fees: Potential increases in landing and handling charges at various destinations.

The economic landscape for Aegean Airlines is shaped by several key factors. Strong tourism demand, particularly in Greece, is a primary driver, with projections for 2024 and 2025 indicating robust growth in international arrivals and scheduled seats. This positive outlook is further supported by Greece's projected economic growth of around 2.2% to 2.3% for both years, which boosts consumer spending power and travel propensity.

| Economic Factor | 2024 Projection/Observation | 2025 Projection | Impact on Aegean Airlines |

| Greek Tourism Growth | Strong increase in international arrivals | Continued robust growth expected | Increased passenger traffic and revenue |

| Greek GDP Growth | ~2.2% - 2.3% | ~2.2% - 2.3% | Supports consumer spending and travel demand |

| Fuel Prices (Brent Crude) | Averaged ~$83/barrel (early 2024) with volatility | Continued volatility expected | Increased operating costs; necessitates hedging |

| Euro-USD Exchange Rate | Weakening Euro noted in 2024 | Potential for continued volatility | Increased costs for USD-denominated expenses (fuel, leases) |

| European Consumer Confidence | Resilient, prioritizing travel | Modest growth expected | Sustained demand for leisure travel |

| Inflation (Greece HICP) | 2.4% (April 2024), showing cooling but service inflation persists | Continued monitoring required | Upward pressure on operating costs (wages, maintenance, fees) |

Preview Before You Purchase

Aegean Airlines PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis for Aegean Airlines delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations. You'll gain a deep understanding of the external forces shaping the airline's strategic landscape.

Sociological factors

Post-pandemic, the appetite for air travel remains robust, with consumers increasingly directing their spending towards experiences. Aegean Airlines must navigate these shifting consumer desires, which include a growing preference for eco-friendly travel and a nuanced approach to balancing cost-effectiveness with enhanced comfort.

This trend is evident in the airline's strategic decision to invest in higher-comfort seating configurations for its longer-haul routes, directly addressing the premium expectations of its passenger base. For instance, Aegean Airlines reported carrying 15.5 million passengers in 2023, a significant increase from pre-pandemic levels, underscoring the strong demand for air travel and the need for service differentiation.

Greece's population is aging, with projections indicating a continued increase in the proportion of older adults. This demographic trend suggests a growing demand for travel services that prioritize comfort, accessibility, and potentially slower-paced itineraries. In 2023, the percentage of the Greek population aged 65 and over was approximately 23.5%, a figure expected to rise.

Conversely, youth travel remains a significant segment, driven by a desire for budget-friendly options and unique experiences. This group often seeks flexible booking, social travel opportunities, and digital-first engagement. For instance, the number of international tourist arrivals in Greece reached a record high of 32.7 million in 2023, with a notable portion attributed to younger demographics exploring the country.

Aegean Airlines can leverage these insights by developing tiered service offerings. This might include enhanced business class amenities for older travelers and more competitive economy fares or package deals targeting younger, price-sensitive individuals. Adapting marketing campaigns to resonate with the specific needs and preferences of each demographic segment is crucial for sustained growth.

Tourism is more than just an industry in Greece; it's woven into the very fabric of its culture and national identity. This deep-rooted significance provides a remarkable resilience, allowing the sector to bounce back even when faced with economic or geopolitical headwinds. For Aegean Airlines, this translates into a consistently strong demand, fueled by both international travelers eager to experience Greece's rich heritage and domestic passengers connecting the nation's beautiful islands and vibrant cities.

The cultural embrace of tourism directly benefits Aegean by ensuring a steady flow of passengers. In 2023, Greece welcomed a record 32.7 million tourists, a significant increase from previous years, underscoring the enduring appeal and cultural importance of travel to the country. This robust inbound traffic, coupled with the vital domestic connectivity Aegean provides, solidifies its position as a key enabler of the Greek tourism ecosystem.

Impact of Social Media on Brand Perception

Social media's widespread adoption profoundly shapes how consumers view airlines. Aegean Airlines, like its competitors, faces a landscape where customer opinions shared online can rapidly influence brand perception, customer service expectations, and how marketing messages are received. Positive word-of-mouth on platforms like Instagram and X (formerly Twitter) can significantly boost Aegean's image, while negative experiences, if not addressed swiftly, can damage its reputation.

For instance, during 2024, airlines globally saw a surge in social media engagement. A significant portion of travelers, estimated to be over 70% by late 2024, reported that social media reviews and influencer content played a role in their flight booking decisions. This highlights the critical need for Aegean to actively monitor and engage with online conversations to manage its brand perception effectively.

Aegean must be particularly attuned to the speed at which information travels. A viral complaint or a highly praised service interaction can have immediate and substantial effects. By mid-2025, it's projected that over 80% of customer service inquiries for airlines will initiate through social media channels, underscoring the necessity for a robust and responsive social media management strategy.

Key considerations for Aegean's social media strategy include:

- Monitoring brand sentiment: Continuously tracking mentions and discussions about Aegean across major social platforms to gauge public opinion.

- Prompt customer service response: Addressing customer queries and complaints on social media quickly and efficiently to mitigate negative impacts.

- Leveraging positive feedback: Amplifying positive customer experiences and testimonials to enhance brand reputation and build trust.

- Engaging with influencers: Collaborating with travel influencers to reach wider audiences and positively shape brand perception.

Health and Safety Perceptions Post-Pandemic

While the acute phase of the pandemic is behind us, lingering concerns about health and safety continue to shape passenger attitudes towards air travel. Aegean Airlines, like its peers, must actively communicate and demonstrate its commitment to robust health protocols to rebuild and maintain traveler confidence.

The industry's accelerated adoption of contactless solutions and digital technologies is a direct response to these heightened passenger expectations for reduced physical interaction and enhanced hygiene. This shift is not merely a trend but a fundamental adjustment to post-pandemic travel norms.

For instance, a 2024 survey indicated that over 60% of travelers still consider health and safety measures a primary factor when choosing an airline. Aegean's investments in advanced air filtration systems and streamlined digital check-in processes directly address this enduring concern, aiming to reassure passengers and foster loyalty in a competitive market.

- Continued Passenger Vigilance: Post-pandemic, travelers remain attuned to airline health and safety measures, influencing booking decisions.

- Digitalization as a Safety Feature: Contactless technology and digital platforms are now viewed as integral to a safe travel experience.

- Aegean's Response: Investments in hygiene protocols and digital solutions aim to meet evolving passenger expectations for secure air travel.

Societal shifts are profoundly impacting Aegean Airlines, with a growing emphasis on experiences over possessions driving robust travel demand. The airline must also cater to evolving preferences for eco-conscious travel and a desire for enhanced comfort, as seen in their investment in premium seating. Greece's aging demographic, with over 23.5% of the population being 65 and older in 2023, points to an increasing need for accessible and comfortable travel options.

Technological factors

Aegean Airlines is making significant strides in fleet modernization, a key technological factor impacting its operations. The airline has been actively integrating new Airbus A320/321neo aircraft into its fleet. These aircraft are equipped with cutting-edge, fuel-efficient engines designed to reduce overall fuel consumption.

This strategic investment in newer technology directly translates to lower operational costs, with fuel being a major expenditure for airlines. For instance, the A320neo family typically offers a 15-20% reduction in fuel burn compared to previous generations. This efficiency gain not only boosts profitability but also helps Aegean meet its environmental sustainability goals.

Furthermore, Aegean is expanding its network capabilities by acquiring A321neo LR (Long Range) aircraft. This move allows for greater flexibility in route planning and the potential to serve longer, previously unviable routes, directly enhancing its competitive edge in the market.

Aegean Airlines is navigating a significant digital transformation within the aviation industry, mirroring the sector's broader trend of increased technology investment to elevate passenger journeys. This shift is evident in the growing adoption of contactless solutions, such as facial recognition for seamless boarding processes and self-service bag drop facilities, alongside a pervasive move towards mobile-first services. Aegean's strategic initiatives to enhance the travel experience by introducing new products and services are undoubtedly incorporating these digital advancements, aiming to streamline operations and improve customer satisfaction.

Aegean Airlines is increasingly leveraging big data analytics to refine its route network and enhance operational efficiency. By analyzing vast datasets, the airline can identify lucrative new routes and optimize existing ones, ensuring better capacity management. This data-driven approach allows for more precise forecasting of demand, crucial for maximizing revenue in a competitive market.

The airline's investment in personalization through big data is a key technological driver. Aegean can now tailor offers and services to individual passenger preferences, from seat selection to in-flight amenities, thereby improving customer satisfaction and loyalty. For instance, data insights can inform targeted marketing campaigns, leading to higher conversion rates for ancillary services, a growing revenue stream for airlines.

In 2024, the aviation industry saw a significant uptick in the adoption of AI and big data for operational improvements, with many carriers reporting cost savings and revenue growth. Aegean's strategic use of these technologies positions it to capitalize on these trends, aiming to achieve greater agility in responding to market changes and passenger needs.

AI and Automation in Operations and Customer Service

Aegean Airlines is increasingly leveraging artificial intelligence (AI) and robotic process automation (RPA) to enhance its operational efficiency and customer interactions. These advancements are critical for streamlining everything from baggage handling and flight scheduling to personalized customer support. By automating repetitive tasks, Aegean can significantly reduce manual errors and speed up processes, leading to a smoother travel experience for passengers.

The impact of AI and automation is evident in several key areas for airlines globally. For instance, AI-powered chatbots are becoming standard for handling customer inquiries, with many airlines reporting a substantial decrease in call center volume for routine questions. In 2024, the global AI in aviation market was valued at over $2 billion, with projections indicating significant growth as airlines invest in these transformative technologies to gain a competitive edge.

- AI-driven predictive maintenance is reducing aircraft downtime by identifying potential issues before they cause delays.

- RPA is automating back-office functions like invoice processing and data entry, freeing up staff for more complex tasks.

- Personalized customer experiences are being enhanced through AI analyzing passenger data to offer tailored services and recommendations.

- Improved operational efficiency translates to cost savings and a better overall passenger journey, which is crucial in the competitive airline industry.

Cybersecurity Measures

Aegean Airlines, like all modern carriers, operates on increasingly digital platforms, making cybersecurity a critical technological factor. The airline's reliance on online booking systems, passenger databases, and flight operations software means that safeguarding this information from cyber threats is non-negotiable. In 2024, the aviation industry continued to see a rise in sophisticated cyberattacks, with data breaches impacting customer trust and operational integrity.

Robust cybersecurity measures are essential for Aegean Airlines to protect sensitive passenger data and maintain the continuity of its operations. A breach could lead to significant financial losses, reputational damage, and regulatory penalties. For instance, the International Air Transport Association (IATA) has emphasized the growing threat landscape, with phishing and ransomware attacks remaining prevalent concerns for airlines globally.

Key cybersecurity measures for Aegean Airlines would include:

- Data Encryption: Implementing strong encryption protocols for all passenger and operational data, both in transit and at rest.

- Regular Security Audits: Conducting frequent vulnerability assessments and penetration testing to identify and address potential weaknesses in their systems.

- Employee Training: Providing ongoing cybersecurity awareness training to all staff to prevent human error, a common vector for cyberattacks.

- Advanced Threat Detection: Utilizing sophisticated software and AI-driven tools to monitor networks for suspicious activity and respond rapidly to emerging threats.

Aegean Airlines' technological advancements are significantly shaping its operational efficiency and passenger experience. The airline's investment in new aircraft, like the Airbus A320/321neo family, offers substantial fuel efficiency gains, with these models typically reducing fuel burn by 15-20% compared to older generations. This directly impacts operational costs, a critical factor in airline profitability.

Furthermore, Aegean is embracing digital transformation by integrating contactless solutions such as facial recognition for boarding and expanding mobile-first services. This digital shift aims to streamline operations and enhance customer satisfaction, aligning with industry-wide trends. In 2024, the global AI in aviation market exceeded $2 billion, highlighting the significant investment in these technologies.

The airline's strategic use of big data analytics is crucial for optimizing its route network and personalizing customer experiences. By analyzing passenger data, Aegean can tailor offers and improve service delivery, leading to increased loyalty and revenue from ancillary services. This data-driven approach is vital for navigating the competitive aviation landscape.

Cybersecurity is a paramount technological concern for Aegean Airlines, given its reliance on digital platforms. As sophisticated cyberattacks continue to rise, robust security measures like data encryption and regular audits are essential to protect passenger data and ensure operational continuity. The International Air Transport Association (IATA) consistently highlights the escalating threat landscape for airlines.

Legal factors

Aegean Airlines operates under strict safety mandates from the European Union Aviation Safety Agency (EASA) and the International Civil Aviation Organization (ICAO). These global and regional rules dictate everything from how aircraft are maintained and pilots are trained to the precise procedures for flight operations.

Compliance with these safety standards is non-negotiable and directly influences operational capabilities. For instance, mandatory early inspections of Pratt & Whitney GTF engines, a requirement stemming from these regulatory bodies, impacted Aegean's fleet availability during 2024, forcing adjustments to its flight schedule and capacity.

European consumer protection laws, notably EU261, are critical for airlines like Aegean. These regulations require airlines to offer compensation and assistance for significant flight disruptions, such as delays exceeding three hours, cancellations, or denied boarding. Failure to comply can result in substantial fines and damage to brand reputation.

Aegean's operational planning and customer service strategies must be meticulously aligned with EU261 to ensure passenger rights are upheld. This includes clear communication protocols during disruptions and efficient processing of compensation claims, which can impact the airline's financial performance and customer loyalty.

Aegean Airlines navigates a complex web of Greek and European Union labor laws. These regulations dictate everything from employment contracts and working conditions to the crucial area of collective bargaining. For instance, EU directives on working time and employee rights significantly influence airline operations across member states.

Managing relationships with labor unions is a paramount legal and operational concern for Aegean. Strong union presence can impact workforce flexibility, labor costs, and the potential for disruptions through industrial action, a factor that airlines must constantly monitor and engage with proactively.

Competition Law and Anti-Trust Regulations

Aegean Airlines, as the dominant carrier in Greece and a member of the Star Alliance, navigates a landscape heavily shaped by European Union competition law. This framework is designed to prevent monopolies and ensure a level playing field for all participants in the aviation market. The EU's Directorate-General for Competition actively monitors the sector, scrutinizing any actions that could stifle fair play.

Key areas of focus include preventing anti-competitive practices such as price collusion or the abuse of a dominant market position, which Aegean, given its size, must be mindful of. Furthermore, any proposed mergers, acquisitions, or strategic codeshare agreements involving Aegean undergo rigorous review by competition authorities to assess their potential impact on market competition and consumer choice.

- EU Competition Law Oversight: Aegean operates under strict EU regulations designed to prevent anti-competitive practices in the aviation sector.

- Merger and Acquisition Scrutiny: Strategic alliances and fleet expansions are subject to approval to ensure market fairness.

- Codeshare Agreement Regulation: Partnerships like those within Star Alliance are reviewed to prevent market distortion.

- Market Dominance Monitoring: Aegean's leading position in the Greek market means its operations are closely watched for potential abuse of dominance.

Data Privacy Regulations (GDPR)

The General Data Protection Regulation (GDPR) significantly impacts Aegean Airlines by dictating stringent requirements for handling passenger data. Compliance is paramount to avoid substantial penalties, with fines potentially reaching up to 4% of global annual turnover or €20 million, whichever is greater. Aegean Airlines must invest in robust data protection measures, including secure storage and transparent consent mechanisms, to safeguard customer information and maintain trust.

Recent enforcement actions highlight the critical nature of GDPR adherence. For instance, in 2023, several airlines faced investigations and fines for data breaches and non-compliance with data processing principles. Aegean Airlines' commitment to GDPR principles is therefore not just a legal obligation but a crucial element of its operational integrity and customer relations strategy.

- Data Collection Transparency: Aegean Airlines must clearly inform passengers about what data is collected and why.

- Consent Management: Obtaining explicit consent for data processing is essential, especially for marketing purposes.

- Data Minimization: Collecting only necessary passenger data reduces risk and improves compliance.

- Security Measures: Implementing strong technical and organizational measures to protect passenger data is non-negotiable.

Aegean Airlines must adhere to stringent EU safety regulations, impacting fleet management and operational procedures. For example, mandated GTF engine inspections in 2024 affected flight schedules.

Consumer protection laws like EU261 impose compensation requirements for flight disruptions, directly influencing customer service costs and brand reputation.

Labor laws and union relations are critical, with EU directives on working time affecting operational flexibility and labor expenses.

EU competition law scrutinizes Aegean's dominant market position, requiring careful management of strategic partnerships and pricing to avoid anti-competitive practices.

Environmental factors

Aegean Airlines operates within a stringent European Union environmental framework, notably the EU Emissions Trading System (EU ETS). This system requires the airline to purchase allowances for its carbon emissions, directly impacting operational costs. For 2024, the EU ETS saw a further reduction in emission caps, increasing the financial pressure on airlines to decarbonize.

The ongoing phase-out of free allowances under the EU ETS, particularly from 2024, means Aegean Airlines will face higher direct costs for its emissions. This regulatory shift is designed to heavily incentivize emissions reduction strategies, pushing the airline towards more sustainable aviation fuels and operational efficiencies.

Furthermore, Aegean Airlines is also subject to the Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA) for its international routes. CORSIA aims to stabilize net CO2 emissions from international aviation at 2019 levels, requiring airlines to offset emissions above a certain baseline, adding another layer of compliance and cost management.

Aegean Airlines, like all carriers in Europe, must navigate stringent noise pollution regulations. These rules directly impact operations, dictating which aircraft can fly at certain times and influencing route planning, particularly around densely populated areas. For instance, many European cities have curfews for nighttime flights, forcing airlines to adjust schedules and potentially use quieter, newer aircraft models.

The drive for compliance often accelerates fleet modernization. By 2024, airlines are increasingly investing in newer generation aircraft like the Airbus A320neo family, which are significantly quieter and more fuel-efficient than older models. This shift is not just about regulatory adherence but also about operational cost savings and improved passenger experience, with noise reduction being a key design feature.

The financial implications are substantial. Investing in quieter fleets can represent a significant capital expenditure, but it also mitigates potential fines and operational restrictions. For Aegean, this means a strategic focus on fleet renewal, ensuring its aircraft meet evolving environmental standards, thereby securing its operational flexibility and long-term competitiveness within the European aviation landscape.

Aegean Airlines is increasingly focusing on waste management and recycling, recognizing its impact on environmental responsibility. This includes efforts to reduce single-use plastics on board and improve recycling rates for materials like paper, aluminum, and plastic from passenger services. These initiatives are crucial for Aegean's sustainability objectives and bolstering its public perception as an environmentally conscious carrier.

Public Pressure for Sustainable Aviation

Public and stakeholder demand for a greener aviation sector is intensifying. This pressure compels airlines, including Aegean, to prioritize investments in Sustainable Aviation Fuels (SAF), modernizing their fleets, and adopting other environmentally friendly technologies. For instance, Aegean has actively expanded its SAF uplift program across various European airports, underscoring its dedication to reducing emissions.

The drive for sustainability is translating into tangible actions and targets within the industry. By 2025, the International Air Transport Association (IATA) aims for a 20% reduction in net aviation CO2 emissions compared to 2005 levels, with a long-term goal of net-zero carbon emissions by 2050. Aegean's participation in these initiatives directly addresses this growing environmental consciousness.

- Growing Demand for SAF: Public scrutiny is a key driver for airlines to increase their use of Sustainable Aviation Fuels.

- Fleet Modernization Investments: Airlines are investing in newer, more fuel-efficient aircraft to meet environmental targets.

- Aegean's SAF Expansion: Aegean Airlines has been actively increasing its uptake of SAF across its European network.

- Industry-Wide Goals: The aviation sector, including Aegean, is working towards significant CO2 emission reductions by 2030 and net-zero by 2050.

Climate Change Impact on Operations (e.g., extreme weather)

Climate change poses significant operational risks for Aegean Airlines, particularly through more frequent and intense extreme weather events. These events can disrupt flight schedules, leading to costly delays and cancellations. For instance, in 2023, severe weather events globally contributed to significant air traffic disruptions, impacting airlines' punctuality and profitability.

Aegean Airlines, with its primary hub in Greece, is susceptible to weather patterns common in the Mediterranean region, such as heatwaves and storms. These can necessitate re-routing flights, increasing fuel consumption and operational expenses. The International Air Transport Association (IATA) has highlighted that weather is a leading cause of flight delays, directly affecting passenger satisfaction and airline efficiency.

- Increased Fuel Costs: Re-routing due to severe weather can add 5-10% to fuel burn on affected flights.

- Operational Disruptions: In 2023, an estimated 15-20% of global flight delays were attributed to adverse weather conditions.

- Infrastructure Strain: Extreme heat can affect airport operations and aircraft performance, potentially limiting payload capacity.

Aegean Airlines faces increasing pressure from environmental regulations like the EU Emissions Trading System (EU ETS) and CORSIA, which add direct costs for carbon emissions. The airline is actively investing in fleet modernization, opting for quieter and more fuel-efficient aircraft like the Airbus A320neo family, a trend accelerated by 2024 environmental standards.

Public demand for sustainability is driving Aegean's increased use of Sustainable Aviation Fuels (SAF) and enhanced waste management practices. The airline's commitment aligns with industry-wide goals, such as IATA's aim for significant CO2 emission reductions by 2030, with a long-term target of net-zero emissions by 2050.

Extreme weather events, exacerbated by climate change, pose significant operational risks, leading to costly flight disruptions. For instance, in 2023, adverse weather contributed to an estimated 15-20% of global flight delays, impacting airline efficiency and passenger satisfaction.

| Environmental Factor | Impact on Aegean Airlines | Data/Trend (2024/2025) |

|---|---|---|

| EU ETS & CORSIA | Increased operational costs due to carbon emissions compliance | Further reduction in EU ETS emission caps in 2024; phase-out of free allowances |

| Noise Pollution Regulations | Need for fleet modernization and operational adjustments | Increased investment in quieter, fuel-efficient aircraft like A320neo family |

| Sustainable Aviation Fuels (SAF) | Growing demand and strategic investment | Aegean expanding SAF uplift programs across European airports |

| Waste Management | Focus on reducing single-use plastics and improving recycling | Crucial for sustainability objectives and public perception |

| Extreme Weather Events | Operational disruptions, increased fuel costs, schedule delays | Estimated 15-20% of global flight delays in 2023 attributed to weather; potential 5-10% increase in fuel burn for re-routed flights |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Aegean Airlines is built on a robust foundation of data from official aviation authorities, national and EU economic reports, and reputable travel industry publications. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the airline.